How to leverage yEarn to maximize yield

Level up your open finance game five times a week. Subscribe to the Bankless program below.

Dear Bankless Nation,

Andre Cronje is a mad scientist. He’s built one of the most unique and fastest growing ecosystems with yEarn. (Learn about yEarn in episode 25)

yEarn is always looking for the best yield.

You can deposit crypto dollars and it’ll automatically deploy capital into the highest earning opportunity at any given time. No work required.

The returns are pretty incredible. (The risks too! Remember…Andre tests in prod.)

You won’t find this type of stuff in your Wells Fargo account.

Let’s learn how to make bank on your dollars the bankless way.

-RSA

P.S. Weekly assignment just launched too—earn CRV as a Curve LP…here’s how. This is a direct to source alternative to using yEarn. 📺

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

We just released episode 10 of SOTN—GAMING

📺 Watch State of the Nation #10: GAMING — MONEY GAMES, YAMS NOT DED, CRV LAUNCH FAIR? MAXI’S GETTING DUMBER??

Also, we will now be live streaming State of the Nation — join us at 10am EST every Tuesday!

WEEKLY ASSIGNMENT:

Here’s our assignment from Market Monday!

Curve Finance, a decentralized Automated Market Maker (AMM), just released its new governance token CRV. To help you hop onto this new yield farming opportunity, DeFi Dad shows how you to become a Curve LP so you can earn the new CRV token.

The tutorial also includes how he considers lending idle assets with DeFi Score, how that leads him to a yield aggregator like yearn.finance, and why he eventually chose to deposit stablecoins in the yCurve Pool.

DeFi Dad walks us through the following:

1️⃣ How to compare DeFi lending rates and why yCurve made sense

2️⃣ How to deposit into the yCurve Pool and become a liquidity provider (LP)

3️⃣ How to stake a Curve LP tokens and earn CRV

4️⃣ Recap of risks

👉Check out Bankless YouTube for & tactics by DeFiDad!

👉Check out DeFiDad’s YouTube channel for extended tactics

TACTICS TUESDAY

Tactic #52: How to use yEarn to maximize yield

Guest Post: Darren Lau, Senior Analyst at The Spartan Group.

yEarn.finance is an automated DeFi yield aggregator that finds the best yields for your stablecoin (or LINK) deposits.

Anyone can simply deposit and forget it as yEarn vaults constantly find the best yield strategies for you. Every time someone makes a deposit or withdraws from a yEarn Vault, the smart contracts reallocates capital held in the Vault into the highest yielding opportunity. An automated yield optimizing money robot at your disposal.

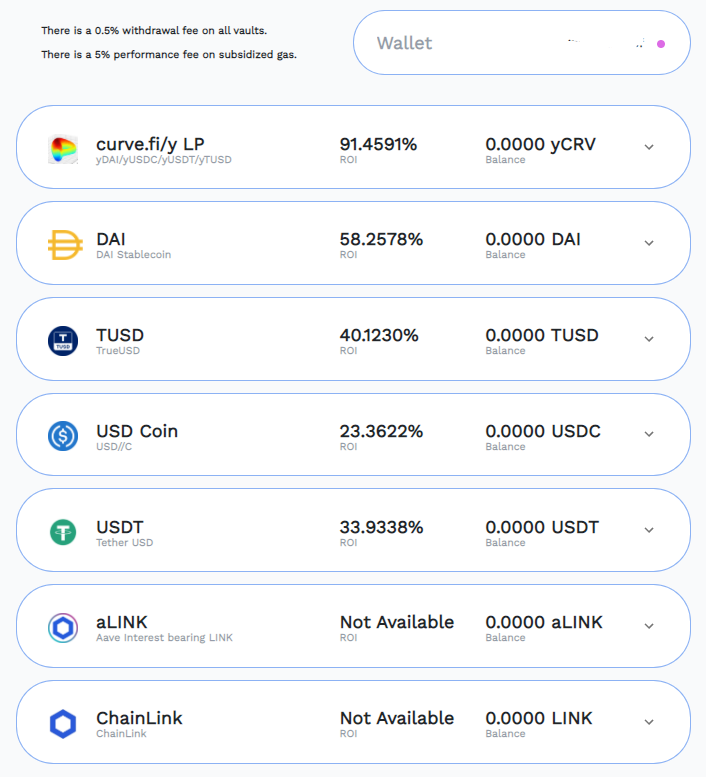

The costs are just a 0.5% withdrawal fee and a 5% performance fee on gas.

