RSA w/ Compound’s Robert Leshner

Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

Happy Thanksgiving U.S. readers!

Sneak away from the turkey & read this when you can…this was really interesting.

I like Robert a lot. And Compound is one of the most successful money protocols on Ethereum today. The bullish case for DeFi and for Ethereum the network, the value of decentralization in protocols—there’s much we agree on.

But there were a few things we disagree on—I think ETH is a commodity money, an emerging store-of-value, and will remain the best long-term trustless collateral on Ethereum. Robert sees ETH as fuel, short-term collateral only, and not sustainable in the long-run. (He’s not bullish on BTC either)

I enjoyed hearing his perspective. And I’m reminded again that the bankless movement is a big tent. There’s room for many opinions.

And I’m also reminded why BTC and ETH are priced as they are. Many don’t think they’ll accrue and retain monetary premium—even active builders of these systems. But if everyone expected them to become major non-sovereign value stores, well, there’d be no upside for us.

Risk and reward is funny like that.

Let’s level up!

- RSA

THURSDAY THOUGHT

Growing DAI to trillions:

RSA w/ Compound’s Robert Leshner

Note: this conversation has been edited for brevity. Bolding mine to highlight the main points.

The skeptic converted

RSA: If I recall you were a bit skeptical of crypto at first. Now you’re helping to lead a major crypto protocol. How’d that happen?

RL: I was skeptical at first. I dismissed Bitcoin multiple times after reading the whitepaper. I remember just laughing when it crossed a dollar thinking “you can’t create money out of thin air, so have fun everybody experimenting with Bitcoin”

In 2013 I dabbled in mining to get a sense of the economics of the system. But I lost interest soon after. My realization: while Bitcoin has a lot of interesting properties it wasn’t fundamentally interesting to me.

Flash forward to the Ethereum whitepaper, again I was initially dismissive. Too complex, an entire virtual machine, I was skeptical it would ship and skeptical that smart-contracts would work. It wasn’t until the DAO that I said “wait, not only has Ethereum shipped, but you can program assets and organizations with it?” You could program anything with it. It was so awe-inspiring and powerful in that moment that I was immediately full-on excited about Ethereum.

Are ETH and BTC a store-of-value?

RSA: Are you still skeptical of Bitcoin’s store-of-value narrative? And related, do you think ETH is a store-of-value?

RL: This’ll be sad news to you and most people but Bitcoin isn’t a store-of-value and neither is Ether. A store-of-value is an asset with a generally predictable future value. Almost every other financial asset we think about is a better store-of-value than BTC or ETH because they have lower volatility. Real-estate, gold, the U.S. dollar are all better store-of-values than BTC or ETH because they have a more predicable future value. The best store-of-value is cDAI—we could riff on that more. U.S treasuries are a better store-of-value than Ether using the classical definition. I think the community has reinvented the term store-of-value to try to fit a speculative narrative that they would like people to buy into, but from my perspective Bitcoin is an absolutely terrible store-of-value.

RSA: Does that make you bearish on Bitcoin and Ether at their current prices? Why should they be priced so high if not due to their potential as a future store-of-value—a reserve collateral for this financial system?

RL: Just because something’s not a traditional store-of-value doesn’t mean there’s not a purpose for it. The properties of Bitcoin (that are now shared by pretty much every cryptographic asset) are powerful. It settles roughly instantly, can be transacted for low costs, it’s pseudonymous, it’s permissionless, it’s essentially self-sovereign. I do think Bitcoin has uses there. It started slightly nefarious, but over time it’s being seen as an alternative value transmission mechanism. There’s a purpose for cryptographic assets even if all they do is have a speculative value.

So I think there’s a universe where Bitcoin will alway exist. I couldn’t tell you in five years whether the price of Bitcoin is going to be down, sideways, or up. Obviously people in the community tell you it’ll be up—but there’s nothing guaranteeing that in my mind.

cDAI as a store-of-value

RSA: You said earlier that cDai (interest-bearing Dai) is a better store-of-value than ETH and BTC—what did you mean by that? Isn’t cDai itself backed entirely by ETH as store-of-value collateral?

RL: The magic of the Maker system is that it can take a volatile collateral asset that’s not a store-of-value and essentially isolate the piece that is a store-of-value. They can basically strip out the volatility to keep the non-volatile piece—that’s what Dai is relative to ETH. It’s a fraction of the value of the ETH but it’s the fraction that’s predictable. It’s the fraction that can maintain a store-of-value without the volatility. So the assets backing Dai don’t have to be a store-of-value, they can be extremely volatile—a leveraged stock, cryptoassets, they can be anything that’s volatile and Maker stabilizes it. I’ll go on record and say ETH is not a store-of-value but Dai is.

