Straddling two worlds: crypto & fiat (Market Monday)

Reminder: if you’re not a paid subscriber this is your second last Market Monday on the program! Free trial stops Thursday! 😲 Don’t miss out. Subscribe now & get 20% off forever!

Dear Crypto Natives,

This week the world’s largest aggregator of social data is trying to strike a deal with congress for a public/private FedCoin. And the president of China is vowing to accelerate Blockchain innovation while fast-tracking the roll out of a national digital currency.

You know what? Neither of these things help my friend Mariano.

Mariano lives in Argentina. The people of Argentina are suffering from hyperinflation due to ineffective central banking policies—inflation at 55% this year—and increasing. As the Argentine peso drops, the demand for dollars increases as Argentinians struggle to preserve their wealth and survive. The government responds by implementing capital controls though its commercial banks—only $200 per month can be converted to USD, the rest must be held in the rapidly declining Argentine peso.

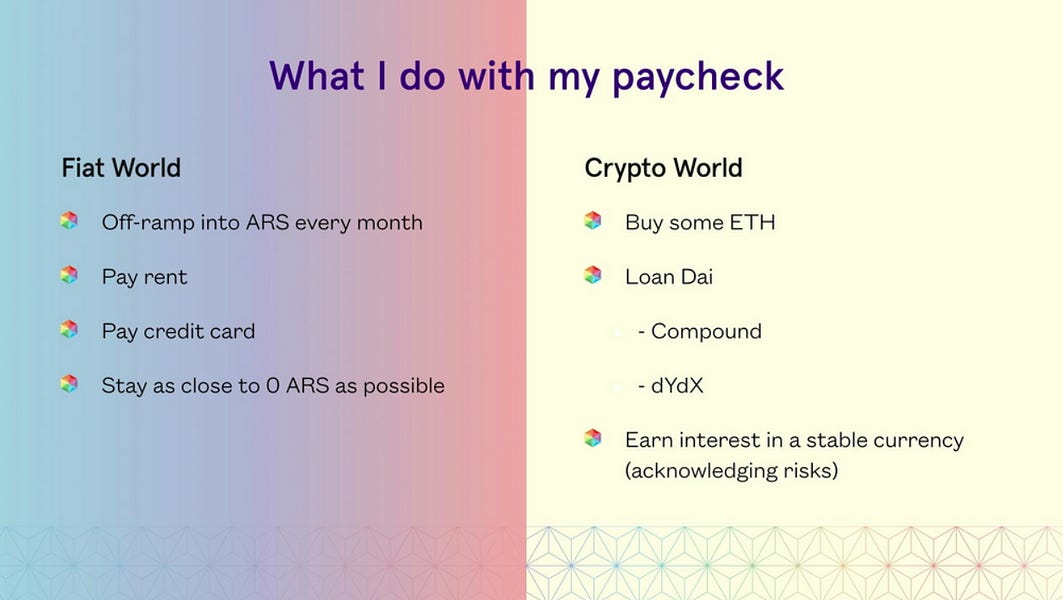

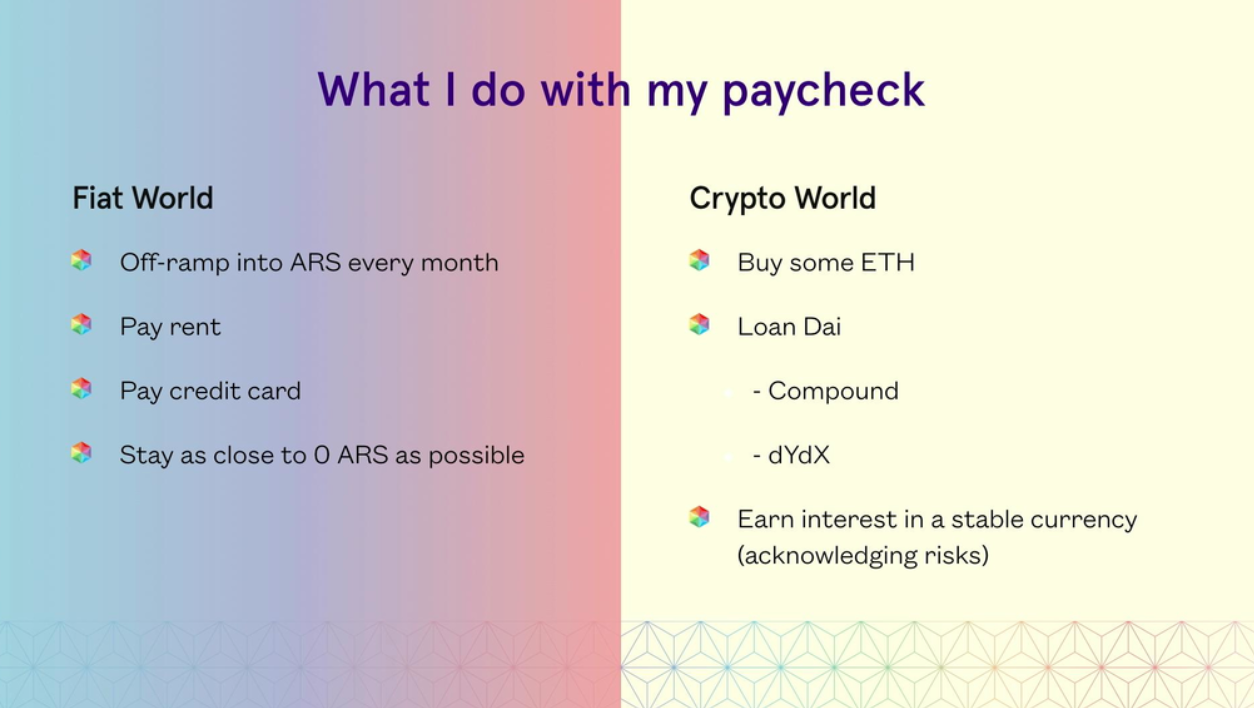

Mariano has been able to preserve his economic freedom by straddling two worlds. Here’s what he does with his paycheck:

He uses the fiat world only when necessary—mainly for day-to-day payments like groceries and rent. He keeps the rest of his paycheck bankless—ETH as a long-term investment, DAI as liquid cash, and Compound and DyDx as his high-interest savings accounts.

He acknowledges the risk of keeping paychecks in crypto—volatility, smart-contract risk. But here’s the thing. For Mariano the crypto risk is less than the risk he’d face in the Argentinian banking system.

👉 Take 10 minutes and listen to his story

This is why we’re doing this.

We need a money system that’s neutral and open to everyone, no borders—global, public, programmable, uncensorable, permissionless, with privacy options. We need non-sovereign digital monies that can’t be inflated away by government policy.

We have an internet of communication.

We need an internet of money.

Facebook and the Chinese government won’t give us an internet of money. They won’t help people like Mariano. They’ll preserve their existing banking apparatus, extending it with the help of big tech to add new avenues of surveillance and control.

