Invest in DeFi like a Financial Planner

Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

I have a few friends who are professional financial planners.

All of them own crypto now. 👹

Maybe it’s my corrupting influence. Or maybe it’s just part of a wider trend. (17% of financial advisors now own crypto according to recent surveys.)

But owning crypto for them means buying it on Coinbase and hoping price goes up. They wouldn’t touch DeFi. Still too scary…still geek stuff.

I don’t know any financial planners who use DeFi.

Except one.

Adam Blumberg is a Certified Financial Planner and has been a member of the Bankless community since early days. He know DeFi. He uses it. He even publishes educational videos about it. (Check this one from Ethereal conference)

🤯

So what does a Financial Planner think about DeFi?

Let’s find out.

- RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

THURSDAY THOUGHT

Your DeFi Portfolio:

A Financial Advisor's Perspective

Guest Post: Adam Blumberg is a Certified Financial Planner ® (CFP) & co-founder Interaxis

As Decentralized Finance grows in popularity, it will need to go from a fun hobby for DeFi and Crypto enthusiasts, to a safe investment option. While we need developers and the community to work on building the ecosystem, we also need investors to be smart with their money, and highlight the demand for safety features that will make DeFi a viable investment in the future, for both institutional and retail investors.

The Audience

This article is focused on two audiences.

- First is the DeFi enthusiasts, mainly in the developed world (of which I am one). We don’t need DeFi at this time. We have plenty of places to invest and use our money. But we do like having more options, especially those with limited intervention from intermediaries like banks, broker/dealers, and governments

- The second is those that are looking to invest, but don’t really have other options. The developing world. Regions that don’t have stable currency, government, banks, or financial systems. These are the people who benefit most from an open, global financial system. Welcome to DeFi, and to investing.

We’re on a mission to build a globally accessible financial system—for anyone in the world with an internet connection. At the end of the day, crypto is a financial system. And in order for us to maximize success, we need to think like financial professionals.

So here are three steps to evaluate your DeFi portfolio like a financial professional.

Step 1: Assess Your Risk Tolerance

As a Financial Planner, one of the first things we always do with clients is to assess their risk tolerance. This is sometimes done with a questionnaire and some conversations.

I always tell clients that risk is a measure of your stomach, not your head.

That means you need to really think about how you would feel if you opened up your account to find it lost 20-30% of its value.

Would you be nauseous, not sleep, call and yell at me? If that is the case, you don’t you’re not an aggressive risk taker.

Given the nascency of crypto assets and DeFi, we don’t have many risk assessment tools available, especially since the whole ecosystem is considered “risky”. However, take a real look at yourself, and decide how much you are willing to lose.

Within DeFi, are you conservative, moderate, or aggressive?

Step 2: Allocate & Rebalance

Now, you might want to look at your DeFi portfolio and start thinking of it in terms of portfolio allocation. How much will you devote to Growth, Income, and Safe money?

Let’s talk about each:

Growth might refer to just holding some tokens in the hopes that they go up in value. You might hold ETH, MKR, or SNX because you think they will go up. Even in that case, you might want to have a price in mind at which you start to take some money off the table. If ETH goes up 30%, are you going to sell some—dollar cost average out?

Income could be participating in Uniswap liquidity pools which pay a regular fee to token holders, or staking SNX to earn a passive income. Of course, you are still taking the risk on the value of the tokens being staked, but at least you are also increasing your holdings. You’re earning money while you sleep—a critical piece to building wealth.

Safe money, in this case, could mean keeping an allocation of DAI or USDC, and even lending it out via protocols like Compound, RAY, or the DSR. You know you can get to it anytime you need it. (RSA note—here’s a DeFi portfolio I put together in January using these themes)

Determine your allocation

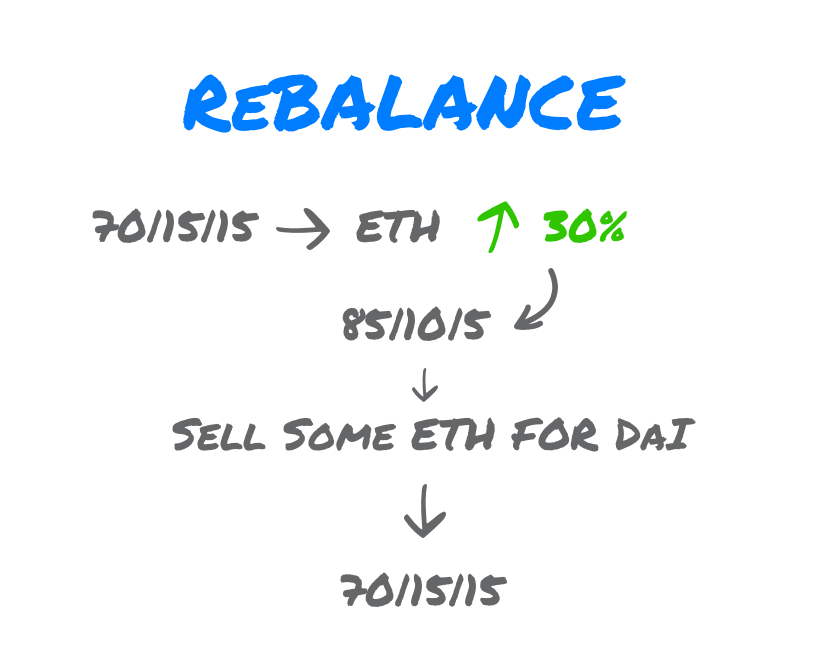

With all of that in mind, based on your risk profile, you can determine how much goes to each of these allocations. An Aggressive strategy might give you 70/15/15 to Growth, Income, and Safe respectively. Conservative might be closer to 50/25/25.

