The best DeFi indices for your crypto portfolio

Level up your crypto finance game five times a week. Get on the Bankless Program

Dear Bankless Nation,

Index investing is one of the best ways to gain passive exposure to a diversified portfolio. You just set it and forget it and let the market do the work.

YFI, SNX, NXM, MKR, UMA…which ones do you invest in?

Say don’t want to research every new DeFi token to find the gems but you know DeFi as a class of capital assets are going to be huge.

Can you just buy an index of DeFi tokens?

Yes.

We’re seeing more and more “DeFi ETFs” emerge. Tokens that you can buy to gain exposure to the DeFi asset class.

Lucas gives us an overview on all the major DeFi indices in the game today and how they’ve performed against each other. Ranked in order by liquid market cap. 🥇🥈🥉

Time to level up on indices.

- RSA

P.S. Hey builders! Only a few days left to sign up for the Filecoin Accelerator. Get $20K in grants + up to $1M in funding for building something cool on Filecoin. Apply here!

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

New Meet the Nation w/ Andrew Keys & James Slazar of LiquidStake!

Learn how LiquidStake is enabling liquidity loans for Eth2 stakers in Phase 0 & beyond!

WRITER WEDNESDAY

Bankless Writer: Lucas Campbell, Editor and Analyst for Bankless

Best DeFi Indices for Diversifying your Crypto Portfolio

Simplicity is a massive advantage with index investing.

Anyone can allocate their capital into an index, like an ETF or a mutual fund, gain exposure to a diversified basket of assets, and experience competitive performance with the broader market. There’s little knowledge needed and it’s the best way to “set it and forget it” when it comes to investing.

And with DeFi shaping up to act as a foundational piece to the broader crypto market, it may be wise for any crypto investor to have a small allocation towards this new paradigm in finance.

But for many of us, having a deep understanding of decentralized finance, the nuances behind each protocol, and which tokens have attractive economic designs can be cumbersome for some and mystifying for others.

That’s the value of index investing. You don’t really need to know much about the specific assets but more about the broad implications of the sector you’re buying into. As an example, you don’t need to know about the nuances behind biotech and biomolecular processes to know which companies are the best to invest into — you can just buy the SPDR Biotech ETF and gain exposure to innovation within the sector.

And while crypto indices have been few and far between, the past few months have featured the launch of a handful of new DeFi-specific indices, allowing anyone to gain exposure to the innovation in open finance.

Better yet, with the proliferation of liquidity mining, many of the tokenized indices offer bonus yields in return for becoming a liquidity provider. Notably, all of them feature an ETH pair.

So by becoming an liquidity provider for a DeFi index, your portfolio holds an allocation of ETH along with a basket of DeFi tokens while simultaneously earning a high yielding passive income; making it one of the most attractive investment opportunities for DeFi and Ethereum bulls at large.

So let’s explore the state of DeFi indices and the opportunities that await.

