Dear Bankless Nation,

We’ve talked ad nauseam about why The Merge will go down in history as one of crypto’s biggest events.

The Merge will cut ETH’s daily issuance rate by 90%—we’ll go from 19k ETH issued per day to 1,280. That’s the equivalent of three Bitcoin halvings (12 years)!

Assuming constant demand for ETH, this big reduction in supply could mean bullish things for ETH’s price.

So how do we capitalize on this?

William previously covered different ways to maximize yield on your existing ETH, but if you’re experienced and want to add additional risk/reward to your position, you could consider leverage.

Leverage is usually risky and reserved for seasoned traders with greater risk appetites.

But with innovative DeFi composability, we’re able to automate leveraged trading while avoiding its pitfalls, all with the click of a few buttons.

William shows us today some ways we can leverage long on ETH without worrying about liquidation risk.

- RSA

Using borrowed capital for investments is known as leverage, with the idea being to multiply returns.

Many crypto investors seek leveraged “long” exposure to ETH because its fundamentals and tailwinds suggest the asset has attractive returns worth multiplying going forward.

Using leverage can be complicated and risky, though. Today’s Bankless tactic shows you a handful of straightforward ways to get leveraged long on ETH with little to no risk of liquidations.

- Goal: Learn how to get leveraged long on ETH

- Skill: Intermediate

- Effort: 1 hour

- ROI: Increased exposure to ETH gains

Why low-risk leverage on ETH

- ETH is the preferred medium of exchange around NFTs.

- ETH is the reserve asset of DeFi.

- ETH staking is paving the way to the internet bond and the internet’s native risk-free rate.

In other words, ETH is the center of action in the cryptoeconomy right now. ETH’s fundamentals and its prospects going forward are promising, too, so there’s reason to believe the asset will continue to grow as an economic force in the years to come.

Sure, no one can predict the future, and plenty of things can happen that can complicate or slow the rise of ETH going forward. Yet it’s already hard to imagine how ETH won’t be much more valuable in a decade than it is today.

In other words, the joke that “none of us has enough ETH right now” is ringing truer than ever these days. So the play here is, you guessed it, to keep stacking as much ETH as possible!

Toward that end, most people simply buy and hold ETH, which is perfectly fine and has worked well for many. Others, confident that ETH is going to keep generally trending upward for the foreseeable future, are attracted by leverage and its ability to multiply ETH’s base gains.

Of course, if your leveraged ETH long pans out, you’ll have more ETH gains than you would’ve otherwise. The problem, though, is that many leverage options in the cryptoeconomy are complicated, riskier affairs.

Unless you’re a leverage expert, the need to manually monitor and manually attend to traditional crypto leverage positions isn’t for the faint of heart. For example, you can use Maker to borrow DAI against ETH to buy more ETH. That’s good ol’ fashioned leverage, but you could be liquidated and lose money if you don’t actively tend to your position during a big market downturn.

We want to stack as much ETH as possible, not lose ETH. So to give you some ideas for further consideration, here are four leveraged long ETH opportunities that face little to no risk of liquidations. Stack in style, baby!

