How to lend crypto to institutions

Dear Bankless Nation,

Credit markets are essential.

But in crypto they’re hard.

Variable interest, liquidations, and over-collateralization don’t impress the credit markets of the off-chain world.

To onboard the next wave of big capital, we need to build equivalent mechanisms that emulate the predictability of off-chain credit markets while retaining the values embedded in decentralization.

Maple Finance is one of the projects pioneering this area. They’ve built a decentralized credit market where anyone can deposit USDC to earn interest.

On the other side of the market, verified creditworthy institutions can borrow capital from the pool, where they stake their reputation against the loan—just as in traditional finance.

Now we can use DeFi to lend to corporations. Kinda cool.

Let’s dive in.

- RSA

How to lend to companies using Maple Finance

Maple Finance is an undercollateralized corporate lending protocol built on Ethereum. The project connects crypto liquidity providers from around the world with creditworthy companies seeking transparent, on-chain loans.

This tactic demonstrates how you can lend through the decentralized credit market as you please!

- Goal: Learn how to lend through Maple

- Skill: Intermediate

- Effort: 1 hour of research

- ROI: ~20% aggregate pool APY currently

Why Maple Finance?

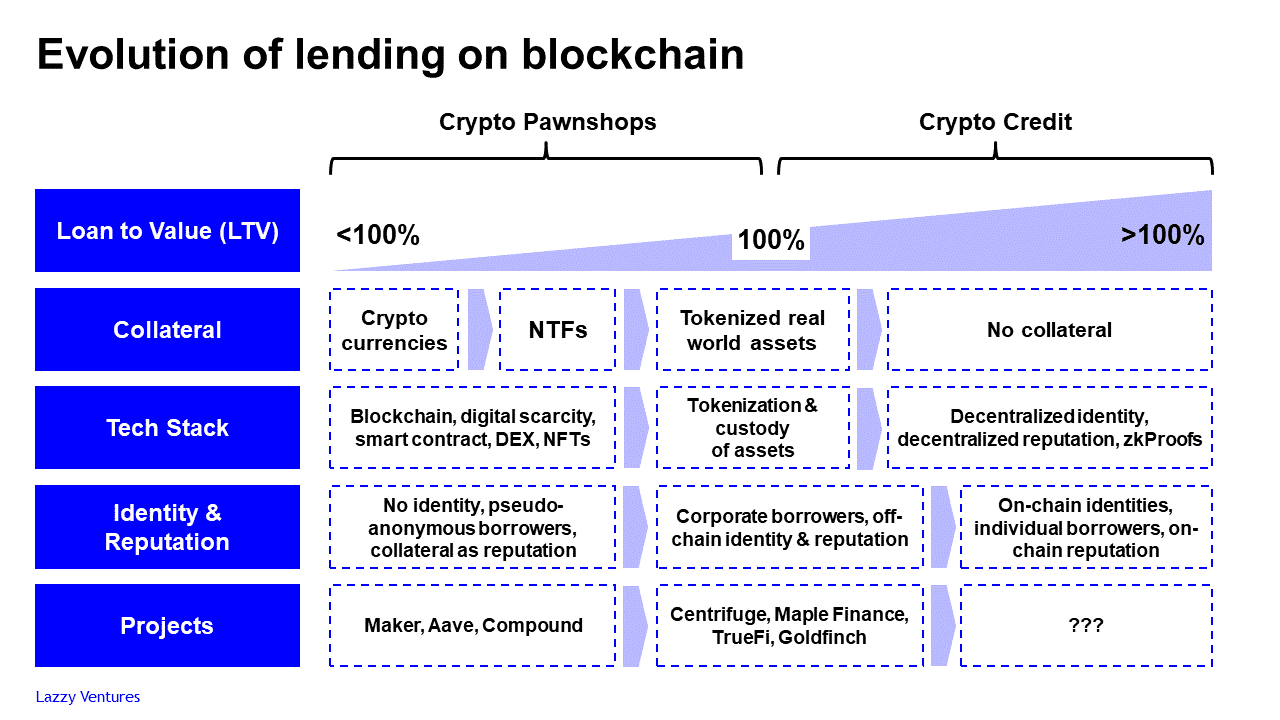

Back in May, Bankless published a guest submission from Roman Buzko of Lazzy Ventures titled “The Evolution from Crypto Pawn Shops.”

