How to record your crypto for taxes

Level up your open finance game three times a week. I’m releasing this Free for Everyone until November 1. Get the Bankless program by subscribing below.

Dear Crypto Natives,

It’s Tactics Tuesday! Every Tuesday we focus on one tactic to help you level up.

Today we’ll learn how to setup a tax recording system for your crypto transactions. Of course this is not tax advice—I’m not a tax advisor or CPA. But I think the detail here is just as necessary. It’s exactly the sort of information I wish I had when first starting in crypto.

No matter your jurisdiction or tax position I think you’ll gain something here.

- RSA

P.S. I’ve included an awesome deal on my favorite crypto tax tool for you—don’t miss it!

TACTICS TUESDAY:

Tactic #4: How to record for your crypto taxes

If you live in a jurisdiction that taxes gains and losses on crypto you need a system for recording crypto taxes. And the more bankless you become the less you can rely on crypto banks to generate tax reports for you. You’ll want your own tools. In this tactic we’ll cover how to setup a system for recording your crypto taxes.

- Goal: Setup a tax recording system for your crypto transactions

- Skill: Intermediate

- Effort: 2 hours initially plus 1 hour per month

- ROI: Good tax recording can easily save you thousands—possibly much more

Who’s this written for?

If most of what you’re doing right now is paycheck dollar-cost averaging into crypto using something like Coinbase then a crypto tax system is overkill. Just skip this tactic—you can use the reports your exchange generates to calculate taxes.

If you’re asking “does Coinbase report to IRS?” this isn’t the post for you, either.

But if you’re opening Sets, buying DAI with ETH, using decentralized exchanges, borrowing against CDPs, trading across multiple crypto exchanges, lending BTC with BlockFi, staking assets—if you’re going down the bankless path—a crypto tax system is an essential tool to get you organized.

A crypto tax system?

The purpose of a crypto tax system is to track and record your crypto transactions for tax purposes. A good system makes tax recording easier, it helps you understand your current positions, and to implement tactics that minimize your taxes.

A few years ago there weren’t many systems available for this.

Today we have:

- Blox

- CoinTracking ( 👈my tool of choice)

- CoinTracker (heard good things)

- Cryptkit (features for funds)

- CoinLedger (good international support)

- Kaunto

- GildedFinance (more accounting)

- Google Spreadsheet (i mean it’s free)

- InterChange (more for businesses)

- Node40

- Rotki (open source)

- SoftLedger (more for business/accounting)

- TokenTax (heard good things)

- VeriLedger (more bookkeeping)

- ZenLedger

And I know I’ve missed some because new ones emerge every week.

Now, to be clear I haven’t used all of these. So I can’t tell you which is best. And I’m guessing best is relative anyway—it depends on your needs. So instead I’m going to share a general approach that can be applied across many of these. And I’ll also apply them to the tool I use to give you the easy button.

Here’s what we’re going to do:

- Select a crypto tax system

- Create a schedule for importing transactions

- Categorize transaction types

- Evaluate gains & losses

There’s more to cover of course. But this is the place to start.

1. Select a crypto tax system

I recommend a crypto tax system as part of the Bankless program. Not a once a year tool but something that’s continuously updated and reviewed, multi-year tax planning.

Some things I looked for when selecting a tax system:

- Ease of importing transactions (automated import from exchanges & chains)

- Ability to manually enter/edit transactions (can’t be too rigid)

- Ability to track each entry by category (e.g. Income/Trade/Mined/Spend/Gift)

- Accurate & automated calculation of cost basis (using external crypto prices)

- Ability to export tax reports (for accountant or tax prep software)

- Reporting on current gains/losses (for tax strategy management)

- Basic portfolio management tools (to see prices and positions at a glance)

- Security & 2-factor authentication (including option to sign up pseudonymously)

- Support for my jurisdiction (United States—IRS codes)

- Ability to export logs (to avoid platform lock-in)

- Web version and mobile version (apps for both)

You’ll have your own criteria. And I encourage you to try a few systems to see what you like. Many have free versions or trials.

What did I end up with?

The Easy Button

I use CoinTracking as the easy button for this. I’ve been using it for years and recommending it to others. I think it’s easy enough for people just getting started and sophisticated enough to scale for the pros. And anyone can start with a free version.

Special offer—10% off CoinTracking 🔥🔥🔥

With my referral code you’ll get 10% off the purchase of CoinTracking for any package. They’ll also give a portion to support Bankless. The Pro package probably suits most—it automates imports & gives more transactions. I did Lifetime licensing but that’s not suited for most.

