5 Tax Tips Every DeFi Farmer Should Know

Fund the Bankless Gitcoin Grant! 1 DAI goes a long way in helping the world go Bankless.

Dear Bankless Nation,

You made money this summer yield farming.

Serious question—have you thought about your taxes?

I saw it happen to people in 2018 and 2019…the paper gains of ICO mania faded but the tax obligations on the gains from trades and airdrops remained. So tax season brought a nasty surprise forcing people to desperation to sell quality assets at bad times in order to pay the taxman.

Some of you are tempted to ignore taxes. “It’s too complicated for the tax authorities to figure out” or “It’s not like they’re paying attention” are the common refrains.

Going bankless is a marathon.

Don’t make costly mistakes in the first few miles of the race.

So here are some tips on how to report your yield farming gains to Uncle Sam written by the brilliant CPA who wrote our “How to do DeFi Taxes” article.

The do-not-miss tip was near the end—save some farming proceeds for taxes!

- RSA

P.S. Readers outside the U.S. may get better tax treatment than this—drop your country-specific knowledge in the comments!

P.P.S. Tomorrow, we’re hosting an AMA with Hugh Karp of Nexus Mutual. Listen to our podcast with him & get your questions ready! Starts at 12pm EST on YouTube.

🙏Sponsor: Zerion – Invest in DeFi from one place. 🚀 (I use this app daily - RSA)

WRITER WEDNESDAY

Guest Writer: Shehan Chandrasekera, CPA, Head of Tax Strategy at CoinTracker

What is Yield farming?

Yield farming is the process of depositing capital into a DeFi protocol to maximize interest earned. For example, users can deposit their crypto assets into a DeFi protocol like Compound to earn interest from lending along with COMP tokens, the protocol’s native governance token.

The combination of these two income streams creates an enticing, high-yielding opportunity. As of writing, users can deposit DAI (a crypto-native dollar) to earn ~2.88% APY in interest PLUS an additional 4.91% APY in COMP tokens—nearly matching the S&P500 in annualized returns via passive income.

And this is just the beginning. There are dozens of yield farming opportunities in DeFi. All of them offer extremely attractive returns, some of which reached upwards of 1,000% APY within recent weeks.

That said, with the DeFi community starting to make a lot of money from yield farming, it’s important to recognize that many of us (especially U.S. citizens) will have to pay our taxes.

Here are 5 tips on how to report your yield farming gains:

1️⃣ Yield farming Income is taxable

This one shouldn’t be too much of a surprise. At a high level, cryptocurrencies are treated as “property” by the IRS and all the general rules applicable to property apply to your crypto transactions. Every time you earn, spend, sell, or exchange a crypto asset, it’s a taxable event.

So far, all the guidance issued by the IRS (Notice 2014-21, Rev. Rule 2019-24, 45 FAQs) has been generic and does not address DeFi at all.

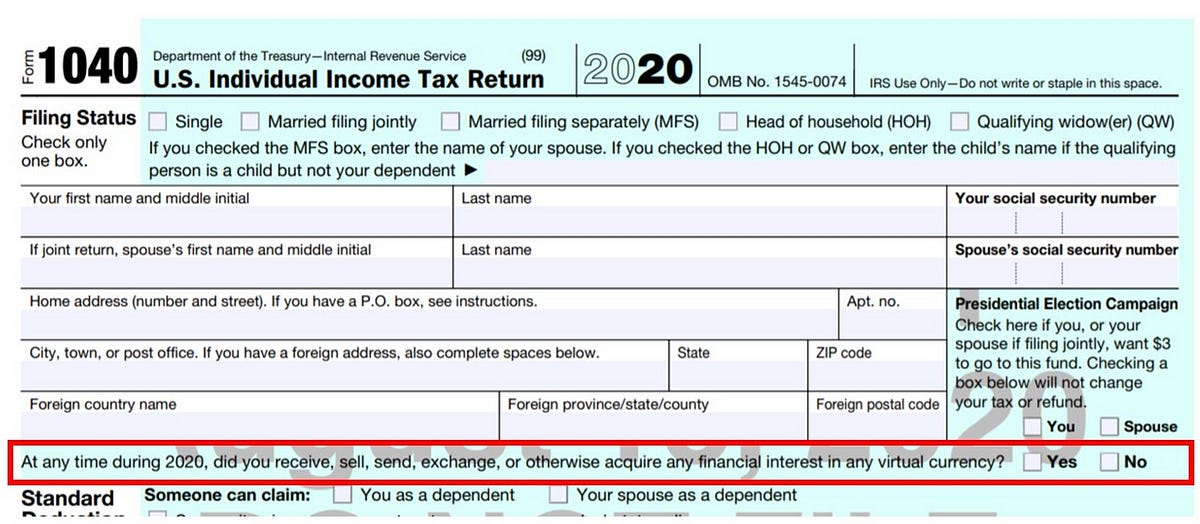

However, they won’t accept this as an excuse not to report any of your yield farming related taxes. There’s enough guidance and legacy law in place to infer tax implications of yield farming transactions. Moreover, not reporting anything is a bad decision considering the IRS’s recent actions like moving the infamous crypto question to the front and center of the tax form and sending a 2nd round of crypto tax warning letters.

