Last chance to give 1 DAI to the Bankless Grant. Help me build the program! Ends tomorrow.

Dear Crypto Natives,

Four years ago people were asking the same question they’re asking today.

Am I late to crypto?

Things had been bumpy. Enterprise blockchain was the rage. Ethereum’s functionality looked like it could be swallowed by Bitcoin smart-contracts. ETH priced dropped to its lowest point and the Ethereum Foundation was out of money.

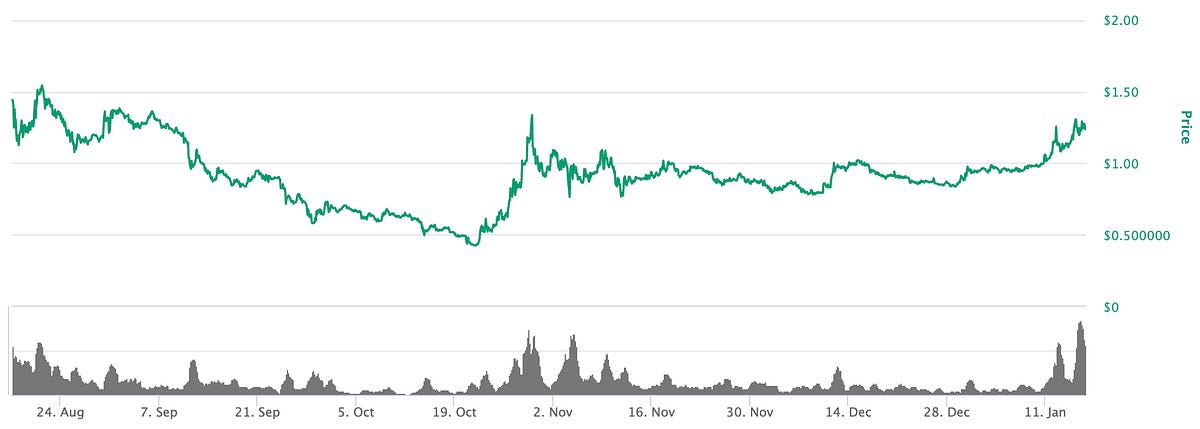

(Above) ETH price from August 2015 to January 18th 2016

But in late October 2015 there was signs of life. Just a flash. Then November and December showed signs of recovery. New tokens were planning to launch on the Ethereum…they called them ICOs. And there was rumor of something more ambitious—a decentralized capital pool—the world’s first DAO for investing?

Of course Ethereum wasn’t going anywhere!

By early January 2016 price had shot up 3x from the lows.

That’s the context for this reddit thread from 4-years ago. A bunch of people thought they missed out on ETH because the price had just spiked over $1. “Too rich for my blood. Should of been here in November.” says one commenter.

They thought they were late to ETH.

