DeFi in Ten Years

I’m sending this thought piece to everyone—including free subscribers. If you’d like to receive future Thursday Thought Pieces then subscribe to the program as a paying member now.

Dear Crypto Natives,

As we prepare to enter 2020 it’s a good time to zoom out and go big picture. So I asked Kain Warwick of Synthetix to give us his thoughts on DeFi in 10 years.

Is DeFi capital coordination more efficient than the firm?

Will DeFi completely replace finance or will we get a hybrid?

What are the superpowers and shortfalls of money protocols?

He answers those questions in today’s thought piece. He also gives one of the best definitions of DeFi I’ve seen (I bolded that part so you don’t miss it).

As one of the few crypto projects that has successfully pivoted Kain provides a unique perspective on the future of DeFi—grounded and pragmatic, yet visionary.

Enjoy today’s Thought-piece!

- RSA

P.S. Tomorrow’s weekly recap will include some extra anti-doxxing tips—the community came up with some awesome ones in the Inner Circle after Tuesday’s tatic. Watch for it!

P.P.S. Check out the How to make money on Synthetix tactic if you missed it

THURSDAY THOUGHT

DeFi in Ten Years

By Bankless contributor: Kain Warwick - Founder Synthetix

It’s very tempting when asked what DeFi will look like in ten years to simply say “finance”. I think this answer misses the mark on two dimensions. The first is time. Scientific and technological revolutions take a long time, much longer than anticipated by early adopters. The thinking often goes, “This technology is just so self evidently superior how could everyone not switch?” but changing entrenched behaviour is hard and so transitions typically take decades not years.

The second dimension is the lack of clarity as to whether decentralised coordination can more efficiently allocate capital than the status quo, and thus replace it. Finance is essentially the coordination of capital allocation to where it can most efficiently be used. Over the last five hundred years firms have become the preeminent capital coordination method of choice for modern societies. DeFi offers a compelling alternative to this model for a number of reasons but it is not clear yet that it is capable of replacing every aspect of the existing financial system.

I believe that it will ultimately replace most financial coordination games, or at the very least force them to evolve into a new hybrid form that leverages the best aspects of DeFi and CeFi. The most critical reason I think this will be the case is that efficient allocation of capital requires competition, in markets with low or no competition efficiency tends to be poor. DeFi is is a hyper competitive alternative to corporate capital allocation. DeFi lowers barriers to entry for market participants and simultaneously increases the efficiency of competition between market participants to a new level. DeFi means more competition, and better competition, which results in far more efficient markets.

The most efficient lending market imaginable

To illustrate these two points, let’s look at Compound, a decentralised lending protocol. The Compound protocol is a permissionless marketplace for lending. The barriers to entry are effectively zero. The rules for participants are clear, predefined and immutable. Apart from a current structural limitation in loans needing to be overcollateralized, Compound represents probably the most efficient lending market imaginable. Anyone anywhere in the world with capital can allocate it to Compound where anyone anywhere in the world can access it. This is very different to a traditional lending marketplace, where several firms compete with each other to efficiently source capital and then allocate it. In that model there are extremely high barriers to entry for both lenders and borrowers. So the majority of the competition is between a small number of large firms. There is some minimal intra-firm competition between salespeople and other employees in these firms trying outcompete their peers, but this is highly structured. In Compound you can have millions of sources of capital directly competing to allocate capital, and then at a higher level you will have other lending protocols competing to access these capital sources creating even more competition, so clearly the DeFi lending space is going to result in both more market participants and higher levels of competition between them. We are seeing glimmers of this already today.

However, the incumbent lending corporations have a significant advantage in that they have more information about lenders and can rely on the legal system for enforcement of debts, so they can offer low or no collateral loans which vastly expand their addressable market. So the current structural inefficiency in decentralised lending protocols will reduce the impact on lending markets until these inefficiencies are removed or reduced.

What’s missing from DeFi today?

Which brings us back to our original question, is it even possible to remove the structural inefficiencies that hold back DeFi? Crypto protocols operate in an environment where anything permitted by the system will likely happen. In traditional lending markets enforceability of contracts is reliant on the legal system, which is ultimately reliant on people with guns and cages. If DeFi can’t use guns and cages to enforce the rules, can it efficiently implement undercollateralized loans? And if not, what does this imply for the evolution of lending in DeFi? My sense is that it can but there are pieces missing such as decentralised identity, privacy in DeFI is another barrier.

