Dear Crypto Natives,

ETH FUTURES ARE HERE!

Not tomorrow. Not next month. Today.

I’m talking about regulated futures of course. And ETH is only the 2nd crypto asset to pass the Commodity Futures Trading Commission (CFTC) gauntlet and receive U.S. regulator approval.

This is a theme. It’s just ETH and BTC and nothing else is close.

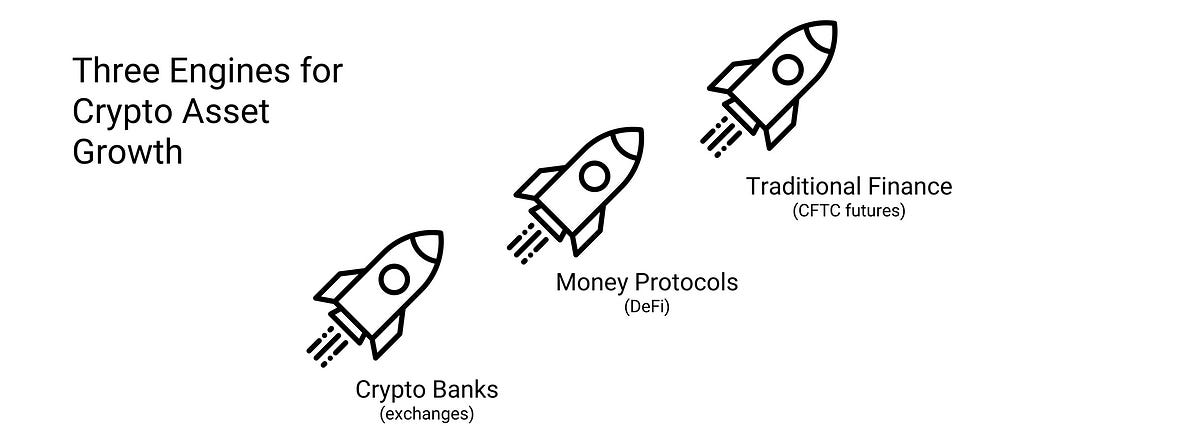

The Three Engines

People say—I wanna do something with crypto what should I buy?

I say—buy ETH and BTC then nothing till you understand what you bought.

That’s always my answer for beginners. Just two assets. ETH and BTC.

Why?

Because despite what the pumpers say nothing else is close to becoming a global commodity money. Most other crypto assets aren’t even on the path! ETH and BTC are the only crypto monies showing signs of financialization in all three financial networks—crypto banks, money protocols, and traditional finance.

Let’s look at progress in the traditional finance engine over the last few days…

Last week Paul Tudor Jones bought bitcoin futures.

This is a a big deal. This is the Harvard of hedge funds validating the bankless money system for every other hedge fund in the world. He leads, they follow.

Here’s an excerpt from his letter:

Truth in advertising, I am not a hard-money nor a crypto nut. I’m not a millennial investing in cryptocurrency, which is very popular in that generation, but a baby boomer who wants to capture the opportunity set while protecting my capital in ever-changing environments.

Wow! He’s not just validating bitcoin for hedge funds, he’s validating it for the entire baby boomer investor class—a cohort that owns nearly 60% of all wealth!

(Above) Younger generations are more likely to own crypto but less likely to have wealth

Realize how many gates bitcoin needed to be pass to get to the point where a fund manager with the reputation of PTJ would purchase it.

Bitcoin needed:

- Track-record—10 yrs of history

- Narrative—digital gold meme

- Liquidity—billions in daily liquidity

- Regulatory—CFTC approved futures markets

None of this comes fast or easy. It can’t be manufactured by VCs or marketers.

This last one—regulatory? That’s how Tudor’s Fund got its bitcoin price exposure. They didn’t purchase bitcoin on spot markets. They purchased it on CFTC regulated futures. Not possible before bitcoin futures were approved in 2017.

This is crypto being financialized in the traditional system. This is bitcoin showing us what ether is about to do.

Today ether futures launched

The first CFTC-regulated ether futures launched today on ErisX. These are physically settled, meaning actual ETH must be purchased for settlement. Though ErisX is a small exchange regulated futures are a major step for ETH and I expect CME and Bakkt to follow.

We knew ETH futures were coming. When the CFTC reaffirmed ETH as a commodity it was only a matter of time. Here’s what the CFTC chairman said in October year:

‘It is my view as Chairman of the CFTC that Ether is a commodity, and therefore it will be regulated under the CEA. And my guess is that you will see in the near future Ether-related futures contracts and other derivatives potentially traded.”

People underestimate how difficult it is to get the CFTC to make a statement like that—blessing a crypto asset as a commodity. In 2018 the SEC chair famously said, “every ICO I’ve seen is a security”. Translation: fat chance for 2017 era ICOs to become commodities. And given most newer token projects raised funds as securities from the the start it’s unclear if there’s a path for any of them to become sufficiently decentralized in the eyes of U.S. regulators to make the transition to commodity.

And without commodity status it’s next to impossible for a crypto asset to get liquidity from the traditional financial system. PTJ ain’t buying it.

BTC and ETH got through the regulatory window…and nothing else is close.

But we’re bankless! Why do we need regulated futures?

We don’t need them per se. I think crypto wins against the final boss regardless.

But liquidity is bandwidth. We’ll need trillions in value if we’re going to build an alternative money system. And we’ll get our bandwidth faster if we tap into the liquidity of old finance. Regulated futures helps with that. It gets boomers and traditional funds like PTJ on board.

Now both ETH and BTC have them.

The three engines of economic bandwidth for crypto?

✅Crypto banks

✅Money protocols

✅Traditional finance

BTC and ETH are firing on all engines…and nothing else is close.

- RSA