How to use Gnosis to profit on stablecoins

Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

Another money protocol was born last month. A liquidity protocol called Gnosis.

Three reasons it’s worth learning about:

- It’s on the trustless end of the spectrum—high density—like a Uniswap

- It takes a new approach to liquidity—not AMM, not orderbook—batch auction!

- You can do cool stuff with it today

We’re going to focus on that last part in today’s tactic.

Specifically, how can we use this batch auction mechanism to profit on stablecoin mis-pricing—almost passively?

You’ll remember tactic #34 where we showed you how to do this with automated market makers like Balancer. Turns out we can do it with Gnosis too!

Cool right?

Let’s dive in!

-RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

TACTICS TUESDAY:

Tactic #39

How to use Gnosis to profit on stablecoins

Stablecoins are low-volatility assets that approximately peg the US Dollar. However, in practice, stablecoins tend to deviate from the $1.00 price point. In today’s tactic we’re going to show you how to use the Gnosis protocol through the Mesa exchange front-end to exploit this spread and make a profit. In the the process you’ll learn about the Gnosis protocol—the most trustless Ethereum exchange mechanism since Uniswap.

- Goal: Provide liquidity to Mesa DEX and slowly earn a spread

- Skill: Beginner/Intermediate

- Effort: 10-15 minutes

- ROI: Variable

Note: the Mesa exchange is still in beta and the Gnosis protocol is new. Be aware of the risks!

