How to accept crypto payments

Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

A year ago I said I’d love to run a company someday without a bank account. I have nothing against traditional banks (or do I?) but with crypto they’re like travel agents in the age of Expedia—I don’t need em!

But how do you take your business bankless? That’s the central question in our How to take your business bankless series. We’ll do a tactic in this series every month or so, starting with crypto payments today.

If you’re anxious to move faster here are some tools to investigate:

- Accounting: Cryptio / Veriledger / Gilded

- Credit cards: Monolith / Crypto.com / Wirex (I did a post on this)

- Payments: Coinbase Commerce / BitPay / StablePay (👈bankless!)

- Payroll: Sablier / Bitwage / PaymentX

- Invoicing: Request Network (payment & document flows)

- Self-custody bank: Multis / Gnosis

- Crypto bank: Coinbase / Binance / Gemini

- Tokenization: OpenLaw (legal) / Aragon

- Taxes: Many! I put together a list here

- Subscription payment/management: Unlock

The tools change fast and keep getting better. And I bet things will accelerate now that we have solid stablecoin options. It’s incredible what you can do when your bank account is an ETH address!

Let’s level up.

-RSA

TACTICS TUESDAY:

Bankless Business Series

Tactic #22: How to accept crypto payments

The first step to taking your business bankless is learning how to accept crypto payments. Why to accept crypto, which currencies to accept, where to store funds, how to send a crypto invoice—it’s all here.

- Goal: Learn how to accept crypto as a payment method in your business

- Skill: Beginner

- Effort: 1 hour

- ROI: Accept payments globally & access new markets

Post by: Gil Hildebrand, CEO at Gilded

Four reasons to accept crypto payments

The goals of businesses differ from those of individual consumers.

While an individual may care deeply about decentralization, privacy, or economic freedom, businesses are aggressively focused on the bottom line: profit and loss.

Many factors go into profit and loss beyond basic unit economics of manufacturing the products or services being sold. What if there was one single action you could take to positively impact everything from operational costs to cash flow, marketing spend, and more?

1) Crypto makes it easier to operate globally

A decade ago, the term “offshore” was used to describe international suppliers and vendors. Today it carries less weight, because operating internationally is a given.

When the internet and cryptocurrency are combined, a customer in one country can easily do business with a supplier or vendor in an entirely different part of the world. Ultimately, global commerce makes the market more efficient and leads to greater wealth creation for both the merchant and the customer.

2) Crypto can improve cash flow and profits

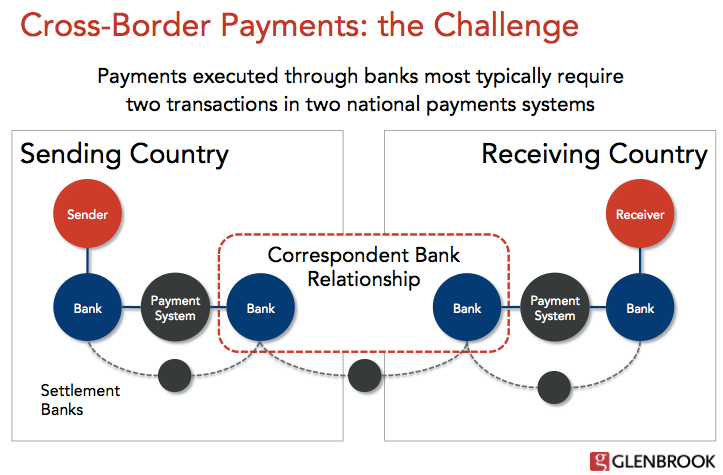

Nothing offered by the traditional banking system comes close to the speed or cost of crypto for international payments.

In a best case scenario, a business can hope to receive an international wire transfer the day after it was sent. Unless that date was on a weekend or holiday, in which case there will be delays. If the two banks don’t have a direct relationship, then one or more intermediary banks can slow the process several more days. If the payment is held up for compliance purposes, it can be weeks before a payment is received.

International wire transfers utilize one or more correspondent banks that introduce fees and delays.

The costs can be considerable. Fees for International wire transfers are typically around $50 when combining those paid by the sender and recipient. Currency conversion can lead to additional fees.