An Overview of DeFi Indices

Ordered from largest market cap to smallest

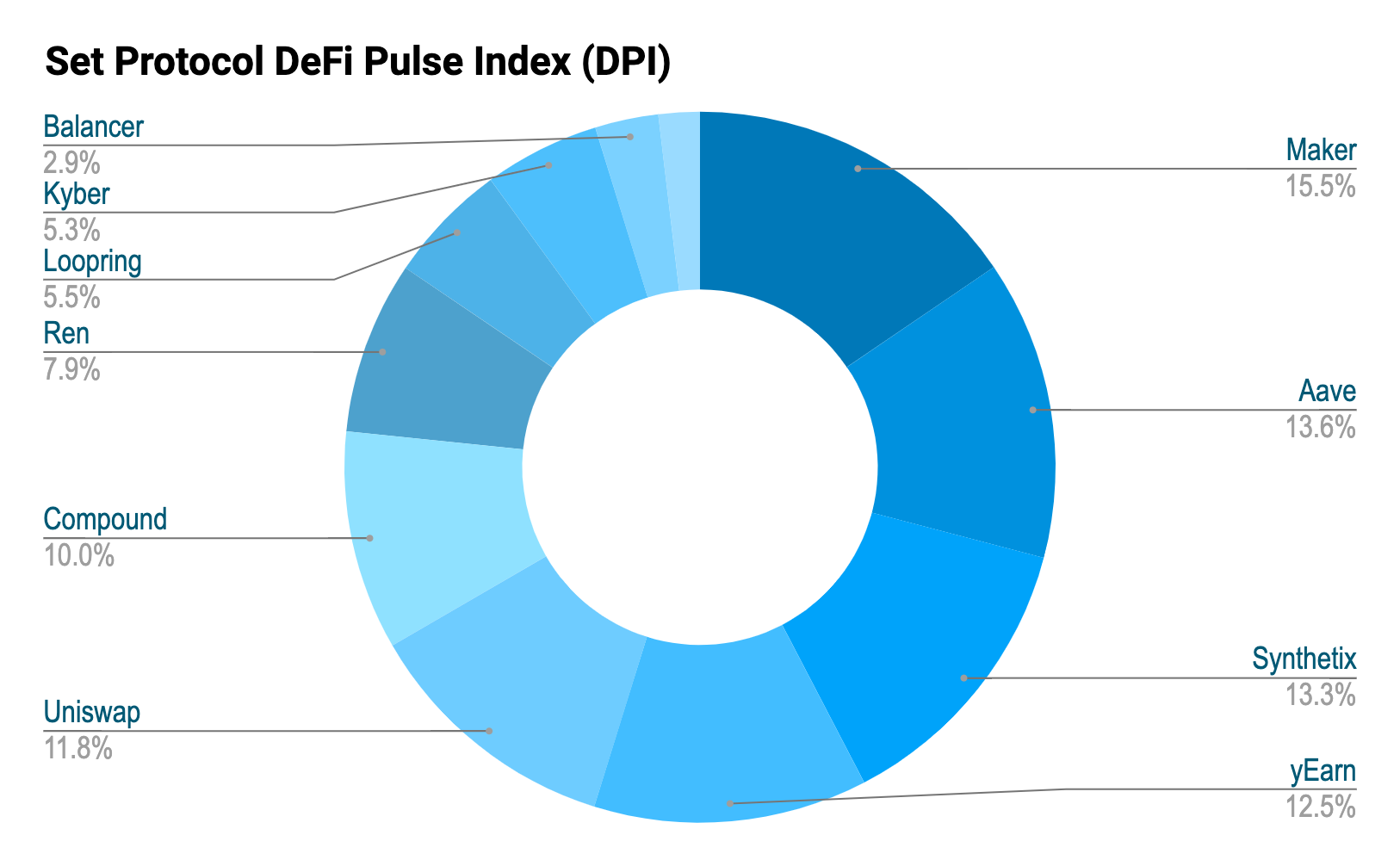

🥇 Set Protocol’s DPI

- Market Cap: $14.5M

- Number of Assets: 11

- Largest Allocation: Maker’s MKR, 15.5%

- Smallest Allocation: Augur’s REP, 1.9%

- Liquidity Mining: Yes — INDEX

- Fee: 0.95% annualized

A collaboration with DeFi Pulse and Set Protocol, the DeFi Pulse Index (DPI) is a market capitalization weighted index featuring the top DeFi tokens in the space.

The biggest assets in the index include Maker, Aave, Synthetix, yEarn, and Uniswap, which aggregate for 66.7% of the index. With that said, these are all widely regarded as leaders within their respective sectors, making it a comfy hold knowing that a majority of the portfolio contains “blue chip tokens”. The index also features some of the newcomers in DeFi like Balancer and Ren which both launched midway through this year.

It’s important to point out that all the assets held in the DPI are actually redeemable for the underlying assets, meaning you can always redeem 1 DPI for the underlying basket of tokens.

The DPI also features an attractive liquidity mining opportunity with the recent launch of Index Coop—a decentralized cooperative focused on building and maintaining an ecosystem of crypto index products. As a result, investors can provide liquidity to the ETH/DPI Uniswap pool, stake it into the Index Coop Farm, and earn ~65% APY in the cooperative’s native token, INDEX.

