How to dollar-cost average into crypto

Dear Crypto Natives,

It’s Tactics Tuesday! Every Tuesday we focus on one tactic to help you level up.

Today’s is a simple yet effective way to increase your crypto wealth. It’s something you can do at any skill level—it just requires a bit of discipline.

Make sure you knock out the action at the end. This is the first foundational tactic I’ve introduced in the program so far. That means you don’t want to skip it.

On Thursday we’ll turn again to strategy. Try to knock this one out before then!

- RSA

P.S. The next time someone asks you “when should I buy crypto?” just forward them this.

To build crypto wealth you need to buy crypto money. But when do you buy? This tactic is a tool that answers that question.

- Goal: Implement a dollar cost average buying strategy

- Skill: Beginner

- Effort: 1 hour

- ROI: A disciplined way to increase your crypto wealth

When do you buy?

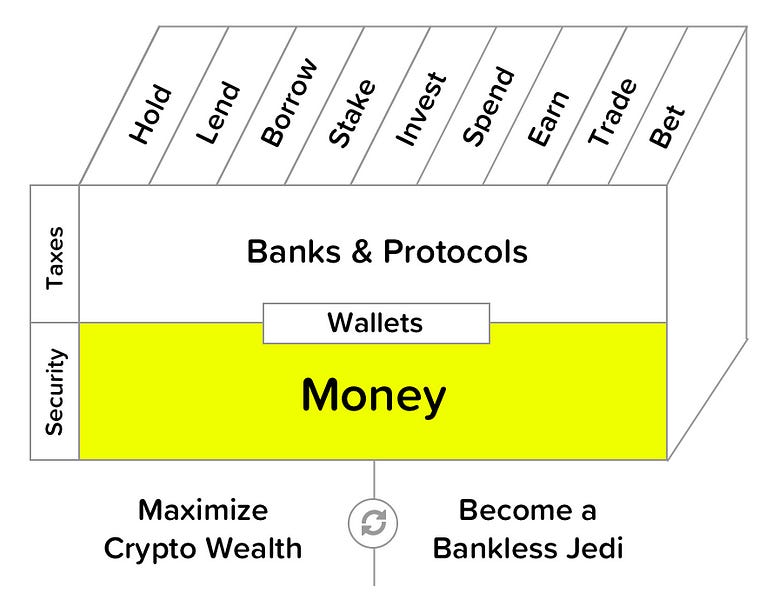

We’ve established that accruing crypto money is the foundation of the Bankless program. But what’s the best way to do it?

Should you:

- “Buy the dip”

- “Read the charts”

- “Time the market”

- “Go all in now”

My answer to the above: no, no, no and no.

There’s a better method. One that’s more effective for both your returns and your mental health. It’s called dollar-cost averaging (DCA).

We’re going to learn how to do it and come up with a plan to execute it.

What is dollar-cost averaging?

Dollar-cost averaging (DCA) in crypto works like this:

- You take the amount you want to invest in crypto: say $9,000

- You pick a frequency and time period for your buys: say weekly over a year

- You commit to the schedule and you follow through

That’s it!

It’d be really simple to implement the above: you might schedule your crypto purchases on Sundays at 8pm, buying part ETH and part BTC once a week. You’d buy $173 worth of this mix every Sunday, making 52 of these buys over the course of the year, investing your full $9,000 by the end.

This tactic ensures that you end up with the average price of those 52 combined Sundays throughout the year. You never bought too low, you never bought too high. You reduced the impact of volatility. And your cost-basis is a nice average price.

Changing the variables

Of course you can change the amount, time period, or frequency to anything you like.

The amount depends on how much of your net worth you want to allocate to crypto. If you’re older or less risk-adverse 1-5% might be appropriate, if you’re younger or more risk-tolerant, 5-20% could be reasonable. I even know a number of quite unreasonable crypto natives with YOLO amounts—50% or more—I guess it works for them. (We’ll talk allocation factors another time.)

The time period requires some thought. If the period is too short you’ll find yourself overweight on a short-term trend. Too long and you’re missing upside. No one has the perfect answer on time period, some do 6-12 months, others longer. Less than 3 months is probably ineffective. With crypto cycles getting longer, I’d say 12 months seems about right if you’re starting now.

For frequency, I prefer weekly. You could go bi-monthly though. Even daily.

Don’t over-optimize

Does the above sound too simple? Good! That’s the point.

The big mistakes we make in crypto are psychological. We try to over-optimize. We FOMO buy at the tops and FUD sell at the bottoms. We think we’re immune to cognitive bias, oblivious to the fact that our perceived immunity is just another a mental trap. We’re herd creatures with lizard brains—we make bad decisions when immersed in extreme volatility.

So we don’t need to be the extra clever in our tactics. Just extra disciplined.

We embrace tactics like dollar-cost averaging as a hack around our cognitive biases.

Think of it this way: the investment decision that really matters was your decision to invest in crypto money in the first place. That’ll either go really well for you. Or it’ll go nowhere. You don’t need to hyper optimize within that decision.

This is why DCA is the buying tactic I recommend in the Bankless program.

It’s the one we’re least likely to screw up.

Dollar-cost averaging your paycheck

DCA isn’t limited to lump sum purchases either.

It’s even easier to implement on top of an income stream like a salary.

You just pick a percentage of your paycheck to allocate. And you allocate that percentage to crypto buys every paycheck. (You can even do even this within a tax-sheltered account.)

Paycheck DCA’ing is a disciplined way to gradually convert your legacy money into crypto money. Implementing it is an essential component of this program.

Making this even easier

You may already have a preferred place to buy crypto for your DCA plan. Great! Just make sure it’s a trusted exchange. Preferably one that offers FDIC insurance on your fiat since you’ll be keeping some in the exchange for the scheduled buys.

But what if you’re new to this? I recommend Coinbase. Good security. Easy setup.

Two options:

- Use the Coinbase retail app to schedule reoccurring purchases (daily, weekly, monthly) automatically drawn from your bank account. This is the easiest approach but comes with higher fees—1.49% in US and higher in Europe and Canada, or…

- Use the Coinbase Pro exchange product to manually execute trades on your DCA schedule. This is less convenient but saves fees—.50% instead of 1.49%.

The important thing is to use the option you’re mostly likely to follow through on. An automated purchase may be worth extra fees if it results in more crypto wealth.

Final Words

You don’t need to buy the dip. Or read the charts. Or time the market.

You can set it and forget it.

You can dollar-cost average your crypto purchases.

Don’t make the mistake of dismissing dollar-cost averaging because it’s simple. The pros I know use this tool all the time.

And remember, the hardest part about DCA is the discipline to stick to the plan. You can’t react to market volatility and change course. Don’t trust your feelings in the moment. Stick to DCA plan you determined in advance.

Sometimes this is really hard to do.

But in the Bankless program you’re not alone.

Like a good coach, I’ll be here to remind you of your commitment. And when the crypto market is crumbling or things get silly exuberant a reminder is often the thing you need most.

Action steps

- Start a DCA buying plan for a lump sum crypto investment (as applicable)

- Start a paycheck DCA buying plan (don’t skip this—it’s foundational)