Meanwhile, crypto payments made using a stablecoin on the Ethereum blockchain cost about $0.01 and take less than 5 minutes to settle. For a business accepting payments internationally, crypto lowers costs by reducing transaction fees and improves cash flow by increasing payment speed.

3) Crypto is radically more transparent

One of the challenges with traditional payment methods is lack of transparency. Once a payment is sent, there is no visibility into the current status of the payment, nor a confirmation of receipt.

Sending an international wire transfer often feels like sending money into a void. There is no way to inquire about the status or receive an estimated time of arrival. The more money sent, the more nerve-wracking this can be.

Even local payment methods, such as ACH transfer in the US, give no indication of the status.

This is a major advantage for blockchain, where numerous block explorers can report on the status of a payment and confirm receipt once the payment is complete. Peace of mind is one of the most compelling reasons to accept crypto payments.

4) Crypto is great marketing

For a business looking to get noticed, crypto is a great way to stand out.

One of my favorite crypto startups, Lolli, has built a marketing machine by hyping partnerships with traditional retailers who offer cash back in Bitcoin.

Companies like Overstock and NewEgg have benefited for years from the publicity around accepting crypto payments. Armanino made headlines last summer as the first major accounting firm to accept crypto payments. And if an accounting firm can pull it off, no business is too mundane to benefit.

Plus, crypto is viewed favorably by millenials and is a great way to tap into an affluent, upwardly mobile audience.

