The first profitable blockchain

Dear Bankless Nation,

Profit = Total Revenue - Total Expenses

Some people think this formula doesn’t apply to blockchains. “Blockchains aren’t businesses—they don’t have profit margins”

I think that’s wrong.

The profit formula applies to blockchains just as it applies to households, Fortune 500 companies, non-profits, and nation-states.

To be sustainable over the long run a network has to sell more than it consumes.

But what does a blockchain sell?

Blockchain sell blocks! That’s the revenue.

And what are a blockchain’s expenses? Security! Both issuance and transaction fees.

But here’s the dirty little secret: blockchains are hemorrhaging money. None are profitable. None are sustainable at current security levels.

But for the first time in crypto history, one chain is about to become profitable. Not profitable by a little. Profitable by a lot.

So which chain is about to become the first profitable blockchain and how?

Lucas digs into the data to show us.

- RSA

The Blockchain Business Model

The US dollar is valuable thanks to the dominance of American hegemony.

The Visa network is valuable because it acts as the rails of the financial system that connects billions of economic actors. The problem with these, as crypto-natives understand, is that they are not “secure” in a sociopolitical sense. These centralized institutions offer a “settlement” layer, but at the end of the day, the settlement layer is controlled by a centralized institution, be it a government or corporation.

Blockchains provide a neutral alternative. Blockchains are in the business of acting as a secure settlement layer for value while maintaining neutrality through decentralization. Blockchains achieve this by selling blocks, which can settle a finite number of transactions in each block, at certain intervals. For example:

- Bitcoin sells blocks every 10 minutes that can fit 1 MB worth of transactions.

- Ethereum sells blocks every 15 seconds that can fit 80 KB worth of transactions (which is equivalent to 4 MB every 10 mins).

Blocks process transactions, facilitating economic activity for users. This can include sending and receiving money, swapping tokens, taking out a loan, collecting digital items, and anything else of value that can be programmed.

