How to make bank off the funding rate

Dear Bankless Nation,

We’ve learned about perpetual contracts a few times before.

These are the biggest derivatives in crypto, responsible for billions of dollars in volume every single day.

The problem? You have to get leveraged. And leverage is risky—especially when the market doesn’t go your way. You can get liquidated and you can lose money. Yikes.

But…did you know there’s a relatively safe way to earn a substantial yield on perps while maintaining market neutrality?

It doesn’t completely eliminate risks (as you still have to get some leverage), but it does give you a way to earn passive income from these widely traded derivatives products. Importantly—you can play the system so that your exposure is market neutral.

Weiting shows you a couple strategies on how to do this, even one where the current returns are upwards of 32% APY.

But please be careful! This is an advanced tactic for traders—this is not for everyone. So proceed with caution ⚠️.

Here’s how you can make bank off the funding rate.

- RSA

Tactic Tuesday

Guest Post: Weiting Chen, Growth Manager at Perpetual Protocol

How to make bank off the funding rate

In today’s tactic, we’ll learn how to earn yield from funding payments on perpetual swaps while maintaining market neutrality. Before starting, I want to point out that because the market is dynamic, the tactics mentioned in this issue might not work (as effectively) at all times. It’s all dependent on the market conditions.

Having said that, you can still learn how to achieve market neutrality and earn yield on the funding rate through multiple ways once you finish reading.

Let’s get into it.

- Goal: Learn how to earn yield from funding payments (and beyond)

- Skill: Advanced

- Effort: Variable - depending on how you achieve market neutrality

- ROI: Variable - depending on the funding rates (and other yield sources)

⚠️ Disclaimer: Leveraged trading is risky and not recommended for beginner traders. Please rationally judge your investment ability and make decisions prudently once you’re well informed about how perpetuals work. Perpetual markets are not currently available to U.S. users.

Perpetual Contracts & Funding Payment 101

⏩ Skip this section if you already know how perpetual contracts and funding payments work.

The perpetual contract is a derivative that enables you to speculate on an asset’s price without the need to hold the actual asset. Users can open a leveraged long position if they expect the underlying asset’s price (of a perpetual contract) to go up, or a short position if they expect the price to go down.

Since it’s a derivative, the price of a perpetual contract isn’t necessarily the same as the underlying asset’s spot price. That’s why the price of a derivative can keep going up if everyone opens a long position on a derivative exchange, which creates an opportunity for arbitrageurs to open short positions to push the price down.

What’s more—to further drive the price of a perpetual contract (called the “mark price”) toward the spot price of the underlying asset (the “index price”), derivatives exchanges typically adopt a mechanism known as “funding payments” to incentivize traders to take the less popular side.

Here is how funding payments work:

In a given interval (usually once per eight hours), a derivative exchange calculates the difference between the time-weighted average price (or “TWAP”) of the mark price and the TWAP of the index price. If the difference is greater than 0 (funding rate > 0), that means there are excessive long positions on the exchange.

As such, long position holders will pay shorts from their margins and vice versa if the difference is negative (funding rate < 0).

Summary:

When mark price > index price, longs pay and shorts receive

When mark price < index price, longs receive and shorts pay

🧠 Check here if you want to learn more about why the perpetual contract was invented and compare it with other derivatives. Watch the first part of this AMA if you need a basic primer on derivates in general!

What Affects the Direction of the Funding Payments

Two things that can affect the direction of the funding rate:

- The overall market sentiment toward an asset, and

- The characteristics of the trading venue

The first one should be self-explanatory—if the overall market sentiment is bullish toward an asset, the funding rate is likely to be positive because there are more longs than shorts; otherwise, the funding rate is expected to be negative.

However, the trading venue’s characteristics also play a role in determining funding payment.

