5 ways to earn fixed-rate yields on DeFi

Dear Bankless Nation,

Managing a DeFi portfolio is an active job.

How many times have you aped into a pool offering greater than 50% APYs, only to look two weeks later and see that it’s dropped down to 25%?!

That’s because many of DeFi’s yield opportunities are still dependent on token emissions and available liquidity. (PS, read last week’s guide on Sustainable Yield Farming if you haven’t!)

Other people’s activities affect your yield.

However, in 2022, we have a slew of fixed-yield products. These are your proverbial “set-it-and-forget-it” opportunities that offer stable and predictable returns.

I’ve written before about why fixed-yield is important for DeFi, but this aggregate list has me thinking about how many unique and creative methods there are for offering fixed yield!

For example:

- Element Finance splits tokens into principal and yield tokens, which trade at a discount

- BarnBridge creates tranches where fixed-yield tranches offload market volatility to variable-yield tranches

- Maple Finance lends at a fixed rate to institutions and passes those rates to retail LPs.

These allow a diversity of opportunities and risk profiles. Cheers to optionality! 🍻

Let’s learn how to earn fixed yields in DeFi.

- RSA

Volatile interest rates defined the early DeFi yield landscape, appealing to the high-risk-high-reward retail investor. But to bring DeFi to the masses, there is a blooming sector of dapps focused specifically on fixed-rate yield offerings. This Bankless tactic will demonstrate how to use 5 of these dapps to lock in stable DeFi earnings.

- Goal: How to earn fixed-rate yields

- Skill: Intermediate

- Effort: Less than 30 minutes (per project)

- ROI: Up to +12% APY depending on the opp

Fixed-rate yields and how to earn ‘em

Fixed-rate yield products are among the key pillars of the mainstream financial system. These offerings allow people and institutions to earn fixed amounts over a fixed period, like 6 or 12 months, by locking in their interest rates ahead of time.

As such, fixed income is great for determining earnings beforehand and managing your spending and saving. Now, with a maturing DeFi ecosystem, it’s easier than ever to access in DeFi. Here are 5 fixed-rate DeFi yield opportunities you can consider today!