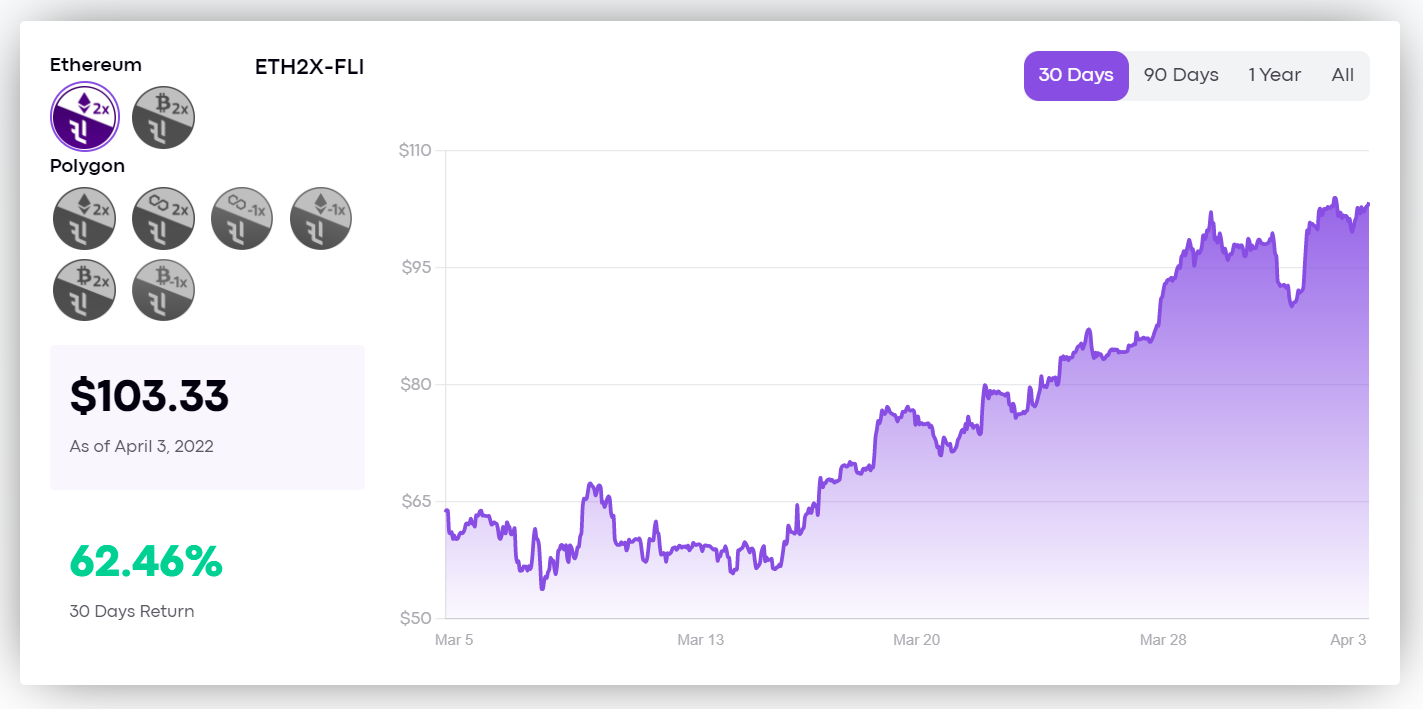

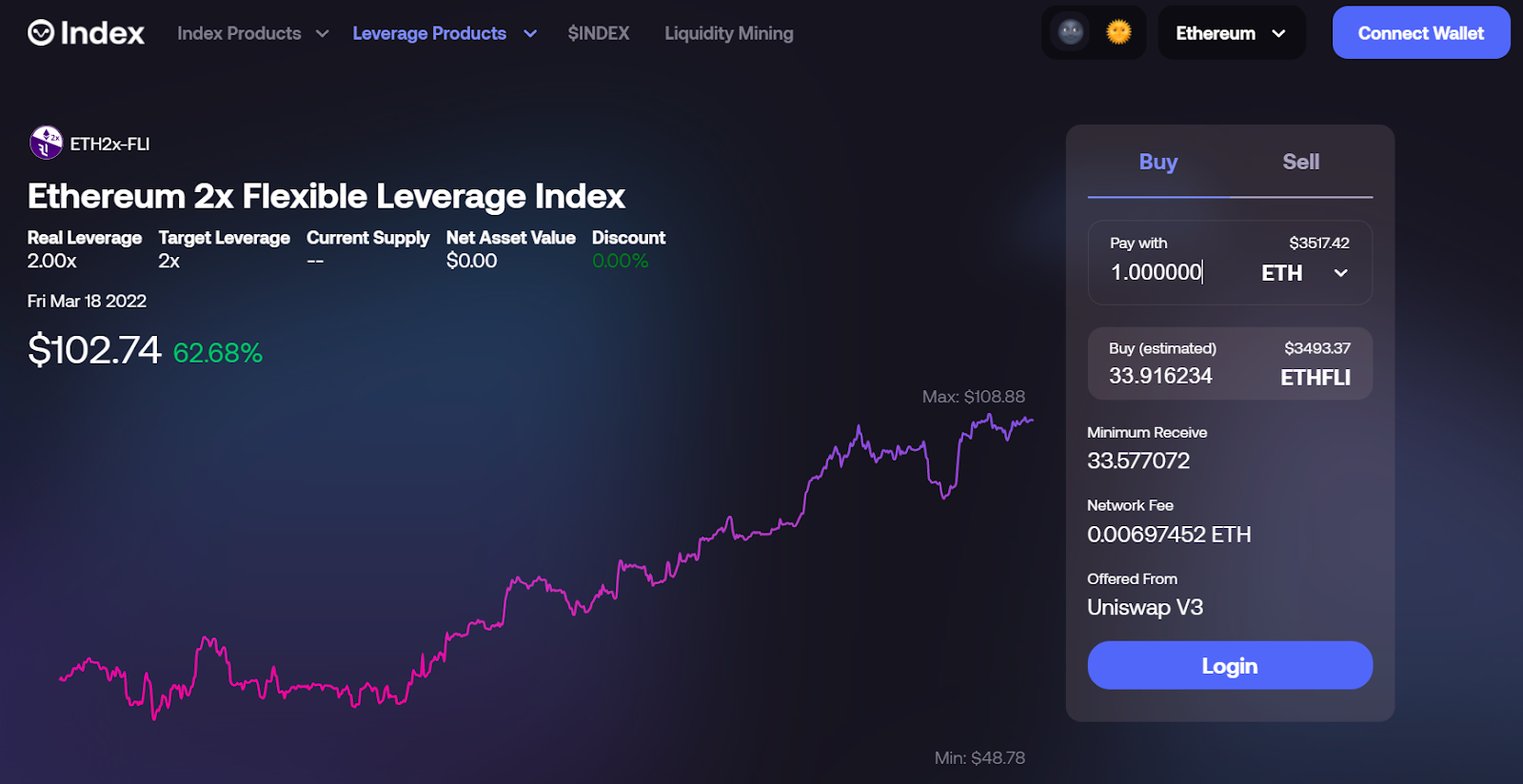

1. ETH 2x Flexible Leverage Index (ETH2x-FLI)

⚠️Skill level: Easy

What you need to know

- Created by Index Coop and Scalara (previously Pulse.inc), ETH2x-FLI marks DeFi’s first fully collateralized ERC20 leverage token.

- The token tracks a 2x leverage ratio to ETH, though this ratio can fluctuate between 1.7x to 2.3x leverage depending on market conditions. Consider how the value of ETH2x-FLI has risen +60% over the last month, which is more than double what plain ETH has gained in the same span.

- Under the hood, ETH2x-FLI takes your ETH collateral, deposits it to Compound, borrows USDC, trades that USDC for ETH, and then deposits that ETH back into Compound (where it becomes cETH) to earn interest.

- Instead of carrying out all these steps yourself, ETH2x-FLI automatically handles the process and rebalancings and tokenizes it all into a single ERC20 that can be bought and sold. No active management necessary! However, beware of volatility drift, in which volatility can cause your position to underperform amid a “broadly positive market move.”

- It’s possible to mint ETH2x-FLI into existence, but the simplest way to acquire the token is to purchase it from a decentralized exchange like Uniswap.

How to go long with ETH2x-FLI

- Index Coop offers a simple UI for buying ETH2x-FLI via Uniswap, so you could start by heading to app.indexcoop.com/ethfli and connecting your wallet.

- Use the trading interface to input how much ETH2x-FLI you want, then press “Buy.”

- Complete the purchase transaction with your wallet, and that’s it! You’ve now got automated, low-risk leveraged ETH exposure.

- You can hold the ETH2x-FLI for as long as you want to capitalize on the extra ETH exposure. If you ever want to convert back to regular ETH, simply head back to app.indexcoop.com/ethfli and use the “Sell” portion of the trading UI.

- A version of ETH2x-FLI exists on Polygon, too, so keep that in mind if you want to optimize for faster and more affordable transactions.

