Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

Remember when I said we’re beta testing a new financial system for the world?

Well, turns out we’re also beta testing tax codes.

Recently I tweeted this:

The perfect candidate emerged. Shehan is a CPA and tax guy at CoinTracker—he understands DeFi and articulates positional advice. He’s written several great articles recently like How the IRS knows you own crypto and 3 Crypto Tax Pitfalls to Avoid.

Positional advice is key. Because that’s what we’re forced to do as DeFi users—we have to take tax positions on new financial constructs the IRS doesn’t understand or doesn’t know exists, and mostly both.

And that’s my best advice on how to sort out your DeFi taxes: get a crypto tax tool, deploy tactics to optimize (like this), and file positions you can reasonably justify. Cause IRS guidance is massively lacking right now and could change any time.

For my many readers outside the US—I know this is IRS centric content today. Some of it may apply, some of it will not. It’s likely your jurisdiction is less stringent and opaque, so I’m hopeful you can take this and dial it back to easily met the requirements of your own jurisdiction.

So here’s answers to the top 10 questions you had about DeFi taxes.

Read carefully. There could be be a few hundred maybe even a few thousand dollars worth of savings for you here.

Let’s level up!

-RSA

TACTICS TUESDAY:

Tactic #24: How to do DeFi taxes

Guest post: Shehan Chandrasekera, CPA, Head of Tax Strategy at CoinTracker

I asked you to send me your big hairy DeFi taxes questions. These were the top 10. Today one of my favorite crypto tax guys goes through them one-by-one, sometimes enumerating more than one position for a transaction. More than anything else, I want you to learn how to take justifiable positions on crypto transactions in the face of unclear guidance. Use these as examples: staking, stablecoins, snythetix—let’s dive in.

- Goal: Learn how to take positions on tricky DeFi transactions

- Skill: Intermediate

- Effort: 1 hour

- ROI: 1-10% per year when you avoid unnecessary taxes & optimize tax strategy

Questions from Bankless community / Answers from Shehan

Disclaimer: this post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.

Ethereum & Staking

Q: Is converting ETH to WETH a taxable event?

A: Most likely, not. The intention behind converting ETH to WETH is to enable ETH to be directly traded with other ERC20 tokens. ETH and WETH prices are almost identical. There is no capital gain or loss because there is no disposition (permanent withdrawal of the property from the user) of ETH.

Q: Is spending ETH on gas a taxable event?

Yes. When you spend ETH on gas, you are disposing of a “property” to cover a fee. If there is a difference between how much you paid for the ETH (Cost basis) and the FMV at the time you pay for gas fees, there is a capital gain or loss.

Q: If I deposit ETH into a staking contract does it trigger a taxable event such that I’d need to claim capital gains?

A: Depositing ETH into a staking contract is not a taxable event. Generally, a taxable event occurs when you dispose (i.e, a permanent withdrawal of the property from the user) of ETH. Depositing ETH into a staking contract is not qualified as a disposition because you can get it back. So, there is no taxes involved with this event.

Q: Will upgrading my ETH from Eth1 to Eth2 trigger a crypto-to-crypto trade such that I’d need to claim capital gains taxes at that time on gains or losses? Is the ETH 2 token a new asset?

A: Migration from Eth1 to Eth2 could be treated as a token swap which is non-taxable, similar to the token swap of Sai to Dai. This is highly likely assuming all ETH 1 tokens are replaced by ETH 2 at a 1-to-1 ratio. This position assumes that after the migration you only have access to Eth2 ETH and Eth1 ETH is no longer valid.

Stablecoins

Q: Is converting Chai to Dai a taxable event?

A: Chai is an ERC-20 token that lets you earn interest on Dai without requiring it to be locked in the Maker Dai Savings Contract.

- Position 1: Cryptocurrencies are treated as property per IRS Notice 2014-21. In tax terms, the conversion of Dai to Chai could be interpreted as disposing of one property and gaining access to another. So, If there is a slight difference between the price of Chai and Dai, the difference may be taxed as a capital gain or loss.

