How to make money trading stablecoins

Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

Last month I watched the DAI/USDC exchanges rates on Coinbase hit $1.08.

If you had some DAI and could get it to an exchange—instant 8% profit.

While a spread like this is rare, moderate spreads of a few percentage points are more common. And you can make money any time these spreads exist.

Jake shows us two methods for doing this. One requires some sophistication. But the second? Well, it just requiring know how to use a rebalancing money robot.

If you’ve been leveling up past tactics you’ll have no trouble at all.

Going bankless gives you superpowers, remember?

Time to use them.

Time to level up.

-RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

TACTICS TUESDAY:

Tactic #34: How to trade stablecoins when they're off their peg

Stablecoins come in different sizes and qualities, but for the most part they try to stay close to the value of 1 dollar. So when you see stablecoins worth more or less, and if no cataclysm is going on in the market, you might be witnessing an inefficiency and an opportunity to bet that the price will return to its peg. In this article, we’ll explain how a real-world mean-reverting strategy might work on a DAI-USDC market, as well as how to approximate such a strategy with Balancer portfolios.

- Goal: Earn a return by betting with USDC that DAI will return to its peg

- Skill: Intermediate to Advanced

- Effort: Regular monitoring of pricing and position adjustments

- ROI: 1-2% per round trip

How to trade stablecoins when they're off their peg

Guest post: Jake Brukhman is the founder & CEO at CoinFund

Disclaimer. The content provided in this article is for informational and discussion purposes only and should not be relied upon in connection with a particular investment decision or be construed as an offer, recommendation, advice, or solicitation regarding any investment. The author is not endorsing any company, project, or token discussed in this article. All information is presented here “as is,” without warranty of any kind, whether express or implied, and any forward-looking statements may turn out to be wrong. CoinFund LP has active investments in Balancer, Maker, and may be holding stablecoins mentioned in this article.

Method 1: Directly trading the DAI-USDC spread

Skill-level: Advanced—requires quantitative models and automated systems

Since the ‘Black Thursday’ crash in cryptomarkets in March, DAI has been trading decisively above $1. The chart below shows the Coinbase market, which displays the price of DAI in USDC, a 1:1 dollar-backed stablecoin. As we can see, in mid-March traders paid over $1.05 per DAI and the current price is $1.01194.

⚠️Why USDC? I chose USDC in our example because USDC is equivalent to 1 dollar at all times and it’s easy to reason about relative to DAI. However, similar strategies are possible with multiple algorithmic stablecoins as well.

One strategy we can implement in this market is to sell DAI for USDC when we think the price is high and buy it back for USDC when it returns to the peg (or when we think DAI is cheap again). Historically, between August 2019 and March 2020, the spread between DAI and USDC has been mean reverting and about 2 to 3% wide. Coinbase will take 0.10% commission on limit orders, so we’ll pay 0.20% to close a “round trip” trade. Trading thus only makes sense if the spread is higher than the total fees.

⚠️Alternatives to Coinbase. You can also use alternative markets for DAI-USDC outside Coinbase, including on Balancer’s swapper, Curve, Uniswap, or on any other venue where you can minimize your costs of going between these two assets.

So what does an active DAI-USDC strategy look like?

Executing the DAI-USDC strategy

We will see that quantitative strategies like stablecoin trading grow in complexity quickly. In the real world of financial markets, strategies are supported by quantitative models and automated systems which compute the models in real time and trade autonomously on markets. In this section, we’ll outline the steps that such an automation might perform. For a more practical approach, check out the next section where we can approximate the strategy by deferring the active trading to a Balancer portfolio.

Here is what a stablecoin trading strategy might look like:

- Find the Mean Price. Pick a time frame, like the past 72 hours, and measure the average price of DAI-USDC from hourly data. This is our mean price and we will take the view that in the current market regime, DAI-USDC will fluctuate around this price level.

- Determine Buy and Sell Levels. Next, we’ll want to determine a sell price for DAI. One way to do it is to examine the average price at which DAI has transacted above the mean price, but we can also use other measures like volume-weighted average price above the mean. We’ll determine a buy price below the mean in a similar fashion.

- Trade the Spread. Our strategy will look to buy DAI with USDC at the buy price and sell it at the sell price, taking the spread net of our venue’s fees on each round trip. We’ll certainly also want to make sure that our spread, the difference between the buys and sells, is sufficiently wide to be profitable.

