Ethereum will eat Wall Street's settlement layer

Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

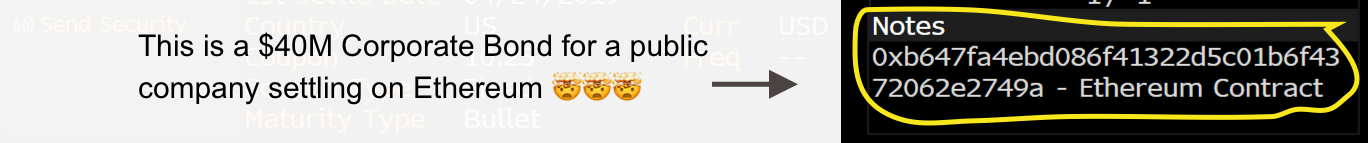

Notice anything different about this Bloomberg terminal?

There’s a lot there I know.

You’re looking at a bond that’s been issued to a NASDAQ traded restaurant corp called Fat Brands—a company that franchisees over 400 restaurants.

Pretty normal stuff right?

Wait…what’s that in the bottom right corner? An ETH address? Was this $39.7m corporate bond issued on ETHEREUM?

Couldn’t be. Ethereum is just for geeks.

But wait…

Here’s the ETH address of FAT Brands LLC the bond issuer.

Here’s the $39.3m of bond cash on ETH (purchase price less principal reserves).

Here’s tranche A and tranche B2 on Ethereum.

This is legit. OMG Bloomberg terminals using Ethereum for asset settlement!

Interest paid via stablecoin to ETH addresses.

A $40m bond last month and $500m in the pipeline.

Is this the beginning of Wall Street replacing its settlement layer with Ethereum?

Why Ethereum?

And what’s it like to buy one of these bonds?

I asked someone who’s done it.

Josh Johnson a Bankless reader, crypto aficionado, and accredited investor (you have to be accredited to buy a U.S. security) shares his personal experience today. 🔥🔥🔥

- RSA

P.S. I need your help to translate articles like this—give a DAI to the Translations grant

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

THURSDAY THOUGHT

Ethereum will eat Wall Street's settlement layer

Guest post: Josh Johnson, Machine Learning Engineer and Crypto Aficionado

A few weeks ago I was on the phone with my broker from Fidelity. Somehow, in the midst of moving money between my financial institutions and making trades I had accidentally placed orders with more money than I actually had in my account. A few days prior to speaking to the representative I had received a letter stating that if I didn’t transfer enough funds by the end of the week they would liquidate enough assets to cover the shortfall.

I asked the person on the other end of the line, “How was this possible? Why was I allowed to place a trade when I didn’t have the money?”

She didn’t really have a good answer. Basically, she stated that Fidelity is able to allow people to place a trade without the money as long as they believe that it will be paid by settlement time. Somehow, I had stumbled into a loophole that I came to find out was not that unusual and I was reminded that I don’t really own the assets in my brokerage.

The problem of traditional finance and settlement

The problem of tracking ownership of assets is a difficult one, not just for brokerages. Cap tables are often tracked in spreadsheets and can get fat-fingered. Rehypothecation and short-selling can lead to more shares existing than should. Then there’s the whole story of Dole Food, where shareholders ended up owning about 33% more shares than were supposed to exist. It’s a challenge because there’s no one global representation of the state of ownership at any point in time. But if you’ve been in crypto for any period then you’ve probably heard all of this and know of several companies trying to tackle this problem with a blockchain: t-Zero, Securitize, etc. However, I would wager that you haven’t heard about one company that is already using Ethereum’s mainnet to solve this problem in the niche finance space of securitized business lending: Cadence. (RSA: these are the guys issued the bonds from the intro)

Looking for high yield in a low yield world

Before diving into their solution, I’d like to give you a rundown of how I found Cadence and what their business provided me as an investor.

We’ve obviously been in a low interest environment for at least a decade and the past few weeks indicate that this period will remain for the indefinite future. So, where do investors go to get yield? How do retirees, like my parents, make a reasonable cash flow on a lifetime’s worth of savings? Gone are the days of making 5% on bonds and other low risk lending. Peer-to-peer lending, once seen as a way for retail to tap into bank lending returns, has now been crowded out by the very institutions it was meant to replace. As rates have fallen, investors have had to seek yield in higher risk assets: high yield dividend stock, lower grade bonds, and real estate. Where do you turn when money is cheap and the world is flush with dollars?

