How to bet on DeFi with Polymarket

Level up your open finance game five times a week. Subscribe to the Bankless program below.

Dear Bankless Nation,

I think it’s time to take a look at prediction markets.

Yes, crypto’s talked about them forever.

No, we haven’t found product-market-fit yet.

So talk about them now?

- Augur V1 UX was painful—liquidity never took off. But now Augur V2 is close.

- Gnosis protocol hasn’t done it yet either. But now there’s Omen.

- Mainstream finds all this stuff too hard. But now there’s Polymarket.

There’s now at least three different attempts at prediction markets in DeFi. We’ll cover them all I’m sure, but today we’re going to show you how to use Polymarket.

Polymarket makes some interesting tradeoffs. It uses Ethereum’s financial infrastructure but keeps its oracle—the thing settling bets—centralized. For Polymarket it’s more about building a UX good enough to for mainstream than about maximal decentralization. (Haseeb makes a case for this type of approach here.)

The coolest thing—you can bet on DeFi markets now.

We’ll show you how.

-RSA

P.S. This is a new tool so please be careful of risks as always—I believe Polymarket uses audited smart contracts from the conditional token framework

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

📺 Our SotN #34 With Polygon’s Mihailo Bjelic & Sandeep Nailwal

📺 Watch the Episode

TACTICS TUESDAY:

Tactic #46: How to bet on DeFi with Polymarket

Guess Post: Shayne Coplan from Polymarket

Polymarket is an information markets platform, where speculators bet on the world's most highly-debated topics—producing actionable insight on the matters most important to society, and helping people plan better plan for their future.

Built on Ethereum and using USDC as the underlying currency, in this article we’ll walk you through how you can start using Polymarket to profit from accurately predicting DeFi trends.

All you need is Metamask, USDC, some ETH for tx fees, and you’ll be ready to instantly start trading all the unique DeFi markets and others on topics like Coronavirus and Politics on PolyMarket. Earn cash for being right!

- Goal: Earn $ for accurately betting on the future of DeFi

- Skill: Beginner

- Effort: 5 minutes

- ROI: 2-10x your wager (if you’re right!)

⚠️ Heads up—Polymarket is in Beta. Like most DeFi protocols and applications, it’s early, so proceed with caution. Don’t put in more than you’re willing to lose!

What’s a prediction market?

The ability to cheaply create, trade, and resolve globally-accessible markets of any type and size is one of the most powerful use cases for blockchain technology.

Often termed “prediction markets”, this phenomenon of markets on everything—be it binary outcome markets, perpetually traded synthetic assets, or scalar markets—remains largely unrealized after a few early, well-capitalized players have struggled to ship products for the last 5 years.

But make no mistake, this vertical of DeFi has a good chance of bringing the industry mainstream and having a profound global impact.

A month ago we launched Polymarket, a product aimed at making this vision a reality.

At first glance, Polymarket is a fully functional, intuitive ‘prediction markets’ platform built on Ethereum using:

- Ethereum wallets and addresses

- A stablecoin (USDC) for the underlying currency

- AMMs (Uniswap and Balancer) for market structure to guarantee tight spreads

Polymarket is the culmination of:

- our team’s experience using generalized markets platforms

- the study of the relevant academic research,

- constant iteration based on user feedback.

We place a strong emphasis on purposeful product design and try our best to give the end-user the magic UX of owning your own money along with the intuitive UX of a well-built web 2.0 product.

OK—that’s the background. Now let’s get to the tactic. First stop, we’ll check out the DeFi markets featured on Polymarket and head to poly.market to make our first trade!

DeFi Markets on Polymarket

Though Polymarket aims to support any type of market one category we’ve focused on early is DeFi.

