Banking without a Bank

Level up your open finance game five times a week. Subscribe to the Bankless program below.

Dear Bankless Nation,

The world is going bankless.

We’re getting closer to the point where people don’t need a bank to bank.

Savings accounts, mutual funds, mobile payments—these can be replaced by a bankless alternative….today! Alternatives that are better than incumbents options—alternatives that are accessible to anyone in the world with a smart phone!

Jeremy’s article today is perfect recap for someone new to the bankless journey. And for you veterans it provides good perspective on how far we’ve come.

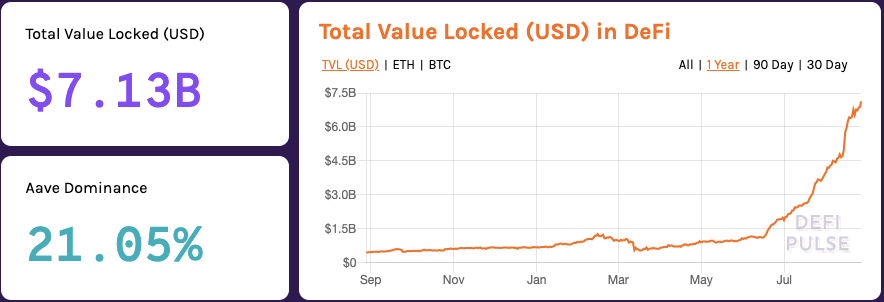

Just think—a year ago most of these things didn’t exist—at least not to the level they do now. DeFi is innovating at unprecedented speeds.

We are pioneers among the first millions starting the bankless journey.

Billions yet to come.

