ETH the Reserve Asset

Dear Crypto Natives,

Happy Thursday. On Thursday’s we zoom out. We think. We calibrate.

Earlier this month I introduced the crypto money portfolio: money bets, bank bets, and stablecoins. I recommended the money bets as your biggest holding—the big thing you need to get right for everything to fall into place.

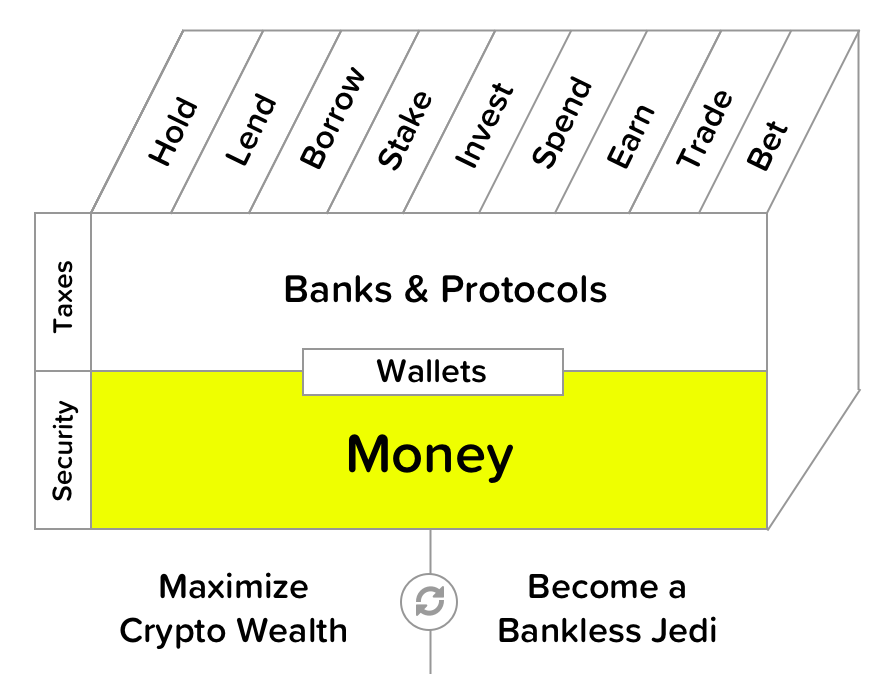

So today we’re spending more time on money layer of the skill cube. Last week we talked about the two paths to money for ETH & BTC. Now it’s time to zoom in on each. We’ll do ETH first, since less is written here, and since it’s currently the more contrarian of the two money bets. But I’ll be getting to BTC a bit later.

Tomorrow I’ll send you an action summary as you head into the weekend.

- RSA

Quick note: Inner Circle had an incredible start—caliber of folks is off the charts—will update you tomorrow—I think you’ll want access to this resource

THURSDAY THOUGHT

Some background: i’ve written previously about ETH as a triple-point asset—a reserve currency for a non-sovereign economic network. Read my thread first to get up to speed.

ETH the reserve asset

A reserve asset is an asset held by banks. It backs the value of other assets and balances interbank transactions. Reserve assets are readily transferable and highly liquid. Sovereign-bonds, currencies, and gold are the reserve assets of central banks.

ETH is also a reserve asset.

Not yet for central banks, but for money protocols.

And the reserve asset quality of ETH provides utility to the Ethereum economy.

Here’s how Vitalik Buterin put it last week:

ETH has a lot of intrinsic utility as a reserve asset for the Ethereum ecosystem. It’s the only fully trustless asset that can be used as collateral for a lot of decentralized finance applications. It’s the natural asset to use for things like security deposits. It’s the most convenient asset to use for payments between Ethereum applications.

ETH as collateral backing. ETH for security deposits. ETH to balance transactions.

ETH providing intrinsic utility to the Ethereum economy not just for fuel or for network security, but through its value as a reserve asset.

And that makes sense.

As crazy as it sounds, reserve assets are valuable because they’re valuable. And the higher their liquidity and aggregate value the better they can serve as reserve assets.

(This is a reflexive (self-reinforcing) property by the way. A higher value ETH makes it a better reserve asset, leading to a higher value ETH, making it a better reserve asset and so on.)

For ETH value is utility.

That means ETH price is economic bandwidth.

ETH price is economic bandwidth

Think about DAI.

DAI is a synthetic asset pegged to a dollar and backed by ETH as a reserve asset—a debt note for ETH issued by the Maker money protocol. It works much the way banks used to issue bank notes backed by gold or the way dollars used to be redeemable for bullion.

Today DAI uses $316m of ETH to mint $86m of DAI.

That means 1.3% of all ETH supply is backing DAI as a reserve asset.

But let’s say the network value of ETH was 50x smaller than it is today. So $446m instead of $22b. 2016 levels. To get $86m DAI at the same collateral ratio it would take 70% of all ETH supply. DAI couldn’t feasibly grow past $100m. A boutique money—nothing world changing.

But what if the network value of ETH were 50x larger that it is today? That’s $1.1 trillion in network value with an ETH price above $10k. In that case using 30% of ETH supply at similar ratios would put DAI over $100b—the size of an entry-level global currency.

See what I mean?

The potential size of DAI is capped by the economic bandwidth of ETH.

If the price of ETH increases, the economic bandwidth available to money protocols also increases. Like dial-up internet vs fiber—only for money.

Value is utility.

