A crypto banking reality check

Level up your open finance game three times a week. I’m providing this thought-piece free for everyone today. For more like it subscribe to the Bankless program below and start leveling up.

Dear Crypto Natives,

I asked Nic Carter to shares his insights on crypto banks with the Bankless community and he delivered a fantastic piece. He hits topics like:

- How much BTC and ETH are we entrusting to crypto banks today?

- Can we minimize the trust requirements of crypto banks?

- What guarantees do we have on their solvency?

This is vital for us to understand since the banking layer is the primary way we accomplish tasks with our crypto money like lending, borrowing, trading, & staking. Today much of this activity happens in crypto banks rather than in open protocols.

Nic gives us the breakdown—a timely piece considering how we started the week.

Ready? Let’s level up on crypto banks.

- RSA

THURSDAY THOUGHT

A crypto banking reality check

Post by: Nic Carter, Partner at Castle Island Ventures

In the last 18 months, functions associated with traditional banks have taken root in the crypto industry. When conjoined with trust-minimization, this phenomenon is generally referred to as DeFi, and the bulk of such activity occurs on Ethereum, with some exceptions.

The nuts and bolts, and indeed, potential of DeFi have been well covered in this newsletter and others, so I won’t discuss to the specifics here. Instead, I’d like to take a look at an under-explored topic: whether trust can be minimized in deposit-taking institutions, or crypto banks. (I’m fully aware of the irony of making the case for banks in a newsletter named Bankless!)

Let’s very quickly recap what commercial banks do, in decreasing order of importance:

- Accept deposits from individuals (typically, they do not retain a full reserve, instead holding a relatively small fraction and creating loans based on those reserves). In many jurisdictions, these deposits are guaranteed by the government up to a certain threshold

- Depending on the account type, pay interest on these deposits

- Serve as a source of credit for consumers who need credit cards, small business loans, overdraft, mortgages, and so on

- Serve as a transactional interface and agent for users wishing to send wires, receive checks, pay bills, and so on

- Issue debit and credit cards

- Give consumers the ability to acquire physical cash in exchange for electronic deposits, either through branches or ATMs. This service is effectively a subsidy (or loss leader), since it’s often (but not always) free for account holders

- Offer physical storage for various goods, like valuables (or even your private keys!)

Now, crypto exchanges don’t carry out all of these services, but I do often refer to them as ‘banks’ because they do crucially cover the deposit taking use case — and they’re getting into more and more of these other functions. I won’t repeat Hasu’s work here: his piece on the various services offered by exchanges (“crypto banks”) is an excellent rundown of the direction that the industry seems to be headed. The question for me is: if crypto banks are here to stay, and users will continue to seek them out, is it possible to minimize the trust required? And are cryptocurrency deposits themselves more amenable to this trust minimization than fiat deposits?

Why users choose crypto banks

In my view, the primary concern of the crypto industry is, and will continue to be, to allow users to own and transact with financial assets, under an array of trust models. Bitcoin’s creation catalyzed a new ownership mode: strong ownership of a portable digital good. Settlement is final (probabilistically) for each on-chain transaction. This meant that transactions aren’t subject to the normal issues associated with digital transfers, which result from the latency between payment and final settlement. However, Bitcoin and all subsequent cryptocurrencies reintroduced the problem of requiring that users self-custody their assets.

Since storing information carefully is rather difficult for many people, custodians for cryptocurrency naturally emerged. And since the main way people acquire cryptocurrencies is at exchanges, many individuals chose to also use those exchanges as custodians. So the industry over time developed full-reserve banks, which are referred to as exchanges (although some dedicated non-exchange custodians also exist). These crypto banks have come to capture a large and growing fraction of the supply of major cryptocurrencies. As staking, lending, and interest bearing instruments take off, many users are choosing to get exposure to these experiences through centralized custodians.