Non-sovereign DAI

RSA: Part of the magic of Dai for many people is that it’s backed by a non-sovereign store-of-value. Are you attracted to this property of crypto or does that not appeal to you?

RL: I think that’s actually extremely appealing to a large number of people around the world. Just having an asset that’s self-sovereign and has stable value is very powerful. You’re essentially delegating to the Maker community the confidence that they can maintain the value without engaging in shenanigans. And given the parameters of the system there’s a high amount of confidence that they can maintain the Dai peg.

Some Dai use is extremely utilitarian—for example sending money across borders without middlemen. It’s not because we’re trying to engage in any awkward behavior it’s literally because there are massive frictions around international payments and settlement. So having neutral store-of-value currencies can bring a significant efficiency for a lot of people.

But right now Dai is inefficient—using it still feels very clunky. Will it feel clunky in 5 years? No. A lot of crypto is going to feel a lot better in 5 years just from the user experience perspective. I don’t think Dai is at the point where it can be used as an alternate currency, but it has signs it’s headed in that direction. And that’s the promising part about it.

What is ETH then?

RSA: So you like the idea of Dai as a non-sovereign store-of-value. I’m trying to figure out what you think about ETH as an asset then. If ETH isn’t an emerging store-of-value, then what is it?

RL: I think of Ether as an asset in its most literal form. It is the ability to purchase computing on the Ethereum blockchain. Ether’s value comes entirely from its use to process transactions and to incentive miners to add transactions to the blockchain. It’s gas or fuel.

When you think about ETH as an asset you’re really making a speculative decision on whether you think there’ll be more or less demand to process transactions on Ethereum relative to the capacity constraints of the network. People who actively use the Ethereum network can tally up what they spend and make a decision on how much Ether they might need. So then apply that same framework to the rest of the world. As in, “if everyone were to use Ethereum how much ETH would we need?”

And that demand to be weighed against the mechanics of the blockchain itself. Is capacity increasing? Does something like Eth2 fundamentally change the amount of transactions that can be processed for the same computational costs? Ironically I think Eth2 could be terrible for the price of ETH because you widen the size of the pipe with the same amount of volume that wants to go down it.

So I view ETH very literally as fuel for the network. I personally spend a small amount of ETH using the network just like anyone active in DeFi. And that’s the value of it—being able to add your transactions to this global state stored on the blockchain. I don’t see it as money. Some may decide to transact in a fuel—in a Mad Max world maybe fuel is a better asset to transact in than something neutral—but I view ETH as the ability to use the network and transact with DeFi.

RSA: So how does Dai grow as a trustless non-sovereign store-of-value without the market cap of something like ETH growing? Or is trustless collateral not needed?

RL: Personally I think ETH is not sustainable long-term. It’s the perfect collateral in the the short term. Because it’s native to the network Maker and Dai is operating on. And it’s highly valued relative to the market cap of Dai today.

So right now ETH is ideal collateral. But long-term it’s not ideal. Because it’s value is unknown and unpredictable. The value of ETH could be flat 5 years from now. It could be down 5 years from now. It’s hard to say. So it’s not the ideal collateral to back the entire system.

The best part about Ethereum is that you can start to bridge it to other blockchain, other assets, and other real world activities. I’m personally excited about the tokenization of BTC on the Ethereum blockchain. I think projects like TBTC from the Keep team is extremely exciting as a means of bringing additional collateral to the DeFi ecosystem and serving as the next 10x jump in the capacity of DeFi.

Beyond that—Ethereum will have to find a way to bridge into the broader financial systems and to start to represent external value. There’s no reason why we can’t start to use things like tokenized gold. Or tokenized securities eventually. The Maker community has a while to figure this out, and eventually we’re going to see that Ether is not the dominant collateral.

Are you saying BTC is special?

RSA: Does your argument for ETH also apply to BTC—that BTC is just a fuel for Bitcoin transactions just valued based on demand for Bitcoin blockspace? Or it BTC more money-like than ETH?

RL: Yeah, I think Bitcoin is more money-like because it really doesn’t do anything else. It’s like Ethereum without the virtual machine and smart-contract. Because it does so much less, it’s kind of this self-referential system, in that the only thing you can do is send it to other people. So I think it gets perceived in different ways.

Again, I’m not long-term bullish or bearish on Bitcoin. I personally don’t see a large bull argument for it, but that’s a personal perspective.

Let’s talk about DeFi

RSA: Are you bullish on DeFi then?