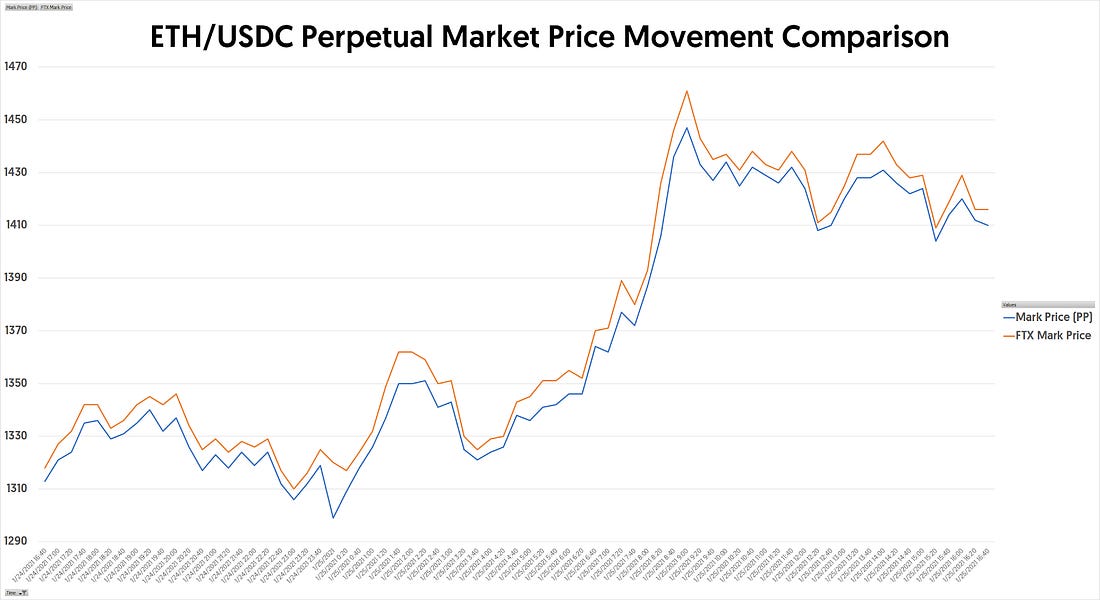

For instance, on Perpetual Protocol, despite the daily trading volume for ETH/USDC perpetual market exceeding 10M USDC, the price of the derivative is still frequently lower than that on a CEX, as the chart below shows:

My theory for this phenomenon is that Perpetual Protocol uses the constant product curve of x*y=k inside a virtual automated market maker (vAMM) to determine the price of a perpetual contract, requiring more capital to move the market price compared to an orderbook derivative exchange.

For this reason, traders are more conservative on the platform—because if a trader is too aggressive buying during a bull market, they might need to wait longer for the price to go up to a point where they would normally close their positions.

📑 You can know more about how Perpetual Protocol works by reading this Bankless issue.

