How our crypto money portfolios performed

Level up your open finance game five times a week. Subscribe to the Bankless program below.

Dear Bankless Nation,

Back in January, we wrote a piece on “how to build a portfolio like a crypto native”.

We broke it down into three options for you:

- Stable Portfolio

- Bankless Portfolio

- DeFi Maximalist Portfolio

All three portfolio’s offered a different risk/return profile depending on your goals. All of them offered some sort of passive management strategies by leveraging the available money protocols at the time.

And all of the portfolios exceeded our expectations.

So let’s check in on how they did.

- RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

WRITER WEDNESDAY

Guest Writer: Rebecca Mqamelo, Head of Growth at Zerion

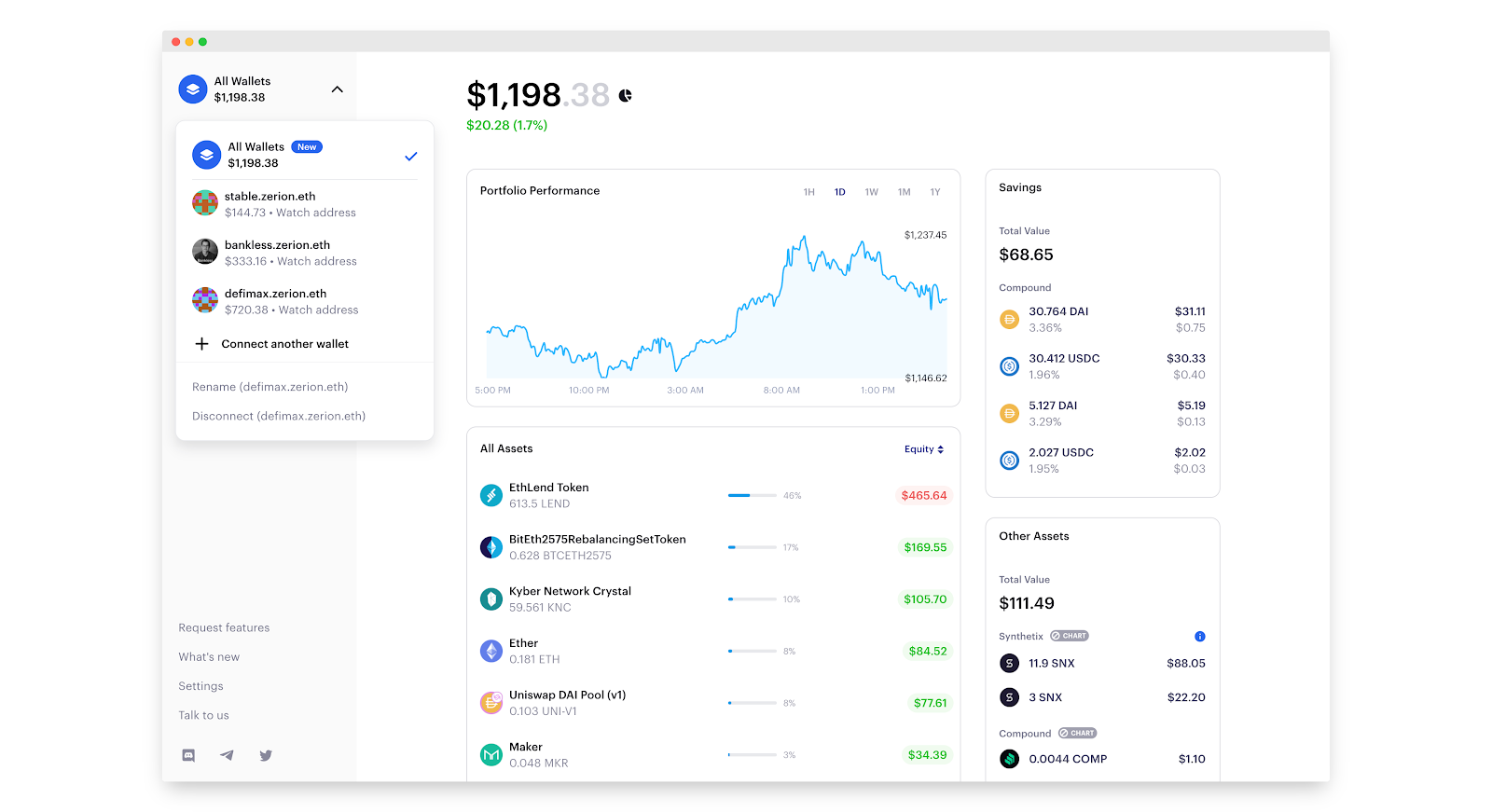

A few months ago, we created three template DeFi portfolios to help you invest like a crypto native. Since then, Zerion has undergone some major changes, making it even easier to evaluate returns. Highlights include the ability to track the entire DeFi market, view the performance of individual assets, and get an aggregated view for multiple wallets.

So we’ve decided to revisit the topic and review the returns on the Stable Portfolio, Bankless Portfolio and the DeFi Maximalist Portfolio in light of the recent bull market.

Here’s how they did.

