How to make money on Synthetix

Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

If we solve a couple of the outstanding problems I’m convinced synthetic assets backed by crypto monies are absolutely world changing. In particular, synthetics based on Ethereum are a big reason to be bullish on ETH. DAI is a synthetic.

One of the most interesting projects in synthetic assets right now is Sythetix. Their platform grew from $1m to $90m in locked value over the last nine months. They move fast and take a pragmatic approach to just about everything—if Maker is DeFi’s version of Coinbase then maybe Sythetix is DeFi’s version of Binance.

Their SNX token is particularly interesting. A bank bet entitling its holders to a share of usage fees, but also used as a collateral to back the system itself, just as ETH is used to back DAI. Self-referential yes, but also a clever way to bootstrap the system?

Today’s tactic will teach you the basics of the Sythetix system including how to make money by using it—both as a beginner and as a power user. I asked Bankless member Fiskantes to write this one. He writes far better on Sythetix than I could.

Ready to level up on Sythetix? Let’s go!

- RSA

TACTICS TUESDAY:

Tactic #10:

How to make money on Synthetix

Guest post by: Fiskantes of Sigil Fund

Get access to decentralized derivatives, provide liquidity for derivatives exchange and bet on price of gold, stocks or indices on Synthetix.io. Learn what are synthetic assets, how to use them, mint them, and assess the risks involved.

- Goal: Learn how to stake SNX and use synthetic assets

- Skill: Advanced

- Effort: 2 - 3 hours

- ROI: Expected positive, but with high risk

Please be aware that we are dealing with early stage crypto technology, which is very risky. You can lose your funds playing with it. Nothing written here should be taken as an investment advice and you should only use the amount of money you can comfortably lose.

What are Synths?

Synths, or synthetic assets, are derivatives similar to CFDs. Buying them lets you participate on price movements of underlying assets without needing to hold the underlying assets—there is no delivery of the underlying asset. Almost any asset can be mirrored as a synth—cryptocurrency, token, commodity, stock, indice, or fiat.

Synthetix uses price oracles to feed prices of assets into its smart contacts to mirror the price of underlying assets.

Examples of synths

sXAU - By buying synthetic gold (sXAU), you participate on the price change of gold (price of sXAU mirrors market price of 1 gold ounce), but you of course do not have access to any physical gold and there is no real gold backing sXAU token anywhere. It's yet another way to buy tokenized gold, bankless way.

sUSD - synthetic USD (sUSD) that mirrors the price of USD. Apart from DAI, synthetic fiat currencies are one of the few decentralized stablecoins backed by crypto collateral. Staking SNX and minting sUSD is similar to opening a CDP.

iBTC - reverse synths, with symbol “i”, are used for getting short exposure. iBTC means bitcoin short position - e.g. if you hold 1 iBTC, you are short 1 BTC and when price of BTC goes down, “price” of iBTC goes up).

sCEX - this synth represents an indexed basket of assets, in this case a basket of exchange tokens such as BNB, LEO, Huobi Token, OKex token and Kucoin Shares. Buying this synthetic asset gives you exposure to the whole segment of crypto exchange tokens. It's essentially a “bank bet”, as outlined in crypto money portfolio.

sAAPL - Even stock indices and individual stocks (in this case Apple stock - AAPL) can become synthetic assets.

Uses Cases

Derivatives are huge part of legacy financial system and synths are their bankless version. What are they actually being used for?

- Long and short speculation - you can bet on rise (long) or decline (short) in the prices of multiple crypto assets. Do you believe that BTC will go up, but you don't want to leave the comfort of decentralized Ethereum ecosystem? Just buy sBTC! Are you convinced TRX (Tron) is over-priced and dump is imminent? Buy iTRX. Just note that, there are some restrictions (profit / loss cap) for inverse (short) synths.

- Stablecoins - DAI is by far the most used decentralized stablecoin, but synth fiat currencies can be an interesting alternative. Apart from sUSD, you can use sGBP, and sEUR.

