The Best Yields on USD

Dear Bankless Nation,

I want to show you something sad.

This is screenshot from from my WellsFargo account. I earned 5 cents in interest last month…a WellsFargo’s Way2Save® savings account pays 0.01% APY.

What a joke.

The traditional money system literally forces people to put their savings into their stock and real-estate ponzi games. They give us no other place to store wealth.

They’ve killed the savings account.

But now we have an alternative…a bankless alternative.

There’s no shortage of opportunities to earn anywhere between 20%—50% APY on your dollars in DeFi. Yes, you have to be savvy. Yes, there’s risk. But at least in this system, you have the freedom to choose.

These are the best yields on USD we’ve found.

- RSA

TOKEN THURSDAY

Bankless Writer: Lucas Campbell, Editor & Analyst for Bankless

The Best Yields on USD

Let me show you something.

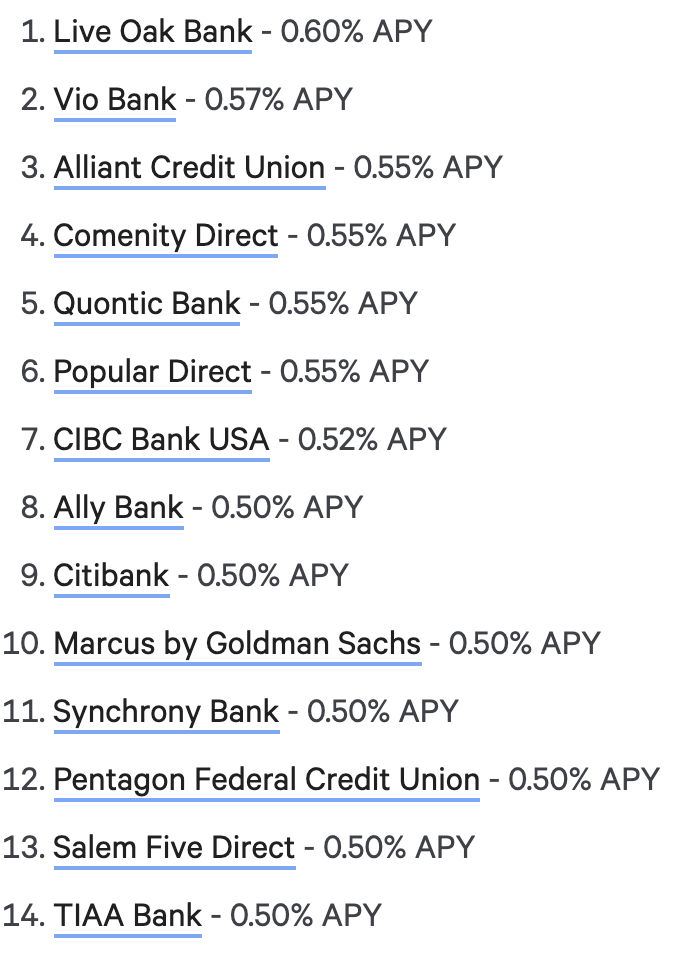

These are the best “high yield” savings accounts in the U.S—like the best of the best according to Nerd Wallet. The fact that they even call these high yield in the first place is laughable, but that’s the reality we live in.

Just to give you an idea on the ROI, 0.5% on $10,000 equates to $50…per year. Oof. But you know what’s worse?

Most of these accounts come from smaller banks competing for new deposits—they’re doing everything they can to attract new money from the big institutions that dominate the U.S. banking system.

The WellsFargos and Bank of Americas? They don’t even try. WellsFargo’s “Way2Save” Savings Account offers 0.01% APY. Like what in the actual f**k is that. Excuse my language but calling it pathetic would be an understatement.

Ok…so traditional savings accounts aren’t offering anything even remotely substantial, so where can people look elsewhere for low-risk returns?

