The Life of a Protocol Politician

Less than 24 hours left! If you want Bankless in video give 1 DAI & let’s make it happen!

Dear Bankless Nation,

The protocol politicians are here.

What do they do?

How will these influential actors evolve?

Should you become one?

Did you know:

- There’s only 37 political seats in Compound with the power to propose changes

- In the Kyber Protocol politicians have the ability to earn salary of sorts

Incentives. Influence. Control.

Let’s dive into this new world with Cooper today.

Let’s dive into the life of a protocol politician.

- RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

THURSDAY THOUGHT

Guest Post: Cooper Turley is the Chief Editor at DeFi Rate

The Life of a Protocol Politician

It’s Monday morning. 9AM. Time to get to it.

While others are commuting and getting caught in traffic, you open your laptop and boom—you’re off to the races. You open up Twitter, Discord, and Reddit to check in on the latest discussions.

Yes, this form of work is a bit unconventional. It requires specialized knowledge and the capacity to inspire change—the life of a protocol politician is grounded in sovereignty.

As we’ve been covering endlessly over the past few weeks, yield farming is all the rage. And while it’s easy to see liquidity mining as a means to a profit, the premise underpinning these systems is where the true value lies.

Governance—or the ability to participate in protocol discussions which shape the future of crypto’s most popular products—is the main event here.

For the vast majority of DeFi protocols, yield farming is done to harvest native governance tokens. Whether it be Compound, Balancer, Curve or the dozens of other protocols soon to follow suit, these tokens are a means of influence.

The best part? Power can be earned by anyone in the world with an internet connection. All they have to do is showcase tangible value.

Just like with legacy governance systems, the framework for digital legislation looks similar.

Discussions evolve to working docs which turn into votes. The benefit DeFi governance has over traditional systems is that voting all happens on-chain. It’s completely transparent and anyone can verify how their legislators are voting.

Now, with the ability to delegate power in a few clicks across any corner of the world, we no longer compete as nations, but rather as one borderless ecosystem.

What exactly is a Protocol Politician?

Protocol politicians are someone (or a group of people) who:

- Oversees governance across specific protocols they are well versed in

- Participates in governance regularly to instigate positive change through new proposals

- Is willing to publicly vote on controversial issues and back up their votes with rational arguments

This last point in particular is worth expanding on. Just as we’re seeing with Dharma playing a huge role in Compound’s governance, it’s likely that these systems will be driven by the key players of these protocols.

What’s in it for the politicians?

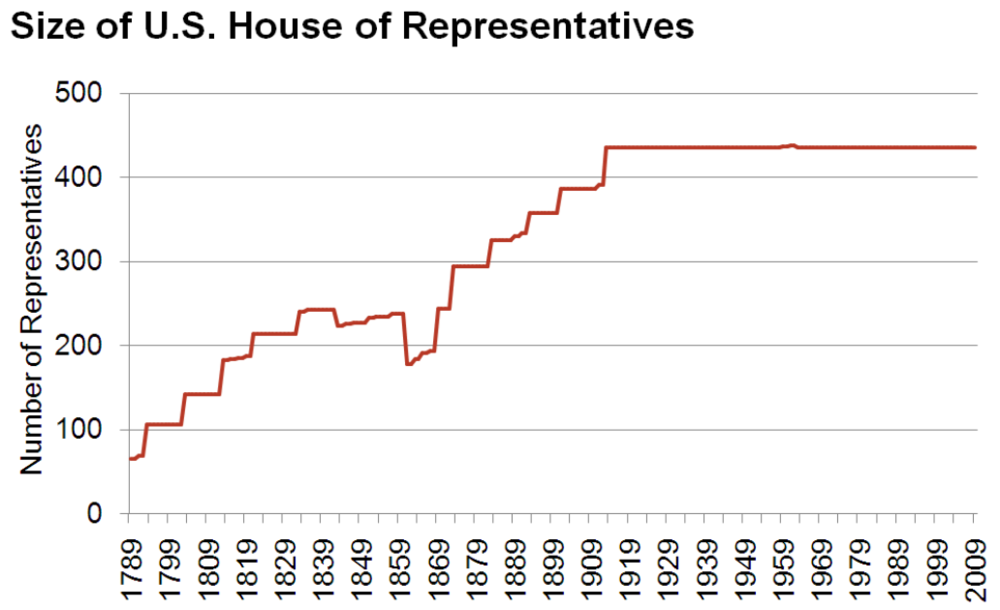

Influence has value. And people are willing to pay for it too, especially as protocols facilitate more and more capital flowing through them. Drawing a parallel to today’s politics, U.S. congressional campaigns are raising cash in record numbers. Candidates for the House of Representatives collectively raised ~$1.2 billion in January 2017, over $200M more than the inflation-adjusted ~$1 billion set in the 2010 election cycle.

(Above) Number of seats in the house of representatives

Equally as important, there’s only a limited number of seats at the table. With the 3.7M COMP in circulation, there’s only room for ~37 possible delegates (100,000 COMP per delegate). Fully diluted and there’s an absolute max of 100 Compound delegates able to propose changes to the protocol. Eventually, individuals and companies will start to bid for those spots.

While it’s still early, we suspect that the capacity for protocol politicians to earn fees will create enticing revenue streams too. Best highlighted by the KyberDAO and the ability for Pool Master (aka protocol politicians) to earn a portion of delegated rewards, we expect there to be individuals and companies that are able to generate sustainable revenues entirely from governance.