- Hedging - biggest use case of derivatives, apart from speculation, is hedging - insuring against price of an asset failing. Imagine an ETH 2.0 staker, who has ETH tokens locked in staking, but expects price drop. He can simply open leveraged iETH position on SNX and when the price drops, he will cover his loss on staked ETH with profit from shorting.

- Index investing - Some investors don't want to pick individual projects to invest in, and rather want to bet on the whole segment or industry, such as betting on centralized exchange tokens, via the sCEX synth we covered earlier.

- Stocks and commodities - Being able to long and short gold, silver and stocks without leaving Ethereum ecosystem. All synths are tokenized, so they can be utilized within the whole DeFi ecosystem.

- Leveraged trading - trading derivatives on margin let's use leverage (borrowed money) to get bigger position with smaller capital. However, it's very risky and recommended only to very experienced traders. Currently it's not possibly, but leverage is on project roadmap.

Parts of the Synthetix engine

- Synthetix exchange - Native DEX, where you can buy or sell various synths. Its flat trading fees of 0.3% per trade is distributed among SNX stakers. There is no order book, since trades are settling directly with the smart contract (Peer-To-Contract) in the whole synth liquidity pool.

- Mintr- app used by stakers and minters who provide liquidity for synths and earn rewards.

- Dashboard - monitor metrics from Synthetix ecosystem.

Since Synths are tokenized they can be used in the Ethereum ecosystem outside of the Synthetix exchange. Synths are a money lego. They can be composed into clever use cases, dDAI for example, allows you to lend DAI, and earn interest in synthetic gold. Synths can be traded on exchanges like Uniswap and used as medium of exchange.

What is the SNX Asset?

If you trade on an exchange, you may win or lose, based on your luck and skill. But there is one player who always wins - the exchange. Exchanges are one of the most profitable businesses in crypto. No matter where the market is going, they will get their fees, they just need volume. Holding and staking SNX tokens is similar to holding equity in a centralized exchange—you get your piece of the fees, generated by trading on the exchange. But we are in the money protocol world, so Synthetix can take this idea further—not everyone holding SNX have claim to trading fees. Only those who put their SNX tokens at work by staking them, minting synths, and taking care of their collateral ratio have the right to claim fees and rewards from newly created SNX tokens.

This makes SNX a new kind of programmable asset, one that incentivizes behavior of key players, i.e. stakers, to help the network grow. It serves the Synthetix ecosystem as revenue sharing asset and collateral needed to mint and cover Synths. SNX collateral ratio needs to be over 750%. Which means that for every 7.5 USD worth of staked SNX tokens, stakers can mint 1 USD worth of synthetic assets. This is much higher than MakerDAOs 150%. But MakerDAO is using ETH as collateral, which is less volatile and risky. SNX holders also hold voting rights for Synthetix Improvement Proposals (SIPs). One of the proposals actually aims to introduce ETH as collateral to SNX ecosystem as well.

Holding and staking SNX is basically an investment into the success of Synthetix project. It has significant risks (like any crypto investment) but can lead to nice profit.

If you want to dig deeper into Synthetix from professional investor's perspective, you can read my research.

How to make money on Synthetix?

Here we will focus on practical, actionable steps. Everyone can start staking SNX with negligible amount of money first, without risking too much.

Basic User—Alice

Meet bankless investor Alice - Alice wants to profit from trading fees and SNX rewards by providing liquidity on Synthetix. She doesn't have much time, so she does it the easy way. If you are like Alice, follow her steps. (For more detailed guide, read here).

