How to bet on DeFi with Augur v2

Level up your open finance game five times a week. Subscribe to the Bankless program below.

Dear Bankless Nation,

Augur is one of the OG Ethereum money protocols.

It allows anyone, anywhere, to bet on anything. No betting limits. No KYC. Pure Bankless. A powerful primitive.

Last week, Augur launched its highly anticipated v2 upgrade. It provided improvements over the first version and features only possible by incorporating other money legos—Uniswap, Maker, 0x—this is Ethereum’s tree of life in action.

The big upgrade people were waiting for.

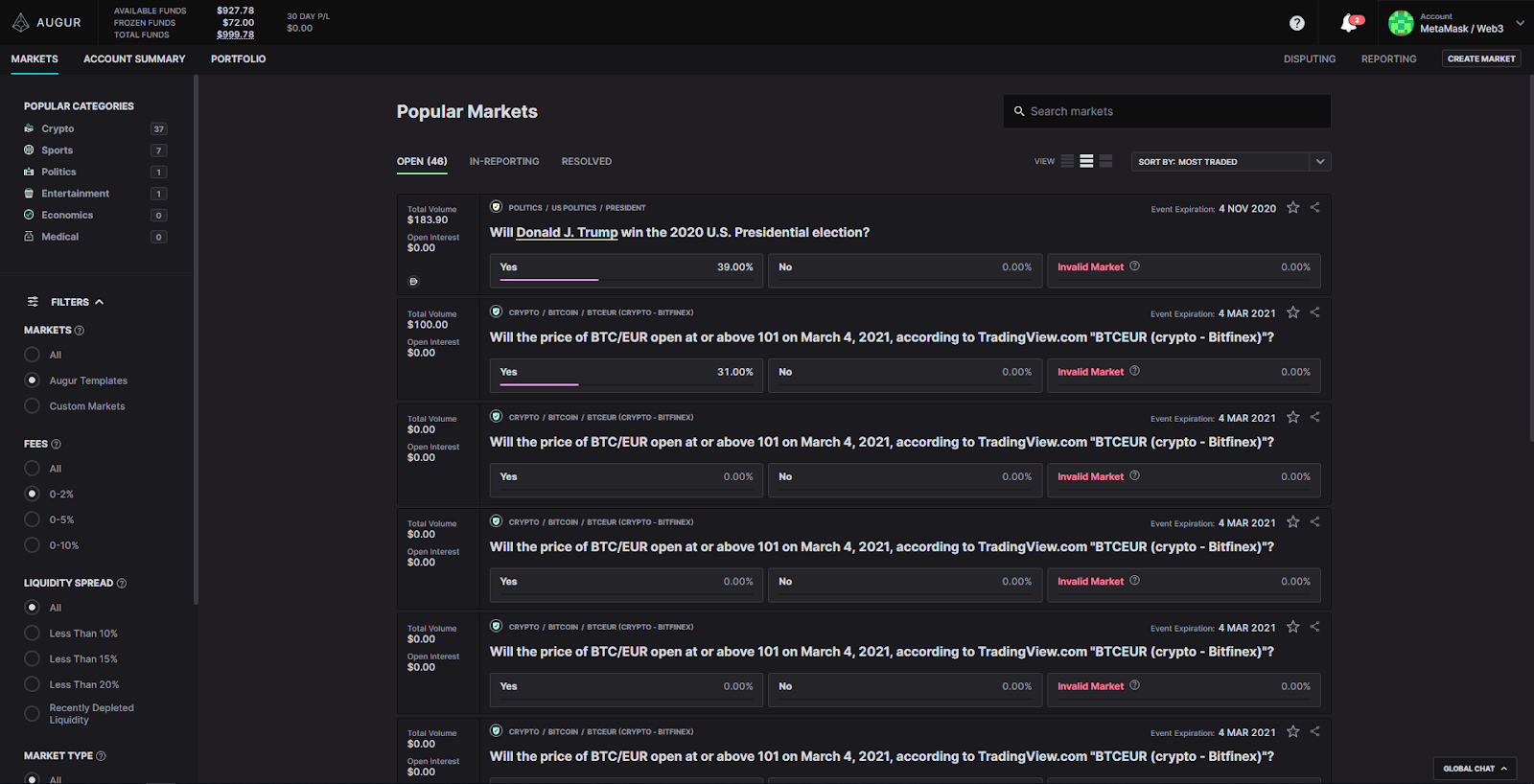

So we brought in Ben to show us how to leverage Augur to predict the future outcome of an event. And what better event to predict than the future number of DeFi’s go-to metric, Total Value Locked (TVL).

At the beginning of June, TVL reached $1B. By the end of July, it was $4B.

What will TVL be by the end of the year? $5B? $10B? $20B? Or will it go lower?

If you think you know the answer, you win some Dai.

Yeah, a second tactic this week. Gotta level up fast—we’re in the bull market now!

-RSA

P.S. for more on Augur vs alternatives check out our podcast with Joey Krug—he also talks about navigating high gas fees!

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

TACTICS TUESDAY:

Tactic #50: How to bet on Total Value Locked with Augur v2

Guest Post: Ben Davidow, Writer for The Augur Edge

How to bet on DeFi TVL with Augur v2

Augur is one of OG bankless protocols on Ethereum, decentralized to the core.

You can think of Augur as a global vending machine that pops out “outcome tokens” in exchange for DAI. These tokens confer exposure to or insurance against any future state of reality.

