Dear Bankless Nation,

Over the past couple of weeks we’ve been talking a lot about the Merge.

This will be the biggest event of the year in crypto. It cannot be overstated.

How do you capture upside opportunity?

Of course, one of the best ways to get price exposure to the merge is to maximize your price exposure to ETH, which you can do in a variety of ways:

But there’s another angle that Bankless hasn’t fully covered: Staking protocols.

By reducing the hardware requirements to participate in the network’s security, PoS dramatically lowers the barrier to entry to become a network validator.

Sorta.

It’s still not easy to be a validator. For one, running a full node requires 32 ETH, over $100,000 are current rates. In addition, running a node requires a level of technical expertise that most people don’t have.

To address these challenges, we’ve seen a number of staking protocols that abstract away much of the technical complexity while also lowering the capital requirements even further.

These staking protocols have already racked up billions in TVL and stand to grow massively as we continue to get closer to the merge.

But does that make their tokens a good investment?

Today, Ben breaks down Lido Finance and Rocket Pool—their market positions, protocol architectures, tokenomics.

- RSA

Anyone can be a node validator

After years of development and anticipation, Ethereum’s transition from Proof-Of-Work (PoW) to Proof-Of-Stake (PoS) is nearly complete, expected to finally be completed in late Q2 or Q3 2022.

There are numerous, wide-reaching implications that will come with the Merge.

For starters, it promises to reduce Ethereum’s energy consumption by orders of magnitude, as the network will no longer require intensive, energy-inefficient mining to secure itself.

The switch to PoS also cuts ETH issuance by more than 90%, while paving the way for future scalability upgrades such as sharding.

The impact of the Merge will also be felt at the application layer, as it is poised to catalyze the growth of Ethereum’s liquid staking services. These protocols remove the opportunity cost of staking from users, as they enable holders to earn yields while still being able to deploy their assets throughout DeFi and the broader Ethereum economy through the issuance of a derivative token.

The stakes (pun intended) are incredibly high, as due to the high barriers of entry and network effects from liquidity and integrations, liquid staking seems likely to become a winner take most market.