RL: Yes, I’m extremely bullish on DeFi. You have to first define DeFi because I think a lot of people have a lot of different perspectives.

DeFi is having a transparent, auditable, autonomous series of financial contracts and activities. And I think that’s extremely powerful because it really challenges existing financial instruments. A lot of traditional financial activity is opposite—it’s opaque, it’s manual, it’s complex, it’s closed. What I love about DeFi is that’s it’s all the positive virtues that financial markets should have. No one can argue with financial markets being more transparent, more auditable, more efficient.

It doesn’t have to mean Ethereum smart-contracts but DeFi has a very bright future ahead of it. We might see more and more financial markets blending with DeFi. The ability to operate in a transparent, autonomous, way onchain—it’s a better and more fair financial system.

RSA: What about composability and programmability—is the money legos meme part of the value proposition here too?

RL: Yeah, the money lego thing is a very significant piece of value. What’s interesting is that it wasn’t even possible until this wave of Ethereum DeFi. There’s composability of products in the traditional finance world too—but in DeFi each money lego is more transparent, more understood, easier to value, more fair—a better lego itself.

Will Ethereum lead DeFi in the future?

RSA: Where does DeFi live in the future, just on Ethereum? Or is there a DeFi interchain and how does that impact composability?

RL: Ethereum has a really good headstart that gives it an advantage. There’s already a critical mass. So if you’re deciding where to add a project Ethereum is the logical answer because it’s instantly interoperable with every other money lego. That’s very powerful. It’s a network effect. And that network effect is growing.

I think it’s possible that another platform can start to gain dominance, especially as there’s connections between blockchains. Cosmos for example attempts to bridge multiple blockchains, you can have activity that doesn’t have to live in one place. But if you look at how Cosmos operates and how it moves state and value, you might not have the same level of interoperability as you would if everything is in on Ethereum.

It gets more complex in Eth2 with shards, and activities have to go between shards and store state in different places, but for the world we live in right now it seems very clear that Ethereum is the dominant platform and will continue to be the dominant platform for DeFi in the near future.

Crypto Banks vs Money Protocols

RSA: We talk about crypto banks vs money protocols a lot on Bankless. Do they compete, cooperate, or a bit of both?

RL: The biggest difference between the crypto banks and the money protocols is that the crypto banks are not very crypto native. They happen to deal with crypto assets, but they’re not aggressively built on blockchains. They’re not utilizing the best parts of blockchains. You could have conducted these businesses 50 years ago. Yeah, they push transactions to a node to send to a user wallet—but that’s pretty much the extent of it.

The money protocols—Maker, Compound, they’re built with the native languages of the blockchain. Maker and Compound are both operating as series of smart-contracts. They live on the blockchain entirely. And they make use of the best features that Ethereum has to offer. They’re mostly autonomous, they’re transparent, and they operate in a novel fashion.

Over time I expect to see crypto banks become more crypto native and start to exist on chain in which case they will be slightly more competitive with money protocols. But you probably won’t see the opposite—the money protocols won’t become more like crypto banks.

RSA: You don’t see money protocols turning into banks?

RL: I think there’s a lot of virtue in a money protocol being autonomous, decentralized, and community governed. That’s a direction Compound is continuously headed in. We practice what we call “increasing decentralization” where over time the goal is to move entirely to community governance. And the reason why this is virtuous is because in a lot of ways it’s more fair—it’s significantly better than a single entity having control of how the system operates.

When a community is able to govern something on its own without a single point of control it’s easier to trust the system. That makes it easier to build on, and extend, and to integrate into your own use cases and applications.

If Dai was a stablecoin that was run by a corporation it would lose some of the magic. And I think the community needs to preserve its status as being run by the community. That enables new developers to use it as their foundation knowing that the rules aren’t going to change underneath their feet in some arbitrary way.

The decentralization of Compound

RSA: Compound had some controversy regarding it’s level of decentralization a couples months ago. How is it moving in the direction of decentralization?

RL: It’s funny because I think every single DeFi project is on a spectrum—no project is fully decentralized—there’s still access controls even in Maker and every other project out there. It just so happens because of Compound’s growth we had the luxury of being in the spotlight for a bit.

Our goal is for there to be no central administrator whatsoever. No access controls. And no emergency buttons. Which is a really dangerous and hard things to get to.

One of the reason so many protocols have access structures is because building onchain is extremely dangerous. This is all experimental technology. Ethereum itself is experimental. And these are protocols that are routing value around.