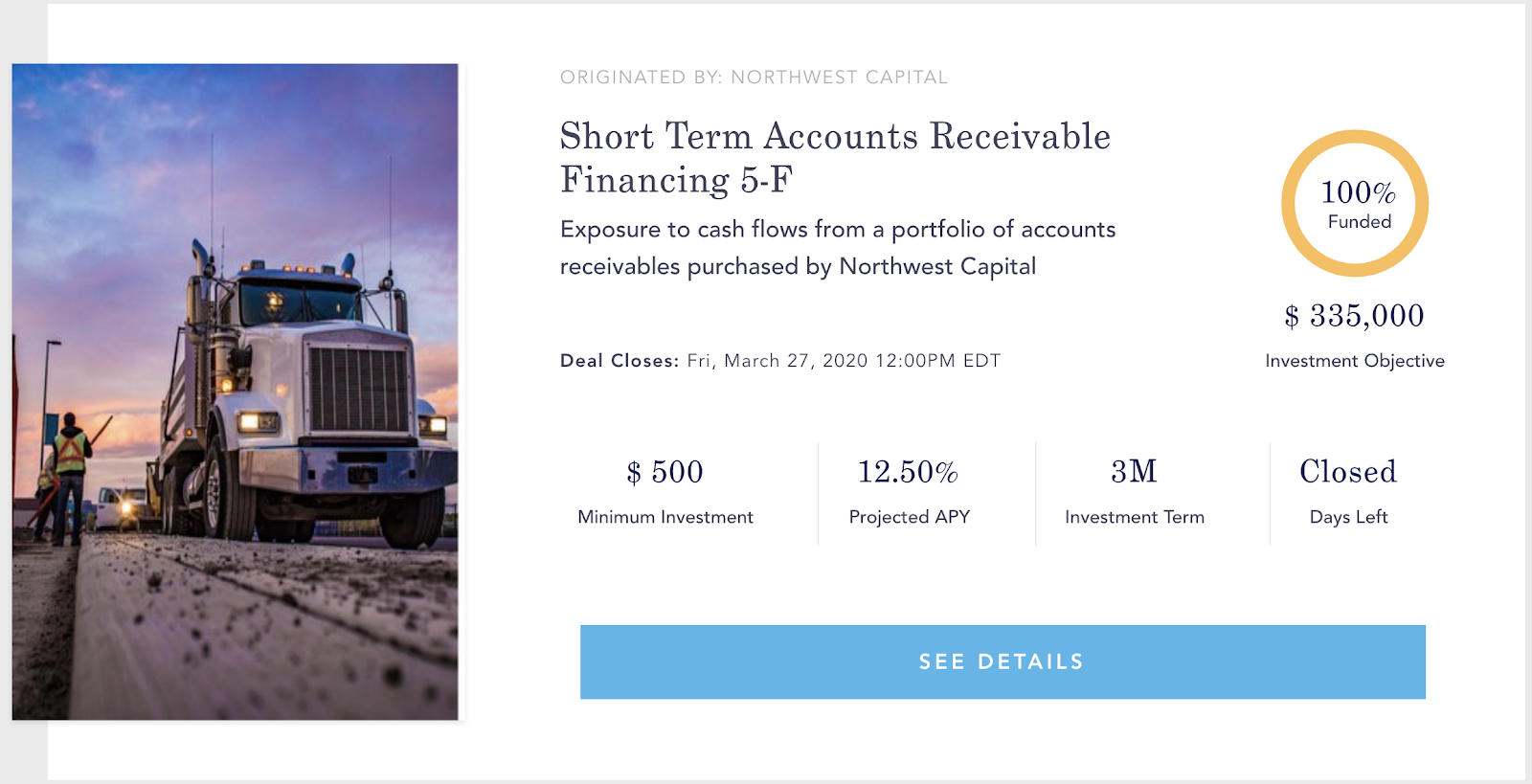

One place that I decided to look was in small business financing. For those small businesses that need short-term cash flows to pay suppliers and payroll while their invoices float, they are willing to pay a higher lending rate. These businesses are usually collateralizing their accounts receivables or other assets to get access to short-term financing. And this provides a fairly good risk-to-reward for investors looking to diversify their passive returns. I think of these investments as a way to fill out my risk profile since the returns are uncorrelated to equities and other high yield investments. There are a number of companies out there that allow accredited investors to invest in these assets but they often require a large amount of capital or don’t have a transparent view of their asset flows. Then I stumbled onto Cadence. They made it easy to invest with as little as $500, they were integrated with Bloomberg terminals, their website was intuitive and they offered competitive returns. And then I learned that they use Ethereum mainnet under the hood. Sold! I had to give them a try.

I’ve been investing with Cadence for over 6 months now and have been pleasantly surprised by the performance of my investments and the ease of use. I’ve invested in 11 deals, and the return rates generally range from 9% to 12% APR. The returns have been inline with expectations and I can rollover into new rounds as the old ones mature. The duration of each deal ranges from 1 month to 1 year but is typically 3-6 months. They are sourced by various loan originators that have a specific industry focus—transportation, small to medium sized businesses, Mexican small biz, even crypto lending.

