The best product of the decade

Dear Bankless Nation,

Here’s a line from Chris Dixon on this week’s podcast that stuck with me.

“I think blockspace is the best product to be selling in the 2020s.”

Wow.

You ask a veteran internet investor who’s predicted every major era of the web what’s the best product of the decade and he says “blockspace”.

People sometimes forget what blockchains sell.

Apple sells iPhones.

Facebook sells eyeballs.

Blockchains sell blocks.

What’s special about blockchain blocks?

They’re the global banking ledger. They’re the property rights of the Metaverse. They’re the economies of digital nations. They’re a civilizational trust anchor.

If all that sounds too abstract to you let me show you concrete numbers.

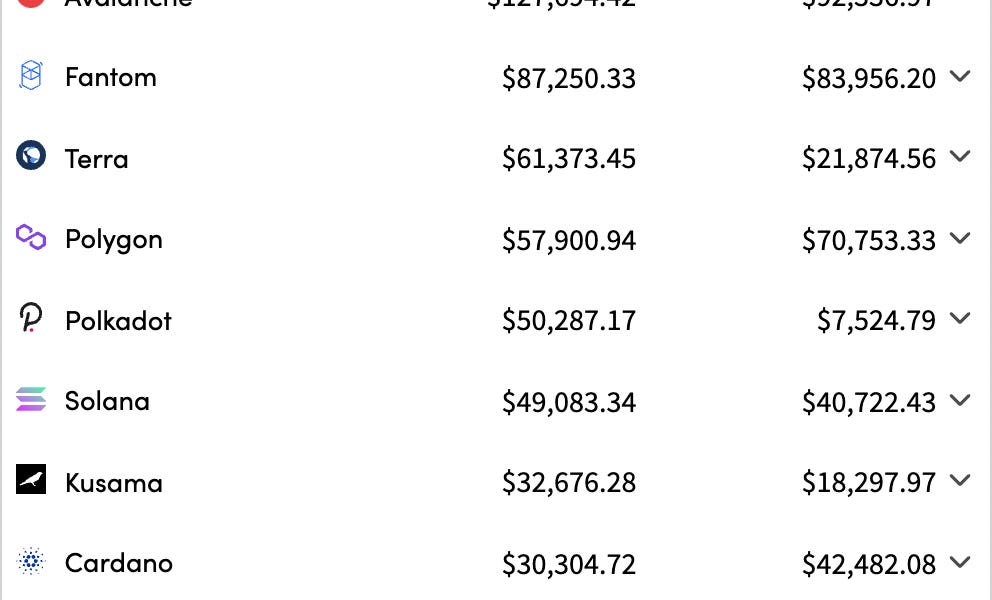

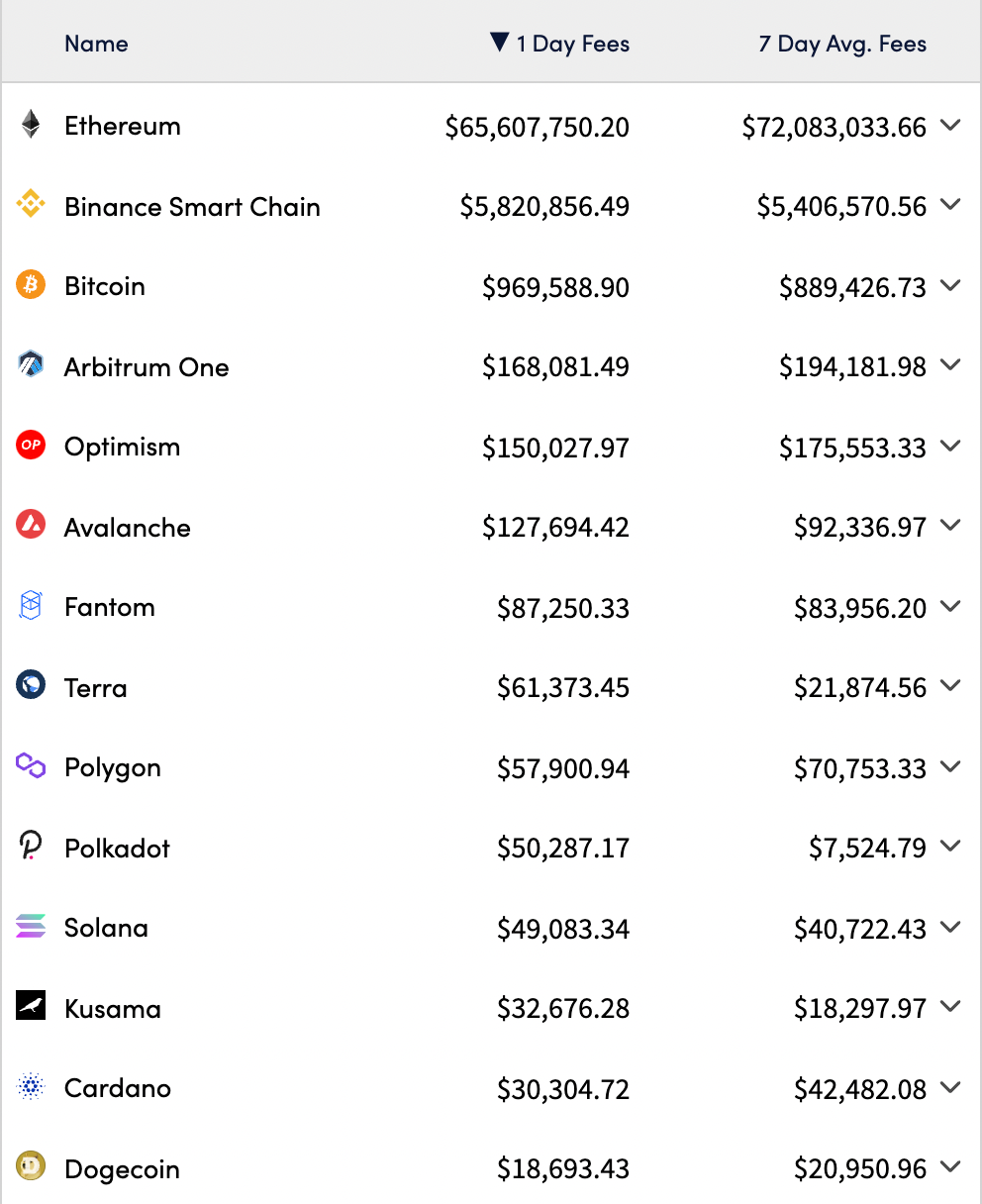

This is the block sales volume last week in crypto:

The number don’t lie. The market values blockspace.

And in the blockspace market, Ethereum has the most valuable blockspace by far.

It’s not even close.

Ethereum sold $504m worth of blocks last week—$26 billion annualized.

Ethereum did nearly 100x the block sales of Bitcoin.

Ethereum did nearly 1,770x the block sales of Solana.

Heck, two of Ethereum’s layer 2’s each did over 3x Solana last week.

For perspective, if the value of Layer 1 assets were based on block sales then ETH would be over 91% of the market cap for all Layer 1s. 🤯

The purpose of a blockchain is to make its blockspace more valuable.

Without valuable blockspace a chain is unsustainable.

A company whose costs exceed its product sales isn’t sustainable over the long run.

This is the same for chains.

A chain whose issuance exceeds its block sales isn’t sustainable over the long run.

So the purpose of a chain is to make its blockspace more valuable.

For perspective, Solana had $100m of issuance costs last week on $40k worth of sales. A net loss of 99.96%. This can’t last forever—in order to become sustainable Solana must increase block sales (📺 clip).