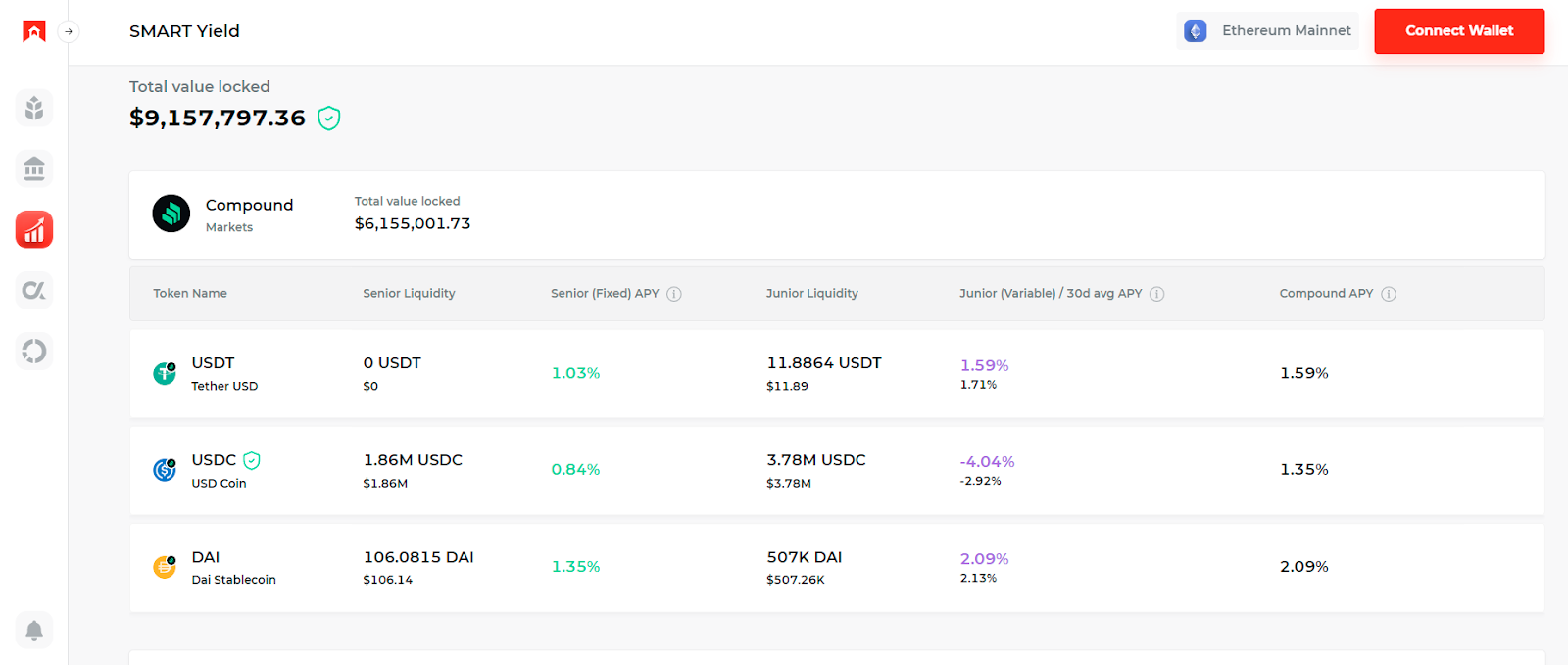

1) BarnBridge

The 101

- BarnBridge is a decentralized protocol for tokenizing risk.

- SMART Yield, BarnBridge’s flagship product, offers fixed-rate or levered variable yields on stablecoin deposits.

- SMART Yield lends these deposits throughout DeFi and tranches the yields into senior bonds (NFTs called sBonds) and junior bonds (ERC-20s called jBonds).

- Both sBond and jBond holders can be profitable simultaneously, though jBond holders are responsible for covering any shortfalls created by market action. Accordingly, sBond returns are fixed income, while jBonds offer higher-risk, higher-reward opportunities.

- ✋ Read our full tactic on BarnBridge!

Earning fixed yield with SMART Yield (up to 1.7%)

- Go to the SMART Yield overview page and connect your wallet

- Select from the available markets (Aave and Compound) and click on your desired stablecoin (USDC, DAI, etc.)

- Click “Deposit,” select the Senior tranche option, and read the provided warning to make sure you understand the process.

- Next input your desired deposit amount and maturity date and then click “Enable” to approve BarnBridge to access your funds.

- Press “Deposit” to finalize your deposit, after which you’ll receive an sBond NFT and start earning fixed income! Note, this NFT is what you’ll use to redeem your principal and interest on your bond’s maturity date via the SMART Yield app.

- ✋ Read our full tactic on BarnBridge!

2) Element Finance

The 101

- Element Finance is a decentralized protocol for fixed and variable yield markets.

- Element lets users split the underlying asset, e.g. ETH, of a yield-generating position into two fungible tokens, a principle token (PT) and a yield token (YT).

- A PT represents the value of the base principal, e.g. ETH, and is redeemable after the token’s term period concludes. Before this period ends, the PT trades at a discount to its base asset.

- However, a PT’s value eventually converges on a 1:1 basis with the underlying asset, so buying a discounted PT prior to maturity offers a fixed rate of yield if you hold the token to its redemption date.

- ✋ Read our full tactic on Element Finance!