We’re still finalizing the theories on how we want to hand off the administrative rights of our protocols—our administrator is responsible for adding new assets, upgrading the protocol and maintaining the parameters of the protocol. But our core thesis is that the applications that build on top of Compound—the Dharmas of the world—are the agents best equipped to govern administration of Compound and our goal is have these applications share responsibility for the protocol over time.

How does Compound get to 10s of billions?

RSA: You recently raised $25m—it’s not a bear market for DeFi it seems—it sounds like part of Compound’s growth is expected to come from crypto banks. How does Compound get to tens of billions?

RL: To get to ten billion requires a lot of changes. Maker is thinking about the same things, what’s the collateral in the system and how much is there? We’re still limited by the size of assets on Ethereum. For now. But we want to enable crypto banks to build on top of Compound.

The best part of the protocol is that we don’t have to partner with other organizations. They can simply start to build on it themselves—they don’t have to ask our permission. That’s the magic of DeFi.

We want to help educate the crypto incumbents on how they can integrate Compound. Show how they can integrate a source of return on their idle assets and a source of liquidity when users want to borrow assets.

There’s a lot of advantages to integrating Compound verses building a system in-house. It’s a shared liquidity pool that has network effects. It’s already battle tested and running. It also leads to a system where a larger number of applications are providing governance to the protocol. They all have say in how it’s operated.

Do the crypto banks had a hidden advantage?

RSA: Are money protocols limited by requiring all loans to be over collateralized? Could the crypto banks out compete them by moving to fractional reserve models and becoming more capital efficient?

RL: The reason money protocol require excess collateral is so that there’s not human judgement in how they operate.

Yes, it removes a lot of the ways borrowing and lending work traditionally. But I think that’s an good because you can interact with it and know what you’re getting on the spot. Machines can build on top of it more easily. That’s a significant advantage for crypto banks with businesses, with humans, and with large organizational footprints because it allows them to expand away from human judgement and towards instant autonomous financial activity.

Maker vs. Compound

RSA: Is Maker a competitor to Compound? Is the Dai savings rate something you have to compete with?

RL: The relationship between Maker and Compound is symbiotic in a lot of ways. I think that Maker would have a more difficult path without Compound and vice versa. We love that Dai exists, that they’re building the stablecoin, that’s it’s pegged. Compound extends Maker in a lot of ways.

Going Mainstream

RSA: There’s 30k or so users of these bankless money protocols. That’s small. How do we go mainstream?

RL: The user experience is the challenge. The systems are starting to be battle-tested enough, but the user experience is extremely difficult. You still have to store your own funds and interact with crypto assets and use an Ethereum blockchain—and it’s very cumbersome still. There’s a long gap before it’s usable by everybody.

In a lot of ways I don’t encourage users unless they’re technically competent and open to risks to use DeFi. Just because most people have to custody their private keys in some way—and that’s probably more risk than most DeFi applications by a long shot. The amount of crypto lost and stole each yeah is exorbitant. The process of operating in crypto is very challenging.

I think the way it changes is that applications get built on top of protocols like Compound that are user-friendly, that aren’t cumbersome, that aren’t as complicated, that don’t require complex crypto expertise to navigate.

I’m particularly excited about projects like Dharma for exactly that reason. They have a chance to abstract all of the complexities of interacting with Compound to a user base. To build fiat on and off ramps, to provide a customer experience which is phenomenal. I think that’s really the next wave to help people interact with DeFi.

The risks of Compound

RSA: Some say the money lego meme is wrong. It’s more money jenga—if a jenga block gets removed the whole thing comes crashing down. How do you think about the risks of using these protocols today?

RL: I think the top projects like Maker and Compound spend an exorbitant amount of effort to ensure the systems are safe. We’ve both gone through numerous security audits. It requires you to build in a slower more deliberate fashion. Knowing that there’s always risks—we both have bug bounty programs, we encourage responsible disclosure, we have repeated audits, formal verification into the development process, and you still can’t say that either of these platforms are 100% safe or ever will be. Just because it’s new technology. The innards of the Ethereum virtual machine might have bugs that haven’t been discovered yet—nothing onchain can ever be considered 100% safe. Period. There’s always risks.

Some users may take a look and decide that there are risks, but that they’re modest. That’s the way I personally feel, but that’s because I spend all day looking at solidity and understanding how these things work. For the average user—don’t assume anything built on Ethereum is 100% safe. Don’t assume anything on Bitcoin is 100% safe. It’s only through the trial of considerable amounts of time and assets at risk that anyone should begin to become 100% confident.

Value capture

RSA: Compound doesn’t have business model yet, but what do you think of DeFi token models?