- Manage Risk. As time goes on, we’ll need to recalculate our mean, buy, and sell prices and these prices will change over time. In our example DAI-USDC market, the mean has stayed relatively stable from the end of March and through April. But it all depends on our model’s choice of time frame and how the market moves. The model may very well break down if the regime changes, as it did during Black Thursday, and it is important to stay actively engaged in the market and manage risk if things go awry.

- Repeat. If the market is indeed mean reverting, we’ll want to deploy the capital multiple times, catching as many round trips as we can. Over many such round trips, we should statistically start to book a profit approximately equal to the spread minus costs.

Method 2: Rebalancing stablecoins w/ Balancer

Skill-level: Intermediate—requires DeFi skills to use Balancer (see tactic #33)

For most people, manually trading a mean-reverting strategy or automating such a strategy on an order book exchange or dex is a complex undertaking. So, in this section, we’ll take a simplified approach: we’ll deposit stablecoins into a Balancer’s liquidity mechanism when there is a spread and let Balancer re-weight them as their relative prices change. If the price of DAI returns to the peg, we can withdraw our stablecoins from Balancer and book a return.

Balancer won’t exit our position for us, so we’ll still need to watch prices, and we may incur some costs in terms of impermanent loss (as with any automated market maker) that will be comparable to fees in the previous strategy. But the upshot is that this is a simple on-chain mechanism, and since we are a liquidity provider for Balancer’s capital pool, we may also earn some trading fees on top if the portfolio becomes popular.

🔥Use interest bearing tokens to increase gains. On Balancer, we can do trading between Compound c-tokens—cDAI and cUSDC—and earn an extra lending return while we trade. What do you say to that, Coinbase?