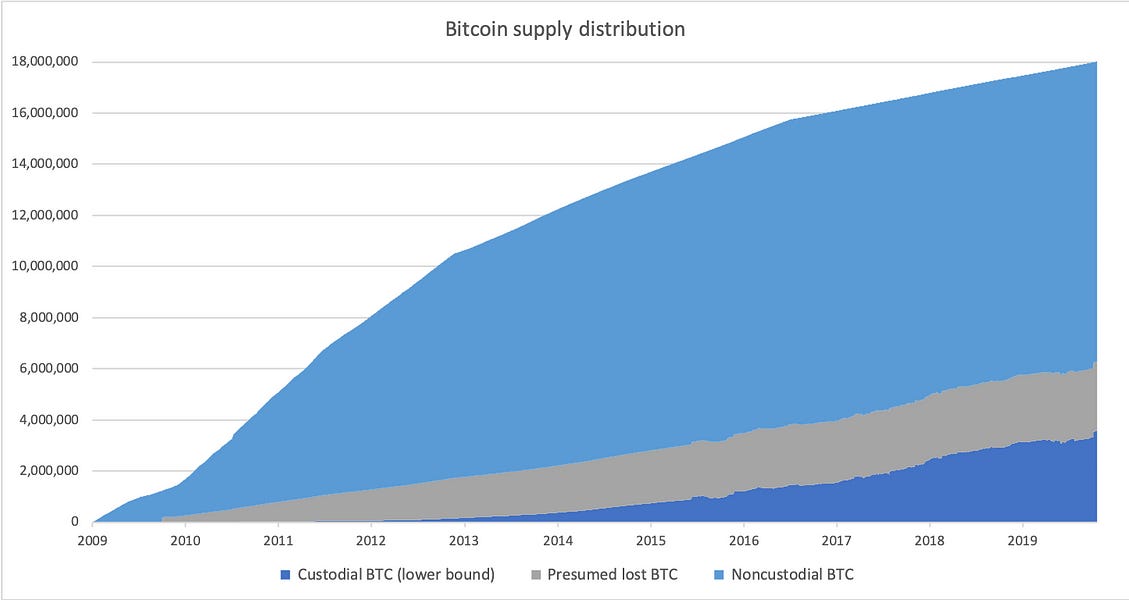

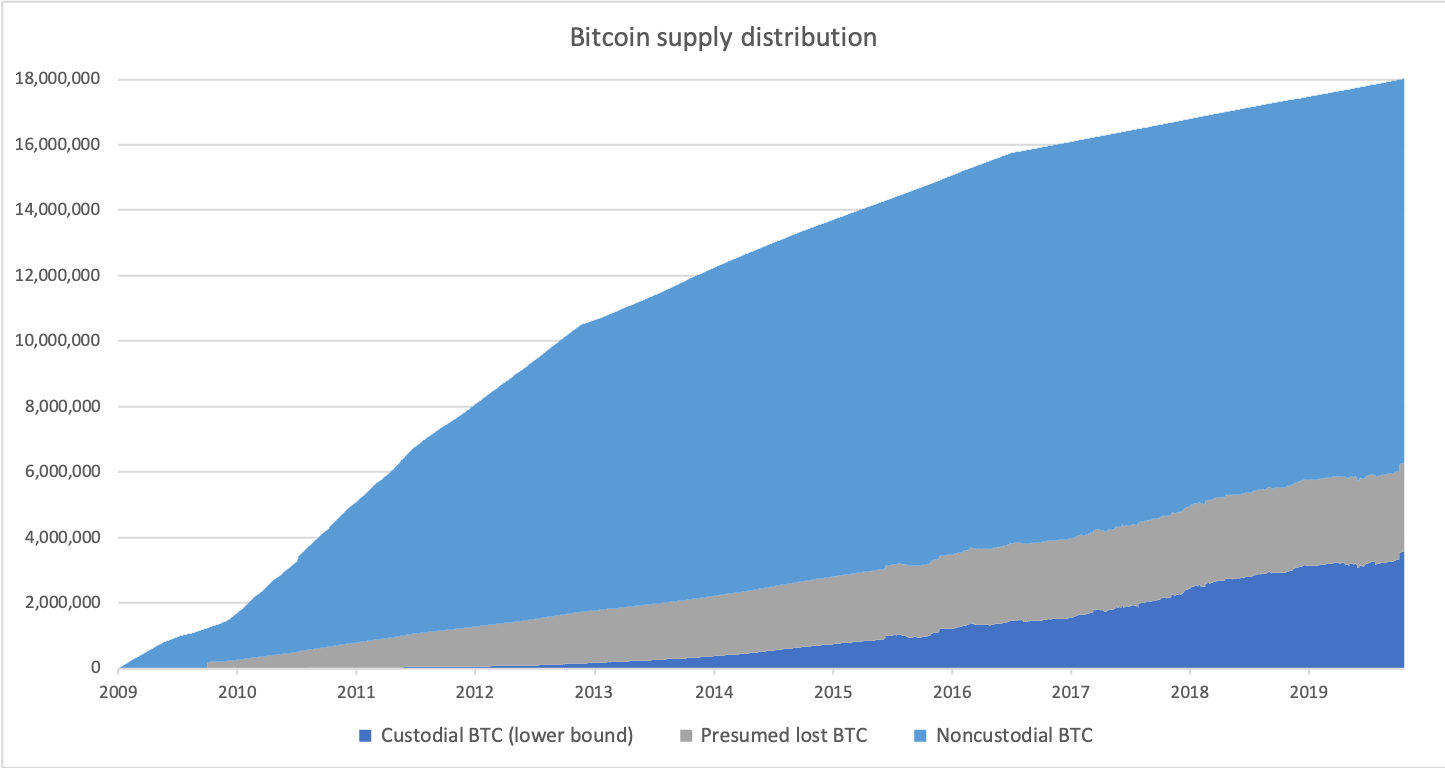

Thanks to address tagging and a bit of detective work, we can estimate Bitcoin’s supply breakout between custodial and noncustodial. I’ve also included long-term inert supply because lots of early coins are presumed lost.

Presumed lost BTC estimate by Coin Metrics. For custodial BTC data sources see below. Data originally presented at Macro.WTF and revised here

As you can see, custodial Bitcoin has grown rapidly, accounting for a share of at least 20% of total mined supply, and a larger fraction if you exclude presumed-lost coins.

