Sushi's Sin of Betrayal

Dear Bankless Nation,

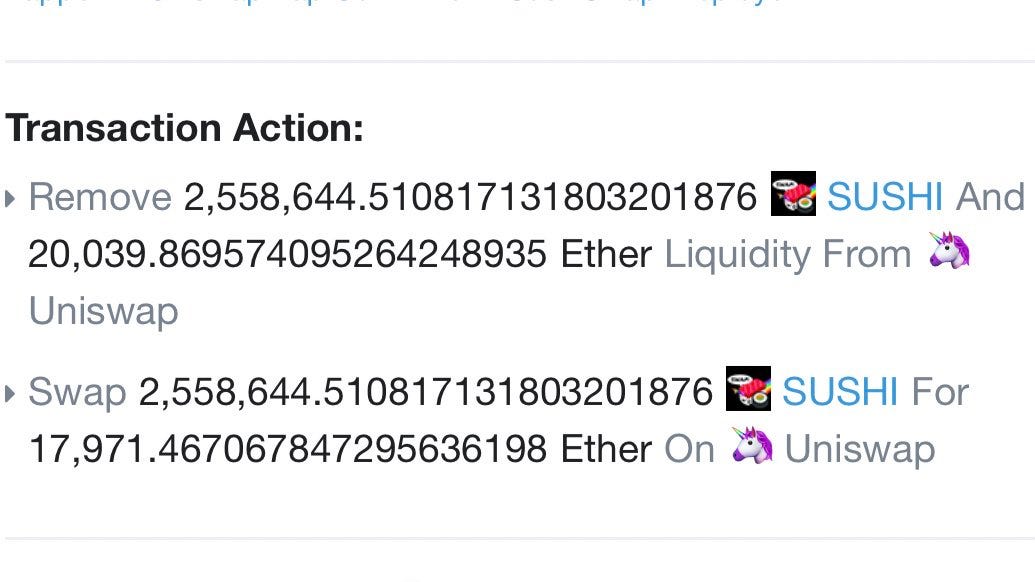

Early morning on September 5th, the anonymous creator of Uniswap clone SushiSwap market-sold all of his SUSHI, causing a significant drop in the token’s price and delivering a critical blow to both the SushiSwap community and the broader concept of Yield Farming at large.

Let’s get a few things clear.

Nothing happened that was outside the scope of the code. This anonymous founder farmed SUSHI like everyone else and decided to dump all his SUSHI for ETH. The founder did not exercise any privileged abilities that anyone else did not have access to.

However, unlike other Yield Farms out there, SUSHI had a 10% developer fund allocated to the SUSHI Dev team (a team of 1 person, the SUSHI founder) which the founder decided to treat more as a ‘founders reward’ than a ‘dev fund’, as he turned the allocation into ETH and took off with it.

Again, nothing that happened was a misuse of the code. This was not a bug, hack, or exploit of any kind.

So why did this cause so much drama and result in SUSHI losing 80% of its value?

Defecting

Every single successful protocol that has come out of the crypto space has been successful because of the community that it inspired.

Bitcoin, the original yield farm, succeeded because it garnered an avid community of stakeholders and stewards that all agreed to follow a social contract of cooperation over defection.

This entire space is defined by communities of people that chose to not defect from each other.

The reason why this yield-farming phenomenon is so cool is that it enables a new and improved vehicle of community creation. Yield Farming creates seigniorage of new governance tokens and drips them out to community members who contribute to the protocol.

What results is instant community cohesion and vitality in a way we’ve never seen before.

This was the same promise of the ICO: get ownership into the hands of many, and have the many become incentivized to be stewards and custodians of the protocol. However, the ICO mania broke down because too many people began spinning up ICOs with the intent to defect and market-dump their tokens on unbeknown trusting individuals.

That’s what happened to Sushi.

Yield Farming is a huge upgrade from the ICO, because:

- It doesn’t risk capital (except contract risk)—there’s no investment.

- It’s more difficult to capture a significant portion of the supply.

- The labor involved with farming creates long-term adherence and cooperation with the social contract of the Farm

…but at the end of the day, any farm is able to be burned from the same breakdown of incentives that broke the ICO. It’s just slightly more resistant to this outcome.

Defection

The anonymous SushiSwap founder didn’t commit a legal crime, or securities fraud, or discovered a code exploit. He used the protocol as intended.

The crime that the SushiSwap founder committed was the crime of violently breaking the social contract, and defecting from the community.

Early communities like the ones arising from these yield farms (the yEarn community, YAM community, BASED community, etc) are so incredibly fragile.

These things are in their infancy, and the only way they can develop is through the continuing, unrelenting faith, trust, and adherence to the social contract established by the farm. It’s the belief that the rest of the community will act in the best interest of the protocol.

When the anonymous founder market-dumps all his SUSHI upon the rest of the community, it is a sin of the highest order because the person that was supposed to be a leader instead defected and took everyone else for chumps.

Lessons Learned

Ameen Soleimani made a post-mortem tweet thread on this subject that is worth reading. Here are the best three tweets:

The lessons learned from the SushiSwap Rug Pull:

- Yield farming is still subject to the same pitfalls that humans have been trying to overcome since forever. While it offers a stronger foundation, it is by no means a perfect solution.

- The fundamentals of a protocol are always important to consider, but the fundamentals of the strength, faith, and robustness of the community are just as important regardless of what the protocol does.

- You don’t have to participate in this game of community creation. There are plenty of vehicles to gain exposure to the upside without getting involved directly.

- David