Below is a list of DeFi markets currently live on Polymarket you can bet on today:

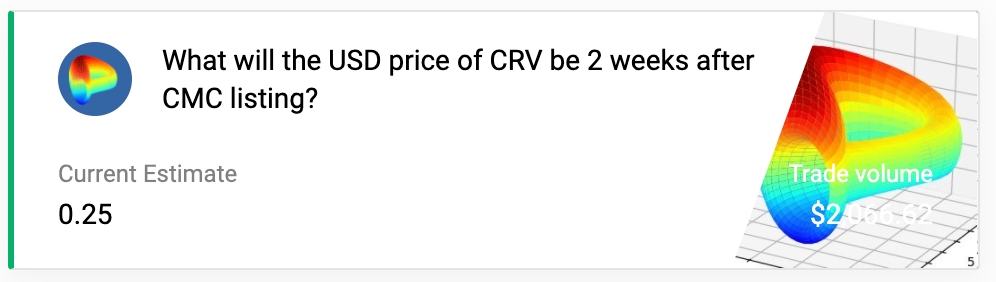

1) What will the USD price of CRV be 2 weeks after Coinmarketcap listing?

Curve is planning to reward all active liquidity providers in Curve AMMs since the protocol's inception with CRV tokens. CRV isn’t live yet, and a date for when it will be has yet to be announced. Using Polymarket, future CRV recipients can hedge their risk by going Long or Short before the token is even live. They can also calculate their expected earnings via price discovery for CRV tokens when active markets don’t yet exist elsewhere.

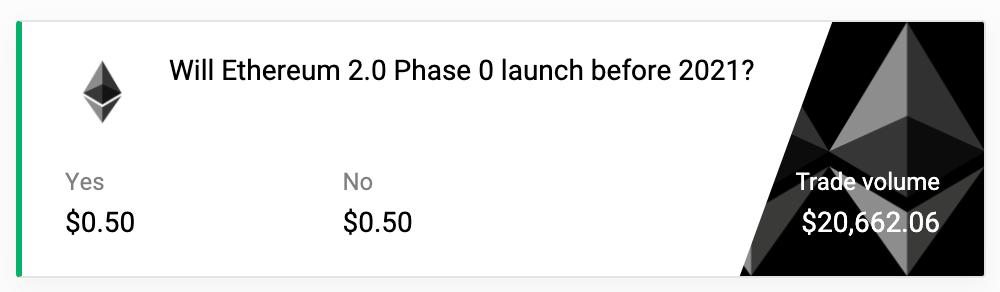

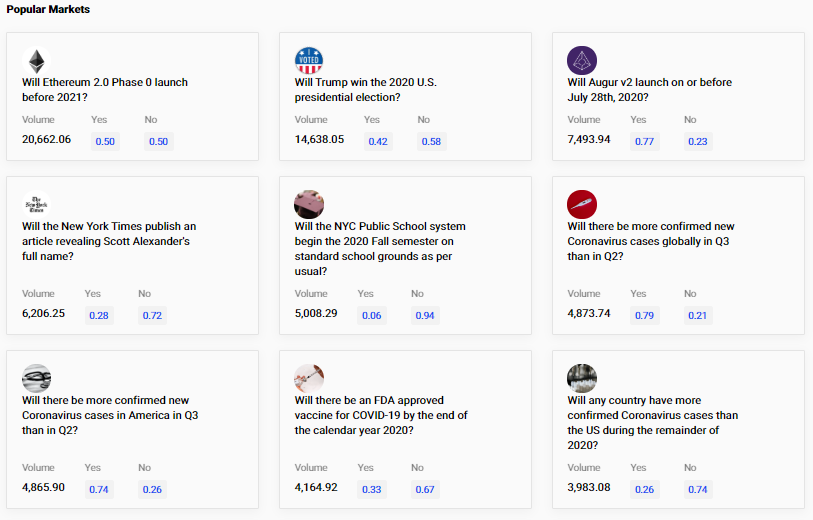

2) Will Ethereum 2.0 Phase 0 launch before 2021?

This is one of the most highly debated questions in the Ethereum community. Using Polymarket, anyone can track the real-time likelihood of this deadline being met, can hedge against their ETH position by buying “No” shares, or, more creatively, can strengthen the incentive for the Ethereum core team to meet the deadline by buying up “No” shares, thus making it more lucrative for the developers to Buy “Yes” shares and positively influence the outcome of meeting the deadline.

