Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

Is Ethereum a sandbox for self-propagating lifeforms that feed on the economic bandwidth of ETH?

David Hoffman explores in today’s Writers Corner.

What’s Writers Corner? It’s a monthly-or-so post I’ve added to the program to help you level-up faster. You’ll get these every few Wednesday’s just for subscribing.

The cool part? Writers Corners articles aren’t organized by me. The writers have free rein. I just curate the list of writers. I select for people like David, who’ve shown repeated ability to write outstanding material for the bankless community.

More writing more level-ups! 🚀

- RSA

WRITERS CORNER

By Bankless writer: David Hoffman, COO RealT & POV Crypto host

Ether Is Equity

Defining Ether as an asset is a never-ending journey of exploration and discovery. Crypto-economic systems like Bitcoin and Ethereum are emergent and self-defining, making their respective assets difficult to pin down and formally define.

This is my latest attempt to define Ether, the native asset to Ethereum.

I also recommend reading my last attempt: Ether, a New Model for Money

Ethereum is The Commons

Ethereum is a financial landscape. It is a place where things live, grow, and interact with others. These things are generally called applications.

Applications on Ethereum have infinite possibility. Because of Ethereum’s EVM (Ethereum Virtual Machine, the part of Ethereum that allows it to run software), the full spectrum of possible applications are able to be built and added to the ecosystem.

This is what turns Ethereum from a single use-case like Bitcoin, to an infinite set of use-cases, only limited by the imagination and engineering skills of the builders who are building on it.

Read more about the Ethereum landscape: The Two Faces of Ethereum

Applications are Organisms

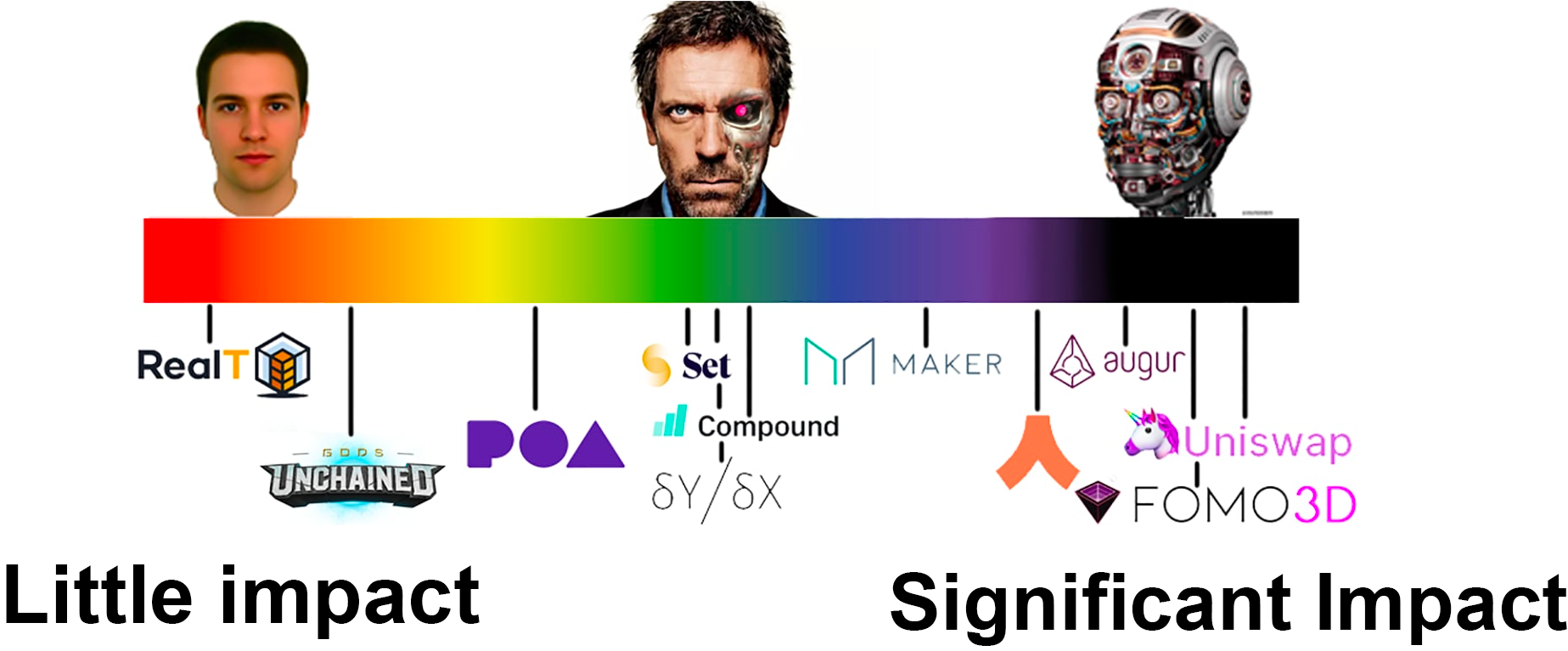

The main takeaway from my article The Two Faces of Ethereum is

- There is a vast spectrum between autonomous, perpetual, computer-run applications, and applications that depend on humans for their operation

- The autonomous, perpetual, computer-run applications are much more valuable than the human ones.

- The absolute bull-case for Ethereum is as a landscape of interoperable, interacting, self-perpetuating, autonomous financial applications

The reason why Bitcoin is valuable is because it is the first successful example of unstoppable financial application.

The Ethereum’s ideal product is a vast landscape of financial applications that all match Bitcoin’s level of trustless-ness and autonomous-ness, while being able to execute any kind of financial logic that humans find useful and willing to pay for.

When it comes to having these qualities, the current set of applications on Ethereum are generally not there yet. Most MakerDAO oracles depend on centralized actors. Compound and dYdX have backdoors. SET Protocol is gated.

Since 2015, two applications have emerged on Ethereum that are ‘Bitcoin-grade’ applications:

- Uniswap

- Augur

(Bitcoin-grade: Uncensorable, permissionless, unstoppable, autonomous)

Others have a clear path to achieving this, but are not there yet. Compound has a backdoor they need to plug. MakerDAO needs more MKR diffusion, and needs more Bitcoin-grade oracles available. Many Ethereum applications are not far from being Bitcoin-grade, but simply haven’t made the leap.

