Pick a time horizon

Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

People ask me about technical analysis. They ask me which narratives are going to be hot in the next few months. The truth is I don’t pay much attention to these things.

That’s because I’ve selected a time horizon for crypto investing that isn’t subject to short-term price patterns or the narrative de jour.

Have you picked your time horizon? It makes a big difference for the type of investment strategy you deploy.

Are you a trend trader, narrative investor, or fundamentals investor?

We discuss all of these things today.

- RSA

THURSDAY THOUGHT

Pick a time horizon

Filtering through the noise

When you first get into crypto investing you’re hit with a barrage of charts, memes, and expert opinions all at once. It’s noisy. It’s chaotic.

How do you sort through the noise?

First, get a framework

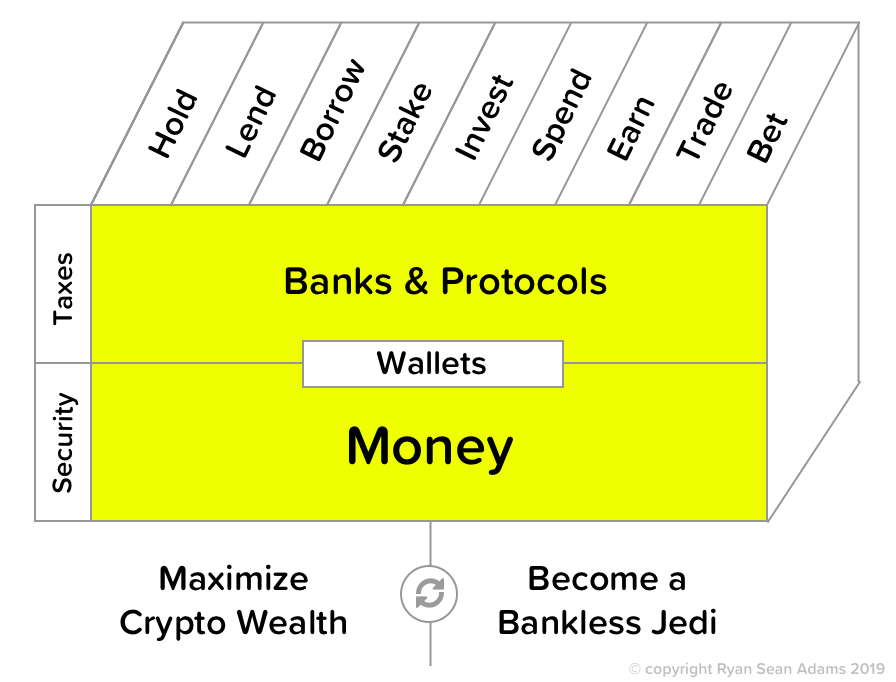

The first thing you should do is develop a framework for understanding this crypto world. The Bankless program uses the money skill cube framework and a portfolio with three types of bets: money bets, bank bets, and stablecoins. We think crypto is best understood as a parallel money system, less emphasis on a decentralized internet and more on a bankless financial system.

Second, pick time horizon (👈 today’s topic)

Your time horizon will guide how and when you enter or exit positions. It’ll also determine which assets you buy or sell. If you expect an asset to perform well for the next 5 weeks, but not for the the next 5 years it’s a good buy if your time horizon is measured in weeks, but a bad buy if your horizon is measured in years.

Third, level up weekly

If you want to become a better crypto investor you have to level up weekly. That means using crypto systems and learning what makes them valuable. You’re looking for assets that create value and capture it. Filter for value creation by using the crypto products for yourself—good product can’t be faked. Then, make sure the asset you buy has a mechanism to capture the value created—more like Google and less like BitTorrent.

Make sense?

Ok, let’s get to the main topic today: picking your time horizon.

Three time horizons for crypto investing

A lot of the noise and conflicting advice in crypto comes from people pursing wildly different investing time horizons. Someone with a day trading outlook will have a very different lens than someone buying with a 5 to 10 year time horizon. Analysis tools, asset choices, advice and opinions—all vary wildly depending on time horizon.

At a high level, there are three different time horizons you can operate under. Each comes with a different strategy and lens for thinking about crypto assets.

- Trend trading (daily/weekly time horizon)

- Narrative investing (months long time horizon)

- Fundamentals investing (years to decades long time horizon)

Let’s start with Trend trading.

Trend trading

Horizon: days to weeks

Tools: technical analysis

Skills: ability to identify trading patterns

Trend traders are the masters of technical analysis (TA). They analyze statistical trends gathered from crypto trading activity, like price movement volume. They tend to ignore fundamentals, like development roadmaps and onchain activity, and focus instead on price patterns. They believe price tends to move in repeating trends. They make trading decisions by understanding these trends and evaluating where an asset is within a trend.

You’ll see charts like this from TA traders with line, curves, and triangle attempting to pattern future price move probabilities:

Narrative investing

Horizon: 3 to 18 months

Tools: narrative front-running

Skills: ability to predict future crypto market narratives

Crypto is a narrative heavy market. Narratives are collections of stories that the market chooses to believe about the potential of an asset. It’s a hard pill to swallow but I firmly believe narratives not fundamentals drive crypto price in the short to medium term. Narrative investors predict the narratives that will be popular and then buy assets that will benefit from those narratives. For a narrative investor it’s not necessary that the asset fulfill the promise of the narrative. The aim of narrative investing is simply to front-run narratives by buying when the story is first formed and selling at narrative peak before moving onto the next one.

