Level up your open finance game 5x a week. Subscribe to the Bankless program below.

Dear Bankless Nation,

One of my favorite features of this industry is how it relates to so many different domains of knowledge. Mathematics, cryptography, computer science, game theory, economics, finance, physics, sociology, politics…

But one of the most underappreciated is how cryptocurrency relates to biology.

Today, we explore this subject as I attempt to illustrate Ethereum as a plant.

Ethereum as a plant produces trust as its fruit. In a world devoid of trust, Ethereum can serve an important role in filling that void.

Some of the world’s most successful plants are the ones that produce products that humans want, and humans want trust.

I hope you enjoy!

- David

If you prefer audio over reading, here’s this article read aloud on the Bankless YouTube.

🙏 Sponsor: Argent – DeFi in a tap (👈 go download this wallet now - RSA)

THURSDAY THOUGHT

Bankless Writer: David Hoffman, Bankless Founding Father

Ethereum: The Tree of Trust

Life

Life is a bottom-up phenomenon. It emerges out of mechanisms that produce order out of chaos. By harnessing the energy of the world around it, ‘life’ is the product of organic algorithms that are capable of inputting the energy from the world around it, and outputting order. Once an initial foundation of order is established, life progresses and develops by adding on further and further layers of order on top of its initial foundation.

This is how life went from single-cellular to multi-cellular organisms, to complex symphonies of organs, integrated systems, hormones, brains, and consciousness. It started small, and then it layered further and further structures upon itself, over many millions of years, to evolve into the massively diverse and complex life forms we know today.

Importantly, every iteration on the evolution of life was based on the incentives of each individual unit. Richard Dawkin’s book ‘The Selfish Gene’ discusses how each gene of an organism is the smallest unit of life, and its inherent self-interest in its own preservation and replication offers the foundational pattern to which all of life stands on.

Good genes survive. Bad genes die. Genes that band together with others do better than those that stay independent because group coordination makes survival more efficient.

Charlie Munger’s quote “show me the incentive, and I’ll show you the outcome” applies to life as well. Life inherently has the incentive to ‘survive’; it is the prime motivational force that gives life its sticking power and ability to progress. Life is simply the combination of the desire to live with the tools needed to do so.

Given enough time, we can eventually expect there will be a flourishing planet full of life of all forms, as the motivational force to live long and prosper will come to fill all voids and niches with some new form of life.

Nature abhors a vacuum, and all corners of space-time are places where life can emerge. With sufficiently strong foundations and life-producing tools, even the most void areas of space-time are capable of hosting life.

Crypto-Economic Life

Crypto-economic systems like Bitcoin and Ethereum represent life forms in an entirely new domain of existence. They are Internet-native life forms, and their existence in this alternative plane of reality is what makes them so fundamentally unique.

Bitcoin and Ethereum aren’t the first organisms to inhabit the Internet domain. Computer viruses are basically as old as the Internet itself. As the march of evolution goes, first comes simple, highly replicable life, and later comes complex bodies with internal structures that work in harmony to produce something greater than the sum of its parts.

Some of my favorite work in this space has been done by Brandon Quittem, warmly known as 'Bitcoin Mushroom Man’, for his fantastic work illustrating the connection between Bitcoin and mycelium, which are underground networks of fungi that flower above ground as mushrooms.

📚 For more on ‘Bitcoin is a mushroom’ read: Bitcoin is a Decentralized Organism

One of the best features of this industry is how it somehow relates to all domains of knowledge, and specifically, I think how crypto-economics relates to Biology is one of the most fascinating and under-appreciated.

A comprehensive understanding of crypto-economic systems like Bitcoin and Ethereum must leverage a biological perspective, while also integrating concepts of complexity and adaptive systems.

When we discuss Ethereum and Ethereum-related applications or concepts, we are often zoomed in too close to view the system in a holistic manner. When you zoom out and view Ethereum as one coherent system, biology becomes the best lens to view it from.

For example, a metric that we often use to illustrate the health of these systems is ‘node count’, or how many instances each system has been able to replicate itself upon. Good crypto-economic systems are easily replicable, and ‘downloading the chain’ is something that can be easy (Bitcoin) or hard (Ripple, EOS). Systems with good replicability are anti-fragile and find it easier to survive.

This is how systems like Bitcoin and Ethereum become viral. No feasible amount of coordinated labor can eliminate nodes faster than they can be created.

Bitcoin and Ethereum want to live. They have their own native motivations, as well as unique strategies for achieving their goals. Like all of life, they are goal-oriented systems with a will to live long and prosper.

Ethereum applications that discover product/market fit are instances of Ethereum growing new structures to help it achieve its goals. When a new protocol is developed on Ethereum, it’s like Ethereum sprouting a new appendage, which is a new tool it can leverage to survive and thrive.

Humans evolved bipedal locomotion, opposable thumbs, a pre-frontal cortex, and we use these structures to achieve our goals and aspirations. Similarly, Ethereum develops money legos, and these structures are stitched and combined to produce functioning, input-sensing structures that enable competitive edges over its competition.

