How to get the best yields on your crypto money

On Thursday, we’re hosting an AMA with Matt Finestone of Loopring! Full subscribers can join the Discord to have priority for questions. Become a full subscriber to join the AMA!

Dear Bankless Nation,

The food & meme protocols had their moment. But it’s time to sober up.

Let’s step away from the 1,000%+ annual returns and get back to reality. Fortunately, there’s still plenty of yields to be earned. Passive returns in DeFi still dwarf traditional finance.

And best of all…we can earn them all with exposure in our primary forms of crypto money—ETH, BTC, and USD.

We can earn yields from the more battle-tested protocols. Protocols that have been audited. And protocols with known founders that have their skin in the game. (That doesn’t mean these things are risk-free—still highly risky!)

So let’s sober up. And let’s learn how to get the best yields on crypto money with sustainable risk/return ratios.

- RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

We just released episode 13 of SOTN—POSITIONING

📺 Watch State of the Nation #13: — SOBERING with Anthony Sassano

SUSHISWAP FOUNDER DEFECTS, THE NEW ETH2 KILLERS ARE HERE & YIELD FARMING FOR GITCOIN GRANTS

We’re now live streaming State of the Nation—join us at 10am EST every Tuesday!

TACTICS TUESDAY

Tactic #54: How to get the best yields on your crypto money

Bankless Writer: Lucas Campbell, Analyst for Bankless & Growth at DeFi Rate

While DeFi meme & food protocols have dominated the landscape over the past few weeks, offering four-digit APYs, it’s important to take a step back and identify some of the “lower-risk”, yet high-yielding opportunities available in decentralized finance.

This tactic will explore some of the best yields on crypto money available in DeFi — mainly for those holding onto BTC, ETH, and USD.

- Goal: Access the best yields on crypto money with minimal work

- Skill: Beginner / Intermediate

- Effort: A few minutes

- ROI: 10 - 80% APY on BTC, ETH, and/or USD

How to get the best yields on crypto money

The past few weeks in DeFi have been an absolute party.

Everyone’s been earning crazy returns with all the new food protocols, which have usually followed a similar model established by Yam Finance back in early August.

But now we’re sobering up following SushiSwap’s “rug pull” from Anon Founder, Nomi Chef.

We’re starting to learn that sometimes yolo’ing your money into a new, unaudited smart contract that’s only a week old isn’t necessarily the best move. Or that trusting some random anonymous Twitter account to not dump millions of tokens with no vesting schedule isn’t a bright idea either.

Given that traditional financial returns aim for 8-12% per year, beating that standard in DeFi via passive income opportunities leveraging battle-tested protocols is actually pretty easy. Equally as important, you can maintain plenty of upside with exposure on the primary forms of crypto money — those being BTC, ETH, and USD (in the form of crypto dollars).

And you don’t even need to do much work anymore. Or know much about yield farming either. With the emergence of yEarn, we’re fortunate enough to have automated money robots to do all the yield optimization, farming, and recycling for us.

Yes, there are a few other strategies out there that may be able to squeeze out a few extra basis points, but in terms of the amount of time you have to spend in DeFi to find them, it’s getting harder & harder to beat the robots.

Towards the end, we’ll also show you how to easily get into these all of these opportunities with a single transaction using Zapper.fi!

Here are the best opportunities on the market today for earning a passive income on your crypto money.

Note that the yields are constantly changing based on market conditions!

1) Earn with ETH

Here are the top ways to earn yield with ETH you’re already holding…

TOP PICK 🥇

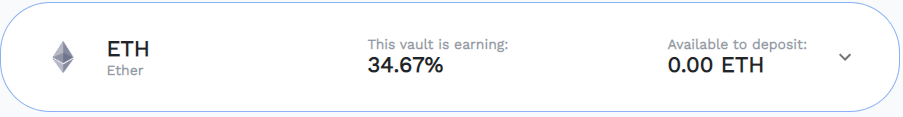

yETH Vault from yEarn

ROI estimate: 34% APY

Method: Deposit ETH in yEarn vault (see tactic #52) or use Zapper.fi

With last week’s release of the yETH vault, it became one of the best ways for earning a passive income on your idle ETH.

In less than two days, yEarn’s newest vault attracted over 385,000 ETH into it as the expected ROI reached as high as 100% per annum. While the yETH vault is new, yEarn’s track record so far has been outstanding as the protocol is quickly becoming the gold standard for yield optimization.