Outcome tokens may be used for anything from betting and trading to bounty creation and risk hedging. The new financial primitive of outcome tokens represent transferable, programmable, and censorship-resistant shares that payout based on real-world events.

Markets that trade these shares are called “prediction markets,” as they may produce forecasts on future events, thanks to crowdsourced information and skin in the game incentives. For example, if YES shares on an Augur market on Trump’s reelection are trading at .40 DAI, the market is signaling 40% odds he will win the election.

Today, we’ll learn how to use newly-launched Augur v2 to bet on what the Total Value Locked in DeFi will be at the end of 2020.

- Goal: Place your first trade on Augur v2

- Skill: Intermediate

- Effort: ~12 mins

- ROI: Up to ~100%

Augur v2: The Future of Predicting the Future

Anyone, anywhere, can create or trade markets on anything using Augur.

You can bet on the election, sports, crypto prices, the economy, or how many Twitter followers Kanye will have next month. Any verifiable event in the universe.

Augur v2 delivers a fresh user experience built on an array of beloved “money legos” including Uniswap, 0x, and MakerDAO.

The coolest part of Augur, though, may be its native oracle.

An oracle is a mechanism for transferring real-world information onto a blockchain, in the case of a prediction market, the actual event outcome e.g., did the Lakers win? Augur has what may be the most bulletproof oracle known to date, with game-theoretic guarantees that you can learn about here.