Let’s learn how to leverage yEarn to maximize your yield.

- Goal: Learn how to deposit into Curve and use yEarn vaults

- Skill: Intermediate

- Effort: 30 mins

- ROI: the best yield on the market (and saving on gas costs!)

⚠️DISCLAIMER: With returns comes risk! Like all yield farming opportunities, depositing capital into yEarn can be risky and you CAN lose all of your money. Andre tests in prod. Please be careful and only farm with what you’re willing to lose! ⚠️

Background

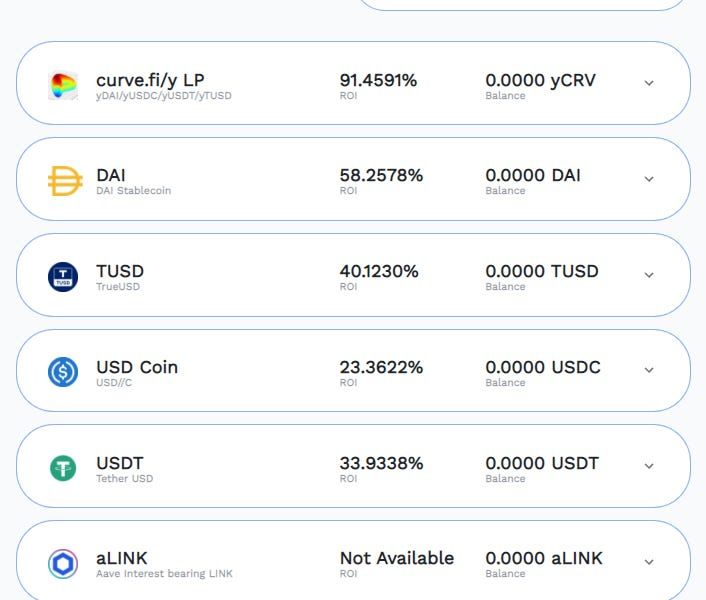

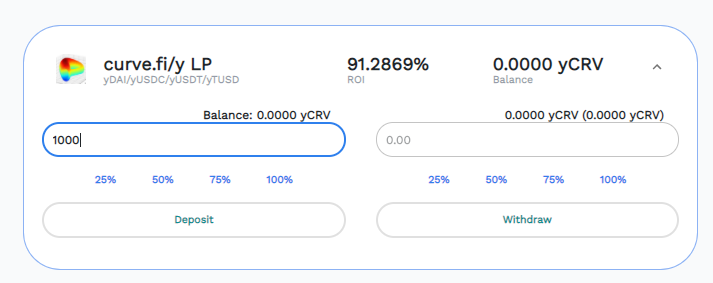

Currently, the best vault strategy is the curve.fi/y liquidity provider (LP) vault. This vault farms the CurveDAO tokens ($CRV) using y-Curve LP tokens.

Below is a screenshot of the ROIs at time of writing:

Yup that’s right—91% APY on crypto dollars. You won’t find that at Wells Fargo.

It’s possible to manually earn this rate without yEarn too. But the reason we recommend using the yEarn Vault instead of doing it yourself on Curve.fi is because the yEarn Vault automates this process and you save on the gas costs in the long run.

This strategy is excellent for those that do not have a large capital as well.

Part 1: Get yCurve tokens

You can get yCurve tokens by either:

- Providing liquidity to the Curve pool

- Buying yCRV from DEXs. You can check which markets it’s trading on here. Buying from exchanges may be good for smaller sizes depending on the liquidity in the DEX!

👉 Tip : you can also use an aggregator like 1inch.exchange to purchase yCurve tokens for the best rates across all DEXs.