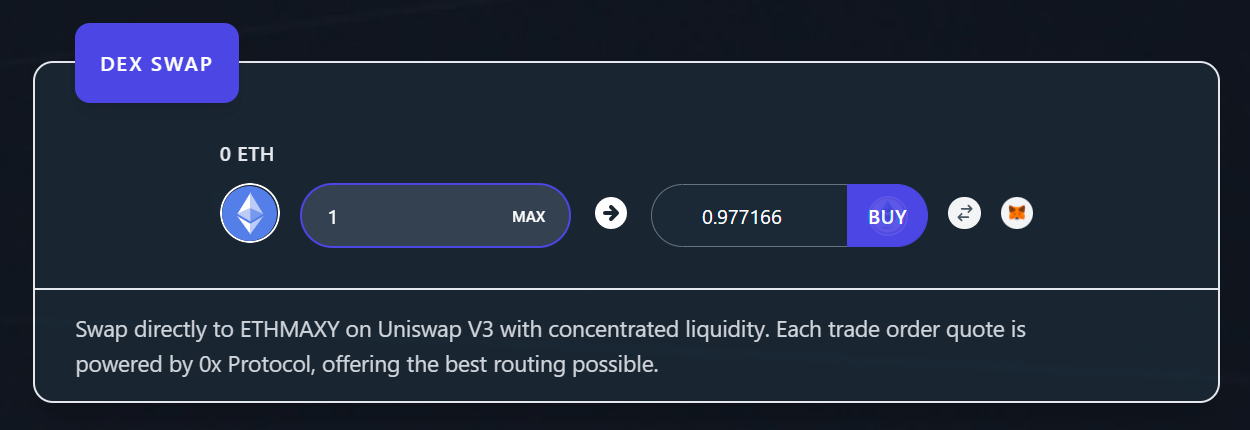

2. ETHMAXY

⚠️Skill level: Easy

What you need to know

- ETH Max Yield, or ETHMAXY, is a new crypto structured product developed as a collaboration between Galleon DAO, an asset management methodologist guild, and Beverage Finance, a decentralized leverage protocol.

- Built on top of Set Protocol, ETHMAXY automatically levers up 3x via collateralizing and borrowing against Lido staked ETH (stETH) through Aave and then reinvesting back into stETH, etc. So if stETH staking yield is ~4% APR, ETHMAXY aims at a tripled ~12% APR and so forth.

- “The ETH Max Yield Index was built as a partnership product aiming to give DeFi natives the most yield possible on their staked ETH in addition to acting as a best-in-class treasury diversification asset for DAOs looking to maximize the productivity of their idle ETH,” the creators have said.

How to go long with ETHMAXY

- Go to setswap.xyz/ethmaxy and connect your wallet.

- Scroll down to the “DEX SWAP” interface, which is a UI overlay for a Uniswap V3 liquidity pool.

- Input how much ETH you want to convert into ETHMAXY. Keep in mind that the current exchange rate is 1 ETH to ~0.98 ETHMAXY.

- When you’re ready, press “Buy” and complete the purchase transaction with your wallet.

- That’s it! Now you can hodl what amounts to three times the Lido staked ETH yield rate but in a single, simple way to manage ERC20 token.

3. Alchemix self-repaying ETH loan

⚠️Skill level: Intermediate

What you need to know

- Alchemix is a DeFi borrowing protocol that offers advances on yield farming rewards via alUSD, Alchemix’s native stablecoin, or alETH, the project’s synthetic version of ETH.

- Alchemix directs users’ yield farming rewards to automatically pay down their loans, meaning over time Alchemix loans pay for themselves. This constant and automated repayment process mitigates the risk of liquidations, and Alchemix only allows self-enacted liquidations anyways.

- Using Alchemix manually for leverage is similar to using Maker for leverage: you could deposit ETH into a vault, borrow alETH against the collateral, and then trade alETH to ETH to stack the real deal. The difference is that Maker won’t automatically pay down your leveraged position’s debt over time, but Alchemix will.

- Note that Alchemix recently launched its new-and-improved v2 update and also just added Rocket Pool’s rETH and Lido’s wstETH as alETH collateral options. Stake and stack, baby!