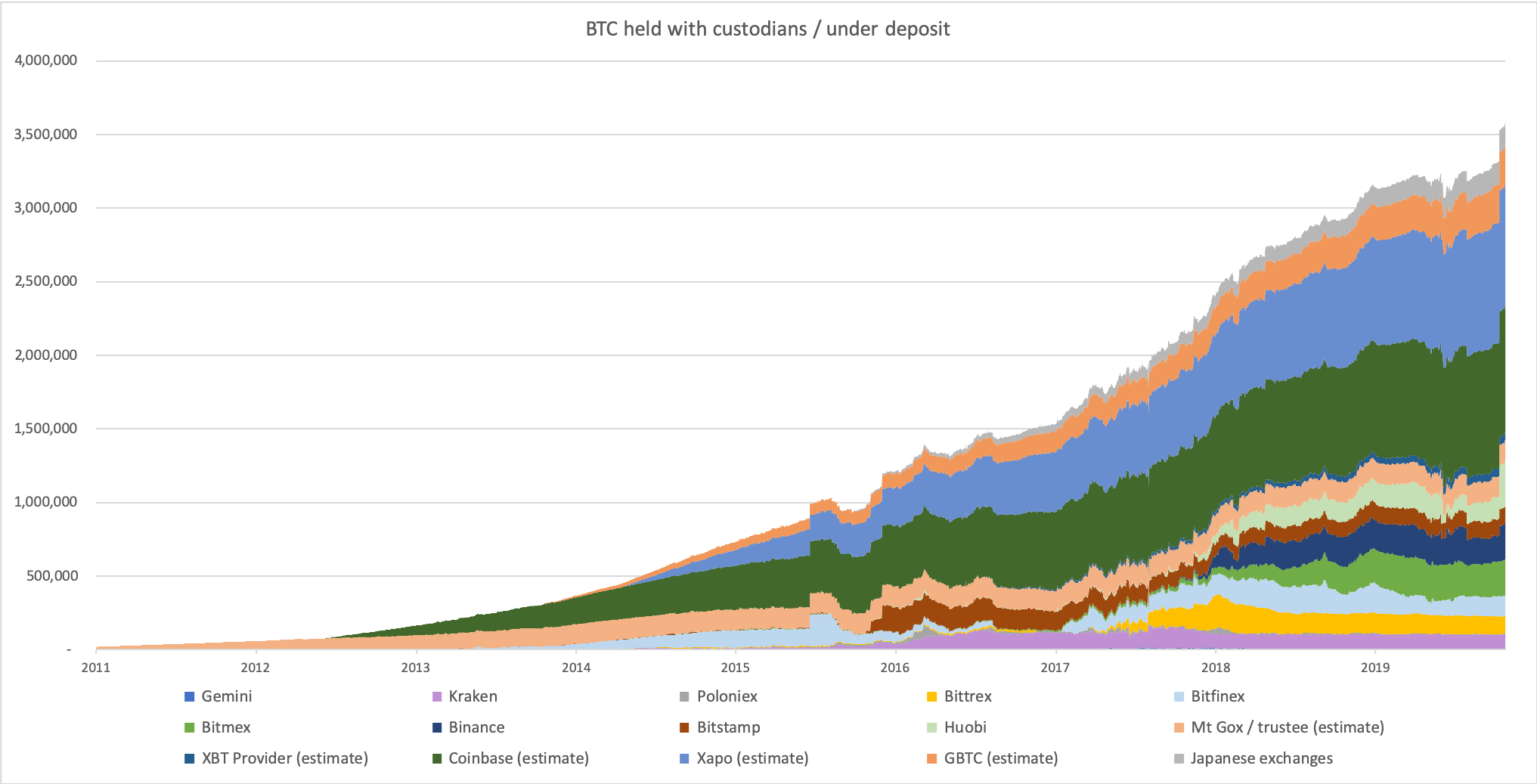

I’ve also approximately split out the holdings by custodian (keep in mind some of these are rough estimates):

Sources: Coin Metrics, Grayscale, XBT Provider, Meltem Demirors/Coinshares, Japan Virtual Currency Exchange Association

Admittedly, the historical estimates involve a bit of extrapolation, since I don’t have good data on exchanges like Mt. Gox or historicals on Coinbase, Xapo, and others. Usefully, Japanese exchanges self-regulate, and actually disclose their holdings. I’ll concede that this is only a lower bound estimate of custodial Bitcoin: there are many smaller exchanges that I am not counting here. But I believe this is the bulk of it. And the trend is rather alarming: custodial Bitcoin is growing much faster than the Bitcoin supply. Who knows what fraction it will eventually capture.