In that post, Buzko noted the early DeFi lending scene has been dominated by overcollateralized lending—depositing more collateral than is borrowed. This is the pawnshop model, in other words, you can deposit $150 in ETH to borrow $100 DAI from Maker, like pawning an item to borrow USD in meatspace.

According to Buzko and others, the next great evolution in DeFi lending will come via credit markets. These center on undercollateralized lending, or the facilitation of loans based on creditworthiness rather than collateral.

DeFi’s evolution to undercollateralized lending is now taking off, and Maple Finance is one of its rising stars, providing a decentralized credit market for corporate lending.

Indeed, when Buzko’s post was published in May, the entire size of DeFi’s corporate lending ecosystem had yet to reach $100M. Fast forward to this week and Maple Finance now has +$100M in just one of its lending pools!

👩🏫️ Bankless lending resources

- How to take out an interest-free loan (Liquity)

- How to get a loan on your NFT

- How to open an unsecured loan from Teller

How Maple works

Maple Finance connects whitelisted institutions with lending pools populated by deposits from crypto investors like you. The companies enjoy transparent, on-chain loans, while investors earn yields for providing liquidity to the lending pools. It’s a win-win!

The whitelisted institutions you lend to include organizations like:

- Alameda Research

- Folkvang

- Nibbio

- Wintermute

- FrameWork Ventures

Most of the above are crypto native companies who use the capital for growth.

