Dear Crypto Natives,

It’s not 2017. We’re not in a bull market.

But Ethereum usage is already at all-time-highs.

(Above) Daily gas used. Every transaction on Ethereum requires gas—sending ETH, sending a token, depositing to Compound. So all-time-highs in gas means Ethereum is being used more than ever.

So why isn’t ETH price at all-time-highs too?

Remember the asset is not the network. Demand for Ethereum blockspace is not the same as demand for ETH the asset. We’re dealing with two different commodities:

- ETH the asset—a scarce commodity money with 110m units and algorithmic issuance enforced by social contract; and

- Ethereum blocks—a scarce commodity for settlement space produced by Ethereum in quantities of 6,000 units per day with each currently containing almost 10m in computation space as measured by gas.

While it’s true that Ethereum blocks must be paid in ETH (the same way U.S. taxes must be paid in USD), there are other sources of ETH demand that outweigh the relatively small demand pressure that comes from block demand (just as the bulk of demand for USD is unrelated to US taxes)—that’s why there’s a divergence.

Sources of block demand over last 30 days come from things like:

- Tokens (e.g. USDT spent $1.6m on gas)

- DeFi (e.g. dydx, kyber, IDEX, Uniswap, 0x spent >$500k gas)

- Ponzis (e.g. a Russian ponzi spent >$500k on gas)

While sources of ETH asset demand over last 30 days come from things like:

- Store-of-value speculation (e.g. buy and hold ETH as non-sovereign money)

- Collateral asset (e.g. using ETH as DAI collateral)

- Liquidity pair (e.g. using ETH trading pair in Uniswap)

- Medium-of-exchange (e.g. using ETH to pay for GU cards)

- Gas fee payment (e.g. using ETH to pay for gas fees)

Only about $200k worth of ETH per day comes from gas demand.

Ok…but are ETH price and block fees correlated?

That said, there is a strong historical correlation between the price of ETH the asset and the price of Ethereum blocks. Further, it seems we’re in a one of those rare periods where blocks fees are rising faster than ETH price.

At this point, either block fees must fall or ETH price must go up in order for this historical relationship to revert to the mean.

That’s half the reason I tweeted this today:

I’m expecting high usage of the Ethereum network to drive up the price of ETH in the medium term. That’s what’s happened historically. It’s how Ethereum’s in-game scarcity mechanics are designed—the utility of Ethereum drives the value of ETH.

But that’s just half the story

I’d take it a step further.

I expect growth in the demand of ETH not just to catch up to Ethereum blockspace demand, but to outstrip it as ETH becomes recognized as a store-of-value reserve asset in the coming years.

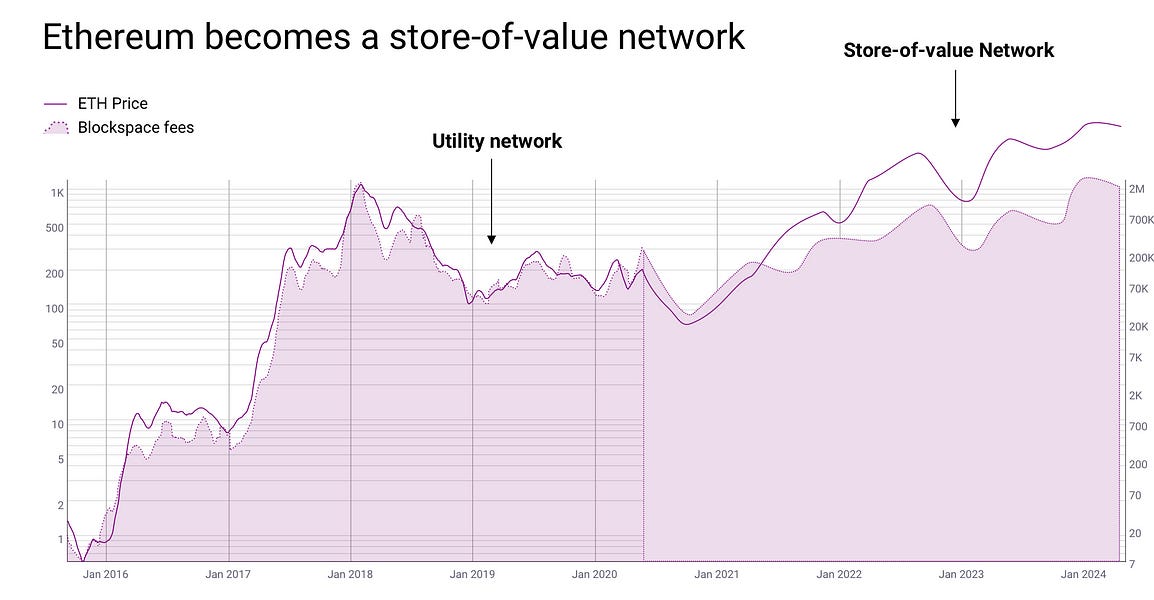

We saw Bitcoin take this path. Over the last 5 years the Bitcoin narrative changed from a utility network for peer-to-peer payments to a store-of-value network for the BTC reserve asset. You can see it in the premium of price vs blockspace fees.

We haven’t seen the same transformation play out in Ethereum, but I believe it’s on its way—ETH recognized as a commodity, ETH as economic bandwidth, ETH locked in DeFi, ETH staking released and issuance policy solidified.

Do you feel the tremors of a narrative change?

Ethereum as a utility network is the narrative of today. Ethereum as a utility network with ETH as a non-sovereign store-of-value is the narrative of tomorrow.

People who say it can’t happen remind me of the people who said Bitcoin is a fraud. (The guy who said that is now banking Coinbase btw.)

If I’m right it means ETH is doubly undervalued.

First, ETH is undervalued as a utility network.

Second, ETH is undervalued as a non-sovereign store-of-value.

Did I mention it feels like 2016 again?

- RSA