Guest post by: Ingamar Ramirez is a freelance writer for Blockchain startups

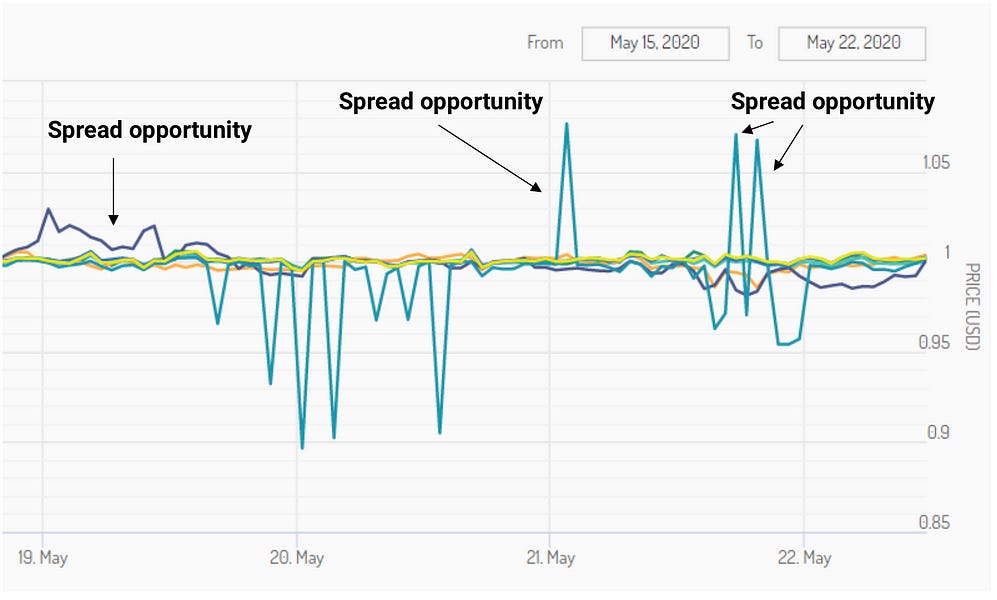

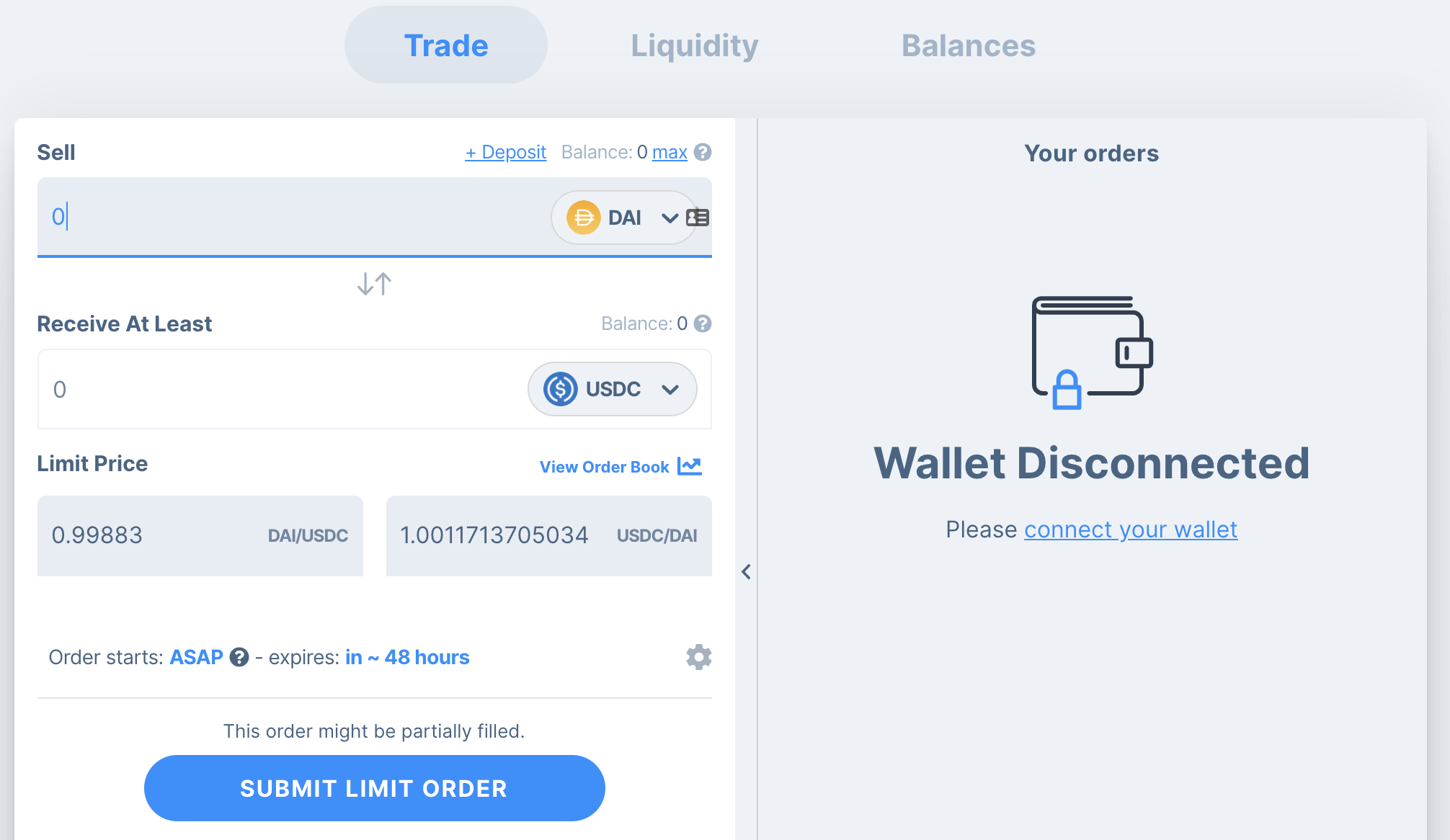

This is a chart of stablecoins.

Each of the spots where the lines are over $1.00 were opportunities to sell stablecoins at a spread using the Gnosis protocol and earn profits. This tactic will show you how.

But first, what is Gnosis?

