How DAI gets to $300B

Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

How does DAI get to $300B?

There’s a lot loaded in that question.

Every $1 in DAI must be backed by more than $1 in assets.

But should DAI remain mostly backed by trustless assets? Away from the grasp of third-parties and settled on Ethereum—maybe that’s the point of crypto.

Or should DAI open the door to trusted assets? Increasing resilience with non-correlated assets from traditional finance—maybe that’s how to onboard the world.

It’s clear Maker is going in the direction of the latter. But it’s also clear that someone (maybe Maker?) will reclaim the the former.

There’s a fork in the road for DeFi but we get to choose both paths.

Here’s the thing—until now there hasn’t been a good set of tokenized assets for Maker to consume. But a few projects are starting to change that.

Centrifuge is one that launched this week. They’re taking revenue streams from digital music and supply chain, tokenizing them, and adding them to DeFi. They see Maker as a global credit system for the world. They see DeFi as a force for traditional asset democratization—the future of FinTech—a new backend for global finance.

Banked assets using bankless protocols? We’ve written about this before.

This is the second path for DeFi.

Let’s explore.

- RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

WRITERS CORNER

Post by: Jason Jones, commercial lead at Centrifuge and huge Bankless fan

Decentralizing the global credit system

Contrary to public opinion, a securitization is one of the greatest inventions in modern financial history. A securitization requires the coordination of a large number of parties to package and sell pools of loans. When structured properly, it is an incredibly efficient way to distribute vast sums of capital to deserving recipients. It optimizes risk and reward for different types of investors and it provides efficient access to capital to large and small businesses on a global basis.

The securitization market is moving onto the blockchain with companies like Provenance, Cadence, and Centrifuge (my project) leading the way.

- Provenance is taking the private chain approach by using a forked version of Hyperledger to coordinate with traditional financial players to complete large, rated securitizations while eliminating costly intermediaries.

- Cadence is democratizing securitizations by offering smaller sized pools to retail accredited investors by issuing tokenized borrower payment dependent notes on Ethereum. (RSA note—great article on Cadence here)

- Centrifuge is building a securitization Money Lego for the DeFi community starting with a MakerDAO adapter.

There are three macro factors that make the timing perfect to move the entire securitization market onto the blockchain.

Factor #1: The Blockchain Can Democratize Access

The current securitization market issues over $1 trillion a year globally but is only open to institutional investors. The average deal size is often around $750m-$1 billion and the buyers are typically pension funds, insurance companies, sovereign wealth funds, and credit funds. The deals are so large because it is structurally expensive, but by using the blockchain we can cut costs, reduce deal sizes, and widen the audience of Asset Originators and Investors. Provenance offers these same players the opportunity to use their lower cost infrastructure to complete similar transactions. Cadence is opening this market to smaller sized investors and asset originators. Tinlake is bridging this market to DeFi.

Factor #2: The Blockchain provides Transparency

For most regular folk, if they have ever heard about the securitization market it is because of its systematic meltdown in 2008 and the subsequent movie The Big Short, which did a great job of spotlighting how things got out of hand. The blockchain can help with data normalization and transparency, can help with information sharing and transaction privacy, can set systemic rules, and can align incentives of market participants.

Factor #3: Fintech Has Already Primed the Market

P2P lending is a pre-cursor to decentralized lending. In 2013 Eaglewood created the first fintech securitization by pooling $53m in Lending Club loans. SoFi completed their first securitization in 2014 and since then has securitized over $20 billion in student loans. It took several years for the banks, auditors, administrators, trust companies, valuation firms, and credit rating agencies to accept marketplace lending as a legitimate channel for asset origination. There was a high level of doubt, mistrust, and unwillingness to accept change. But over the past few years fintech has become one of the leading drivers of growth and that stigma has almost completely faded. This market has been primed and is open to experimentation.

Maker Decentralizes the Buy Side of Global Credit

MakerDAO could be compared to a bank that offers:

- a decentralized line of credit,

- a DAO that must form a decentralized lending operation, and;

- a stablecoin that needs a diverse set of uncorrelated assets.

Let’s break that down.