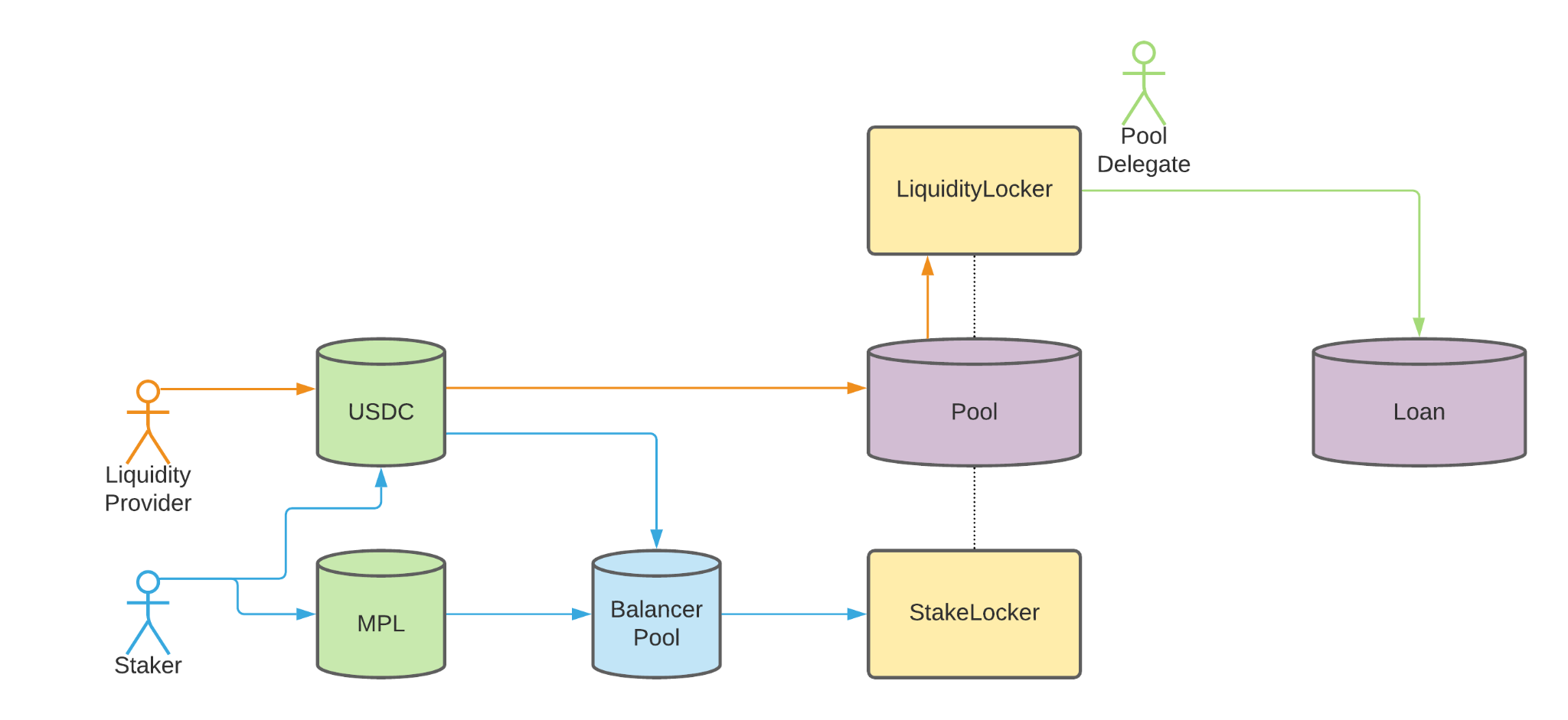

Zooming in, the key to understanding Maple is grasping how the protocol’s four main stakeholders make this corporate credit market go ‘round. These stakeholders are:

- Pool delegates — Industry pros whitelisted by Maple governance to originate lending pools. Delegates are tasked with negotiating loan terms with borrowers, performing diligence, and liquidating collateral in the event of a default. Moreover, each lending pool has a unique delegate.

- Borrowers — Companies that borrow via Maple and pay back the principal plus interest. Here, the Maple project is aiming to attract hedge funds, prop traders, market makers, exchanges, centralized lenders, crypto miners, and startups.

- Lenders — Crypto investors who provide USDC liquidity to Maple’s borrowers via lending pools. These liquidity providers (LPs) earn fixed-rate interest plus liquidity mining rewards denominated in MPL (Maple’s governance token) for now.