Executing the DAI-USDC Balancer portfolio strategy

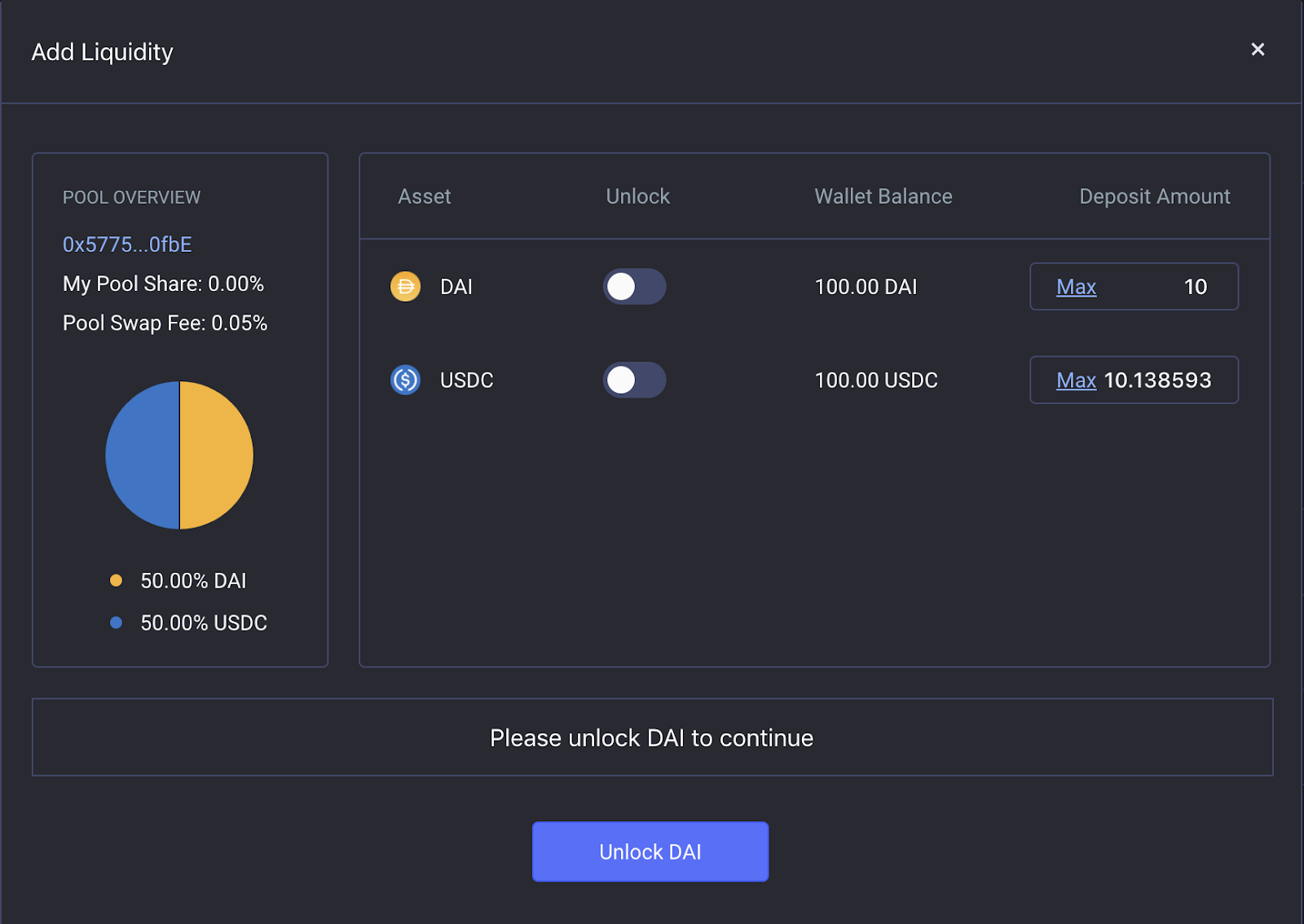

- Find Balancer’s 50/50 DAI-USDC pool (or, alternatively, you can use 50/50 cDAI-cUSDC pool if your stablecoins are in Compound).

- Wait until DAI becomes expensive relative to USDC and deposit both assets into the pool. For example, in the screenshot below we would need to deposit 10 DAI and 10.1385 USDC into the pool. (Optional step for power users: create a Maker Vault and issue DAI, use it to buy USDC so you end up with the 50/50 ration you need for the Balancer pool. If you are bullish on ETH, you can create the vault with ETH collateral; otherwise, use USDC as collateral for the Vault.)

- As the pool trades we may incur some impermanent loss, a normal property of automated market maker mechanisms. According to the folks at Balancer, the impermanent loss that happens for such small changes in price are small: for example, assuming a starting price of 1 DAI = 1.10 USDC, the impermanent loss associated with a price change down to 1 DAI = 1 USDC is only about 0.113%; impermanent loss really starts taking its toll for greater price ratio changes. On the plus side, we may also earn some trading fees if users make swaps using this pool.

- When DAI becomes cheap again the pool will have more USDC than DAI, and we will withdraw our collateral plus the spread, as well as the transaction economics (-impermanent loss of the AMM and + the trading fees). Note we can withdraw our assets from Balancer at any time if we need to, booking smaller portions of the spread.

Final thoughts

The de-pegging of stablecoins happens periodically often as a result of some temporary shock to the system. When these events occur savvy traders can often make fast and relatively low risk returns by trading stablecoins.

In this tactic we learned two methods for trading stablecoins when they’re off their peg. The first method requires some market making infrastructure and automation. The second method simply uses the auto-balancing power of the Balancer protocol. In both cases money protocols like Compound (for interest) and Maker (for leverage) can be used in creative ways to further increase gains.

Remember these methods carry risk—trading is risky

If you choose to engage in trading, please be aware that this is a risky activity where you can lose capital. Whether trading on an exchange or through a product like Balancer, upside is not guaranteed, smart contracts can break, and prices can dislocate in unexpected ways. That said, mean-reverting strategies on stablecoins can be relatively safer than strategies holding volatile cryptoassets or engaging in unproven or unaudited smart contracts. Stablecoin spreads, especially across many successful roundtrips, can potentially outperform stablecoin lending today.

Author blurb

Jake Brukhman is the founder & CEO at CoinFund, a blockchain-focused investment firm based in Brooklyn, New York. Previously, he was Partner & CTO at Triton Research, technical product manager and engineer at Amazon.com, and spent 5 years in financial technology in New York City, including at Highbridge Capital Management.

Action steps

- Check now—is DAI/USDC off its peg?

- How can you use this tactic to profit in a future stablecoin de-pegging event?

Go Bankless. $12 / mo. Includes archive access, Inner Circle & Deals—(pay w/ crypto)

🙏Thanks to our sponsor: Aave Protocol

Aave protocol is a decentralized, open-source, and non-custodial money market protocol to earn interest on deposits and borrow assets. It also features access to Flash Loans, an innovative DeFi building block for developers to build self liquidations, collateral swaps, and more! Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.