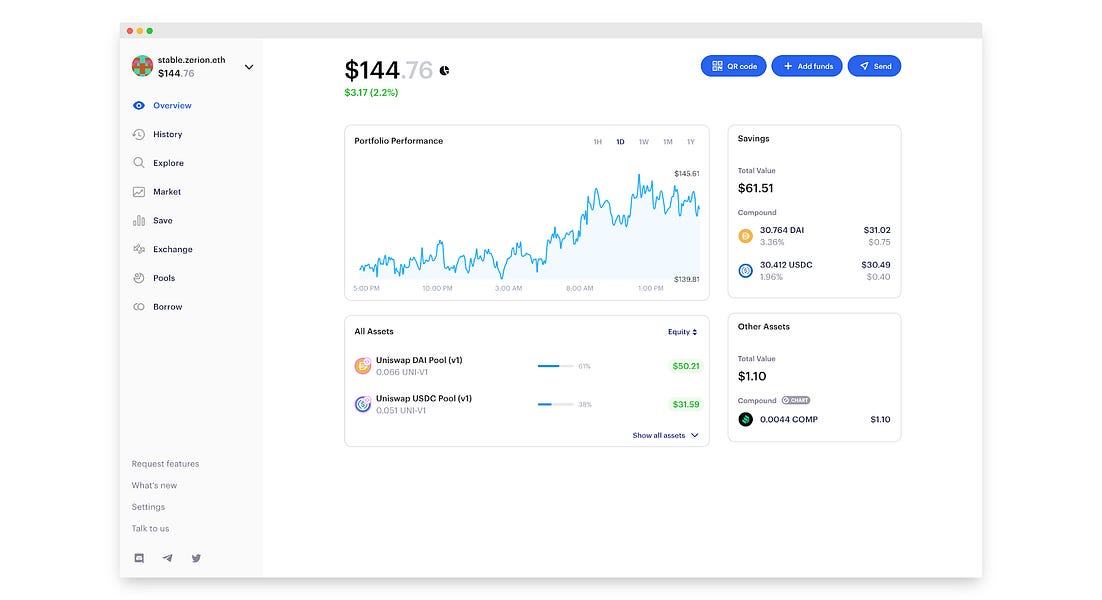

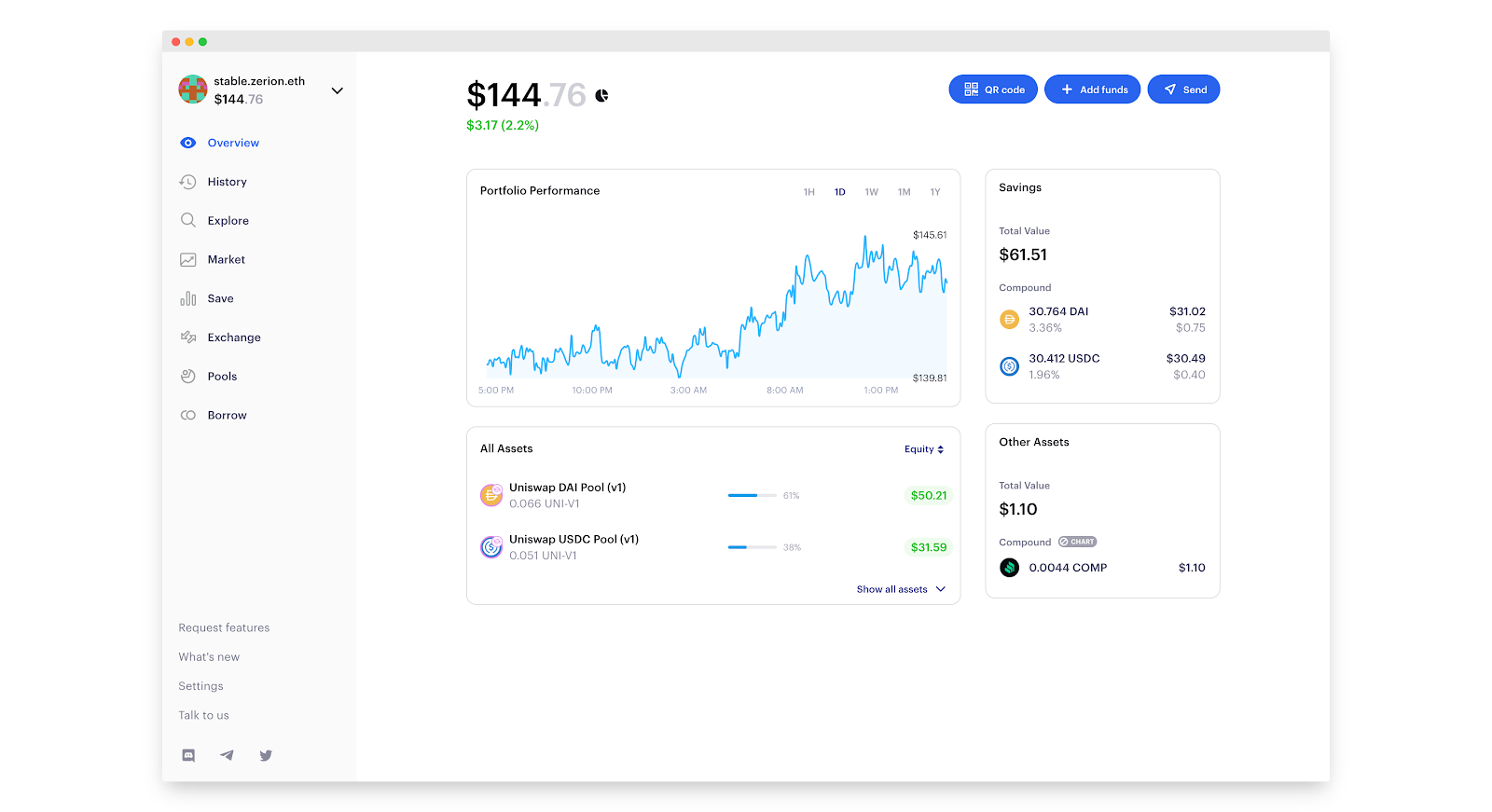

Stable Portfolio

Assets:

60% stablecoin bets (50% DAI on Compound, 50% USDC on Compound)

40% Uniswap Pools (60% ETH-DAI, 40% ETH-USDC)

Anticipated ROI in January 2020: +3% to +8%

Realized ROI: +44.76%

ENS: stable.zerion.eth

The stable portfolio was merely meant to protect your assets against price volatility, and the returns on this investment are pretty impressive. Along with interest earned from stablecoin deposits and fees from liquidity pools, the portfolio also started earning $COMP when the governance token launched back in June. With the anticipated return only ranging between 3% and 8%, the Stable Portfolio’s +44% realized ROI crushed our expectations.