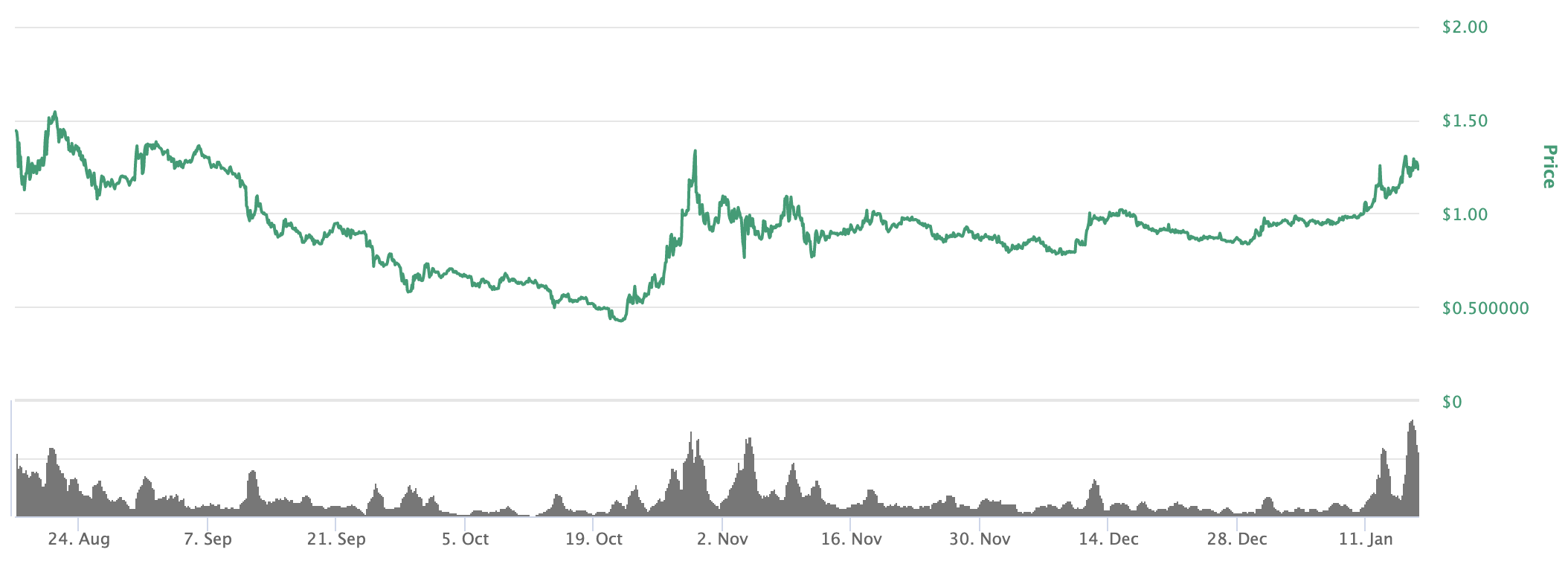

(Above) ETH price from August 2015 to January 20th 2020—red dot is when the above reddit post was made

Everyone always thinks they’re late in crypto.

Let me give you some solace.

It doesn’t matter if you bought in January 2016 or January 2018 or January 2020.

You’re not late.

Less than 1% of the world’s population owns crypto.

There are only 40 thousands DeFi users.

We haven’t scratched the surface.

Sure maybe crypto doesn’t take off. Maybe we never fully solve UX. Maybe the world prefers centralized money systems. Maybe we can never get the tech quite right.

It’s entirely possible we’re wrong on this crypto investing thing.

But we’re not late.

- RSA

Economic bandwidth became a thing last week—that’s cool because ETH’s grew by about $2.5B since last Market Monday. Ok, who knows how I did that math? 🙋♀️

MARKET MONDAY:

Scan this section and dig into anything interesting

Market numbers

- ETH up to $167 from $143 last Monday

- BTC up $8,655 from $8,112 last Monday

- DAI stability fee steady at 6% with savings rate 6% 🔥

Market opportunities

- (Earn) 6% on DAI—deposit into the DSR or get CHAI

- (Bet) using a much less Bankless of PoolTogether (needs Coinbase to login)

- (Pool) Manage a DAO using Discord (early project…but potential)

- (Give) Lock up DAI to plant a tree (we’ll onboard the world w/ apps like this)

- (Trade) for 0 fees if you buy in a big blocks at Gemini 5 BTC / 100 ETH

- (Lend) using Outlet mobile app and get your first $5 free (similar to Linen)

- (Pay) Monolith & Plutus cards reviewed for EU (I like crypto.com card in US)

- (Borrow) using ETH on BlockFi w/ no origination fees (expires January 31st, 2020)

(still can’t beat BlockFi’s ETH and BTC rates at 4.10% & 6.20%)

New stuff

Frontier Wallet adds Maker and Compound (similar to MyDeFi)

Cosmos trading on Coinbase (staking ATOMs next?)

TokenTax adds Uniswap importer (who wants a Tax Tactic comparing these?)

Gemini offers insurance for it's cold storage custody solution (a first!)