The yETH money robot achieves this return by taking the ETH held in the vault and opening a Maker CDP to mint DAI at a 200% collateralization ratio. It then takes the DAI and deposits it into Curve Finance’s Y Pool in order to farm CRV plus some trading fees. The last step here is selling all of those rewards back into ETH in order to compound your returns. With the Curve Y Pool offering 3.13% in trading fees plus a bonus 41% in CRV tokens, the yETH Vault currently offers the highest return on ETH that we’ve seen to date, sitting at roughly 34% APY as of writing.

⚠️While the yETH vault is currently closed for deposits, you should keep an eye out for the re-opening in the coming future.

HONORABLE MENTIONS 🏅

sETH | WETH pool from Balancer

ROI estimate: 17% APY

Method: Deposit equal parts sETH & WETH in Balancer or use Zapper.fi

Balancer’s sETH | WETH pool offers an attractive alternative for farmers while the yETH pool is closed. Despite Balancer governance reducing the rewards for same-asset pairs, the sETH | WETH pool still offers a high-yielding 17.57% ROI in BAL rewards + trading fees while maintaining full exposure to ETH.

ETH lending on BlockFi

ROI estimate: 4% APY

Method: Open a BlockFi account

Centralized crypto bank, BlockFi, is another good alternative for the less-tech savvy users looking for passive income on their ETH. You can simply open up a BlockFi account in the same way you sign up for Coinbase, make a deposit directly from your normal bank account, and your ETH will automatically earn 4% per year with interest accruing every month. While it’s not bankless, it’s worth mentioning for those not looking to get deep in the weeds in DeFi! (⚠️Careful..you could lose your privacy)

2) Earn with BTC

Here are the top ways to earn yield with BTC you’re already holding…

TOP PICK 🥇

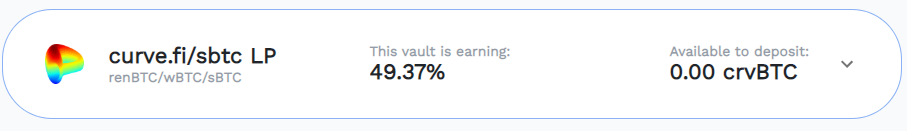

sBTC Vault from yEarn

ROI estimate: 49% APY

Method: Deposit crvBTC into yEarn Vault or use Zapper.fi

yEarn’s sBTC Vault is one of the lesser-known vaults, however, still offers an attractive reward for users while maintaining exposure to the leading crypto asset by market cap. Similar to the above, the sBTC Vault leverages Curve Finance to offer a nice yield on your otherwise idle BTC—but it has to be on Ethereum.

Despite the fact that the Synthetix & Ren incentives ended a few weeks ago, the sBTC Vault offers nearly 50% annualized return on your bitcoin.

Like the yETH vault, the reason the sBTC Vault is so attractive is because yEarn’s money robots automatically sell the Curve rewards back into BTC in order to compound your earnings, meaning you never lose exposure to BTC!

HONORABLE MENTIONS 🏅

RenBTC | WBTC Pool on Curve

ROI estimate: 54% - 112%

Method: Deposit renBTC or WBTC into Curve or use Zapper.fi

The Curve renBTC & wBTC pool technically offers a higher APY than yEarn’s sBTC pool right now. The only problem with this strategy is the constant need to claim & recycle your CRV rewards back into the BTC pool. If you’re bullish on CRV and want to build up a position for Curve’s native governance token, this strategy is definitely a viable option.

uUSD Pool on UMA

ROI estimate: ~204% APY

Method: Follow UMA’s guide here

UMA’s uUSD is the newest yield farming play on the block.

Users collateralize renBTC (thus having exposure to BTC) to mint uUSD and deposit the protocol’s yield dollar into a Balancer uUSD | USDC pool. The interesting piece to this yield farming play is that it’s not only incentivized by UMA rewards (10,000 UMA per week) but also REN (25,000 REN per week) as well as native BAL rewards. With this yield farming opportunity being new and offering multi-asset rewards, exact ROIs are tough to calculate and it requires a fair amount of knowledge to access this yield farm. But, early calculations are estimating a ~200% APY with the caveat being that the synthetic expires on October 1st!

BTC lending on BlockFi

ROI estimate: 6% APY

Method: Open a BlockFi account

Similar to ETH, BlockFI offers a rather attractive interest rate for BTC deposits. Given that users can access a centralized custodian to store their assets, it’s worth mentioning due to the ease-of-use for those not willing to explore the wild west of crypto finance.