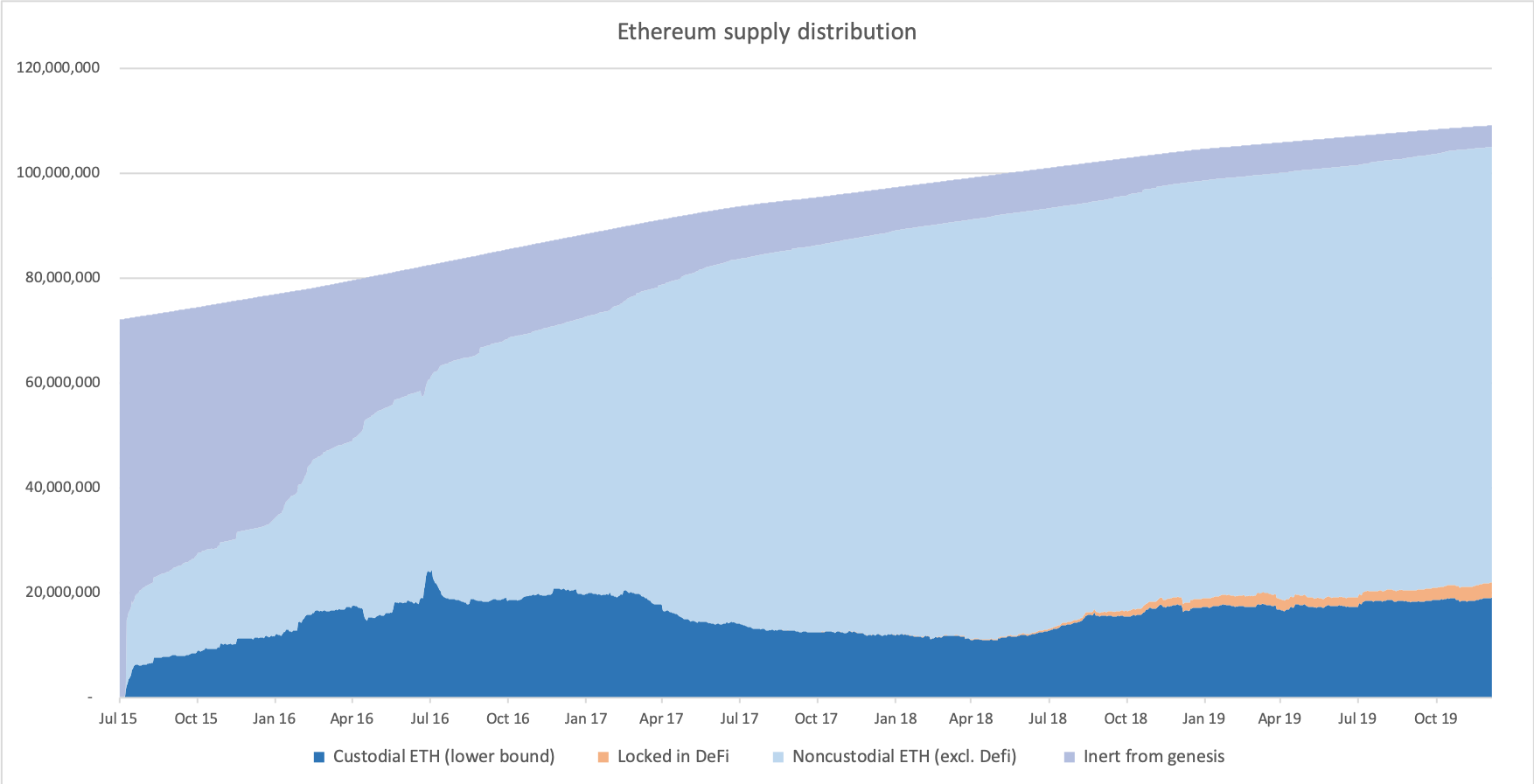

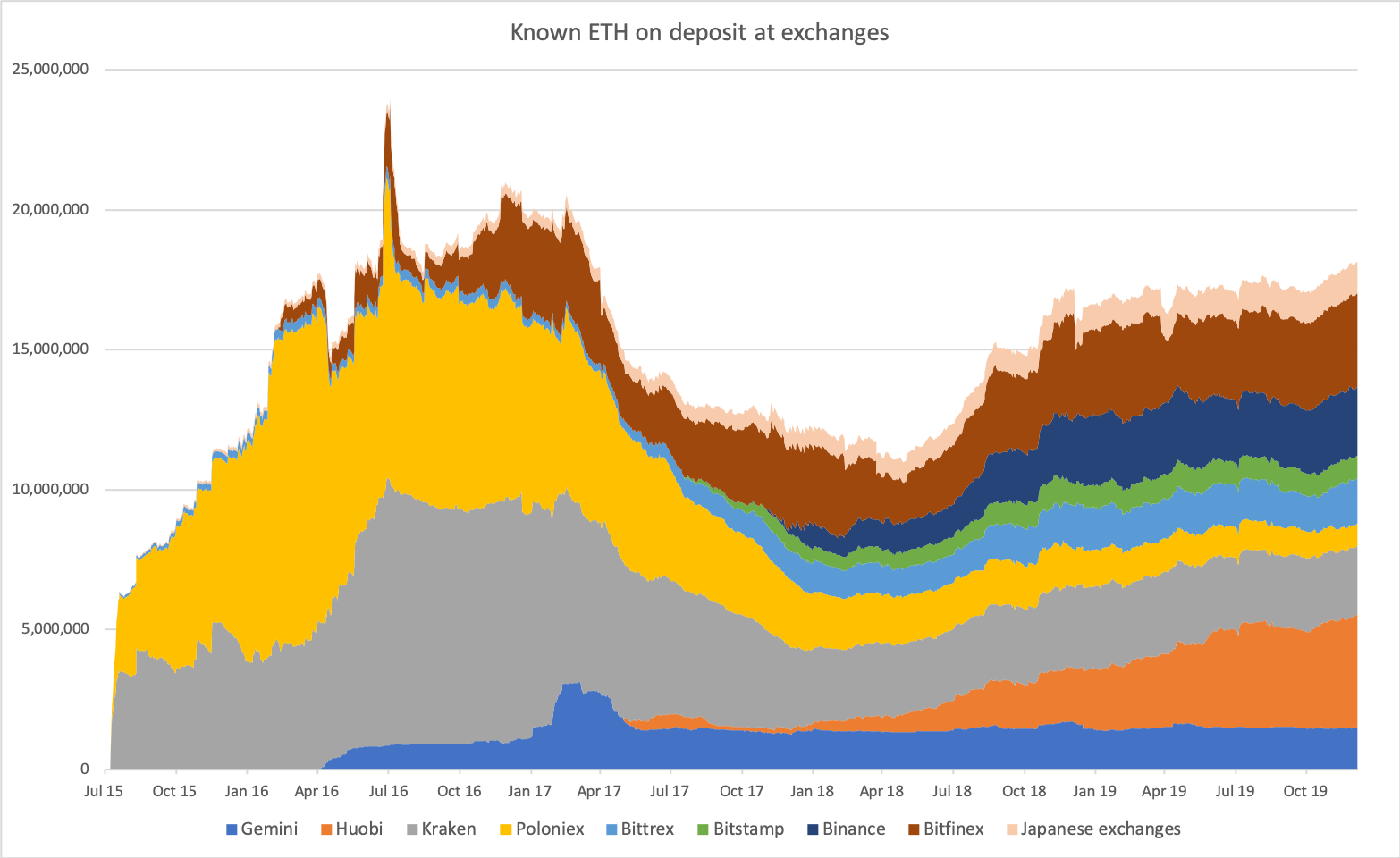

Thanks to data obtained by Coin Metrics, I was able to perform a similar analysis for Ethereum.

Sources: Coin Metrics, DefiPulse

The ‘inert from genesis’ fraction refers to units of ETH that, for whatever reason, never actually left the Genesis block after being allocated in the crowdsale. It’s a startlingly large fraction of supply. You can also see the DeFi phenomenon start to claim a larger and larger share of supply, although it’s still relatively small. And we have custodial ETH held with exchanges, although that estimate is a lower bound. Here’s the per-exchange breakout:

Source: Coin Metrics, Japan Virtual Currency Exchange Association

Again, we have the Japanese exchange SRO to thank for their convenient disclosures. Aside from that, all the balances were found through on-chain estimates. Unlike the same chart for Bitcoin above, I have a high confidence in the full history here thanks to the on-chain methods employed (whereas I had to rely on public disclosures for GBTC and others for Bitcoin). Of course, there are many smaller exchanges which I am not including here, so we’re looking at only a partial sample. We’re also missing Coinbase (which deliberately obscures their balances). I believe that Coinbase has several million ETH on deposit.