Synthetix allowing ETH was collateral (only 5k ETH max at first) on Jan 30

Crypto payments app Flexa integrates with world’s largest PoS terminal maker

I think rollups will scale Ethereum before Eth2 does—look at this:

What’s hot

- 50% of DAI is locked in a DeFi Savings Account—watch out Boomer Banks!

- Watching us move toward 1billion in DeFi (data source DeFi Pulse)

- Value locked in DeFi graphic from 2018 to 2020 🔥

- Paxos gold token has a futures market (fyi-How to Buy Tokenized Gold)

- Is DAI the rate setter for all stablecoins? (more on this in future post)

- 359 projects on Ethereum list

- Explore rDAI in 3d (wild! can you do this w/ non-programmable money?)

Money reads

- Report on what RIA’s think about crypto (manage $5 trillion in assets!) - Bitwise

- Did crypto act as a safe haven during US/Iraq tensions? (maybe!) - CoinMetrics

- Projects that need to ship—Filecoin, Bitcoin, PolkaDot, Eth2 - Ben DeFrancesco

- Bear take on ZRX token fundamentals (TLDR; PE too high!) - SigilFund

WHAT I’M DOING

Check out a few opportunities I’m capturing right now with my crypto money

Unlock added some slick features and I’m considering using them. I’ve been thinking about using Unlock protocol to issue a Bankless token to subscribers that provides access to special content & perks. The reason I’ve waited is UX. My aim with Bankless is to make content more accessible, not to create more UX hurdles for newcomers. That said, new features are cool:

- Price tokens based on bonding curve (price increase with scarcity)

- Ability to token holders to share subscriptions (lease-out their tokens)

- Ability to provide refunds & risk free trials!

It’s a powerful money lego. I can’t wait to see it out in the wild. Maybe a future tactic?

What’s the coolest thing you did last week in crypto? Here’s what you’ve been up to:

- “Played around w/ first zkrollup DEX dashboard” DEX w/ scale! @finestonematt

- “Witnessed pBTC on ETH running live on testnet” @alicecorsini_

- “Gave CurveFinance a spin…amazed by the really low slippage…” - @sassal0x

- “Watched Snythetix all-time exchange volume cross $1 BILLION” - @DeFi_Dad

- “Deposited 1 $DAI into each of the top #DeFi lending platforms to see which dApp will earn the most interest in a year!” @ChainLinkGod

👉See more in thread from last week—they’re getting better every week

WEEKLY ASSIGNMENT:

Make time to complete this assignment before next week

Send DAI to 10 people in 1 transaction. Let’s say you want to give 10 people 1 DAI each. Can you batch this in a single transaction? Yes. We’re going to see how in today’s assignment. (Requirements: MetaMask, DAI, ETH for Gas, .05 ETH for MultiSender fees)

Note: Walk through the first 4 steps in the interface but don’t actually “Send” the transaction unless you want to send the DAI and pay the .05 ETH in MultiSender fees)

- Go to MultiSender.app

- Select DAI as the token to send

- Insert list of recipient ETH addresses & DAI amounts (see here)

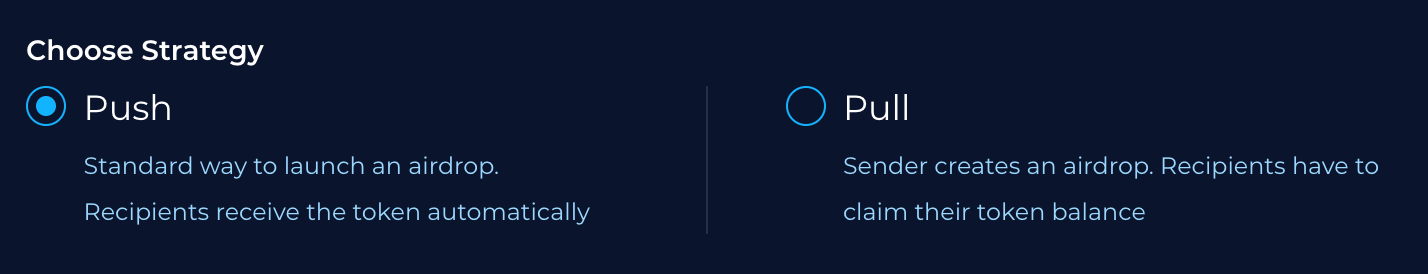

- Select “Push”