1. Buy SNX for ETH on Uniswap (or alternatively on centralized exchange Kucoin).

2. Go to Mintr Dapp and connect Metamask, or hardware wallets Ledger or Trezor.

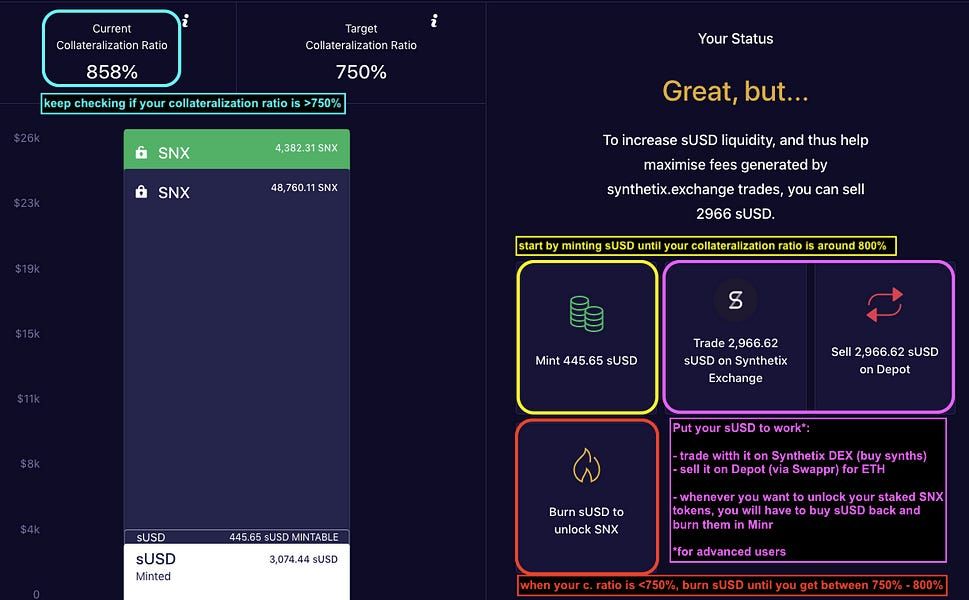

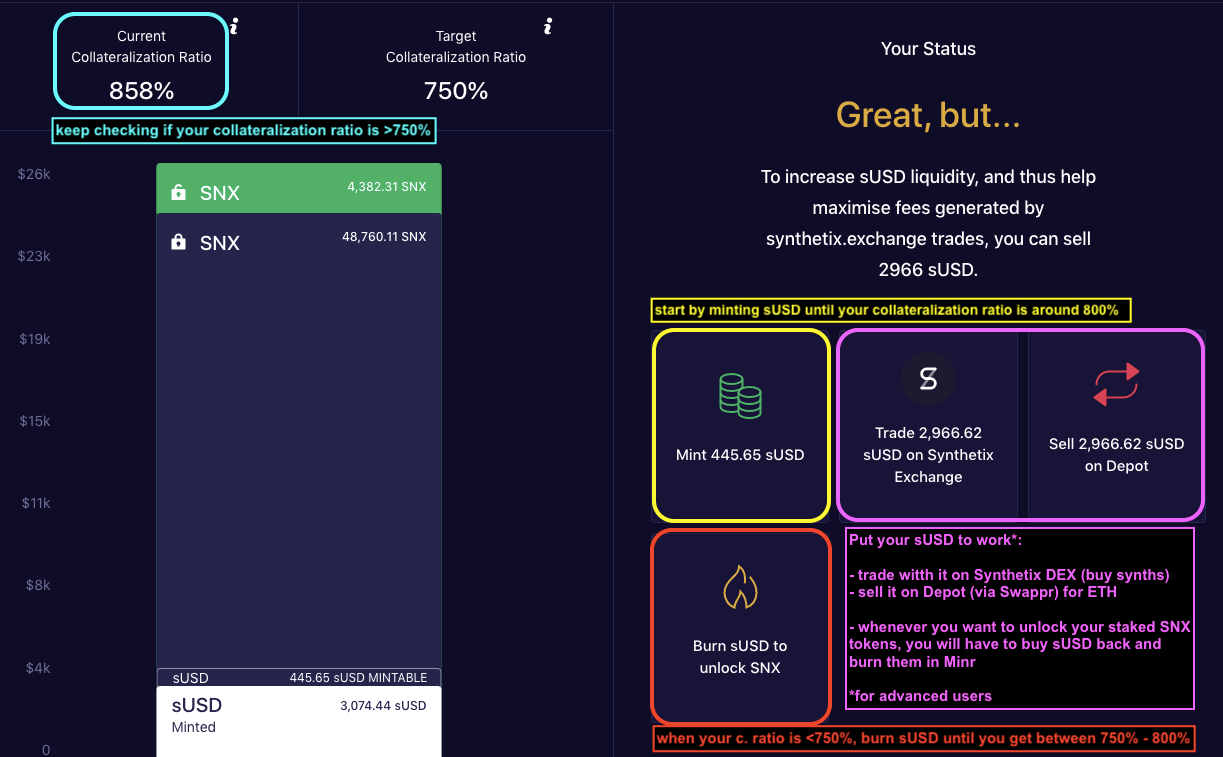

3. In Mintr, mint recommended amount of sUSD. You will automatically lock up SNX tokens as a collateral.

4. Every two weeks, you can claim rewards, which consist of newly minted SNX tokens and trading fees nominated in sUSD.

5. Monitor the collateralization ratio between 750% - 800%. When price of SNX tokens goes up, your collateralization ratio increases, and vice versa. When the collateralization drops below 750%, you lose your claims to rewards. So mint or burn sUSD, to maintain the ratio between 750% and 800%.

This is your Mintr dapp - all synth minting is done here.

Now if you’re like Alice, you can end here—just watch your collateral, claim rewards and live happily ever after. But Alice is not using Synthetix to full extend.

Power User—Bob

Meet bankless trader Bob. Bob is not busy like Alice, and wants to use Synthetix to it's full potential. Bob mints sUSD and claims rewards, but he doesn't end there. To be like Bob, follow his steps

6. Take your sUSD from Mintr and sell them for other synths, getting price exposure to crypto assets, indices or commodities. In the future, you will maybe be able to directly short the bankers the bankless way - via inverse synth stock index.

7. Sell sUSD for sETH and earn market neutral profit by providing liquidity between ETH and sETH on Uniswap - currently the deepest Uniswap pool.

8. When you want to exit the system, you need to buy back the sUSD needed to unlock SNX rewards and initial stake. After your burn them in Mintr your SNX is unlocked.*

*Claimed SNX rewards will be seen in your Mintr Dapp, but you can unlock them only 12 months after claiming. This restriction is aimed to prevent early stakers from selling substantial amount of rewards at the same time, crashing the price and putting the peg and collateral of Synthetix at risk.