Depending on your perspective, you might be encouraged or dismayed that both Bitcoin and Ethereum have about 20–25% of supply held in a custodial manner. Most people that I asked in a straw poll actually estimated that a much larger share of the supply of both chains would be custodial. It’s clear to me that there is stable and growing demand for custodial exposure, both on Bitcoin and Ethereum. Whether this compromises those systems at a certain threshold is an interesting question, but out of scope here. So what distinguishes conventional banks, and exchanges that cosmetically resemble them? Let’s briefly revisit the nature of commercial banks.

Commercial banking today

Commercial banks are an interesting institution in that they are not permitted to fail outright, for political reasons. Society trusts banks to hold the deposits of households and individuals, and even though banks engage in fundamentally risky behavior (making loans), the consequences of total failure are very unpalatable to society (everyone’s deposits being wiped out). So the government effectively guarantees deposits. In the US, the FDIC ensures that if a member bank fails, each depositor will still have a claim on their balance, up to a maximum of $250k. Once upon a time, banks were allowed to fail, taking user deposits with them. However, bank failures tended to be contagious: depositors would get spooked all at once and try and withdraw their assets at the same time. This used to happen in the US, which is why the FDIC was created in 1933, and commercial banks became federally regulated.

So today, in commercial banks, you have stakeholders that are not protected (bank shareholders and creditors) and stakeholders that are explicitly protected (depositors). If banks fail, the investors get wiped out but the depositors are protected (within limits). In crypto-land this established model is not exactly adhered to. Exchanges are not universally regulated as banks or deposit-taking institutions; indeed, in the US, new bank charters are simply not being issued these days. Nor do exchanges want to be regulated as banks, for the most part. Many just opt for the patchwork of state-by-state money transmission licenses, and in some cases register as a New York limited purpose trust company, or seek the New York BitLicense. Many non-US exchanges aren’t materially regulated at all. This has the effect of making it very difficult for depositors at exchanges to know exactly where they stand if something goes wrong. This is a lesson that Gox and Quadriga creditors learned all too well.

There’s a general view in the industry that if you do not personally hold your keys, you don’t own your coins. I am sympathetic to that view, and I feel that cryptocurrency works best when users are the sole proprietors of their coins. If everything ends up custodial, then the custodial institutions can assert control over transactions and re-permission the system, eroding the censor-resistance that we hold dear.