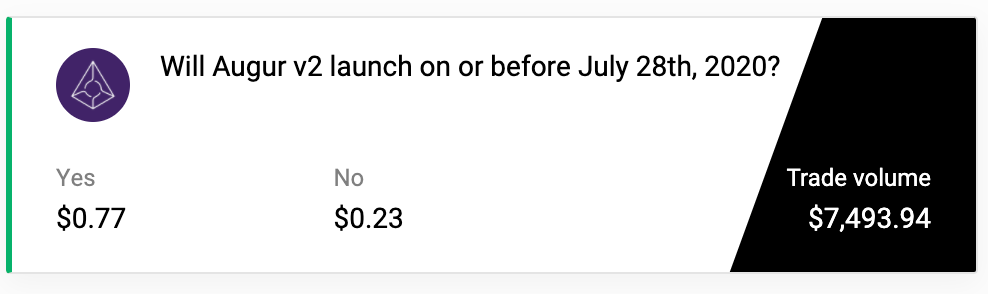

3. Will Augur v2 launch on or before July 28th, 2020?

Augur has long been one of our team’s favorite crypto projects, and there is a good chance we will integrate Augur markets into Polymarket at some point in the future. Augur announced that their v2 product will launch on July 28th, 2020. Using Polymarket, anyone can track the likelihood of that deadline being met in real-time, and can also hedge their REP holdings by buying “No” shares.

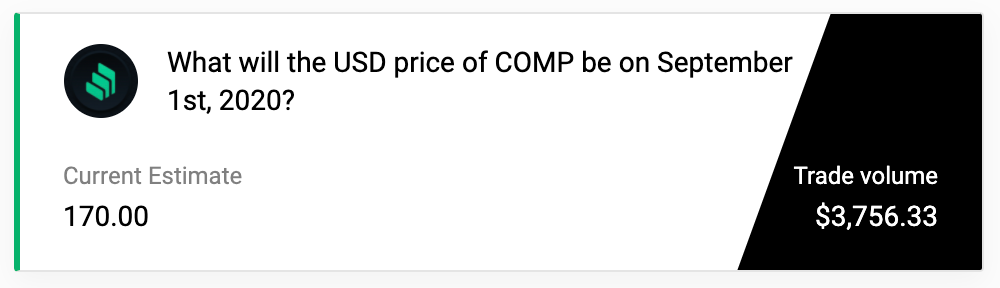

4. What will the USD price of COMP be on September 1st, 2020?

Compound’s governance token, COMP, took a unique path for token distribution. The token, upon listing on decentralized exchanges, skyrocketed in value as only a small portion of supply was available. Using Polymarket, those who own COMP but don’t have liquidity can hedge their risk by buying Short shares.

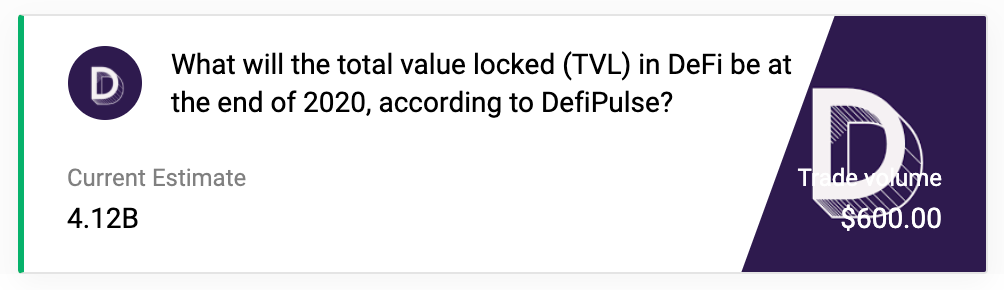

5. What will the total value locked (TVL) in DeFi be at the end of 2020, according to DefiPulse?

The TVL metric on DeFi Pulse, which tracks the total value of crypto assets locked in prominent DeFi protocols and applications, is synonymous with the growth and success of DeFi.

In the past few months, TVL has been growing rapidly, showing no signs of slowing down. Using Polymarket, DeFi investors can get a real-time, provably-accurate forecast of what the TVL will be at the end of the year, which they can then use to make better investment decisions in the present or to hedge against lower than expected growth in the sector.