Ironically, I think their steps into blockchain may help us reach this new world faster. But let’s not mistake their vision for the true destination. Our destination is a permissionless money system for the world.

Bankless not blockchain.

- RSA

If a money protocol can testify to congress it’s not a protocol—it’s a company.

MARKET MONDAY:

Scan this section and dig into anything interesting

Market numbers

- ETH up slightly at $181 from $176 last Monday

- BTC up a lot to $9,388 from $8,240 last Monday

- Maker stability fee dropped way down to 5.50%—lowest since March!

Market opportunities

- (Borrow) Stablecoins in a fixed rate loan via Torque —9.5% DAI / 8% USDC 🆕

- (Lend) Arbitrage by minting DAI at 5.5% & lending on Compound at 6.4%

- (Lend) List of top lending opportunities by DeFiPrime—awesome new tool!

- (Lend/Borrow) Another tool to see top lending & borrowing opportunities

- (Lend) DAI 6.5% / USDC 4.6% on Dharma (great UX—weird log-in to Coinbase?)

- (Lend) BlockFi still 6.2% BTC / 4.1% ETH—whales if you lend $10k you get $250

- (Trade) DDEX looking to compete w/ DYDX on margin lending (audit | giveaway)

- (Invest) ENS names on OpenSea (multi-chain support makes these more valuable)

- (Invest) Looks like a TokenSets alternative (really new & haven’t tested—beware!)

- (Borrow) w/ crypto as collateral at 5.9% via Nexo Credit lines (lowered rate)

- (Trade) KyberSwap has Limit Orders now (free transaction fees if you hold KNC)

New stuff

- Torque adds fixed rate loan for DAI/USDC—first I’ve seen in DeFi (see above)

- BitPay accepting ETH (because ETH is money)

- Monolith Ethereum wallet now on Android (Visa debit card—UK + Europe)

- Unspent portfolio tracking adds Uniswap (need portfolio tools w/ DeFi support)

- Casa thinking about crypto inheritance (e.g. give estate lawyer multi-sig key)

What’s hot

- There’s now 2.37m ETH locked in DeFi—highest ever! 🔥 (more DeFi stats)

- CFTC head says ETH futures probably 6-12 months away (more liquidity is good)

- Ethereum as an IPO platform! (it’s possible Ethereum becomes the standard)

- DYDX now the best DEX for liquidity and lowest slippage? (here’s how!)

