Crypto-fiat: Mutualistic or Parasitic?

Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

$9b in stablecoins now….🚀

The question is: are they mutualistic or parasitic to their host networks?

Nic dives into the data, considers arguments, and explores in depth in today’s piece.

I love the way Nic thinks—the analogy of Ethereum as a monetary sovereign is one of my favorite ways of looking at the system and he provides phenomenal depth here.

And here’s what I realized after reading—there’s so much more to discuss!

What if stablecoins become 10x the marketcap of native crypto assets?

What’s the role of trustless economic bandwidth?

Do all these arguments apply to Bitcoin?

So I asked Nic to come on the Bankless podcast to go in-depth. Look for that episode in early June. In the meanwhile, you can tell us what followup questions this article raised for you in the comments section. We’ll hit them in the podcast.

- RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

THURSDAY THOUGHT

Crypto-fiat: Mutualistic or Parasitic?

Post by: Nic Carter, Partner at Castle Island Ventures

Crypto-fiat has exploded in recent months. By this, I mean representations of either bank or system liabilities that circulate in tokenized IOU form on public blockchains. Or as most people know them, stablecoins. They’re quite popular these days:

Source: Coin Metrics

Generally speaking, these tokens target the return profile of sovereign-issued fiat currencies like the US dollar. They achieve this in a variety of ways. The simplest is treating the token as a bearer instrument which entitles the holder to claim an equivalent amount of electronic dollars held by the issuer. The issuer’s willingness to increase and decrease the supply in response to market forces, in conjunction with a willing set of arbitrageurs, ensures that the token generally trades at par.

The second approach involves using more volatile collateral, for instance the “native units” of public blockchains, to create crypto fiat. This is more complex and less efficient, in that more collateral is required to create one unit of crypto fiat, since it fluctuates relative to the peg. In practice parity is maintained through the combination of overcollateralization, programmatic risk management, and interest rates. The non-bank or crypto-endemic nature of the collateral is an obvious selling point. Lastly, you have a model in which a pool of capital providers assumes the role of an ersatz currency board, and is trusted to stump up funds to defend a peg in times of distress (and is rewarded with seigniorage in times of growth). (RSA note—this is DAI’s model)

The precise mechanics of crypto-fiat systems don’t particularly matter for the purpose of this article. Let’s assume that they work reasonably well and will continue to work in the future. The public blockchain that they circulate on doesn’t really matter either — these questions apply to any standard public blockchain where a native unit (BTC, Ether, etc) coexists with dollar-denominated tokens.

Recently, as crypto-fiat tokens have come to represent a larger portion of economic throughput on popular blockchains, questions have emerged as to their potential impact on the underlying systems. Some analysts refer to them as “parasitic” to the systems that they circulate on. The question is this: if crypto-fiat proves more attractive to transactors than the more volatile native unit, does this compromise the security of the system entirely? And what does it mean for the native currency unit?

To assess this question let’s briefly look at the usage characteristics of crypto-fiat. Just how big are they? And are they really displacing native cryptocurrencies?

Crypto-fiat transaction dynamics

Here I will limit the analysis to Ethereum, as it is the home of about 75 percent of outstanding tokenized dollars. Let’s start by looking at stocks.

Source: Coin Metrics

Today, crypto-fiat on Ethereum accounts for just over $7b, compared to Ether’s market cap of about $24b. A non-exhaustive sample of the largest non-stablecoin tokens on Ethereum adds up to about $10b. So Ethereum still has a “top heaviness” ratio (value of non-native tokens / value of native token) of less than 1. It’s occasionally claimed that non-native tokens exceeding the value of the native token would put a chain critically at risk; I see no reason to believe that this would be the case. However, if non-native tokens outpaced the native unit by a factor of say, 5, that might be cause for concern. I expect that top heaviness will be a long-term feature of virtually all token-bearing blockchains.

What of flows? Arguably more important is the actual economic throughput facilitated by these systems. Stablecoins still account for a relatively small (but growing) share of on-chain transactions. Transactions that result in transfers of Ether are still more popular, while other tokens have been marginalized.

Source: Coin Metrics

Arguably most important is the actual value being transacted on-chain. You can see that, despite accounting for fewer transactions, crypto-fiat has come to dominate the transactional throughput in dollar terms on Ethereum. Other ERC20 tokens are almost irrelevant. Note that there’s significant imprecision in this data, and I’m relying on the adjustments the Coin Metrics team makes to avoid self-spends, churn, and spammy behavior types.