ETH is the only option

That’s silly you say. Why not use other tokenized sources of value as collateral for something like DAI? Tokenized USD, real-estate, sovereign bonds, even BTC seems like a good candidate.

Pay close attention to what Vitalik said above, ETH is “the only fully trustless asset that can be used as collateral”. He’s right. ETH is the only reserve asset in Ethereum that doesn’t have a trusted dependency of some kind. It’s the only reserve asset that settles fully onchain—a digital bearer instrument.

Run through the list of alternative reserves:

- USDC: legal system settlement / trust Coinbase

- Real-Estate: legal system settlement / physical confiscation / trust the issuer

- Sovereign bonds: legal system settlement / trust the issuer

- wBTC: onchain settlement / trust BitGo

- tBTC: onchain settlement / trust Oracle / still requires ETH collateral

Now ETH:

- ETH: onchain settlement / trustless

See the difference?

Yes, there’s going to be demand for less trustless assets, no question. But if you want a purely trustless reserve asset on Ethereum—something closer to native Bitcoin and farther from a tokenized security—then ETH is irreplaceable.

It’s your only option. And it’s your best option.

Trustless reserve assets at the base

Maybe you’re skeptical that the average joe would ever prefer trustless assets if it means sacrificing some convenience. That’s fine. So am I.

But here’s something to keep in mind: a trustless asset can become trusted but the reverse is not true. You can take ETH and make it trusted by putting it in Coinbase and turning into a Coinbase-IOU, but you can’t make a Coinbase-IOU as trustless as pure ETH.

That’s why I think it’s likely that trustless and neutral assets will form the base of this parallel money system on which all the other trusted assets are built. The neutrality of TCP/IP is why the internet was adopted so broadly. It wouldn’t have happend if it was owned by Microsoft.

Why should the internet of value be any different?

The internet of value

Back to DAI. It’s not the only use for ETH as a reserve asset. Almost all of the money protocols use ETH as a reserve in some way. Uniswap uses it as a deeply liquid trading pair. Compound uses it as a dependable collateral source.

And one of the most exciting uses of ETH’s economic bandwidth is in the world of trustless synthetics—coming fast and furious right now. I wrote a tweetstorm about this last week after trying out the UMA protocol:

A trustless reserve asset coupled with a money protocol like UMA is powerful stuff. It gives anyone in the world the ability to issue, trade, lend, borrow any asset—buy TELSA exposure from an internet cafe in a small city in Central America. Or short real-estate in San Fransisco.

Global, permissionless, open.

No borders.

Does that seem bizarre?

Remember when the idea of broadcasting your own tv channel from anywhere in the world was bizarre?

The internet of value.

A store-of-value money lego

My friend David Hoffman coined the phrase money legos to describe the composability of money protocols on ETH. You snap money functions together with code to create money nouns that do the money verbs. Like lego.

And the most important money lego is the one that sits at the bottom of all this. The programmable store-of-value lego that gets snapped together with others to create trustless stablecoins, exchanges, money markets, and synthetic assets.

Without a crypto native store-of-value these money protocols wouldn’t be trustless at all. They’d have to import sources of value from legacy finance.

ETH—the reserve asset of the Ethereum Economy.

ETH—the store-of-value money lego.

A ways to go…

I’d be remiss to point out that there’s still a ways to go for ETH as a reserve asset. The synthetic examples above have problems of capital inefficiency, which can be mitigated in part by identity systems and new mechanism designs.

ETH is also highly volatile. While this is expected in the early days of an emerging commodity money, it’s a challenge for the systems built on top of it. Systems like Maker help to stabilize ETH, and I expect to see the DAI form of ETH (DAI is just stabilized ETH afterall) increase in use as a reserve asset.

Still, problems aside, if you squint you can see it. ETH as a reserve asset for ICO fundraising should have been an early clue. ETH’s use today in the DeFi protocols now makes it obvious: ETH is becoming a reserve asset before our eyes.

The path to money

Vitalik finished his statement above with this one:

So the road to the usefulness of ETH as a [money] is different than the road taken by the Bitcoin community, but it’s still...”

He was cut-off, but I think he was about to end with “still valid”.

This sounds a lot like the Tale of Two Money Systems from last week. And I think it’s true. The path for ETH as a reserve asset for the world goes something like this:

- Stage 1: ETH becomes reserve asset for Ethereum economy

- Stage 2: ETH becomes reserve asset for crypto economy

- Stage 3: ETH becomes reserve asset for world economy

We’re in stage 1-2 right now. We’ll know we’re at three when the large financial institutions and central banks start buying up ETH and ETH bonds for their balance sheets.

And it’s very possible ETH never gets to Stage 3. But there’s a chance it does. And if it ever does, it’ll be because of it’s first strength as a reserve asset for a flourishinng Ethereum economy.

ETH as a Stage 1 reserve asset may measure in the trillions.

ETH as a Stage 3 reserve asset may measure in the tens of trillions.

That’s the bet.

Actions

- Consider: how will ETH as a reserve asset play out?

Continue leveling up. $12 per month. 20% off if you subscribe before November 1.

Filling out the skill cube

By considering ETH’s path to reserve asset status you’re leveling up on the money layer of the skill cube. This is the foundational layer of the program. Study up!

BONUS

Watch Bankless Inner Circle member David Hoffman ask Vitalik and Joe Lubin if they think ETH is money…

After that 🔥question I’d become an Early Believer just to hang with folks like David in the Inner Circle. But maybe that’s just me. 😎

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.