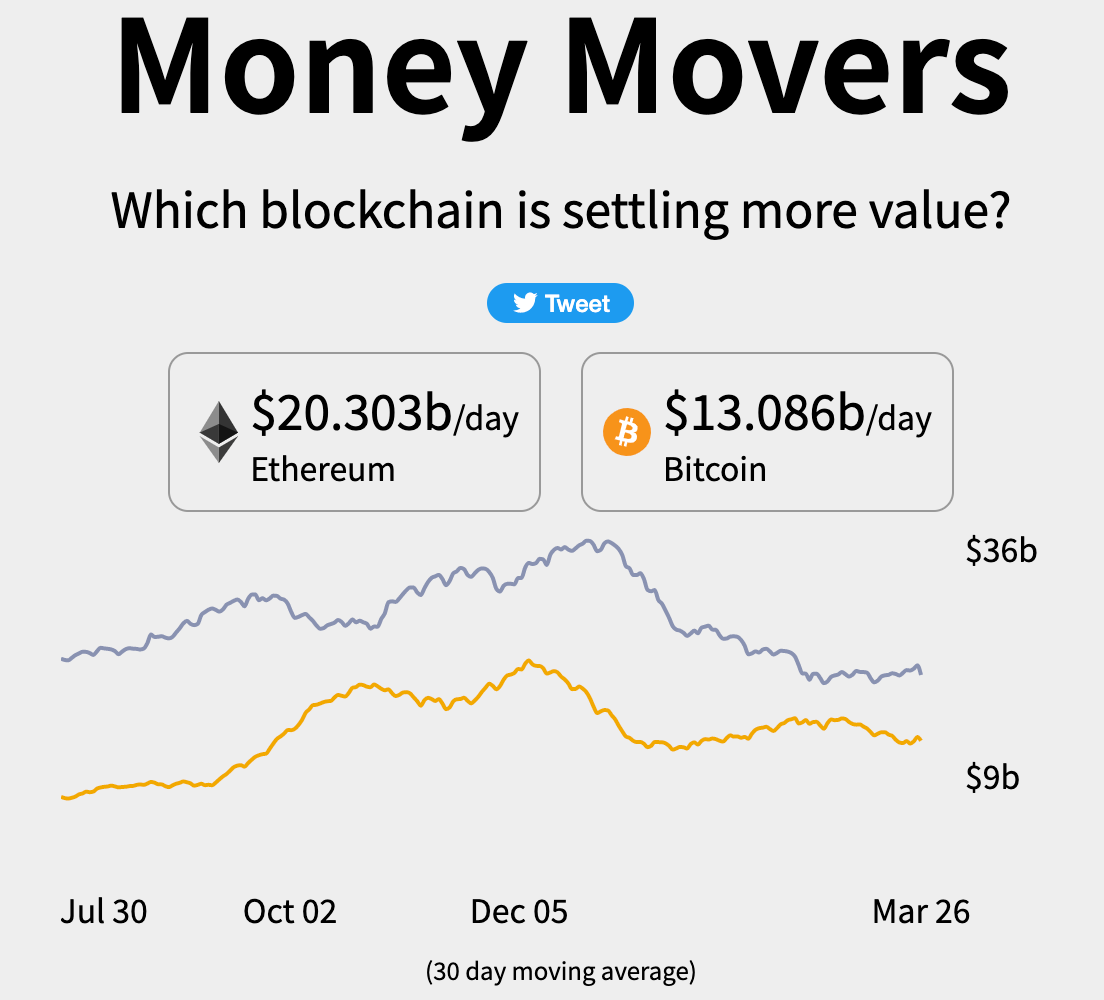

From a business lens, a blockchain’s product is blockspace. The goal is to drive value towards blockspace and collect revenue through it.

So what drives value towards blockspace? Security.

A blockchain with weak security means that transactions can be reversed or censored by a malicious/attacking entity. As such, unsecured networks are not viable settlements layers for value, especially when they’re processing on the scale of tens of billions of dollars every day.

The more secure a blockchain is, the higher confidence others will have in settling transactions, therefore driving demand for blockspace. Becoming a secure blockchain is a foundational priority if a blockchain wants to become a global settlement layer.

But in order to be secure, blockchains need to pay for it. To do this, blockchains incentivize a group of actors through token issuance to allocate resources – usually in the form of computer energy (PoW) or money (PoS) – to the network to make it secure and immune from attacks.

This makes security the primary cost for blockchains.