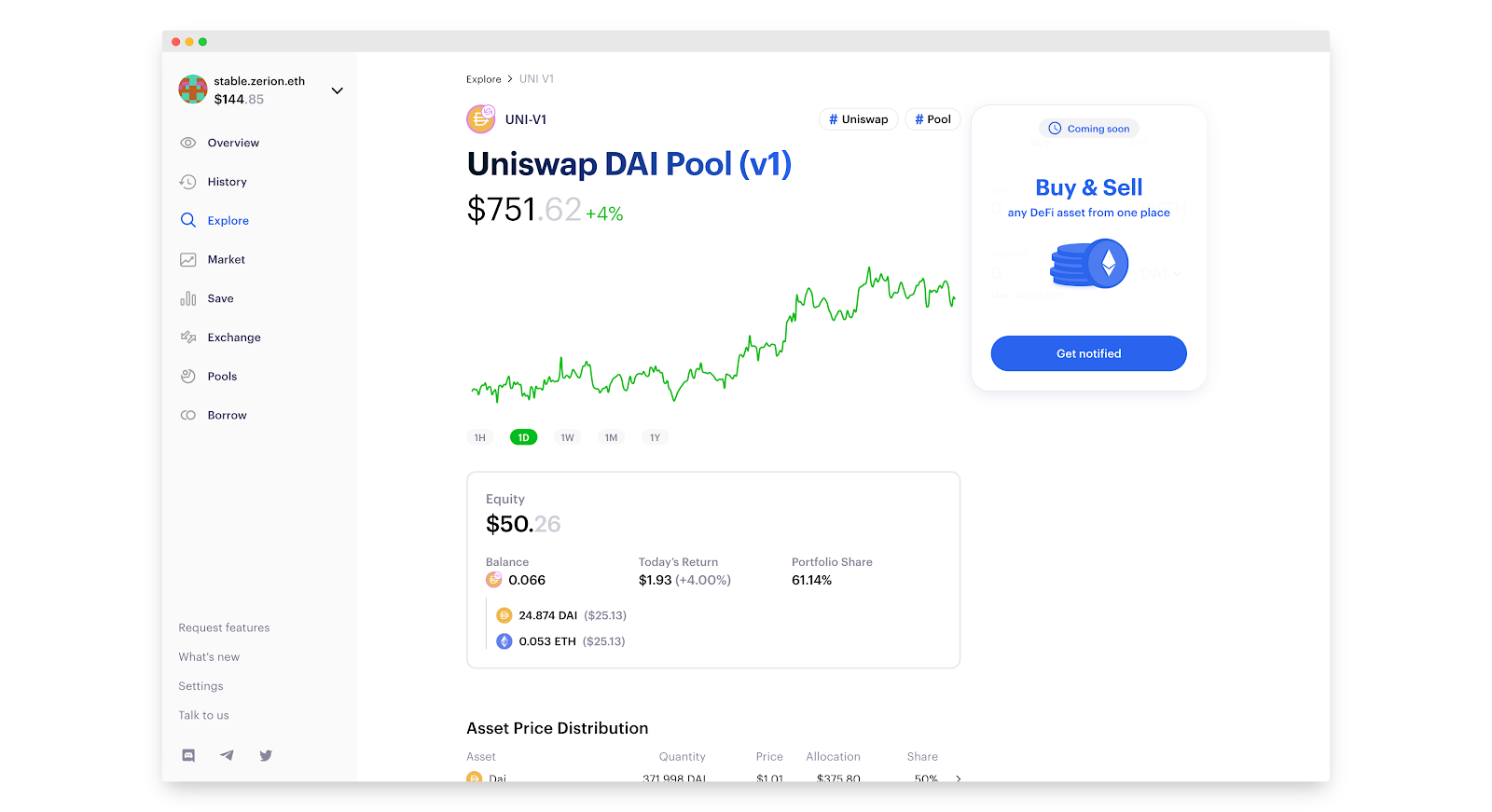

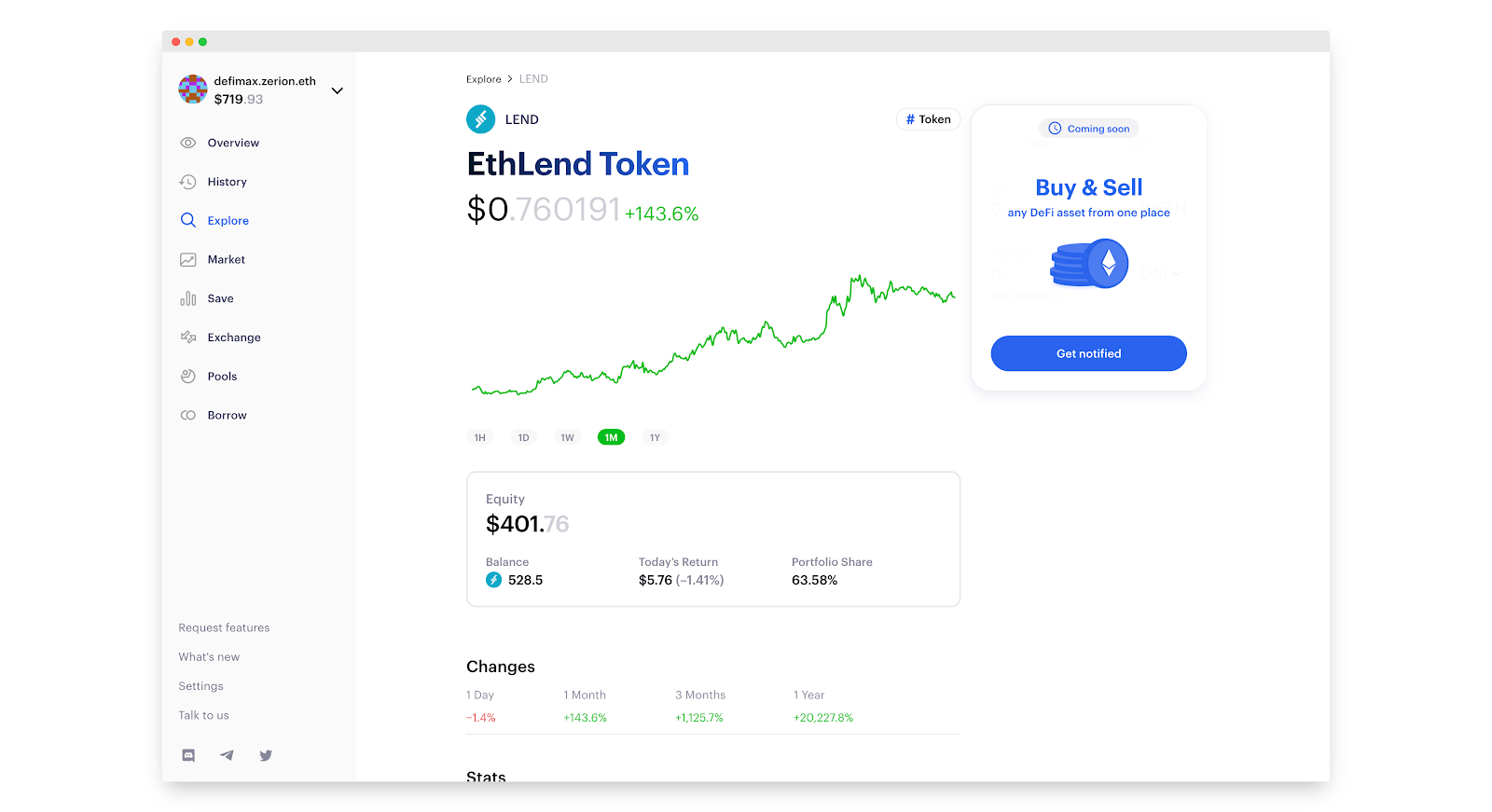

Zerion’s “Overview” page now lets you click on individual assets to check in on performance and transaction history, so this will help us break down why the portfolio performed so well.

As an example, the Uniswap DAI Pool (v1) was bought when it was worth $397.23 – today it’s worth $751.62, a 18.4% return in the past month thanks to an increase in the price of ETH!