Decentralized Line of Credit

When a borrower locks their token into a Maker Vault, Maker provides a revolving line of credit that includes a debt ceiling (credit line) and stability fee (interest rate). This is very similar to when a bank issues a borrower a credit card or warehouse line.

Decentralized Lending Operation

MakerDAO has an open call to Domain Teams to onboard into their system. I recently helped to make the case that Maker should focus on risk, marketing and compliance teams to scale the system globally. These teams will screen MIP6 collateral applications similar to how banks review loan applications. Maker can take some cues from the fintech community that has focused on UX and AI driven automated decisioning. The trick for MakerDAO will be how to get the approval process down to minutes or seconds from months. The right Domain Teams will know just what to do.

A Stablecoin of Uncorrelated Assets

The total market cap of the crypto ecosystem is about $250 billion and the correlation of the top 20 largest cryptoassets (ex-stablecoins) is highly correlated averaging around 0.57 (on a -1 to +1 scale), so let’s treat cryptoassets as one asset class. For concentration risk purposes, let’s say we don’t want more than 10% of any asset’s market cap locked into Maker Vaults and we don’t want any asset to represent more than 25% of the entire Collateral Asset universe. That means that the total Dai circulation backed by cryptoassets could be $25 billion today. If the cryptomarket triples, then the total Dai circulation backed by cryptoassets could rise to $75 billion.

If crypto Dai is 25% of the entire Collateral Asset universe, then real world assets will make up the balance equal to $225 billion of Dai. Multi Collateral Dai makes this possible. Three large categories will be:

- hard assets like gold and real estate,

- currencies (most likely in the form of fiat-backed stablecoins), and

- public and private credit securitizations.

Since these markets are all in the trillions, collectively, they can fill the $225 billion gap. At $300b in Dai circulation, Dai will be considered a legitimate emerging global currency.

Centrifuge Decentralizes the Sell Side of the Global Credit

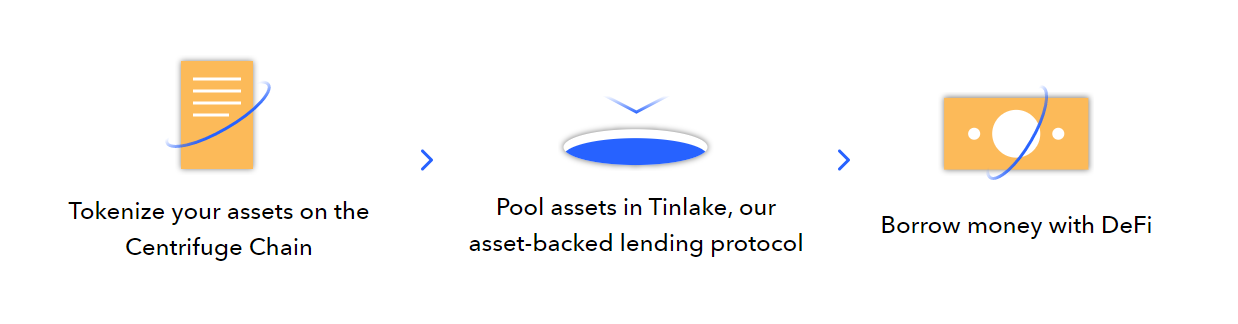

Centrifuge sits on the sellside. Similar to how an investment bank facilitates a new issuance, Centrifuge helps asset originators to bridge their assets to DeFi. Asset originators can tokenize on the Centrifuge Chain, pool on Tinlake, and then borrow from MakerDAO and other DeFi protocols in the future.