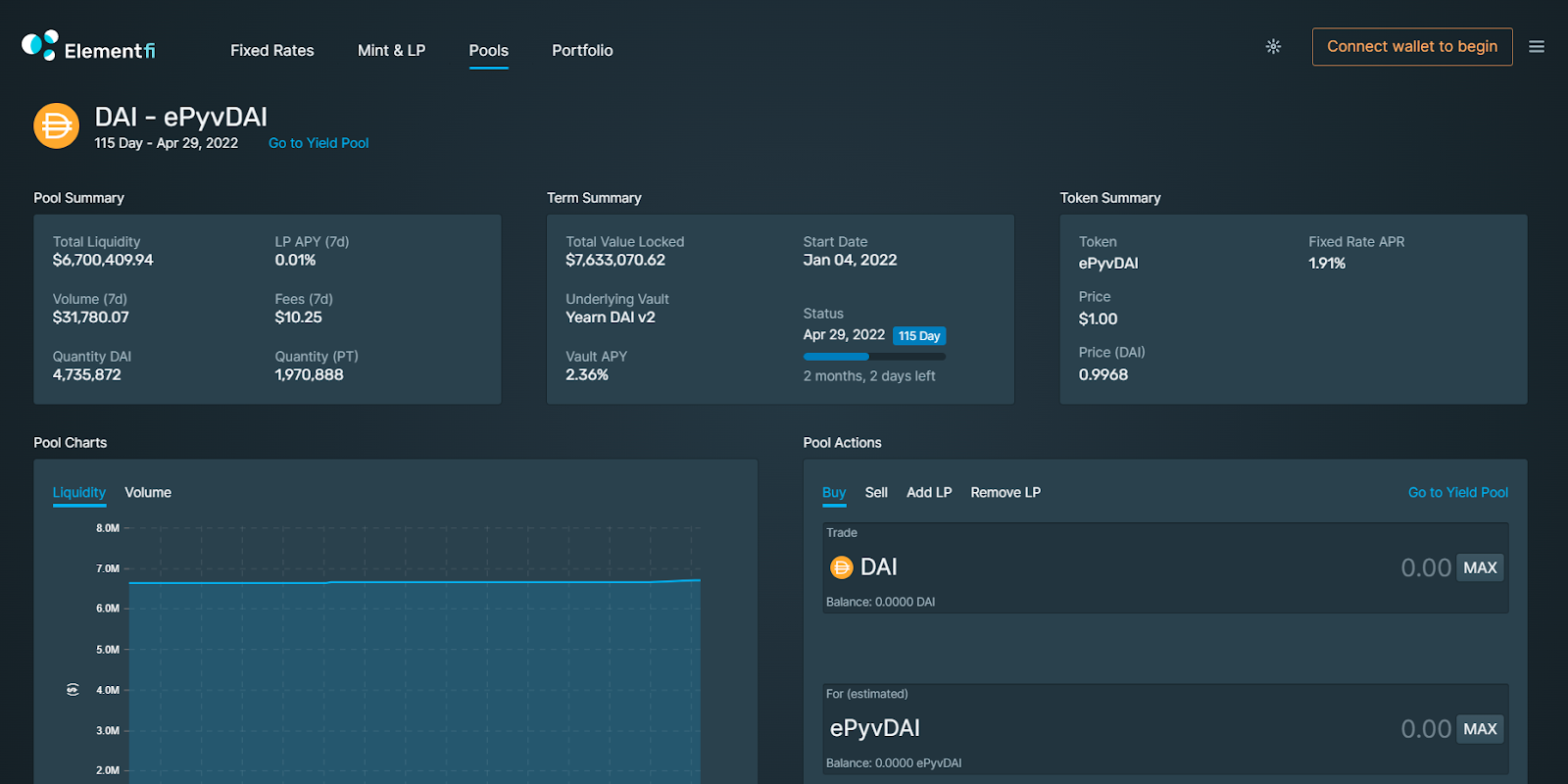

Earning fixed yield with principal tokens (up to 14.6%)

- Go to Element’s Pools page and connect your wallet

- Review the available PT pools and click on your desired option

- In the Buy UI of the Pool Actions menu, input how many PT you’d like to purchase and press “Buy”

- Confirm the purchase transaction with your wallet

- Voila! You can now track your position through Element’s Portfolio page and later redeem your PT profitably once the maturity date is reached

- ✋ Read our full tactic on Element Finance!