- RSA

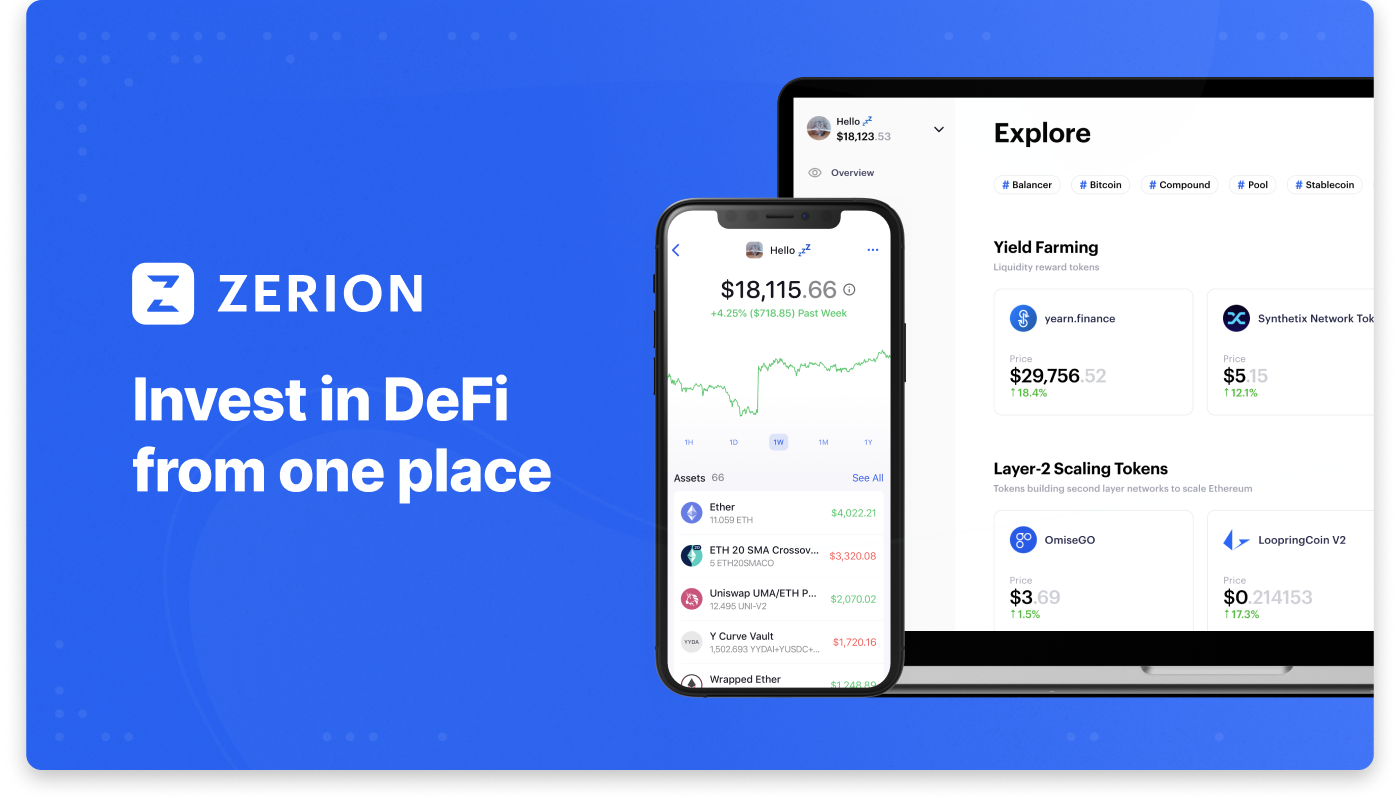

🙏Sponsor: Zerion – Invest in DeFi from one place. 🚀 (I use this app daily - RSA)

THURSDAY THOUGHT

Guest Post: Jeremy Guzmán, Founder and CEO of Mass Adoption

Banking the Unbanked Without a Bank

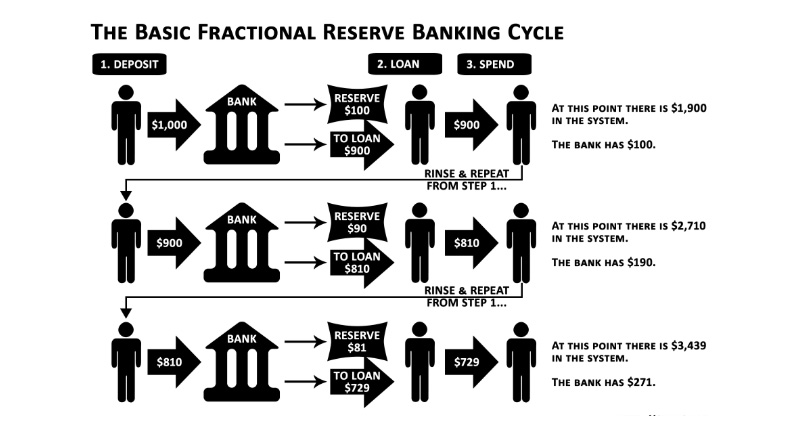

In a substantially centralized society, many people rely on banks to store and secure their assets even though they continue to offer relatively insignificant interest rates. To combat this, others may turn to wealth management firms and brokerages to supervise and execute investment strategies in order to earn a higher return on their capital.

Now, these are common practices that many of us have grown accustomed to. However, many of these banking vehicles are extremely inconvenient, and are only accessible to those living in a developed countries with stable financial systems.

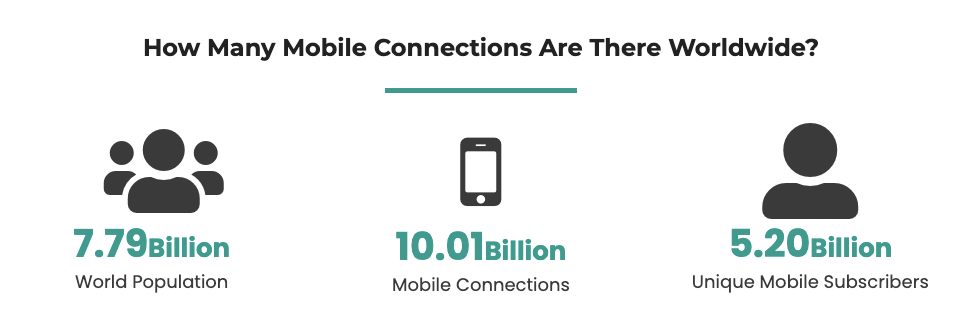

In fact, 1.7 billion people worldwide are considered unbanked/underbanked. That’s 31% of the world’s population without access to any basic financial services. For reference, 4.78 billion people are active smartphone users - indicating that 61.51% of people own mobile phones today.

Ok, so what? And what does this have to do with Decentralized Finance?

Well, given the fact that there are more cell phones in the world than there are individuals with bank accounts, alongside the immense propagation of neo-banks and impending crypto adoption, people no longer need to rely on centralized banking infrastructure to access any sort of financial services.

All they need is a smart phone and an internet connection.

The Rise of Decentralized Finance

DeFi offers a significant improvement over traditional finance; empowering anyone to create self-sovereign, sustainable crypto money portfolios.

Similar to what we see in traditional finance, things like: mutual funds, ETFs, high-interest saving instruments, and passive income opportunities, DeFi offers self-sovereign, automated alternatives.

Actually, it’s a massive upgrade over the conventional services. It has the potential to displace slow, geo-restrictive, centralized banking infrastructure with global, unstoppable financial software accessible by anyone in the world with a smartphone.