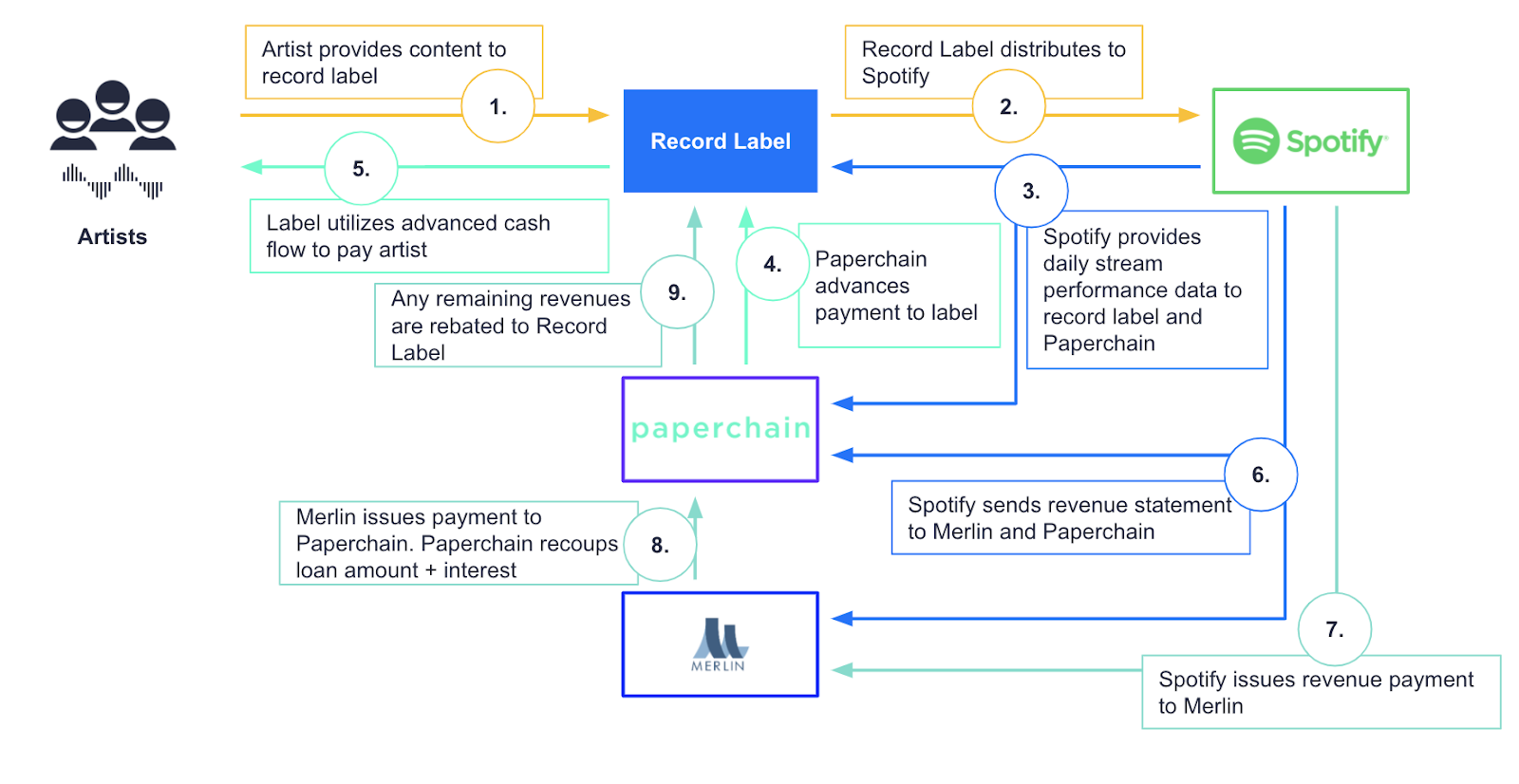

One of our first deployments is with Paperchain, which is an Asset Originator that has submitted a collateral onboarding proposal with MakerDAO. Paperchain allows musicians to get paid faster for their streamed music. In this scenario, the Musician/Record Label is the Supplier and Spotify/Merlin is the Buyer. Paperchain advances money to Supplier today and collects from Buyer in 60 days when the invoice payment is due. Here is a overview of the process:

Every month Paperchain will tokenize additional invoices on Centrifuge, add more collateral to their Maker Vault, and access more Dai to lend to musicians from their revolving line of credit.