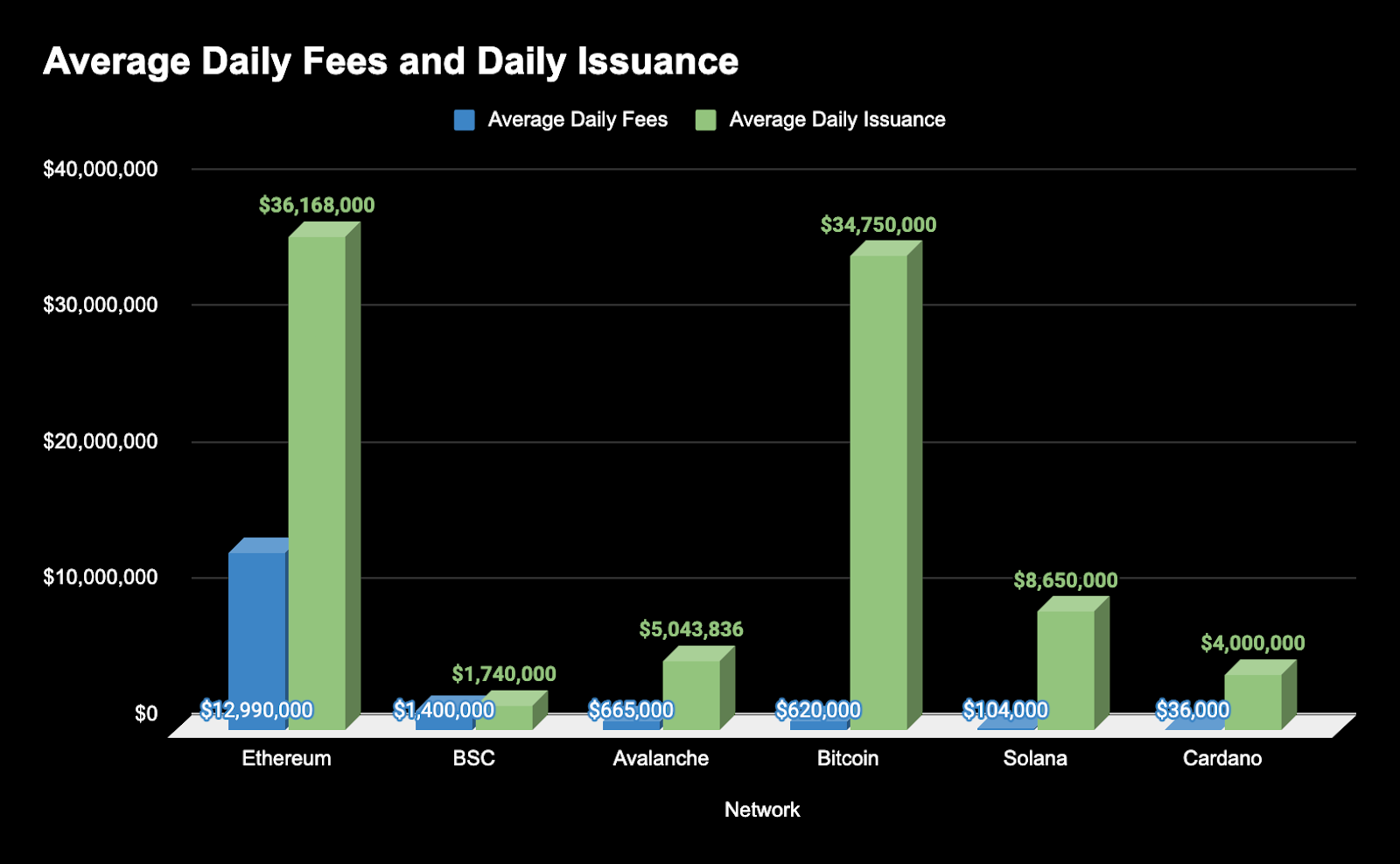

Here we can derive the core business model for a public blockchain. Blockchains earn revenue from transaction fees while their costs are what they pay for security via issuance. Simply put:

- Net Profit = Transaction fees (in $) - Issuance (in $)

As such, we can analyze “successful blockchain businesses” by looking at the amount they spend to secure the blockchain versus the amount of revenue they bring in via transaction fees. If a blockchain is paying more for security than the revenue they bring in, they’re running a deficit.

As a crypto investor, one thing you can do is find the most profitable blockchain business and invest in that. The best blockchain sells its blocks for the most value as people are willing to pay for it, meaning it has product-market-fit as a settlement layer.

People are willing to pay thousands of dollars for iPhone’s because they believe an iPhone is a superior product to alternatives. Last year iPhones accounted for under 40% of global smartphone revenue but over 75% of profits.

The same goes to blockchains. Entities are willing to pay higher transaction fees for a block so long as the block offers the best product (secure economic opportunities).

The question we should be asking—who’s the Apple of blockchain?

What Blockchains are profitable?