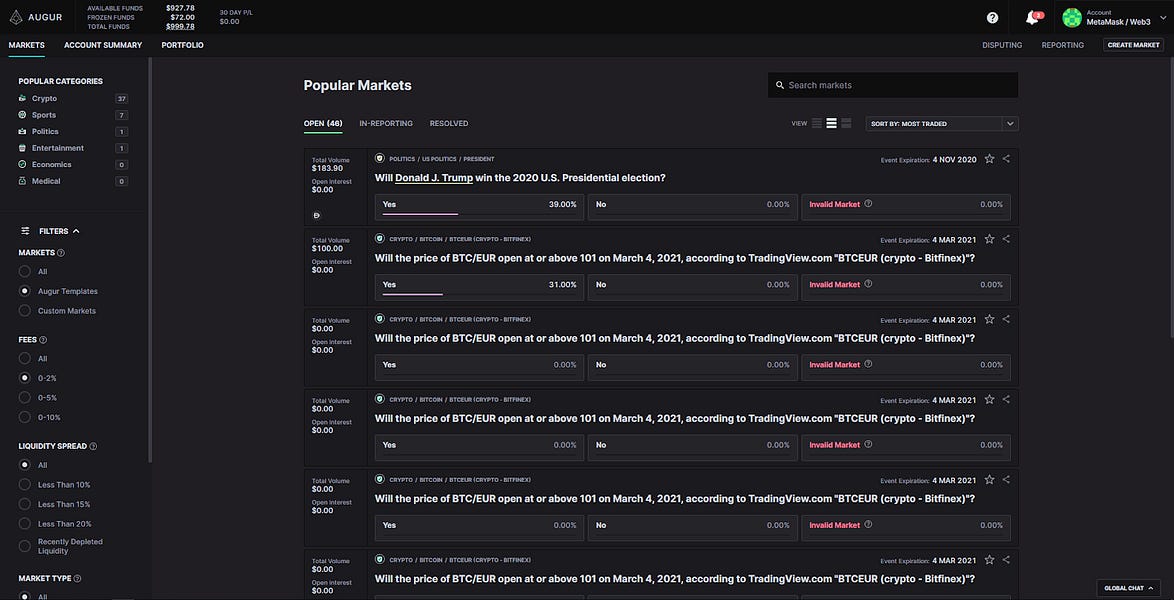

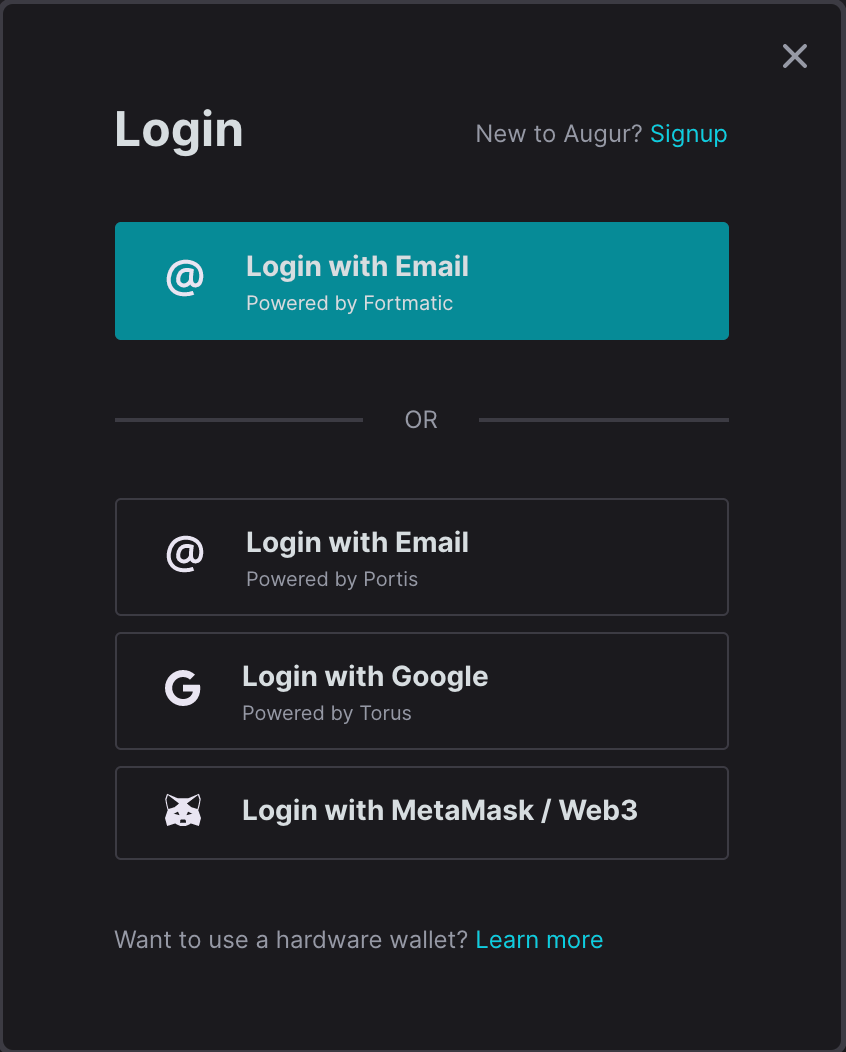

What Augur’s new UI looks like

Will DeFi Continue to Defy Gravity?