Money reads

- Best explanation I’ve read on why negative interest rates exist - Howard Marks

- My notes on this Fed report on Stablecoins - RSA

- Next gen more comfortable with DeFi than traditional finance - The Defiant

- DAI usage statistics - Alethio

- Internet stocks and Ethereum comparison - Anthony Bertolino

Haven’t subscribed? The 20% off Early Believer deal lasts only until Thursday. Includes Inner Circle, Deal Sheet, Bonus content. Costs less than a coffee per week.

WHAT I’M DOING

Check out a few opportunities I’m capturing right now with my crypto money

Exploring a crypto card. Update—waiting for my crypto.com Visa card.

Early calculations for ETH Staking. I plan to stake ETH when the ETH bond market launches and staking becomes available next year. But should I run my own nodes? Physical or cloud? Should I use a service like RocketPool? This staking calculator from ConsenSys CodeFi provides an early estimate of costs of these alternatives. E.g. they estimate you can run an Eth2 validator in the cloud for about $265 per year.

Bought some tokenized gold from PAXG. I’ve been doing some research on tokenized gold—I’ve purchased DGX in the past. I like what I’m seeing in PAXG so far. Will provide a full report on tokenized gold opportunities soon.

Explored Unspent DeFi features. My current crypto portfolio tracking applications don’t provide coverage for DeFi—what if I deposit ETH in Compound? What if I have assets in a Uniswap pool? I have to use specialized apps like MyDeFi to track this. It would be nice to have my entire crypto portfolio in one place. I gave Unspent a try this week after learning they’ve added Uniswap & Compound. Not ready to switch yet, but it’s nice to see growing support for money protocols in portfolio tracking applications.

WEEKLY ASSIGNMENT:

Make time to complete this assignment before next week

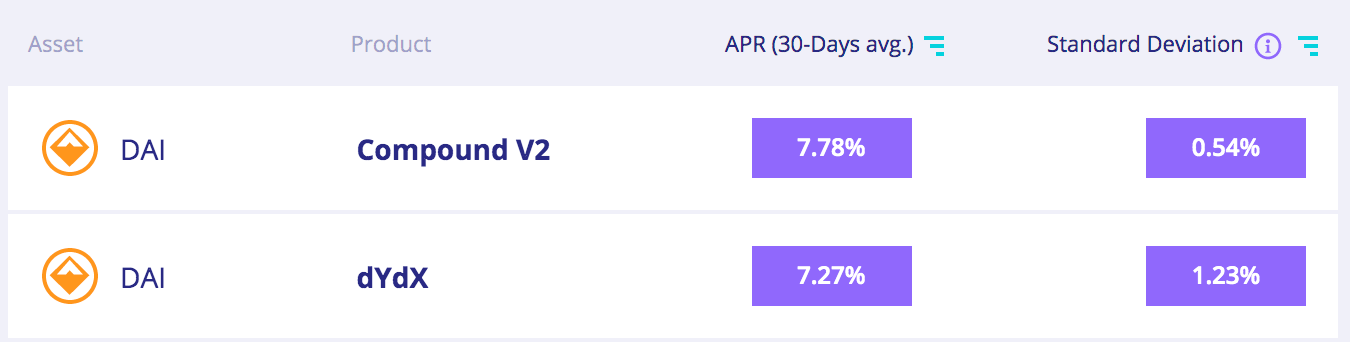

Find 3 good lending opportunities with DeFiPrime Opportunity Finder. (15 mins) My friends at DeFi Prime just rolled out a new Opportunity Finder last week. We’re going to use it to find 3 good lending opportunities.

- Go to Opportunity Finder

- Click symbols to filter by DAI + USDC Stablecoins & ETH Cryptocurrency

- Identify the best lending opportunities for DAI, USDC, and ETH

The nice thing about the Opportunity Finder is that is shows you the previous 30-day returns along with the standard deviations. Remember, each of these are variable rate interest opportunities which can fluctuate up or down based on market conditions.

In the above, lending DAI on Compound averaged 7.78% over the past 30-days at a standard deviation of .54% which is a tighter deviation than DyDx at 1.23%. This means Compound is less likely to vary up or down vs DyDx.

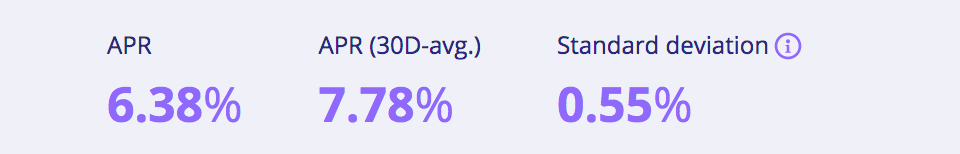

If you click Compound details you’ll see this:

This means that as of today, Compound’s rate for DAI is lower than it’s 30-day average at 6.38%. So can we conclude that Compound’s DAI rate for the next 30 days will be around 6.36% +/- .55% or so?

