How to take out an interest free loan

Dear Bankless Nation,

Borrowing against your ETH can be an effective way to leverage your capital.

Of course you have to manage your position so you don’t get liquidated (95% drops have happened). But tapping into the value of your ETH can useful if managed properly.

The problem: most DeFi protocols today require you to pay an interest rate ranging from 3% to 10% per year. And these rates can change any time! I saw people take out Maker loans in 2018 at 2% who were caught by surprise when their loans jumped to 20% at times during 2019 and 2020.

These loans also require high over-collateralization, usually between 130 to 150%, meaning you can only borrow against a fraction of what your ETH’s worth!

Liquity is a lending protocol aiming to solve this. It allows anyone to take out an interest-free loan against their ETH in the protocol’s native crypto dollar, LUSD. Instead of paying the interest, you pay a one time borrowing or redemption fee when you open or close your position.

And the protocol has seen some serious success in short time. Since launching in early April, there’s nearly 1M ETH already locked up in the protocol while LUSD climbed to the 6th largest stablecoin on the market.

Even though Liquity is only a couple months old, it did survive last week’s market crash—a nice first test of the protocol’s resiliency!

This is a more capital efficient way to borrow against your ETH.

So let’s dig in.

- RSA

P.S. Watch our AMA today with Robert from Liquity to dig into this fascinating protocol.

📺 Watch our AMA with Liquity Founder Robert Lauko

Learn how Liquity is powering interest free loans for the Ethereum economy.

WRITER WEDNESDAY (Double tactic week!)

Guest Writer: Kolten Bergeron, Head of Growth at Liquity

How to take out an interest free loan

In DeFi, borrowing against your ETH can be expensive and capital intensive. MakerDAO ETH Vaults charge a 3.50% to 10% Stability Fee and require a minimum collateral ratio ranging from 175% - 130%. In other words, you pay a much higher premium for capital efficiency.

Liquity provides a cheaper and more capital efficient alternative to borrowing against your ETH. Instead of paying an expensive and variable interest rate, users pay a much cheaper, one-time fee ranging from 0.5% - 5% (most often 0.5% - 0.6% during normal times), with no additional costs and no fixed loan duration. Additionally, Liquity only requires a minimum collateral ratio of 110%*, giving you better capital efficiency and more downside protection during volatile markets.

- Goal: Borrow LUSD interest-free against your ETH

- Skill: Intermediate

- Effort: 10 minutes

- ROI: Reason about your cost to borrow more effectively, allowing you to maximize your opportunities elsewhere in DeFi.

*Writer’s Note: The 110% minimum collateral ratio is increased during a system state called “Recovery Mode”, which is out of scope for this piece.

What’s Liquity?

Liquity is a decentralized borrowing protocol that allows you to draw 0% interest loans against ETH used as collateral. Loans are paid out in LUSD — a USD pegged stablecoin while borrowers only need to maintain a minimum collateral ratio of 110%. In short, Liquity provides one of the most capital efficient and cost effective ways to access leverage against your ETH.

And users have clearly resonated with these benefits. After launching on April 5, 2021, over 1,000 Troves (positions equivalent to Maker Vaults) have been opened, attracting over 950,000 ETH locked. In that short time, LUSD has also grown to become the 6th largest stablecoin in crypto with a market cap north of $1.4B.

Without diving too deep, Liquity replaces the floating interest rates you’re used to with an upfront fee and what we call “redemptions”.

The upfront fee is paid when users borrow LUSD and can range from 0.5% - 5%. On the other hand, redemptions are the ability for any LUSD holder to redeem LUSD at face value minus a fee (1 LUSD = $1 of ETH) against the system — creating an arbitrage opportunity when LUSD falls below peg.

I’ve glossed over some details here, so I recommend reading How Liquity Replaces Floating Interest Rates if you'd like to explore further.

📺 Want to learn more about Liquity and how it works? Listen to our AMA with Robert Lauko, the protocol’s founder!