The Landscape of Applications

The bull-case for Ethereum is that a sufficiently large number of these Bitcoin-grade applications are built, make the legacy financial system antiquated and obsolete, resulting in a migration of economic activity from legacy companies, to applications built on Ethereum.

One of the key messages in Two Faces of Ethereumis that one good Bitcoin-grade application can act as critical piece of infrastructure for other ones. At genesis, Ethereum had no decentralized oracle system; today it has one. Now that Uniswap exists, applications can leverage Uniswap as a decentralized/unstoppable oracle for a ETH/Token price feed, and this oracle only gets better as Uniswap grows larger.

Not only is Uniswap useful as an unstoppable oracle, but Uniswap acts as a bridge between Ethereum and Synthetix. Synthetix as an application would be much harder to access without Uniswap.

As more of these fully autonomous, unstoppable, censorship resistant applications come online, it becomes easier to develop further applications of this quality.

Conway’s Game of Life

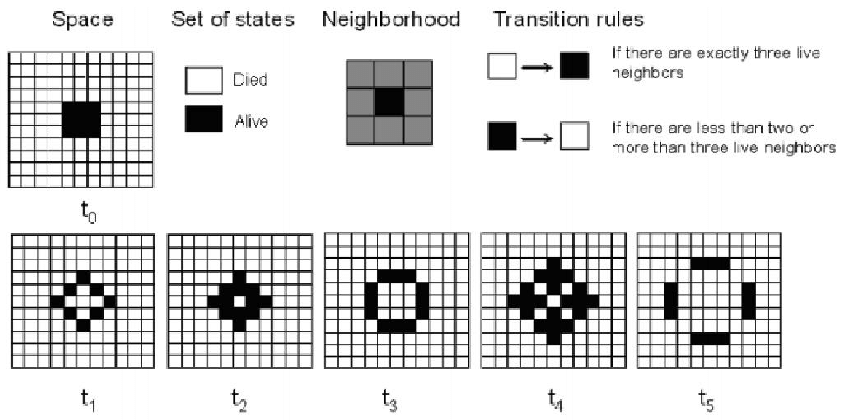

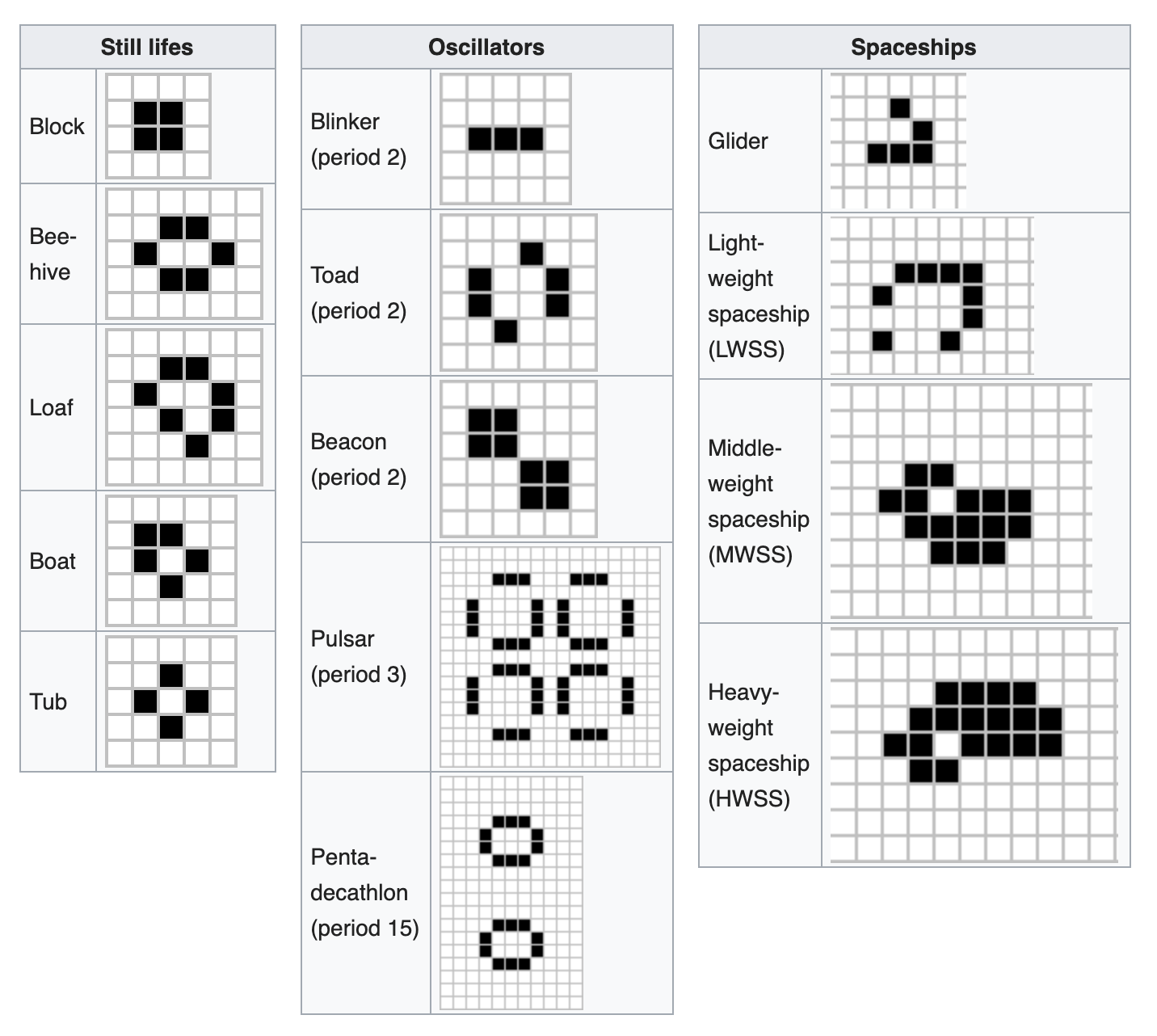

Conway’s Game of Life is an interesting exercise in programming, as well as a peculiar thought experiment. In short, Conway’s Game of Life is an investigation of stable and unstable structures, given a specific ruleset. These structures are a collection of square cells in a grid, inside of a binary universe. The state of a cell, either a 1 or 0 (black or white) will change based on the state of other cells around it, in discrete-time units (state changes).