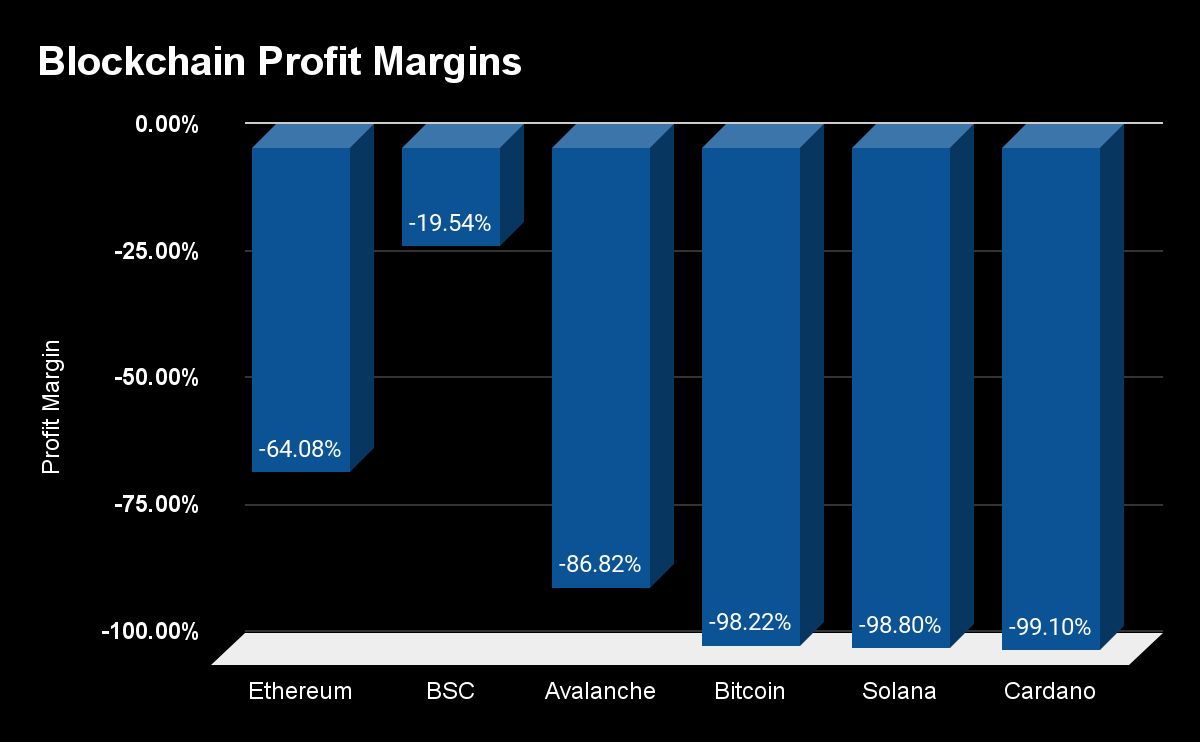

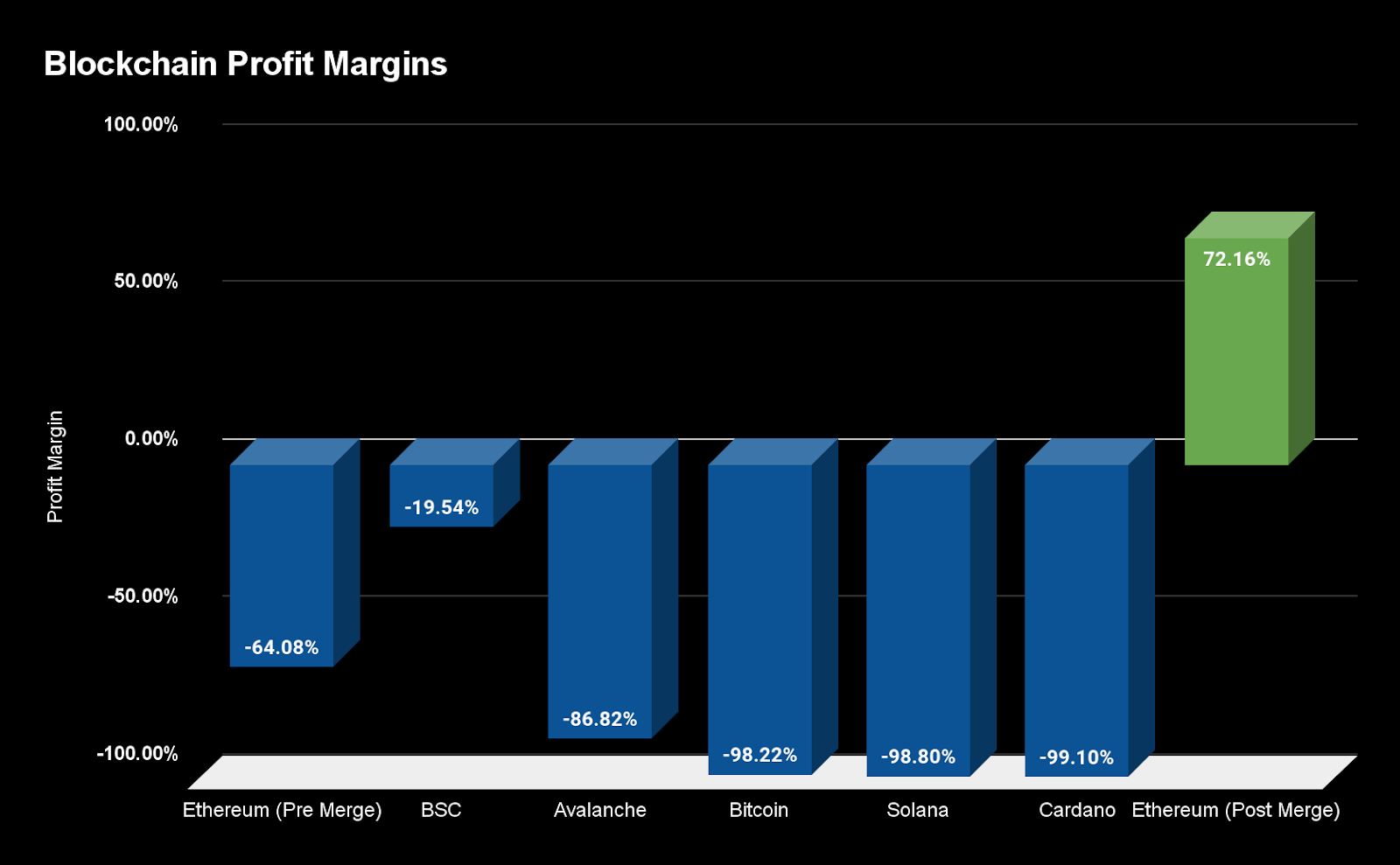

Here’s the truth: no blockchain is profitable today.

Every single major blockchain network is currently paying out more in issuance than its earning in transaction fees. All of them are operating unsustainable businesses.

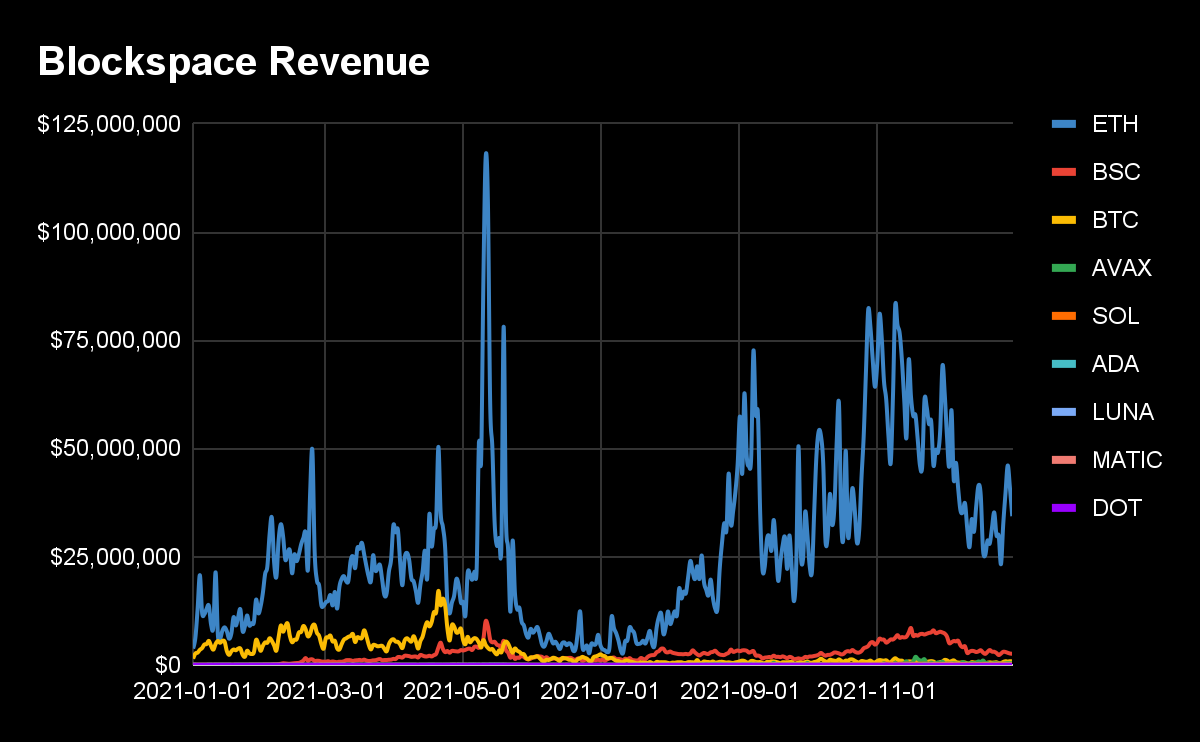

You can see this in the graph below.

Ethereum is bringing in nearly $13M in transaction fees every day, making it the most valuable blockchain by this measure. However, the flip side of that is that in order to produce those blocks, the network is distributing $36M in ETH per day in issuance to miners. As such, Ethereum is currently operating at a -64% loss.

The closest blockchain to reaching profitability is Binance Smart Chain (BSC) as it’s earning $1.4M per day in fees while only distributing $1.74M in issuance. On the surface, you might think this is amazing.

“Time to ape into BNB.”

But this is where this analysis gets nuanced. In fact, I think it’s almost justifiable to disclude chains like Binance from a profitability comparison of other Layer 1 blockchains.