- Click “Send” (👈don’t click Send unless you want to send the transaction)

- Confirm the “Amount to approve” (approve transaction in MetaMask)

- Click “Proceed” to complete MultiSend (MultiSend charges .05 ETH + gas)

Clicking Proceed will airdrop the DAI to the recipients you specified. There’s much more you can do with this including “Pull” Airdrops and .csv uploads for addresses._ Try the tool on a Testnet like Kovan to test before you post real transactions.

Extra Credit Learning

- (Intermediate) Overview on Unsecured Loan methods today (it’s early)

- (Intermediate) Overview of Personal Token options (also early)

- (Intermediate) Learn about Multisig wallets (I recommend Gnosis for teams)

- (Intermediate) Will the DAI savings rate go higher than 6%?

- (Intermediate) Staking options in Eth2

- (Advanced) Buying a Bitcoin Put as an accumulation strategy on Deribit

- (Advanced) Rollups to scale Ethereum transactions (my fave scaling tech)

- (Advanced) Learn about DeFi Liquidators (opportunity there—but hard!)

TAKES:

Read my takes but draw your own conclusions

- I can’t wait to borrow against my ENS names

- Crypto.com selling $500k ATOMs 50% off if you stake—a total Binance play!

- Vote to refund ETH from DigixDAO passes—about time!

- Canadians might make crypto in crypto banks a security—bullish DeFi

(why? DeFi is non-custodial—control is liability)

TWEET-A-QUESTION

Tweet me your question—I reply to one per week

Question from Twitter:

Isn’t ETH’s trustless economic bandwidth going to get swallowed up when BTC comes to Ethereum?

RSA answer:

I lean no! Here are the ways to get BTC on Ethereum today:

- Custodied: like wBTC wrapped by BitGo

- Bonded: like tBTC by Keep or zBTC by REN

- Synthetic: imagine if Maker launched a Maker-BTC backed by collateral

Let's go though them.

Custodied is trusted, no comparison. Skip.

Bonded requires trustless economic bandwidth! In the tBTC design, every 1 BTC must be backed by at least 100% of its value in an ETH bond, this collateral economically secures the tBTC on ETH. If tBTC got popular it would be a large consumer of ETH bandwidth—further strengthening ETH.

In the zBTC design, instead of using ETH as a bond for economic security, zBTC uses the REN token. This means REN must be 3x the value of any zBTC it secures, or else the zBTC can be stolen. REN may be able to bootstrap itself to a decent market cap but it’ll be hard to compete with the economic bandwidth of more widely used assets like BTC and ETH. (And if security of zBTC depends on REN we have to ask—how trustless is REN?)

Lastly, a synthetic Bitcoin that Maker might create would have similar dynamics as DAI. It could be backed in part by trusted collateral—but the more trusted the collateral, the fewer trustless properties it preserves. To remain maximally trustless, a Maker-BTC would need to maximally use ETH as collateral.

So all the BTC on Ethereum designs I've seem to require an awful lot of ETH as economic bandwidth. This demand would just increase ETH’s bandwidth!

The greater threat to ETH is the possibility that people don’t care about trustless economic bandwidth. They're fine with trusted bandwidth—in that world a wBTC, a Coinbase issued USDC, or a tokenize T-bills can serve collateral.

But in that world, what's the point of crypto at all?

- RSA

Some recent tweets…

Actions

- Execute any good market opportunities you saw

- Complete weekly assignment: send DAI to 10 people in 1 transaction

Level up—no interruption. $12 per mo. Includes Inner Circle & Deal Sheet.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.