So rather than having to have an identity, on-boarded into a traditional financial system, anyone in the world can access these alternative financial services that rival the incumbents.

Here are a few examples.

Three Banking Functions that No Longer Require a Bank

Let’s talk about three banking functions DeFi is already starting to replace:

1. Savings Accounts

Wells Fargo ➡️ Compound

Savings accounts are one of the foundational services in traditional finance.

With banks offering marginal returns for storing your money with them, there’s plenty of opportunity in DeFi for anyone in the world to beat normal savings rates by a few orders of magnitude.

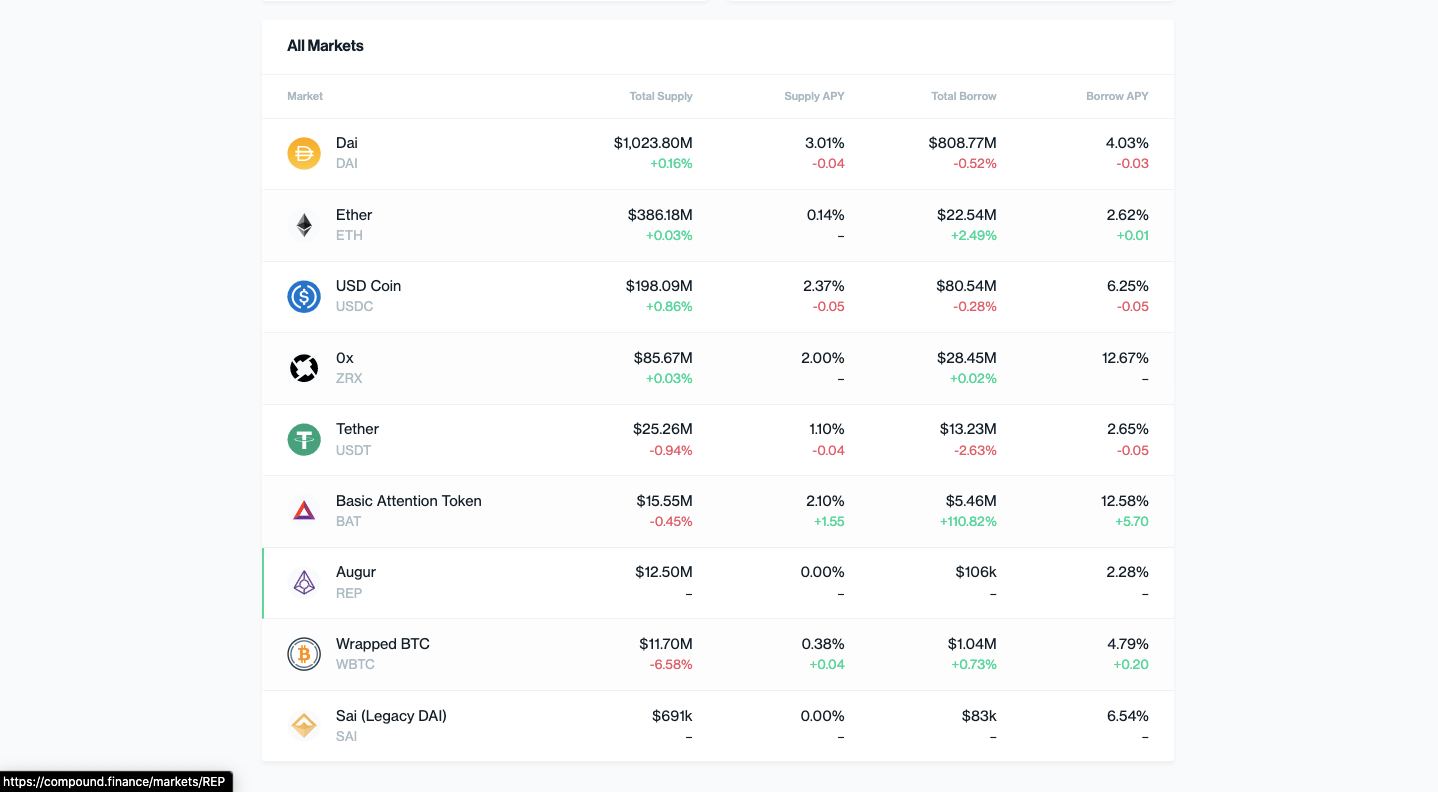

Compound is a prime example as it offers users the ability to lend & borrow crypto assets in exchange for a variable interest rate. For instance, those who supply assets to one of Compound’s money markets will earn interest (plus COMP tokens!) on the respective asset — including a handful of different crypto dollar flavors.