Here’s why:

Recall that blockspace becomes valuable when there is certainty in transaction settlement. And that certainty costs money.

Binance Smart Chain is only secured by 21 validators. This is a closed, permissioned group of entities. In other words, the centralized BSC chain is profitable because it’s not footing its security bill. The 21 validators can easily collude to make anyone’s transactions irrelevant, rendering the blockchain significantly less valuable than a maximally decentralized and censorship-resistant network.

If BSC were truly paying for high security, its cost would certainly be higher. In comparison, Bitcoin spends $34.75M in daily issuance across 1M miners while Ethereum spends $36M over 276,000 validators securing the beacon chain (pre-merge!!).

It’s also worth highlighting that there have been reports of BSC being subjected to wash trading and spamming transactions, which may be disproportionately reporting higher revenues. (Of course there are rebuttals to these claims too—it’s difficult to sort the truth).

But the fact remains, outside of Ethereum and BSC (is it really a Layer 1?), virtually all major Layer 1s are operating at a loss of around 90% or worse.

Each L1 has built impressive, scalable infrastructural layers while dishing out billions of dollars in annual issuance to secure blocks—but how much demand for blocks is there?

Again, this is a tradeoff. It is substantially cheaper to transact on Avalanche or Solana than Bitcoin or Ethereum, but this transaction affordability comes at a cost. These chains don’t bring in enough revenue to outweigh their expenses.

How do you assess demand for a product? Revenue from product sales.

How do you assess demand for a blockchain? Revenue from blockspace sales.

Revenue is the real test of blockspace demand. Not the number of blocks sold.

What about Bitcoin?

Despite a decade of issuance reductions—three Bitcoin halvings—the Bitcoin network is still operating at a -98% loss. Even though the network plans to effectively rely on transaction fees by the end of the decade (after the 5th halving where 95%+ of all BTC will be mined), the network isn’t even close to operating at breakeven. This is worth keeping an eye on over the years as issuance goes to zero and the network only pays out its revenue for security.

The reality is clear: It’s hard to build a profitable blockchain business.

Even Ethereum, the blockchain with the most valuable blocks, can’t maintain profitability in its current state, while Bitcoin is even worse off—on par with alternative Layer 1s.

Why It’s Okay (For Now)

It’s extremely early for blockchains as a technology. Mass adoption hasn’t hit and the technology itself still has plenty of room for optimizations, so it makes sense that blockchains are not profitable right now—they’re still bootstrapping.

This is very similar to the internet companies of the 90s. Amazon was founded in 1994 but it didn’t reach profitability until 2001 when it reported a profit of $5 million from $1 billion of revenue.

It took 7 years for the now multi-trillion dollar corporation to barely become profitable.

For context, Bitcoin has been around for 12 years while Ethereum will be celebrating its 7th anniversary this July. It’s like the year 2000 for blockchains.

This begs the question…will a blockchain reach profitability within the same timeframe as Amazon?

The Path to Profitability

So what’s the path for blockchains to become profitable?

There are two main levers:

- Increase transaction revenue

- Reduce the security expense

1. Increase Transaction Revenue

The primary way for a blockchain to increase its transaction revenue is to increase its block utility; to increase the value of what can be done within each block. This can be done by building valuable applications on top of the network, increasing the surface area for what’s possible on the network and the utility that users can derive.

For example, on Ethereum, anyone in the world can swap $1M of ETH for $1M of DAI on Uniswap. This can be massively valuable for someone. They’ll gladly pay $10 in fees to have that transaction settled. In fact, maybe they’d be willing to pay as much as $1,000. Perhaps during times of stress and volatility, they may be willing to be $10,000 to have their transaction processed IMMEDIATELY. A rational actor is willing to pay slightly more for a block than the value they can extract from such a block.

Blocks become more valuable as the application layer becomes more vibrant because applications (think DeFi, NFTs) create economic opportunities inside blocks.

Blockspace revenue is almost directly correlated to the number of valuable applications on the network and the opportunity they hold.

This is more apparent when we look at Bitcoin. Bitcoin effectively has only one application—moving BTC. As such, it struggles to generate a significant amount of revenue, as seen with its -98% profit margins.

There’s only so much revenue you can generate with one use case.

With smart contract platforms, there’s an unbounded amount of applications that can be built, allowing blockspace revenue to scale more than a single application-specific blockchain.