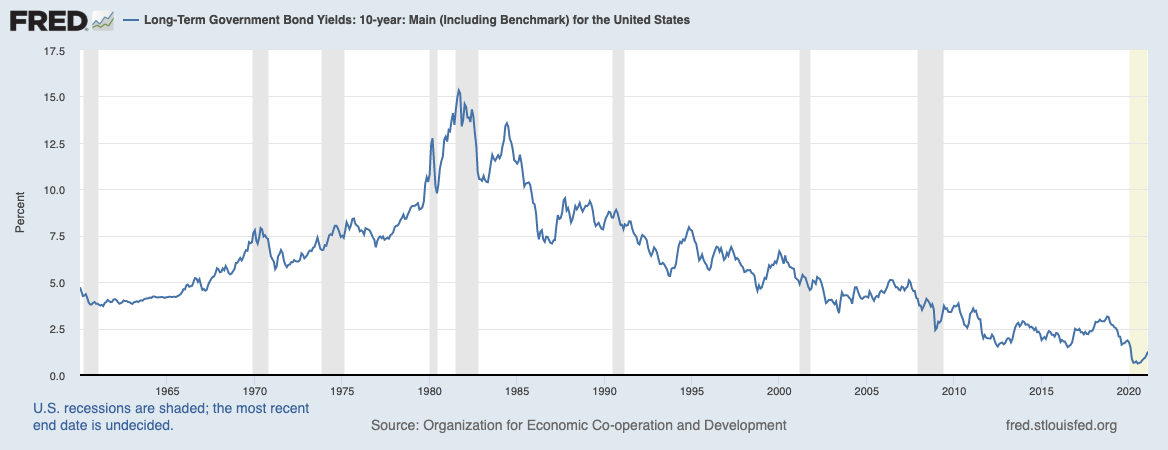

Generally, they’ll turn to the bond market. There’s nothing safer than lending your money to the U.S. government after all. It’s even often referred to as the risk free rate in traditional finance because there’s virtually zero risk associated with it (I’m going to bite my tongue on that statement).

And what do we find? Treasury yields are hitting all time lows. The 10 Year T-Bill is currently offering 1.26% per year in return for giving the government your hard-earned money for a decade. It’s better than what the banks are offering but still…yikes.

With the above in mind, it’s becoming nearly impossible for the average individual to get anything meaningful on their money in a low-risk environment. But it gets even worse.

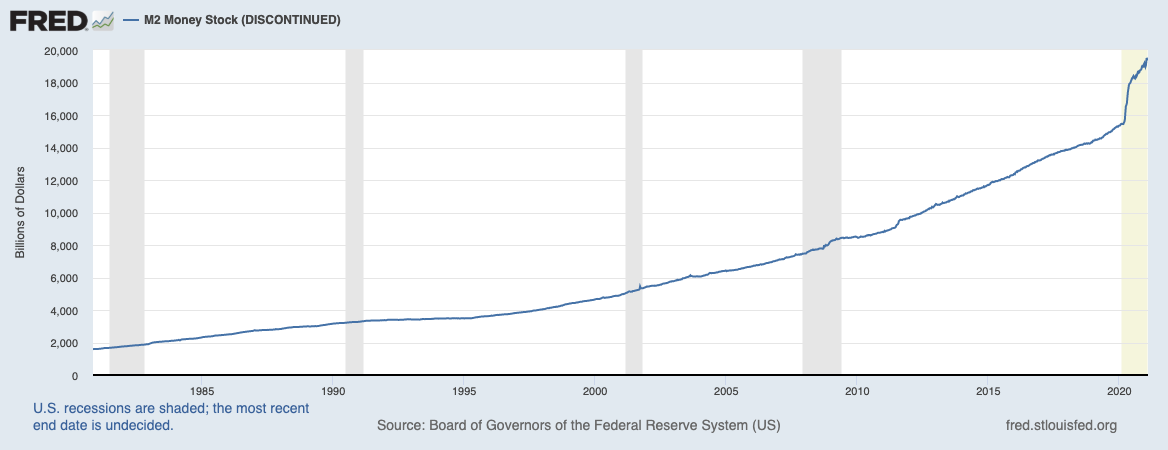

While rates across the board hit all time lows, inflation is hitting all time highs. In response to the global pandemic, the Fed expanded the money supply by roughly ~24% in the past year alone—an unprecedented level of issuance in that time span (for arguably good reasons though). This is a recipe for disaster.

With yields at all time lows and inflation at all time highs, how the hell are people supposed to preserve their buying power in this environment? You can invest in real estate or the stock market, but the days of earning meaningful, low-risk yields are over.

There’s little chance that the average American individual will be able to preserve their purchasing power these days. They're set up to have their wealth decimated.

So what’s left?

While traditional finance leaves investors dry, DeFi is offering the best yields in the world on USD. Full stop.

We’re not talking 2% or 3% per year either, which would already be substantially higher than anything else offered today—we’re talking orders of magnitudes higher returns. These are life changing returns for anyone.

Now, I’ll admit that these require some savviness from investors, but that’s the opportunity at hand. No, this is not for everyone. This is the frontier of finance. It’s risky and you can lose what you put in. But if you want to preserve your wealth in this cut-throat environment, you’re going to have to get creative.

Fortunately in DeFi, virtually every opportunity is offering over 5% APY on USD—even with the safest DeFi protocols today. So we took some time to research where anyone can put their money to work, and not only preserve their purchasing power, but even grow it. Here’s what we found.