RL: Our only goal is to ensure that Compound is reliable infrastructure that the world can build on. That’s the only priority. Figuring out a way to get rich is second to that. We want to ensure that Compound is the most well understood, transparent, dependable system there is. First Compound has to succeed as a protocol.

It’s still very early. There’s a lot of education that’s going to happen in the public spotlight over the next few years as we work to build something that the community can use.

Final thoughts

RSA: Anything else you want to leave us with?

RL: Yes. The Bankless community are the pioneers. This is fertile ground for the future of how finance operates. And that’s very cool.

Actions

- Consider: are you bullish on money protocols like Compound?

- Consider: what do you think of Robert’s take on BTC and ETH as assets?

Subscribe to the Bankless program. $12 per mo. Includes Inner Circle & Deal Sheet.

👉Send Bankless a DAI tip for today’s issue

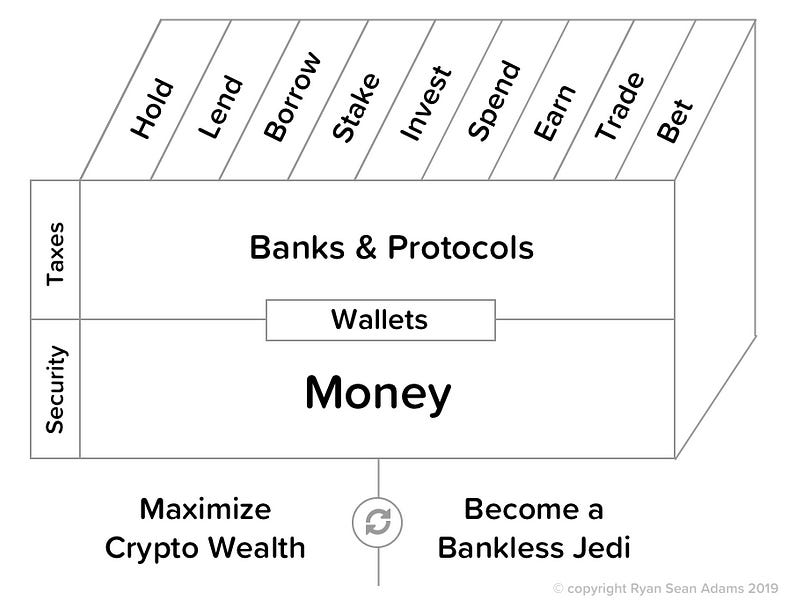

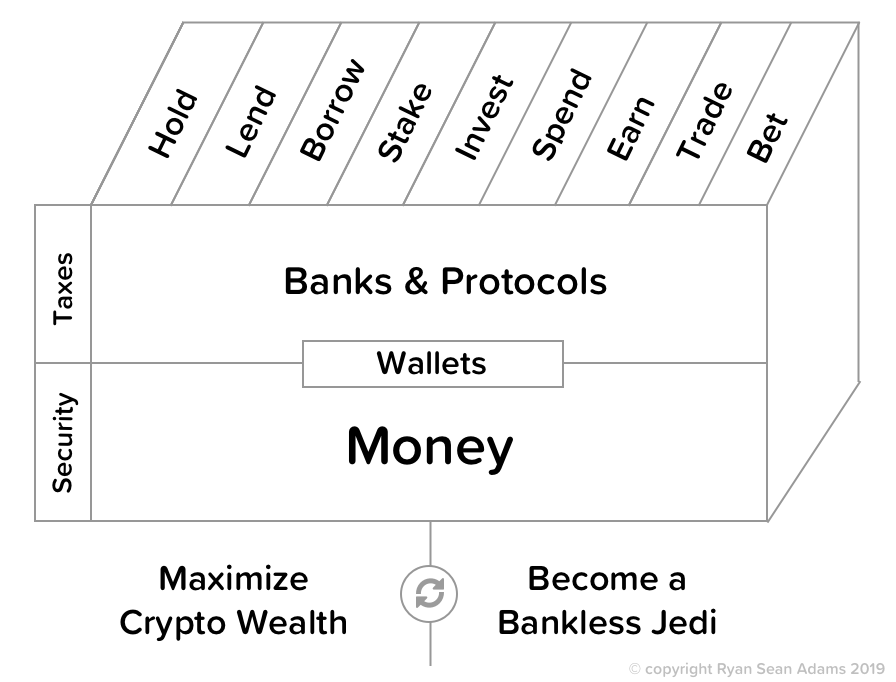

Filling out the skill cube

We covered a lot here. Crypto money, banks & protocols, how it all fits together to build a better financial system. You leveled up on all layers of the skill cube today.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.