While most 0,1 patterns are lifeless, certain 0,1 structures are autonomous structures that endlessly perpetuate into infinity, never to die unless acted upon by an external force. The specific patterns in which these structures are engineered creates a system that has the capacity to self-perpetuate forever.

In a way, this feels like the creation of life inside of a sandbox landscape, with preset rules.

Sandbox landscape… preset rules…

The universe… laws of physics…

Ethereum… the EVM…

Conway’s Game of Life is a state machine. It has rules that cannot be broken, and it offers a landscape for possible things to be built. Most buildable things are non-functioning, or not very interesting. However with some exploration, experimentation, and research, you can build structures that do some pretty cool stuff!

Ethereum’s Game of Apps

Like Conway’s Game of Life, Ethereum is a state-machine landscape that allows for building and exploration of various applications. In addition to Conway’s GOL, Ethereum is also a crypto-economic system like Bitcoin, which means that the applications/structure that exist on Ethereum are inherently financial applications/structures.

Fully-autonomous applications like Uniswap or Augur represent self-perpetuating structures in Ethereum’s Game of Apps. Ethereum is the landscape for these specific structures to be built, and to take on life of their own.

Alternatively: Augur; Augur Markets. MakerDAO; CDPs. Or even: CDPs; Dai.

So long that Ethereum is alive, applications like Uniswap are guaranteed to exist in-perpetuity. The more apps that are on the computer-side of the spectrum the more self-perpetuating structures there are inside Ethereum, and the more Ethereum is itself a self-perpetuating system-of-systems.

If you want to see a visual of what Ethereum’s economy looks like, watch this video!

Watching this video while imagining it’s Ethereum growing is epic AF. Highly recommend.

A System of Systems; a Fire of Fires 🔥

In the beginning, Ethereum was formless and empty; there was only darkness. As Ethereum progressed, sparks of life have caught, and are beginning to explore the environment around it.

A fire is a metaphor for a self-perpetuating system. It is an alternative metaphor to the one of a biological organism. For Ethereum’s DeFi apps, I think it is fitting. Fires consume resources; this is measured by the ETH Locked in DeFi metric, or the Gas-Guzzling Leaderboard. ETH Locked in DeFi is the proxy for how much bandwidth Ethereum fires are consuming. Ryan Sean Adams accurately illustrates this concept as ‘economic bandwidth’. The Gas-Guzzling Leaderboard represents which applications are consuming up all the oxygen (blockspace). The only change to this metaphor that is needed is that the Ethereum fires are generative rather than consumptive ofresources(more later).

MakerDAO

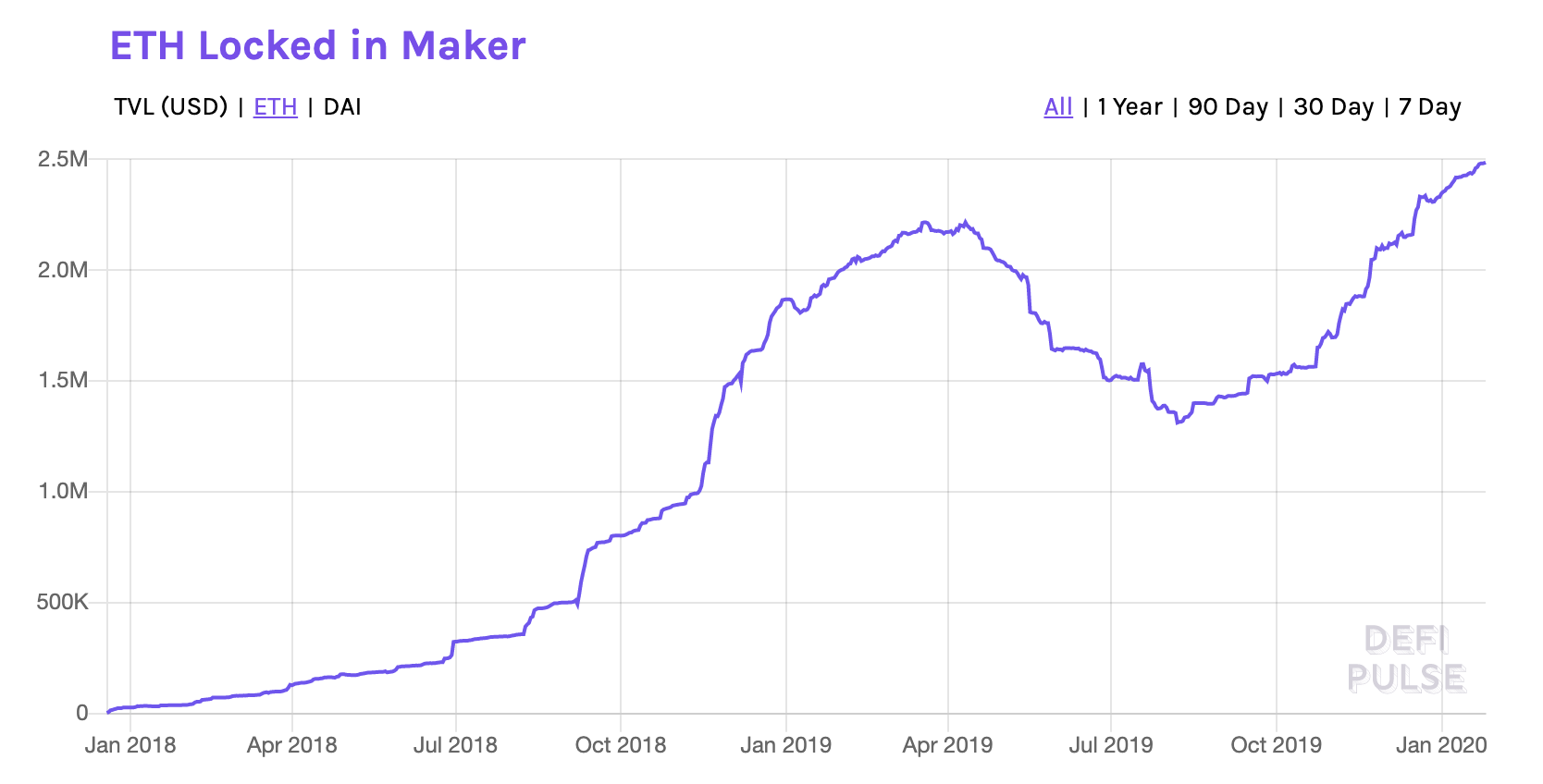

The MakerDAO organism saw its first spark of life in December of 2017, with the launch of Single-Collateral DAI. The application has been eating up ETH ever since, and showing no signs of slowing down.