However, I am also cognizant of the fact that a certain set of individuals will always prefer to hold their cryptocurrency with a third party. Custodying keys can be technically difficult and also open up holders to the risk of extortion or theft. While I don’t endorse depositing cryptocurrency with a custodial institution, I acknowledge that it is a very popular usage mode, especially as exchanges layer on staking rewards, debit card functionality, interest payments, and other ancillary services.

Are crypto deposits guaranteed at exchanges? If, so, how?

There is a view in the crypto industry that if an institution cannot be mechanized, it’s hopelessly subjective and cannot offer users assurances. However, I feel a middle ground is perhaps merited. Is it possible for crypto banks to reduce the trust requirements for depositors? One critical domain is over deposit assurances. Since exchanges are acting like custodians and even extending banking services in some cases, but they aren’t regulated as banks, how are user deposits treated, especially in the case of bankruptcy or insolvency?

Clearly, there will be a difference in how depositors are treated depending on the regulatory regime of the institution. Let’s start with the cohort of crypto exchanges that are partially or completely regulated. Not being an expert myself, I called around, asking folks with direct first-hand experience on the compliance arms of deposit-taking crypto institutions.

In the US, exchanges are not regulated under a unified federal standard. Most exchanges have to register as money services business (MSB) under FinCEN. What this actually requires of exchanges is that they have to develop an AML program, report large cash transactions, report suspicious activities, and generally try to comply with the Bank Secrecy Act. The MSB licenses don’t really cover the exchange’s activity in the context of them being deposit-taking institutions.

Exchanges also tend to register on a state by state basis as money transmitters. The requirements vary on a state-by-state basis, but this often requires proving to state auditors that you have sufficient reserves to be considered solvent. From asking around, the consensus appears to be that state regulators aren’t particularly sophisticated about cryptocurrency (with some exceptions), so the MTL licensing regime doesn’t constitute a particularly strong check against exchange misbehavior.

A stronger regulatory approach would be to obtain NY limited purpose trust license which some exchanges and intermediaries, like Gemini, Paxos, and ItBit have opted for. The trust license does not require that these entities become FDIC insured, but it does allow them to hold dollar deposits on behalf of customers at FDIC-insured banks. This means that deposits for stablecoins like Paxos, the Gemini Dollar, and the Binance Dollar (administered by Paxos) are FDIC insured.

Here’s a question to which I still don’t have the answer. Let’s say a crypto exchange is hacked and rendered insolvent, such that it only has a fraction of the BTC and ETH that it owes depositors. Prior to the hack, let’s imagine the exchange had issued a significant amount of debt. In the normal capital stack, creditors are considered “senior” — that is, they get a claim on the assets of the company in liquidation first, before other stakeholders. What happens in bankruptcy proceedings? Do the creditors get paid off first, leaving nothing for depositors?

Aside from these edge cases though, you can have some degree of confidence that regulators are interested in exchanges being fully reserved, especially if exchanges submit to the more onerous state regimes or obtain the NY Trust License. One thing that I noted in this exploration was the extreme difficulty in obtaining information on which exchanges perform which audits for whom, whether exchanges have structural prohibitions on commingling client and operating funds, and what the status of depositors in liquidation would be. The regulated exchanges could do significantly more on this front to grant these assurances to users.

For the unregulated exchanges, assurances are even weaker. In while insurers or investors might demand audits, unregulated exchanges by definition are not under any pressure to demonstrate solvency to third parties or segregate deposits and operating funds. And indeed, we’ve witnessed some truly shambolic behavior from many of these exchanges over the years. It’s in this context that I believe that Proofs of Reserve become salient. They aren’t perfect, but in the absence of regulators to steward exchanges, demonstrating to depositors that deposits are fully reserved is the next best thing. And more so than the exercise itself, the process of proving reserves on a periodic basis would constitute good housekeeping — and would alert depositors to issues long before they became fatal.

In conducting this exercise, I was shocked at how little I knew about how crypto exchanges think about reserves. It’s not a matter of personal concern to me, since I make an effort to never custody cryptocurrency with a third party. But it is of concern to the industry, and I rarely see dialogue on this topic. I asked a few individuals with insight into the matter which piece of US regulation covered reserve requirements or audits for crypto exchanges, and whether depositors were privileged in liquidation, and was met with bafflement.

