How to bank your business without a Bank

Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

I’d love to run a company without a bank account someday.

When I discovered Multis a year ago I was blown away. They were working to wrap the Gnosis Multisig Wallet (secures over $1billion in assets) in a bank style interface tailor made for businesses.

No traditional bank required. No crypto bank necessary.

Just an Ethereum address and a user interface.

And guess what? It doesn’t just match the features of a bank today. In exceeds them.

This is the future we deserve.

This is the second tactic in our Bankless Business Series (here’s the first).

Let’s learn how to do business banking without a bank.

Let’s level up.

-RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

TACTICS TUESDAY:

Bankless Business Series

Tactic #30: How to bank your business without a Bank

Guest post: Thibaut Sahaghian, CEO & cofounder of Multis

We're going to learn how you can open a multi-signature wallet for your company, invite teammates to secure funds collectively and access financial services you would expect from your modern business bank, without the custody. Tomorrow’s business banking will be bankless!

- Goal: Open a multisig wallet for your company, invite teammates to secure funds and make a deposit in stablecoins to start earning interest

- Skill: Intermediate

- Effort: 1 hour

- ROI: positive ROI if crypto savings rates > legacy markets savings rates

Why should my business go bankless?

Let talk about the why first.

24/7 access to funds and resources

BNP Paribas suffered last year from a major IT breakdown—most banks actually go through the same on a regular basis: all accounts got frozen for 48 hours. No wire transfers, no debit cards, no ATM withdraws. Just this week, our company Multis got all accounts frozen too. 100% arbitrary, without warning. All payments delayed for a week, including payroll, by a week. This could kill a business.

In need of short-term financing to cover unpaid receivables? Small business loans applications take days to get approved, funds transfer even more. This could kill a business too.

That’s the radical innovation behind permissionless networks: an internet connection gives unrestrained access to your funds 24/7 and extra resources to grow your business — without going through the legacy banking system and its limitations, often arbitrary.

Faster and cheaper international payment

Legacy payment gateways are horribly expensive when it comes to cross-border payments. Consider a $1,000 online purchase: Paypal will take a 4.4% transaction fee or $44 plus a fixed fee based on the currency received. Payment will be processed and settled within 4-9 days, depending on geographics.

Now consider ETH or stablecoins. Same purchase, same geographics: the network takes a fixed fee of 20-50 cents—sending $1,000 or $100,000 does not change a thing. Payment will be processed and settled in minutes.

That's the radical innovation behind crypto payments for business: they're the most time and cost efficient way to transfer funds to partners and teams, anywhere in the world.

DeFi means better financial services

DeFi already replicates most basic legacy financial services needed by small companies, in a permissionless fashion, accessible instantly and for a few cents:

- Stable currency = pay with DAI

- Current account with IBAN = store with wallet and ETH address

- Savings account = lend with Compound

- Short-term loans = open vault with Maker

- Forex = convert with Kyber

The permissionless nature of the network enables thousands of finance entrepreneurs to create extra innovative services to provide additional benefits to companies and staff, like salary streaming with Sablier, invoice financing with Centrifuge, or performance-based equity rewarding with Quidli. Possibilities are infinite, providing better ways for companies to grow.

Enter stablecoins

What about volatility? Bitcoin and Ethereum are known for high short term fluctuation—a nightmare to manage a company's treasury. That's where stablecoins like DAI come in handy: they're cryptocurrencies which rate is pegged to USD. They're a game-changer for business: they're still permissionless, time and cost efficient payment rails—but they're no longer volatile.

Note: I’m not covering crypto companies already building with crypto and using it to bootstrap networks and incentivize their community. Hopefully they don't need convincing and are already dog-fooding 😁🐶

Now, what is a multisig wallet?

Let's talk about the best to store crypto as a company: multi-signature wallets or "multisigs".