3) Earn with USD

Here are the top ways to earn yield with USD you’re already holding…

TOP PICK 🥇

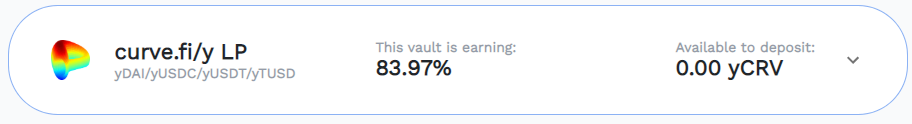

yCRV Vault on yEarn

ROI estimate: 84% APY

Method: Deposit yCRV into yEarn Vault (see Tactic #52) or use Zapper.fi

With all the volatility with crypto assets, it may be wise to have a crypto dollar allocation in your portfolio. This can be a rather viable strategy especially when there are extremely high-yielding opportunities in the DeFi ecosystem.

Per usual, the king here is yEarn’s yCRV Vault which uses Curve’s Y Pool to generate a substantial return on USD. The Vault leverages yCRV, a tokenized basket of DAI, USDC, USDT, and TUSD, and farms the CRV tokens plus trading fees.

One of the benefits here with yCrv is that users are diversifying their exposure to not just one crypto dollar, but a basket of them and therefore minimizing their risk to any potential shortfall events in the future. Given the returns on the yCRV Vault are upwards of 84% on a “stable” asset, this may be one of the comfiest ways to earn a passive income in DeFi.

HONORABLE MENTIONS 🏅

DAI on Compound

ROI estimate: 10% APY

Method: Supply DAI to Compound or use Zapper

Compound effectively popularized yield farming. With that, the interest rate protocol offers some attractive opportunities on USD equivalents. The leading return comes from DAI which offers suppliers ~3.09% APY plus an additional 7.80% in COMP tokens. Given Compound’s perfect track record for nearly two years, this is one of the “safer” yield farming plays in the DeFi ecosystem as indicated by the underlying returns.

USDC lending on BlockFi

ROI: 8.6% APY

Method: Open a BlockFi account

BlockFi’s offers 8.6% APY on USDC deposits, putting the centralized crypto bank in competition with the average annual returns from the S&P 500. Therefore, as mentioned previously, having USD in BlockFi ultimately acts as a viable alternative for those not as deep down the DeFi rabbit hole.