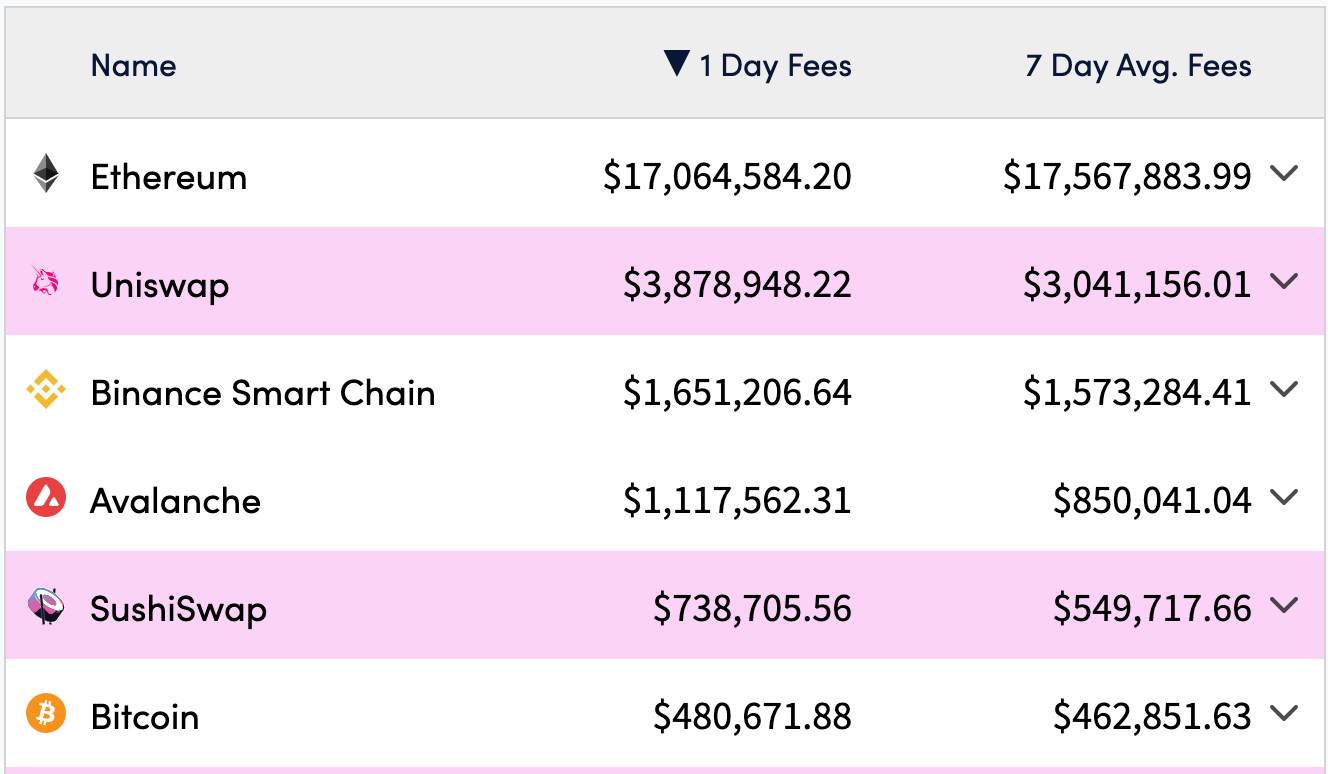

We can see this happening now as multiple smart contract platforms have surpassed Bitcoin in fee revenue, including a couple of Ethereum applications. The market is willing to pay more to swap tokens on Ethereum than they are to move Bitcoin.

The key point here is that blockspace revenue increases with the utility of that blockspace; with more optionality. Blockspace utility scales with more tokens, more applications—a more vibrant ecosystem.

All of this is contingent on the network being decentralized and secure.

As mentioned, blockspace isn’t that valuable if transactions can be reversed or censored and fewer applications will set up a long-term home in such a network.

2. Decrease Security Expenses

Increasing blockspace utility largely has to happen organically. You need developers, applications, and users. You can only incentivize inorganic usage for so long.

As such, the main pathway to sustainability for blockchains will be to reduce the issuance over time, lowering the network’s expenses.

The big tradeoff when you reduce issuance is that you’re spending less on security. Unless the price goes up, every time a network reduces its issuance, there’s less of an incentive for validators/miners to keep operating, and the network can become less secure.