How to make a trade on Polymarket

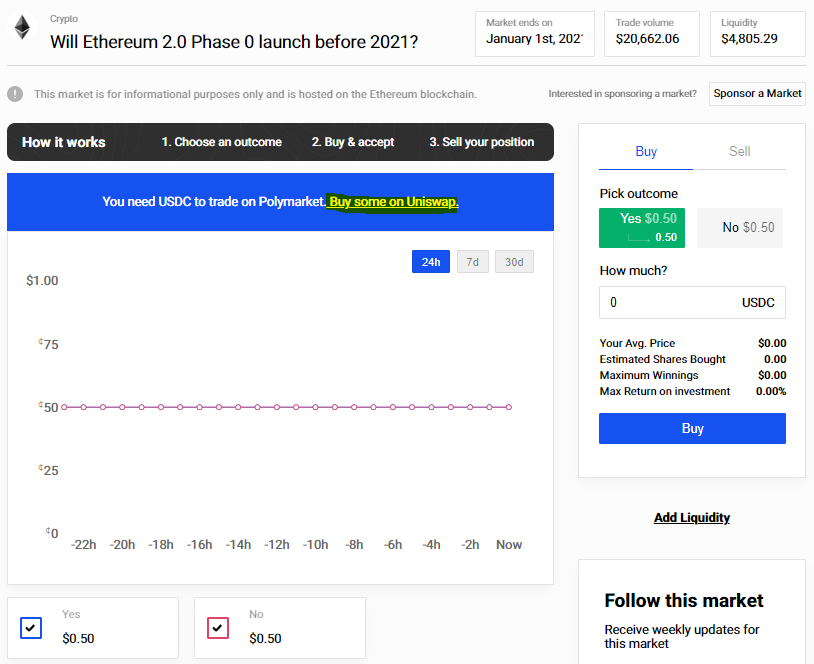

- Visit https://poly.market/, scroll down to the Categories or Popular Markets section, and pick your market!

- Connect your Ethereum wallet (we suggest Metamask), and make sure you have some ETH for tx fees and USDC for the trade.

📔 If you don’t have USDC, there should be a blue box above the graph that contains a link to buying it on Uniswap like this