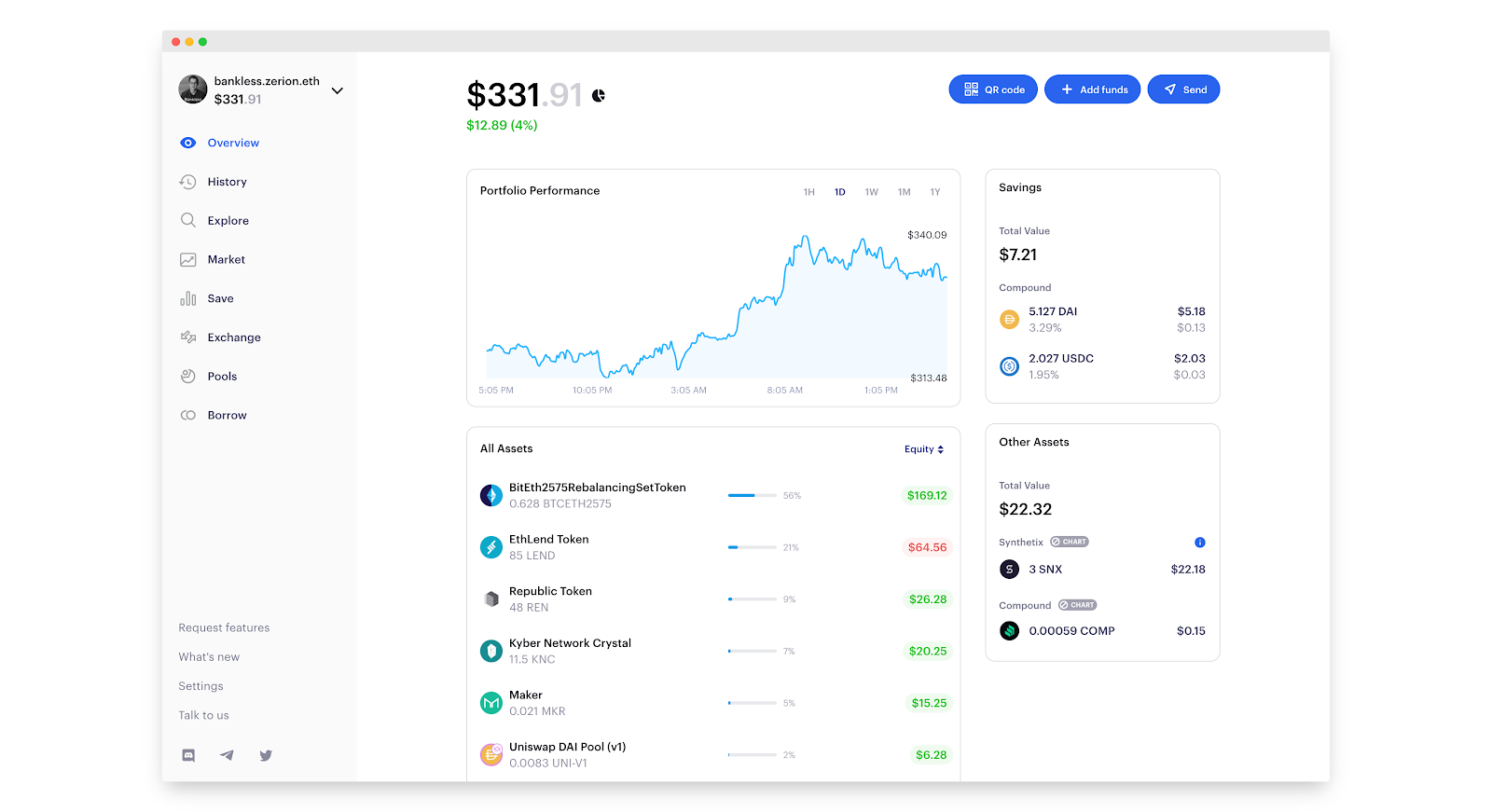

Bankless Portfolio

Assets:

70% money bets (75% ETH / 25% BTC auto-balanced using ETHBTC7525 Set)

20% bank bets (MKR—50%, SNX—15%, KNC—15%, REN— 5%, LEND— 5%)

10% stablecoin bets (50% DAI & 20% USDC Compound, 30% ETH-DAI Uniswap)

Anticipated ROI in January 2020: -60% to +300%

Realized ROI: +231.91%

ENS: bankless.zerion.eth

The Bankless Portfolio balanced the investment between automated trading strategies, bank bets, and liquidity pools.