Source: Coin Metrics

If you depict it in market share terms, you can see Tether eating into Ether’s territory. Even leaving Tether aside, other stablecoins like USDC, BUSD, and DAI account for a considerable amount of value transacted.

Source: Coin Metrics

The big spikes you see in ‘Other ERC20s’ mostly have to do with tokensales. The first big one is the Augur tokensale and that big cliff in mind-2018 is when EOS went to mainnet. Other spikes include activity relating to ZRX, Enigma, BNB, LEO, and Chainlink. However as tokensales became less popular, and lots of tokens that were merely using Ethereum as a pre-mainnet staging ground moved on to the next stage, the relative influence of ERC20s has declined, and crypto-fiat has rocketed to the fore.

By combining these charts you can infer that stablecoins are satisfying a large amount of transactional value with a relatively small monetary base. Computing a naive velocity figure (a measure of how many times a given unit ‘turns over’ in a year) confirms this.

Source: Coin Metrics

Stablecoins exhibit very high velocities when compared with native units: they are used transactionally much more than generic cryptocurrencies (Bitcoin has a similarly low velocity in the single digits). This isn’t altogether too surprising. We know that stablecoins have effectively taken over the inter-exchange settlement use case and are now treated in many parts of the world as non-bank dollar substitutes.

Lastly, it’s important to note that stablecoin transactions are quite different from Ether transactions. The latter tend to be much smaller, in the tens of dollars, whereas your typical stablecoin transaction settles thousands of dollars worth of value.

Source: Coin Metrics

The installed userbase of stablecoins is still relatively small. As of today only about 1.3m addresses across all the various stablecoins on Ethereum hold over $1 in their accounts; the equivalent figure for Ether is 12 million. So we have a smaller, but extremely engaged userbase of active transactors using stablecoins for large, frequent transactions, on a smaller monetary base. It’s worth caveating again that we can’t know for certain if these are crowding out Ether transactions or merely adding to them; but they all compete for the same blockspace, and ceteris paribus, the larger transaction should be willing to bear a higher fee.

Given that stablecoins have attained such popularity in a relatively short period, it’s not too far-fetched to imagine a world where the vast majority of transactions on Ethereum are dollar-denominated. The exchange risk for the duration of the transaction (or contract) appears to be so unpalatable as to compel transactors into using non-native assets. I don’t know whether the architects of Ethereum envisioned this possibility, but now that it appears possible it’s worth contemplating its implications.

So does the growth of crypto-fiat help or hurt the Ethereum system?

Ether-dollarization

There’s a simple feedback loop that powers cryptocurrency systems. Users find a certain type of blockspace desirable, so they acquire the native unit to transact. They also pay fees in those native units. That reservation demand (holding a native unit for a nonzero time period) is a source of buying pressure. The appreciation in the native unit in turn feeds back into security (and optionally, pools of capital like developer funds) as security is generally a function of issuance and unit price. As security and hence settlement assurances increase, the blockspace becomes more attractive. In a proof of stake world, this is simplified: security is presumed to be a function of market cap. If you can induce transactors to buy, hold, and use the native unit for long term contracts or settlement collateral, that demand should be manifested in price, making the system more secure.

Stablecoins puncture that somewhat. Not only do they potentially replace demand for the native unit as a settlement medium, they also force transactors to juggle multiple currencies—one for actual payments, the other for paying fees. Imagine sending a bank wire and being asked to honor the $10 wire fee in the form of shares of your bank’s stock. You would probably just prefer to pay the fee in dollars. (I should note that proposals exist to liquidate tokens to ETH in the background so users can transact without owning ETH.)

There are exceptions, though. Dai is collateralized by Ether on the backend, so even when employed as a transactional unit, it still manifests reservation demand for Ether. Dai has slightly compromised on this vision of liability-free collateral by introducing USDC, BAT, and Wrapped Bitcoin into the collateral mix, however. For now, the most prominent transactional medium (measured in dollar terms) on Ethereum is Tether, which is backed by dollars in a network of offshore banks. While the Dai approach is far more elegant in terms of maintaining the feedback loop of transactional demand ➡️ reservation demand ➡️ security ➡️ transactional demand, Dai accounts for a relatively small fraction of the stablecoin market. Even certain DeFi use cases that began as the exclusive purview of Dai have begun to be serviced by the more pedestrian, dollar-backed USDC. Dollar-backed stablecoins are simply cheaper to issue. While Ether-backed stablecoins promise a harmonious vision of stable transactional units while retaining the native unit as collateral, it appears that generic fiat-backed stablecoins have the upper hand for now.