Simply put, a multisig is a smart contract that locks funds and requires multiple owners to approve transactions with their own individual private keys. They're the perfect compromise between security and flexibility. Here's why:

- They're self-custodian—you don't rely on a third party to store funds

- They're secure against external risk—you need several private keys which makes them hard to compromise

- They're secure against internal risk—no one can flush out company's funds alone

- They enable key recovery—you can lose a private key without loosing funds

- They're software-based—you can transact anywhere, anytime, from a browser

- They're smart contract-based—you can interact with other smart contracts to leverage DeFi

They're simply the best tool for a company to go bankless ❌🏦

Opening your company's multisig with Multis

Let's open an account on Multis.co, a multi-signature wallet designed or business, and start earning interest in 6 steps:

1. Sign in to Multis

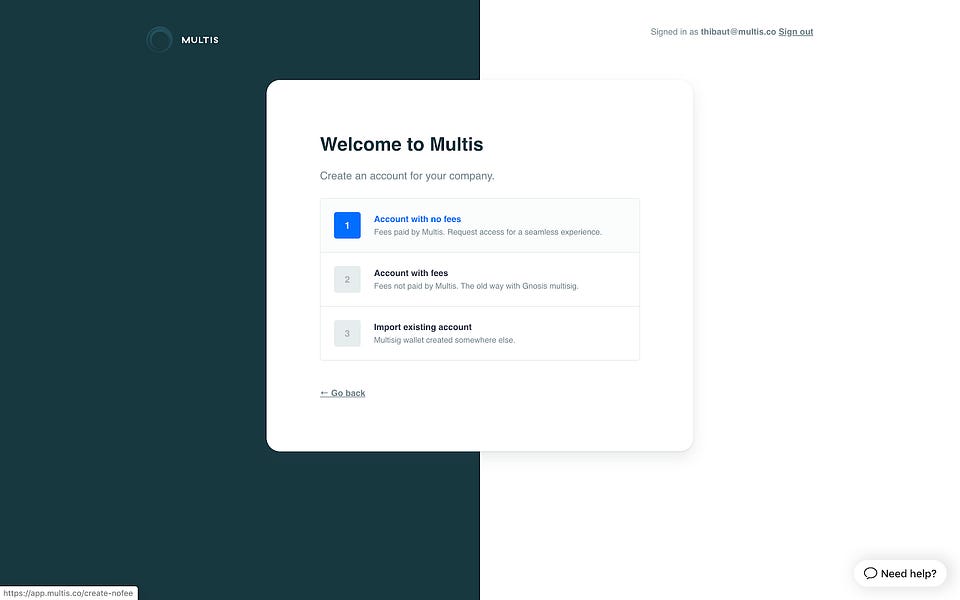

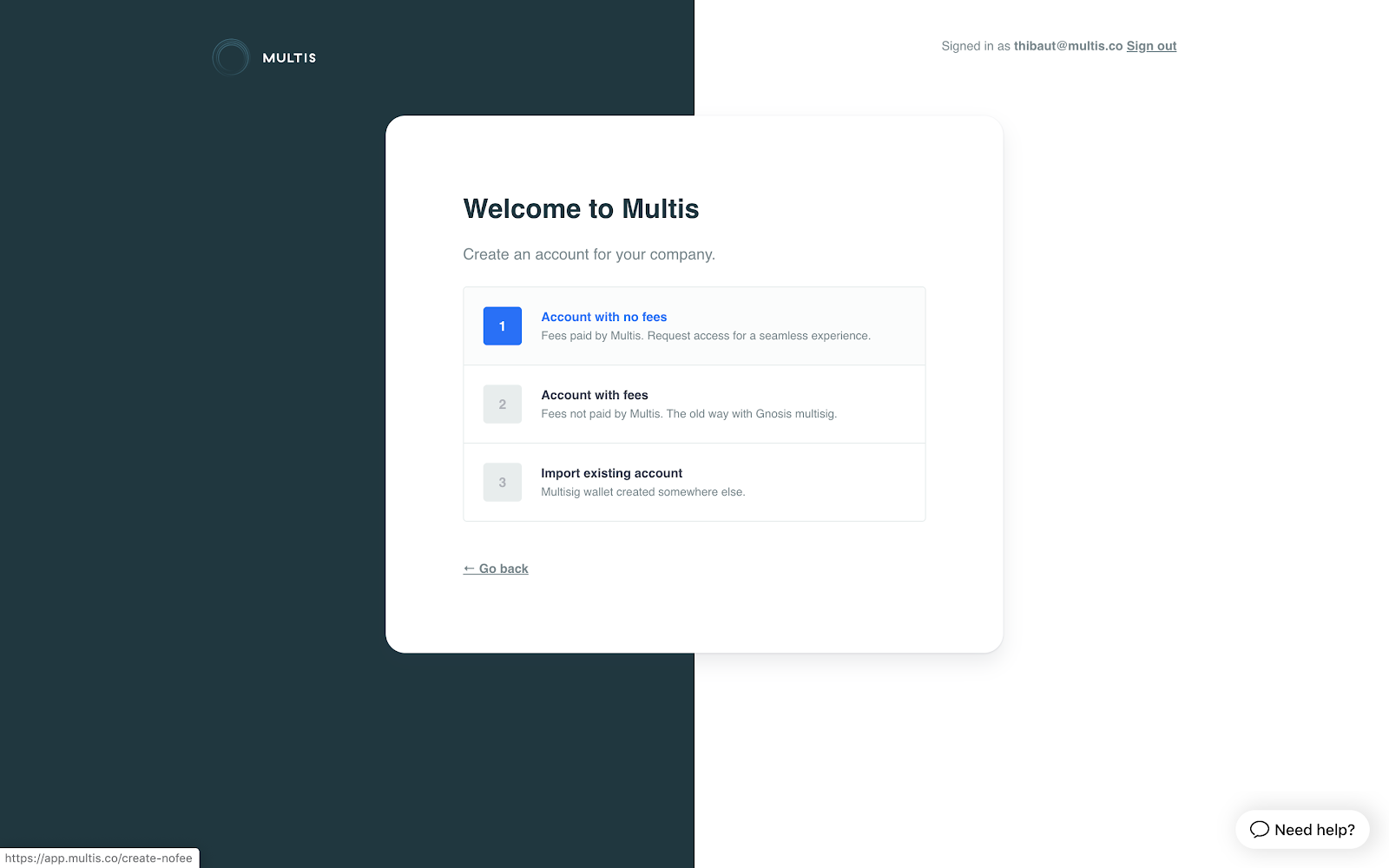

Go to app.multis.co and enter your email address, and click on the link you'll receive. Then simply validate your email address and you will be signed in. You can then enter your company name, and select "account with no fees" (network fees are covered by Multis).