This graph represents MakerDAO’s resource consumption in the Ethereum landscape

Maker for Dummies. Tummy size go up.

Augur

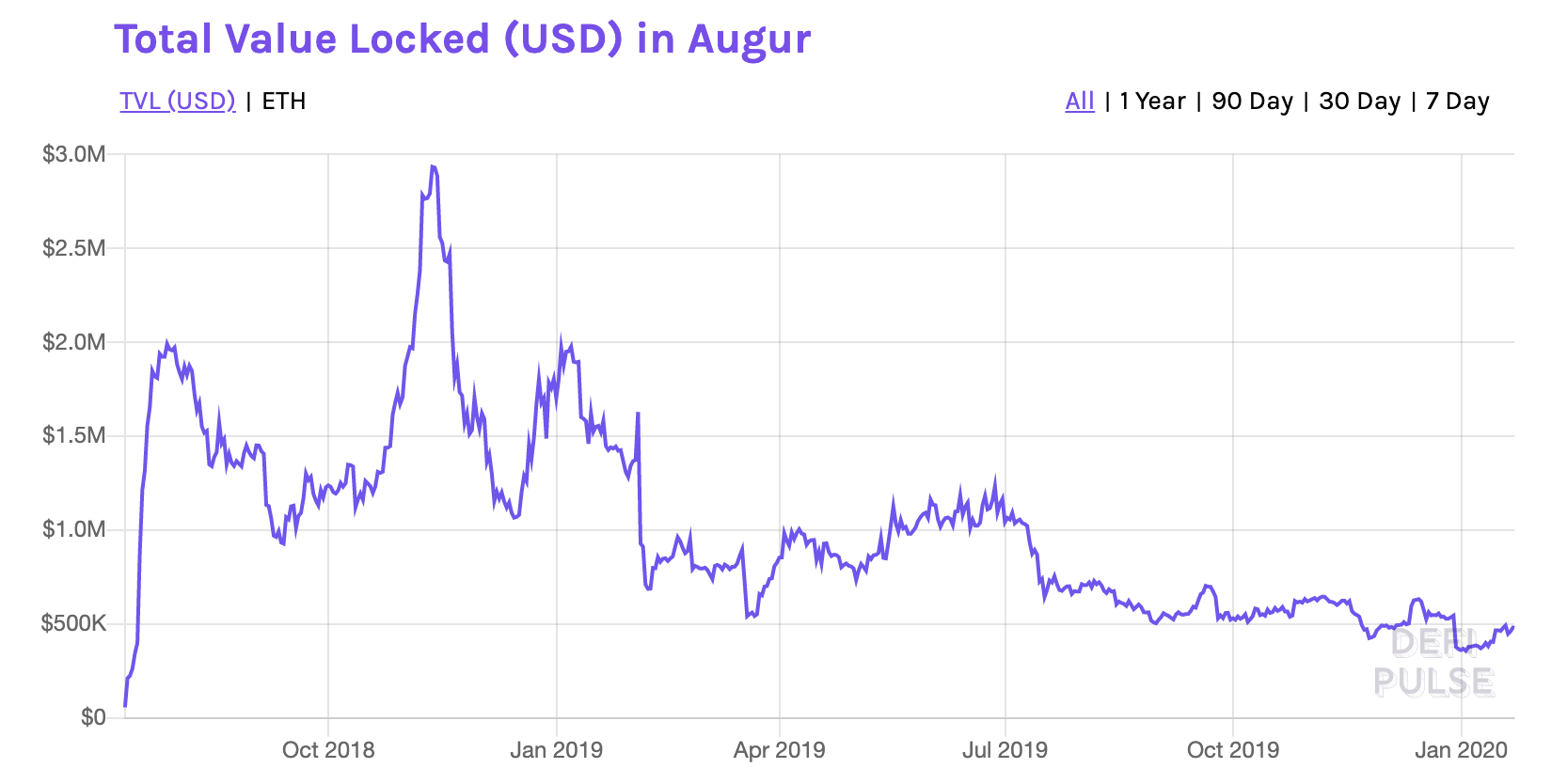

Augur had its first spark of life in 2018. Augur has not yet turned into a roaring fire the same way MakerDAO has, but Augurs architecture implies it will be a difficult beast to kill. Augur’s future growth as an organism will depend on consuming DAI (DAI will be much more nourishing for Augur than ETH) to create liquid prediction markets for the world. A combination of good UI/UX improvements, DAI integration, easier money on-ramps (thank you Wyre), and faster market turn around will allow Augur to better compete for economic resources in Ethereum.

The size of Augurs fire. Looks like it needs more fuel before it can grow bigger.