Gnosis—the Liquidity Maximization Protocol

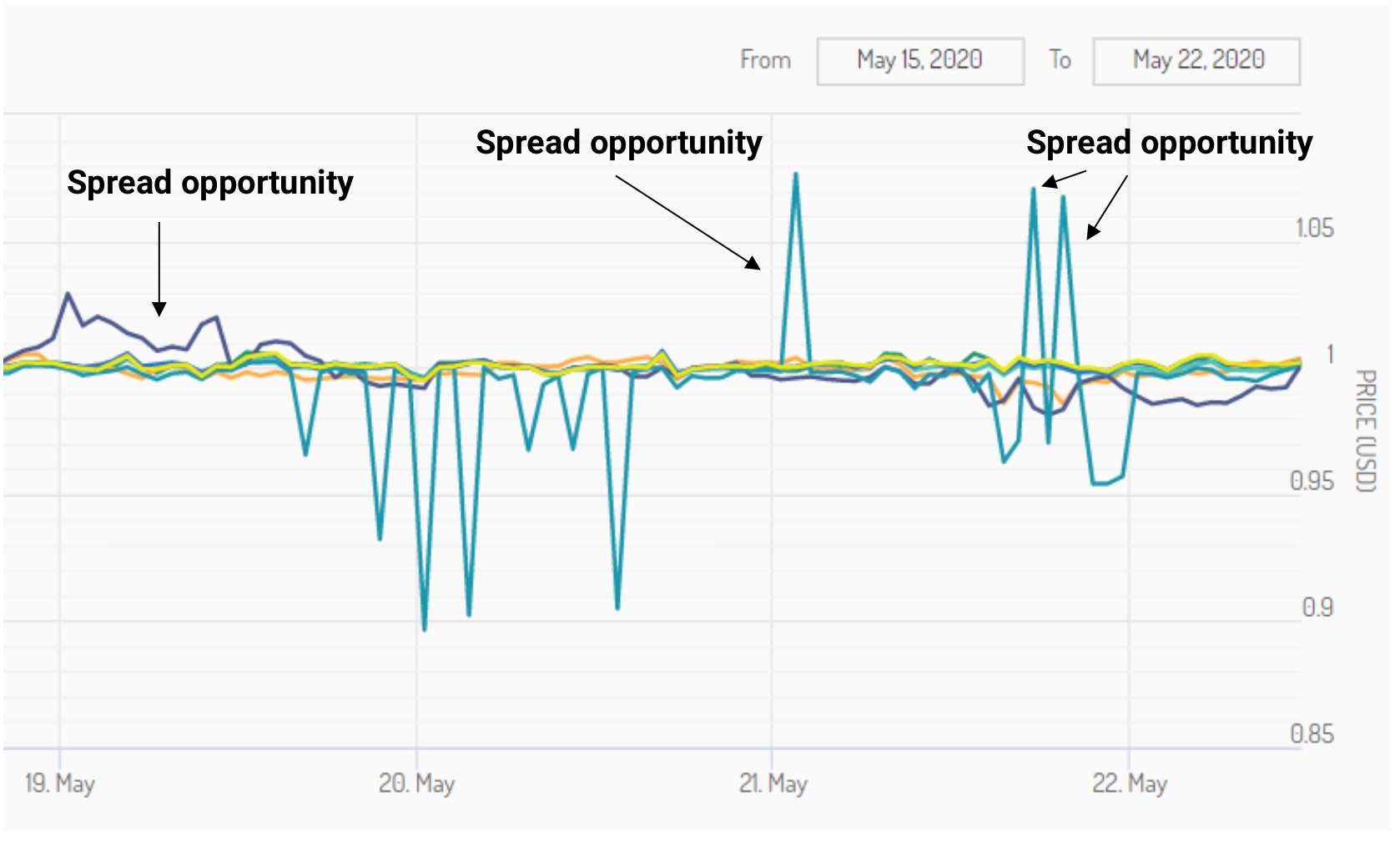

The Gnosis Protocol enables trading platforms to execute “ring trades”, which can match three or more people trading multiple assets. Detailed in the image below, this allows their orders to be fulfilled simultaneously when they would not have been able to otherwise.

(Above) Image from Gnosis Developer Portal

Here’s the process:

- open orders are all laid out at the beginning of a five-minute batch auction

- an open competition for the most optimal settlement solutions is run by solvers to maximize trader welfare and provide single clearing prices

- after five minutes, orders are filled and settled on-chain by the time the next five-minute batch auction begins.

That’s it!

Mesa—a front-end for Gnosis

Mesa is the latest frontend built on the Gnosis Protocol and hosted by the DXdao.