As it stands today, Kyber is projected to earn $3.4M in annualized revenue. The upcoming Katalyst upgrade is set to allocate 65% of the protocol’s revenue towards governance incentives, or $2.21M up for grabs for participants. What’s interesting with Kyber is that the governance rewards will be in ETH. Delegates will be able to earn a cut of those rewards with whatever fee structure they set while delegators will be able to opt-in and out at any time.

We can imagine that as Kyber continues to grow (as it has), the prospective earnings for protocol politicians will only become more lucrative.

Compound is another example. At today’s COMP valuations, the lending protocol is currently sitting on a ~$166M treasury allocated entirely for governance incentives. Even if it drips slowly over the next decade at ~$16.6M per year, it is still a massive treasury—even at today’s prices.

As we’re seeing with Dharma’s active participation in Compound today, teams may even start allocating resources to specifically focus on governance for protocols they’re invested in.

Whether this stems from upgrades that best suit their product or simply having an informed voice over how the protocol evolves, with great composability comes great responsibility. It’s important that people get things right.

We can also consider what a protocol politician looks like without financial incentives in mind. While almost 99% of protocol politicians will be motivated to increase the value of underlying holdings or from fees given to them for participating, we can envision a governance “Ghandi” which holds zero tokens, extracts zero rent, but has tons of voting weight. The politician is simply there for the greater good and long-term growth of the underlying protocol.

As more protocols tokenize their governance, those who were involved early are likely to be rewarded for doing so. Better yet, value-added work can be recognized in a number of ways, meaning even those without crazy sums of capital can earn governance influence.

With Maker, Aave, Kyber, Nexus Mutual, UMA, bZx, and others all set to roll out updated governance frameworks, the time to delegate is now.

What’s in it for a delegator?

With so many governance discussions happening on a regular basis, it’s important to ensure your voting power is being used on every proposal. Rather than having to do a deep dive to vote one way or another, trusted protocol politicians can play this role for you.

We expect protocol politicians to offer services in return for your delegation, including synthesized recaps to keep you informed on key changes without having to be super deep in the weeds on how they got there.

We may even see what James Waugh refers to as Proposal Farmers—that is, protocol politicians competing to build the most impactful and widely accepted governance proposals. These proposals may directly be linked to token incentives (which protocol politicians could share with their delegators) in addition to acting as a signal for delegation.

(Above) Proposal Farming

Most importantly, delegating to a good protocol politician may be quite lucrative. Outside of the proper protocol upgrades benefitting you as a tokeholder, there may be residual benefits as well—just as we’re seeing with Kyber’s Community Poll and the ability to earn ETH rewards with minimal work or knowledge.

Leading Protocol Politicians Today

So far we’ve seen the usual suspects stepping up to take advantage of being an early protocol politician. While we’ve yet to see delegation really take off, we fully suspect teams to allocate significant marketing resources to aggregate as much voting weight as possible, especially as the revenue opportunities become more attractive.

In particular, some emerging protocol politicians include:

- Media: DeFi Rate and Bankless (👈RSA—we have big plans here!)

- Consultants: Gauntlet

- Applications: Dharma, PoolTogether, and InstaDapp

- Thought Leaders: Kain Warwick and Ric Burton

- Venture Funds: a16z, Polychain, and IDEO CoLab,

Keep a close eye on these guys as we expect them to make some big pushes towards governance incentives in the coming year.

A Distributed Future

Let’s imagine these ideas all pan out. What we could very well be looking at are self-sustaining protocols owned and operated by their community. Rather than all the value being accrued to a very small number of people, it is shared pro-rata across all ecosystem actors.

And there’s a lot to be gained for those who elect to dive deep into protocols and build up specialized knowledge. Potentially billions.

There will eventually be a demand for well-thought, well-communicated, individuals that are qualified for protocol governance. A demand for those that can lead these DeFi protocols to proliferate into open financial infrastructure that will eventually support the billions, if not trillions, in capital.

If one thing's for certain, we need the tools to help us get there. From governance aggregation to chat-based voting and delegation, we need to make it easy for the average individual to not only allocate their voting power, but to see how their voting power is being used.

More importantly, we need to show that governance matters. Whether it be implementing new features to grow the protocol, updating value accrual mechanisms, or banding together to fight against centralized players with 10x more capital, the story of yield farming needs to emphasize what distributed governance enables.

Until then, make sure to do your own honest work. Stay informed and keep on harvesting those governance crops!

Action steps

- Learn how to earn and delegate COMP tokens

- Start delegating your honest work to the protocol politician of your choosing!

Author Bio

Cooper Turley is the Chief Editor at DeFi Rate and an active contributor to The Defiant. He is a strong proponent of the DAO ecosystem, heading initiatives like MetaCartel, Raid Guild, and MetaClan. His writing ain't much, but it's honest work.

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Deal Sheet.

🙏Thanks to our sponsor

Aave

Aave is an open source and non-custodial protocol for money market creation. Originally launched with the Aave Market, it now supports Uniswap and TokenSet markets and enables users and developers to earn interest and leverage their assets. Aave also pioneered Flash Loans, an innovative DeFi building block for developers to build self-liquidations, collateral swaps, and more. Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.