Protocols as monetary sovereigns

I find it helpful to think about the problem in the context of nation-states managing their own currencies. They deal with very similar problems: how to enforce a local monopoly for their sovereign currency and ensure it holds its value. Sometimes these states fail in that task and suffer currency substitution on the part of their citizens; this is referred to as dollarization. You might say that, just as in Venezuela, the Kingdom of Ethereum is being threatened with dollarization right now. The question is whether Ethereum has the toolkit to resist this phenomenon or, at least, to de-fang it.

As the local sovereign authority, Ethereum (the protocol) endows Ether (the monetary unit) with certain privileges, the same way the US government gives the dollar privileges. Let’s briefly consider what gives the dollar its strength. It is a conjunction of both explicit privileges and emergent properties which result from systems the US guarantees and maintains.

The dollar’s explicit privileges include:

- The fact that it’s the sole currency that the Treasury will accept for tax payments

- Legal tender laws which define Federal Reserve notes effectively as a valid and legal medium in which to settle debts and pay for things

- The creation by the US government of tax liabilities, forcing businesses and individuals to acquire or retain dollars to pay taxes (if they turn a profit / make sufficient income)

- The dollar’s exemption from capital gains taxes owing to appreciation in the currency, unlike foreign currencies

There are also some emergent features which backstop the value of the dollar:

- The US government will only accept dollars in exchange for Treasury bills, widely considered the safest form of government debt

- Buying securities domiciled in the US like stocks or bonds requires dollars

- More generally, the US is the effective guarantor of the post-WWII western system of international commerce, causing the dollar to be a settlement medium for trade, both within the US and internationally

- The US maintains longstanding arrangements with countries like Saudi Arabia in which they agree to denominate the sale of oil in dollars, and in exchange receive protection and military assistance from the US

- The dollar tends to be more reliable and stable than other currencies, so it is held as a means of preserving purchasing power, even outside the US

Contrary to popular belief, there’s nothing actually stopping Americans from using another currency as a transactional medium, except for the fact that it would be really inefficient, would entail exposure to frictions like capital gains taxes, and transactors would eventually have to acquire dollars for tax purposes anyway. Zeroing in on taxation as the sole driver of the dollar’s value (as many individuals do, when posed the question), is somewhat reductive. While the US does endow the dollar with certain explicit qualities, you could say what it really does is cultivate an environment where it’s generally a good idea to hold dollars. These factors combine to create a very strong reservation demand for the dollar, both within the US and abroad.

It’s also worth mentioning that some countries impose capital controls to prevent their currencies floating on the open market. Instead, they tune the demand side of the equation by effectively prohibiting their citizens from exiting the currency for another. It goes without saying that cryptocurrencies, lacking a government or military, do not have the means to enforce anything resembling capital controls. To the contrary, they are globalized, largely frictionless, and highly portable.

How does Ethereum stack up? It’s not a nation-state and lacks the ability to directly intervene in the economy the way a government might. Moreover it’s inextricably linked to the crypto markets and cannot prevent the free flow of capital. The rise of crypto-fiat can’t exactly be impeded through capital controls. Nevertheless, Ethereum can endow Ether with certain privileges. Borrowing from these common arguments for why Ether will hold value, let’s start with Ether’s explicit privileges:

- Ether is the default unit for fee payments, and fees are mandatory in order to send a transaction

- Ether payments are ‘discounted’ relative to tokens: sending ETH requires 21,000 gas whereas tokens require 40,000+ gas

- A portion of fees paid in Ether will likely be burned (if EIP-1559 is accepted)

Ether’s emergent features are as follows:

- Ether is collateral in contracts on Ethereum and a settlement medium for intra-protocol applications (like Maker etc.)

- A significant fraction of Ether may be locked up when proof of stake emerges

- Ether is the reserve currency for token issuance on the platform (like ICOs) and more generally, as a base currency (alongside Bitcoin) for the crypto market at large

- Ether is an object of speculation; some people take a position just for the sake of it

To briefly address the less compelling arguments: ICOs appear passé and don’t seem to be returning anytime soon. While many altcoins trade against ETH, their dominant pairs are BTC and increasingly USDT. Speculation alone isn’t a sufficient source of reservation demand at equilibrium, and its presence doesn’t yield any useful analysis. And locking up coins through PoS doesn’t guarantee their appreciation—it is always possible that you have a low-velocity tranche of locked coins with transactors using the remaining non-locked Ether on a short term, as-needed basis. Consider that masternode coins like Dash weren’t spared price depreciation, even though a significant fraction of supply was inert in masternodes.