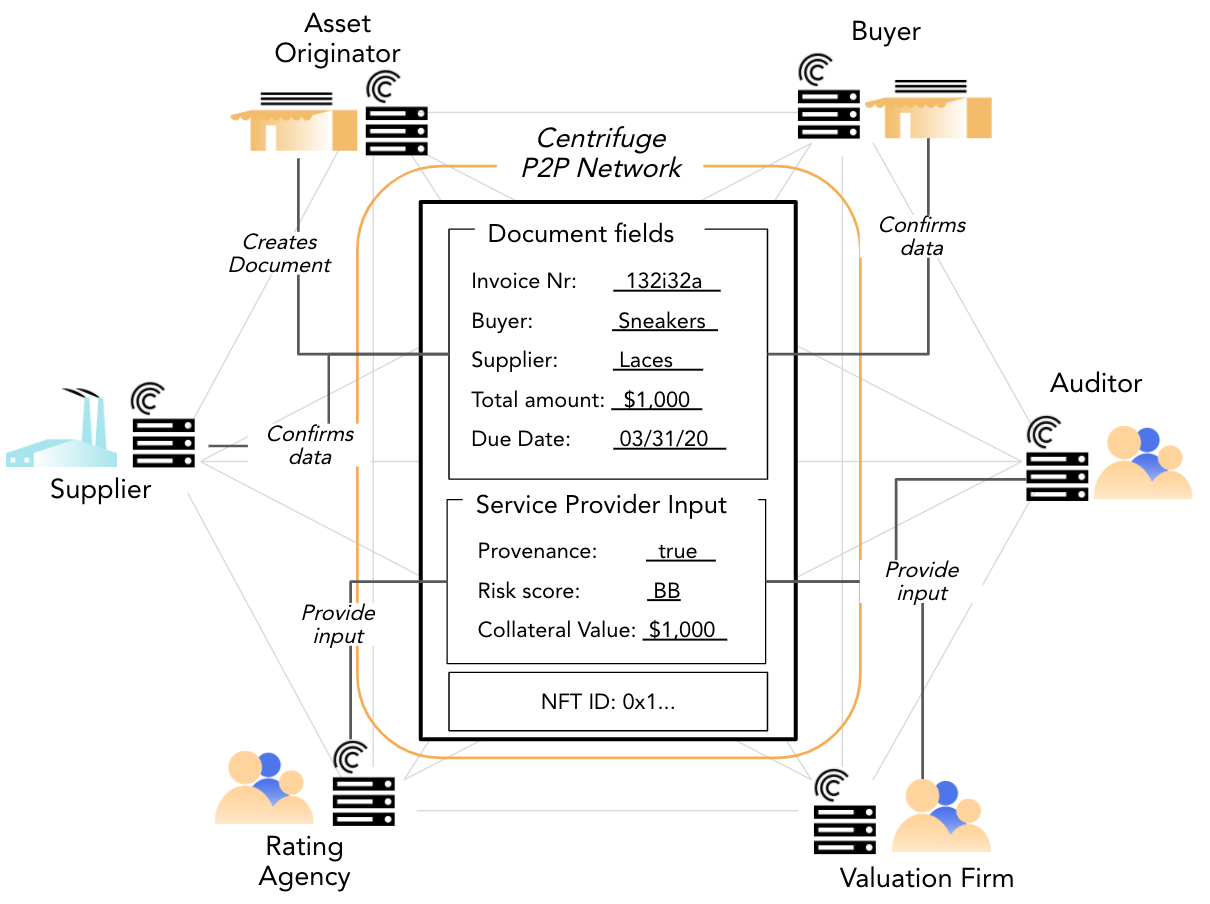

It gets more interesting once we open the process to more than just the Asset Originator and Investor. As I mentioned upfront, a securitization requires the coordination of a large number of parties to package and sell pools of loans. Centrifuge’s protocol is a system of coordination for all parties in a securitization to package and sell a pool of loans.