Uniswap

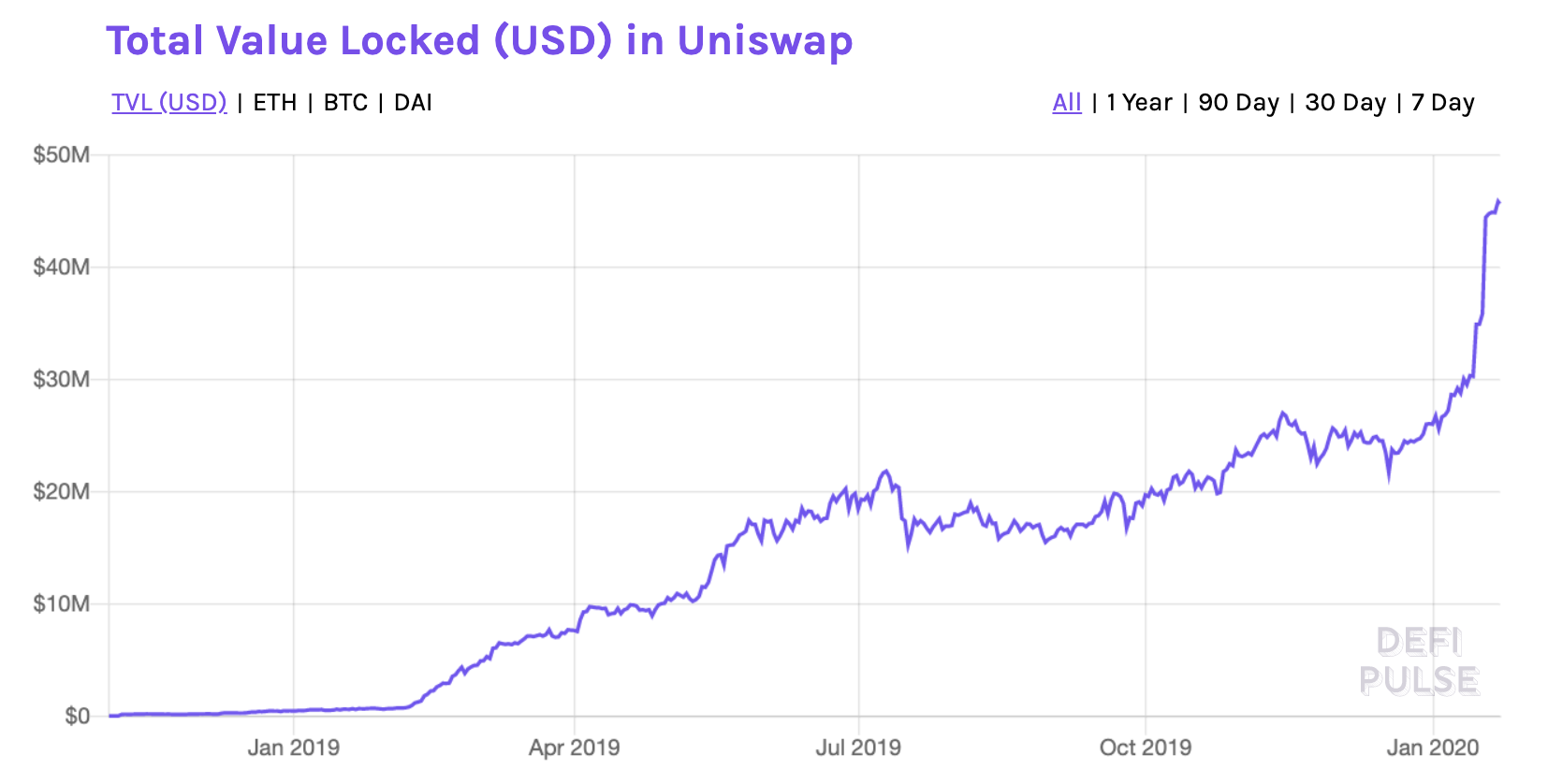

Uniswap sparked in November of 2018, and it seemed to catch fire in March 2019. Uniswap has been gobbling up ETH ever since, because of the clear demand for liquid ETH/Token markets. Uniswap’s architecture makes it particularly difficult application to stop; it’s likely it will continue to gobble ETH until the end of time.

The size of Uniswap’s fire. This fire looks unstoppable to me.