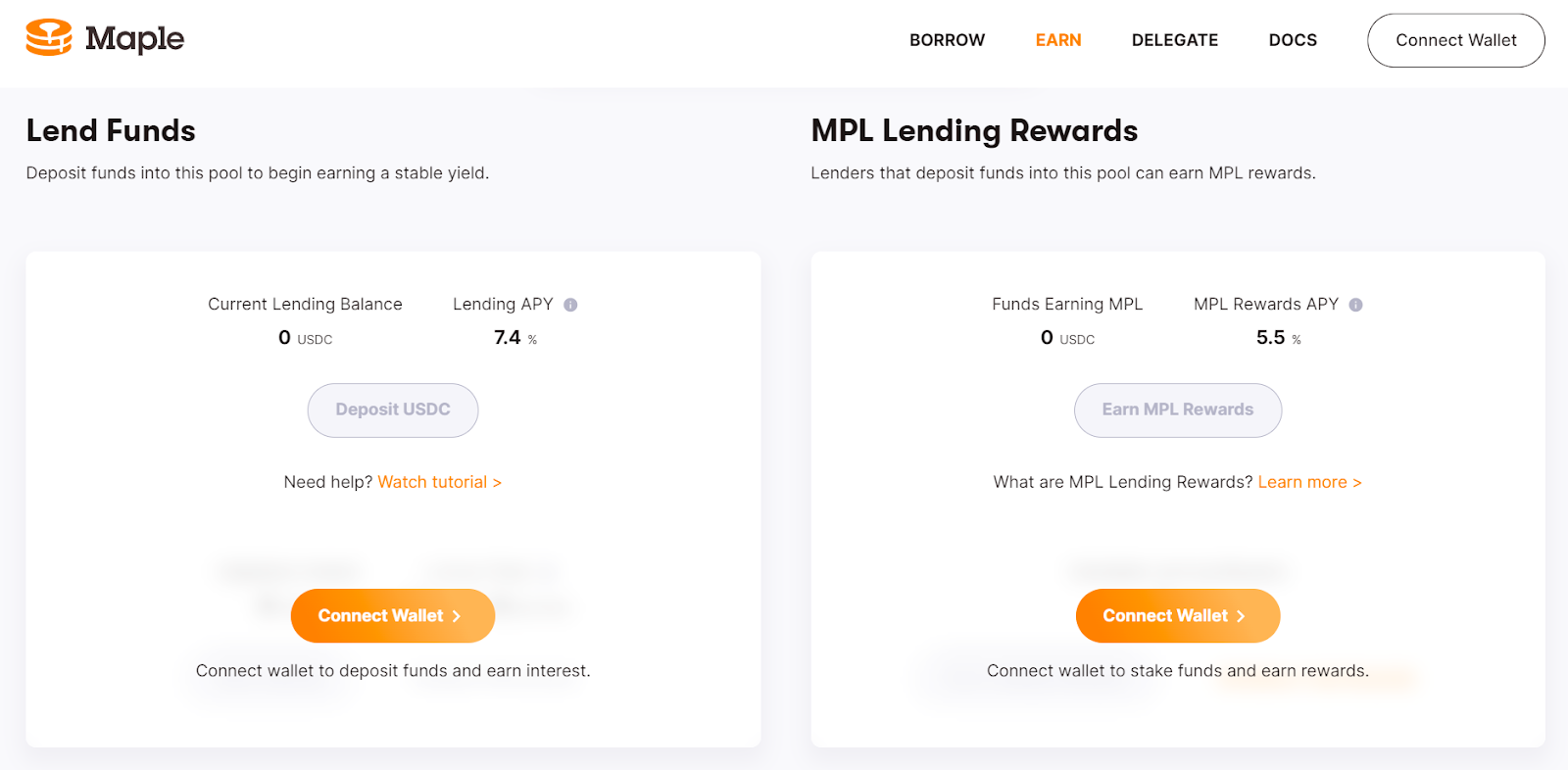

3) Maple Finance

The 101

- Maple Finance is an undercollateralized corporate lending protocol.

- The project allows whitelisted companies to borrow from lending pools populated by public liquidity providers (LPs) without having to put up collateral first.

- Borrowers paying interest on their loans leads to fixed-rate yields for Maple’s lenders.