In spite of these challenges I believe DeFi will continue to create new hyper-efficient markets, but so long as these structural inefficiencies exist DeFi will operate in parallel to traditional finance. Most of the challenges facing DeFi today will be resolved and it a proliferation of DeFi protocols will enable far more efficient capital allocation. The question then is, what will this look like and what will the impact be?

Trustless protocols with predefined rules

To project how DeFi will evolve we need to understand how these protocols function at a fundamental level and what types of capital coordination are best suited to be decentralised. Let’s use Uniswap as an example. Uniswap is a decentralised exchange that allows anyone to trade ETH and ERC20 tokens. Where most DeFi exchanges attempt to replicate the order book model seen in traditional trading venues, Uniswap leverages the trustless nature of Ethereum to enable anyone to pool capital to provide liquidity. You don’t need sophisticated tools or software you just need capital. You can pool your capital with others to provide a service (liquidity) to market participants and are paid based on your contribution. To understand how powerful this is new coordination pattern is let’s try to form a generalised description of a DeFi protocol.

DeFi is the replication of existing financial services by creating trustless protocols with predefined rules that allow open participation, where consumers of these services pay fees which are automatically distributed to protocol participants.

This definition doesn’t capture services like InstaDapp, DEX.AG and 1inch.exchange nor does it capture wallets and other user facing infrastructure. But I do believe it captures the likely path for the underlying protocols, but again this process is early and a lot of experimentation is happening.

In practice this means you no longer need a firm to coordinate capital allocation — a protocol can replace it. This lowers barriers to entry, as participation is open to anyone who abides by the rules. It also increases efficiency because the rules are enforced by the contracts rather than the legal system, ideally lowering risk and enforcement costs. It doesn’t reduce the barriers to entry for creating a new protocol though. Those can still be high, probably the most important though, is liquidity. But fundamentally competition and the open source nature of these protocols will continue to enable experimentation.

The challenges for new protocols

Liquidity will remain as the predominant challenge for new protocols, even the oldest and most well known like Augur and 0x struggle with liquidity today. There is some progress being made implementing cryptoeconomic incentives to bootstrap liquidity, but there is still a requirement for initial capital. Unfortunately this process has been recaptured by venture capitalists due to the failure of the ICO boom in the last market cycle. Which was more due to implementation issues than conceptual ones. DeFi in order to thrive needs to find a way to allocate capital to new protocols that creates strong alignment across all parties. There is some success here already with protocols like Nexus Mutual. Like DAO’s in 2019 I believe decentralised investment will make a resurgence at some point in the next ten years with ideally more structure and alignment between teams building protocols and those bootstrapping them with early capital. This is highly speculative and it’s possible the previous paragraph will not age well for any number of reasons. But it is hard to see how we can truly fulfill the promise of DeFi without alleviating the need for each new DeFi team to decamp to Sand Hill Road for a week. Until that is the case a significant barrier to entry will remain and reduce competition.

The implications of composability

The final aspect of DeFi to consider is the implications of composability—the ability to connect DeFi protocols permissionlessly. The ability to combine two distinct services to get a novel third service obviously exists today—firms form partnerships and joint ventures all the time, but these structures take months or years to be finalised. With DeFi we see protocols merged over a weekend at a hackathon. Probably the best example of this is InstaDapp, which created a bridge between Maker and Compound, two lending protocols, and in so doing increased the efficiency of the entire lending market, in a weekend. This is truly uncharted territory, and one of the aspects of DeFi that is hardest to predict the implications of. What is already clear though is some of the most exciting products and services will be created through combining two or even more protocols into a single interface to offer a new service for users.

A new era

There are significant challenges and uncertainty surrounding this financial revolution, because we are so early. But the promise of success is too large to demure. DeFi has the potential to usher in a new era of productivity as every single human in the world is onboarded and connected to sophisticated financial infrastructure and capital for the first time in human history. It is truly impossible to imagine the impact of a world where capital is deployed in an instant to wherever it is most needed with almost zero barriers. That vision is why we are here, so that we can hopefully live to see it as reality.

Actions

- Consider: will DeFi become more efficient than traditional finance?

- Consider: what’s holding DeFi back today—can these barriers be overcome?