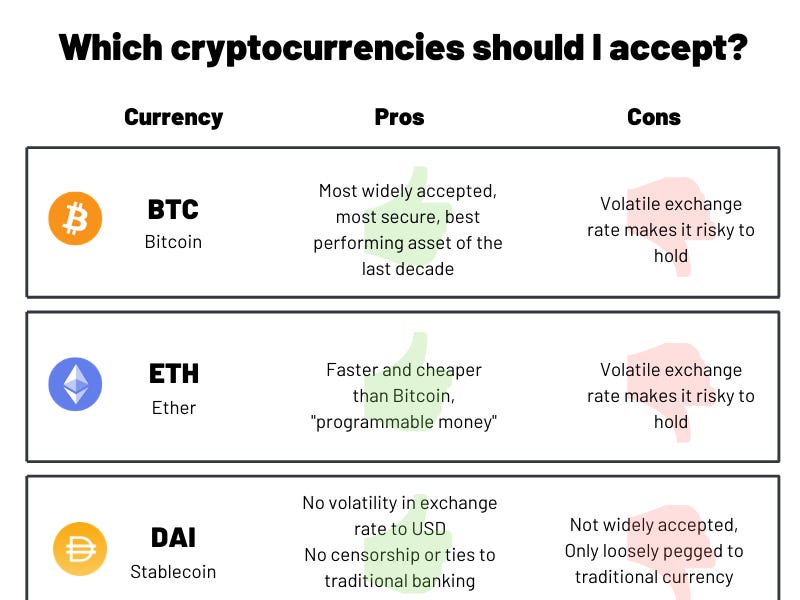

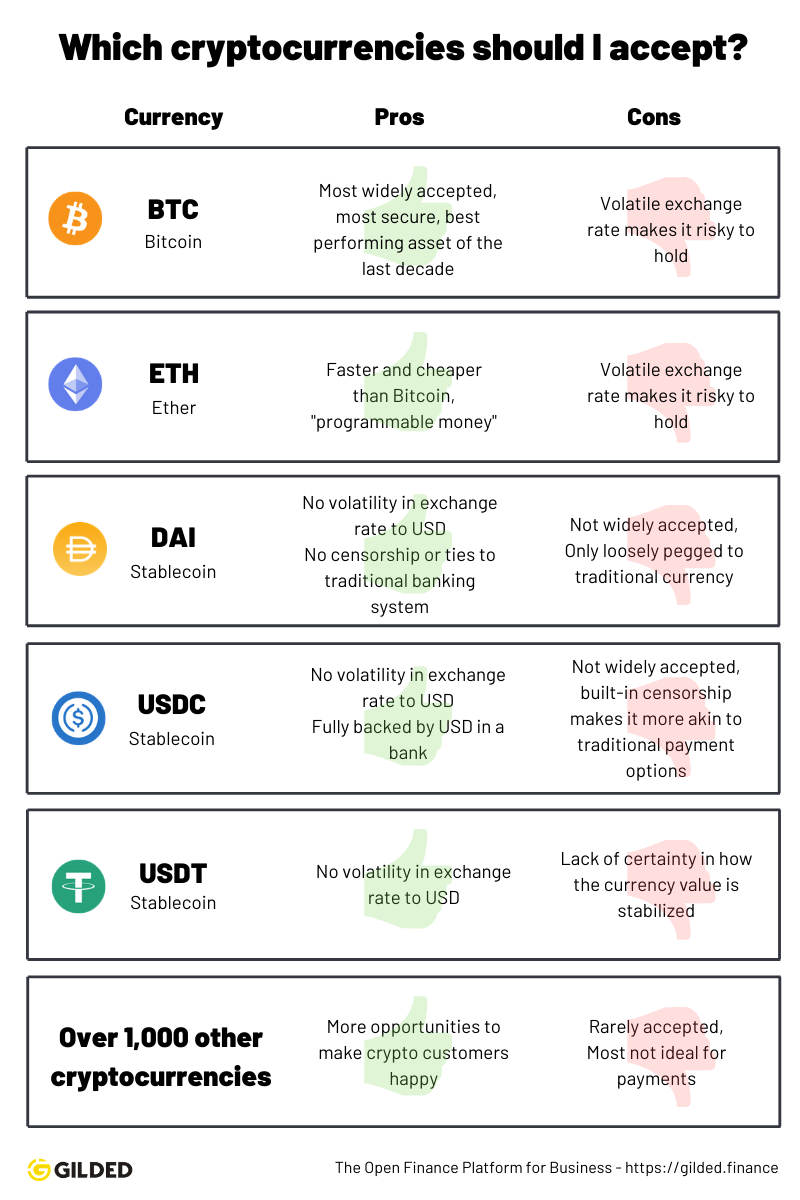

Which cryptocurrencies should you accept?

There’s no denying that Bitcoin is the undisputed king of cryptocurrency liquidity. If a business is going to accept cryptocurrency, Bitcoin almost certainly needs to be one of the options.

But is it the best cryptocurrency to accept for payment? While Jack Dorsey is betting on Bitcoin, the volatility in exchange rate to traditional currencies makes it tricky for a business to hold on to. Until the day when businesses can pay most of their suppliers in Bitcoin, the volatility will always be a major concern.

Recently, the Ethereum blockchain has shown remarkable traction for cryptocurrency payments. Ethereum offers multiple stablecoin tokens whose values are tied to the US Dollar, making them ideal for payments.

The chart below illustrates the most common options for businesses accepting crypto payments.

Where to store the crypto you earn

Bank-less experience

You can store cryptocurrency using wallet software that runs on a computer or other device. This is called “non-custodial” because there is no bank or custodian: you maintain ownership of the tokens at all times, just like the cash you hold in your wallet.

Software wallets like the Coinbase Wallet App and MyCrypto are the easiest options here. Hardware wallets like Ledger are generally more secure. Only a handful of solutions like Multis and Gnosis Safe offer support for multiple users (including approval flows), a necessity for many businesses.

Non-custodial wallets are a more advanced option because they require you to have some knowledge about how crypto works. For example, if you lose your wallet software’s private key, there’s no one you can turn to for help unlocking it. However, non-custodial is the best option for maintaining ownership and full control of your assets.

Bank-like experience

Crypto exchanges like Coinbase offer a bank-like experience for storing your crypto. This minimizes the level of technical knowledge you need in order to hold crypto. Plus, if you forget your password, the exchange’s customer service may be able to help.

On the other hand, there’s danger in trusting a third party with control of your assets. Billions of dollars have been lost in exchange hacks over the years. It’s easier but not quite as safe as the do-it-yourself option. That said, a handful of exchanges like Coinbase, Kraken, Gemini, and Binance are gradually becoming more secure and trustworthy.

How to accept crypto payments

Just like wire transfers have an IBAN and account number in order to route payments from sender to receiver, crypto has a blockchain and a public wallet address (or “Receive” address) to identify a recipient.

Sharing the “Receive” address generated by your wallet software enables you to receive crypto payments from customers. In addition, wallet software is often capable of generating a QR code which, when scanned by another device, transmits your Receive address automatically.