✍️ Author’s Note: This is not a fully comprehensive list and yields are constantly changing! There’s obviously more opportunities out there as you go down the rabbit hole that can offer higher ROIs than the ones mentioned here. We tried to take a balanced approach between high returns and risks when identifying these protocols.

Alternative Saving Accounts for New Crypto Investors

Going down the DeFi rabbit hole isn’t for everyone. As such, these are the more basic options available for those newer to crypto.

Crypto Banks

Crypto banks are the bridge between traditional finance and crypto. And just like banks back in the day, they’re actually offering their clients with attractive yields on dollars today. Some of the Bankless favorites include Gemini and BlockFi which both offer competitive rates that’ll dwarf anything offered with your normal bank account.

DeFi Protocols

Aave and Compound are DeFi favorites among the community. Both interest rate protocols have been battle-tested over the years and continue to offer high-yielding interest rates across a range of crypto dollar flavors. Generally, Dai deposit rates are the highest, however, these are always changing. So keep an eye out!

🧠 Here’s a great resource for those searching for the best yields from major DeFi protocols. Updated hourly!

The Best Yields on USD in DeFi

Curve 🥇

Estimated Return: 20 - 50% APY

It’s no surprise that Curve ended up high-up on the leaderboard. The protocol’s hyper-efficient stablecoin pools are the perfect candidates for high-yielding returns on your dollars. The one that comes to mind is Curve’s sUSD pool.

The sUSD pool not only earns a ~2% APY on trading fees, already beating out the banks, but it’s also subsidized significantly with CRV rewards of roughly ~17% per year along with an additional ~4% in SNX. In total, sUSD LPs can expect to earn a base of ~23% APY with rates going upwards of 48% if you vest your CRV.

Other notable stablecoin pools on Curve include the Y pool which features a basket of Yearn’s interest-bearing yToken stablecoins or Aave’s pool which features a similar basket of aTokens. All in all, Curve features a range of pools that are attractive for any investor looking for the best yields on their dollars.

Bankless Resources on Curve:

PoolTogether 🥈

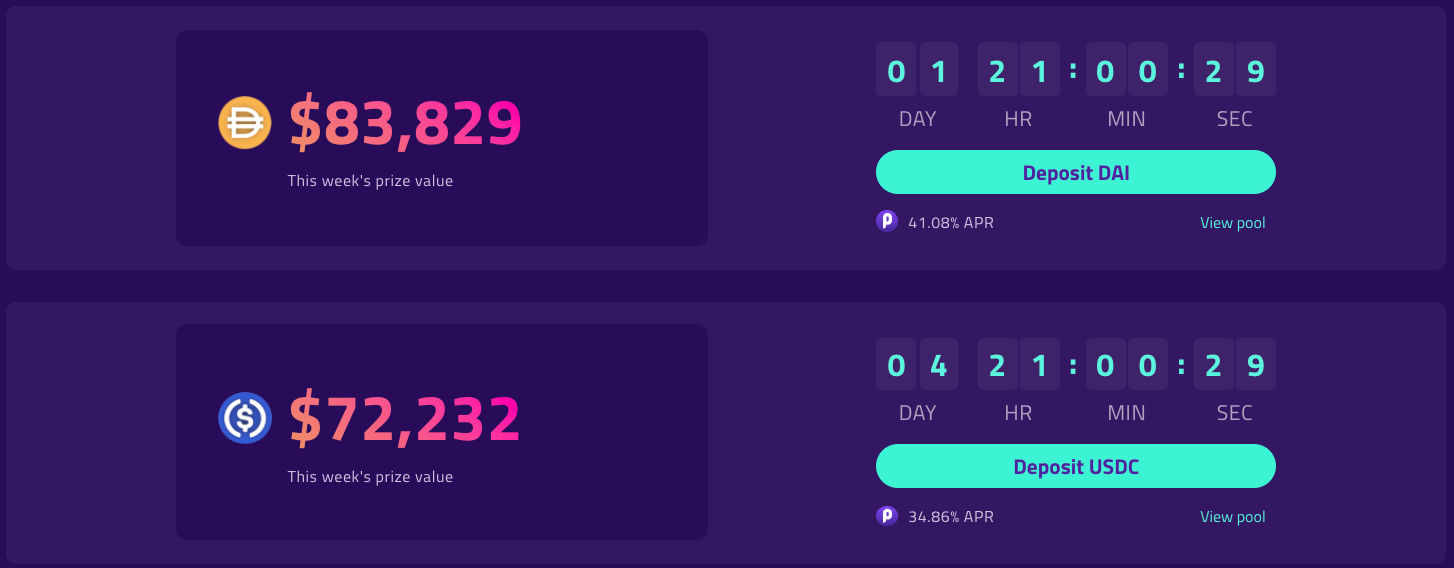

Estimated Return: 34 - 42% APY + Chance to earn weekly prize!