We talk a lot about trust minimization, normally in the context of cryptocurrency protocols. But what about trust minimization in the context of deposit-taking institutions? Bank regulation exists to give normal fiat depositors assurances about their accounts. But there is no federal standard, and most exchanges don’t seek to be regulated as banks (indeed, the ones that do go the regulatory path aim for lighter-touch regulation). In many cases, all we have is an implied promise to segregate user deposits, and maintain full reserves.

But, especially on the crypto side, this isn’t entirely within the control of the exchange. In some cases, events happen on-chain which can impair the quality of reserves in some way. In 2017, Coinbase’s mismanaged UTXO set meant that they had a lot of ‘stranded’ UTXOs which would have cost more in fees to spend than they were worth. Does this mean that they were technically insolvent? There have also been cases where bugs or hard forks have altered the property registry in some way. What would happen if a major exchange was staking and was slashed?

These are questions that exchanges, regulators, and depositors will have to grapple with. My abiding feeling writing this article and conversing with practitioners who are more steeped in these issues is to be struck by a strange paradox inherent in the crypto space: we (rightly) prioritize trust-minimization when open protocols are considered, but the moment the assets become custodial, we write them off and presume that funds are critically at risk (and that users are to blame for trusting an exchange in the first place). Of course, exchanges are not homogenous, and follow a variety of security and regulatory practices. There are shades of grey, and — potentially — avenues to also minimize the trust requirements we place in crypto banks. Of course, a Proof of Reserve for Kraken is much more cumbersome (and less reliable) than simply looking at the Maker CDPs on chain, but I feel that we should still try to hold exchanges accountable, and better understand where depositors stand. In an industry plagued by contradictions, this is surely one of the most telling.

Actions

- Consider: what trust assurances do you have on the deposits in your crypto bank?

Author Blub

Nic Carter is one of my favorite writers and thinkers in crypto. He cofounded Coinmetrics, an onchain data resource that we use regularly in Bankless. He was also the first crypto analyst at Fidelity and is now a Partner at VC-firm Castle Island Ventures. His writing was vital to framing how I think about Bitcoin as a value settlement network.

Subscribe to the Bankless program. $12 per mo. Includes Inner Circle & Deal Sheet.

👉Send Bankless a DAI tip for today’s issue

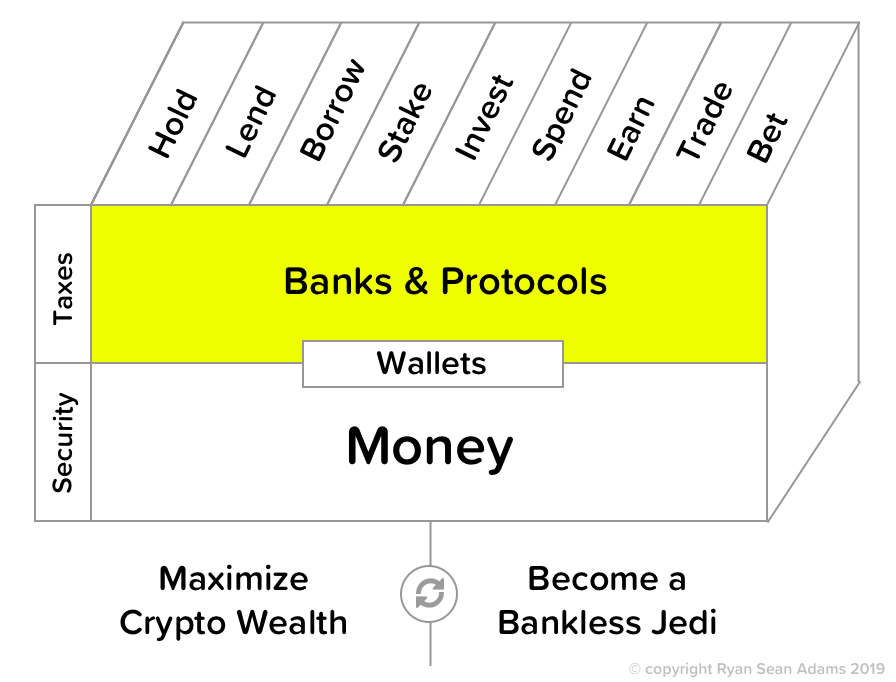

Filling out the skill cube

Crypto banks are less bankless way to hold, lend, borrow, stake, and trade our bankless money. They rest on top of the crypto money layer in the skill cube framework.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.