Unlike credit cards and wire transfers, there is no fee to receive a crypto payment. The payer only incurs a small, fixed-amount fee of a few cents in order to send a transaction.

Bitcoin transactions can take up to an hour to clear (or “confirm”), although an emerging technology called Lightning is capable of nearly-instant Bitcoin payments. Meanwhile, Ethereum and stablecoin transactions can often be confirmed in less than 5 minutes.

Regardless of the method, crypto payments are significantly faster than most traditional payment solutions, especially for international payments. And unlike banks, crypto is open 24 hours, a day, 7 days a week, with no breaks or holidays.

For e-commerce merchants, crypto payment processors CoinPayments and BitPay offer integrations into popular shopping cart platforms like Shopify and Magento. Typically these solutions require only a few minutes to setup. Processing fees range from 0.5-1%, rates significantly lower rate than those of credit card processors.

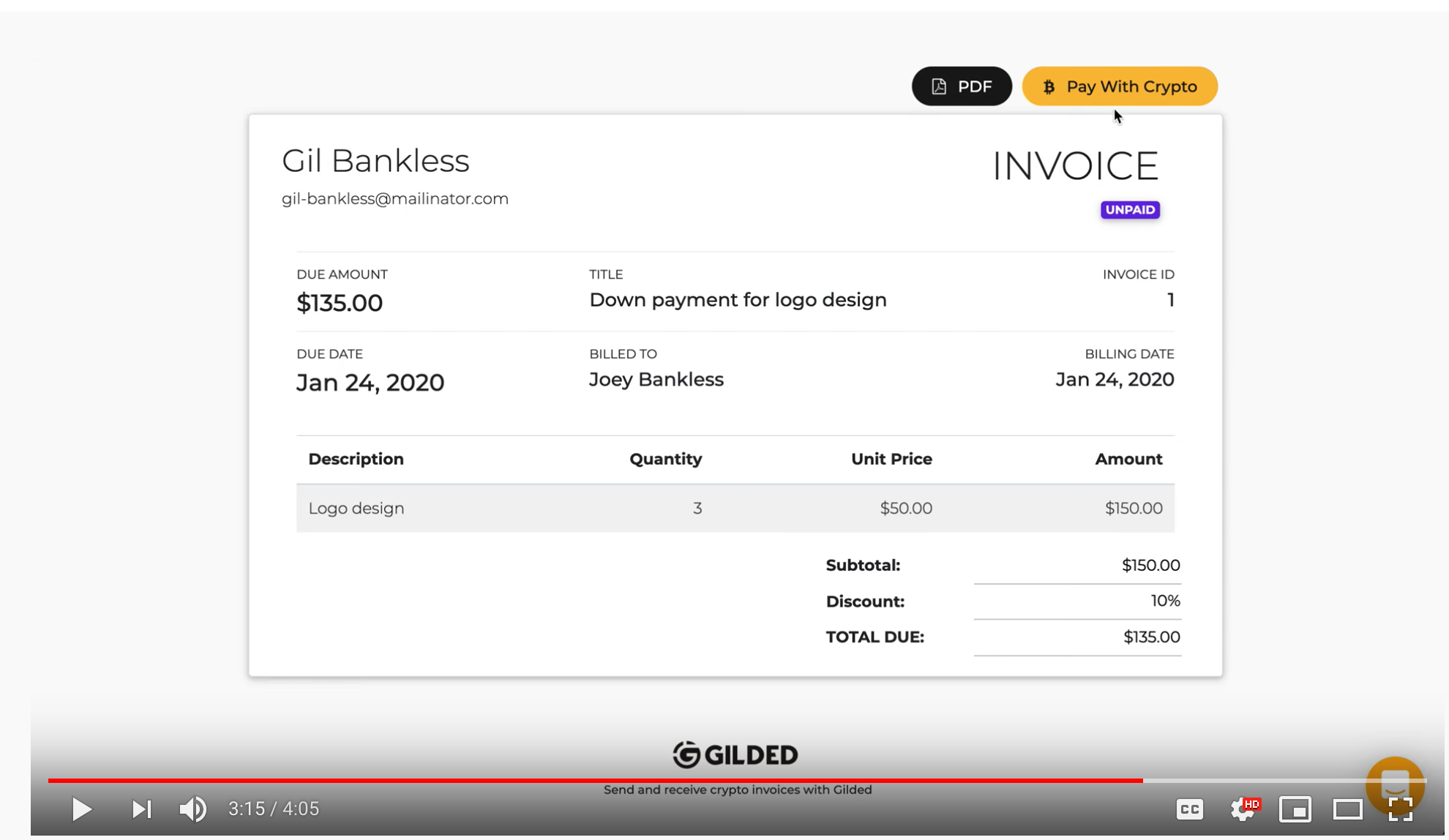

For B2B businesses, invoicing and payment solutions like Gilded make it easy to bill customers, accept crypto payments, and generate tax and accounting records. Gilded integrates with CRMs and accounting software to make accepting crypto a more seamless process. (Full disclosure: this author is CEO of Gilded.)

You’ve received your first crypto payment. Now what?