With both ETH and BTC prices rallying over the past quarter, the ETHBTC7525 Set more than doubled in valued, being bought at $113.42 and increasing to $269.56 since January.

Similarly, there was a positive trend across the board with most DeFi tokens including Aave’s EthLend Token, REN, SNX, and KNC. MakerDAO’s MKR is the only DeFi token that lagged behind its peers despite increasing +48.2% over the past 3 months.

The performance of all these tokens reflects the growth of DeFi over the past 6 months. Given that our expected ROI in January was between -60% and +300%, the Bankless Portfolio reached the higher end of our expectations as the realized ROI reached +231%.

DeFi Maximalist Portfolio

Assets:

50% bank bets (25% MKR, 25% SNX, 25% KNC, 25% LEND)

30% money bets (100% ETH)

20% Pools (50% Uniswap ETH-MKR, 50% Uniswap ETH-DAI)

Anticipated ROI in January 2020: -60% to +300%

Realized ROI: +620.08%

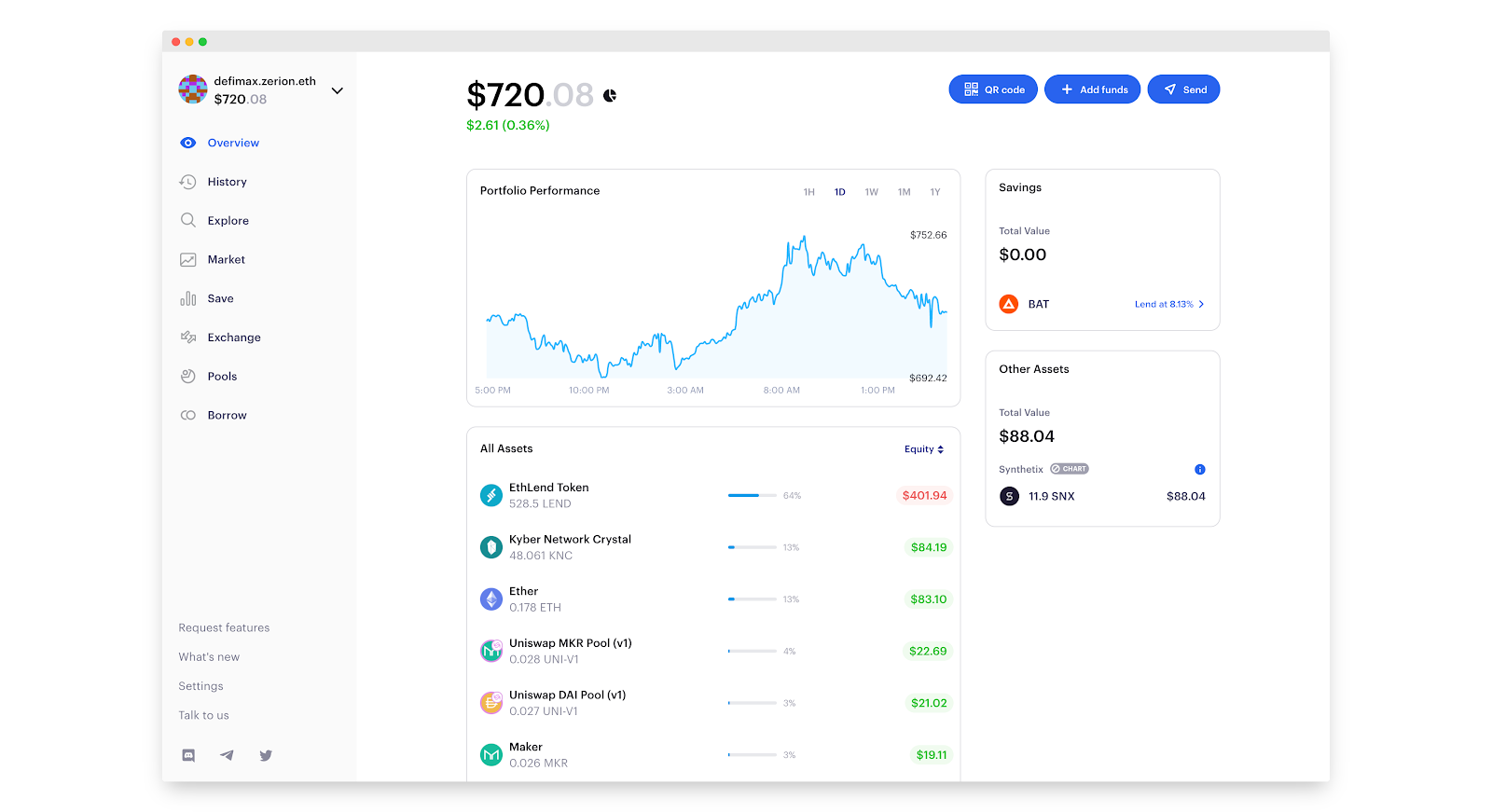

ENS: defimax.zerion.eth

The DeFi Maximalist Portfolio clearly lived up to its name – to say the investment performed incredibly well is an understatement. The portfolio featured popular DeFi tokens like Aave’s EthLend Token, KNC, and SNX. The investment in LEND alone, which was bought with just $12.37, is now worth $401.76 and constitutes 63% of the portfolio.

In addition, KNC and SNX also performed substantially well as SNX has increased by +856% over the past 3 months while KNC increased 154% in the same time period.

With that, it’s safe to say that 2020 so far has been the year of DeFi tokens.

Tying it all together

Since the original investment was just $300, the total return for all three portfolios was 299.46%.

If you’re interested in looking at historical performance, you can click on the individual assets in the aggregated view on Zerion to determine where your biggest gains/losses came from.

In this case, it appears that Aave’s $LEND yielded the highest returns across all three portfolios. And that makes sense.