The most compelling arguments for Ether’s long term value, in my view, boil down to Ether as a necessary asset for fees, and Ethereum’s ability to keep Ether valuable is similar capacity to that of the US and the dollar. The task is to cultivate an environment where it’s generally a good idea to hold and use ETH. More specifically, Ether’s must avoid the joint foes of fee abstraction and settlement medium abstraction.

Fee abstraction

As far as fees are concerned, the Ethereum community seems firmly united against the idea of paying fees in anything other than Ether. It’s worth noting that there is no rule which actually states that a transactor must pay a miner in Ether in order to have their transaction included in a block. They could always make a payment out of band. That said, Ethereum’s protocol itself erects significant barriers to making non-ETH fee payments. Not only are Ethereans highly attuned to the threat of fee abstraction, but Ethereum’s more malleable social contract would likely accommodate a change to the protocol should fee abstraction develop. Already, it looks like EIP-1559, which makes significant alterations to fee logic on Ethereum, will be pushed through.

If you zoom out, insisting that fees be paid in Ether (and then burning them, effectively rewarding holders of Ether at the expense of validator revenue) looks to me like a straightforward form of rent extraction. Imagine an absurd scenario in which the protocol mandated that fees were a colossal 0.5 ETH per transaction. Either transactors would devise an out-of-band method to pay validators (which I would imagine is possible with some creativity, even if the protocol itself forbids it), or they would migrate to an alternative chain without this onerous tax.

While the architects of the Ethereum protocol are free to tinker with it to their pleasure, there’s always the risk that they make the chain unattractive to users. Both the effectively mandatory nature of the fee payment in Ether and then stripping of that fee from validators, and using it to reward holders instead, could discourage putative transactors from using Ethereum. An alternative chain which allowed transactors to pay fees in tokenized USD rather than forcing users to juggle multiple currencies could well use that wedge to seize market share.

Settlement medium abstraction

As with the dollar, there’s nothing which actually requires Ether to be used as the settlement medium on the Ethereum system. And this is really the system feature which is under threat. Fees appear likely to always be denominated in ETH, but fees represent a relatively small fraction of reservation demand, amounting to only 800 ETH per day at current rates. And ETH for fees can be procured on a high-velocity, just-in-time basis, minimizing their demand impact. Far more important is retaining Ether’s status as the dominant transactional medium on chain.

If crypto-fiat becomes firmly entrenched on chain, and marginalizes native units, the valuation of the native unit will suffer. Burns and staking affect the supply side of the equation—what matters is demand. However, Ethereans need not despair. While stablecoins are having their moment in the sun, and eclipsing Ether’s transactional volume for now, they are not perfect substitute goods. Fiat-backed stablecoins carry legal and regulatory baggage which could sting users at any moment. They are not liability free: they depend on an acquiescent set of banks and a benevolent issuer. Counterparty risk is always present. Some on-chain use cases will always require truly native, liability-free collateral.

Poisoned chalice?

The good news is that stablecoins seem to manifest fee pressure for Ethereum. While opinions vary, I am generally of the view that to be sustainable in the long term, as much validator compensation as possible should come in the form of fees (rather than issuance), and that a robust blockspace market is highly desirable. Fees are a form of revenue for the chain, and having revenue streams buys you significant optionality. If you look at just USDT transactions on Ethereum, you can see that periods of heavy load coincide with fee spikes.

Source: Coin Metrics

Note the big spike in Sep. 2019 which manifested in fee pressure with a lag, the trough in January as USDT transactions dropped, and fees creeping up in April as USDT picked up again. Of course there are other confounding variables, so a fuller analysis would be welcome, but copious demand for high-value transactions will always mean willing fee-payers, which is not a bad thing.

One commonly cited drawback of non-native assets on chain is their potential to introduce miner-extractable value (MEV). And if MEV opportunities from non-native tokens grow very large relative to the value of the underlying collateral securing the network, then perhaps an imbalance might develop that could be exploited. The common response is that non-native tokens are not protected solely by crypto-economic measures, but by extra-protocol legal and institutional constraints. For instance, since stablecoins can generally be frozen by their issuers, stealing USDT or USDC might just not be worth it. But then the question is: why bother settling these IOUs on chain, if settlement is in fact a function of the benevolence of the issuer? If these are just paper claims on a database ultimately maintained by a legal corporate entity, why bother with a cumbersome base-layer public blockchain at all, and not a more centralized sidechain?