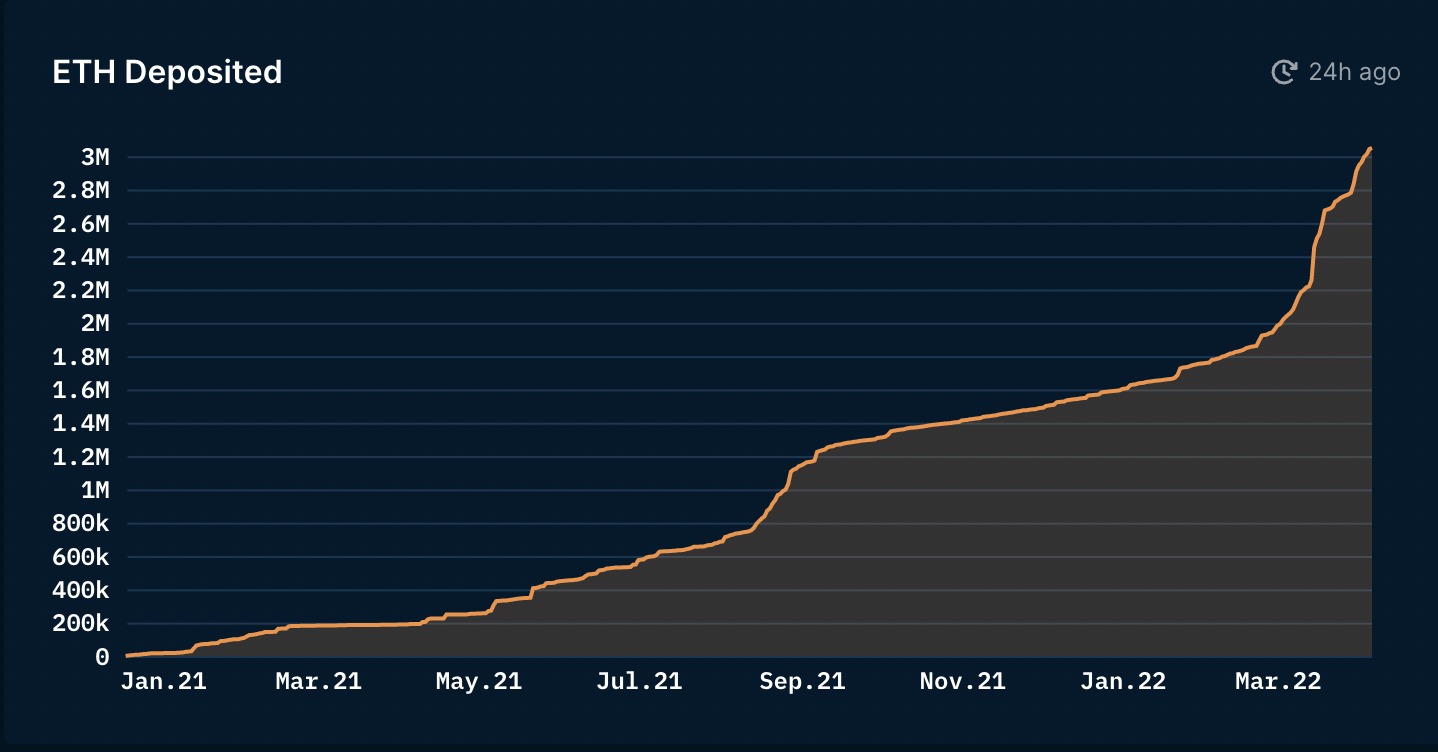

Given that there is already $10.89 billion worth of ETH staked before the Merge at a time when depositors cannot withdraw their assets, the sector seems poised to grow to tens, if not hundreds of billions in the coming years. This is not to mention the burgeoning staking economies on other fast-growing networks such as Terra, Solana, and Avalanche.

While early, the two largest players within this high upside vertical are Lido and Rocket Pool. Although these two protocols offer a similar product to their end users, they are vastly different in terms of their architecture, adoption, growth strategy, and the design of their native tokens.

This begs the question – Which one will win? And is LDO or RPL the better investment?

Let’s find out.

Protocol Design

Let’s look at both Lido and Rocket Pools architecture to see the differences and tradeoffs in each protocol's design.

Lido

For end-users, Lido is a relatively straightforward protocol. An ETH (or other L1-asset) holder can deposit their tokens to Lido’s smart contracts to receive stETH at a 1:1 ratio. stETH is a derivative that represents a claim on – you guessed—staked ETH that is distributed to validators. stETH is a rebasing token that accrues inflation rewards along with transaction fees and can be used and traded like any other ERC-20.

This provides users with increased capital efficiency and utility, as it allows holders to earn staking yields while simultaneously being able to deploy their ETH across DeFi. When Beacon Chain withdrawals are enabled post-Merge, stETH will be redeemable for the underlying ETH.

Although it is non-custodial, Lido is not a permissionless protocol. Rather, the underlying validators are selected through governance by the Lido DAO, who in turn receive a share of the revenue earned from staking. While this model enhances the protocol's scalability and minimizes complexity, and although the DAO has every incentive to act non-maliciously, it does pose a potential centralization vector by concentrating power among LDO tokenholders.

Rocket Pool

From the user perspective, Rocket Pool is like Lido: A holder can deposit their ETH to receive “rETH” , a rebasing ERC-20 derivative that represents a claim on underlying staked ETH.

Where Rocket Pool differentiates itself from Lido is through the process in which validators are selected. Rather than leave the decision in the hands of tokenholders, the protocol is permissionless. Anyone can become a node operator in the network by creating a “minipool.” To do so, a node operator is required to deposit 16 ETH, half of the 32 ETH requirement to become a validator, with the remaining 16 ETH sourced from user deposits. In addition, minipool operators are required to stake 1.6 ETH worth of RPL, which is used as a backstop in the event of a major slashing incident.