(Above) Figure 1. Investment Example

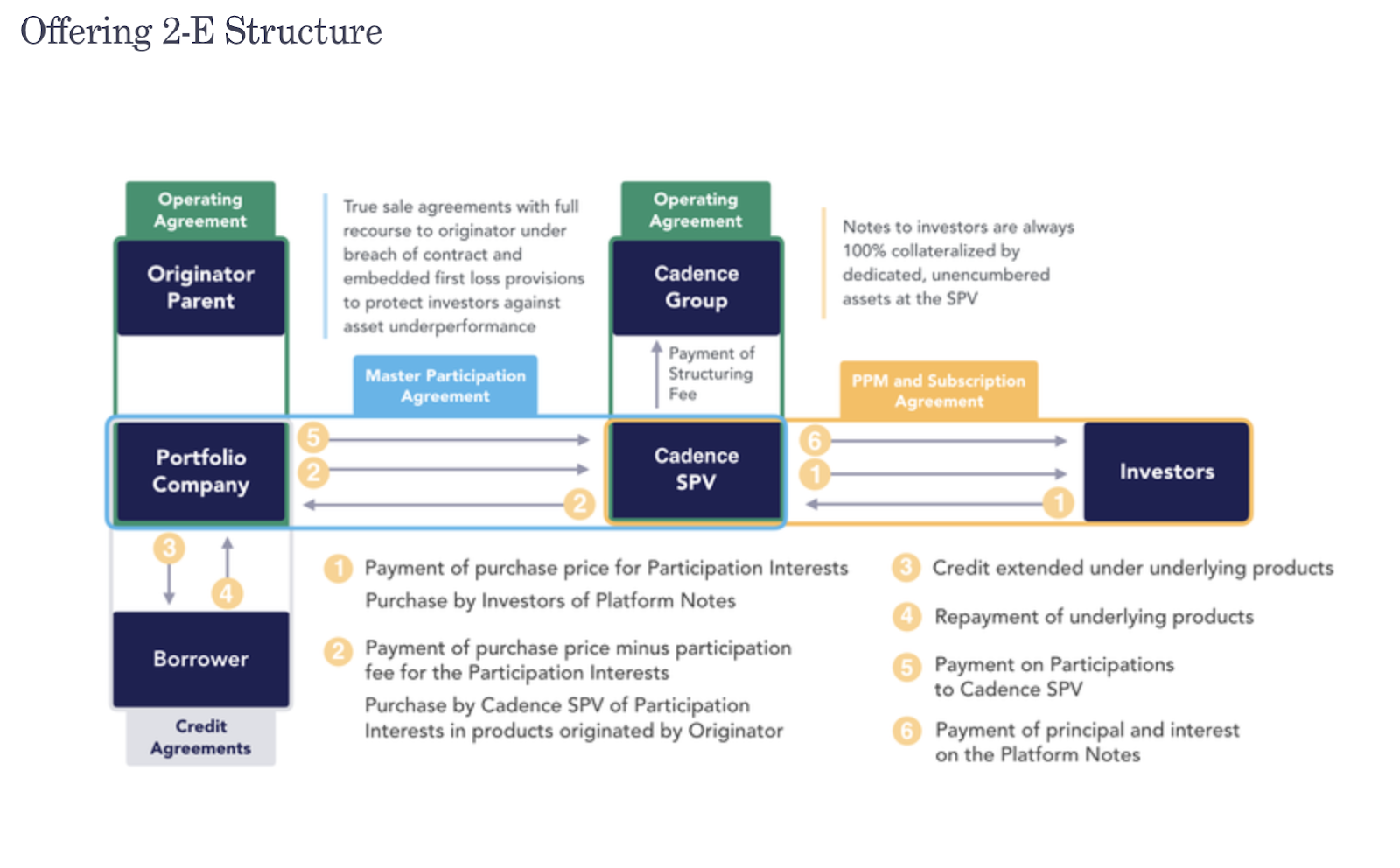

(Above) Figure 2. Example loan offering structure

Gradual replacement of underlying infrastructure

When I talked with the founder, Nelson Chu, I asked him “Why place these deals on Ethereum?” He stated that they use Ethereum so that each person’s wallet serves as a “complete reflection of their transaction activity, it becomes a perfect audit trail.”

