The Bull Case for CC0 NFTs

Build the future of web3 at Graph Day June 2nd-5th. Get $50 off tickets with the link below.

Dear Bankless Nation,

NFTs have taken off in strange and crazy ways no one could anticipate.

Thanks to the immutability of a blockchain, artists and creators now have credible digital ownership over their works.

This wasn’t previously possible in the right-click save digital world.

But blockchains don’t necessarily solve the problem of meatspace ownership.

That’s why companies like Yuga Labs (CryptoPunks) are able to erect walled gardens around their brands in the real world.

Imagine dropping $200K on an NFT and being told no to developing real-world merchandise. 🤯

These restrictions have inspired an explosion of Creative Commons 0 NFTs like Mfers, Cryptoadz, and Nouns that demand more consumer freedom for holders.

Today, Donovan breaks down the intellectual property debate around CC0 NFTs and makes the bull case for it.

- RSA

🙏 Sponsor: Polygon Studios—Fostering culture across Gaming, NFTs, and the Metaverse✨

🎙️ STATE OF THE NATION

Listen to podcast episode | iTunes | Spotify | YouTube | RSS Feed

WRITER WEDNESDAY

Bankless Editor: Donovan Choy

Understanding CC0 in the Web3 World

If you spend time in the world of NFTs, you’ve likely come across talk around Creative Commons 0 (CC0), an intellectual property standard embraced by some prominent NFT projects like MFers, Nouns, Blitmaps or Cryptoadz.

What is CC0, how does it tie into Web3 and does it really matter?

To break down these big questions, it is useful to first situate it within the economic history of art and how blockchains are one more step in the long way of liberating artistic work.

The economic history of art

Historically, art was a plaything of the rich. The highest forms of art had always belonged in the private homes and museums of the wealthy.

With the advent of visual technologies like photography and television in the 20th century, the masses were given the opportunity to peer beyond the locked doors of the wealthy few from afar. This voyeuristic privilege was unleashed by the Internet, subjecting art into an anarchic digital commons where it would be instantly accessible by all.

This was great for consumers but it came at the expense of (some) creators. When art can be viewed and duplicated digitally at zero marginal cost, creators struggle to monetize their works. In economic jargon, art became a non-excludable and non-rivalrous public good.

Coming to the rescue of creators was copyright law, which developed as a response to protecting the ownership rights of creators. In practice however, copyright is a legal machine expertly marshaled (and crafted) by big corporations. While creators can legally sue others for copyright infringement, copyright law remained beyond the means of the average artist who lacked the money to do so.