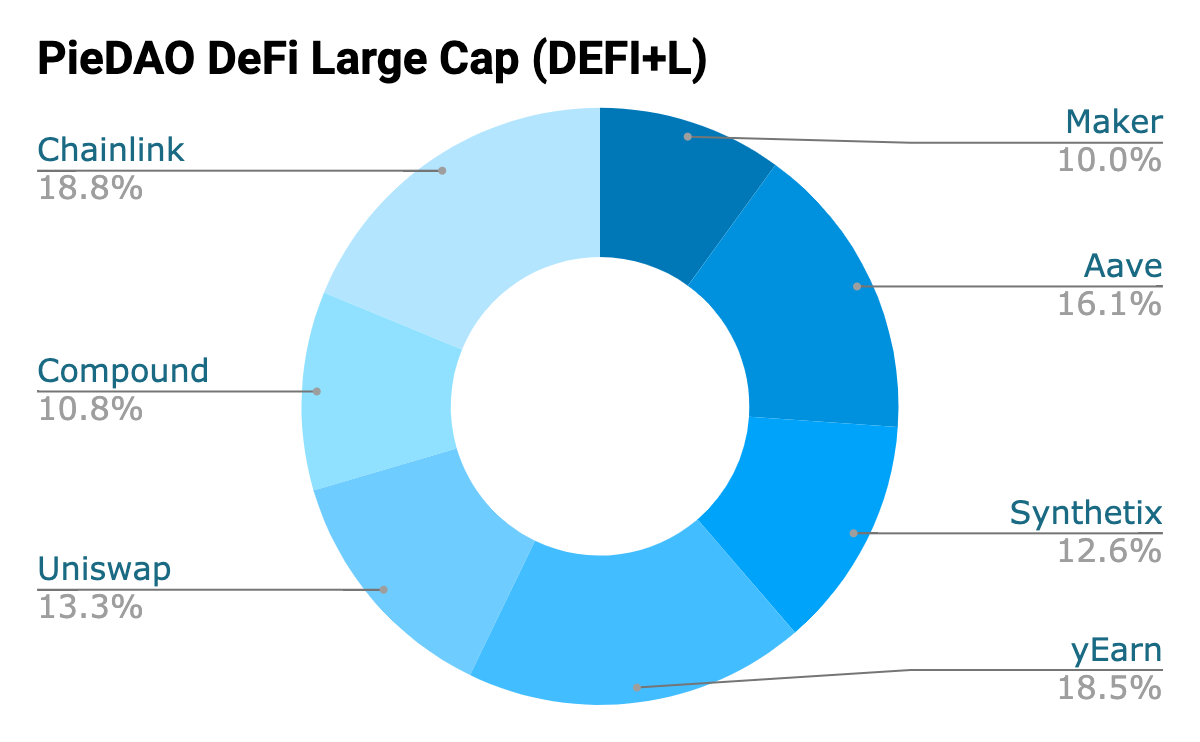

🥈 PieDAO DeFi+L (Large Cap)

- Market Cap: $1.4M

- Number of Assets: 7

- Largest Allocation(s): LINK, 18.8%

- Smallest Allocation:COMP, 10.8%

- Liquidity Mining: Yes — DOUGH

- Fee: 0.1% Swap Fee, 0% Annualized

PieDAO is a protocol for tokenized crypto ETFs, governed by a decentralized community. The notable difference between PieDAO’s ETFs and the other indices is the concentration of the asset allocations.

While sDeFi and DPI feature around a dozen assets in the index, PieDAO is more concentrated as they feature 6-7 assets each—we’ll talk about concentration vs. diversification later.

Regardless, PieDAO’s Large Cap DeFi ETF holds 7 assets in the portfolio, and is the only index to offer LINK exposure. Given Chainlink continues to act as an increasingly important piece of infrastructure as a decentralized oracle provider, it’s worth mentioning for the avid LINK Marines given it represents 18.8% of the portfolio.

PieDAO also recently launched DOUGH, the protocol’s native governance token. Users who provide liquidity to the DeFi+L Balancer pool will earn a lofty APY in DOUGH tokens plus some BAL given it leverages Balancer as a liquidity source. The last difference here is that while the DPI Uniswap pool features a 50/50 pool on ETH, giving investors equal exposure to ETH and DeFi tokens, PieDAO features a 70/30 weight with the liquidity pool leaning heavier towards the DeFi index.