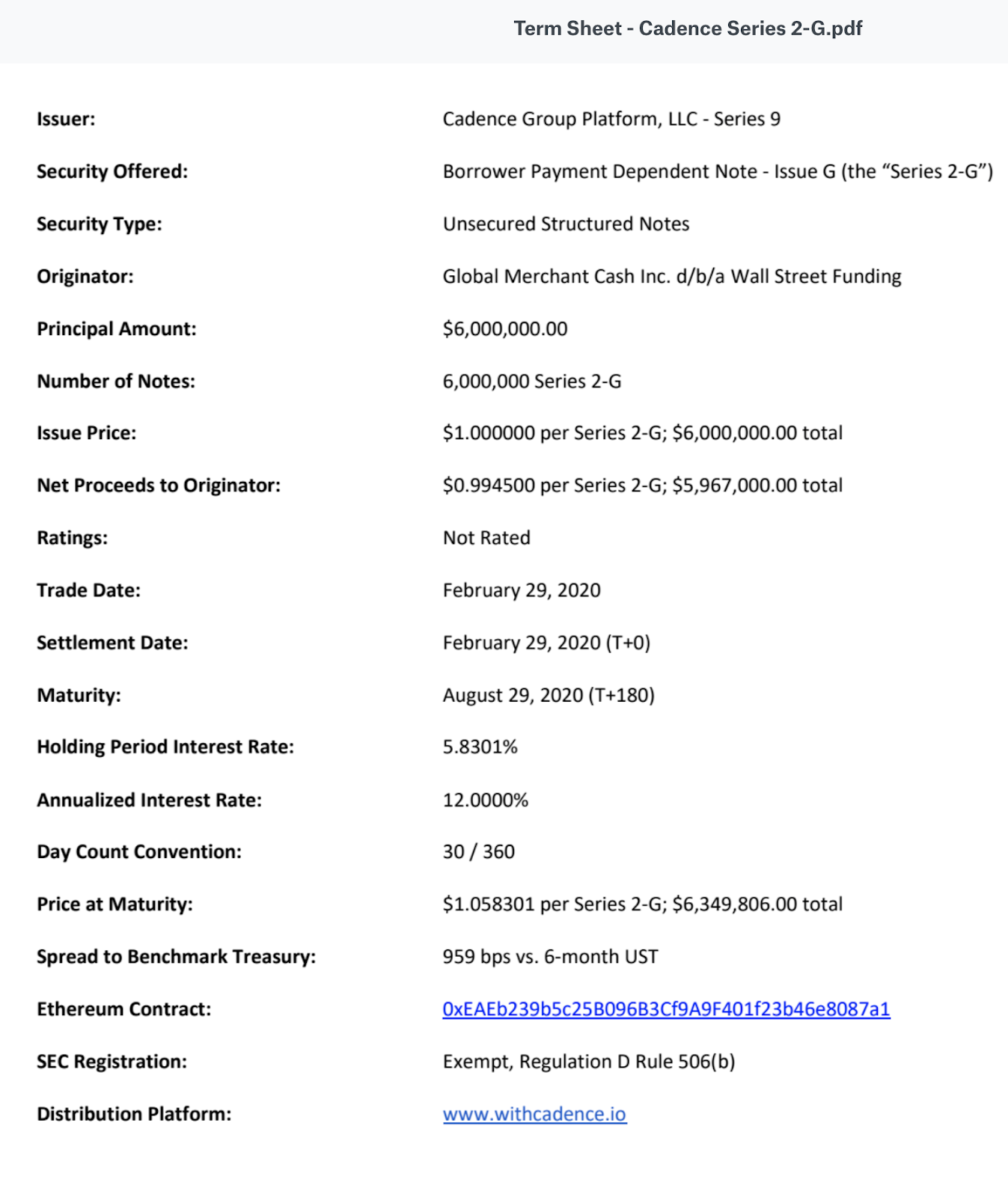

Think about that! A perfect audit trail. The crypto community has been talking about this idea for years. And we are now seeing that dream become a reality. On mainnet. Each investor gets their own ethereum address with ERC-20 tokens that represent their allocation of the specific investment. They can go to Etherscan and view those tokens. The term sheet of the deal points to the particular contract on Ethereum representing all owners (pseudonymously) and their allocations.

Now, don’t get over-excited. This isn’t DeFi like we know it. This isn’t trustless. There is still an intermediary with Cadence. If they fat-finger a contract’s allocations, they can just publish a new one.

These mainnet contracts serve more as a parallel structure that keeps track of the global state of ownership at any point in time. There’s nobody that has to keep track of how many shares are getting Doled out (see what I did there?). Nobody that’s updating a spreadsheet. Ethereum automates the backend for them.

But there’s a long term strategy that Nelson has in mind. When it comes to bigger deals like the one they just completed on the whole business securitization of Fat Brands, institutions expect that these securities will be tradeable.

Here’s what he said:

“So we actually have a path towards the securitization of an asset that people actually want to trade vs. others [who] are just tokenizing things that people have no interest in liquidity for. So when a trustee needs to make distributions, when a bank wants to make a secondary market, the tokens will have a much bigger role to play to know who owns what when.”

This could mean that investors will be able to trade ERC-20 tokens on mainnet that represent loan contracts, and therefore, cashflows.

Mainnet as a Strategic Advantage

Securities. On. Ethereum. Today. And virtually nobody is talking about it. But this is Cadence’s strategic advantage. They can lower the cost of these deals, provide auditability, and automate their backend with Ethereum today.