The Augur market we’ll learn how to trade today is what will Total Value Locked (TVL) in DeFi be at the end of 2020.

As you may know, DeFi has been on a tear lately, rocketing to over 4 billion USD TVL.

Courtesy of defupulse.com

Will this trend hold, accelerate, or . . . reverse?

That’s what our Augur market today will let you predict and profit off of if you’re correct!

How to bet on TVL with Augur v2

Visit Augur’s new UI here.

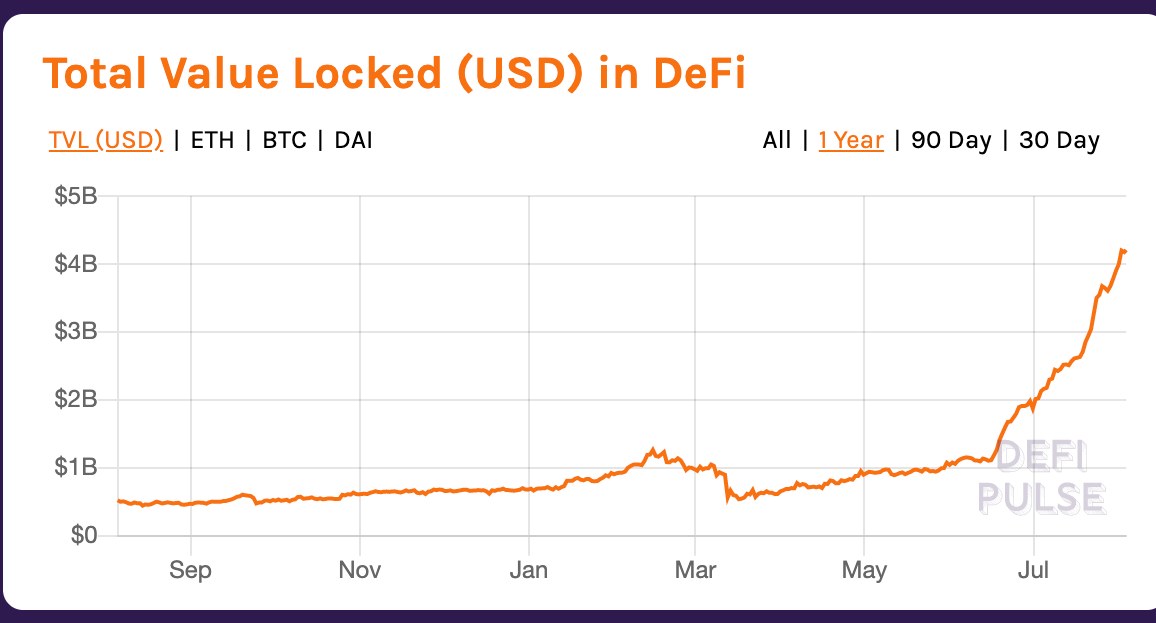

When you land there, click on “Connect” in the upper right.

If you already have MetaMask/Web3, the simplest option is to select “Login with MetaMask/Web3,” but select whichever option you prefer.