- Maple’s liquidity pools aren’t always open for deposits. At press time, the Orthogonal Trading - USDC01 pool was the only one on Maple accepting deposits.

- ✋ Read our full tactic on Maple Finance!

Earning fixed yield via Maple lending (up to 7.4%)

- Go to the Orthogonal Trading - USDC01 pool and connect your wallet

- Click “Deposit USDC” and fire off an approval transaction to let Maple access your funds

- Next input your desired deposit amount and press “Deposit” to finalize your lending transaction

- You’ll then receive Maple LP tokens (MPT), after which you can consider staking them through the same Orthogonal Trading UI to earn additional lending rewards in MPL, Maple’s native token

- Just remember that Maple lenders face a 90-day lock-up period, so don’t deposit any funds that you may need within a three-month window of time

- ✋ Read our full tactic on Maple Finance!

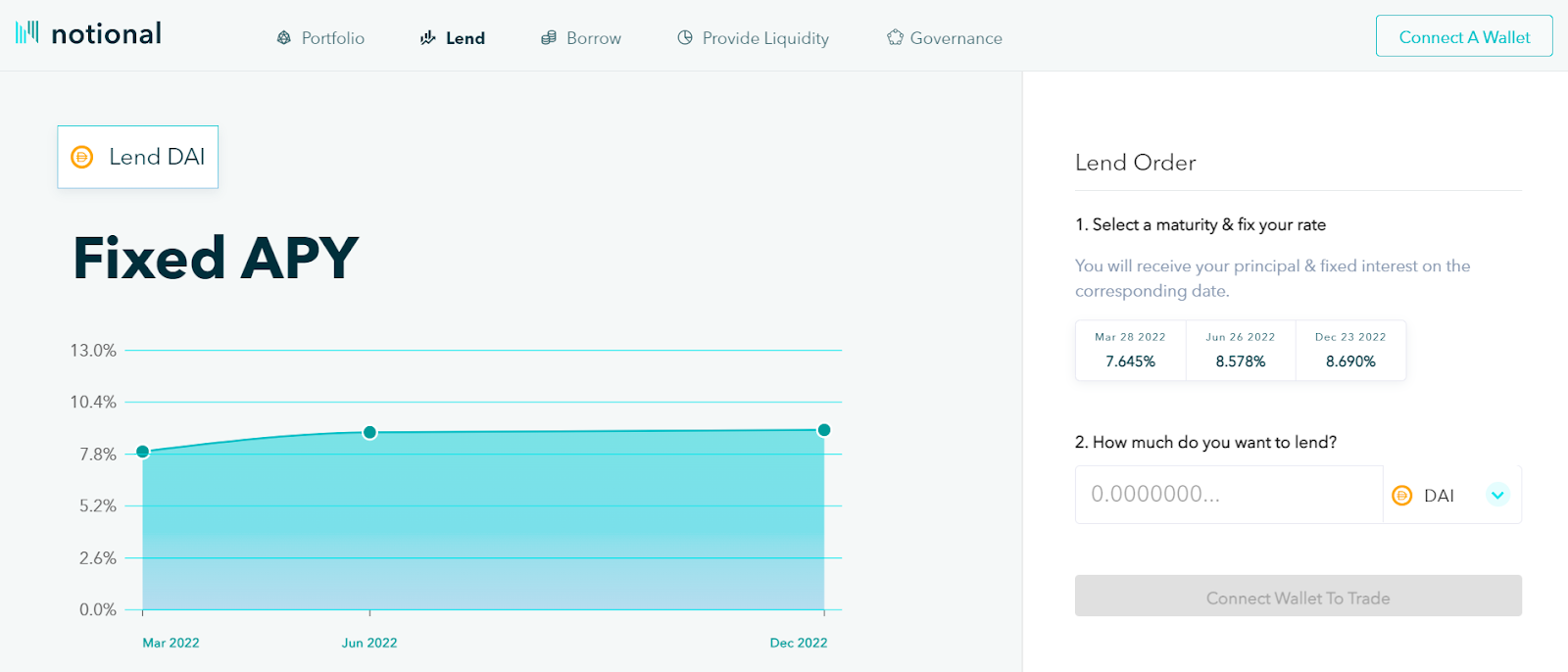

4) Notional Finance

The 101

- Notional Finance is a decentralized fixed-rate borrowing and lending protocol.