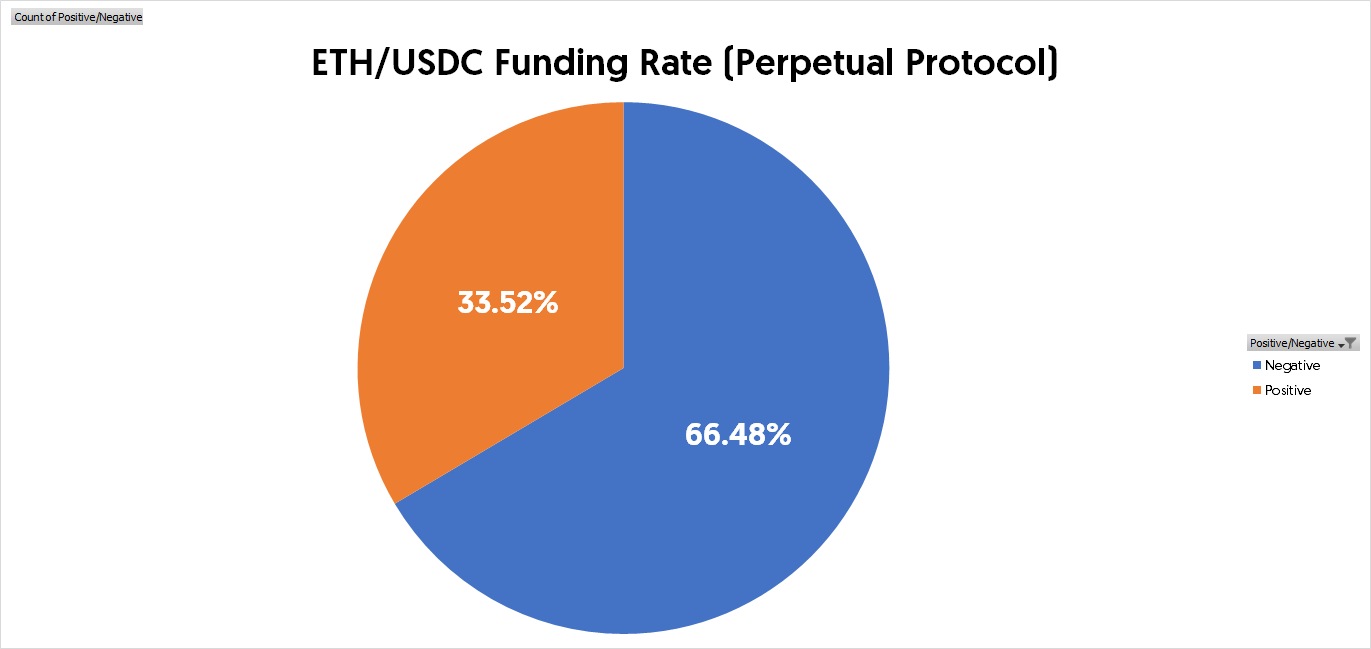

Consequently, Perpetual Protocol’s funding rate has stayed negative for most of the time since genesis. In contrast, on an order book exchange like FTX, the funding rates for the same assets are commonly positive during the bull market (see the chart below).

How to generate yield from the funding rate (and beyond)

Before diving into the following guides, it’s crucial to understand what a market-neutral strategy is.

Investopedia has a good definition: a market-neutral strategy is a type of investment strategy that seeks to profit from both increasing and decreasing prices in one or more markets, while attempting to completely avoid some specific form of market risk.

For today’s tactics, the market-neutral strategies we’ll implement are for creating a portfolio of positions whose profit and loss cancel each other out so that the investors can profit (mainly) from the funding payments.

Let’s start with an easy one.

Tactic #1: Perpetual Market & Spot Market Combo

The easiest way to achieve market neutrality is to open a position on a perpetual market with the direction that receives funding payments while simultaneously opening a position with the opposite direction on the spot market.

For instance, since the funding rates of perpetual markets on the Perpetual Protocol are commonly negative, you can open a long position via a perp and short the same amount of the underlying asset on a margin trading platform like Fulcrum or dYdX.

Remember: Shorts pay longs when the funding rate is negative.

💡 Here are some Bankless resources on how to execute this strategy:

- 📑 How to margin trade without a brokerage (dYdX)

- 📑 How to trade YFI perps (Perpetual Protocol)

If the underlying asset is too new to be listed on any margin trading platform, you can try your luck on Cream Finance, which is similar to Aave or Compound but more aggressive with their asset listings. If you can, you can sell the borrowed asset on Uniswap to cancel out your long position on the perpetual market.

On the other hand, if the funding rate is commonly positive for a perpetual market, you can open a short position on that market and buy the underlying asset on a spot market like Uniswap.

For those who want to execute this tactic: remember to take the transaction fees, interest rate from margin trading, and gas fees into consideration.

⛽ Note: Gas fees are free for all trades on Perpetual Protocol. They’re also running a transaction mining program, which rewards traders with up to 110% of their transaction fees, paid in PERP. Try that here. 🎁

Tactic #2: Two Perpetual Markets with Opposite Funding Rate Directions

As mentioned before, the funding rate on Perpetual Protocol is commonly negative, while the said rate of the same pair is typically positive on an orderbook-type exchange. To profit from this situation, traders can open a position on the respective platform with the same position size but opposite direction.

For example, when writing this, the ETH/USDC perpetual market’s hourly funding rate on Perpetual Protocol was -0.0039%, meaning that you’ll get paid if you hold a long position at the end of this hour.