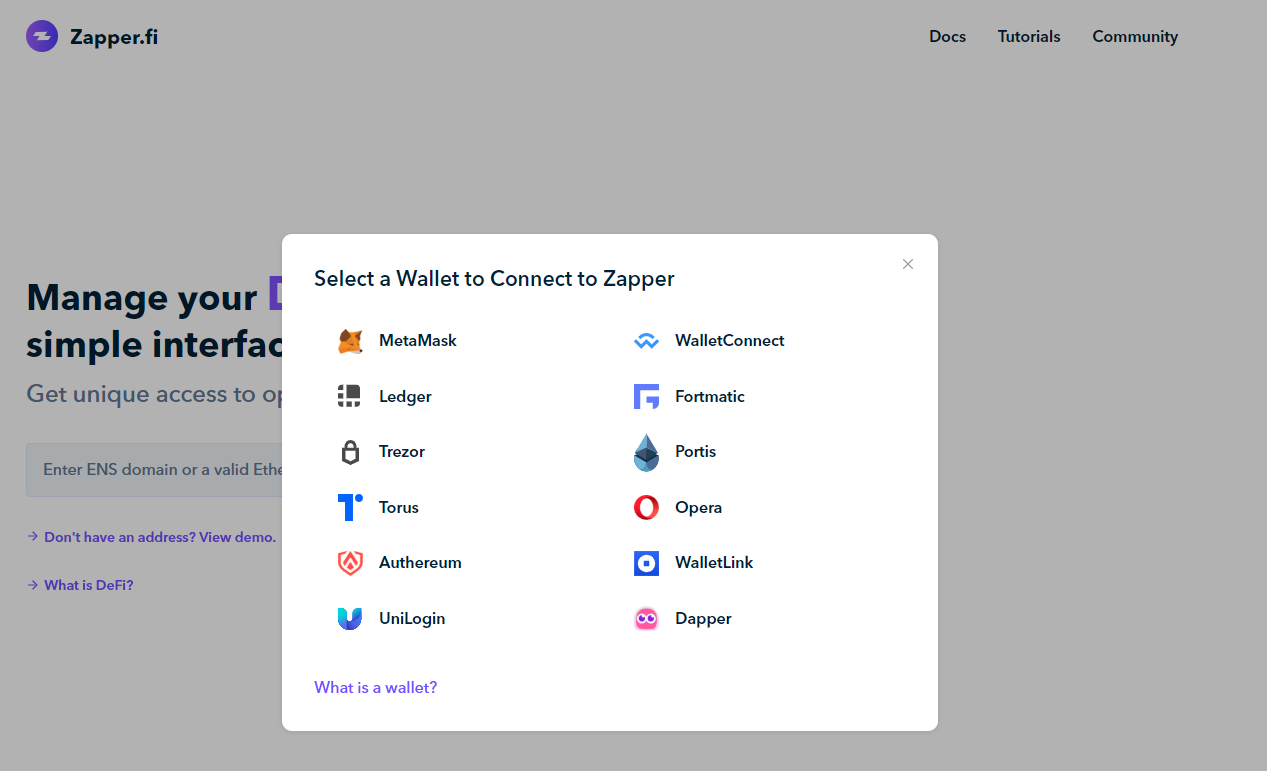

BONUS: How to use Zapper to do this in one transaction 🔥

Now all of these opportunities may seem rather annoying to get in and out. And you may be wondering “how do I get all of these obscure assets like yCRV, crvBTC, or sETH?”

Luckily, our friends over at Zapper make this process really easy and allow you to get into virtually any of the protocols listed above in a single transaction using ETH (except for BlockFi and UMA’s new uUSD synthetic).

Also one of the benefits of using Zapper is that you can easily track your Vault earnings and other income-generating opportunities directly via their dashboard by connecting your Ethereum wallet!

So here’s how to do in a few steps. For this example, we’ll get into yEarn’s yCRV pool.

1. Head on over to Zapper.fi and connect your wallet to Zapper.fi

2. Once connected, click on the “invest” tab.

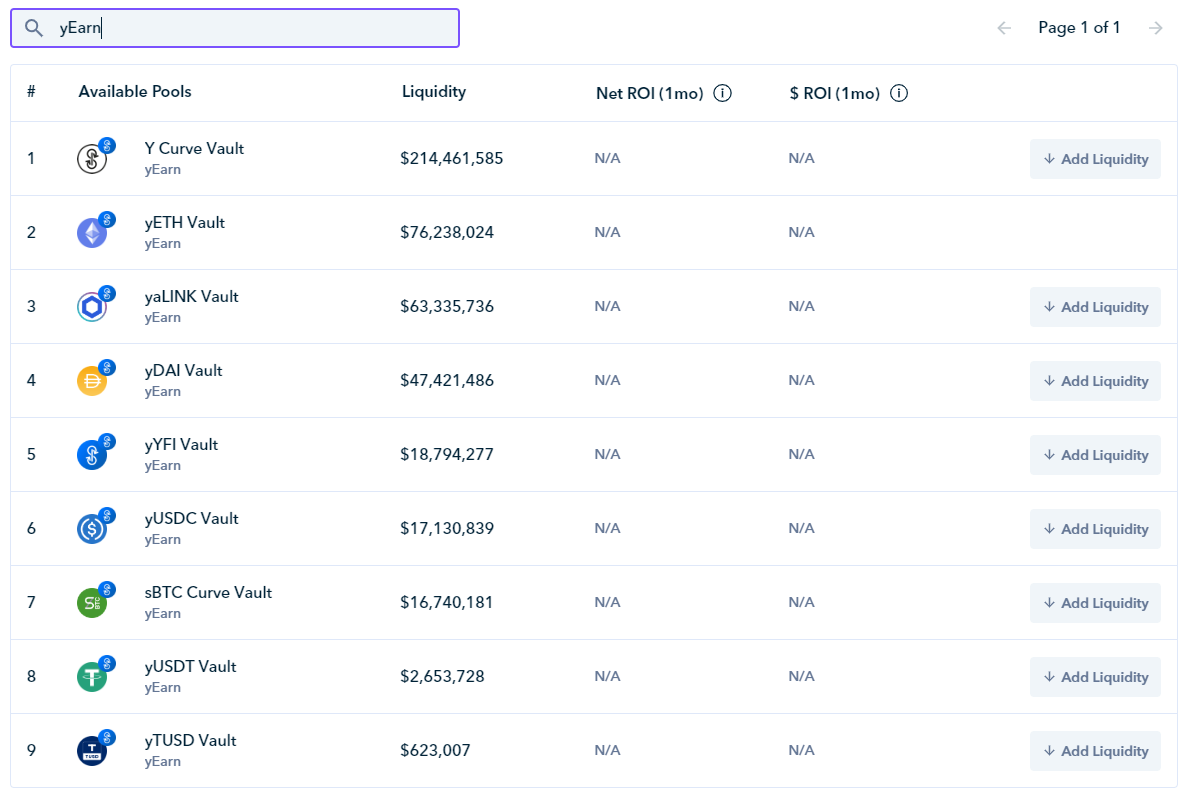

3. Here you’ll be able to view your existing pools as well as look for new opportunities. Scroll down and search “yEarn” in the “Explore Opportunities” search bar.