I wrote Ethereum is an Emergent Structure with this framing in mind. The piece is summarized as:

- The ‘money legos’ of DeFi applications are the building blocks for a single collective DeFi structure

- This single DeFi structure, made up of many different independent components, is what we call ‘Ethereum’

- Applications on Ethereum create new surfaces for other applications to build upon. MakerDAO, Uniswap, Compound, etc all represent Ethereum applications that consume chaos and produce order, creating new arenas of stability, leverageable by other applications

- The linear growth of order-producing applications creates exponential growth of stable surface area able to be built upon.

- The permutations of possible combinations of apps quickly approach infinity, and Complex Adaptation begins to take over. Also see Chaordic Organization.

📚 For more read: Ethereum is an Emergent Structure

Ethereum is a Trust-Producing Plant

Many plants of the world have incentivized humans to do their bidding. The agricultural revolution was the era when energy-capturing plants convinced humans to put down their bows and spears, and instead be aligned and incentivized in the plant’s survival, due to the beneficial product that the plants produced: food.

Plants produce what humans want, and humans dropped everything in order to cultivate these organisms, as the life and prosperity of the crop meant life and prosperity for the farmers.

Wheat, coffee, tobacco, corn, any crop at all is an organism that produces something that makes the plant itself extremely valuable to us. Because the plant is so valuable, humans toil to ensure perfect conditions for the plant’s ability to thrive. We make sure it gets enough water (but not too much!), enough sunlight (but not too much!), and enough nutrients (but not too much!). We innovate pesticides that harm insects but not the leaves. We buy more land and put more plants on it. Then we find ways to put more plants on less land. Then we buy more land and repeat.

From an evolutionary success standpoint, plants that give humans what they want are some of the world’s most successful organisms.

These plants have outsourced replication and proliferating duties to humans. Plants don’t have a brain, yet they have convinced generations of humans to use their brainpower to study and research how to best grow and proliferate these organisms.

They get to spread and replicate their DNA without having to do any work, because humans do it for them instead. Plants that produce value for humans incentive human labor the propagation and proliferation of the species. Nice move, plants.

Wheat produces carbohydrates. Coffee produces caffeine. Sugar cane produces sugar. Tobacco produces nicotine.

Ethereum produces trust.

The nature of crypto-economic systems is to produce trustless coordination infrastructure. The aim is to act as a substrate for the establishment of trust between two or more parties.

Trust is the highly desirable compound produced by the Ethereum plant.

Like food and cash crops that convinced entire populations to be focused on their survival, Ethereum is slowly recruiting all of humanity to help grow and protect it, because the product of the Ethereum plant is so incredibly valuable: trust.

Like how the agricultural revolution created an explosion in population growth and human specialization, the trust revolution will bring similarly unimaginable improvements in the health and proliferation of the human species.

The trust revolution begins with cultivating Ethereum’s Tree of Trust.

My Christmas Cactus

One of my favorite plants is my Christmas Cactus, named after the time of year in which it flowers. How it grows is really cool, and very illustrative of the concept of charodic organization and complex adaptive systems (Ethereum is an Emergent Structure).

New Christmas Cactus leaves extend out of older ones and form a chain that extends all the way back to the base of the plant. Sometimes, two or three leaves shoot out of a single leaf and go in their own direction, forking into a new chain of leaves.

The new leaves that emerge are initially delicate and floppy, and if you’re careless you might break one off!

If you do, you’ll have to wait for a new leaf to re-emerge in its place.

If a Christmas Cactus goes through hardship (not enough water, sunlight, brutal weather conditions), it will begin to drop off all of its newly formed, excess leaves! All plants do this in some manner. If there are trying conditions, the organism needs to become more efficient. It does this by reducing its costs and expenditures. New leaves, being the furthest from the base of the plant, require the most energy to ferry nutrients to and thus are the first to go when times get hard.

This is no different than a company that ‘trims back’ during recessions, or populations that contract during a famine. This pattern is part of the universe we live in, and is exactly what you want to see in anti-fragile, enduring organisms. In order to live long and prosper, it’s important to be able to respond to the conditions of the environment around you. When the going gets tough, you keep your resources close. And you don’t risk costly new ventures.

If there are sufficient conditions for growth, however, new leaves are able to create more energy for the plant than they cost to produce and maintain, and thus earn their way into becoming a more permanent part of the structure of the plant.

The leaves that manage to stick around for a long time start to become woody.

‘Woody’ is a real, albeit non-technical, term that describes the structural tissue of a plant that is composed of highly durable cellulose and lignin. Cellulose provides the carbon-lattice structure that makes wood incredibly strong, and lignin is like the internal circulation system for the plant. Cellulose provides the structure, lignin provides the nutrient circulation. Bones and blood.

Becoming ‘woody’ is a slow, iterative process of adding on layers and layers of cellulose as its structural tissue, and over time hardens into a stem. The woody parts of plants do well during winter conditions due to their resilience to hostile weather and temperature.