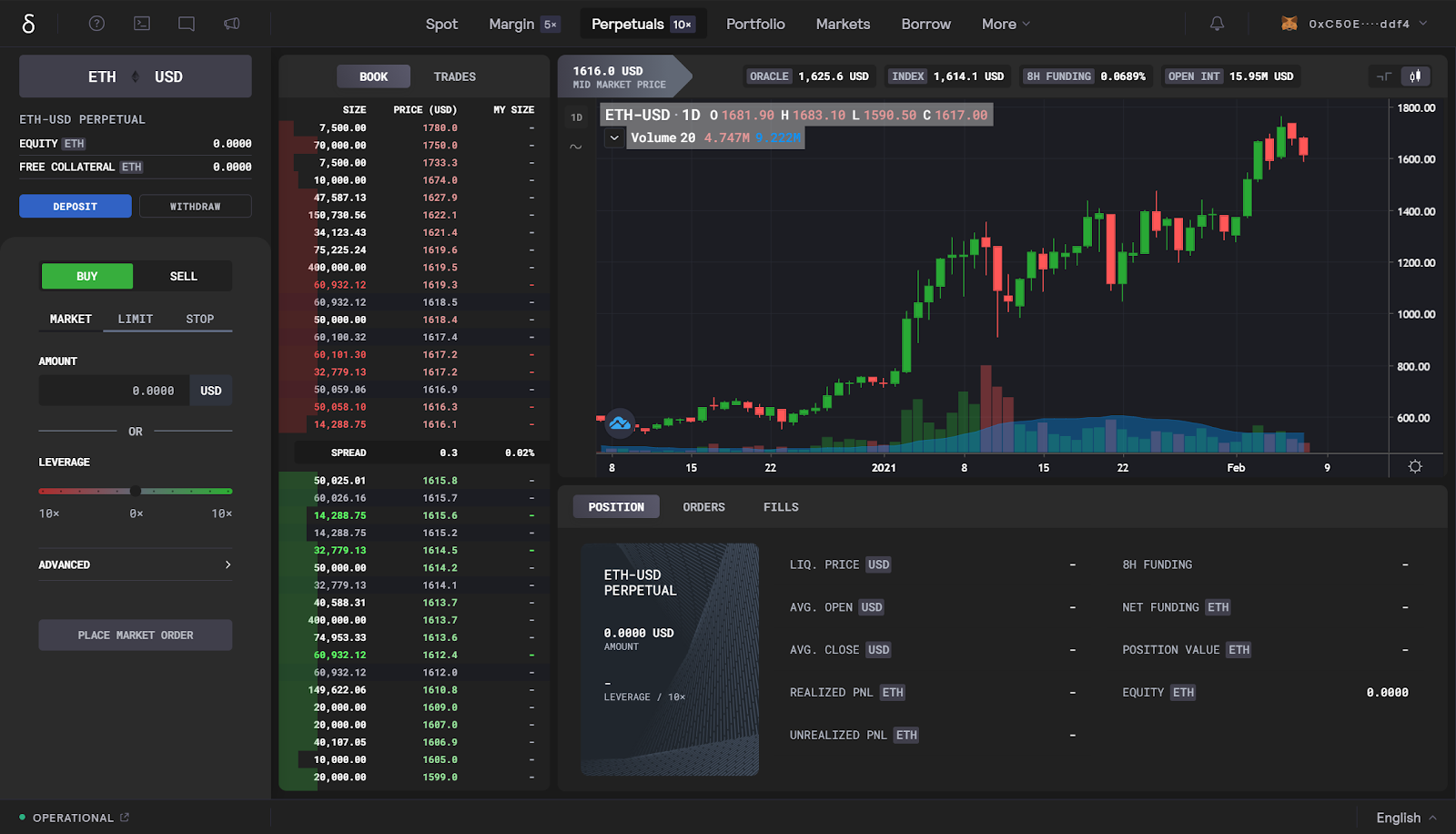

Meanwhile, on dYdX, the 8-hour funding rate for the same market is 0.0689%, meaning that you’ll get paid if you hold a short position during the funding time.