This doesn’t happen every time, but it’s a risk that occurs if the network demand doesn’t reach equilibrium.

There’s a tradeoff between issuance and blocksize that blockchains must contend with. Many alt-L1 blockchains have opted for higher block sizes/more blocks in order to support more total transactions, at lower fees per transaction. Increasing the supply of blockspace of a chain reduces its price, and so far has been shown to be difficult to generate strong revenues for the chain.

Additionally, the tradeoff for increased throughput on the base layer tends to create a more centralized system, reducing the confidence behind the monetary premium of the chain’s native currency.

Blockchains must balance the supply of blockspace they produce with the issuance that this brings along with it. Blocks with faster blocktimes / larger blocks (basically more throughput), must issue more currency to achieve security at this scale.

If you want more scale, you must pay for more security.

You can see this effect in the issuance rates for smart contract chains:

An important note here: Ethereum is currently Proof of Work, which is a capital-intensive security mechanism. Ethereum will become Proof of Stake later this year, and the new issuance of ETH will be reduced by 90%, bringing yearly inflation to ~0.4%.

Let’s talk about that next…

⚠️ Quick Sidenote on Layer 2s

Layer 2s (L2s) have a significant role to play when it comes to increasing the net revenue of a blockchain.

On CryptoFees.info, you’ll notice that Ethereum L2’s are generating $50k-100k daily revenue in blockspace sales for themselves. This is revenue that is native to the L2, and collected by the operators of the L2 (which is likely to be democratized via native L2 tokens later).

Importantly, L2s produce their own demand for Ethereum L1 blockspace. L2s must consume L1 blockspace in order to “settle up” with the main blockchain. You can find Arbitrum, Polyon, Optimism on the ETH Burn Leaderboard on UltraSound.Money.

The critical part about L2s is that they don’t need to issue tokens to pay for security. They inherit their security from the L1 that they settle to. This makes deploying an L2 a trivial thing to do since much of the hard parts about blockchain sustainability is solved by tapping into the resources of the L1.

L2s operate like solar panels for economic activity. They offer low fees to users, and they bundle up user transactions into one package for bulk deployment to the L1. This is where L2 usage translates into L1 blockspace demand, and why a vibrant L2 ecosystem is bullish for L1 fees.

The bull case for Ethereum’s scalability roadmap is that it sells its blockspace not to users, but to other blockchains (Layer 2s). While individual users find Ethereum’s fees unbearable, L2 blockchains are insensitive to L1 gas prices, and will consume blockspace regardless as it onboards more and more users.

The First Profitable Blockchain is Coming

Ethereum is the first blockchain on a clear path to profitability with The Merge. Sometime later this year, the network will shift to Proof of Stake and reduce its issuance by 90%.

The interesting part of The Merge and Ethereum’s shift is that it’s not just a pure issuance reduction.

There’s a fundamental change in how that “security budget” is spent while tapping into higher security efficiency. Given the shift in the consensus algorithm and the improvements it holds, Proof of Stake makes Ethereum more secure while simultaneously allowing the network to reduce issuance.

With the network’s 90% issuance reduction, Ethereum would be distributing less than $4M per day in ETH to stakers. The important part to note is that ETH fees don’t change with The Merge—they stay the same.

This means that later this year, the network will be distributing $4M per day in issuance while generating $13M in revenue, generating a net profit of $9M and a profit margin of +72%.

Ethereum, the first profitable blockchain!

It’s worth highlighting that ETH also completes the triple point asset thesis with the Merge and its full transition to become an interest-bearing asset.

All of the transaction fees generated from the network will go to ETH holders via EIP 1559 (buybacks) and staking (dividends). As a result, ETH staking yields will shoot up to a double digit APY, driving more demand for the asset as investors race to soak up those yields, all while the network becomes more secure from the increased stake.

Ethereum is on course to become the first profitable blockchain.

And it will happen in months, not years. As we’ve written before…this is not priced in.

Will other chains follow Ethereum?

That depends very much on the quality of the product they sell.

How much will the market pay for their blocks?

Will they still buy them when token incentives dry up? Will they still buy when transaction fees increase?

How will Layer 1s compete for profitability against Layer 2’s that don’t have to pay billions per year on security through token issuance?

We’ll find out in the months and years to come.

In the long run, only the profitable survive.