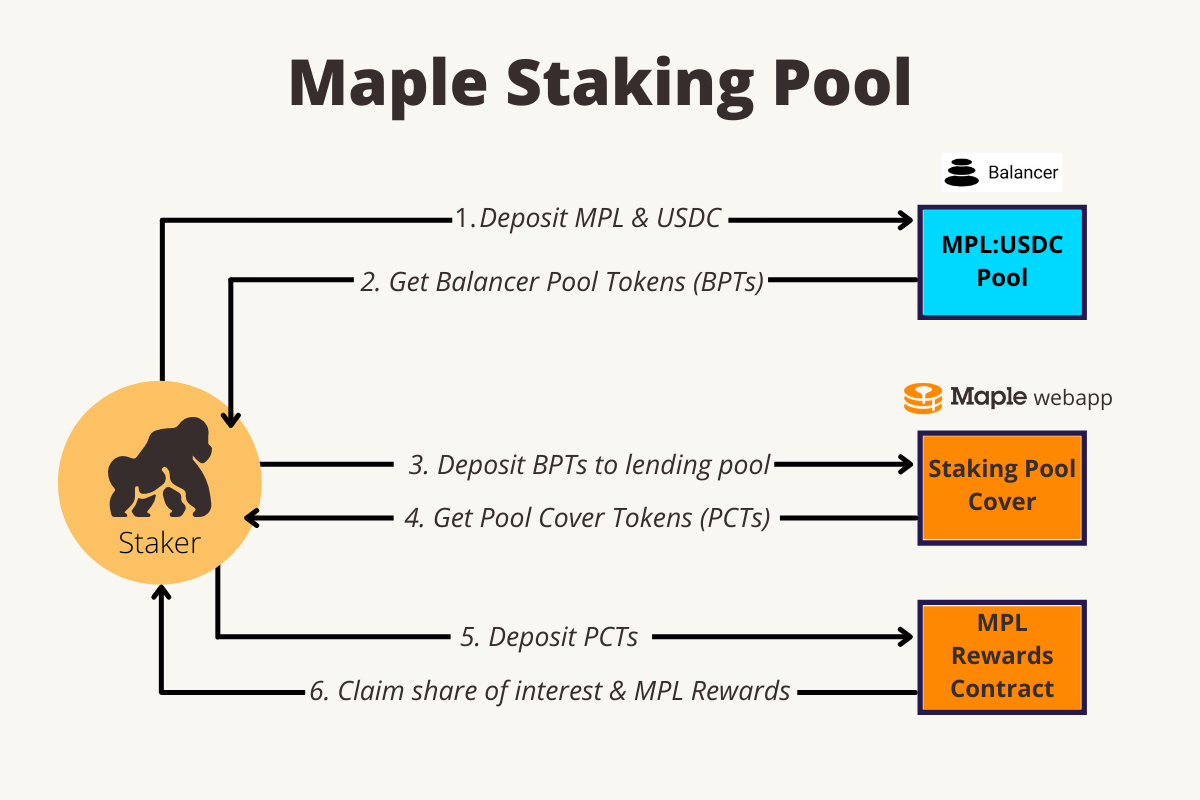

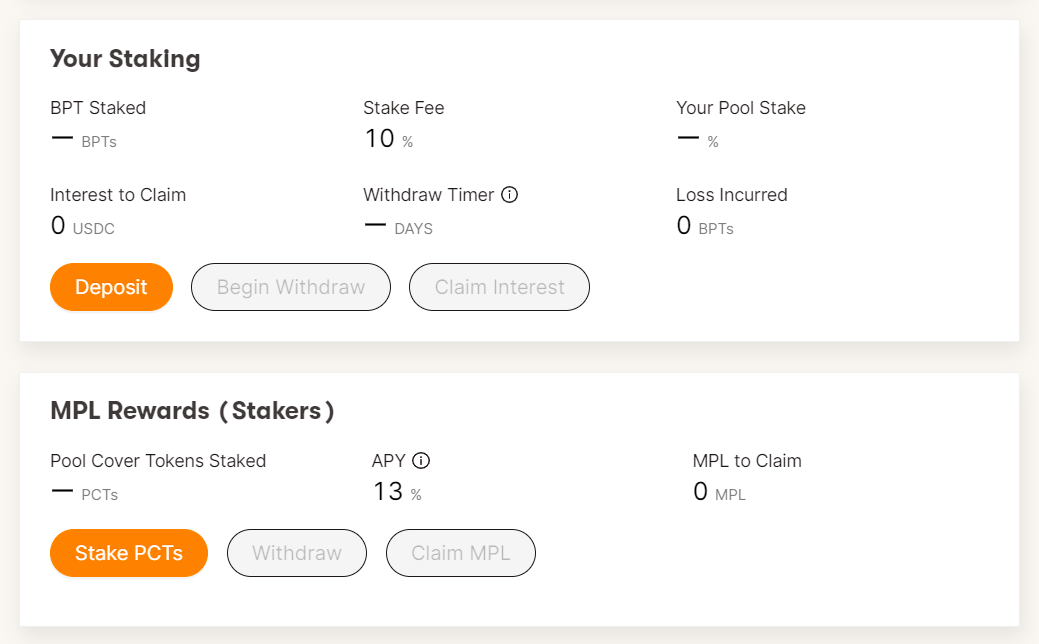

- Stakers — Users who provide USDC and MPL liquidity to Maple’s Staking Pool, an insurance-centric Balancer liquidity pool, and then stake their ensuing BPT tokens. These tokens will be liquidated first in the case of defaults to protect Maple’s credit markets, so stakers earn a cut from borrowers for providing a backstop.