The interesting part about lending to Compound is that there’s virtually no risk of default as anyone who borrows your assets must over-collateralize their position. That said, that design allows borrowers to originate a loan with no paperwork and no identity—just an Ethereum address. (RSA—there are other risks of course!)

Everything is done in a trustless, automated fashion.

Now, how can one utilize these money markets to accrue interest?

This could be done by:

- Using an Ethereum wallet (i.e. Metamask, Argent, Dharma, or any Web3 compatible device)

- Selecting the desired asset you’d like to supply (stablecoins like USDC, DAI, USDT usually offer the best interest rates)

- Supply the chosen token, say DAI, to the respective pool

- Start earning interest in real-time!

It’s as simple as that.

The same way in which one would deposit and leave your cash in a traditional savings account could be done using Compound Finance. Simply deposit your capital into the protocol and you start earning interest in real-time.

The coolest part with DeFi is that you no longer have to wait for your bank to pay you out 1x per month. Instead, you get paid out your interest in real-time.

🤖Compound is just one of the many interest rate protocols. There’s nearly a dozen of them, all offering their own rates. If you’re interested in always having your money to work in the high-yielding opportunity, check out products like yEarn, Idle Finance, and Rari Capital. These are yield aggregators that have money robots work for you to optimize your yield and make sure you’re always earning the highest rate!

2. Crypto Mutual Funds

Vanguard ➡️ Set Protocol

Before we get into “crypto mutual funds”, it may be best to briefly explain what is a mutual fund. A mutual fund is a professionally managed investment fund that allocates investor’s capital in an attempt to earn a return beyond simply holding cash.

There are quite a variety of mutual funds out there, ranging from equity funds, fixed-income funds, money market funds, and hybrid funds. All of these consist of a basket of underlying equities, bonds, indices, treasuries, etc.

But rather than relying on fund managers to effectively allocate capital, DeFi allows us to allocate capital to certain people or even money robots that ascribe to a certain strategy.

The prime example of this is Set Protocol and their product, TokenSets.

Set Protocol a non-custodial, asset management platform that offers automated, tokenized trading strategies. These strategies are known as ‘Sets’ which, similar to the traditional mutual fund, consist of a basket of assets. But in this particular case, they’re crypto-assets.

There are two types of ‘Sets’ offered on TokenSets:

- Social Trading Sets

- Robo Sets

Social Trading Sets are actively managed portfolios by select individuals within the platform. Each Set is administered differently, determined by the time horizon, risk-tolerance, indicator triggering, and performance of the respective Set.

And similar to Mutual Funds, Social TokenSets may have a management fee associated with their respective strategy which is given to the Set’s trader. These fees may include performance fees, buy-in fees, and streaming fees — all of which are set at by the trader.

While Social Set strategies are executed based on human discretion, Robo Sets execute trades programmatically. So instead of relying on an individuals trading strategy & bias, Robo Sets adhere to specific rules encoded into the asset.

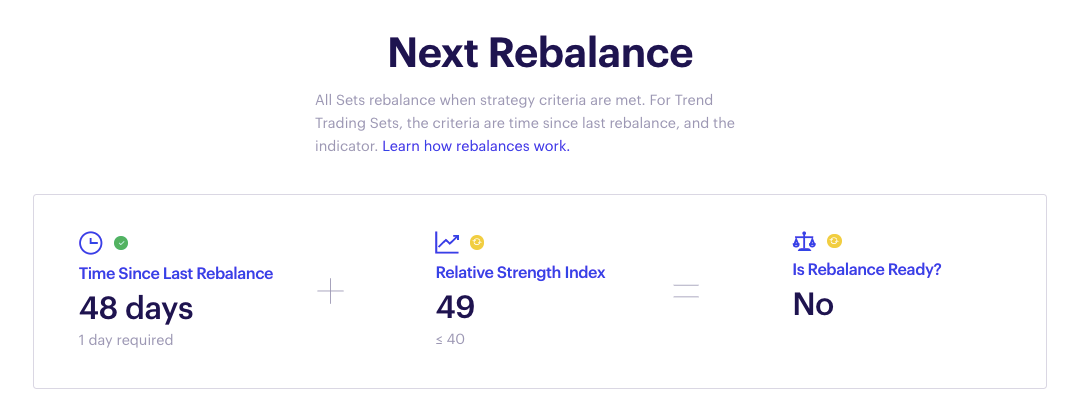

For example, TokenSets offers a passive trading Set like the ETH RSI 60/40 Set.