With that in mind, if you believe DeFi may outperform ETH in the coming future, those that provide liquidity to the Balancer 70/30 pool will have larger exposure to the DeFi gains while experiencing a lower amount of impermanent loss.

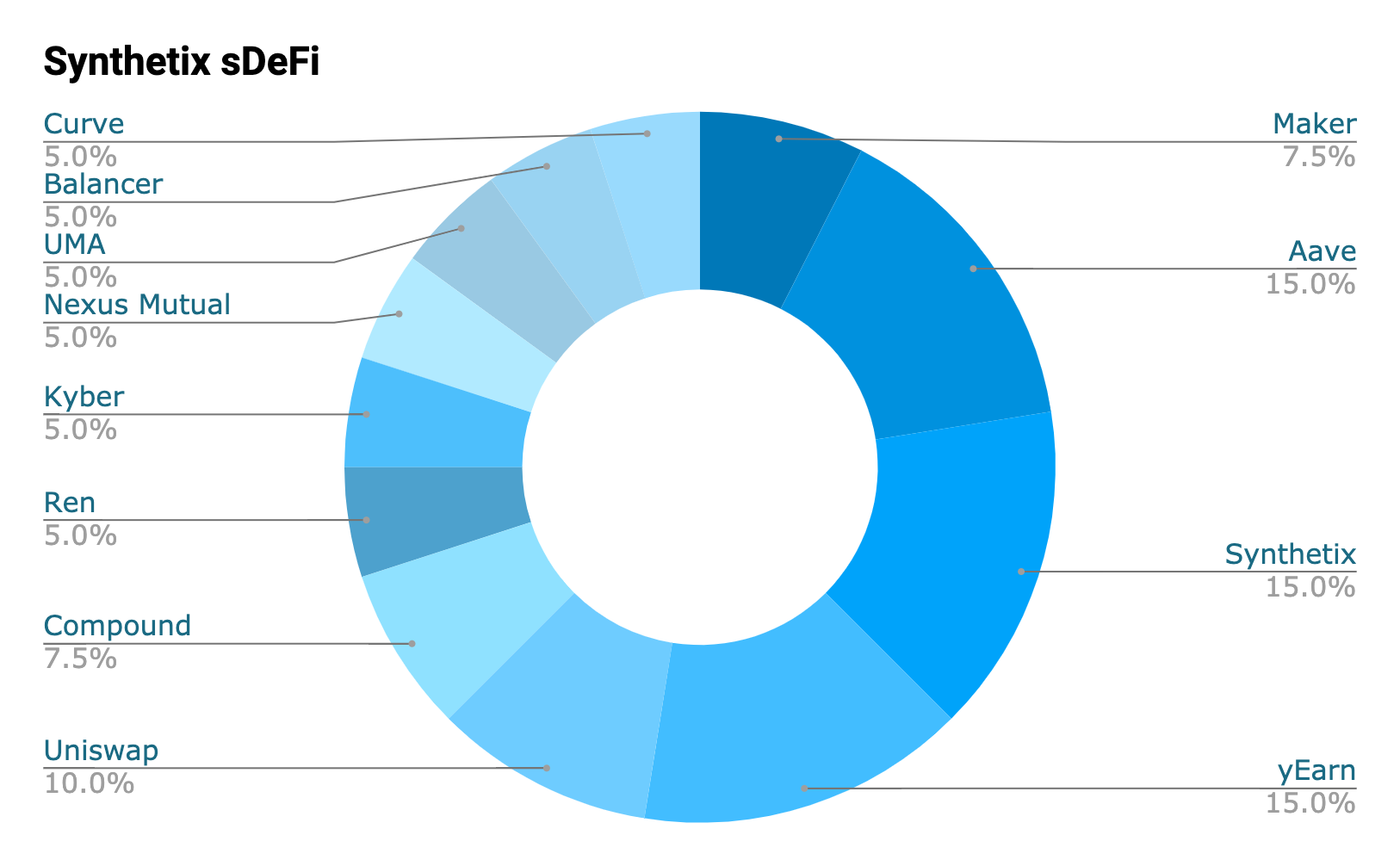

🥉 Synthetix sDeFi

- Market Cap: $1.2M

- Number of Assets: 12

- Largest Allocation(s): AAVE, SNX, YFI - 15%

- Smallest Allocation: NXM, UMA, BAL, CRV, REN, 5%

- Liquidity Mining: No

- Fee: No

With 12 assets featured in the index, Synthetix’s sDeFi is the oldest and most diversified index in the field. The index was recently updated a few weeks ago adding YFI, UNI, wNXM and CRV into the mix while removing ZRX, REP, LRC and BNT. That said, the sDeFi index includes a few other assets not featured in the DPI, namely NXM, UMA, and CRV.