How to lend on Maple

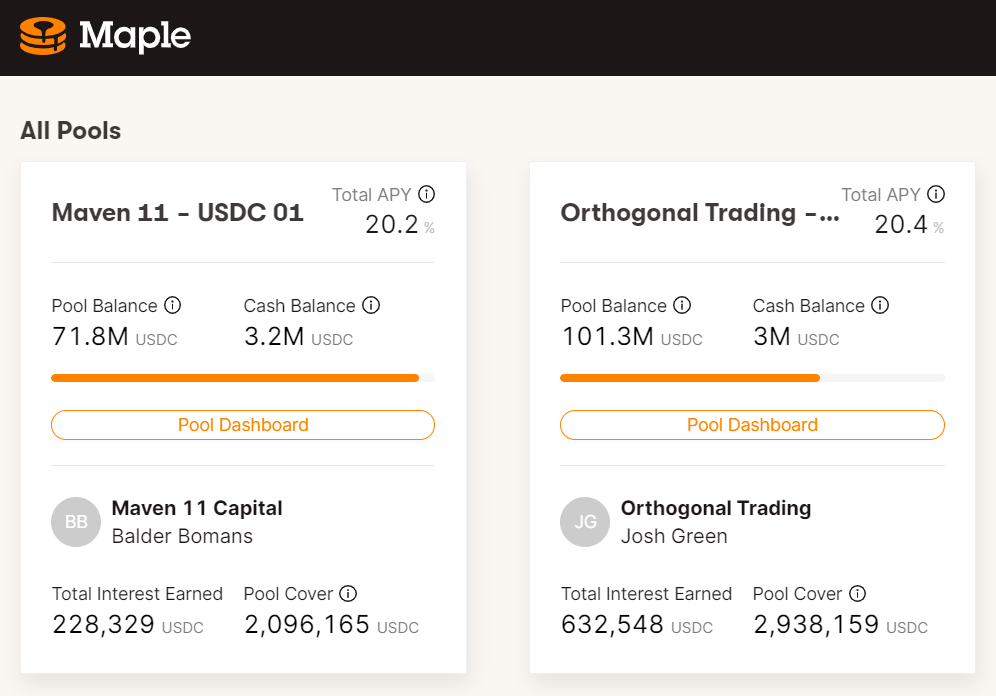

Maple currently offers two lending pools: one managed by pool delegate Maven 11 Capital (75M USDC cap, almost reached as seen above), and another managed by pool delegate Orthogonal Trading (150M USDC cap).

Both pools are currently offering depositors +20% total APYs, which come via both interest payments and MPL rewards. To join these pools you’ll need three things: ETH for gas, USDC for depositing, and a MetaMask wallet for interacting with Maple.