Ultimately, it appears that some degree of settlement medium abstraction is currently occurring, for a straightforward economic reason—denominating medium and long-term contracts in volatile collateral is simply a sub-par experience. Ethereans should hope that either Ether-backed stablecoins become more prominent, or that custodial stablecoins suffer a series of trust failures, reminding users why liability-free native units are so powerful. The fee abstraction risk appears mitigated for now, but designers should be wary of alternatives. Excessive rent seeking and intermediation may push users towards competitors which welcome stable collateral and maintain a looser attitude to fees.

Action steps

What’s your take—will the advent of stablecoins on Ethereum be parasitic or mutualistic to Ether as an asset?

Leave a question in the comments that we should ask Nic on the podcast

Read related articles:

Author Blub

Nic Carter is one of my favorite writers and thinkers in crypto. He cofounded Coinmetrics, an onchain data resource that we use regularlyin Bankless. He was also the first crypto analyst at Fidelity and is now a Partner at VC-firm Castle Island Ventures. His writing was vital to framing how I think about Bitcoin as a value settlement network.

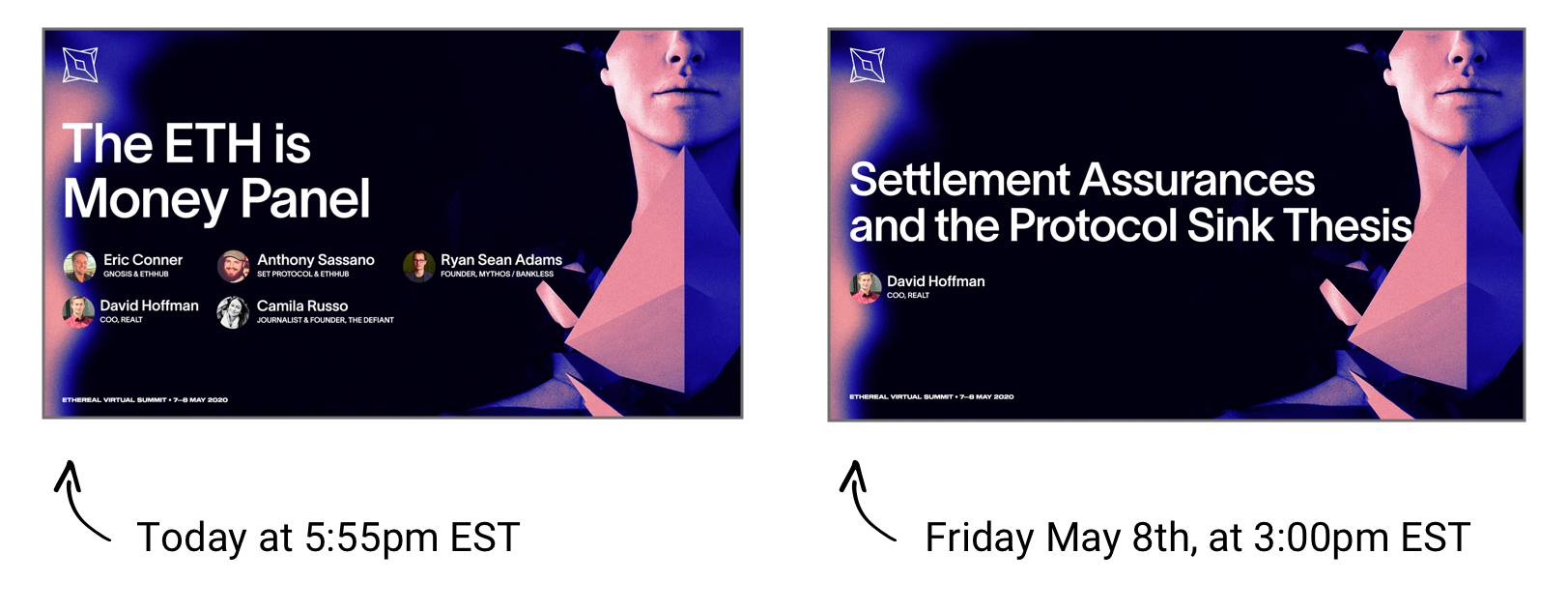

📺Watch Bankless Live at Ethereal Today and Tomorrow

Ethereal is a free virtual conference going on now. Today Ryan & David will be featured on an ETH is Money panel with Eric Conner, Camila Russo, and Anthony Sassano. Tomorrow David is giving a talk on the Protocol Sink Thesis. Don’t miss it!

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Deal Sheet.

🙏Thanks to our sponsor: Aave Protocol

Aave protocol is a decentralized, open-source, and non-custodial money market protocol to earn interest on deposits and borrow assets. It also features access to Flash Loans, an innovative DeFi building block for developers to build self liquidations, collateral swaps, and more! Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.