In human biology, we use the term ‘calcification’ which describes the layering of calcium and phosphate into a matrix that becomes bone. We also use the term ‘calcification’ in the crypto world to describe the hardening of these systems and the ability to make changes to then. Bitcoin is considered ‘calcified’ because of its resistance to protocol changes.

The opposite of ‘woody’ plants are ‘herbaceous’ plants, which exhibit no woodiness and thus have ephemeral above-ground growth. When the winter comes, the above-ground growth dies off, and the root-system goes dormant until conditions become more favorable. The strategy of letting your surface-growth die off each year, just to grow it back later is an interesting one. It means that plant survival isn’t dependent on its above-ground growth and therefore can endure through extremely hostile conditions.

However, not being able to produce long-term, above-ground growth is overall constraining for the potential of the plant. Woody growth is a system that allows a plant to ‘lock-in’ the growth it makes each growing season. Without this ability, a plant starts anew each year.

Every growing season, many fresh new leaves are added to the plant. Due to the ample nutrients and favorable conditions found in growing seasons, plants are able to bear the risk of costly new growth due to the possible upside of new, year-round, sustainable energy capture.

Meanwhile, in order to support and sustain any new successful ventures, all the old leaves on the Christmas Cactus become woody. The internal structure of older leaves begins to harden. They morph from being floppy, soft, and delicate into woody, firm, and durable. These older leaves form a solid stick-like structure on their inside, which helps generate a stable and dependable branch for new growth to build from. Next growing cycle, some fresh new baby leaves are sure to grow out of these veteran leaves.

New leaves are able to capture new resources, and older leaves become better at circulating these new resources. This positive feedback loop is how life proliferates.

Not all leaves make it to the point of being woody and stable, but once they do the likelihood that the leaves become a permanent structure in the overall plant increases significantly. The more woody and firm the Christmas Cactus becomes, the more dependable surface area it has to grow new leaves from its stable base.

The Trust Plant

You’re probably thinking “David, what the hell is all this talk about plants for?”

This is exactly how Ethereum grows as an ecosystem.

Early primitive foundations are constructed, and over time new extensions emerge out of this foundation. If the extensions are good, they are retained by the system. If they are bad they get washed out from neglect.

The ERC20 standard was one of the first emergences out of the Ethereum foundation, and this structure has become a crucial, unbreakable scaffolding for almost all of Ethereum.

In 2017, a multitude of ICOs came to Ethereum. Thousands of new leaves were born out of a relatively young plant. These new leaves were enabled to grow because 2017 flushed Ethereum with resources. 2017 gave Ethereum a seemingly limitless supply of sunlight, water, and nutrients, and as a result, a thousand new leaves of Ethereum emerged out of the protocol.

In 2018, the sun, water, and nutrients all dried up, and 95% of the leaves that were born in the 2017 growing season died and dropped off the plant. Ethereum had not yet built a stable enough foundation to be able to host all of these new leaves, and many of the new leaves were deformed and weren’t adding sufficient value back to the base plant.

In these conditions, anti-fragile organisms like Ethereum do what they do best.

They trim the fat and harden up for the winter.

2018 and 2019 was a long winter for Ethereum. Few resources came into the ecosystem, causing Ethereum to continue to cut back, closer and closer to the core of the plant. Like a body experiencing hypothermia, plants contract their resources closer to the core of the plant. An extended period of insufficient resources meant that the Ethereum organism would continue to have to consolidate and become more efficient.

No one is immune from the depths of the bear market. Even high-quality projects like Nexus Mutual came close to ‘dropping off’ due to the lack of funding. Even the most resilient of plants will still die without the required resources, and the organism will continually ‘cut back’ until new resources come until it completely dies.

DeFi Summer brought a wave of new energy into the Ethereum system, and with that new energy came a new wave of growth out of the Ethereum plant. Capital flowed into the economy and new projects were established.

Most importantly, the projects that had made it through the 2018-19 bear market have become scaffolding to support all this new growth. After learning to survive under famine conditions, the parts of Ethereum that had made it through the winter had become extremely lean, consolidated, and efficient. They are capable of maximizing the value found in new nutrients being poured into the ecosystem.

Uniswap first emerged in 2018 and was one of the few leaves that were able to grow during the 2018-19 winter. If a new structure can grow during times of hardship and lack of new resources, imagine what it can do during a growing season.

It’s barely springtime in Ethereum-land, and Uniswap is already doing more volume than Coinbase.

Uniswap as a structure is able to host new growth extending out of the protocol. It is one of Ethereum’s most efficient leaves because it creates massive surface area for further growth to emerge out of it. Uniswap quickly turned into a woody, stable component of Ethereum’s internal circulatory system, and many new leaves have been enabled to depend on it for structure.

Uniswap was built on the dependable, stable structure of the ERC20 token. As a result, it produced its own dependable, stable structure which is now hosting a diverse variety of new growth in the Ethereum ecosystem.

Structural Modularity

Purveying the DeFi ecosystem, one sees a diverse landscape of applications all with varying degrees of attack vectors and protocol hardness/security.