For this tactic, you can open a 5 ETH long position with 2x leverage on Perpetual Protocol and simultaneously open a 5 ETH short position with 2x leverage on dYdX. Assuming the funding rate stays the same on both protocols, you’ll cumulatively get paid 0.03% from your positions once per 8 hours, which translates to 32.85% APR.

💡 Author’s note: I used a lower amount of leverage here because I want to reduce the risk of my positions getting liquidated.

In addition to the yield from funding payments, you can also receive the aforementioned transaction mining rewards from Perpetual Protocol and maybe even a retroactive token airdrop from dydx in the following months (I’m speculating here!).

Tactic #3: Perpetual Market & Quarterly Future Market Combo

For a perpetual market whose funding rate has consistently been in the same direction, you can open a payment-earning position on the perpetual market while opening a position in the opposite direction on the quarterly futures market for the same underlying asset. By doing this, you can maintain market neutrality and still receive funding payments.

💡 There is no funding payment for traditional futures contracts.

For example, when the Filecoin perpetual market and quarterly futures market launched on FTX last November, due to its high fully-diluted valuation, the perpetual contract funding rate has been negative since day 1.

If we could go back in time, you could open a 100 FIL long position on the perpetual market and simultaneously open a 100 FIL short position on the December 28th futures market.

One question in your mind might be: “when should I close my positions?” Well, it depends on your strategy. But I would close my positions 1) when the direction of the funding payment has changed for some time, i.e., market sentiment has changed, or 2) when the quarter future expires.

Unfortunately, at the moment, this tactic can only be executed on CEXs since there are only a handful of perpetual markets on DEXs—even Perpetual Protocol, which has the most extensive collection of perpetual markets among other DEXs—has fewer than a dozen markets.

But I believe that the situation will be significantly improved this year because:

- New protocols such as SynFutures are building traditional futures on-chain, and

- Perpetual Protocol will launch a market creation feature, allowing anyone to add trading pairs, just like on Uniswap.

Tactic #4: Perpetual Market + DeFi Yield

If you’re creative enough, you can find more ways to earn yield besides just funding payments.