While still in beta, it offers a market trading interface (reminiscent to Uniswap) with an additional feature:

Liquidity Orders 🔥

Liquidity Orders allow users to set a spread at which they are willing to sell their stablecoins for other stablecoins (i.e., 0.3% spread to always sell 100 DAI for 100.3 USDt, or buy 100 USDt for 99.7 DAI). This is predicated on the assumption that your stablecoin is always worth at least $1.00. A liquidity order costs a one-time gas fee but after it you can simply sit back and observe your order’s progress. 🏖️

⚠️ Ideal for large liquidity providers. Liquidity Orders on Mesa are typically ideal for large liquidity providers due to the initial gas fee. However, once this Liquidity Order is submitted, all transactions are gasless indefinitely until you decide to change or terminate your Liquidity Order.

How to submit a liquidity order on Mesa

Let’s submit a liquidity order on Mesa and try this out.

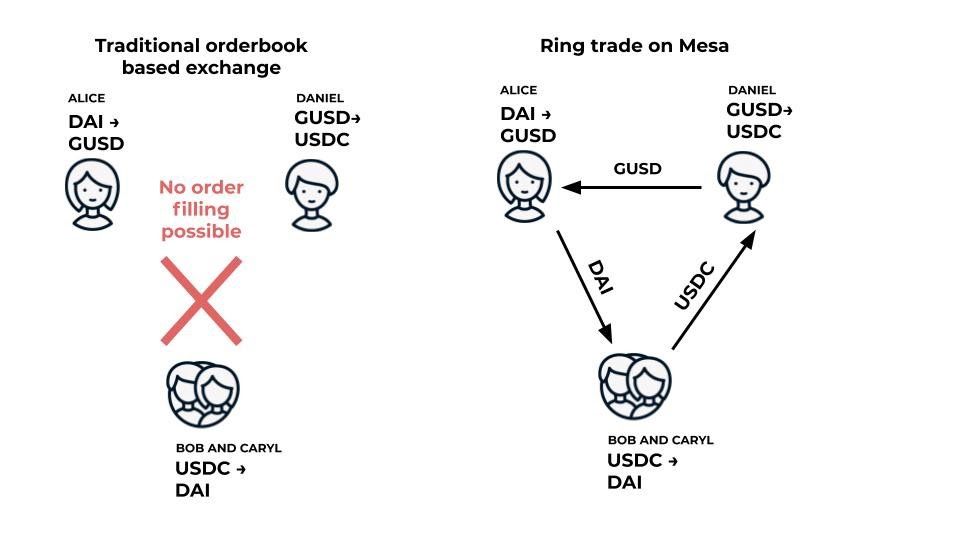

1. Go to Mesa

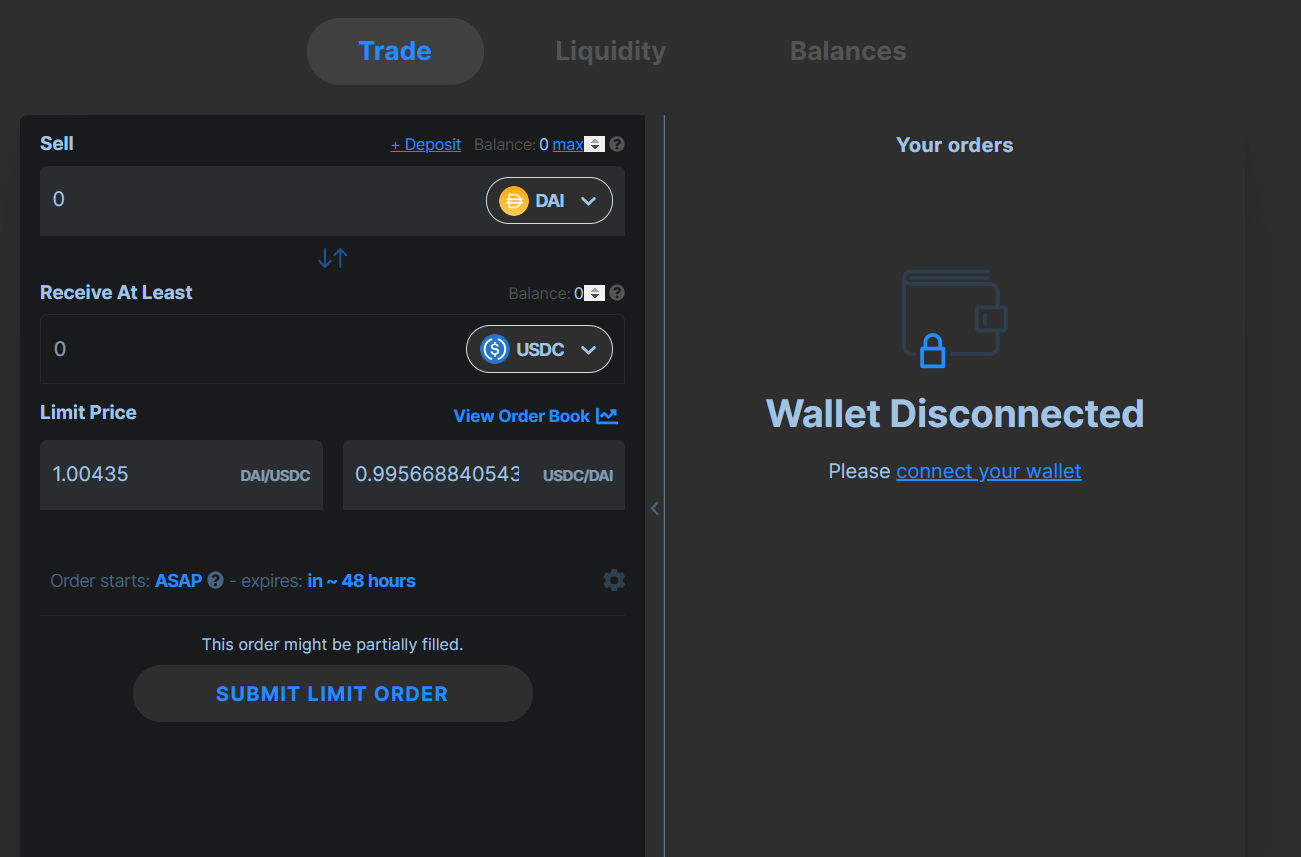

At the Mesa front page (mesadev.eth.link) you will see a place to trade your crypto on the left, as per usual for DEXes. After connecting your Metamask wallet, click “Balance” to see how funds are deposited into the platform.