Uniswap, MakerDAO, Compound, Aave, Curve, Synthetix, Balancer, Yearn all resemble varying degrees of dependable surface area for others to build from.

Notably, many are concerned about how much growth has been off of MakerDAO. DAI is becoming increasingly backed by centralized assets, leaving the MakerDAO leaf perhaps more fragile than what’s ideal.

If the MakerDAO leaf on the Ethereum plant died, it would kill all other leaves built on it as well. If the foundation crumbles, everything above it dies. This would be bad for the plant. However, as even the most novice horticulturalist knows, losses to a plant can always be rebuilt with time.

We already see this with Aave and Compound—two redundant copies of similar scaffolding. While MakerDAO continues to dominate the decentralized stablecoin landscape, a new cohort of startup leaves are establishing themselves to help support the plant: RAI, Empty Set Dollar, and Dynamic Set Dollar.

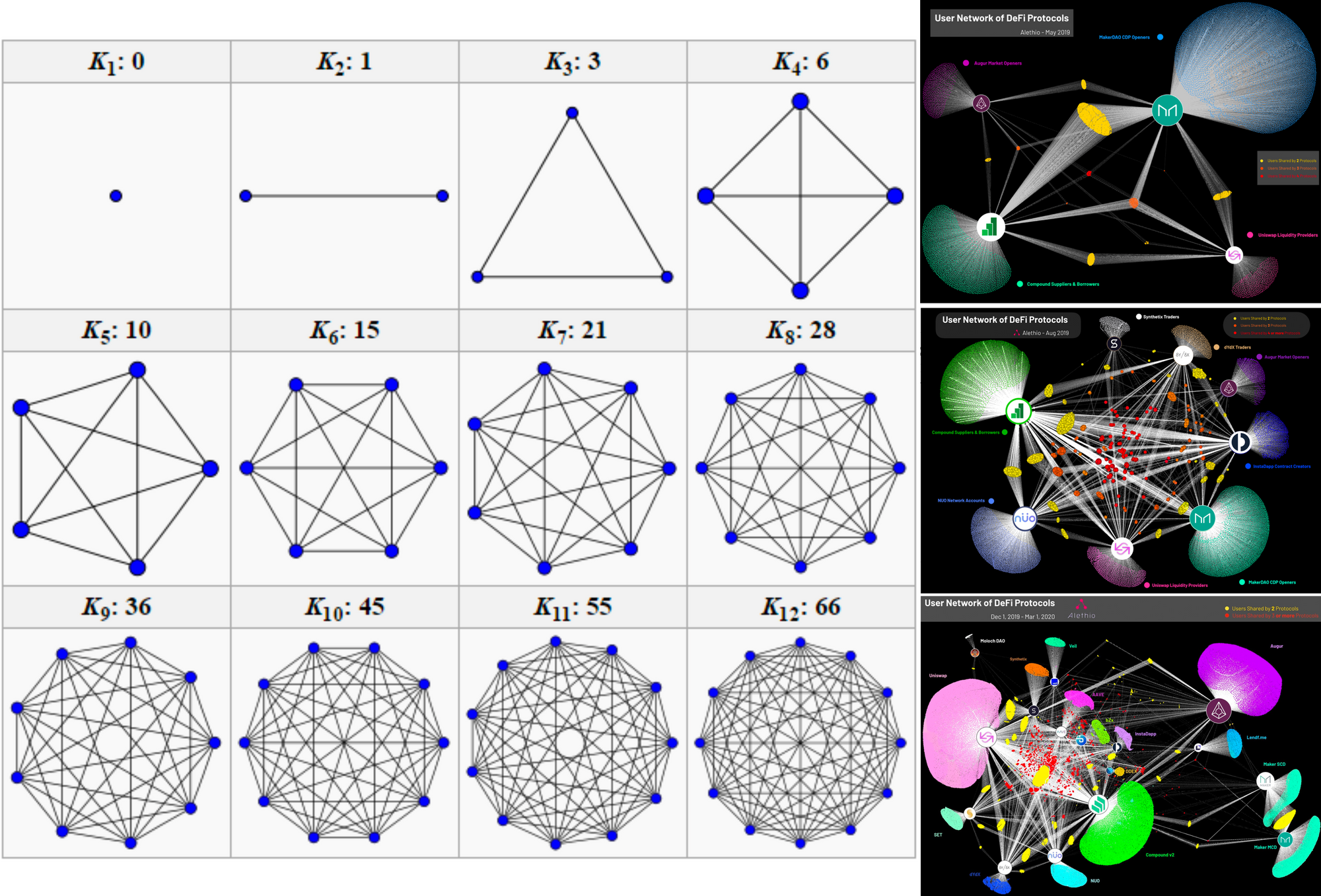

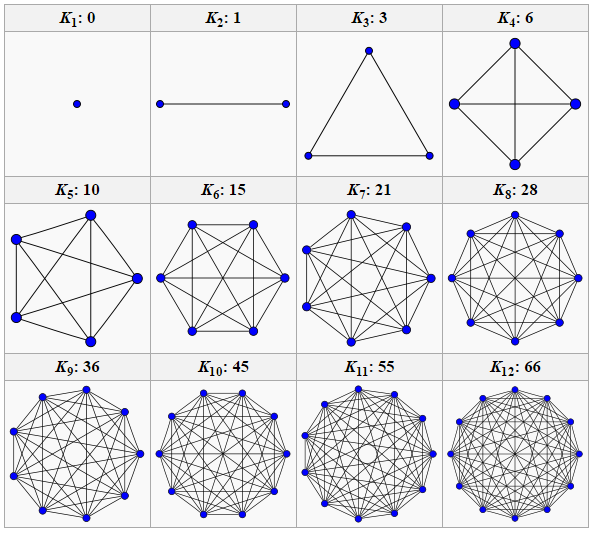

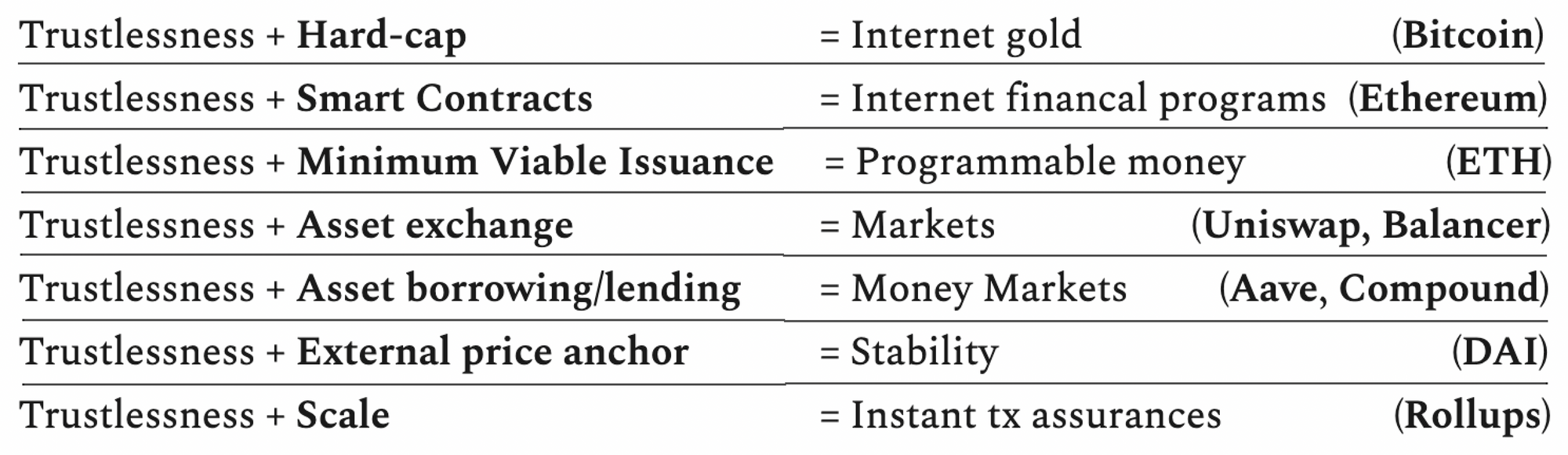

Remember this figure:

Anti-fragile redundancy is at the core of all life, and the establishment of a diverse ecosystem of overlapping DeFi applications produces a healthy network of both interdependent and independent products.

Ethereum is in the process of growing a holistic mesh network of woody, stable growth out of the base of the plant. The more dense the mesh-network is, and the more woody and stable it becomes, the more ready DeFi is to support the world’s economy.

Ethereum Roots, DeFi Leaves