How to go long with Alchemix

- You could head to alchemix.fi and connect your wallet. Click on the “Vaults” button in the dashboard, and then select and sort by the “alETH” vaults.

- You can choose from the Yearn WETH, Lido wstETH, or Rocket rETH vaults. Click “Deposit” on your choice, use the UI to input your desired deposit amount, and then complete the deposit transaction with your wallet.

- Then use the “Borrow” button to select your vault and configure your loan. Keep in mind that you can borrow up to 50% of your deposited collateral’s worth.

- Once your borrow transaction is completed, you could head to the Curve ETH-alETH Factory pool and trade your synthetic alETH for cold hard ETH. Leveraged long secured!

- ✋ Read our full tactic on how to take out a self-repaying loan via Alchemix (v1)

4. Long Squeeth by Opyn

⚠️Skill level: Intermediate

What you need to know

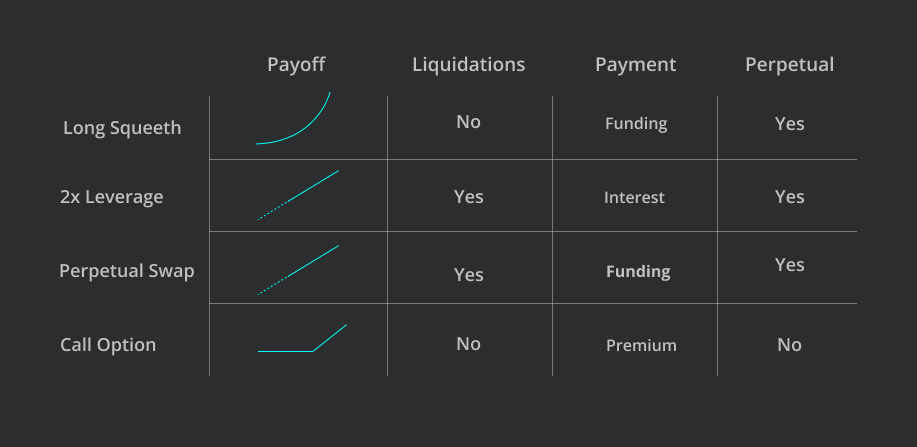

- Squeeth (Squared ETH) is a new DeFi primitive known as a Power Perpetual. Akin to a mix between an option and a perpetual swap, Squeeth was developed by researchers at Opyn, a derivatives and options protocol project, and Dan Robinson of Paradigm.

- You can take long or short positions through Squeeth. Notably, a Long Squeeth leveraged position cannot be liquidated, in contrast to traditional DeFi perpetual positions. Moreover, if ETH rises 10x in value, Long Squeeth rises 100x in value, etc.

- However, Long Squeeth holders have to pay a funding rate to maintain their positions, with this funding going to short ETH holders. This funding rate can lead to larger or smaller payoffs compared to 2x leveraged perps over similar time spans, though Squeeth earns more when ETH rises and loses less when ETH drops.

