6 Bull Run Tax Tips for 2020

Gitcoin Grants ends this week! Last chance to give 1 Dai towards building a bankless future.

Dear Bankless Nation,

Bitcoin just crossed ATH. Ether up 370% on the year. DeFi’s yield farming summer.

I’m betting some of you that followed the Bankless program did pretty well this year. That’s the good news. But you know what it also means? It means taxes. If you’re in the U.S., Uncle Sam is knocking at the door. He wants his cut.

But your strategy for taxes should be much different in a bull run vs a bear market.

Don’t ignore taxes btw. You might think “it’s too complicated” or “no way the IRS will figure this out”. That’s probably not a good strategy.

The bankless movement is a marathon. The last thing you want to do is make costly mistakes in the first few miles of the race.

Given the bull run profits, we brought in our favorite crypto CPA to drop some knowledge on how we can all save on our tax bill this year.

Here’s how to legally minimize your tax bill in the U.S.

- RSA

P.S. Not in the U.S.? Drop tips or questions in the comments about your local jurisdiction.

🙏 Sponsor: Argent – DeFi in a tap (👈 go download this wallet now - RSA)

Watch our Meet the Nation with Harvest Finance!

Learn about this yield aggregator on Ethereum, focused on optimizing yields and returning it to liquidity providers and FARM holders!

WRITER WEDNESDAY

Guest Writer: Shehan Chandrasekera, CPA, Head of Tax Strategy at CoinTracker

6 Bull Run Tax Tips for 2020

This post discusses crypto tax saving strategies that you can take advantage of during a bull market like 2020. The strategies are listed in the order of easiest and most difficult to implement.

1. Time Your Crypto Sales

The US tax system works on a calendar year basis. Especially near the year-end (now!), you can take advantage of this cut-off period by pushing your current year tax liability to the next year.

Say you purchased 10 ETH at $100 each in the beginning of 2020. Now this position is worth $6,000 ($600*10). You might be tempted to sell this during the Nov-Dec time period. If you were to do so, you would have to pay taxes on $5,000 ($6,000 - $1,000) worth of gains when you file your 2020 taxes by April 15, 2021. However, if you were to sell this on January 1, 2021 (or any second after December 31, 2020 midnight), you will have to pay taxes on the gains after 15 months (April 15, 2022).

Just by moving the timing of your sale, you can effectively defer your taxes by 15 months!

This strategy is even more effective if your income tax bracket is going to be lower in 2021 due to change in career, personal life, or retirement.

2. Use HIFO Accounting To Reduce Crypto Taxes

Highest-In-First-Out (HIFO) accounting is a method by which you calculate capital gains by using the crypto coins which you paid the highest amount for. By doing so, you can minimize your capital gains and related taxes. In order to use this accounting method for crypto, you need to have detailed records of all of the above items set for the by the IRS. This includes:

- The date and time each unit was acquired

- Your basis and the fair market value of each unit at the time it was acquired

- The date and time each unit was sold, exchanged, or otherwise disposed of, and

- The fair market value of each unit when sold, exchanged, or disposed of, and the amount of money or the value of property received for each unit.

If you are using a reputed crypto tax software, you can choose this accounting method with just a click of a button. If you don’t satisfy all four IRS requirements, your accounting method defaults to First-In-First-Out (FIFO) which may not be very advantageous for you.