2. Connect to the network

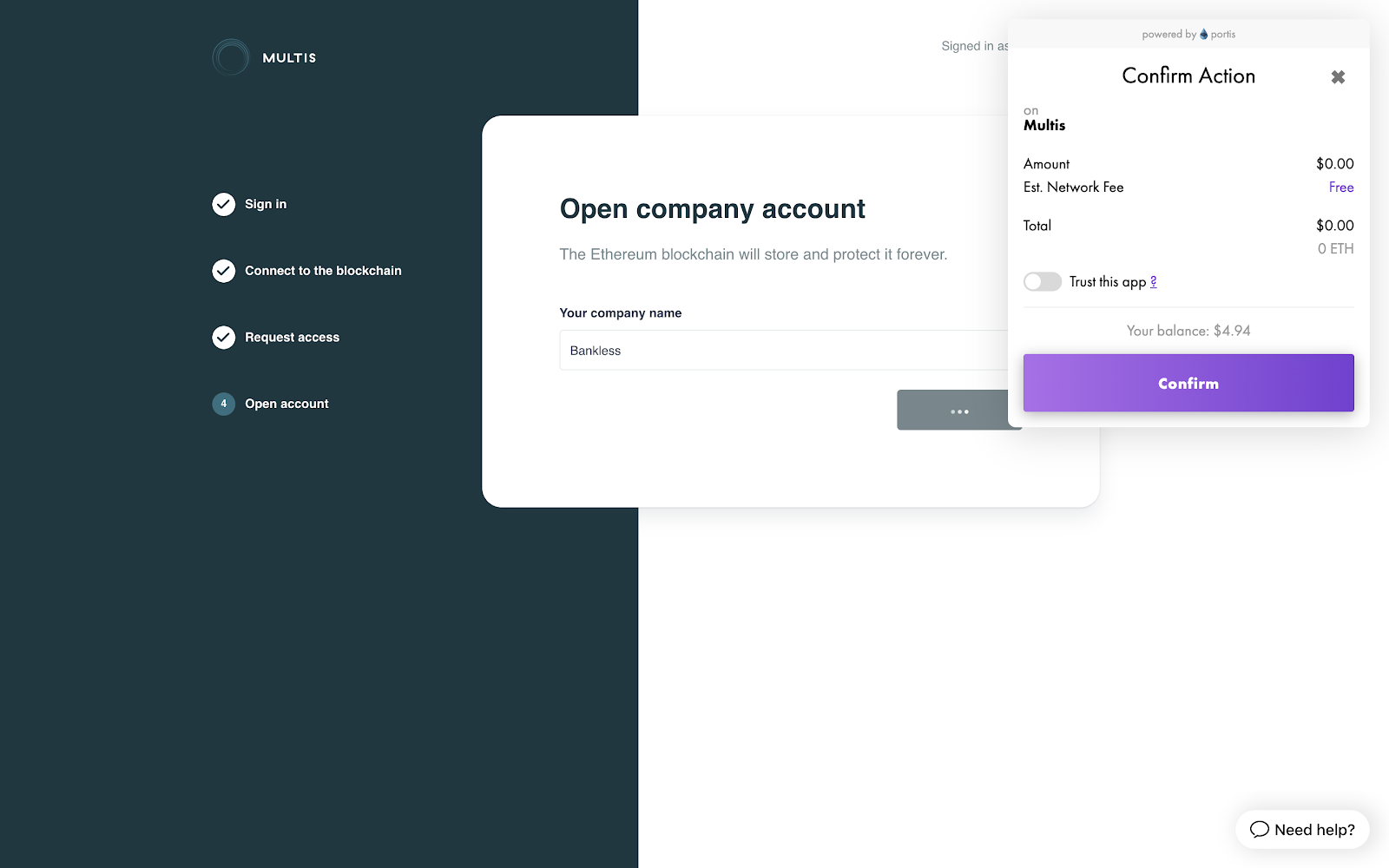

Hit "connect with Portis" to proceed. Portis is a non-custodial browser wallet that lets you store your private keys and connect to the Ethereum network with your email address. Multis never holds your keys so you need to go through this step to manage your account.