The Chinese Bamboo Tree is capable of some of the fastest growth in the world, capable of 80 feet of growth in just six weeks!

How is this possible? The answer is because the 6 weeks of growth is simply the expressive period of the plant, but is actually only one small component of the overall growth process of the Chinese Bamboo Tree. It actually takes the bamboo tree 5 years of underground root development in order to be able to create all the impressive above-ground growth.

Five years of ‘dormancy’, as the plant grinds away at developing its nutrient-collection and circulation system. Then, when the conditions are just right, the plant makes up for its five years of dormancy in just six weeks by growing 80 feet tall.

It wasn’t called ‘crypto-winter’ for nothing. Starting in 2018 and ending in early 2020, the winter period for crypto was looooong. It was 30 months of consolidation as crypto-economic systems pruned themselves to be able to maintain life.

Miners dropped off. Funds went bankrupt. Projects shut down.

But one thing never stopped happening: the progress and development of Eth2 and structural improvements to Eth1x. During the crypto winter, Ethereum’s roots seemed un-phased by harsh, above-ground conditions, and have grown into an extensive network of parallel growth and development (see Vitalik Roadmap).

With Phase 0 live and underway, EIP1559 on the horizon, and the Rollup ecosystem consolidating into its final form, the foundational roots of the Ethereum economy seem as anti-fragile and dependable as we could have ever hoped.