Aave’s Total Value Locked (TVL) shot up over the past few months and now tops the leaderboards on DeFi Pulse (or it did when this was written…DeFi moves fast) as the money markets protocol offers the most diverse range of DeFi collateral on the market.

Conclusion: what would we do differently?

At the beginning of 2020, we couldn’t have known that DeFi would explode the way it did.

Yield farming is now one of the most popular DeFi strategies, and in reality a DeFi Maximalist portfolio with more than $100 starting capital would have greatly benefited from recursive investing – folding the investment many times over in order to maximize yield on protocols like Balancer, Curve and yearn.finance.

In addition, there are a number liquidity pools that could have partially or entirely replaced the above portfolios, for example:

- In place of the Stablecoin portfolio, Curve’s Y pool consisting of yDAI, yUSDC, yUSDT and yTUSD

- A staked Curve sBTC pool consisting of renBTC, wBTC and sBTC – eligible to earn BPT (SNX + REN) and BAL rewards. While the incentive program recently ended, the current CRV rewards alone earn a 100%+ APY on your Bitcoin. Good luck trying to beat that BlockFi.

With Set V2 soon to launch, there’ll be even more of these high yielding opportunities!

And as the liquidity mining bull market continues on, we’re sure that there will be plenty of new (and risky) ways to earn a tasty yield in the coming future.

Action steps

- Analyze the performance of your crypto money portfolio with Zerion

- Determine which crypto money portfolio best fits your risk & goals

- Identify better yielding opportunities given the current landscape

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Badge.

🙏Thanks to our sponsor

Aave

Aave is an open source and non-custodial protocol for money market creation. Originally launched with the Aave Market, it now supports Uniswap and TokenSet markets and enables users and developers to earn interest and leverage their assets. Aave also pioneered Flash Loans, an innovative DeFi building block for developers to build self-liquidations, collateral swaps, and more. Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.