With the launch of PoolTogether’s native governance token earlier this year, the no-loss lottery received a substantial steroid in the protocol’s growth and underlying yields. As a result, weekly prizes have skyrocketed on the back of the resurgence in liquidity (along with better interest rates on Compound).

By depositing USDC or DAI into PoolTogether, you’re not only getting the chance to win the weekly prize, which is as high as $80K per week in DAI or $64K in USDC, but also earning a nice subsidy in POOL tokens.

For the DAI pool, base returns in POOL are upwards of 42% while USDC pools are around 35%. Even if you never win the no-loss lottery, the returns on these pools are significant in POOL, and you can always sell on a recurring basis to compound your earnings. That said, winning the weekly prize pool would just be a cherry-on-top!

Bankless Resources on PoolTogether:

KeeperDAO 🥉

Estimated Return: 25% - 30% APY

KeeperDAO is a protocol focused on executing liquidation, arbitrage, and rebalances in DeFi. The protocol’s profit-seeking bots deploy capital into specific strategies in order to earn an immediate profit, returning it back into the protocol’s underlying LPs.

As such, there’s a sizable opportunity for those holding onto crypto dollars to earn a yield by leveraging this protocol.

KeeperDAO currently offers two stablecoin pools, USDC and DAI, which both boasts substantial yields for depositors. Importantly, a significant amount of the yield is subsidized in KeeperDAO’s native token, ROOK, in order to provide LPs with more attractive rates. For reference, currently yields on DAI and USDC are 30% and 26%, respectively.

While we’re mainly focused on USD, it’s worth noting that KeeperDAO also offers similar yields for ETH and BTC as well!

Bankless Resources on KeeperDAO:

Yearn 🏅

Estimated Return: 29% - 40% APY

When we originally wrote the sister article back in September, Yearn was the dominant force as the primary yield aggregator on the market. While times have changed, and new protocols began to compete for this growing market, Yearn continues to stay relevant.

The two primary Yearn Vaults to look into are the DAI and USDC pools, which offer rates of 13.5% and 16.5% APY, respectively. But the protocol also offers a longtail of more flavorful alternatives for more risk-seeking investors.

You have options like the MUSD, crvGUSD, or the crvSUSD Vaults which offer higher rates of 29% - 35% APY. What makes Yearn Vaults so attractive is that yields are automatically reinvested and compounded on a regular basis, allowing depositors to maximize their yields while minimizing the overhead of managing their positions.

These are just the tip of the iceberg for Yearn Vaults too. For those interested, I implore you to check out all the Vaults and see what looks good for your risk profile.

It’s also worth noting that Yearn integrated Zapper.fi’s “zaps” which abstracts the process of getting vault-specific assets and instead, allows you to deposit directly into the vault with whatever capital you have in your wallet—like ETH or BTC!

Bankless Resources on Yearn:

Honorable Mentions 🏆

As you can imagine, the DeFi rabbit hole goes deep. You can always find a protocol that’s offering something worth looking into. Here are few that we found:

BarnBridge Stable Pool (Dai, USDC, sUSD)

Expected Return: ~25% APY

mStable’s mUSD/3POOL Curve Pool (mUSD, DAI, USDC, USDT)

Expected Return: ~17% APY

Rari Capital Stable Pool (DAI, mUSD, USDC, USDT)

Expected Return: ~14% APY

Conclusion

While yields in traditional finance are hitting all time lows, there’s no shortage in DeFi. The best part about this?

Anyone, anywhere has the ability to participate. It’s not restricted to just U.S. citizens. You don’t need anything more than an internet connection, some capital to put to work, and the willingness to learn and explore the frontier.

That’s why this is so powerful. You can not only preserve your dollar-denominated buying power, but you can grow it with these opportunities. You can actually outpace inflation.

That in mind, it’s becoming harder and harder to justify keeping USD in a bank account other than paying for your monthly expenses.

Why would you anyways? Today’s crypto banks are offering magnitudes higher returns than what normal banks can offer. Your money is right there, and only a wire transfer away. Better yet, both Gemini and BlockFi are about to offer credit cards for account holders. I wouldn’t be surprised if most of us end up replacing our Wells Fargo accounts in the next few years—it’s becoming a significantly better product.

Now while the yields in DeFi are impressive, there’s naturally risks associated with any of the above strategies—even the crypto banks. The world of crypto is young, it’s risky, it’s not for everyone.

But for those willing to explore this new froniter, there’s no shortage of opportunity for you.

Huge shoutout to William Peaster for the help with this article. Make sure to subscribe to Metaversal to get the latest news in the world of NFTs :)

Action steps

- Leverage DeFi to get the best yield on your dollars

- Read “How to get the best yield on crypto money”