3. Harvest Tax Losses To Offset Crypto Gains

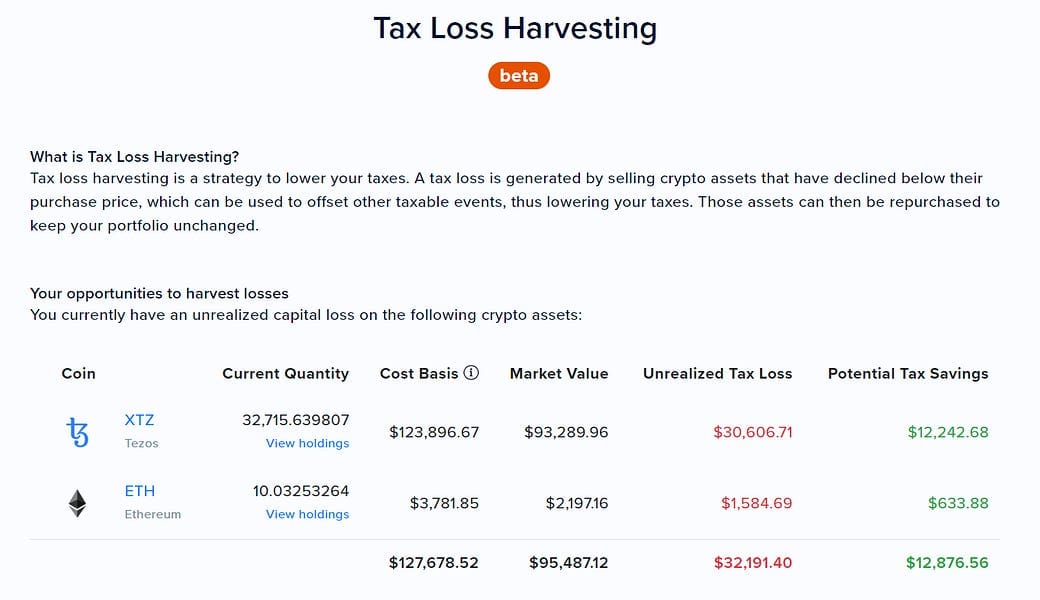

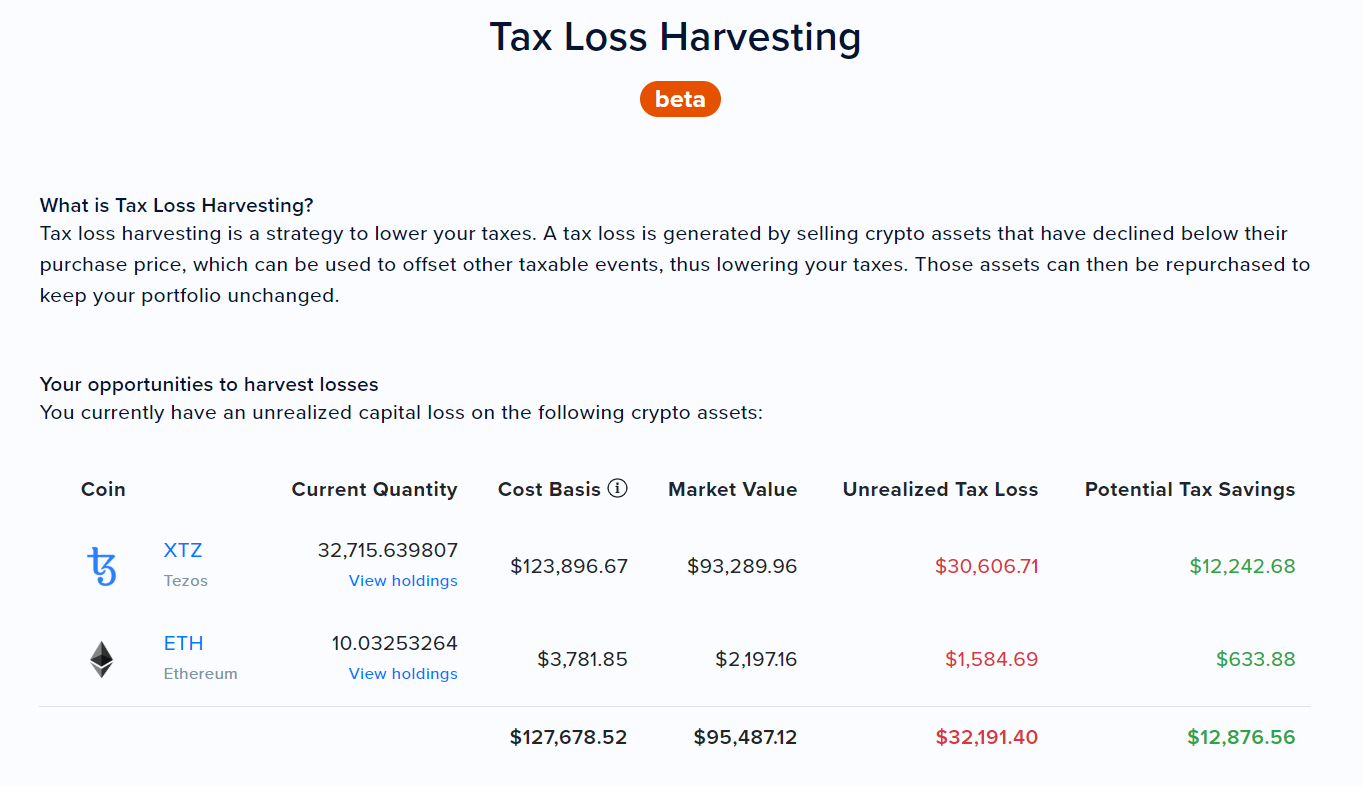

Tax loss harvesting is a strategy where you sell your losing positions to claim losses for tax purposes. Although the top 10 cryptocurrencies are nearing their all time high during the 2020 bull market, you can use this strategy on holdings where your cost basis is higher than the market value.

If you have connected all your wallets and exchanges to CoinTracker, Tax Loss Harvesting dashboard will show your holdings where you can harvest losses. When you harvest losses, that will help you reduce your capital gains from both crypto and non-crypto positions as well.

4. Donate Crypto to reduce taxes!

Donating crypto to charities is one of the handful of tax strategies allowed in the tax code that gives you two benefits at once. By donating cryptocurrency to charities:

- You get to bypass the capital gains taxes on appreciated cryptocurrency holdings.

- You get a deduction on Schedule A which will reduce your both crypto and non crypto taxable income.

Say for example, you purchased 10 ETH a few years ago for $1,000 and it’s now worth $5,000. When you directly donate this coin to a charity, you can avoid capital gains taxes on $4,000 ($5,000 - $1,000) and claim $5,000 as a deduction on Schedule A which will reduce your overall income.

Note that in order to get the full advantage of charitable deductions, you must itemize on your tax returns. If you don’t itemize, you get to bypass the capital gains taxes, but you won’t be able to get the benefit of the deduction.

5. Gifting Crypto To Family Members

Gifting cryptocurrency to your loved ones allows you to share your wealth without triggering a taxable event.

Each year, you can gift up to $15,000 worth of crypto to your spouse, children or any person of your choice without triggering a taxable event for any parties involved.

If the amount of the gift is more than $15,000, don’t panic either. There won’t be any taxes you have to pay immediately as long as it is below the lifetime gift tax exclusion of 11.58M.

However, if you gift someone more than $15,000, you will have to file IRS Form 709 to report information about the gift.