- Position 2: Chai & Dai are stable coins. They are intended to work as traditional money. IRS has not come up with any direct guidance related to stable coins. Since there is no direct guidance and Chai & Dai do not work as speculative assets, one could argue that the small price deferral at conversion should not be taxed as capital gain or loss, whatsoever. For example, if you earned $100 last month and spend that money next month on something, there is probably a slight fluctuation of the value of that 100 dollar bill due to inflation or deflation. You are not picking up any gain or loss in this case because you are not holding the 100 dollar bill as a speculative asset.

- Position 3: Treat the Dai to Chai as a deposit into the Dai Savings Rate with no tax event. Probably not as preferable to taxpayer as disposing Dai for Chai as in Position 1 would cause a capital loss.

In all positions the interest earnings in Chai may be treated as either interest income or rental income.

Note: The above positions could also apply to other stablecoins exchanges such as Dai to USDC or GUSD to USDT.

Liquidity Pools

Q: Say you add liquidity to Uniswap—how is this taxed?

A: Let’s address each component of this transaction separately.

Adding liquidity to Uniswap:

- Position 1: not taxable. You are not disposing of your property; you are only depositing a pair of tokens. Uniswap token you receive is a mere representation of your original deposit ratio; it is not a new property.

- Position 2: taxable. It could be argued that you are selling your original deposit and receiving a new property, Uniswap token. Crypto to crypto trades are taxable (A15).

Earning Fees on Uniswap:

- There’s a 0.3% transfer fee that Uniswap charges to the swapper that is then split among all the liquidity providers in that specific pool based on how much of the pool they’re offering. If we apply the staking rules, these fees can be either taxed as interest income or rental income as you earn them.

Trading (or swapping) on Uniswap:

- Crypto to crypto exchanges are taxable. (A15). Your gain or loss is the difference between the FMV of the property you received and your cost basis in the virtual currency exchanged.

Changes in liquidity ratio:

- Every time your original deposit ratio changes, it means you either have gained access or lost access to one side of your pair. It could be argued that you are selling one side of the pair in exchange for the other side of the pair. (crypto to crypto exchange). Therefore, every time the ratio changes, a taxable event occurs. However, this will be virtually impossible to track because the ratio changes very frequently. One alternative is to tax when you remove your deposit. See below.

Removing liquidity:

- If changes in the original deposit ratio isn’t taxed real time as mentioned above, an alternative approach is to tax when you take out your position from the pool. This is more of a mark-to-market approach. For example, you can compare the cost basis of ETH at the time you entered them into the liquidity pool vs the FMV when you retrieve them. The difference can be taxed as capital gains or losses.

Sets

Q: Are Sets taxed like an ETF?

If two tokens are bundled in a token and held are the trades inside taxable?

A: In the traditional finance world, when you trade ETFs, they are taxed similar to stocks. According to the SEC, “ETFs are a type of exchange-traded investment product that must register with the SEC under the 1940 Act as either an open-end investment company (generally known as “funds”) or a unit investment trust”. Since none of the sets are registered with the SEC, they are not technically ETFs although they function similar to ETFs.

So yes, it is reasonable to think that when you trade sets, taxation is similar to selling the underlying asset. I.e. it will result in capital gains and losses.

DeFi interest & payments

Q: Are DeFi rewards interest deductible? (Is it interest or merely capital gains?)

Since the IRC definition of interest income does not include anything that even closely resembles DeFi platforms, and traditional interest income is derived from lending “money” per Deputy v. Du Pont, 308 U.S. 488 (1940) as opposed to property, it could be argued that DeFi interest is not interest income for tax purposes.

DeFi Interest may be classified as rental income for tax purposes. According to Reg § 1.61-8, “gross income includes rentals received or accrued for the occupancy of real estate or the use of personal property”. Personal property is any property that is not real property like land and building. Since cryptocurrencies are treated as “property”, rewards you receive from DeFi platforms look more like rental income.

(RSA: I asked Shehan what’s the benefit of rental income vs interest income? He said rental income can be offset against rental expenses whereas you cannot deduct expenses against regular interest. Rental expenses could include cost of maintaining a node, interest expenses on a Maker loan 💪or it could be used to offset rental losses coming from real estate)

Q: If you stream someone tokens with Sablier at what point does the taxable event occur for each party?

A: Let’s address this for payee and payer separately.