2. Load funds

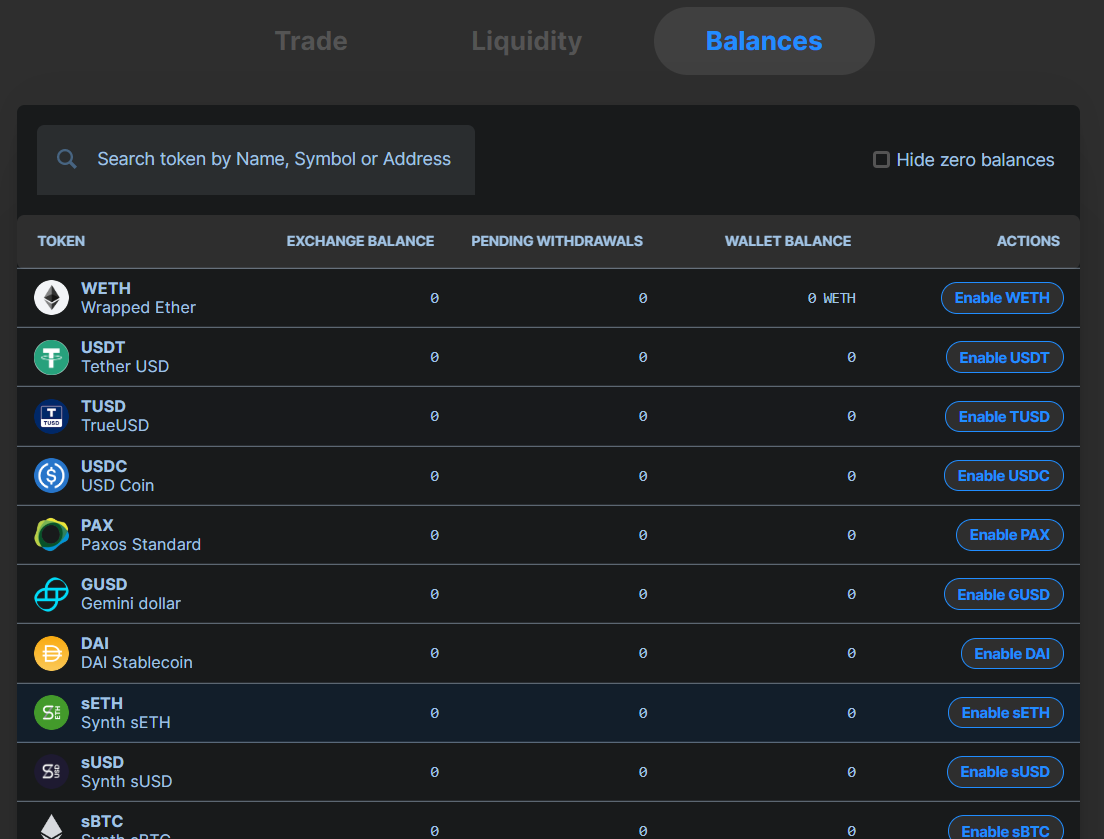

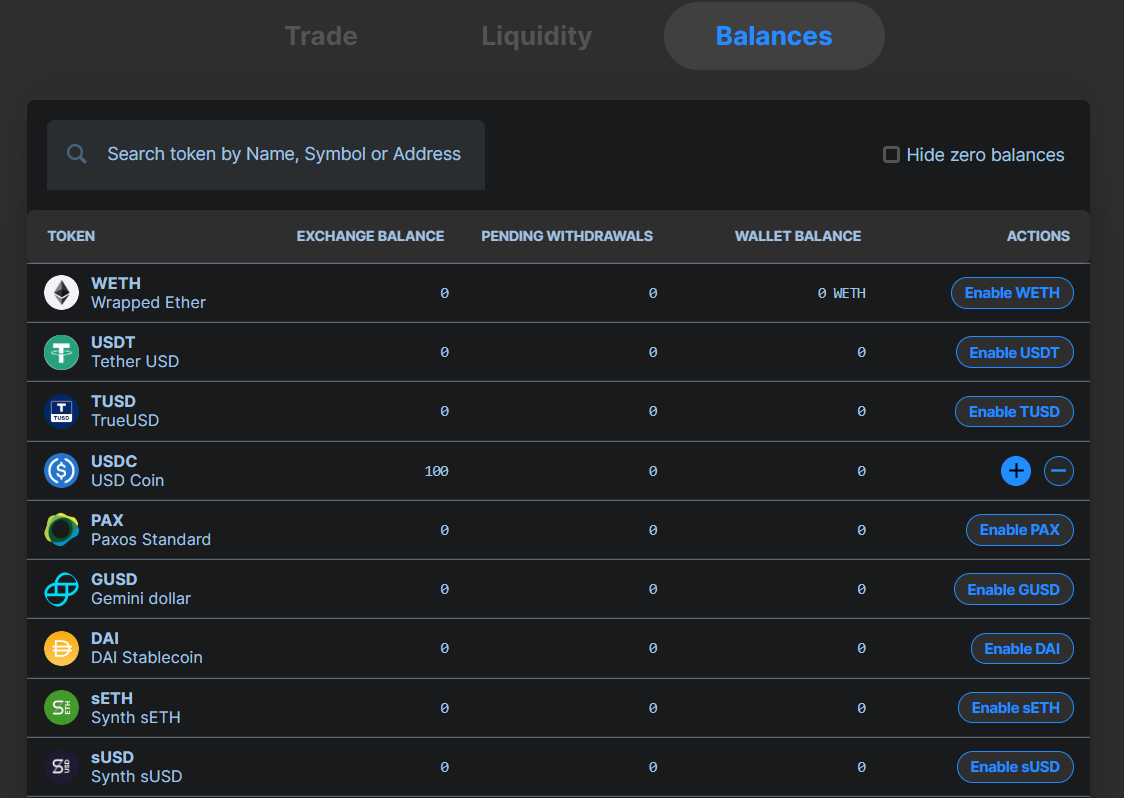

To load wallet funds into the exchange platform, click Enable, corresponding with the stablecoins you wish to deposit for your Liquidity Order.