- The project is underpinned by fCash tokens, which are used to track liabilities within the Notional ecosystem at any given time.

- Notional maintains its own liquidity pools, which are composed of an fCash denomination and a settlement token (e.g. fDAI and cDAI).

- As such, people who want to lend their money to earn fixed yield can buy fCash tokens from Notional, similar to how Element’s principal tokens work.

Earning fixed yield with fCash (up to 8.7%)

- Go to Notional Lend dashboard and connect your wallet

- Click on your market of choice, e.g. DAI, and then configure your desired maturity date and deposit amount

- Press “Confirm” and then “Enable” and complete the approval transaction to let Notional access your funds

- After that finish up by submitting your final deposit transaction, and you’ll be done

- Once the maturity date is reached, you can redeem your fCash for your underlying assets

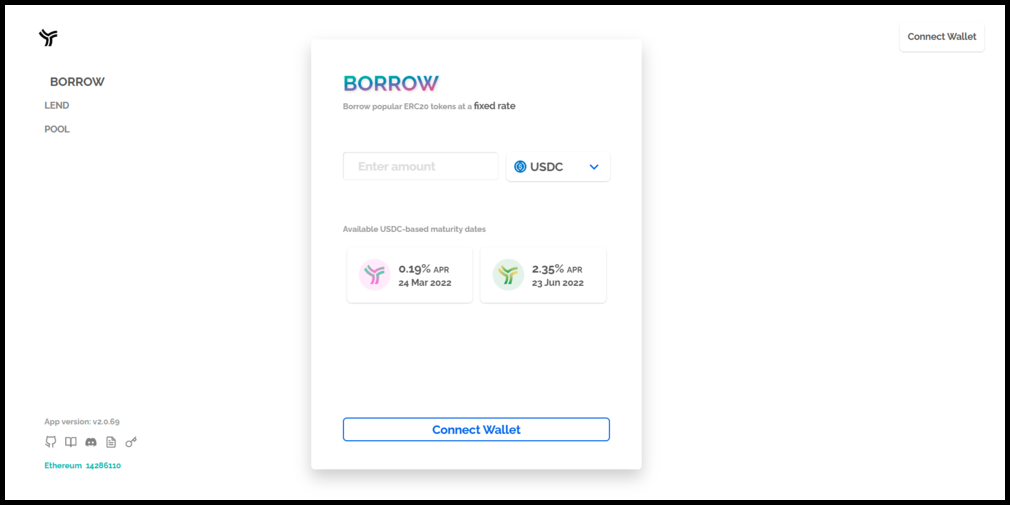

5) Yield Protocol

The 101

- Yield Protocol is a decentralized fixed-rate borrowing and lending protocol.

- The project revolves around fyTokens, which are “Ethereum-based ERC-20 tokens that can be redeemed for an underlying asset one-to-one after a predetermined maturity date… if you have one fyDai token, you can redeem it for one Dai after the maturity date.”

- Alas, to lend through Yield Protocol you simply buy fyTokens of your choosing.

- These special tokens aren’t inherently interest-bearing but instead are purchased at a discount, which thus locks in fixed income if held until maturity.