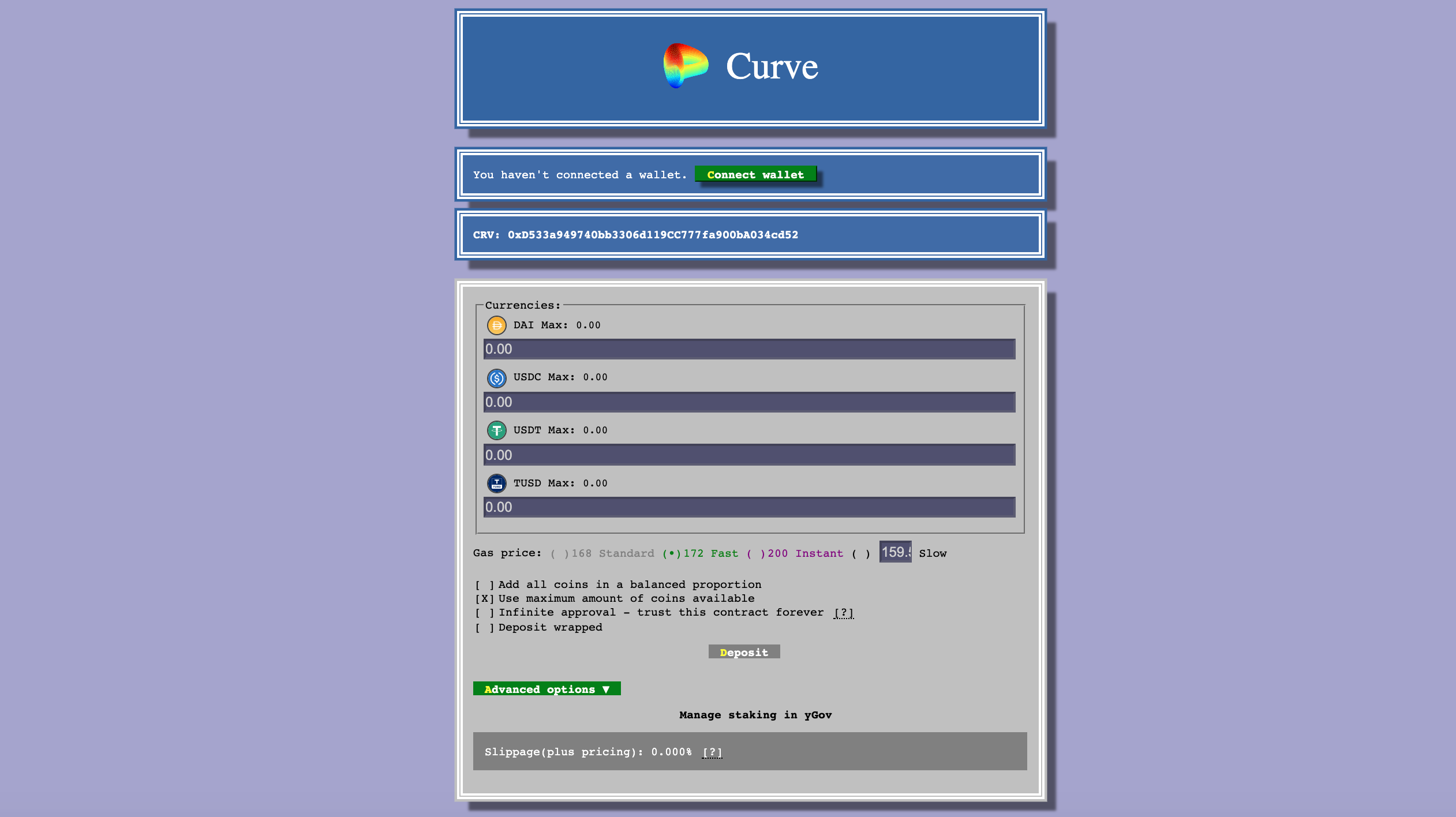

To provide liquidity to the yCurve Pool, head over to Curve.fi.