How to Use Liquity

Step 1: Choosing a Frontend

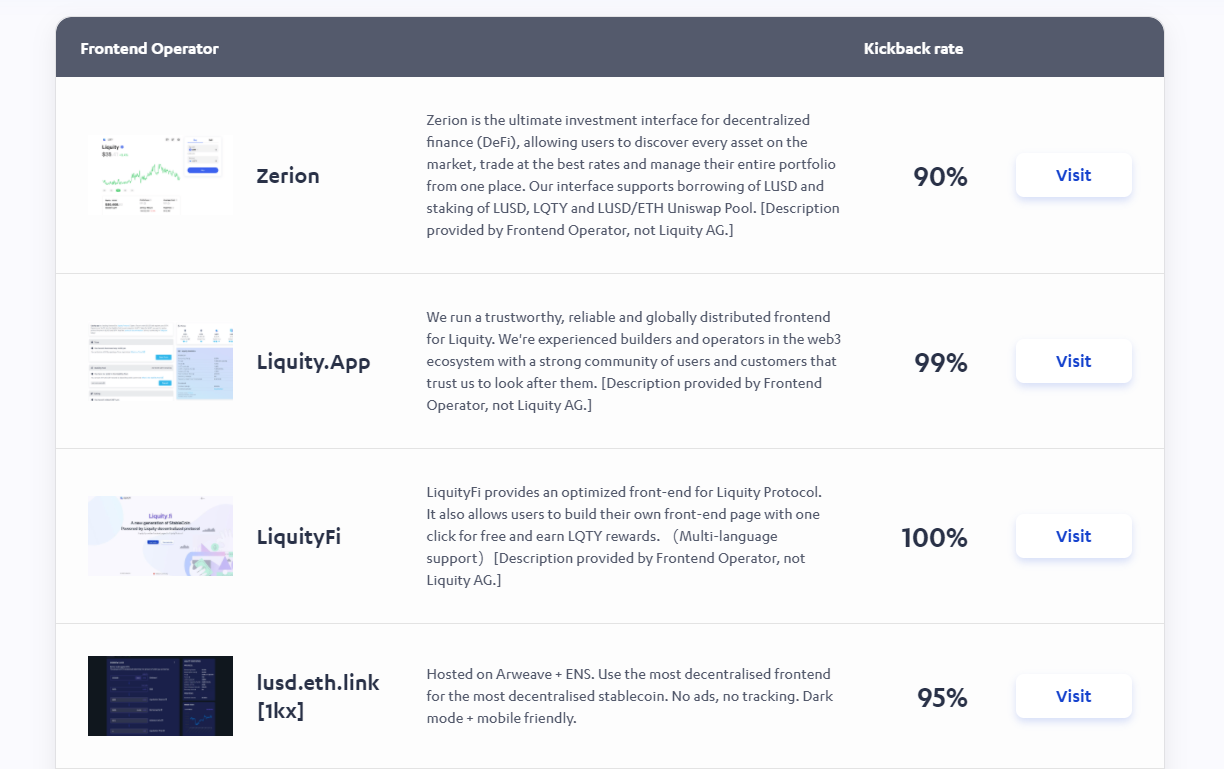

To start using Liquity, users should first visit the front end directory and choose a Liquity frontend.

This step seems a bit weird, but fear not — it’s part of Liquity’s radical approach to decentralization. All Liquity front-ends are run by third parties and are incentivized to do so via LQTY rewards. This creates decentralization at the product level in addition to the protocol level. More details here.

You can see a few frontends to choose from below:

For this tutorial, I’ve chosen to use https://lusd.eth.link/, but feel free to choose another that fits your needs. You can access your Trove from any frontend, so you can easily switch to another later.

👉 Note: A frontend’s “kickback rate” is not relevant for borrowing LUSD and only matters for Stability Pool deposits, which is out of scope for this tutorial.

Step 2: Opening a Trove

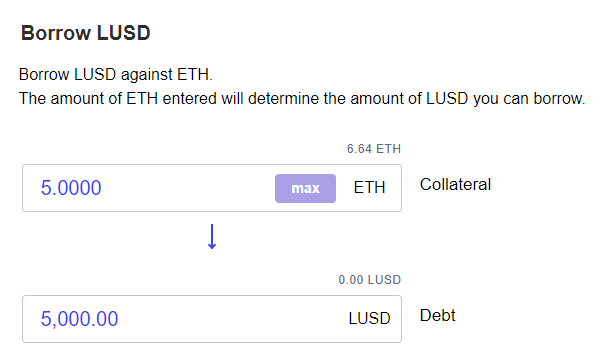

After choosing a frontend, your next step is opening a “Trove”. A Trove is where you manage your position, similar to a “Vault” in MakerDAO.