3. Open account

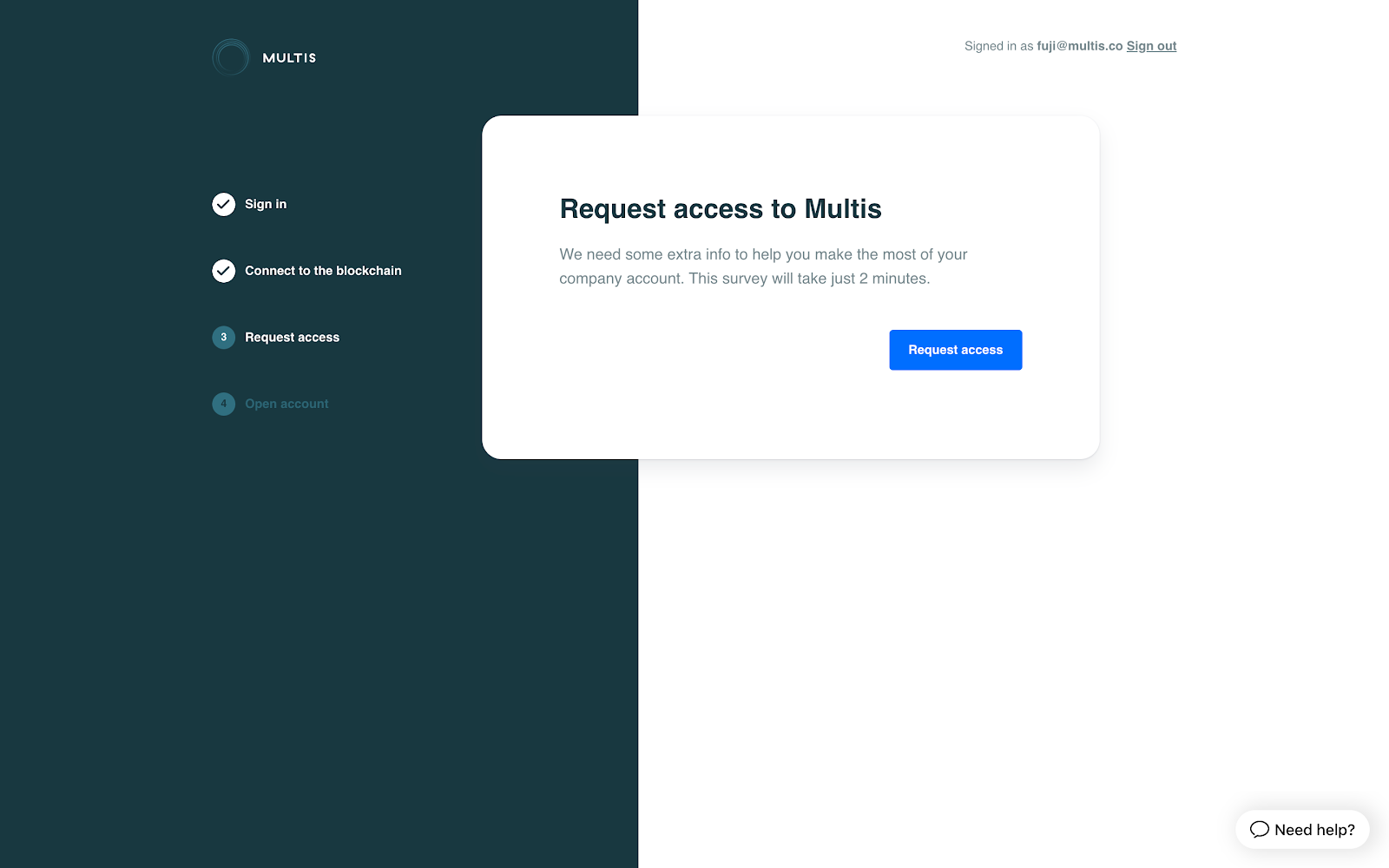

Multis is on waiting list mode for now. Fill up the 30-second form and use the code "bankless" access code to jump the queue!

Log back in to app.multis.co once you've received an email confirmation. Hit "request access": Portis will pop up, asking you to connect and sign the transaction. This transaction will create your smart contract wallet. Hit "confirm".