Rocket Pool’s model aligns incentives between the protocol and node operators by requiring them to stake RPL and minimizes trust assumptions by automating the process of joining the network.

That comes, however, at the cost of reduced scalability. Unlike Lido, which can perpetually distribute an unlimited amount of ETH to validators at any time, Rocket Pool's growth is constrained by the 16 ETH requirement to join the network and dependent on a continual stream of new node operators coming online.

Takeaway

While Lido and Rocket Pool may feel identical for the end-user, the two are drastically different under the hood when it comes to onboarding new validators into the network.

While it comes at the cost of increased trust assumptions relative to Rocket Pool, Lido’s model is inherently more scalable and capital-efficient, as validators are not required to match user deposits with their own stake of ETH.

Strategy & Adoption

Now that we understand how each protocol works under the hood, let’s look at each protocol’s strategy, growth, and competitive positioning.

Lido

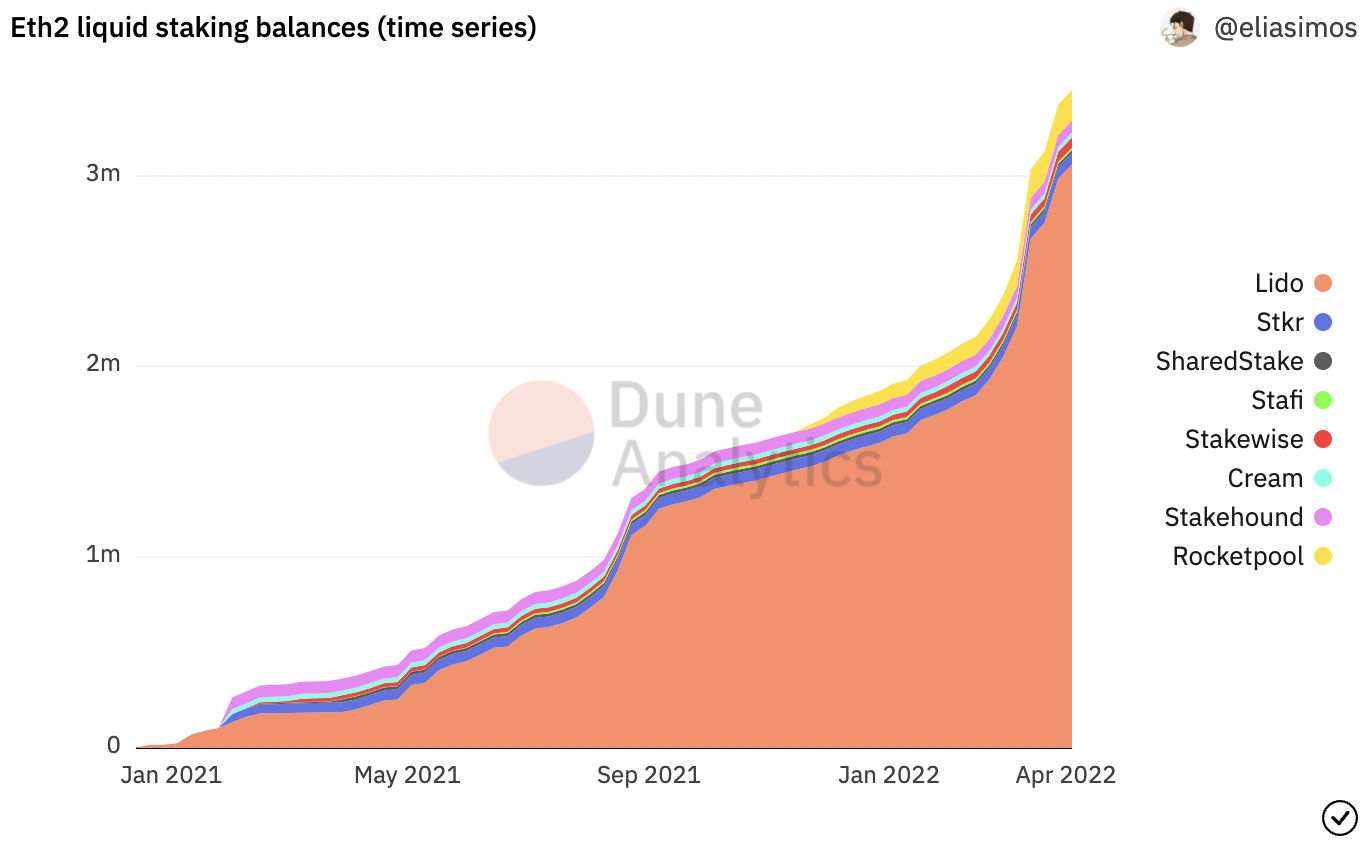

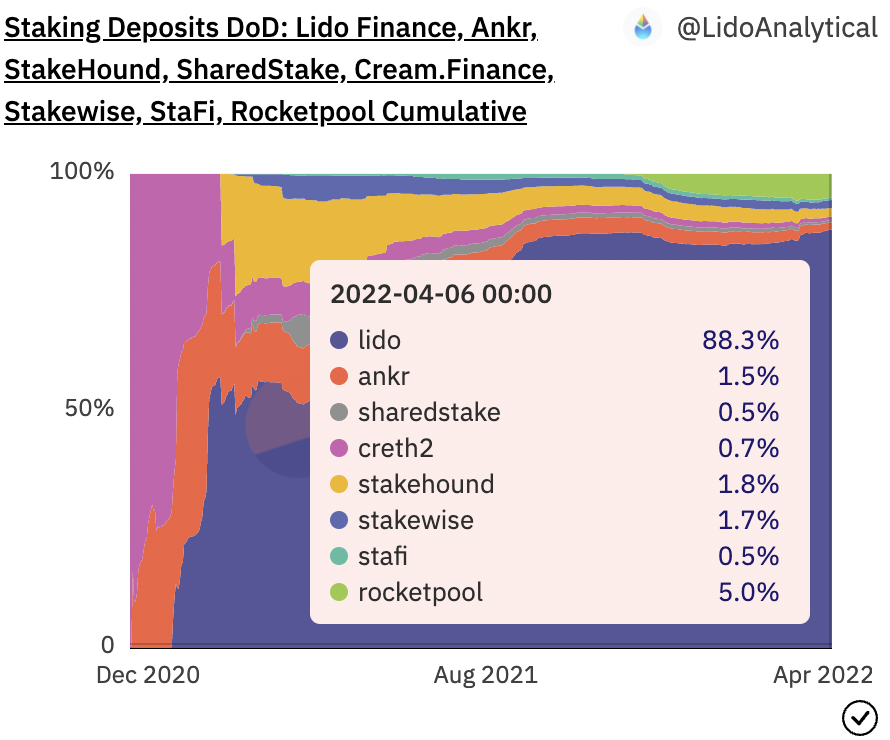

Lido has experienced tremendous growth since its launch in December 2020. The protocol has accumulated more than 3.05 million ETH from more than 33,600 unique depositors, worth roughly $10.3 billion at current prices and accounting for roughly 28% of all Ether staked on the Beacon Chain. Within the liquid staking services market, this accounts for 88.1% of all ETH, cementing Lido as the dominant player in the sector.

Lido’s success is also in part due to its pursuit of a multi-chain expansion strategy. Along with ETH, the protocol has liquid staking offerings for LUNA, SOL, KSM and MATIC, the native tokens for Terra, Solana, Kusama, and Polygon respectively. This diversification has led to the protocol accumulating $9.66 billion in deposits, with stLUNA/bLUNA as the largest liquid staking solution on Terra, with stSOL holding the second-place spot on Solana.