In the next edition of the “How to take your business bankless” series, we’ll talk about how to manage and track your crypto. We’ll discuss issues such as volatility in exchange rates, how to convert crypto to your local currency, and what tax obligations you may have.

Send a crypto invoice

- If you don’t already have a crypto wallet, create one by signing up for the Coinbase Wallet App (mobile, do-it-yourself experience) or Coinbase.com (bank-like experience)

- In your wallet software, select Ether and copy the Receive address for ETH

- Create a Gilded account and paste in your Receive address as the “public wallet address” when setting up your account

- Send a crypto invoice using Gilded (full instructions here)

- Wait for your payment!

(Above: instructions for sending a crypto invoice)

Action steps

- Should your business start accepting crypto today?

- Get your crypto wallet ready and send a crypto invoice

Author Blub

Gil Hildebrand is the CEO at Gilded and a self-taught nerd with a passion for learning. In summer 2017 he began diving down the crypto/blockchain rabbit hole. Now it’s an obsession. In his words, “I have no choice but to dedicate all my efforts to the revolution.”

Subscribe to Bankless. $12 per mo. Includes Archive access, Inner Circle & Deal Sheet.

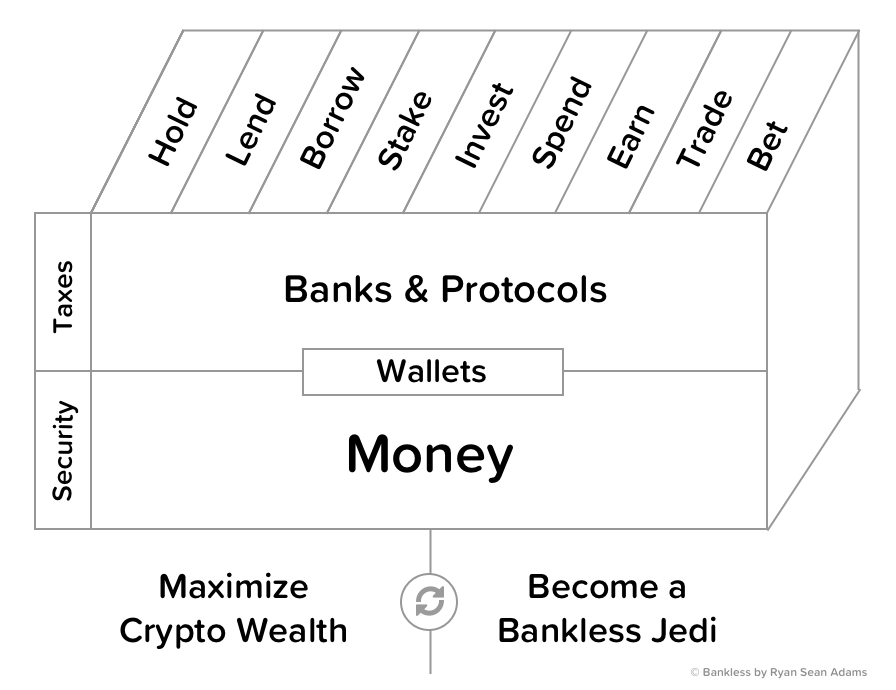

Filling out the skill cube

You just leveled up on how to accept crypto payments in your business. One day that’ll be the default for everyone—until then, you’re ahead of the curve.

👉Send a tip for today’s issue (rsa.eth)

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.