(Above—hmmm…can you spot the new question the IRS added to the Form1040?)

According to these rules, every time you earn interest on your locked collateral or receive a governance token, you have to report ordinary income equivalent to the market value at the time of receipt. For example, suppose you received 400 UNI tokens for being an early user of Uniswap. At the time you claimed these tokens, 1 UNI was worth $3. In this case, you have to report $1,200 ($3 * 400) as ordinary income on Schedule 1, “Other income line”.

This becomes your cost basis.

Suppose you later sold the 400 UNI for $5,000. Here you would report $3,800 ($5,000 - $1,200) of capital gains.

Follow Up Question ❓

RSA: You mentioned that yield farm proceeds become revenue when they are claimed not necessarily when they accrue. Since a user generally determines when to claim the farmed tokens, is it advantageous to claim tokens you intend to hold when prices are low?

Correct.

People had questions specifically regarding $UNI tokens. It was released at a certain price but at the time people were able to claim it, the price was higher (people had to claim it later because of network congestion).

In that specific scenario, you have to report income equivalent to the market value at the time you claim it. In other words, the IRS wants you to report income when you get control over the asset.

With that said, people can not leave a token somewhere and claim later intentionally to defer taxes. The $UNI situation was out of their control.

💡Consider when you claim tokens—a regular rhythm (eg. weekly) is most defensible

2️⃣ Holding gets your a better tax rate

If you keep these tokens for more than 12 months before selling, you would be subject to more favorable long term capital gains taxes (15% for most taxpayers). If you sell them within 12 months of receipt, gains will be considered short-term capital gains.

Short-term capital gains are subject to less favorable ordinary income taxes which vary with your income level.

Keep the governance token at least 12 months to get a better tax rate!

Follow up Questions ❓

RSA: Is selling a farmed token for another crypto asset is a taxable event?

That’s correct—selling your farming gains for another crypto asset is a taxable event. Like-kind exchange treatment isn’t applicable to crypto.

RSA: How about when you stake a token into a farm? Is that a taxable event?

When you put tokens into a staking pool, that’s not a taxable event. However, staking rewards are taxable.

3️⃣ Gas fees have tax benefits

Gas fees have recently skyrocketed due to the popularity of yield farming. Luckily, you could get a tax benefit for these expenses.

Gas fees on sales and dispositions are deducted from proceeds. For example, if you sell 1 ETH for $100 and spend $5 for gas, your total proceeds on the transaction would be $95 ($100 – $5).

Gas fees on transfers could be added back to the basis of the token. Suppose you purchase 1 ETH at $10 on Coinbase. In order to transfer this token to Metamask, you have to incur a $2 gas fee. Once the transfer is complete, the cost basis of your 1 ETH on Metamask will be $12 ($10 + $2).

When you up the cost basis, the eventual capital gains will decrease.

💡Keep track of your gas fees—they can be subtracted from your taxable gains!

4️⃣ Set aside funds for taxes now

If you are a whale, you should be closely working with a crypto savvy CPA to analyze your tax obligation for each quarter. Once you run this analysis, you would know exactly how much taxes you have to pay for each quarter.

If you are a hobbyist investor and can’t afford a CPA, the best practice would be to convert at least 20% of your crypto-to-crypto gains into a stablecoin or USD. This way you have enough funds to pay your taxes at year-end.

💡Set aside 20% of your crypto-to-crypto farming gains for taxes!

5️⃣ Use tax software

As you can see, tracking basis, gas fees, market value, and applying the proper tax treatment manually on a spreadsheet is virtually impossible especially when dealing with yield farming.

Tools like CoinTracker can help you track your portfolio and calculate your DeFi and yield farming taxes. You should use them!

💡Get 10% off Cointracker if you’re a Bankless member (other options here)

If you have any further questions, reach out to me at @TheCryptoCPA or @CoinTracker.

Disclaimer: this post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.

Action steps

Create a plan for your yield farming taxes!!

Try out tools like CryptoTracker to calculate your taxes (10% off w/ link)

Read our previous tax pieces:

Author Bio

Shehan is the Head of Tax Strategy at CoinTracker, a Forbes Tax Contributor and a CPE instructor who has won various awards: 2019 CPA Practice Advisor 40 under 40 accounting professionals, Outstanding Young CPA of the year & Among 21 accountants mentioned on Accounting Today who will be helping shape (and reshape) accounting in 2020 and beyond by Accounting Today.

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Badge.

🙏Thanks to our sponsor

Zerion

Zerion is the easiest way to manage your DeFi portfolio. Explore market trends, invest in 170+ tokens, view returns across wallets and see your full transaction history on one sleek interface. They’re also fully bankless, which means they don’t own your private keys and can’t ever access your funds. I use this app daily! Start exploring DeFi with Zerion on web, iOS or Android. 🔥

- RSA

P.S. Don’t forget to get check out Zerion’s new Uniswap integration. 🦄

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.