Due to providing LDO incentives for liquidity providers, and spending millions in bi-weekly bribes to CVX holders, Lido has also managed to establish incredibly deep liquidity for stETH on Curve, with more than $5.1 billion locked in the stETH-ETH pool. This not only increases the ease with which holders can swap back to “pure” ETH, but strengthens the token’s peg and the protocol’s network effect, establishing stETH as the largest liquid staking derivative.

As such, Lido has managed to secure numerous integrations across DeFi, with stETH able to be used as collateral on money markets like Aave and Fuse, and to mint stablecoins such as DAI.

Rocket Pool

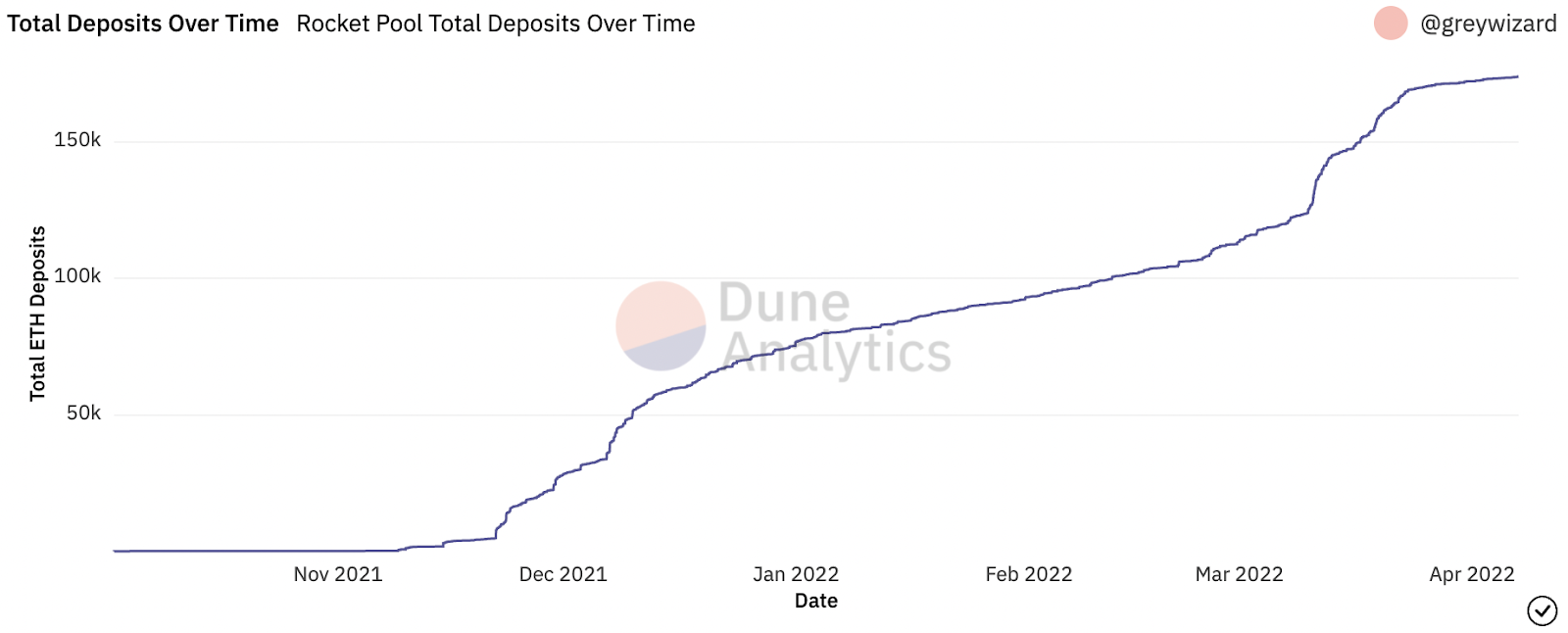

Rocket Pool launched in November 2021, 11 months after Lido, accruing north of 173,000 ETH, ~$571 million at current prices, from more than 2300 unique depositors. This works out to a roughly 5% share of all liquid staked ETH – A very distant second to Lido but more than 2x greater than the next closest competitor in StakeHound.