6. Move to a State with No State Taxes On Crypto

If you don’t live in a state with no income taxes (Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming) your crypto capital gains are subject to both federal income taxes and state income taxes.

For example, if you live in California and make over $500K or more, your crypto short-term capital gains are subject to 37% federal income tax rate and 12.3% California state income tax rate.

Note that this does not mean 37 cents and 12.3 cents of every dollar you make goes to the federal government and California government, respectively. The tax rates are applied to taxable income after reducing your total income by various deductions, exemptions and credits.

Nevertheless, moving to a no income tax state and selling your crypto assets while you are in that state will completely shield your gains from any state level income taxation.

If you have any questions or comments about crypto taxes let me know at @TheCryptoCPA

Disclaimer: This post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.

Action steps

Capitalize on these six tax tips for 2020 (only 15 days left!)

Read past Bankless pieces on taxes:

Author Bio

Shehan is the Head of Tax Strategy at CoinTracker, a Forbes Tax Contributor and a CPE instructor who has won various awards: 2019 CPA Practice Advisor 40 under 40 accounting professionals, Outstanding Young CPA of the year & Among 21 accountants mentioned on Accounting Today who will be helping shape (and reshape) accounting in 2020 and beyond by Accounting Today.

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Badge.

🙏Thanks to our sponsor

Argent

You were promised the future of money. Instead you got '90s banking UX and a paper password. Enough is enough. Argent protects your assets and gives you peace of mind. Earn interest and invest in a tap. No seed phrase. No problem. This is one of the best DeFi mobile wallets in the game today. Start exploring DeFi on the go with Argent. 🔥

Argent just added even more…

🔥 Yearn Vaults live! Automatically earn yield on your assets. Simply choose a Vault and amount to invest, and Yearn handles the rest.

🔥 Balancer live! Earn BAL tokens by providing liquidity.

- RSA

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.