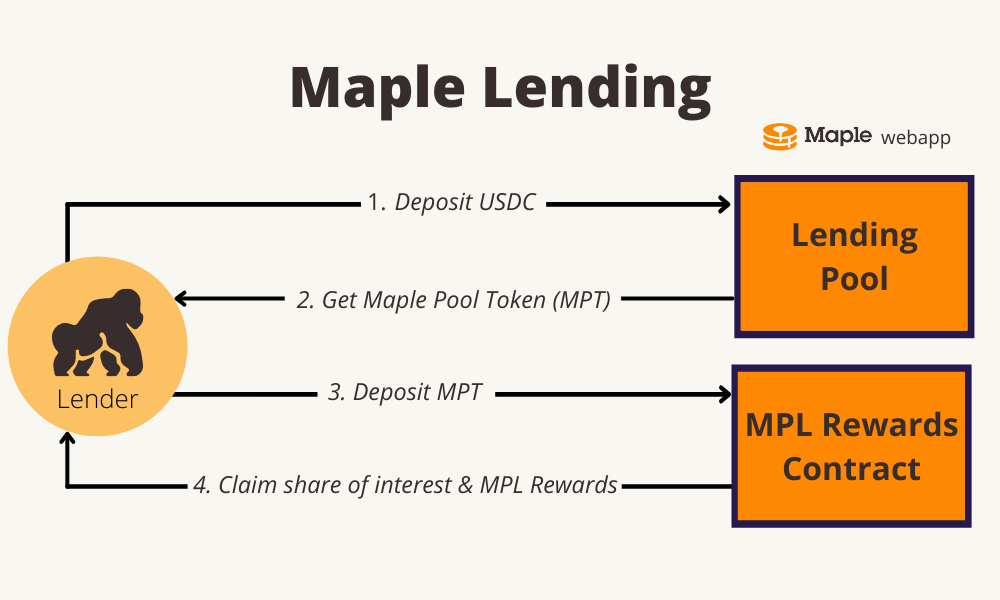

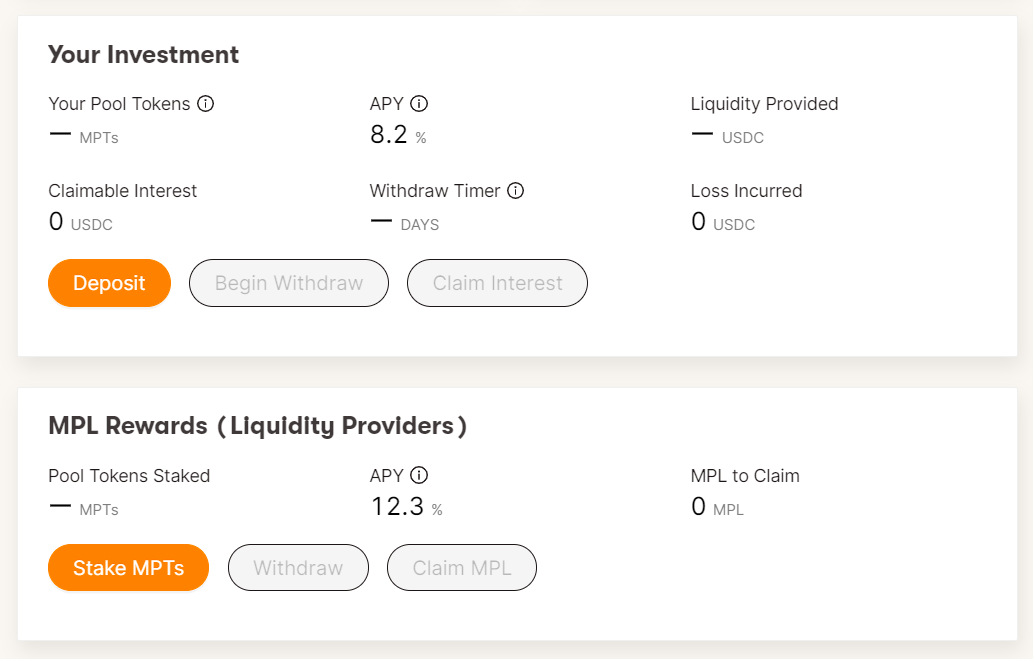

Once you’re ready to go, pick which lending pool you want to participate in and go to its dashboard. Here you’ll fire off a USDC deposit transaction and immediately thereafter receive an associated amount of Maple Pool Tokens (MPTs), which represent your share of the lending pool’s liquidity.

To finalize your claim on the interest earned by your pool + your share of MPL rewards, you would then take your MPT and stake them through your pool’s main dashboard.

The interface is demonstrated in the picture below, note the “Stake MPTs” button:

After staking your MPTs with another deposit transaction, you’ll start automatically accruing MPL rewards. You can claim your rewards and withdraw your liquidity through this same dashboard whenever you want.

Bonus: Using the Maple Staking Pool

We previously mentioned Maple’s Balancer-based Staking Pool, and how it serves as an insurance backdrop for unexpected liquidations. Here’s how you can use the pool to earn USDC yields + MPL rewards!

With this opportunity, then, you’d start by depositing USDC and/or MPL to the 50/50 Balancer pool, for which you’d receive Balancer Pool Tokens (BPTs) to track your share.

Then you’d take your BPT and stake them your Maple pool dashboard to earn interest via USDC. After you stake your BPT, you’ll receive Pool Cover Tokens (PCTs), which indicate your cut of the staking reserve.

You can stake these PCTs right below the BPT staking interface to start earning MPL rewards, too!

Conclusion

Maple Finance is a compelling early effort in DeFi’s corporate lending sector.

Now instead of having to go to a bank to get a business loan companies can opt instead to go to the people — namely the crypto-savvy depositors underpinning Maple’s lending pools — to get more working capital. On the flip side, LPing on Maple is just the latest yield avenue for DeFi’s vanguard.

Are these syrupy yields but a taste of the very on-chain future that’s to come?

We’ll see, but it’s starting to feel that way as we watch projects like Maple rise.

Action steps

- 🥞 Check out Maple’s “How to lend” guide

- 👀 Check out Maple’s “How to stake” guide