Part of the key here is to rebalance regularly. In the example above, when ETH goes up 30% in a short period of time, it might make your Growth allocation shoot up to 85%. You can then take some off the table, and put it in your “income” and “safe” buckets.

You may be a little upset if ETH continues to run up, but you’ll be even more frustrated if it goes back down 40% and you didn’t rebalance when you should’ve.

Another way to manage this is by using something like Set Protocol (see tactic #3). Since you probably don’t have unlimited time to manage your funds, you can either create a Set, or use one of the TokenSets already created. It will do the rebalancing for you. It’s your own personal robo-advisor.

Note: Balancer is another interesting alternative for automating your portfolio allocations. It’s like Set Protocol and Uniswap had a baby. Automated portfolio management while earning trading fees for providing liquidity. Here’s our piece on how to make money with Balancer.

One item to note with regard to overall portfolio allocation is that, contrary to what many might have you believe, it’s beneficial to have cash—or DAI in this case.

If an opportunity arises, and you have properly managed your portfolio (meaning you have some spare DAI to be able to invest) you can capitalize on any sudden opportunities.

For example, if the price of ETH is cut in half overnight due to the uncertainties of a global pandemic, you can capitalize on the opportunity and purchase some ETH at a discount.

Step 3: Understand Your Risk

One of the most important aspects when managing your DeFi portfolio is to understand the risk you are taking.

Obviously, you need to understand the risk in the values of any asset you’re holding, including crypto assets. If you’re holding ETH, MKR, SNX, you should know that they are volatile. They can lose value quickly.

You should ideally have a good reason as to why you’re holding them...not just because someone on Twitter typed the symbol next to the word MOON. (RSA - Read how to value crypto capital assets and the crypto money portfolio)

What are the risks?

In the DeFi world, we also have to understand the technology risks. First is the personal tech risks—I could lose my private keys or passphrase. I could die and then no one has access to my funds.

Someone could hack my computer or phone and find the passphrase I took a picture of and stored in iCloud (I didn’t do that...but I thought about it).

We also need to add in the risk of Smart Contract hacks, which have become more prevalent with the proliferation of DeFi. As more money floods into some of the larger Smart Contract protocols, they become a bigger target for hackers. As value locked increases in DeFi, so does the incentive to steal it.

You should understand what would happen if a protocol gets hacked and/or liquidated. Even audited contracts aren’t completely sealed.

There’s also potential issues with market manipulation. Sometimes a Smart Contract doesn’t get hacked, but the incentive mechanisms get gamed and manipulated to the point that they drain the contract, or make your investment worth much less.

The last is risk due to the composability of the DApps, protocols, and the whole ecosystem. If you were to stress-test your DeFi portfolio, how does it perform? Since so many protocols are driven by the price of ETH, what is your exposure? If the value of ETH drops by 30%, what happens to your portfolio?

Do your vaults get liquidated? Do your leveraged positions close? Does a 30% drop in ETH make for a 50% drop in your portfolio...or do you even know?

We see this in the traditional world, where investors have a far greater exposure to very few equities than they imagine. An investor might think he’s diversified by using 2 different advisors, and several ETF’s. When we evaluate it all, we find he owns Google and Apple in every account. This is the opposite of diversification. Are you in the same position with ETH?

As you are evaluating the potential risks in your portfolio, don’t be scared into not investing. Fortunately, you have the opportunity to purchase Smart Contract Covers through Nexus Mutual, or hedge some of your positions via Opyn.

💡Don’t know how to use Opyn yet? Check out this week’s Tactic Tuesday on How to Protect your ETH with Opyn

Hedging and Insurance likely eats into your potential gains, but they will certainly protect you from the big losses. Limiting the downside of your investments is far more important for the long-term health of your portfolio than increasing your upside.

Education

The common thread for all of this is the need for education. We’re at the stage in DeFi where you have to take time to personally understand the protocols, tokens, and DApps you are using. More importantly, you should have a good understanding of why you are utilizing or investing in them.

Learn when and how you earn, how to get in and out, and what can drive the growth higher and lower. There are so many resources in this space:

Of course, the Bankless program, YouTube channel, and podcast!

Summary

There are so many exciting protocols, investments, growth, and neo-banking opportunities available in DeFi. We love the growth and exuberance from the community.

In order for more growth to come from outside this community, we need more thoughtful planning abilities from the retail investors, and we can look to financial planning concepts and models to help. Have a plan. Know yourself. Manage your risk.

There’s so much innovation in DeFi from talented developers and entrepreneurs. They need investors. They need capital. In the end, our hope is to help all prospective investors grow the decentralized finance ecosystem in the long run.

Action steps

- Think about your risk tolerance—are you conservative, moderate, or aggressive?

- Understand the risks associated with your DeFi portfolio

- Bonus: Hedge your portfolio risks with Opyn or Nexus Mutual

Guest Author Blub

Adam Blumberg is a Certified Financial Planner ® and co-founder of a financial planning firm in Texas. Adam and his co-founder, Ron Dixon, started Interaxis in 2019 as a YouTube Channel aimed at explaining some of the complexities of crypto and DeFi investments.

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Deal Sheet.

🙏Thanks to our sponsor

Aave

Aave is an open source and non-custodial protocol for money market creation. Originally launched with the Aave Market, it now supports Uniswap and TokenSet markets and enables users and developers to earn interest and leverage their assets. Aave also pioneered Flash Loans, an innovative DeFi building block for developers to build self-liquidations, collateral swaps, and more. Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.