How to trade on Synthetix exchange

If you do not want to provide collateral and liquidity for Synthetix, but want to trade synths, it's similar to any other DEX:

- Go to Synthetix exchange and connect your Ethereum address (Metamask or hardware wallet).

- Buy sUSD for ETH (alternatively buy sUSD or sETH on Uniswap).

- Now you can start trading synths from the growing selection of trading pairs offered on Synthetix DEX.

Final Thoughts

Synthetic derivatives are a great expansion of decentralized, bankless ecosystem, allowing us to participate on price moves of different underlying assets without living Ethereum permissionless ecosystem. However, holding synths doesn't mean we are holding the underlying asset. Synths only work thanks to SNX stakers, who mint synths and provide SNX tokens as collateral, in exchange for SNX inflation rewards and trading fees. Holding and staking SNX is bet on success of Synthetix derivatives platform.

This is advanced stuff—both staking SNX and trading synths carries high risk and should be tried only after careful research and only with capital you are willing to lose. For experienced bankless users, Synthetix can provide additional profits and potentially a way to speculate on commodities and stocks, hedge against price moves or use alternative stablecoins.

Addendum on Risks

Based on the feedback from our vigilant Bankless community, we would like to expand on potential risks of staking SNX tokens:

1. Peg related risk: Currently, Synthetix is a bit self-referential. SNX is used as collateral, but the value of SNX is largely derived from the success and utility of the Synthetix network itself. It's a bit similar to a chicken and egg problem.

The price of synths is derived from the price of their underlying assets, but (like DAI), they do not always hold their peg. And with connection to risk of SNX collateral can lead to de-pegging of all assets.

This article by TheBlock expands on peg related risk, and Synthetix team wrote a balanced response to it.