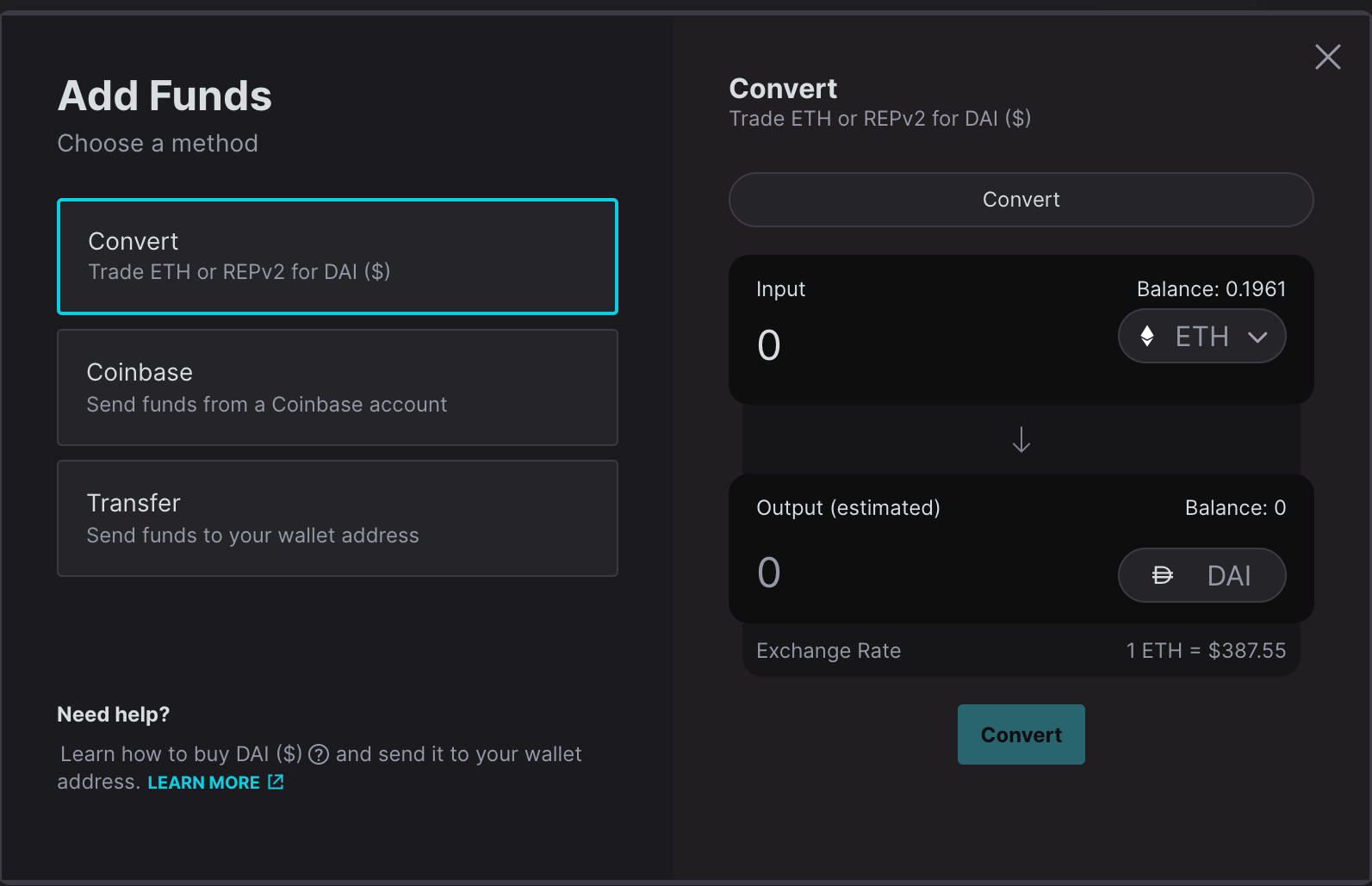

With Augur v2, you use DAI to trade. If you don’t have any yet, the UI makes it super easy to get your hands on some. Click your account on the top right and select “Add funds.”

You can then swap ETH or other assets into DAI or transfer DAI from another wallet or exchange it to your address. Just make sure to keep a little ETH around to cover tx fees!

Explore the Market

Augur markets let you get long (or short) exposure to DeFi TVL. Specifically, it predicts what the TVL will be at the end of 2020, according to DeFi Pulse.

It’s a unique kind of Augur market called a “scalar,” where the market question concerns something along with a sliding, numerical scale, and rather than getting an all-or-nothing payout, traders get paid proportionally.

Put simply, if you buy long shares in the market and DeFi TVL ends up a bit higher than the price you bought at, you stand to gain a little profit. If it ends up a lot higher, then you stand to gain a lot.