⚠️ Note: After signing through Metamask, the Enable button will be replaced with a + and - symbol. “+’’ allows users to deposit, while “ - ” allows users to withdraw back to their wallets. You do not need to Enable a coin to withdraw it.

Depositing with Metamask will prompt another signature request, and after your approval you can move on to the next step by clicking the Liquidity tab.

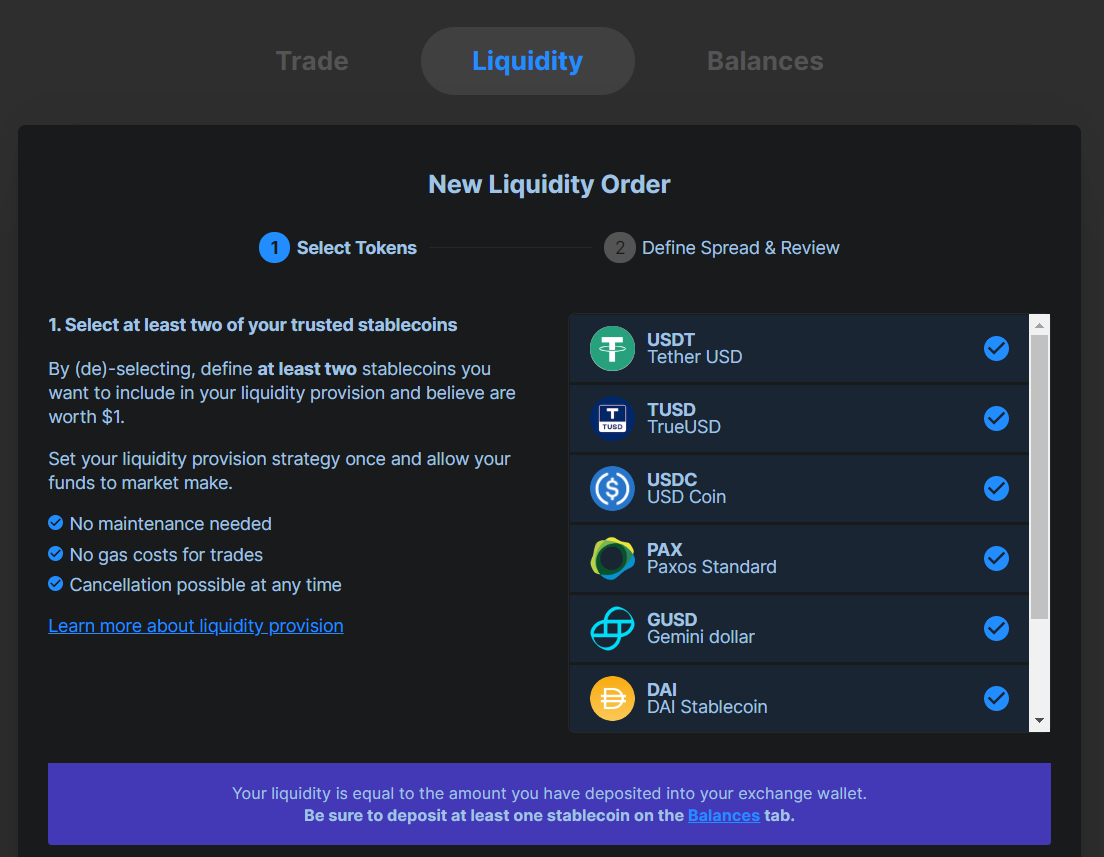

3. Set Liquidity Order

Now you will see the “New Liquidity Order” page, where you can select which stablecoins you wish to include. The more you include, the more opportunities your Liquidity Order will have. Before continuing make sure you select the stablecoins you wish to add to this order.