The Meta-System; The Collective Fire

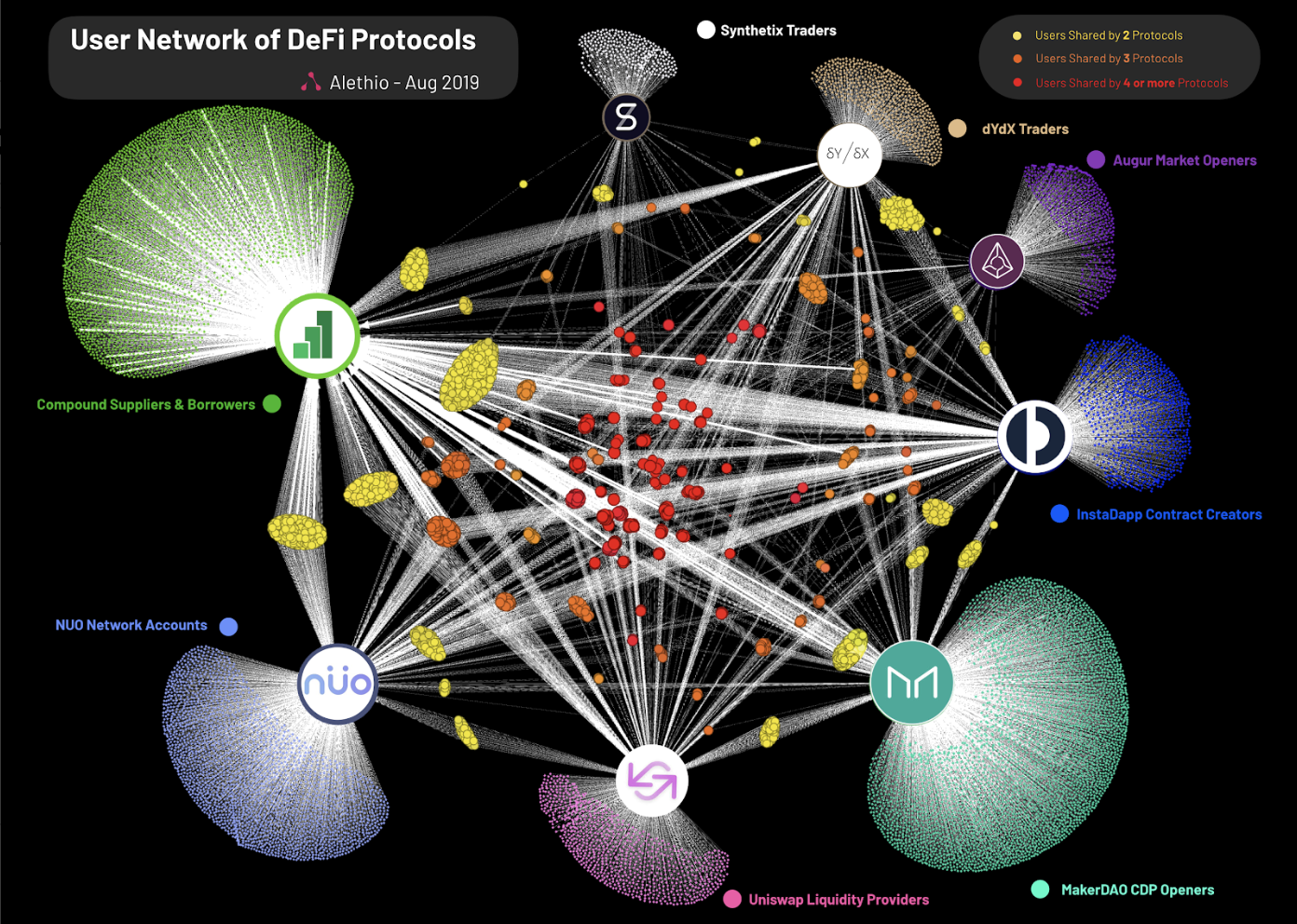

Ethereum is the place where these organisms interact, integrate, and grow. Ethereum is the collective bonfire that is created when many smaller fires find each-other. The more interconnected Ethereum applications are, the hotter and larger the collective Ethereum bonfire is.

Viewed through the lens of Conway’s Game of Life, Ethereum is the emergent super-structure that is created when all the independent mini-structures combine, interoperate, exchange, and derive each-other.

Ethereum: More than the Sum of it’s Apps

Gestalt Psychology refers to the brain “an organized whole, that is more than the sum of its parts”. You can compartmentalize different areas of the brain, and point to what they do:

- Occipital lobe: Inputs and processes visual stimulus

- Temporal lobe: Inputs environmental stimulus and outputs meaning/significance

- Parietal lobe: Orients the body in space-time

- Pre-Frontal Cortex: produces goal-oriented behavior from the signals from the rest of the brain

However, you cannot find the brains ‘consciousness center’. Consciousness is an emergent phenomenon that is created when you combine the separate functioning structures of the brain together.

Each application on Ethereum is an independent structure. However, Ethereum’s killer feature is its composability: the ability for applications to interoperate and interact with each-other. Whatever Ethereum’s equivilent of consciousness looks like, it will be from the emergent structure that is created when Ethereum apps stitch together.

Ethereum isn’t the applications, it’s the webbing between them.

Ethereum is the emergent structure that is created from the composability and interoperability from its applications.

Ether is the equity of this structure

Ether is Equity

Ethereum is an emergent financial super-structure. Finance requires value to function, and the financial asset that the emergent structure uses is Ether.

Financial applications on Ethereum grow the same way that traditional businesses grow: by providing valuable goods and services to their customers. ETH Locked in DeFi and the Gas-Guzzler Leaderboard represent two metrics for measuring the value that Ethereum applications are providing to their users. MakerDAO’s product, DAI, has convinced Ether holders part with 2.5M ETH and place it inside of the MakerDAO application, in lieu of using it elsewhere. Consequently, there is 2.5M (2.3%) less ETH available for other Ethereum applications to use.

However, the consumption of ETH by MakerDAO and the other big DeFi protocols doesn’t mean there is less total value available for others. The demand for ETH in DeFi reduces the secondary market supply of ETH; according to the age-old truth of supply and demand, this creates appreciation in Ether. This means that while there is less total ETH available, there is more total value for others to use.

By locking up ETH, applications create new value outside of their respective system. This is why I said that Ethereum fires are generative rather than consumptive of resources. When Ethereum applications remove ETH from supply, it makes the ETH outside of it more valuable. By increasing the price of ETH, other applications can continue their functioning, while using less ETH. This means they are more efficiently consuming resources, and there are more resources to share with other applications.

When it comes to consuming ETH and generating new resources rather than consuming then, MakerDAO is a great example. Many applications (especially financial ones) cannot use ETH as a resource due to its volatility. MakerDAO consumes ETH, and generates DAI, a brand new resource with a different nutritional profile that allows for new apps to receive the nutrients they need to grow. This value-generation is in addition to the value accrual that ETH outside of MakerDAO receives as a result of the reduced supply in the markets.

MakerDAO has consumes 2.3% of all ETH, and therefore made 2.3% of ETH unavailable for other applications to use. However, the 2.3% ETH supply sink adds to ETH scarcity, and therefore ETH price, meaning that MakerDAO returns value to the price of ETH, and allows for more total value available to be consumed by other applications. When applications are successful in capturing ETH, more value is created for others.

Ethereum’s economic pie grows when people eat it. You can literally have your cake and eat it too. If this doesn’t sound like an anti-fragile system, I don’t know what does.

When financial applications on Ethereum grow by providing quality goods and services to their users, they consume and lock up ETH. This supply reduction ultimately makes its way to be reflected in the price of ETH. The collective value that Ethereum provides to the world is reflected in the price of Ether.

The price of Ether is a measure of the value of goods and services Ethereum provides.

Equity Characteristics

In addition to the value-capture mechanism described above, Ether has other characteristics that connect its price to the success if the Ethereum network.

The Ethereum network is like a company. It brings in revenue to miners/stakers. It inflates its supply to sell to the public, in order to access capital and fund its livelihood. Similarly, it also contracts its supply when revenue and profits are strong, by issuing a stock-buyback in the form of burning Ether.

It also has employees, its own company-currency, and all the applications on Ethereum represent a company-store that only accepts the company-currency.

BASEFEE is a Stock-Buyback

EIP 1559 is a EIP that is planned to be integrated into ETH 2 or sooner.

Read a short summary from Eric Conner, or a longer analysis from myself.

I will assume you have read either one of those two pieces in this section.

In EIP 1559, BASEFEE represents the bulk of the transaction fee. BASEFEE is burnt, removing the burnt ETH from the total supply.

Ethereum prioritizing security over monetary policy. It does this by paying for security ahead-of-time, by ensuring constant issuance for validators. This mechanism ensures Ethereum always has the necessary capital available to pay for sufficient security, regardless of the revenue it generates.

This begs the question: if we don’t need fees for security, what should we do with the fees?

The answer is to burn them

This is the correct thing to do for a number of reasons:

- Burning BASEFEE is still paying for security.