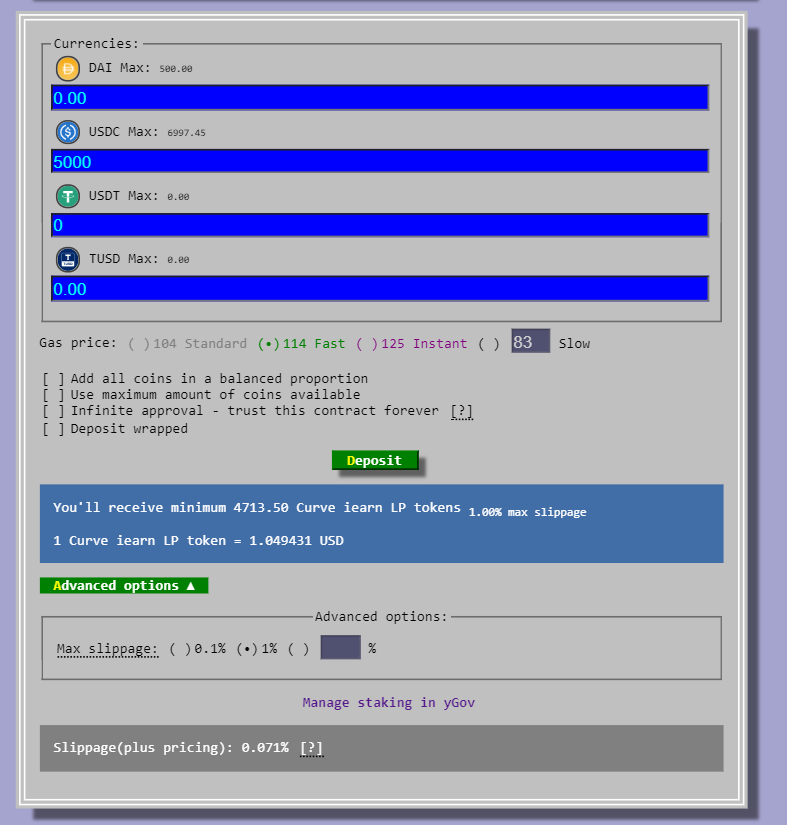

Decide how much you want to deposit in DAI, USDC, USDT, or TUSD. You’re not required to deposit an equal amount of each crypto dollar, you can just add one! Also it’s not recommended to deposit DAI right now because there’s a slippage if you were to withdraw your LP tokens to DAI.

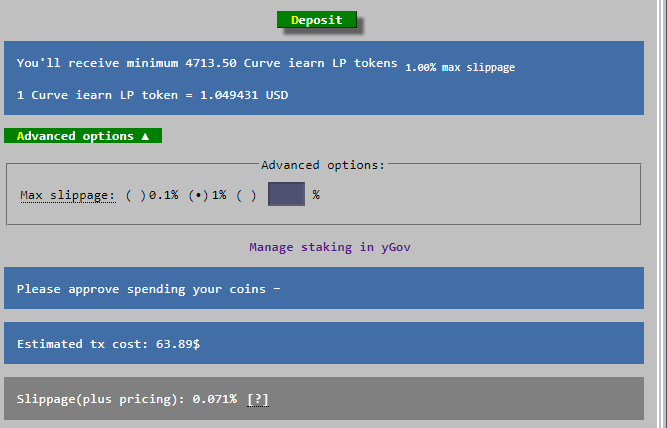

Click on deposit. There’ll be two transactions, one to approve the spending of your coins and the other to add liquidity.

You can see an estimate of your transaction costs here: ~$63.89.

📔Note : This cost depends on gas prices so you may want to do it when gas is cheaper. The high gas costs is another reason why your initial deposit should be 1 large one rather than subsequent smaller one.

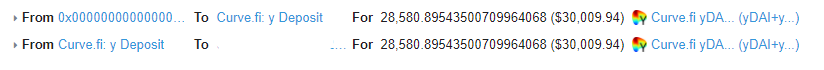

- After depositing your tokens, you will get y-Curve tokens. Here’s a snippet of a sample transaction after depositing 30,000 USDT.

📔Note: 1 y-CURVE does not equal to $1. Instead, it represents your share of the pool which you can withdraw from.

Part 2: Deposit & Withdraw yCurve into the yEarn Vault

With your y-Curve tokens, go to https://yearn.finance/vaults and select the ”curve.fi/y LP” vault.

Input the amount you wish to deposit and confirm the transactions.

Once confirmed, you’re done! You’re now earning interest!

- You can withdraw your yCRV tokens from the vault at anytime using https://www.curve.fi/iearn/withdraw or by selling it on exchanges for any crypto asset that you wish!

Summary

yEarn makes yield farming easy—especially since there’s so many projects going live virtually every day. Andre and the YFI community has created a beast of a project that finds and farms the best yield for users.

If you’re interested in learnings about which strategy the vault is deploying and the capital locked, check out this dashboard!

Author bio

Darren Lau is a Senior Analyst at The Spartan Group — an advisory firm & crypto fund. Prior to Spartan, Darren was with CoinGecko, the world's largest independent cryptocurrency data aggregator for two years. He co-authored the “How to DeFi” ebook and was one of the masterminds behind their new DeFi section.

Action steps:

Get yCurve tokens and deposit them into the yEarn Vault

Check out the other vaults for crypto dollar yield optimization

Level up on these resources:

Go Bankless. $12 / mo. Includes archive access, Inner Circle & Deals—(pay w/ crypto)

🙏Thanks to our sponsor

Aave

Aave is an open source and non-custodial protocol for money market creation. Originally launched with the Aave Market, it now supports Uniswap and TokenSet markets and enables users and developers to earn interest and leverage their assets. Aave also pioneered Flash Loans, an innovative DeFi building block for developers to build self-liquidations, collateral swaps, and more. Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.