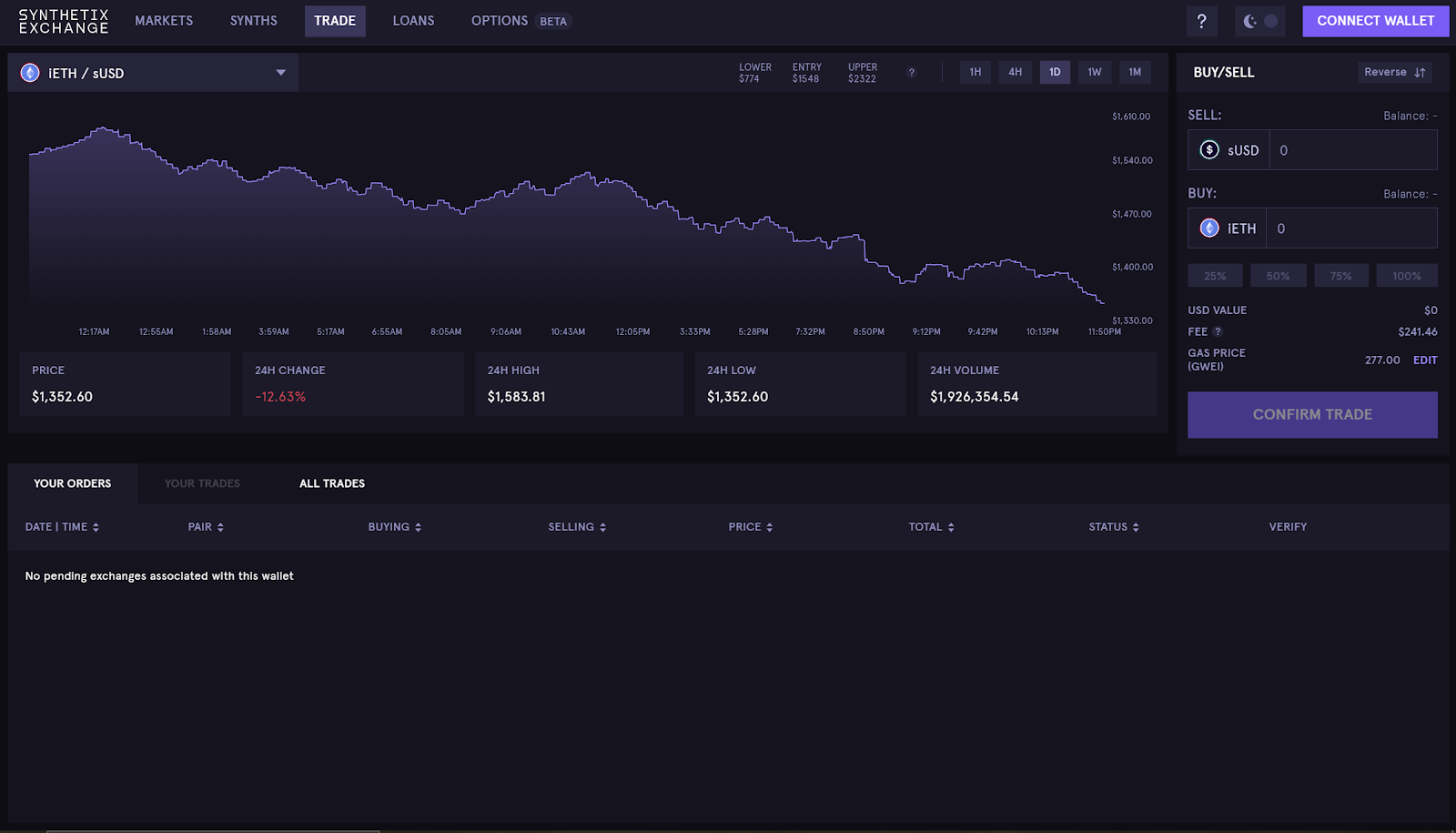

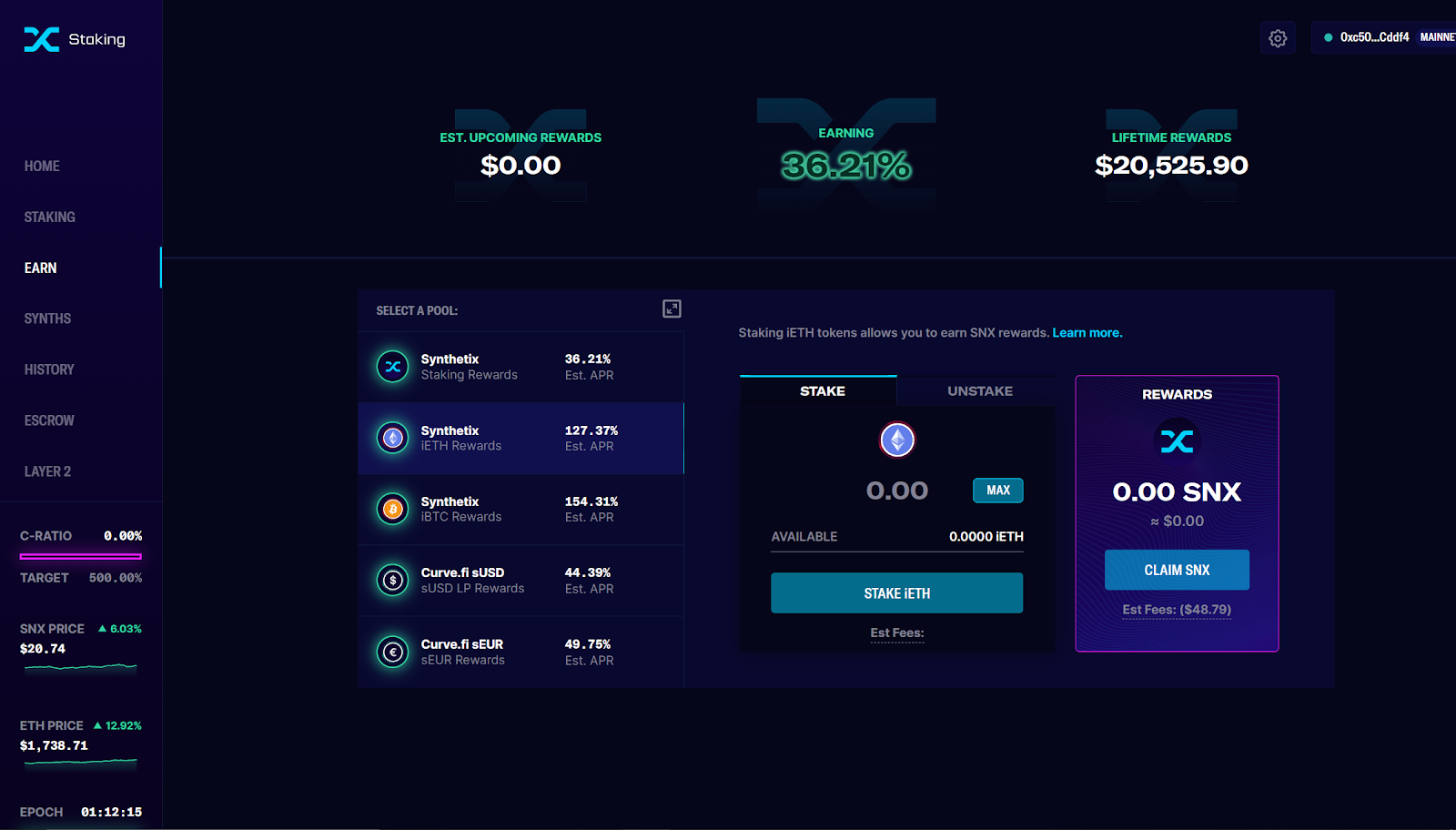

Given that the funding rates have generally been negative on Perpetual Protocol, you can combine a long position on Perpetual Protocol and a short position on Synthetix to achieve market neutrality.

Using this combo, you can receive:

- Funding payments from your long position on Perpetual Protocol,

- Up to 110% rebates on transaction fees (in PERP) from the transaction mining program, and

- SNX rewards from your short position on Synthetix.

Let me use the previous example to explain this tactic in detail.

Today the funding rate on the ETH/USDC perpetual market on Perpetual Protocol is -0.0039%, so you should open a long position to receive funding payments.

Let’s assume you open a 1 ETH long position with 2x leverage here. Again, small leverage to reduce the risk of the position getting liquidated.

Then you go to Synthetix exchange to get 1 iETH, which inversely tracks ETH’s price (inverse as in if the price of ETH goes up 1 USD, the price of iETH drops 1 USD).

💡 You need sUSD to trade on Synthetix exchange. Curve is a great place to do it if you’re in need!

Once you receive your iETH, your combined positions should be market neutral - if ETH goes up 1 USD, your long on Perpetual Protocol profits 1 USD, which negates the 1 USD loss from the iETH on Synthetix. As the last step, you need to go to Synthetix’s earn page to stake your iETH token, for which you’ll receive rewards in SNX. The current APR for iETH staking is over 100%.

Closing Out

There’s plenty of ways to leverage the funding rate to earn a return while also having neutral exposure to the market.

Whether it’s executing more basic strategies like a perpetual market + spot market combos, trying to play both sides of the funding rate on different platforms, or even leveraging other DeFi protocols like Synthetix, there’s a way for you to earn a yield.

However, it’s important to recognize that some of these strategies are only viable doing certain market dynamics (like which direction the funding rate is going) and not available at all times.

Regardless, once you have a deep understanding of how funding rates works and the underlying market dynamics, there’s usually a way for you to play the funding rate to your advantage.

Just be careful as trading with leverage is risky—you can get liquidated!

Action Steps

Go long or short w/ BTC, ETH, DOT, LINK, SNX, or YFI perp (try on testnet first)

Read previous Bankless resources on perpetual contracts

Author Bio

Weiting Chen, Growth Manager at Perpetual Protocol. Before being one of the Perpetual Protocol’s members, he led a project in a CEX based in Bangkok to build a digital bank with interests coming from various DeFi protocols.