According to the Set’s description:

The ETH RSI 60/40 Crossover Yield Set attempts to capitalize on trends by detecting the speed and change of price movements for ETH. ETHRSIAPY automatically triggers rebalances if the Relative Strength Index (RSI) crosses below support at 40 or above resistance at 60 to indicate the price momentum. If the ETH RSI falls below 40, the Set will rebalance from ETH into Compound USDC and automatically accrues interest on your cash when the market is bearish.

As described, the ETH RSI 60/40 Set follows a certain strategy based on the price action of the underlying assets (in this case ETH).

TokenSets can be a great way to set up an automated trading strategy to see if money robots or other people can beat the market—whether your measuring stick is holding BTC, ETH, or even the S&P 500.

For those interested at looking at the performance of each TokenSet, you can check it out here.

🤑Interested in investing in DeFi? TokenSets recently partnered with DeFi Pulse to release the DeFi Pulse Index (DFI) Set. By buying this Set, you get exposure to the top DeFi assets, weighted by market cap.

3. Mobile Payments

Cash App ➡️ Dharma

Mobile payments have exploded in growth over the years. Venmo, Cash App, and others are all competing for the same market share.

But all of these applications rely on existing banking infrastructure. And while Ethereum enables global, peer-to-peer payments natively, using cryptic addresses and MetaMask to execute this functionality is not ideal.

Therefore, we need payment applications that leverages Ethereum’s capabilities while combining it with an intuitive user experience that rivals the likes of Venmo and CashApp.

One of these projects is Dharma

Dharma has eliminated the need to remember or write down 12-16 word seed phrases. Instead, they stuck to the basics—email & password logins. What’s important to recognize with Dharma is that while they’ve implemented a traditional login, users always control their funds. It’s entirely self-custodial.

Like Venmo and Cash App, you have to connect your bank account if you’re looking to get onboarded from fiat. Otherwise, you can always load your account with money from your everyday Ethereum address.

Once you’ve done that, here’s when the fun begins.

After depositing dollars (USD), Dharma automatically converts it into Dai on the backend and supplies it into the Compound protocol. But you never actually know this. It’s entirely abstracted away. This means that when you use Dharma, you automatically accrue a base interest rate in real-time, can send dollars anywhere in the world, and do it all with normal usernames.

It’s like Venmo on steroids.

Pretty cool, right?

It’s an innovative way to execute peer-to-peer payments using Ethereum while maintaining the familiarity of traditional mobile payment applications.

💰Argent is also a great alternative! It’s a smart wallet with similar features to Dharma along with a handful DeFi integrations so you can interact with popular DeFi applications directly from the wallet! Here’s our tactic on how to get setup with Argent.

BONUS: Portfolio Tracking

Mint.com ➡️ Zerion

After you’ve spent some time venturing down the DeFi rabbit hole, it may be best to track the performance of your newfound holdings via a reliable asset management interface.

Zerion is one of the simplest ways to track and manage your DeFi portfolio. Interestingly enough, Zerion gives you the option to exchange, save, pool, and borrow assets once you’ve successfully connected your wallet(s)!

In essence, Zerion gives you the ability to track and participate in the DeFi ecosystem from a single platform. It’s an amazing tool (and a Bankless supporter!)

🧐Want to learn more about Zerion? Check out our Bankless piece on the crypto money portfolio!

Closing Thoughts

The DeFi ecosystem is making strides towards passing traditional finance in value creation. It is literally disrupting an industry that’s been rather stagnated for decades.

The fact that anyone in the world with a smart phone and an internet connection can access a diverse range of financial services without the need for an identity, paperwork, and any other of the cumbersome processes associated with traditional finance is a massive step forward for the world.

Equally important, none of these DeFi services were around a year ago to the same level they exist today. And while there’s still a ways to go before we bank the unbanked (and unbank the banked!) the proliferation of open finance is nothing to brush off.

It’s only a matter of time before billions of financially marginalized individuals are introduced to a bankless financial system.

Just give it a bit more time.

Action steps

Try out some of the DeFi applications mentioned above!

Author Bio

Jeremy Guzmán is the Founder and CEO of Mass Adoption, a one-stop shop for blockchain education focused on introducing the world to crypto & blockchain technology.

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Badge.

🙏Thanks to our sponsor

Zerion

Zerion is the easiest way to manage your DeFi portfolio. Explore market trends, invest in 170+ tokens, view returns across wallets and see your full transaction history on one sleek interface. They’re also fully bankless, which means they don’t own your private keys and can’t ever access your funds. I use this app daily! Start exploring DeFi with Zerion on web, iOS or Android. 🔥

- RSA

P.S. Don’t forget to get check out Zerion’s new Uniswap integration. 🦄

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.