But how do you increase block sales while decreasing transaction fees?

The Type 3 Chain

Let’s get Sci-Fi for a minute.

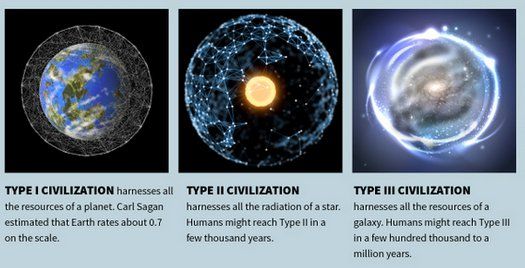

The Kardashev scale measures civilizations technology by energy use.

- In a Type I civilization can harness the energy of its home planet.

- In a Type II civilization can harness the energy of its home star.

- In a Type III civilization can harness the energy of its home galaxy.

Civilizations scale from planetary to stellar to galactic. Humanity is somewhere in the .7 range on the scale. Barely planetary.

Blockchain civilizations also progress in three stages—call this the Polynya scale.

- In a Type I chain individuals buy blockspace

- In a Type II chain applications buy blockspace

- In a Type III chain other chains buy blockspace

As modular blockchains scale the users of layer 1 change from individuals to applications to rollup chains. You might say Ethereum is in the 2.2 range—individuals still buy Ethereum blocks but applications are now the largest consumers.

But with $5 billion in rollups and a modular design Ethereum is in the early stages of becoming a fully-fledged Type III chain.

This is the path to scalability, but most chains will never get there.

Blockspace is the new oil.

Dixon is right.

Blockspace is the product of the decade.

But not all blockspace is equal even though it seems that way during a bull run.

When in doubt look for the blockchains that sell blocks.

Here’s next week…

- An incredible podcast with Coinbase CEO Brian Armstrong (early access here)

- Trent is giving you the key updates on the Ethereum Roadmap

- We’re bringing on the ENS guys to chat about the $ENS token.

Enjoy the weekend everyone.

- RSA

P.S. You can sign up for Dharma’s leading mobile app and you’ll get $50 in free ETH on Polygon. Use this link and go bankless.