4. Invite owners

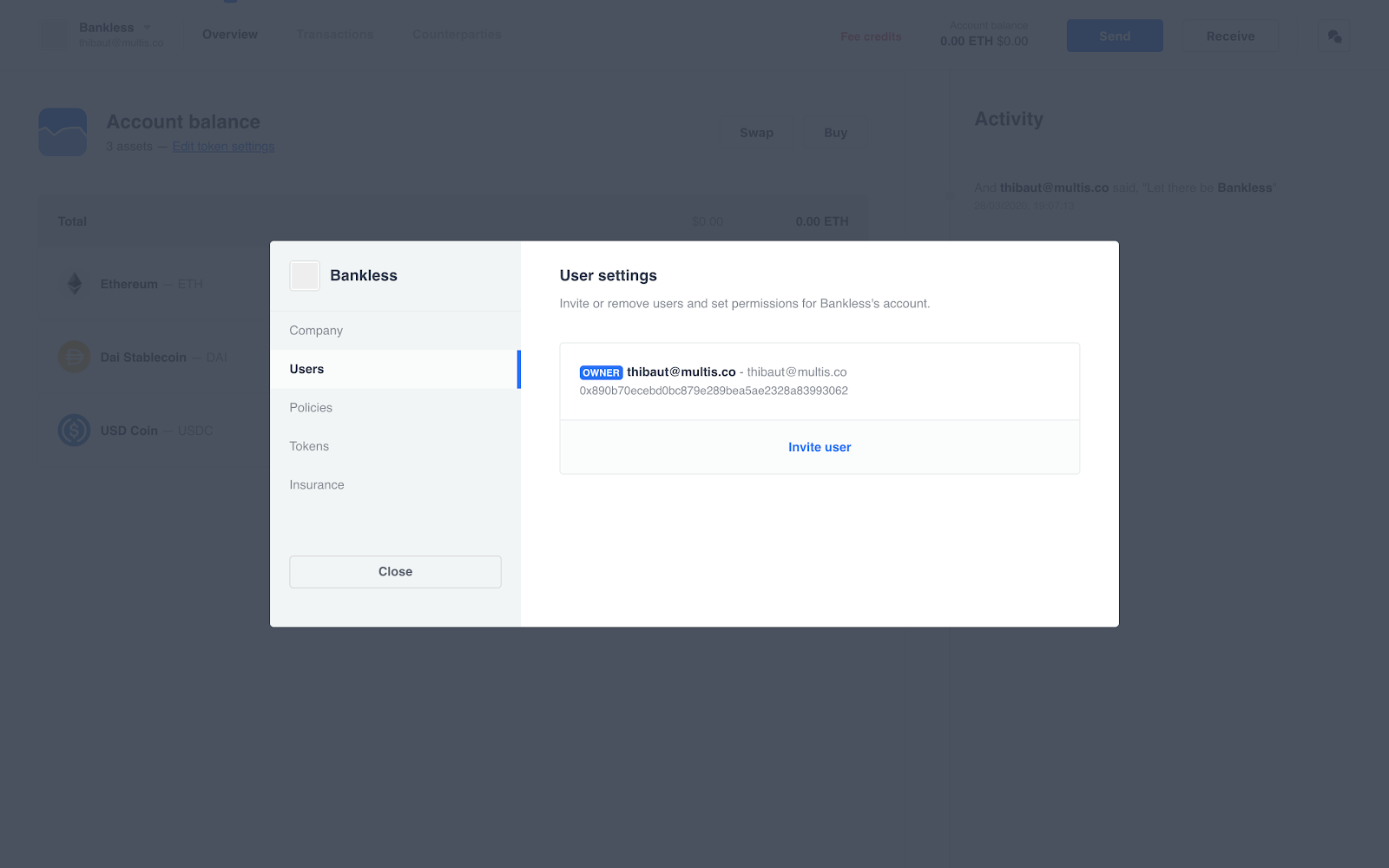

You made it! Best thing to do now is to invite teammates to secure deposits. Go to company settings, then "user" section where you can send email invitations for them to join. They'll have to open a Portis account too, join the account and have you appoint them as owners (ideally, you want to invite 2 extra owners to maximize security).