Blockchain empowers artistic creators

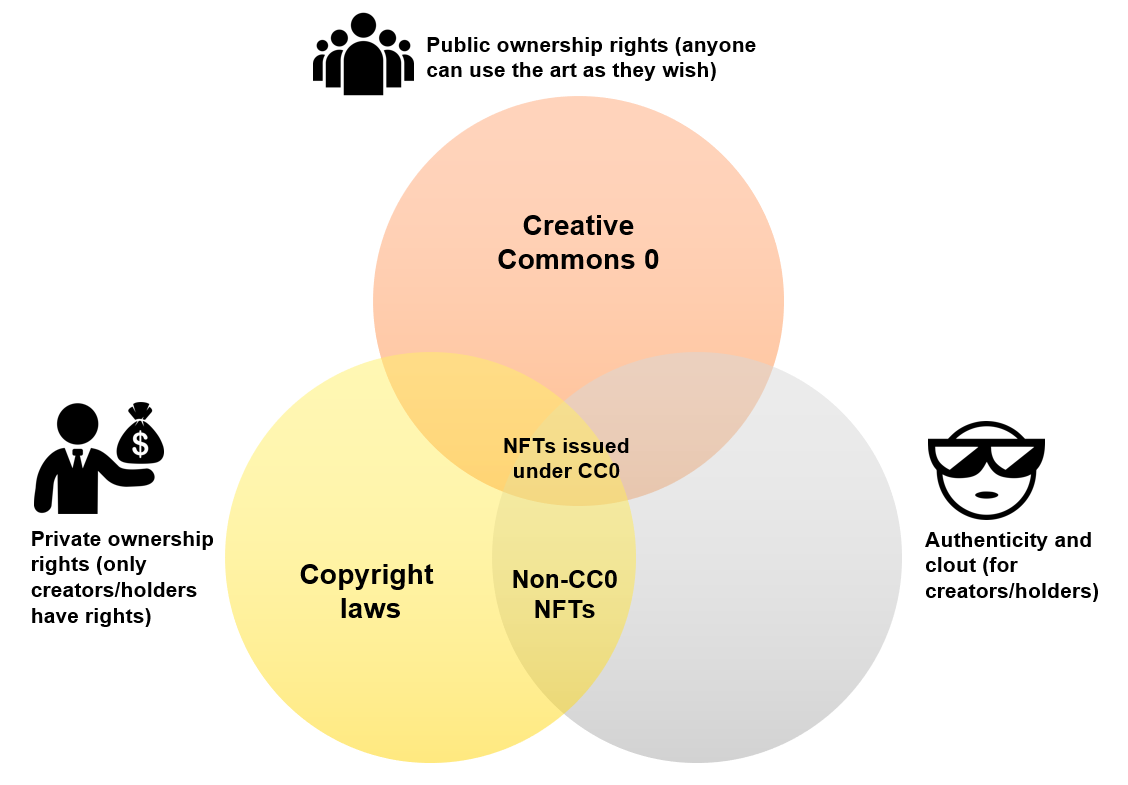

This is where blockchain technology provides some relief. Blockchains allow artists a costless way to assert their ownership over works online, while leaving it in the public domain for viewing.

It’s what the economist Chris Berg calls the new patronage economy. Everyone can enjoy viewing it, while availing to creators a viable monetization stream.

A public blockchain ledger offers what art markets lack: The ease of verifying authenticity. Or in the words of Brian Frye, it offers NFT holders the “clout” that comes with authenticity.

Clout is the ephemeral prestige and esteem that the “public” grants to select individuals or things, what social scientists call social capital. It is also what right-click-savers ironically generate more of when they boost awareness to a NFT project in their attempts to troll.

Blockchains, in effect, enable a kind of “de facto” property ownership over digital assets within the anarchy of the Internet, as opposed to the “de jure” means of copyright law. For intellectual property activists, the rise of NFTs on blockchains was simply a big “fuck you” to copyright.

Blockchains are a monumental step forward in liberating the ownership rights of creators.

But there’s one caveat: That immutable ownership only exists in the digital realm. Blockchain ownership cannot govern real world markets, because NFT companies can still restrict the rights of their holders to extend their digital ownership into a real world market, such as using their brand imagery on physical merchandise or events.

Larva and Yuga Labs

The debate around intellectual property rights with the CryptoPunks and BAYC projects fleshes this point out clearly.

CryptoPunks exist as an immutable, digital asset on the Ethereum blockchain. But its original creators Larva Labs restricts its holders from creating derivative products or using its branding, presumably in a bid to preserve its own branding for leverage onto a lucrative corporate deal. This stirred unhappiness with its holders, leading to some of them abandoning the project.

Yuga Labs, in contrast, grants BAYC holders greater commercial rights to create derivative products as they please. But they still come up short. For one, these rights are only restricted to BAYC holders (i.e., the filthy rich shopping for overpriced JPEGs). Moreover, ape holders are restricted to using BAYC’s brand name and logos, as Arizona Iced Tea learned when they tried to.

Of course, NFT companies are free to do as they wish as private entities in a free market. But morally speaking, these ownership restrictions are in tension with the philosophical ethos of Web3 and its ideals of trustless, decentralized ownership.

Just as our money should be free from the manipulation of central banks, art and culture should be a public good that is free from Big Media. The restrictions that chain the real-world utility of our on-chain tokens therefore still leaves much to be desired.

NFTs and CC0s

Here’s where CC0 enters the picture.

Copyright laws automatically grant copyright protection to artistic works whether artists want those rights or not. To easily bypass these laws, the American non-profit Creative Commons issued in 2009 the licensing standard CC0 which allows creators to declare their work as belonging in the public domain.

Creators who flag their work under the CC0 label give up ownership in a legal sense, making it free for anyone to creatively remix it for commercial purposes. It embodies “no rights reserved”, the opposite of the redundant “all rights reserved” disclaimer that plasters the page footer of every website.

Again, blockchains liberate creators and consumers by enabling credible property ownership over their works - but only in the metaverse. Slapping the CC0 license on the project is an additional guarantee by private companies to holders that ownership is intact even when they step off the Internet.

But more than that, it’s a radical promise to give up that last bit of control over real world markets to the masses and create a wholly decentralized brand.

CC0 has been referred to as open-source intellectual property - It transcends the intellectual property debates around Larva and Yuga Labs. To modify, use or profit from the intellectual property of a CC0 project in any way, you neither have to be a holder or ask anyone’s permission.

Treading around the amorphous intellectual property boundaries erected by private companies is a thing of the past, because a CC0 license applied to an on-chain NFT renders all those restrictions nil.

To CC0 or not to CC0

Should NFT creators adopt CC0?

The answer is straightforward if you wear a philosopher hat. CC0 aligns neatly with the libertarian ethos of Web3, providing the additional layer of real-world ownership for our NFTs that are out of the blockchain’s reach. In the name of free speech and information, CC0 thwarts the attempts of corporations to wall off a public good and reap private profits from it.

But going CC0 may not necessarily be limited to reasons of lofty morality - the reason may simply be that it works to the self-interest of creators.