In addition, unlike the DPI index, sDeFi’s index is a synthetic asset which tracks the price of the underlying assets rather than having all assets redeemable — this is an important distinction for those who may be interested in redeeming their index for the underlying assets.

While there’s not a direct liquidity mining incentive like the others, you can always stake SNX to the protocol to mint sUSD and use that capital to purchase the sDeFi index while your staked SNX earns inflation rewards and exchange fees.

However, you’ll have to pay back your sUSD debt in order to get your staked SNX back!

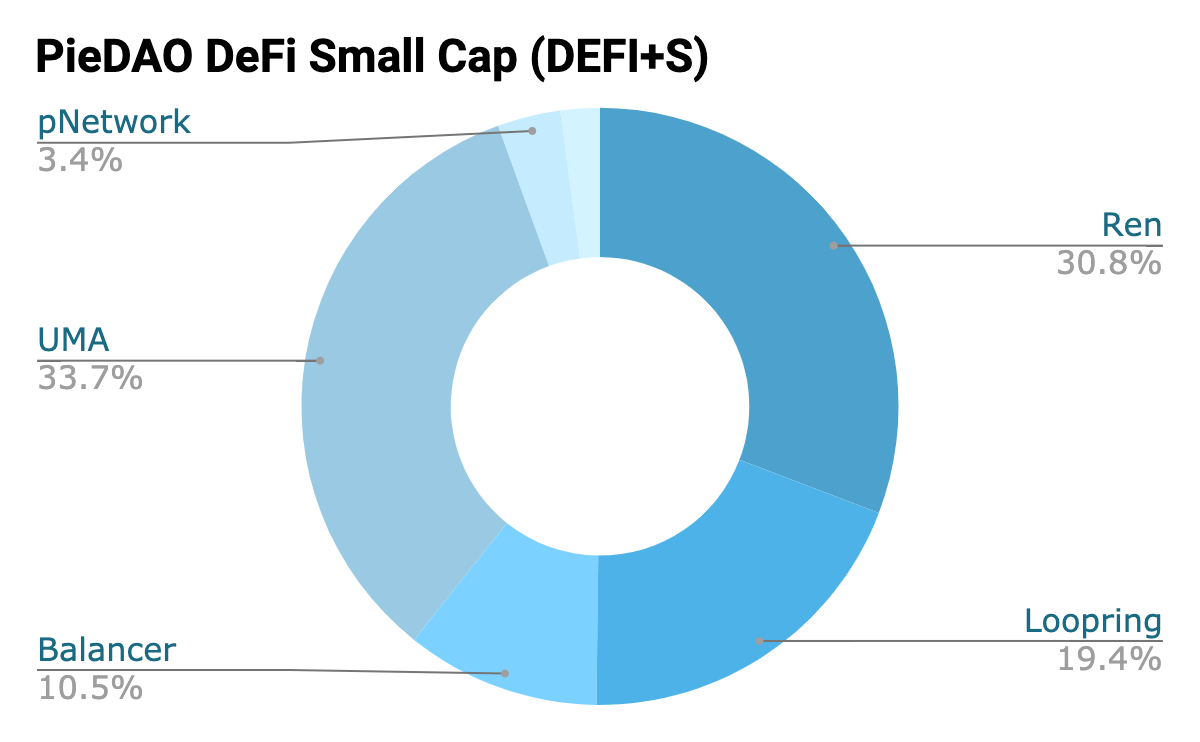

🎖️ PieDAO DeFi+S (Small Cap)

- Market Cap: $970K

- Number of Assets: 6

- Largest Allocation(s): UMA, 33.7%

- Smallest Allocation: MLN, 2.1%

- Liquidity Mining: Yes — DOUGH

- Fee: 0% Swap, 0% Annualized

Similar to the PieDAO’s Large Cap ETF, the Small Cap DeFi ETF features a concentrated basket of tokens, forcing investors to have a higher conviction on the underlying tokens.