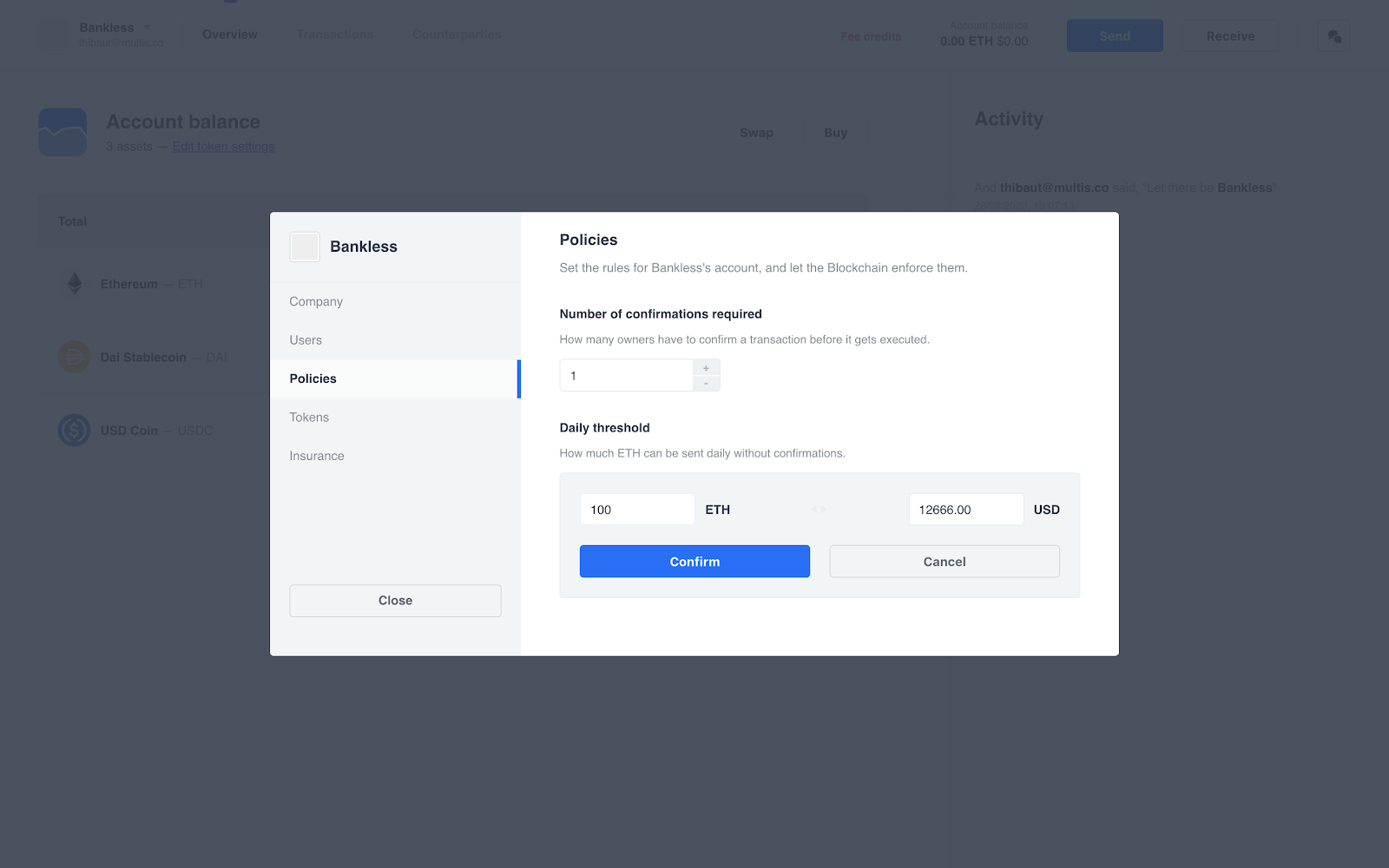

5. Set up permissions and spending limits

In company settings, go to the "policies" sections and choose how many owners have to confirm a payment before it gets executed. For example, 3 owners should require 2 confirmations to secure funds properly. Each sensitive operation (adding owners, changing policies, sending funds out, etc.) will also require confirmations from co-owners. You can also set up a daily threshold for ETH transactions.