2. Debt fluctuation: SNX stakers provide collateral for the whole system, and share the debt of the system, which needs to be repaid. That can lead to a situation when, before unlocking SNX collateral, staker will need to repay their proportion of the overall debt first. Debt rising is especially dangerous to those stakers, who only mint and hold sUSD, if the price of ETH and BTC will shoot up. Because the network of SNX stakers pools and shares the debt of all synths If sBTC and sETH value rises, sUSD minters debt also rises. This mechanics is best explained here.

Many other risks are covered in this research.

To end on a positive note, Synthetix also has exciting news. Team shipped Rigil Release, including many SIPs as well as Mintr v2.0 beta, improving on UX. Synthetix truly is a “Binance of DeFi”, moving fast and constantly shipping. This makes writing guides and analyses for it really hard, it just keeps changing :). Luckily, here is a new user guide created by Synthetix community members for Mintr v2.0.

Action steps

- Buy small amount of SNX on Uniswap and mint sUSD in Mintr

- Consider: are you comfortable with SNX volatility and risks as a bank bet?

- Consider buying sXAU on Synthetix Exchange—an alternative to tokenized gold

- (Bonus) Subscribe to this weekly Sythetics report from Bankless member Caleb

Author Blub

Author's Bio: Fiskantes is an Investment Director of Sigil Fund private hedge fund, investing in digital assets, crypto money and decentralized networks. Sigil is relying on deep fundamental research and only investing in assets, which are already battle-tested on mainnet and listed on exchanges—no pre-sales, no SAFTs, no whitepaper phase ICOs. Author also co-founded Crypkit—digital assets tracking and accounting toolkit for crypto companies.

Subscribe to the Bankless program. $12 per mo. Includes Inner Circle & Deal Sheet.

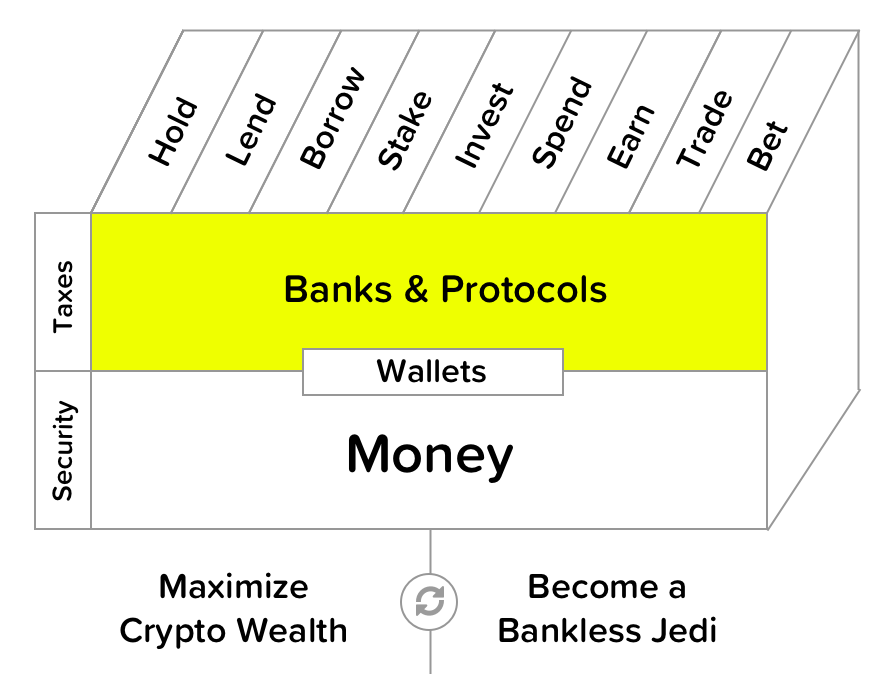

Filling out the skill cube

Sythetix is a money protocol and a “bank bet” in the bankless crypto money portfolio so you just leveled up on the money protocol layer for the skill cube. Nice!

👉Send Bankless a DAI tip for today’s issue

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.