Click here to signup & get 10% off CoinTracking Pro or Unlimited (you can pay in crypto)

2. Creating a schedule for importing transactions

The heart of your crypto tax system is the transaction log. If you get this right everything becomes easier.

You’ll need to import transactions from two places:

- Exchanges and Crypto Banks (ie. Coinbase and BlockFi)

- Public blockchains (ie. Bitcoin and Ethereum)

Most crypto tax systems provide two ways to import:

- Manual—import .csv or .xls transaction logs

- Automatic—via exchange APIs or pulls by wallet address

Both options are good. Manual provides flexibility. Automatic saves time.

(Note: in CoinTracking manual import is free but automatic requires a paid version)

Remember to get the following data imported:

- Any buys/sells/trades on exchanges (exchange logs)

- Any mining/staking/interest revenue

- Any purchases made with crypto

- Any spending of crypto on transaction fees

- Any gift or donation of crypto

And this is vital—make sure you get the timestamps correct on all imports. These systems use timestamps combined with external pricing data to calculate the cost basis of your crypto at the time of transaction. Having an accurate cost basis for each asset in the system is crucial for calculating accurate gains & losses.

Example: If you receive 1 ETH at 12:30pm EST on September 24th then your cost basis for that 1 ETH is $192 USD—if you mixed this up and logged it as 12:30am then your cost basis for that 1 ETH would be logged as $201—big difference.

If you’re doing manual imports I recommend an initial import follow by monthly or quarterly frequency. If automatic, still make time to review the imports on a regular basis. Schedule it to remember.

BONUS TAX TIP

Hate recording crypto transactions? You don’t need to record them for the portion of crypto you tax-shelter in an IRA. Good thing you already leveled up on this.

3. Categorize transaction types

Next you’ll want to make sure the transactions you import are categorized correctly for proper tax treatment. The basic transaction categories in CoinTracking go like this:

- Trades: Fiat-to-crypto trades and crypto-to-crypto trades

(incur capital gains/losses on each trade in the U.S.) - Income: Someone paid you in crypto—includes income from lending

(taxed as ordinary income in the U.S.) - Mining/Staking: Crypto received from mining or staking—same as income

(taxed as ordinary income in the U.S. ) - Spend: Crypto spent on a good or service—includes spending on transaction fees

(incur capital gains/losses on the spent crypto in the U.S.) - Gift: Crypto you gave—same as spent (maybe deductible if to registered charity)

(incur capital gains/losses on the spent crypto in the U.S.)

A few notes:

- Moving crypto from a wallet you own to another you own is not generally a taxable event—you don’t have to record this

- Exchanging DAI for ETH is a tax event—and to be conservative it doesn’t hurt to record the cost basis on stablecoins like DAI too and report gains/losses

- Airdrops and forks are their own topics you should have a position on

- Wrapping ETH or BTC in an ERC20 contract (e.g. converting ETH to WETH) is not generally considered a taxable event

- Opening a CDP—that’s your call on how to treat—get advice from a CPA

Above all keeping good logs and consistency of treatment will go a long way toward justifying your positions. Absent clarity, act in good faith. In all likelihood, having a solid crypto tax system means you’ll have better records than your local tax authorities.

4. Evaluate gains & losses

Aside from staying on the right side of tax authorities the reason for doing all this is to minimize the taxes you pay. With the transactions logged, you can now more easily see realized & unrealized gains and losses in your crypto money portfolio.

With such information you can:

- Know exactly when your gains become long-term gains to time your sells

(in U.S. long-term capital gains are taxed at a lower rate than short-term capital gains) - Sell a losing asset to reduce your tax obligations

(turn some unrealized loses into realized losses by selling a losing asset to offset gains) - A variation on the above: sell a losing asset by exchanging it for a similarly correlated asset so as not to lose the upside position yet still realize the loss

It’s really endless. Once you have such a system in place, there are many tax optimization opportunities to capitalize on. But you don’t have to do them all at once. The goal here is to build out your crypto tax system so you have an organized process for leveling up. That’s the thing to focus on first.

⭕️Live discussion: what tax tools do you use?

I just kicked off a live discussion in the Inner Circle about tax tools and tactics. If you’re an Early Believer join the discussion now on Discord. If you’re not—subscribe!

Final words

Setting up a crypto tax system is a way to increase your crypto wealth and level up. You don’t have to do it right away—but any work here becomes more valuable the more bankless you become.