Meanwhile, the above-ground conditions have quickly begun to thaw, and new interest in Ethereum is funneling new resources into the ecosystem at a never-before-seen rate.

Ethereum is entering its growing phase. And from what we are able to see, conditions look extremely favorable. The rate of growth of new leaves out of the Ethereum plant is going to be incredible to watch.

The Woodiness of Ethereum is its Values

Ethereum has been designed around a particular set of values and importantly has taken zero shortcuts with learning how to express these values to their maximal degree.

The values of Ethereum are synonymous with the Protocol Sink Thesis:

- Permissionlessness, openness

- Censorship resistance

- Credible neutrality

- Decentralization

These qualities are the qualities that differentiate a private product from a public good, and the whole entire reason this industry exists is to produce globally accessible public goods in money and finance.

📚 Read more on the Protocol Sink Thesis

The formula for how this industry will develop is as such:

Censorship Resistance + Openness + Neutrality + Decentralization + [App] = Extremely valuable global public good. To make things easier, we’ll consolidate the equation into:

Trustlessness + [App] = ???

Here’s what we have so far

If you’ve built a trustless app, you have built something that is dense in the Protocol Sink and is something that resonates with the values of Ethereum.

When an application on top of Ethereum and Ethereum itself is aligned in their design, synergies emerge.

When an Ethereum application finds itself at the bottom of the protocol sink, proximate to the Ethereum protocol, this application will naturally receive favorable treatment from the rest of the Ethereum ecosystem. A trustless application finds itself at the very core of the Ethereum plant and finds itself having privileged access to the resources produced by the plant. It’s simply easier to nurture a part of the Ethereum plant that is close to the core of the organism.

When an application is trustless, asking for resources from Ethereum is an easy sell.

The users of Ethereum look at the application and ask “will I get my money back in the way I expect?”.

Applications with trustlessness always answer: “Yes”. Trustless applications tend to receive ample money and capital deposited into their contracts. Woody growth emerges out of trustless applications.

Ethereum extends itself outwards from its base into its own app layer via trustless applications.

Uniswap is an app in Ethereum’s application layer, but it is a high-fidelity representation of Ethereum itself. This alignment between Uniswap and Ethereum is why Uniswap was able to thrive during a winter-period and illustrates how Uniswap has so quickly become a stable woody outgrowth from the Ethereum plant so early in its life. Uniswap is an above-ground protrusion from the core of Ethereum.

Ethereum wants to express itself via the app layer, and the applications that do not cut corners on trustlessness are the medium through which Ethereum manifests in the real world. After all, the Eth2 developers spent years trying to perfect Ethereum 2.0’s ability to express trustlessness without constraints. The motivation on why this was so important is because applications can only express as much trustlessness as base-layer Ethereum is capable of allowing for.

In previous articles (Uniswap is Infrastructure, Ethereum is an Emergent Structure, Global Public Goods and the Protocol Sink Thesis), I’ve illustrated a feedback loop between the presence of dependable, trustless structures like Uniswap, and other applications on Ethereum.

DeFi is one single super-structure of financial applications. DeFi apps are ‘money legos’, and there is this inextricable gravitational pull for all applications to coalesce together. What’s the point of having separate legos?

Coders on Ethereum seem to be primarily interested in either

- Producing new apps, or

- Stitching other applications together (but that is actually just a subset of #1).

Therefore, all of DeFi is marching towards one single application superstructure. I call this structure ‘Ethereum’.

When an application like Uniswap is added into the structure, it imbues the rest of the struture with their trustlessness. When applications like Uniswap exist, it helps other applications grow their own trustlessness, because they can simply plug into Uniswap if they need an exchange feature.

As more applications on Ethereum grow in trustlessness, building further trustless applications becomes easier and easier, as there are more trustless tools available to the builder.

Extending this to the plant metaphor, trustlessness is the woodiness of the plant. As the Ethereum super-structure grows in trustlessness, the Ethereum plant has stronger, longer, and more efficient woody growths that are capable of hosting so many more leaves!

When the sun finally breaks through the clouds, Ethereum has built the circulatory structure it needs to produce and maintain the leaves needed to capture that energy.

Full Spectrum of Values

Ethereum’s best feature is that it can host financial activity of any kind. The protocol itself is designed to be maximally expressive, so the full taxonomy of possible activities are able to be achieved on Ethereum.

There are people who wish to build things on Ethereum that do not maximize trustlessness. Tokenized securities, real-world assets, permissioned walled gardens.

Trusted or not, these can all be useful products.

While we believe things like this do not fall down the Protocol Sink Thesis, there is no rule that you need to build something on Ethereum that does. The Protocol Sink Thesis simply suggests that the things that do build trustnessness will be organically favored by the ecosystem, and things tend to gravitate towards the bottom of the sink.

With that in mind, the thesis doesn’t prohibit the possibility of great value being found outside the sink either.

An adaptable plant like the Christmas Cactus gets to have it both ways too! Closer to the base, it has its woody, dependable structure, but further out it has its green, sunlight capturing leaves. A healthy plant needs both!