In the screenshot above, you can see that I’m opting to deposit 5 ETH to my Trove, while opting to borrow 5,000 LUSD against that ETH.

👉 Note: A minimum debt of 2,000 LUSD is required for all Troves.

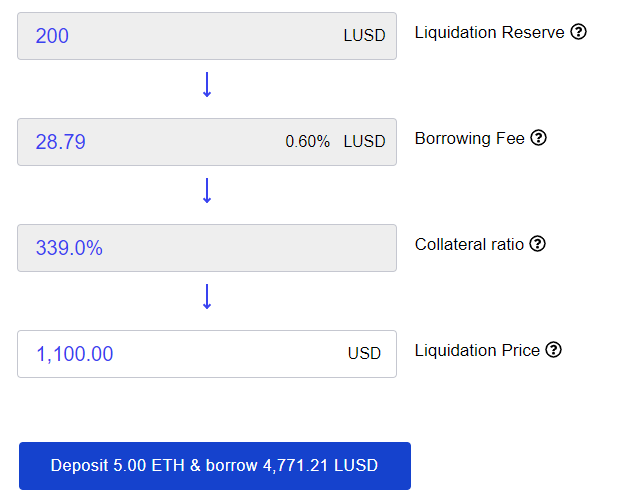

After choosing the amount of ETH you want to deposit and the amount of LUSD you want to borrow, you should see the following information:

The “Liquidation Reserve” is 200 LUSD that is set aside from your debt to reward liquidators in case your Trove goes below the 110% minimum collateral ratio and gets liquidated. This is not a fee and you “get it back” when you repay your debt.

The “Borrowing Fee” is the amount of LUSD you pay upfront for your loan. In this case, I’m paying a fee of 0.6% that goes directly to LQTY stakers.

Your “Collateral Ratio” is the ratio between the Dollar value of the ETH collateral in your Trove and its debt in LUSD. While a 110% collateral ratio is the minimum allowed, it’s not recommended due to increased liquidation risk.

The Liquity docs provide information on a “recommended'' collateral ratio here. More ETH collateral and less debt means higher collateral ratio and vice versa. To open your Trove and receive your newly minted LUSD, simply click the “Deposit & Borrow” button!

Step 3: Maintaining your Trove

Once you’ve opened a Trove, there is some maintenance required such as monitoring your collateral ratio and eventually repaying your loan.

👉 Note: There is no cost to repay your Trove’s debt and no maximum loan duration.

It’s important to remember that the lower your collateral ratio, the greater your risk of liquidation, which normally means losing all of your deposited ETH collateral.

In such an event, your Trove is closed and you keep your outstanding LUSD. To avoid liquidation, you can always increase your collateral ratio by repaying some of your debt or depositing more ETH collateral.

In order to reclaim all of your ETH collateral and close your Trove, you need to repay all of your LUSD debt (minus the Liquidation Reserve of 200 LUSD which is refunded), which can be done by adjusting your Trove’s debt via your frontend of choice.

In Closing

Liquity is a new protocol for borrowing against your ETH. Rather than paying a continuous stability fee, borrowers are charged a one time borrowing and redemption fees for their loan—meaning once the loan is taken out, you have it for free!

It’s a new way to borrow in DeFi in a highly capital efficient manner. And the success the protocol has had speaks for itself. However, like everything in DeFi, it’s risky. Hacks, exploits, and especially liquidations happen all the time, meaning you can lose what you put in. Please use at your own risk!

For the sake of brevity, I’ll refer users to some Liquity resources to further explore the protocol and Trove maintenance:

- https://docs.liquity.org/faq/borrowing

- Managing your Trove

- Understanding Liquity’s Redemption Mechanism

Happy borrowing!

Action Steps

- Watch our AMA with Liquity to learn more

- Consider taking out an interest free loan!

Author Bio

Kolten is Head of Growth at Liquity AG, the company behind Liquity — a decentralized borrowing protocol that allows you to draw 0% interest loans against Ether used as collateral.