That’s a reasonable guess—but you can do even better than historicals by estimating Maker’s future stability fee for DAI. Just today the DAI stability fee dropped from 9.5% to 5.5%. This is a quote a drop and means the Compound lending rate will likely dip much more significantly than it’s standard deviation—I wouldn’t be surprised to see DAI lending on Compound in the 3% range before long.

Extra Credit Learning

- (Beginner) VIDEO: 5 Ways To Get DAI Stablecoin - Chris Blec

- (Intermediate) VIDEO: Requirements for ETH staking - Chico Crypto 🔥

- (Intermediate) VIDEO: Understanding Money Protocols (e.g. SET, UMA)

- (Intermediate) Understand Set Asset Token categories (see our past Set how-to)

- (Advanced) VIDEO: Isolated & Cross Margin Trading on dYdX - Chris Blec

- (Advanced) Overview of Synthetix (I plan to spend more time on Synth soon)

MAIN TAKES:

Read my takes but draw your own conclusions

The ETH FinalityGadget project is one of the most important projects in Ethereum right now and I’m watching it closely. Why? The completion of this project will allow the staked ETH in the Eth2 chain to secure the Eth1 chain—this eliminates the need for proof-of-work mining and related issuance. This alone could cut Ethereum issuance by over 4% annually. ETA is sometime after Eth2 phase 0 and before phase 2, so sometime in the next two years?

Maker is launching MCD next month. A few things to know:

the Dai savings rate (DSR) is likely to start at 2-3%

BAT is likely to be the only other collateral besides ETH at launch

ETH is likely remain close to 99% of MCD collateral at launch

an ETH-only DAI is being seriously considered by Maker—but may come only after assets like EuroDAI, no ETA

MINI TAKES:

- ZeroHedge argues Ethereum is undervalued even if you think it’s just a stablecoin settlement network—yeah, I think so too.

- Compound continues to give up admin control of its protocol which is a sign of DeFi maturity in my opinion—remember the De in DeFi is a spectrum

- I run a validator on Cosmos and it’s interesting to observe how onchain governance is panning out—some Cosmos validators are lowering fees in order to gain more political influence—a flaw in the system?

TWEET-A-QUESTION

Tweet me your question—I reply to one per week

Question from a Bankless Reader on the ETH monetary policy article:

What are the implications for the [Ethereum] security model when the value of assets secured by the chain (including ERC-20 tokens and such) exceed the market cap of the native token?

RSA Response:

How much security does a nation-state need? It’s hard to know—it depends on the benefit an attacker might gain from an attack. This is also true for crypto money systems.

Now, there’s more to gain from attacking Ethereum as the value of assets on Ethereum increases. Ethereum, of course, is secured by the value of ETH. So what happens if the value of assets on Ethereum starts to far exceed the value of ETH?

Here’s the thing to remember. There are two types of assets on Ethereum:

- Permissioned assets that can be reissued by a central party (e.g. USDC, Tokenized gold, tokenized securities)—if these are stolen, a crypto bank can reissue them—these are settled by legal system

- Permissionless assets that are bearer instruments and cannot be reissued by a centralized party (e.g. ETH, DAI, REP)—if these are stolen, they become the property of the thief—these are settled by blockchain

I think permissioned assets can far exceed the value of ETH without problem. Why? Ultimately, permissioned assets are secured by the legal system, not Ethereum. Say an attacker reverts the chain and steals $100m USDC—they don’t have the actual dollars, those are sitting in a Coinbase bank account—why wouldn’t Coinbase simply reissue the USDC funds to the rightful owner?

Permissionless assets on the other hand, well, these do require ETH value to grow proportionally. If stolen, they can’t be reissued. They’re bearer assets. But there’s reason to believe ETH value will grow in some proportion to permissionless assets like DAI and REP. Why? Because these assets tend to use ETH as economic bandwidth. DAI for example, is backed by ETH. As designed now, DAI can’t grow to $1 trillion without ETH growing to $1.5 trillion.

As long as ETH remains the main permissionless economic bandwidth on Ethereum I’m not worried about Ethereum’s security model—it should scale proportionally with the growth of permissionless ERC20s.

- RSA

Some recent tweets…

Actions

- Execute any good market opportunities you saw

- Complete weekly assignment: use Opportunity Finder to find three lending deals

Level up—no interruption. $12 per mo. 20% off includes Inner Circle & Deal Sheet.

Pay with crypto

You can pay using ETH, BTC, or USDC. Annual subscription. Early Believer status.

Let’s onboard 1 billion people to open finance…

If you believe in what we’re doing don’t keep it to yourself—share Bankless with as many people as possible.

Post. Tweet. Tell. That’s how we take back our money system.

We’re going bankless…Paul’s on the journey…

So is Mike…

How about you?

👉Send Bankless a DAI tip for today’s issue

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.