Specifically, ~64% of the ETF comprises of just REN and UMA, the cross-chain liquidity protocol and generalized derivatives protocol. While both assets have performed substantially well since the beginning of #DeFiSummer2020, given these two assets represent the large majority of the portfolio, you should be comfortable being long on the respective assets.

Similar to DeFi+L, the DeFi+S ETF features an attractive liquidity mining opportunity using a 70/30 Balancer pool where liquidity providers can earn upwards of ~118% APY in DOUGH while maintaining significant exposure to a concentrated bet of DeFi tokens.

For any risk seeking crypto investors with a bullish outlook on REN and UMA along with BAL and LRC, this is your ETF.

For those that are struggling to choose between the DeFi+S and DeFi+L, PieDAO recently launched the DeFi++ which is a combination of both ETFs into a single, tokenized (and highly diversified) investment vehicle.

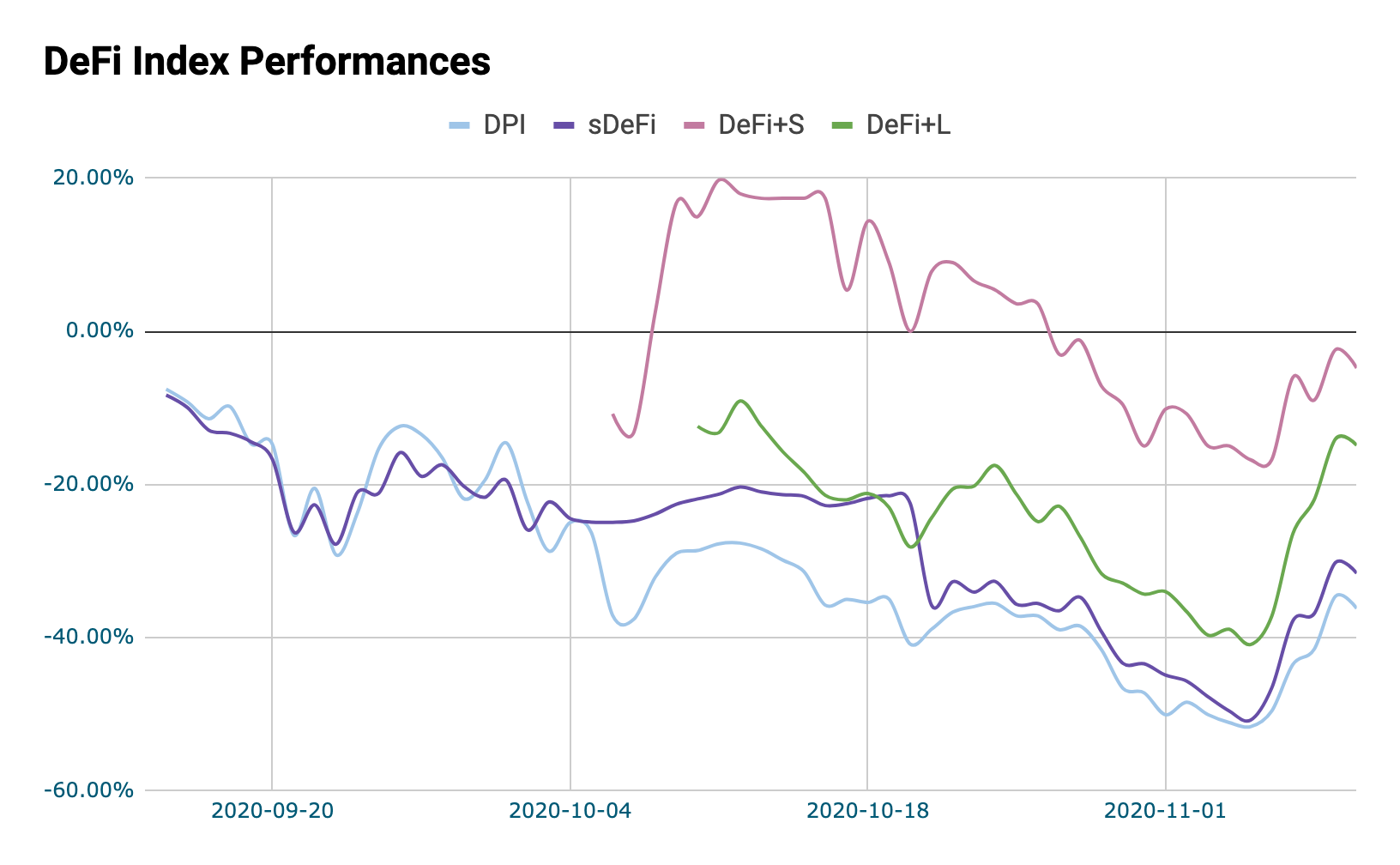

Index Performances

Since most of these DeFi indices have only been around for a few weeks, and in the midst of a DeFi bear market, it’s tough to gauge historical performance. Regardless, here’s a quick snapshot of how the above DeFi indices have performed over the past few weeks amid the bear market:

PieDAO’s Small Cap ETF is the best performer to date as the fund has shielded holders from the significant losses in DeFi since the peak in September, only losing roughly -5% of its value.

On the other hand, the DeFi Pulse’s DeFi Index, which was introduced right at the peak of the market cycle, is the worst performer as it lost roughly -36% of its value since inception, barely losing out to Synthetix’s sDeFi which lost -32% over the same time period.

The recent rebound in DeFi has bode well for all the indices, however, it’s too early to tell which of these ETFs is the best to put your money into as rather than having years of data to compare them, we have weeks. So take this with a grain of salt!

It really comes down to your preference on which assets are held in each respective fund.

Concentrated vs. Diversified Investing

Buying into an index is the best way to get a diversified exposure to a market. You don’t have to worry much about the nuances behind open finance, giving you peace of mind when it comes to your crypto portfolio.

But there’s a caveat here.

Since diversification is a great way to mitigate risk, you’re inherently reducing your potential gains. Making lots of money from investing isn’t achieved by putting money into dozens and dozens of assets, it’s about making concentrated bets. The real money is made when you build an iron-clad conviction on the long term prospect of an investment and heavily allocate your portfolio towards it.