Not every business needs to be a DeFi business. Not every business will start out being trustless. But gradually, people will see that having a global ledger that is transparent and open will give them a strategic advantage over their competitors. As Chu put it:

“It’s a long game we’re playing. We just got the trustee comfortable with the fact that we’re even issuing a digital security to begin with! As long as we can prove we make their lives easier and they make more margin, the chance of adoption is higher.”

I believe this is how we will see the traditional financial infrastructure move to Ethereum. It will be in pockets, those pockets will connect and work seamlessly together. Building and reinforcing liquidity on each other and making it easier and easier to transact, audit, trade, and invest.

Author bio

I am a machine learning engineer by day, a dad by night. I bought my first Bitcoin in 2013 just as Mt. Gox was collapsing and luckily heard about Ethereum while it was still a project. I’ve been a part of Ethereum since genesis and consider myself an active user and investor in the space. I’ve remained in Ethereum through thick and thin because I believe in what this community stands for and want to see us bring an open, permissionless financial infrastructure to the world. You can catch me on Twitter @joshuahjohnson .

Action steps

- Consider: what are the benefits of traditional assets on Ethereum?

- Will this be positive of negative for the value of ETH?

Go Bankless. $12 / mo. Includes archive access, Inner Circle & Deals—(pay w/ crypto)

🙏Thanks to our sponsor: Aave Protocol

Aave protocol is a decentralized, open-source, and non-custodial money market protocol to earn interest on deposits and borrow assets. It also features access to Flash Loans, an innovative DeFi building block for developers to build self liquidations, collateral swaps, and more! Check it out here.

New to the Bankless program? Start here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.