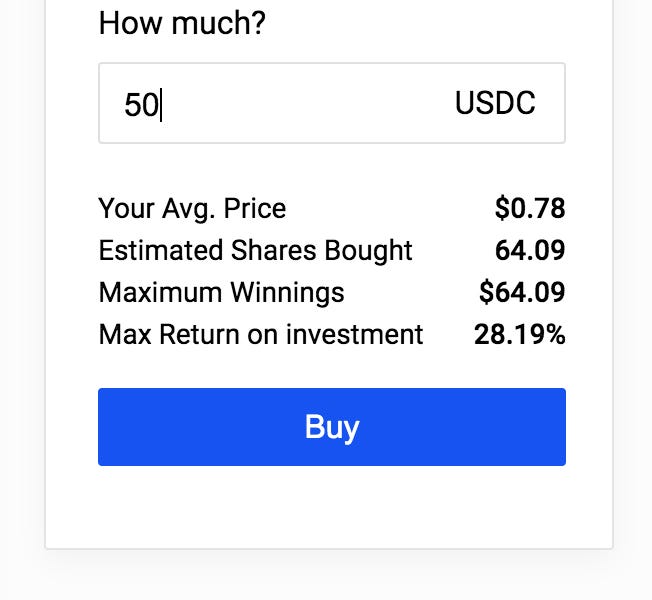

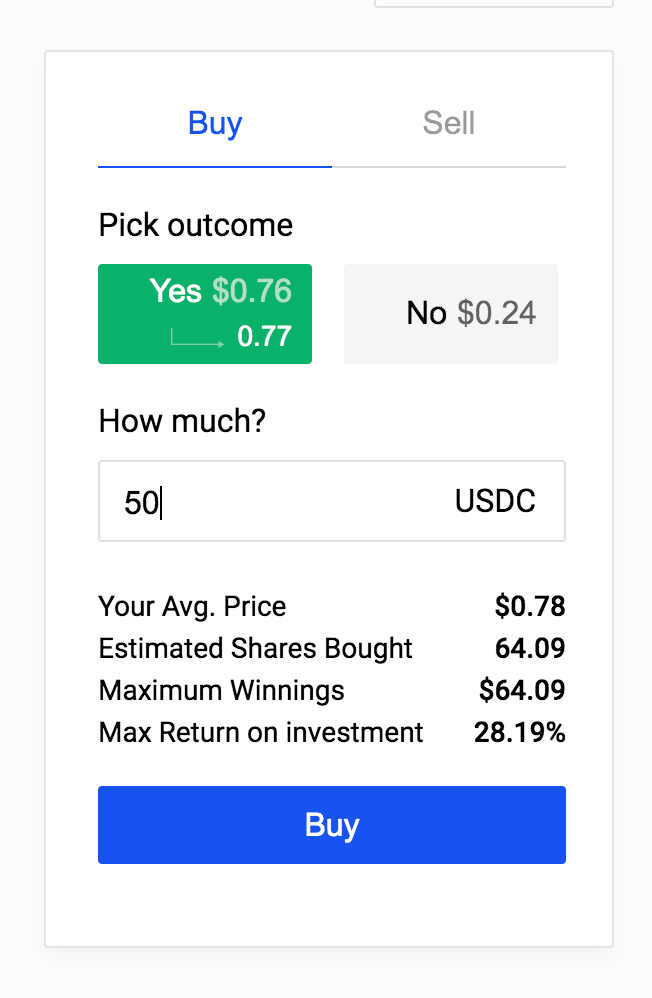

- Select the outcome you think will resolve to be “TRUE” and input how much you’d like to buy. Pay close attention to your average price and maximum winnings as you decide how much to buy, as they change dynamically to your order size due to the nature of the AMM.