Unlike Lido, Rocket Pool has chosen not to pursue a multichain strategy – Rather, the protocol has chosen to focus exclusively on Ethereum. While this specialization may help the project entrench itself within this niche and endear itself to the Ethereum community, it ultimately limits the Rocket Pool’s addressable market relative to its chief rival.

Despite being live for under six months, Rocket Pool has only recently begun to see increased integrations for rETH. For instance, a recently launched rETH-wstETH Curve pool has attracted more than $126 million in TVL, despite the pool receiving no secondary incentives. This pool represents an opportunity for rETH to grow and deepen its liquidity should Rocket Pool take a page out of Lido’s playbook in providing secondary RPL incentives and/or bribes.

Takeaway

Although Rocket Pool has experienced strong growth in the months since its launch, Lido remains the clear market leader among liquid staking services on Ethereum. Furthermore, given its multichain focus, Lido has a far greater TAM than its competitors.

Token Economics

Now that we’ve gone through the differences in protocol design and market adoption between Lido and Rocket Pool, let’s look at the token design and economics of each project.

Lido

Lido is governed by the LDO token. As touched on above, currently LDO is utilized solely for governance with holders able to select node operators as well as the fee split between them and the DAO treasury. Although the protocol has generated $21.2 million in revenue over the past year, none of this is currently directed to tokenholders, as the protocol's 10% cut of staking rewards is being equally split between node operators and slashing insurance.

Although Lido has outstanding fundamentals, the token currently faces numerous headwinds in its quest to sustainably capture value. For instance, due to its lack of utility within the protocol, there is no natural demand for the token. In addition, due to being used to incentivize liquidity and pay bribes, LDO faces natural sell pressure from farmers and stakeholders seeking to lock in yields.

This lack of demand drivers to counteract emissions suggests that the token may struggle to retain value when not facing narrative tailwinds, such as it is now with the impending Merge. We may be seeing early indications of this dynamic playing out. While LDO has managed to outperform RPL over the past month over Q1 2022 (the former is up 88% compared to a 40% rise in the latter), it still finds itself 48% off all-time highs, compared to 41% for the native token of its competitor.

Rocket Pool

Like LDO, RPL is used for governance. However, as previously mentioned, the token is used as slashing insurance, with node operators required to stake 1.6 ETH worth of RPL to participate in the network.

This provides utility for RPL and ties the demand for the token to the growth of the network. As more users deposit into Rocket Pool and node operators come online, a greater amount of RPL will be required to be commensurately staked. This usage positions RPL as a commodity token with utility (albeit one with governance rights) rather than pure crypto-native equity, like LDO. The benefits of this utility helps blunt the inflationary pressure of RPL emissions that are paid out to node operators to increase their returns, thereby making it more attractive to stake on the network.

Takeaway

While Lido has incredibly strong fundamentals and seems likely to ride the narrative tailwind of the Merge, LDO in its current form may struggle to retain value over extended periods of time due to its lack of utility and buy pressure.

Furthermore, Rocket Pool has the more value accretive token design, with RPL benefiting from demand and organic buy pressure commensurate with the growth of its network.

Conclusion

Both Lido and Rocket Pool are poised to be prime beneficiaries of the boom in liquid staking.

While Rocket Pool’s design is optimized for minimizing trust assumptions, and its Ethereum focus is likely to entrench it as a top player within the sector, Lido has the clear advantage in terms of scalability, growth strategy, and competitive positioning.

Despite this, Rocket Pool has the more value accretive token design, benefiting from organic demand for the token as the protocol grows in usage, while the LDO token may struggle due to emissions with no natural buy pressure to offset it.

This leaves us with an interesting conclusion – While Lido may wind up the more successful product, it may not make for a better investment relative to RPL.

As experienced crypto investors have learned time and time again: The token is not the protocol.

Will this remain the case?