Picking the right tax tool is key. Getting your transactions imported is the foundation. Make sure you categorize transactions correctly. Once you stand up your system, you can begin reviewing your gains and losses on a regular basis and start implementing tax optimization tactics.

Don’t forget to run your system by a CPA—most of the crypto tax tools can help you find a crypto friendly CPA if you don’t have one.

Action steps

- Select a crypto tax system (you can try most systems free—I like Cointracking)

- Create a schedule for importing your transactions & categorize them well

- Review realized & unrealized gains/losses on a monthly or quarterly basis

Continue leveling up. $12 per month. 20% off before Nov 1 plus Inner Circle access.

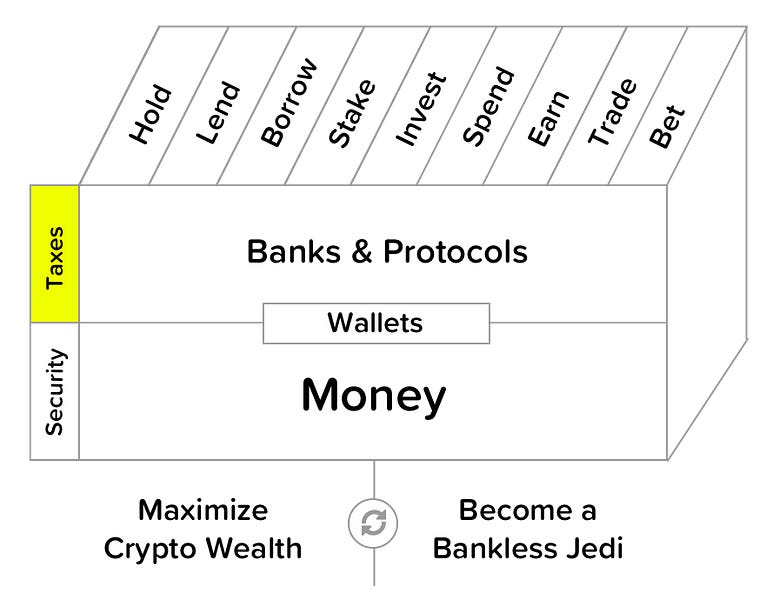

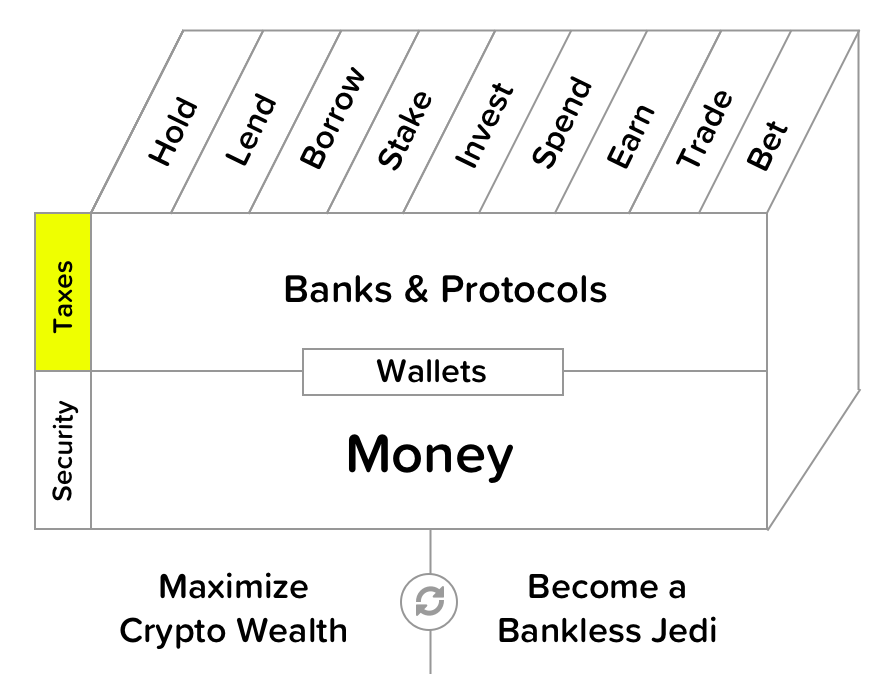

Filling out the skill cube

This week you leveled up on Taxes in the skill cube! A crypto tax system will help you maximize your crypto wealth & become a Bankless Jedi. Subscribe to keep leveling up!

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.