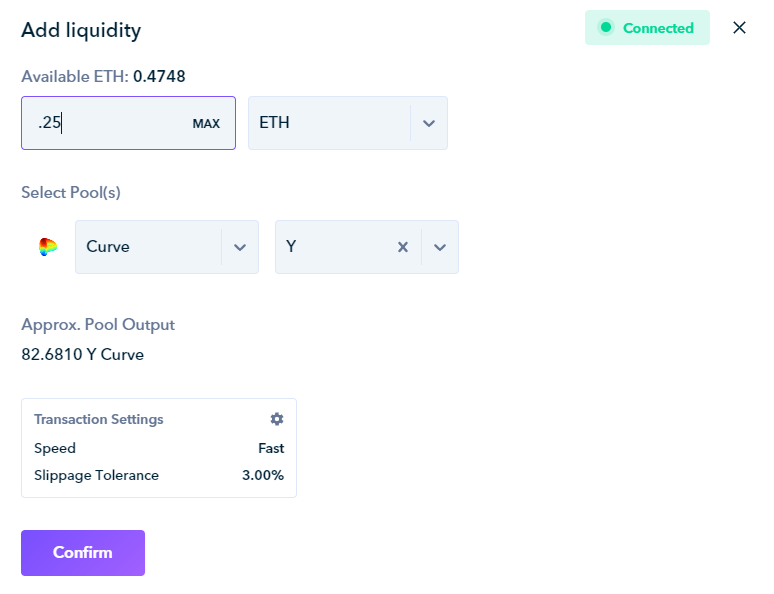

3. Find the Vault of your choosing and click “Add Liquidity”. You can make a deposit with any of the assets supported by Zapper (usually ETH, DAI, USDC, and a handful of others!)

4. Click “confirm” on Zapper and confirm all of the transactions via your wallet provider.

And there you have it! Once the transaction is verified on Ethereum, you’ve made a deposit into the yEarn Vault and you’re now earning a nice APY on your crypto money.

🗒️ Note that you can do this with any protocol supported by Zapper. Try searching “Balancer” or “Curve” in the search bar and you can easily Zap into the protocol to start earning!

Common Themes? Is DeFi For High Yields a Thing?

You can’t beat the money robots, that’s DeFi yield farming. It’s hard to stay up to date on every best yield farming crypto opportunity, let alone the highest yielding ones with an optimal risk/return ratio.

That’s why yEarn has attracted so much capital throughout this yield farming craze. You save on gas fees in the long run and you can take some time to step away from the screens and maybe get a bit of sleep (but not too much).

(Above) SBF sleeping while the money robots out-farm him. Meme courtesy of Blue Kirby

yEarn’s money robots identify the best yield, deploys the capital into the optimal strategy, sell the underlying tokens back into the base asset, and compounds your return - all while you do nothing. The entire process is automated and, generally, these strategies are updated from the best farmers in the space.

For those that are deep down the yield farming rabbit hole, there are surely some better opportunities to earn a higher return with whatever the newest and hottest crop rotation is.

And for those that are asking “wtf is yield farming” or they’re still uncomfortable interacting with DeFi, BlockFi is a viable alternative that stays competitive with traditional financial returns — albeit the yields are substantially lower than what you can find in DeFi.

It’s important to recognize that while many of these protocols are more robust than the meme protocols that have gained popularity in recent weeks, DeFi is still risky.

And with yield, comes risk! We’re in the wild west of crypto finance and your capital could always be jeopardized.

For those interested in protecting their capital, check our yInsure for permissionless insurance (underwritten by Nexus Mutual) or check out our tactic on Nexus Mutual to learn how to get directly protected from smart contract risk.

Happy farming!

Author Bio

Lucas Campbell is an Analyst for Bankless and leads growth at DeFi Rate. He also engages in token economic & DAO advisory with 🔥_🔥

Action steps:

Start earning passive income on your crypto money w/ any of the above strategies

Try out Zapper to easily get in & out of yield farming opportunities

Check out our previous learnings on yEarn & yield farming

Go Bankless. $12 / mo. Includes archive access, Inner Circle & Deals—(pay w/ crypto)

🙏Thanks to our sponsor

Aave

Aave is an open source and non-custodial protocol for money market creation. Originally launched with the Aave Market, it now supports Uniswap and TokenSet markets and enables users and developers to earn interest and leverage their assets. Aave also pioneered Flash Loans, an innovative DeFi building block for developers to build self-liquidations, collateral swaps, and more. Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.