Earning fixed yield with fyTokens (up to 1.29%)

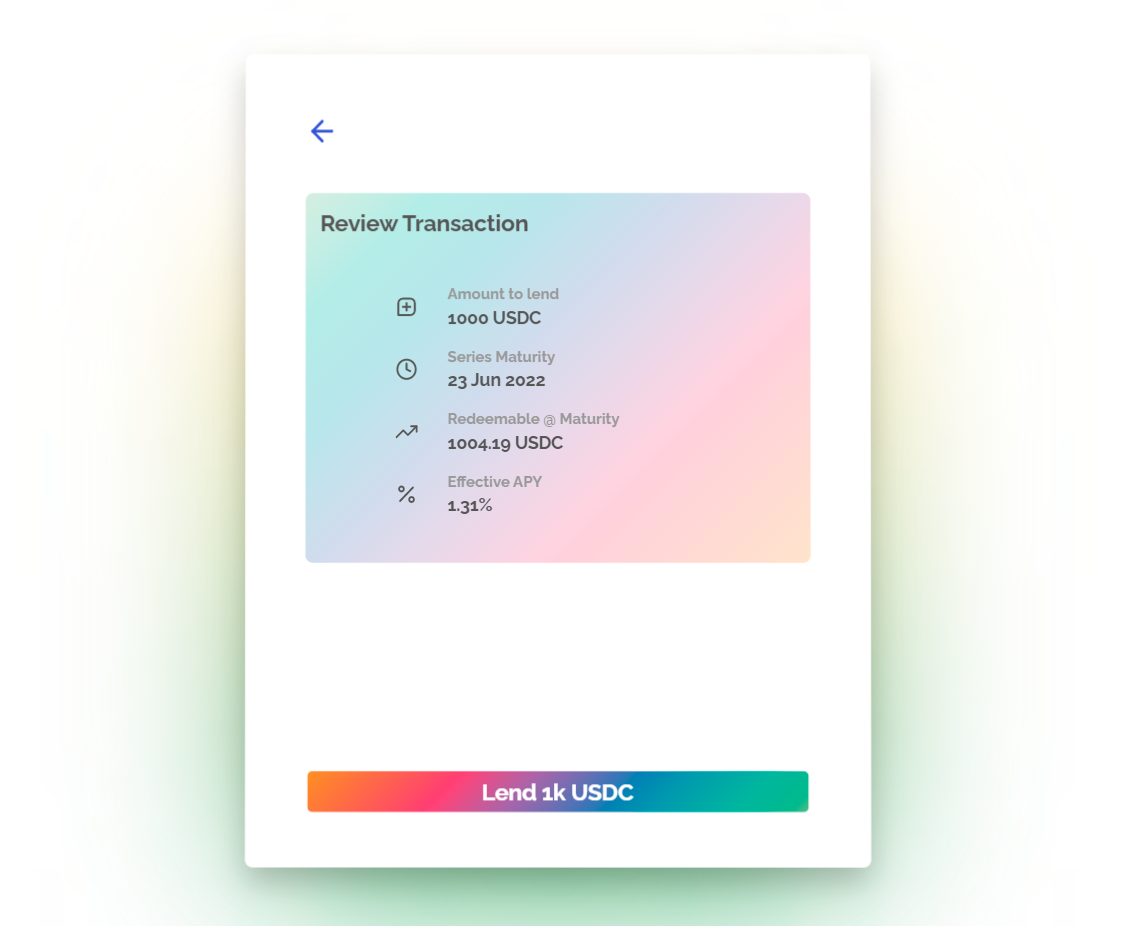

- Go to Yield’s Lend dashboard and connect your wallet

- Choose between the USDC or DAI market, input your desired purchase amount, select your desired maturity date, then press “Next Step”

- Review the details of your transaction, then click “Lend” and sign the ensuing approval transaction

- After you make your deposit, you can manage your vault by clicking on its icon on the lower left side of the Lend dashboard and then going from there

- You can redeem your fyTokens at maturity or extend your position through your personal vault page

Conclusion

Volatile interest rates are no longer the only option in DeFi, as there’s a rising wave of young protocols focused on offering fixed-rate yield products that people and institutions can seriously plan around. The projects outlined above offer fixed income in their own unique ways, but all of them point toward a future in which fixed-interest rates will become a much larger part of DeFi.

Action steps

- 💸 Try earning fixed yield via BarnBridge, Element Finance, Maple Finance, Notional Finance, or Yield Protocol

- Go deep on BarnBridge, Element Finance, and Maple Finance with our previous tactics

- 🚦 Read our previous tactic How to get started in DeFi - 2022 Edition if you missed it