That’s how renown value investor Benjamin Graham made a significant amount of his money (along with Warren Buffett). Graham invested roughly 25% of his partner’s capital into GEICO for $712,000 in 1948, an unprecedented allocation relative to his track record and general investment strategy. But 25 years later and the investment amassed to $400M. He was adamant about the future prospects of the company and put his money where his mouth was. And it played out well.

Had Graham invested that same money into the S&P500 index over the same time period, he would’ve walked out with $5.5M — a nice return, yet dwarfed by his concentrated investment into a single company that he strongly believed would succeed.

That’s the difference. So while investing in an index is a viable strategy, especially for those that are new to DeFi and don’t have the time to dig into each protocol, it’s tough to outcompete those that have the knowledge to take on higher risk by making highly concentrated investments with high conviction into a small handful of protocols that they believe will succeed in the future.

But the numbers will speak for itself over the long run.

For the yield farmers out there, most of these new indices feature attractive opportunities to earn a high yielding passive income, all while maintaining exposure to ETH and a diversified portfolio to crypto’s hottest sector.

With PieDAO and Index Coop now effectively competing to create the best indices in crypto, the coming year should feature plenty of new diversified funds for the industry.

Keep an eye out.

Action steps

- Explore the different DeFi indices around today

- Consider how you can yield farm with these indices to earn a passive income

Author Bio

Lucas Campbell is the Editor and Analyst for Bankless. He also engages with teams on token economic & governance design through 🔥_🔥 (Fire Eyes DAO), working with industry-leading projects like Aave, Rocket Pool, and others.

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Badge.

🙏Thanks to our sponsor

Aave

Aave is an open source and non-custodial protocol for money market creation. Originally launched with the Aave Market, it now supports Uniswap and TokenSet markets and enables users and developers to earn interest and leverage their assets. Aave also pioneered Flash Loans, an innovative DeFi building block for developers to build self-liquidations, collateral swaps, and more. Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.