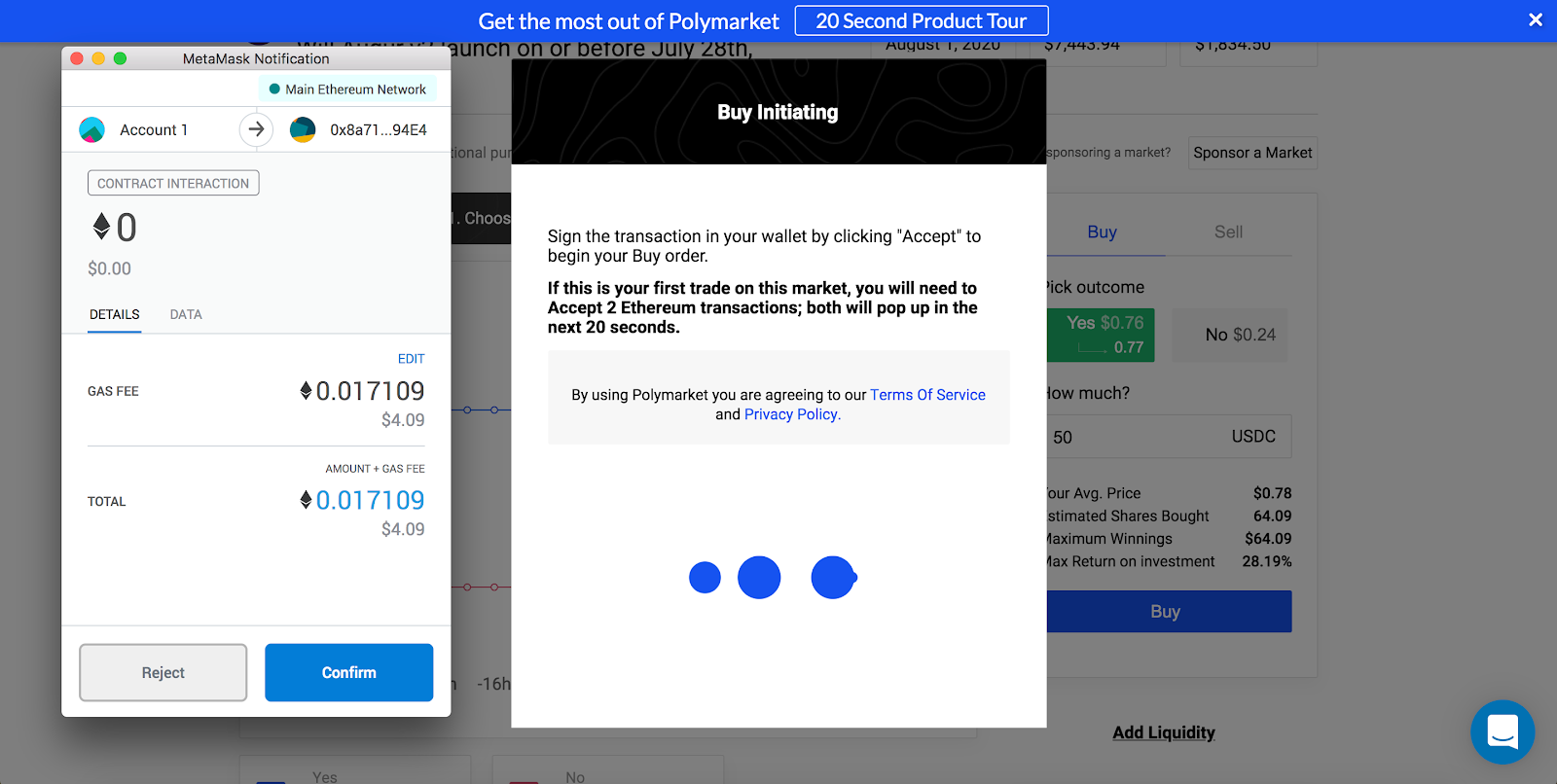

- Click “Buy” and sign all the transactions that come up. If it’s your first time trading the market, there’ll be 2 transaction pop-ups. If you’ve traded it before, there will only be one.

👀 If you’d like to get early access to our new onboarding process which streamlines this process, scroll down for an exclusive offer to Bankless subscribers!

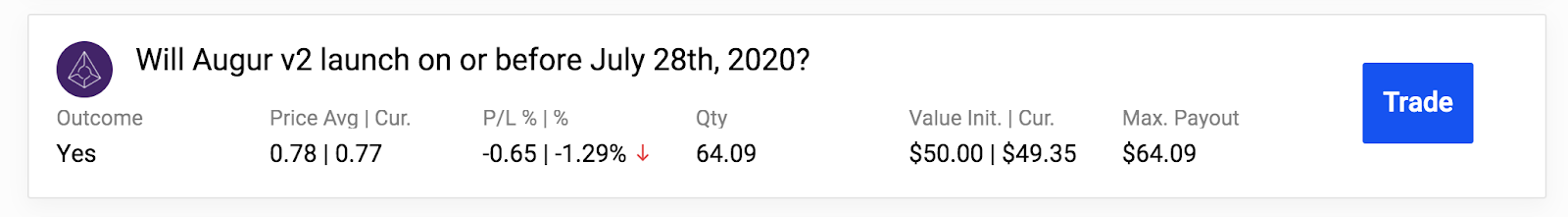

Voila, you successfully bought your shares! Now you can follow your positions either in the respective market page under “My Positions”, or on the portfolio page, which will show all your active positions on Polymarket. When the market resolves you can redeem your winnings on the respective market page.

Interested in the market topic but not in trading it? That’s all good—in fact it’s how we expect most people to use Polymarket. On any market, scroll down and learn about the use cases, and enter your email to receive updates about market activity.

That’s it! Easy.

Early Access for Bankless Subscribers 👋

Reach out to hello@poly.market & put Bankless in the subject line, tell us what you like about Polymarket, and get exclusive access to upcoming Polymarket features before they come out.

To stay up to date on Polymarket follow us on Twitter and join our Discord!

Happy betting!

Author bio

Shayne Coplan is an early cryptocurrency adopter from NYC now focused on building Polymarket.

Action steps:

- Make your first bet on Polymarket

- Reach out to the core team and get exclusive access to new features!

- Listen to State of the Nation #5: HEDGED

Go Bankless. $12 / mo. Includes archive access, Inner Circle & Deals—(pay w/ crypto)

🙏Thanks to our sponsor

Aave

Aave is an open source and non-custodial protocol for money market creation. Originally launched with the Aave Market, it now supports Uniswap and TokenSet markets and enables users and developers to earn interest and leverage their assets. Aave also pioneered Flash Loans, an innovative DeFi building block for developers to build self-liquidations, collateral swaps, and more. Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.