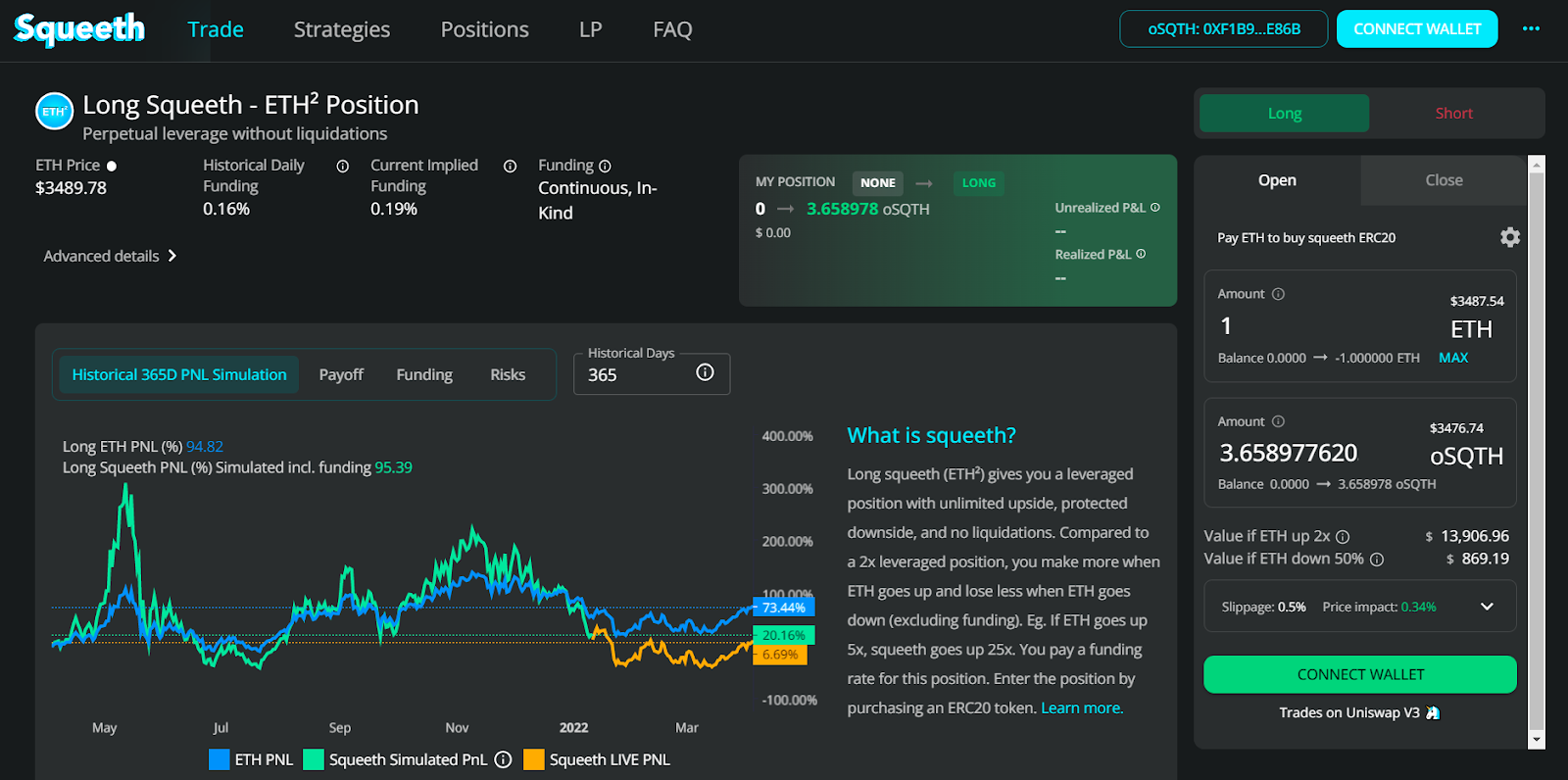

How to go long with Long Squeeth

- It’s possible to simply buy Long Squeeth (oSQTH) via Uniswap V3 through squeeth.opyn.co. Note, though, that the Squeeth app currently isn’t available to U.S. users.

- Since Long Squeeth has a funding rate, you don’t just want to mindlessly ape into oSQTH without further consideration. Make sure you fully understand how the primitive works before taking the leap in. First and foremost, understand that if the ETH price stays flat for a long time, you may lose a considerable portion of your position to funding. The current daily funding rate is 0.19%.

- Once you’ve acquired some oSQTH, you simply hold it for however long you want to have out the “squared” exposure to ETH. Exiting your position is as simple as selling your oSQTH back for ETH on squeeth.opyn.co or Uniswap V3.

Zooming out

Leverage is never something to take lightly in crypto. But if you are going to use leverage, it is compelling to use lower-risk offerings like the ones described above precisely because they offer more simplicity, and thus much less stress, than alternative options. This illustrates the beauty of smart contracts and composable DeFi. Nowadays we can build unprecedented financial instruments that can empower people around the globe in new, interesting, and automated ways.

Action steps

- 💸 Explore ETH2x-FLI, ETHMAXY, Alchemix, and Long Squeeth

- ✍️ Read our last tactic How to build a web3 publication if you missed it