The woody base for structure and nutrients, and the leafy branches for value surface area. Centralized projects on Ethereum are easier to build than trustless projects, and from the perspective of a plant, all growth is good growth. Only a few trustless projects are needed to be able to support many centralized products, and overall I expect centralized products to offer the greatest total surface area for the Ethereum plant.

Some Ethereum applications are doing fantastic work capturing a ton of value for the ecosystem as a whole while existing in the permissioned, centralized realm:

- USDC from Circle

- Gods Unchained from Immutable

- Rarible

- dYdX

- Monolith’s Visa card

All of these are Ethereum applications bringing in economic activity from centralized products and services. They are capturing value for the ecosystem as a whole, and users have the freedom to exit from these applications, back into the trustless parts of the Ethereum ecosystem.

Over time, centralized entities have the ability to harden-up themselves, as it is a good strategy to plug up attack vectors with a trustless application or as they become available, further establishing trust and density in the protocol sink while maintaining some degree of centralization.

The plant grows in all directions!

Cultivating Trust

In a world where trust in institutions are at all time lows, Ethereum is a newly discovered life-form that produces trust as a product.

Another piece from Brandon Quittem that I think holds a lot of weight is his ‘Bitcoin and the Forth Turning’ article, which explains the thesis behind the book The Fourth Turning from the perspective of Bitcoin and it’s role to play in generational cycles.

The Forth Turning in a paragraph:

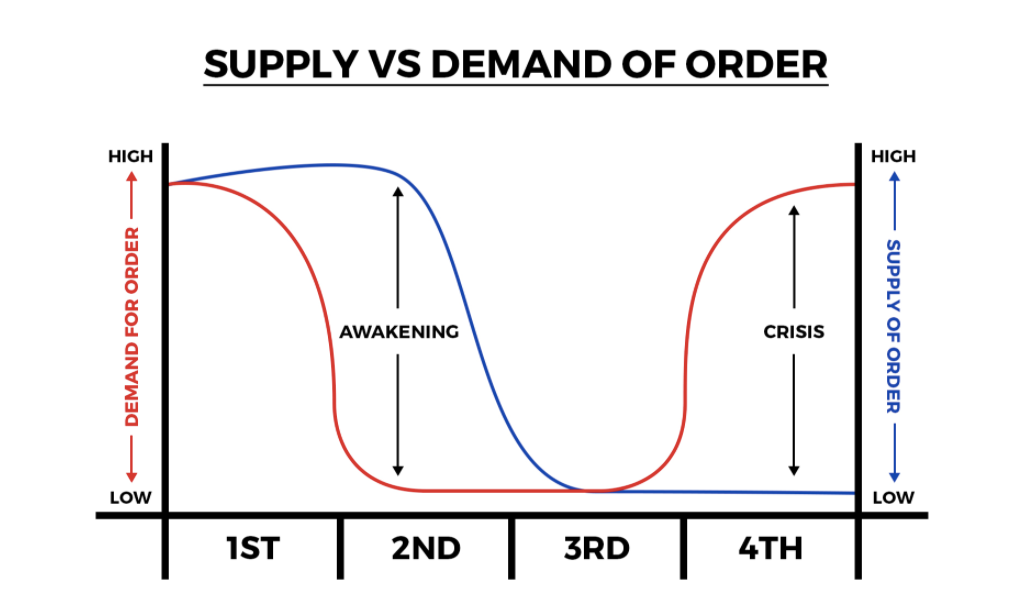

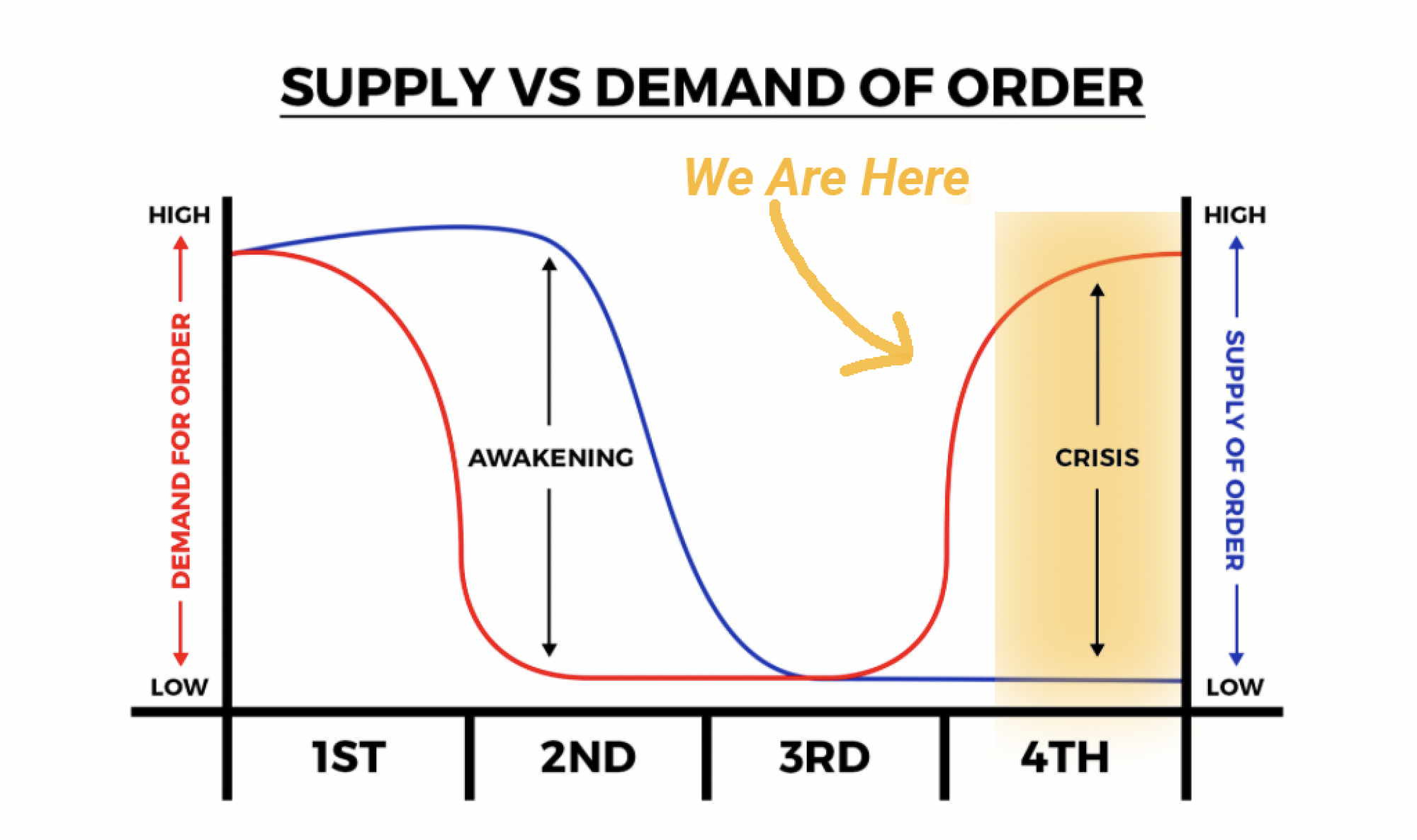

Strauss–Howe generational theory, also known as the Fourth Turning theory, describes recurring generation cycles. Historical events are associated with recurring generational personas, and each generational persona unleashes a new era in which a new social, political, and economic climate (mood) exists. They are part of a larger cyclical "saeculum" (a long human life, which usually spans between 80 and 100 years). After every saeculum, a crisis recurs in American history, which is followed by a recovery. During this recovery, institutions and community values are strong. Ultimately, succeeding generational archetypes attack and weaken institutions in the name of autonomy and individualism, which ultimately creates a tumultuous political environment that ripens conditions for another crisis.

In a chart, the Fourth Turning theory is represented by two out-of-sync sine waves, one representing the supply of order, and the other representing the demand for order.

According to the Fourth Turning thesis, we are currently in a time in which there is low supply of order, with growing demand for order.

Like me, you may be pessimistic for American democracy to be able to ‘vote’ our way into a better world. The trajectory doesn’t seem to back that up. I personally am more optimistic about the demand for order being met by constructing alternative institutions that are independent of the health and capabilities of current human governance systems.

But what other institutions are out there than can help people find order and stability in the world? The Silicon Valley gargantuans? Seems dystopian.

How will the market come to serve the demand for order in our lives? What will come to serve this need?

Conclusion

Ethereum is a crypto-economic system that produces trust as its yield. The more Ethereum is cultivated and nourished, the more trust it is capable of producing for the world.

Ethereum is just 6 years old, and potentially about to emerge from its ETH 2.0 chrysalis as a mature plant capable of extending trust across all corners of the Internet.

Like all crops that produce yield for their farmers, Ethereum will recruit the people of the world to do its bidding. They will help it grow, provide it with nutrients and give it sunlight. They will do this because the healthier Ethereum is, the more trust it yields, and trust is something that is in low supply and high demand.

Ethereum has what we want: trust.

And it’s going to leverage humans and our need for trust to help it grow into the largest single life-form we have ever known.

Thanks for reading!

Action steps

Identify the ‘woody’ protocols on Ethereum and their role in the ecosystem

Read David’s previous pieces on relevant concepts:

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Badge.

🙏Thanks to our sponsor

Argent

You were promised the future of money. Instead you got '90s banking UX and a paper password. Enough is enough. Argent protects your assets and gives you peace of mind. Earn interest and invest in a tap. No seed phrase. No problem. This is one of the best DeFi mobile wallets in the game today. Start exploring DeFi on the go with Argent. 🔥

Argent just added even more…

🔥 Yearn Vaults live! Automatically earn yield on your assets. Simply choose a Vault and amount to invest, and Yearn handles the rest.

🔥 Balancer live! Earn BAL tokens by providing liquidity.

- RSA

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.