⚠️ Note: the more tokens to be included in the liquidity order the higher the gas fee.

In the next section, you will be prompted to define the spread. This means inputting the profit you intend to make under the assumption that your stablecoin is worth $1.00. The higher the spread, the less likely the orders will fill. The lower the spread, the more likely orders will fill, but with less profit.

Some things to be aware of:

- When you hit “Submit Transaction,” you may wish to lower gas fees to save on ETH. However, this may jeopardize order fulfillment, as there is only a 15-minute window for these transactions to be mined. It is recommended to either not lower, or raise the one-time gas fee for your Liquidity Order, so that miners can fulfill the transactions in time.

- Once your Liquidity Order is submitted, there is no more work to be done. Transactions from here on are gas-free.

4. Sit back & wait

That’s it—your trading work is done.

You can check back periodically to see if profits are gained.

Today, the best way to know if profits are gained is to check the Balances tab and see if your balances have changed. In the future there will be alternate ways to check this.

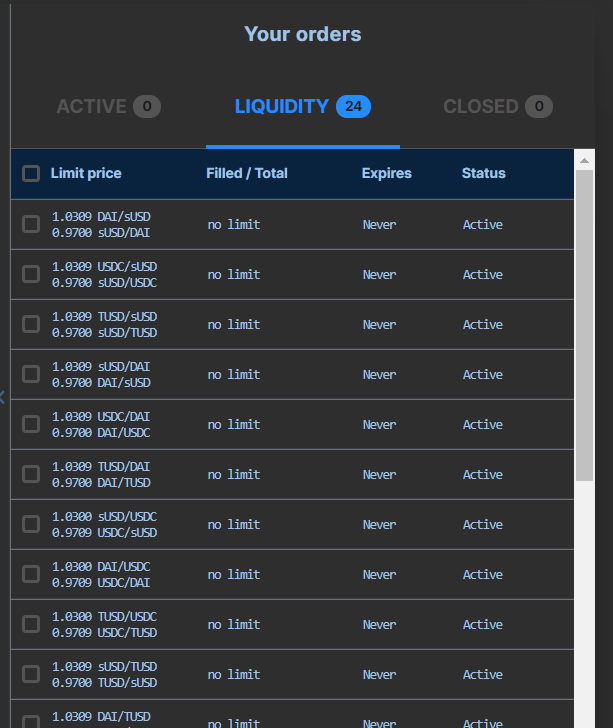

You can also head back to the “Trade” to view the orders. These are combinations of the stablecoins you selected in the Liquidity tab. There is nothing you need to do here, as it is just for display. However, you can cancel any number of these orders if you so choose. (The Closed tab is for spot orders on the left, or closed Liquidity Order pairs.)

The Future

Gnosis is a liquidity money lego for batch auctions. It maximizes liquidity at low cost for certain types of trades. In four steps steps you were able to execute a liquidity order on Mesa using the Gnosis protocol to profit on stablecoin spread across a range of stablecoins.

No bank. No centralized exchange. Just you and your Ethereum wallet.

💰Want to go deeper and earn more? There’s an incentive program running for liquidity providers to earn GNO tokens as they trade on Mesa. More in Gnosis discord.

Author bio

Ingamar Ramirez is a freelance writer, copy editor, and marketing consultant for blockchain startups. He hosted two seasons of Top of the Block podcast and is currently focused on DAO-related content.

Action steps

- Understand the basics of Gnosis—a batch auction money protocol

- Use a Liquidity Order on Mesa to profit on stablecoins when they rise above $1

Go Bankless. $12 / mo. Includes archive access, Inner Circle & Deals—(pay w/ crypto)

🙏Thanks to our sponsor

Aave

Aave is an open source and non-custodial protocol for money market creation. Originally launched with the Aave Market, it now supports Uniswap and TokenSet markets and enables users and developers to earn interest and leverage their assets. Aave also pioneered Flash Loans, an innovative DeFi building block for developers to build self-liquidations, collateral swaps, and more. Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.