Meanwhile, if TVL ends up lower than the price you bought, you’ll pay the market.

🧠 For more info on how scalar markets work, see here.

If you prefer to place a simple bet on a YES/NO market instead, you can check out a market like this one on the U.S. presidential election. You can also check out our tactic on Binary Options!

But assuming you want to trade on DeFi TVL, click here to access the market in question.

Once you land on the trading page, you’ll see something like this:

- Market Info: market question, terms, expiration date etc

- Order input box to buy or sell shares of your preferred outcome

- Current prices for each outcome and historical price chart

- The order book, listing the market’s open orders

- Your own orders and positions

- The market’s trade history

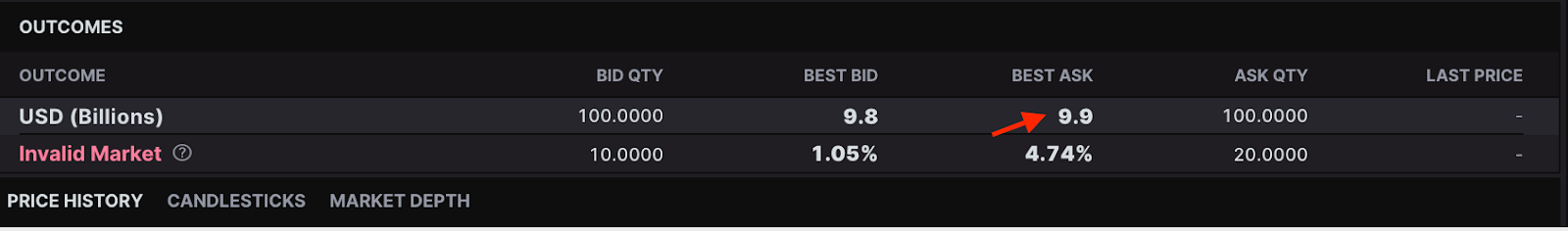

In our DeFi TVL market, the denomination is in billions rounded to the nearest decimal point. For example, 9.8 signifies $9.8 billion USD.

The market’s lower bound is $1 billion and its upper bound is $20 billion. This means that if the outcome (TVL end of 2020) ends up at or above $20 billion, long positions will pay out the maximum possible amount and short shares will pay out zero.

If the market ends up at or below $1 billion, short shares will pay out their maximum possible amount and long shares will pay out zero.

Take a look at the outcomes section [3].

The “best ask” is the lowest price you can buy shares (go long) at while the “best bid” is the highest price you can sell shares (go short) at. The midpoint between the best bid and best ask signals what the market thinks DeFi TVL will be at the end of 2020.

Go long (or short)

If you think that DeFi TVL will be higher than the best ask, then you’ll want to go long. If you think it will be lower than the best bid, you’ll want to go short.