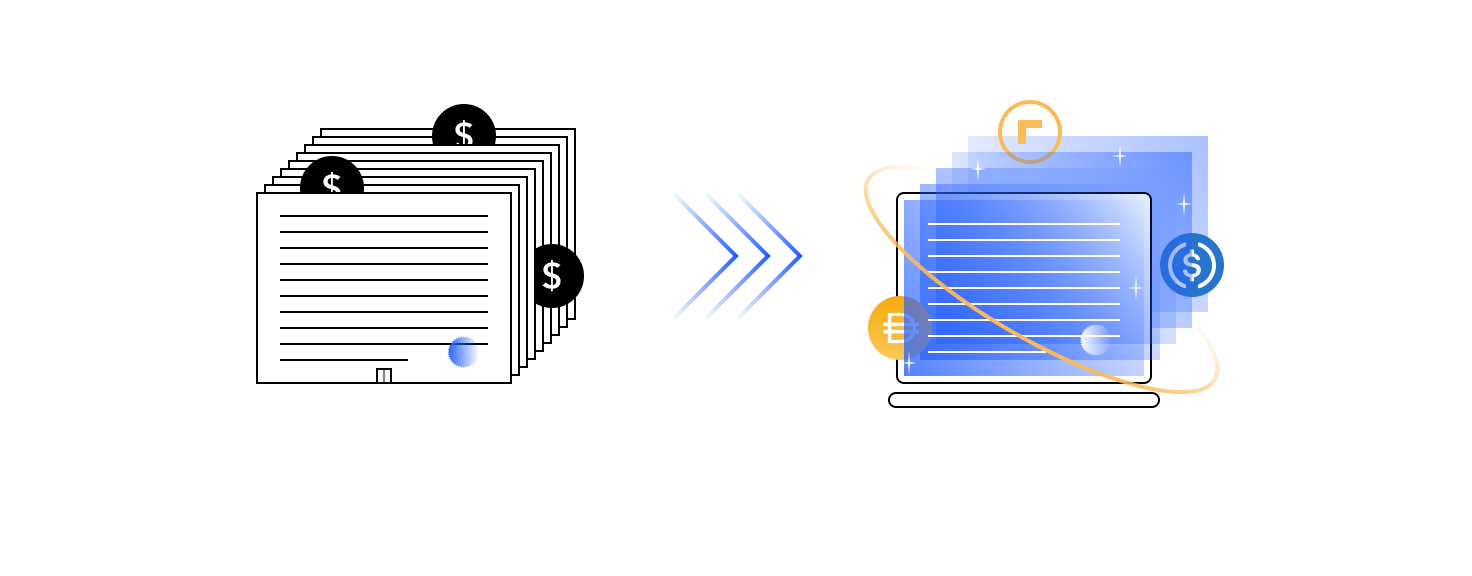

As you can see in the illustration below, Asset Originators can add Service Providers as collaborators to a document. In this case the Asset Originator has added an Auditor, a Valuation Firm, a Ratings Agency, and the Buyer as collaborators. All of the collaborators are connected through nodes in the Centrifuge P2P network.

Now, when the Asset Originator uses the Centrifuge Chain to mint their NFT, they have a document that is a verifiable, transferable, digital representation of the document.

Build Open Finance to Instill Trust

I would like to wrap up with a quick discussion about the concept of Trustlessness. There are only a few things in this world that are actually trustless… gravity, taxes, a mother’s love for her baby. These things are beyond trust, they are facts. Everything else is on a spectrum. I love the idea of a “Purity” Dai backed only by trustless assets that are decentralized and settled on-chain. As a community I think we are trending in the right direction as we approach trustlessness. But the trustless Purity Dai market it too small to satisfy the needs of stablecoin market. We will run out of collateral assets, heighten the stability risk of Dai, and will limit the circulation of Dai. MakerDAO has made the right decision to focus on Global Dai.

So as we bridge real world assets into Defi, let’s continue to strive for trustlessness but let’s also focus on the higher goal, which is to grow Dai into a globally accepted digital currency that can be used by anyone, anywhere, anytime. We can build an open and transparent system on-chain even though real-world asset will still settle in local legal jurisdictions. And some day we will reach the point where code truly will become law and settlement can move on chain making us one step closer to a trustless asset.

Author bio

Jason Jones is commercial lead at Centrifuge & a huge Bankless fan. Check his full bio here.

Action steps

- Recap—how can Maker can be used as a global credit system?

- How much of DeFi’s growth will come from tokenized traditional assets?

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Deal Sheet.

🙏Thanks to our sponsor

Aave

Aave is an open source and non-custodial protocol for money market creation. Originally launched with the Aave Market, it now supports Uniswap and TokenSet markets and enables users and developers to earn interest and leverage their assets. Aave also pioneered Flash Loans, an innovative DeFi building block for developers to build self-liquidations, collateral swaps, and more. Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.