The most successful NFT projects rely on curating a strong community. CC0 licenses enable this. It reduces the inertia for a project’s most loyal fans to get that ball rolling towards gaining a network effect.

By allowing the public to freely build and adapt their existing work, NFT creators can harness the commitment of their “100 True Fans” and propel their work into recognition.

Perhaps the best example of this is the 8 months old CC0 NFT project Nouns which has already inspired 130 derivative on-chain projects (and counting) and real world merchandise that all serves to buttress its brand value. Do all these derivative creators own a Nouns NFT? Probably not. But the correct answer is: No one cares.

To some extent, we also observe this with BAYC. Although not CC0-licensed, its greater intellectual property freedom has invited mainstream musicians (Timbaland) and major record labels (Universal) to build on top of the BAYC brand. In contrast, these derivative creations are notably absent from the CryptoPunks brand, despite its blue-chip status.

Yet, BAYC still comes up short. In the absence of CC0, business risks exist even for its wealthy holders. As one writer puts it:

With a non-CC0 project that creates no cap on individual commercialization, builders still run the risk of not being able to establish legally compliant partnerships with other companies or projects. And ultimately, builders that elect to create around a non-CC0 project run the risk of the project changing terms in the future.

NFT creators should also be cognizant of the fact that they are competing on Web3 infrastructure where composability and interoperability is the name of the game.

Should the metaverse live up to its hype, the art and characters that are copied the fastest and hardest will also be the ones that are impeded by the least barriers. CC0 projects then, by virtue of its permissionless nature, will have a significant edge over its non-CC0 counterparts, whose legal barriers will restrict their works from being fully interoperable in a multichain future.

CC0 acts as a multiplier effect, but only if creators let it.

Practical considerations of CC0

Considerations of CC0 adoption may also just depend on the nature of the NFT project and what creators goals are. Simon de la Rouviere argues that CC0 projects will be more appropriate for base layer NFTs with low fidelity resolution because it allows a wider scope of interpretation for third-party builders.

That makes projects with pixelated art such as Cryptoadz or Nouns, or barebones trait-only projects like Loots perfect for CC0 licensing. For that same reason, CC0 is probably least suitable for projects that want control over detail, presumably to tell a particular story over a long period of time.

Will CC0 mean utter chaos?

Skepticism of CC0 tends to stem from a fear that without some level of centralized creator control, the world would be deprived of a rich, coherent universe like that of a Star Wars or Harry Potter universe (if this is true by the way, enjoy what’s left of Batman and Superman as they will enter the public domain by 2033).

There’s no doubt that CC0 projects are more vulnerable to malicious actors seeking to derail or disrupt its existing branding.

But there are three reasons why I’m convinced the harm on art will be minuscule, relative to the benefits.

- Firstly, art always triumphs where the many are creating, as opposed to the few. Comic book universes perfectly encapsulate this phenomenon. Marvel and DC own the fundamental intellectual property to their characters, but they regularly cede creative control and permission to various third-party writers and filmmakers. It’s why superheroes and villains have multiple characterizations and depictions across different timelines. Thanks to this, audiences are constantly exposed to a breath of fresh reimaginations across pop culture.

- Second, CC0-skeptics underestimates that even the richest film or video game universes are not designed by one creative mind in a vacuum. The most epic universes are a patchwork of pastiches, constantly borrowing from previous artists. Star Wars is amazing, but George Lucas lifted heavily from 20th century Japanese filmmakers like Akira Kurosowa, as he himself acknowledged. Dwarves and elves in modern pop culture are often attributed to the artistic genius of J. R. R. Tolkien, but Tolkien adapted them heavily from Norse mythology. Even some of Marvel’s most popular superheroes, like Thor and Loki, were created based on ideas in the public domain.

- Finally, and perhaps most importantly, blockchain technology is upon us. Remember that without blockchains, art can be rapidly reproduced while creators struggle to establish ownership. But a public decentralized ledger brings some semblance of order into the fold by allowing the public to easily discern from the amateur trolls and the grand visionaries in an organized, neutral fashion, without having to rely on a politicized tool like copyright law.

Action steps

Author Bio

Donovan Choy is a writer based out of Singapore, and co-author of Liberalism Unveiled.

Subscribe to Bankless. $22 per mo. Includes archive access, Inner Circle & Badge.

🙏Thanks to our sponsor

POLYGON STUDIOS

Polygon Studios is on a mission to help build digital culture, play-to-earn gaming, NFTs, and the Metaverse ecosystem on Polygon. Some of the key projects supported by Polygon Studios include The Sandbox, Skyweaver, Big Time, Crypto Unicorns, and Decentraland—among others. Polygon Studios also helps fundraising & onboarding. Check it out here.

Stay updated on the latest amazing gaming, NFT, and metaverse projects:

👉 Join the Polygon Studios Discord

👉 Follow Polygon Studios on Twitter

Want to get featured on Bankless? Send your article to submissions@banklesshq.com

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.