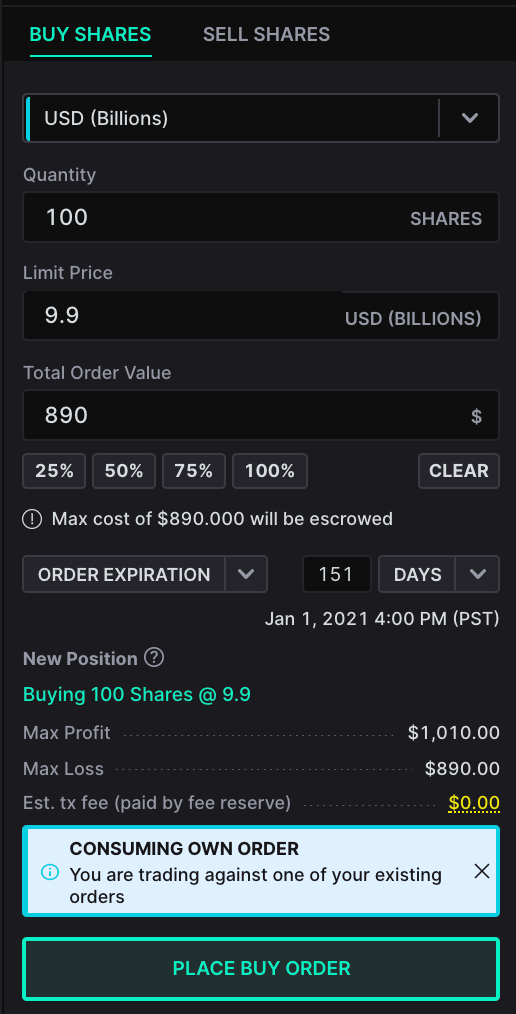

- To go long, click on “buy shares” on the left side of your screen or click on the price under “Best Ask.”

- To go short, click on “sell shares” on the left or click on on the price under “Best Bid.”

Once you do so, the order input on the left [2] will populate with your order info:

Feel free to adjust the quantity or limit price or just leave as is! Below the order input, you’ll see max profit, max loss, and estimated transaction fees.

To avoid tx fees, you may place a new limit order rather than filling an existing order, as makers don’t pay fees on Augur thanks to 0x (except when they manually cancel orders). For quicker and near-guaranteed execution, however, filling an order is the simplest option.

Once everything looks good to you, click the order button at the bottom which will say “Place Buy Order” if you are going long or “Place Sell Order” if you are going short (brave soul!).

You will then be asked to sign transactions to interact with the contracts and execute the order.

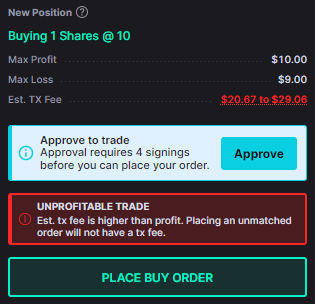

🗣️ Heads up! We’re living in an expensive time for transactions. If you’re looking to make small bets on Augur, you may be priced out with high fees (try placing a limit order instead to avoid fees!). Also, if it’s your first time using Augur, you will have to sign a handful of transactions that may eat into your profits.

Below: Trying to make a 10 Dai bet on Augur. Fees are estimated to be $20 - $30 😱

Once your order goes through, you’ll see your position under “Positions” [5] as well as on your “Portfolio” page (or if you place a limit order you’ll see it under “open orders”).

You can track your estimated profit/losses over time there as well.

And there it is! You’re now an official early adopter of open prediction markets.

Congratulations and welcome to the future!

Final note about scalar markets

If you’re taking a long position in a scalar market, then you are taking on Invalid risk, meaning that if that the market resolves as “Invalid” due to an ambiguous or unverifiable outcome, you will get zero payout if you haven’t bought any Invalid insurance.

While this market’s terms have been formulated to minimize this risk, you may wish to buy Invalid shares to insure against this scenario. Note that this risk only applies here if you are taking a net long position. If you are taking a short position in the market, then you get a full payout if the market resolves as Invalid.

To stay at the cutting edge of DeFi prediction markets, check out Ben’s weekly newsletter The Augur Edge

Author bio

Ben Davidow writes about open prediction markets and is helping develop an Augur integration with Balancer to facilitate easier access for traders.

Check out his newsletter The Augur Edge to stay at the cutting edge of the DeFi prediction market space!

Action steps:

- Bet on what DeFi’s total value locked will be by the end of 2020

- Explore the other markets on Augur v2 (presidential elections are always a good one!)

- Listen to the Bankless Podcast with Augur co-founder Joey Krug!

- Check out a more centralized Augur alternative & compare (tactic #46)

Go Bankless. $12 / mo. Includes archive access, Inner Circle & Badge—(pay w/ crypto)

🙏Thanks to our sponsor

Aave

Aave is an open source and non-custodial protocol for money market creation. Originally launched with the Aave Market, it now supports Uniswap and TokenSet markets and enables users and developers to earn interest and leverage their assets. Aave also pioneered Flash Loans, an innovative DeFi building block for developers to build self-liquidations, collateral swaps, and more. Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.