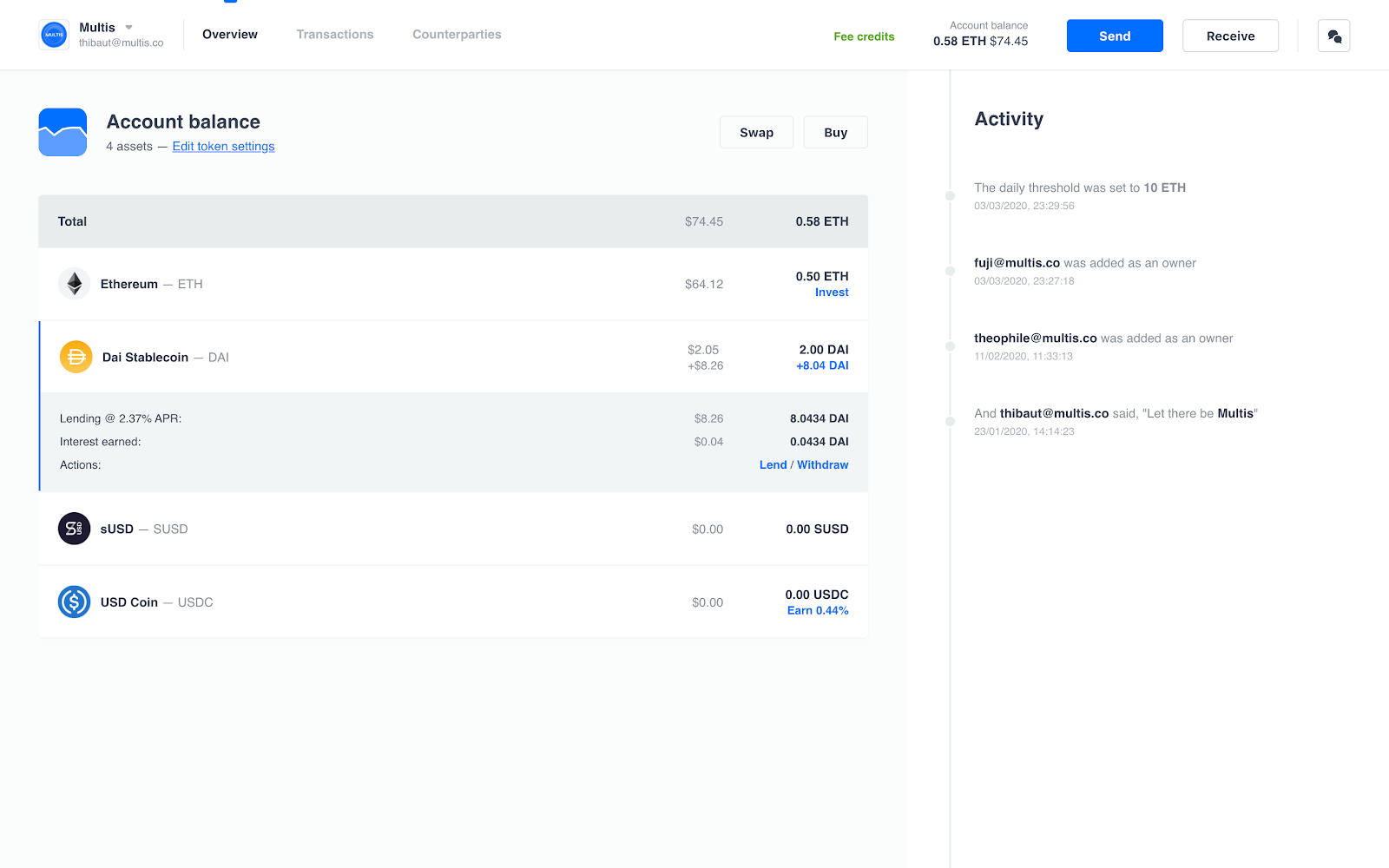

Bonus: earn interest on treasury

You made it so far, so why not start earning interest? Here is how to put idle treasury to work through Compound. From the company's dashboard: make a deposit in DAI, then hit "Lend". Next thing you have to do is select an amount, and proceed to lending. Co-owners will have to confirm. That's it: you can now earn interest and withdraw whenever convenient—a turbo-charged savings account.

Author blurb

Thibaut Sahaghian is the CEO & cofounder of Multis (YC S19), a banking solution designed for companies holding cryptocurrencies. Multis help them store funds with multi-signature wallets, earn interest and streamline payments with custom workflows.

Action steps

- Open a multi-signature wallet for your company on multis.co

- Invite teammates to secure funds & set spending limits

- Bonus: deposit funds and start earning interest on idle treasury

Go Bankless. $12 / mo. Includes archive access, Inner Circle & Deals—(pay w/ crypto)

🙏Thanks to our sponsor: Aave Protocol

Aave protocol is a decentralized, open-source, and non-custodial money market protocol to earn interest on deposits and borrow assets. It also features access to Flash Loans, an innovative DeFi building block for developers to build self liquidations, collateral swaps, and more! Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.