An example of a successful narrative investment:

Narrative: “Ethereum has a scaling problem & layer 2 will solve it”

Dates: Q1 2018 into Q2 2018

Period: Lasted 3-5 months

Beneficiary assets: LOOM, OMG

Description: At the end of 2017 Ethereum had almost a full year of massive price growth. It seems unstoppable. A few higher-level narratives were lurking in the background too. The Fat Protocol narrative—base assets token can capture value. The CryptoKitties narrative—Eth can’t scale. The Plasma narrative—Eth layer 2 solutions are on the way. All of these came together in early Q1 to present a buying opportunity for Ethereum centric layer 2 assets. If you got ahead of this narrative, connected the dots and bought LOOM by March 19 you’d have seen a 7x price increase over the next 6 weeks. To realize the gain from this short burst of a narrative you’d also have to sell in the first half of 2018. As the narrative deflated for the rest of 2018 and died in 2019 LOOM now trades 97% down from it’s all-time high.

Other successful narratives:

“Fat protocols thesis—any protocol can capture value like an app” - 2017 (all ICOs)

(I call this the lazy fact protocol thesis because it’s a bad interpretation of the original post)

“ICOs will disrupt all venture capital” - 2017 (ETH)

“Rise of the ETH killers” - 2018 (EOS, TON) again in 2019 (DOTs)

“IEOs are the new ICOs” - early 2019 (BNB)

“DeFi rising with better token mechanics” - 2019 (SNX)

It’s tricky to predict the next hot narrative in crypto and its magnitude. It’s even trickier to time entrance and the exit. Some narratives last months, others weeks. Most never find traction at all.

Fundamentals investing

Horizon: Years to decades

Tools: long-term thesis and fundamentals

Skills: ability to get broad macro trends right & conviction through volatility

While stocks now have a long history of metrics and valuation techniques, fundamental analysis is in its infancy in crypto. Groups like CoinMetrics are doing great work here (see my two-part post here and here) but in truth we’re still in the early stages of developing and propagating valuation techniques for crypto assets. It’s my guess that assets high in monetary premium will be difficult to value even in the long-run—like gold, monetary crypto assets are better priced than valued.

Where does that leave those who don’t want to play the trend trading or narrative investing game? Actually in a good place. The fundamental investor doesn’t need to divine triangles and charts or chase the next hot fad. They just need to get the big things right, then display the fortitude to stick to their long-term strategy while periodically calibrating prior mental models.

As you might guess, the Bankless program is biased toward Fundamental investors. We aim to get the long-term marco trends right:

- Crypto money systems will eat traditional money systems

- Millennials and younger generations will store their wealth in crypto

- The trend toward bankless—banking without a bank—is inevitable

And we want exposure to the assets that best capture these macro trends.

We measure price changes across years not months and weeks. We ignore short-term narratives and look for signs of real traction—if it’s a money bet, are people using it as money? If it’s a bank bet, have we used the money protocol ourselves—do we understand how the asset accrues value?

Fundamental investing removes the noise from your crypto experience. You can:

- Ignore 90% of these cryptoassets and focus on the ones that are real

- Ignore all the short-term TA and price charts

- Ignore the vapid narratives destined to pump-and-dump

With the time you free up you can focus on actually using these crypto systems. In the process of using them, you’re more likely to stumble across new contender for crypto money and you’ll be among the first to see new bank bets as they emerge.

The worst thing you can do

The absolute worst thing you can do is vacillate between these time horizons. So many people think they can chase hot narratives, buy the good assets for the long-term, and sprinkle in some amateur TA all at the same time—it always ends in tears.

The reality: getting good at TA is a full-time job itself (and can you outperform a robot?). Narrative investing? That’s a job too. But fundamental investing requires less raw technical skill—your edge becomes patience, foresight, and good judgement. Something most people can develop.

Avoid the worst thing. Pick a time horizon and stick to it. Don’t vacillate!

Closing thoughts

A decent portion of the noise and conflicting advice you hear in crypto is due to differences in time horizon. Don’t get lost in the noise. Don’t vacillate. Be intentional about picking a time horizon and base the skills you develop and the information you consume around that decision.

To me Fundamental investing in crypto is the closest thing to a get-rich-slow approach to crypto investing. It’s considered, it’s thesis driven, it’s patient—if Warren Buffet were in his 20s today it might be the approach he’d take. So it’s no accident that fundemental investing is the primary approach we take in the Bankless program.

Actions

- Trend trader, narrative investor, or fundamental investor? Pick one!

Subscribe to the Bankless program. $12 per mo. Includes Inner Circle & Deal Sheet.

👉Send Bankless a DAI tip for today’s issue

Filling out the skill cube

Picking a time horizon for your crypto investing is one of the most important things you can do in this program. It guides the decisions you make in the money and banks & protocols layers of the skill cube.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.