Every day that Ethereum runs, BASEFEE will removes ETH from the supply. The BASEFEE amount that Ethereum could have paid directly to validators is instead being paid to ‘Future Ethereum’.

The ability to attack Ethereum 2.0 will be a function of how much ETH is available for purchase on the secondary markets. If there is high ETH supply, then buying enough to attack Ethereum is cheap. If there is low ETH supply, then it is expensive.

By adding to the scarcity of Ether today, Ethereum pays for security tomorrow.

In addition to this, it is also paying for security in a compounding fashion. Say EIP1559 burns 1 ETH, which represents 0.001% (fake numbers) of the supply. Then, when EIP burns 1 more ETH, it will represent 0.00101% of the supply. The decree that EIP 1559 is removing ETH from the total supply compounds, meaning that the additional security it adds has an compounding effect. Perhaps even having a low-cost security expenses also means higher fee burn ratio, because we don’t need to pay validators as much? Maybe. - Burning BASEFEE pays all Ether holders equally.

Similar to how MKR-holders receive indirect access to the revenue generated by the stability fees, EIP-1559 gives Ether holders indirect access to the fees collected by BASEFEE, or what I’m going to call the Security Fee.

Security Fee burn is Ethereum issuing a stock-buyback on ETH.

Ethereum’s SF is a perpetual stock-buyback on Ether, and scales up or down based on the revenue of Ethereum brings in from selling block-space. If Ethereum brings in significant revenue, the SF burns more ETH. If Ethereum brings in less revenue, then the SF only burns a little ETH.

MakerDAO calls their Stability Fees SFs too. I think the Security Fee is actually a better name than the Stability Fee, and this specific asset burn mechanism for MakerDAO and Ethereum is literally the same mechanism, reproduced on both systems.

MakerDAO and Ethereum both have Security Fees, or SFs

(when EIP 1559 is in).

All Apps Pay Homage to Ether

All applications positively impact the value of Ether to some decree. Some applications like MakerDAO and Uniswap have large positive downstream effects to Ether price; others have just a small positive impact, but a positive impact nonetheless.

As a general rule of thumb, trustless/permissionless applications positively impact the price of Ether the most, simply due to the Ether collateralization (supply reduction) requirements in order to become trustless (Maker, Uniswap, Augur).

On the opposite end of the spectrum, companies like RealT (my company) don’t have to collateralize ETH to function. We issue tokenized real estate assets that pay rental income every 24 hours. Every time we issue a token, or pay rent, we are paying Ether to the validators. Additionally, we’ve created economic activity as well, when our customers exchange these tokens through Uniswap or transfer them around. All of the economic activity from both RealT and our customers ends up as fees collected by Ether validators.

Ether ending up in the hands of validators is bullish for Ethereum and Ether, because the validators are the individuals who are least likely to sell ETH.

Eric Wall in his recent piece Proof-of-Stake is Less Wasteful illustrated this point well.

What is the cheapest “capital source” for staking, that you’ll never be able to compete with? If we take Ethereum as an example, it will be people who are long ETH. A person who is long ETH, and who has already decided that s/he wants to be long ETH for the next 5–10 years has virtually zero economic cost for staking…. Such stakers will outcompete other stakers by being willing to accepting lower and lower yields!

- Eric Wall

The set of Stakers that will stake in Proof-of-Stake Ethereum are going to be individuals who are inherently long on Ether. Just as Proof-of-Work goes to where electricity is cheapest, Proof-of-Stake goes to where capital is cheapest. For Ethereum, that cheap capital is found in the Ether-owning individuals who are also perma-bulls on the value of ETH, and will all compete with accepting lower and lower yields, so long as that yield is ETH-denominated.

There are many applications like RealT that have the minimum exposure to ETH. They don’t require Ether collateralization, they don’t offer ETH-yields, and they’re not locking ETH. They're simply doing the bare-minimum: buying Ethereum's block-space.

Buying block-space is the minimum threshold that is required of Ethereum apps. This is how all Ethereum applications create at least some positive impact to the value of ETH. By paying a small fee for every transaction, this moves ETH from the general supply, into the hands of the individuals who are inherently bullish on Ether; rewarding them for being bullish.

Ethereum is the DAO

Ethereum is one big DAO. It is an open-source company who’s product is an open-source ecosystem. The genius of Ethereum is allowing anyone to build on-top of it, allowing anyone to freely contribute work to the DAO, effectively receiving free labor. Good work is results in ETH lockup, which has generally been associated with positive financial rewards from both inside and outside of Ethereum. MakerDAO, Compound, Uniswap, and dYdX have collectively locked over 3M ETH, and collectively raised over $100M from outside firms. That $100M is going towards improving the respective products, which will enable further ETH lockup. Clearly for the funds backing these protocols, the game is about capturing ETH.

Company Scrip

Scrip money is money issued by a company, usually in a closed-loop system like coal towns in 1950’s America.

“The [town] grew into a community with a variety of housing types including boardinghouses for transients and new hires, all the growing community organized around a Company Store. The company would often give credit in the form of scrip, a form of token money that would discourage workers from purchasing items in stores outside the town.”

— Wikipedia, Scrip Money

Companies realized they could generate their own local economy, in the same way that governments generated their own money system. The company would create the roads, housing, the grocery store, while also providing employment. Then they would also charge rent, have a monopoly on the towns grocery’s, and be free from competition. A pretty good business model! Thankfully, no one is forcing anyone to use Ethereum.

In David Graeber’s book Debt: The First 5,000 Years, David illustrates how governments would bootstrap money, and this is how company-towns would do it too.