Subscribe to the Bankless program. $12 per mo. Includes Inner Circle & Deal Sheet.

Author Blub

Kain Warwick is an entrepreneur and the Founder of Synthetix a money protocol for minting and exchanging synthetic assets based in the Ethereum economy. I appreciate Kain’s pragmatic yet idealistic approach to DeFi and it shows in his work—Synthetix is the first successful protocol pivot I’ve seen in the DeFi space—the Binance of DeFi as I’ve called it.

👉Send Bankless a DAI tip for today’s issue

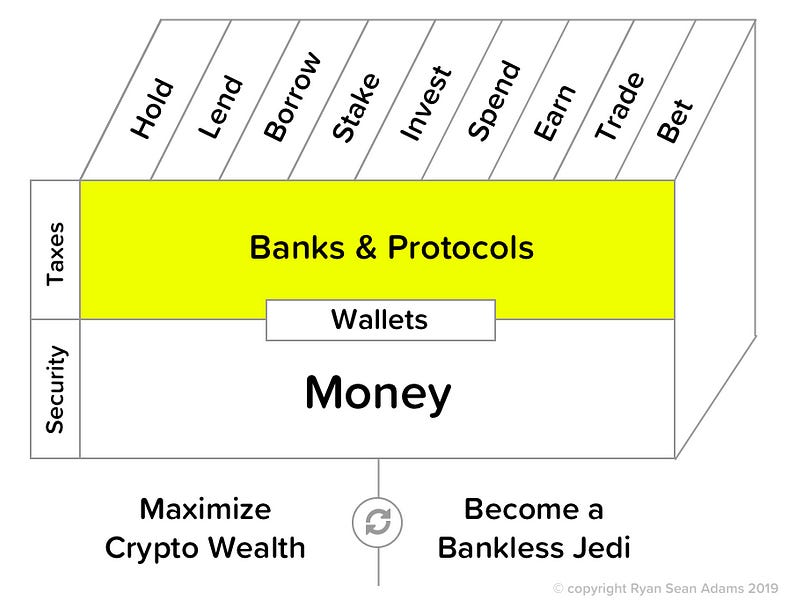

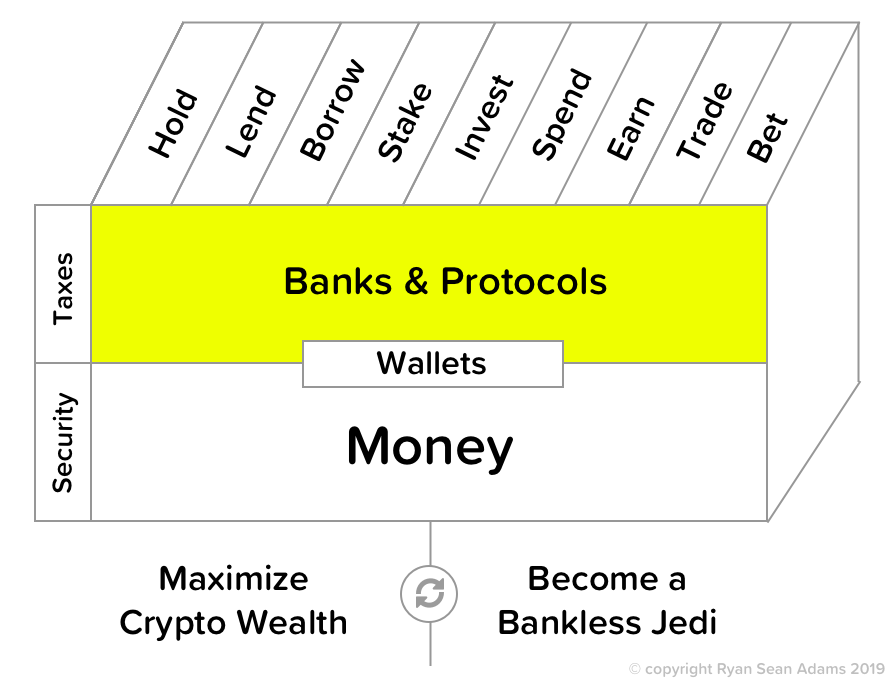

Filling out the skill cube

Focus today was on money protocols—these DeFi protocol sit on top of the crypto money layer of the skill cube. Another Thursday another level-up!

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.