For payee—a taxable event occurs when you receive tokens in exchange for the product or service you provided to the payor. (Based on the way the guidance is written, this would mean recognizing this every block, e.g. every 15 sec. but this won't be possible without an automated tool so it’s reasonable to sum it up daily.) The amount to be recognized on your taxes is the fair market value of the tokens at the time of the receipt (A8 - A12). If there is no liquidity or determinable market value, “the fair market value of the cryptocurrency received is equal to the fair market value of the property or services exchanged for the cryptocurrency when the transaction occurs” (A27)

For payer—capital gain or loss event occurs when you pay tokens to the payee (A13). Also, If the payer is a business, it gets a deduction equivalent to the FMV of the tokens streamed to each employee or contractor. This would be categorized as wages or contractor expenses on the books and tax return. Payers may also be subject to 1099-K and/or 1099-Misc reporting.

Synthetix burns

Q: When you burn sUSD on Synthetix to fix your collateralization ratio, is that considered an increase in your cost basis across for all the underlying SNX that you hold & future SNX/sUSD you claim? What’s a good tool to track this?

A: Distribution cost basis would be a reasonable approach. I don't know any tool that can track this. (RSA—the tools will catch up eventually!)

Action steps

- Determine: which positions will you take for your tricky DeFi transactions?

- Consider crypto tax software to help (10% off from CoinTracker or see here)

Author Blub

Shehan is one of the handful of CPAs in the country who is recognized as a real-world operator and a conceptual subject matter expert on cryptocurrency taxation. He is the Head of Tax Strategy at CoinTracker, a Forbes Tax Contributor and a CPE instructor who has won various awards: 2019 CPA Practice Advisor 40 under 40 accounting professionals, Outstanding Young CPA of the year & Among 21 accountants mentioned on Accounting Today who will be helping shape (and reshape) accounting in 2020 and beyond by Accounting Today.

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Deal Sheet

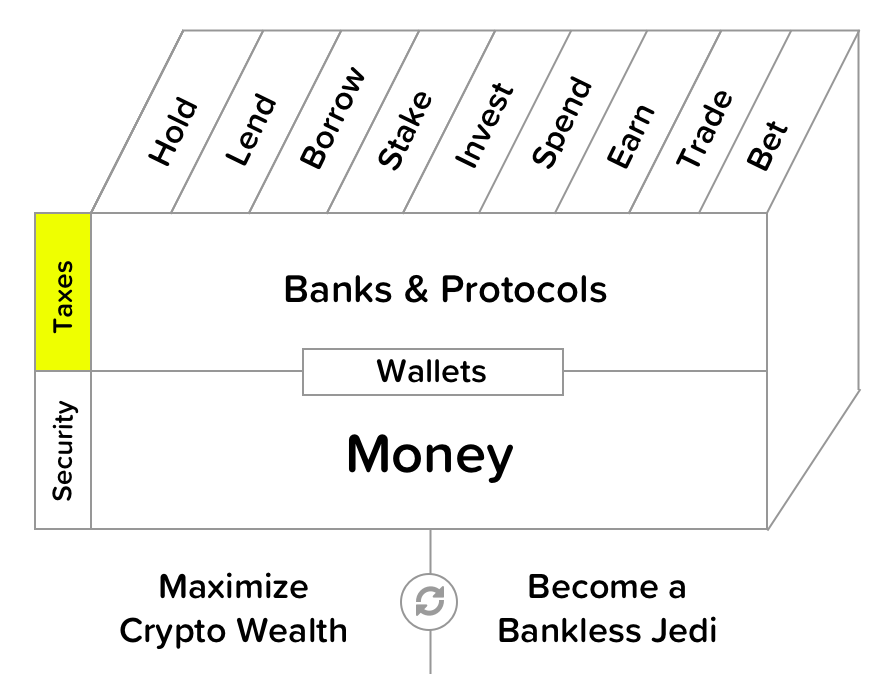

Filling out the skill cube

This week you leveled up on Taxes in the skill cube—great job. Tax optimization will help you max crypto wealth & become a Bankless Jedi. Keep leveling up!

👉Send a tip for today’s issue (rsa.eth)

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.