- Step 1: Issue money

- Step 2: Charge taxes in the form of that money

- Step 3: Citizens create businesses/products/services/labor in order to generate revenue to pay for the taxes

Ethereum follows this same model:

- Step 1: Issue Ether

- Step 2: Require Ether for economic activity

- Step 3: Builders create businesses/products/services in order to collect ETH

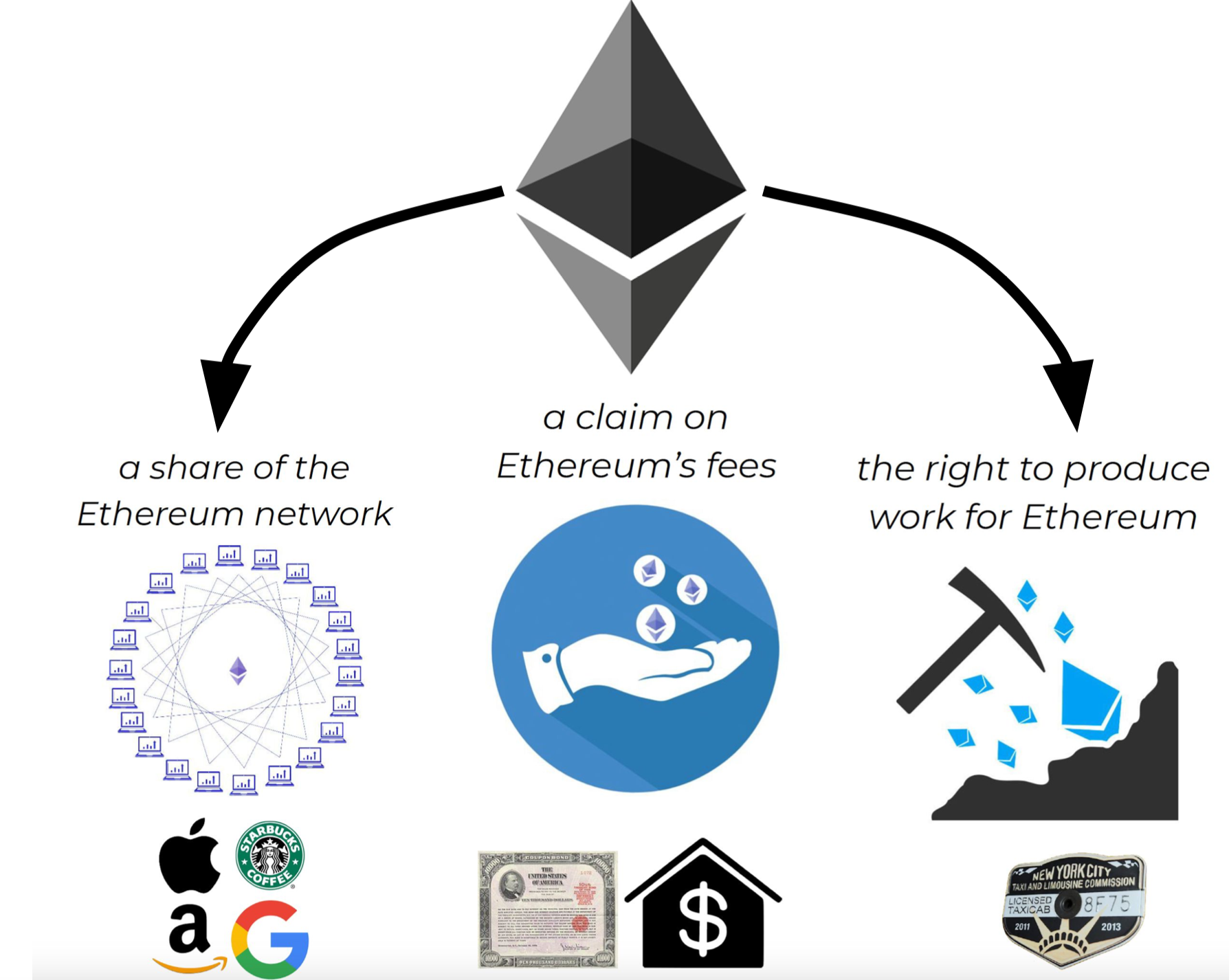

As a currency however, Ether has some extra bells and whistles. In addition to offering you exposure to the upside of Ethereum (imagine if your company paid you in equity that you could buy groceries with).

- Ether is a share of Ethereum

- Ether is a claim on Ethereum’s fees

- IF

- You produce work to Ethereum

Ether enables you the right to work for Ethereum. With Ether, you lock-in the right to some decree of employment to the protocol. All Ethereum employees are all paid equally, and thanks to EIP 1559 they are never over-compensated. Similarly, Bitcoin miners constantly put out the same amount of work, but their compensation is entirely dependent on the fee market, and Bitcoin miners are likely always either under or overpaid. During good times, the strict limit on Bitcoin’s blocksize results in something similar to fee extortion from bitcoin transactors to miners, and then also from miners to ASIC producers (this process laid out here). During bad times, bad miners capitulate, and good miners make it through, hopefully to be able to be compensated with overpayment in the future.

Ether stakers are the fairly-compensated employees of Ethereum. Stakers receive a small ETH paycheck for their labor (3–7% on their ETH YoY), but are much more likely to financially benefit from ETH appreciation; keeping their incentives aligned with the needs of the DAO as a whole.

This elegance in incentive alignment is the beauty of Ethereum that will enable it to scale to a single global financial platform. Everyone is incentivized to come and build on it.

If Ethereum comes to dominate the globe as a single financial platform, it will be because of the establishment of the positive-feedback loops set by the value of Ether as exposure to the growth of Ethereum.

This piece illustrates how ETH as an asset reflects the value of Ethereum as a whole. What Ethereum is, and how Ether fits into that definition is a constant discovery process. The same is true for Bitcoin; the Bitcoin system and the BTC asset are in constant states of flux.

This is because these two systems are their own independent internet-native organisms. Ethereum grows. It adapts to its environment. It responds to stimulus. It has its own nutrient delivery systems. Ethereum applications like MakerDAO and Uniswap illustrate vital organs to Ethereum’s overall biological structure.

As Ethereum grows, it will both be a result of, and encourage new vital organs producing new mechanisms to leverage Ether that benefits the system as a whole. As a result of this truth, we can directly bridge the value of Ether, to the health of the organism.

If Ether price is high, Ethereum is healthy.

Thanks for reading!

Please follow me on twitter @trustlessstate

Author Blub

David Hoffman is the Chief of Operations at RealT and host at POV Crypto. He writes on open finance and Ethereum topics. Check out his recent talk on how ETH accrues value and this accompanying post. (RSA note: this video one of two 4 x 🔥I’ve ever given—highly recommended)

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Deal Sheet.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.