Hold Me, I'm Scared

Independent worker in crypto? Opolis provides payroll, health insurance & benefits! Join now!

Dear Bankless Nation,

It’s goblin town right now.

In order to kill demand and fight inflation, the Fed has sent the equities and crypto markets tumbling after raising interest rates. Both the S&P and NASDAQ have lost over a year of gains, down 17% and 27% respectively.

BTC and ETH are getting sent to goblin town too.

Crypto has lost 12% in the last 24 hours, and 20% over the last 7 days.

The rapid destruction of ~$250b in total crypto market cap has cascading effects upon the rest of the crypto markets, of course. Crypto is no stranger to cascading liquidations, where the liquidations of leverage positioned trigger even further liquidations.

But this time, it’s different…

This time we have algorithmic stablecoins!

Is UST Collapsing?

UST, the algorithmic stablecoin of the Terra ecosystem, is currently in a battle for it’s life. UST has been trading below $1.00 for the last 3 days, but just this morning it broke down and hit a low of $0.92.

At the time of writing, UST is currently at $0.86. With a total supply of 18b UST, that’s $900m in missing market cap due to the broken peg.

In response, the Luna Foundation Guard (LFG) is deploying billions of dollars from its BTC reserves in order to defend the peg.

It’s unclear whether or not the gambit will work—selling BTC to protect UST might end up buckling the entire ecosystem 😬

The Luna Foundation Guard only has $1.4b of ammo left to sell 🙈

Meanwhile, Do Kwon has been forced to showcase confidence to the market, in hopes of quelling fears of further de-pegging.

It will take time to repair the damage caused by this crisis. With macro headwinds and the UST crisis still developing, the light at the end of the tunnel is faint.

📺. PODCAST TEASER: Raoul Pal’s take on the UST Meltdown.

You’re on the list for early access—tap into it on Friday 💪

Bear Market Opportunity

Bear markets hurt. No one likes losing money. If you are experiencing stress and pain, know that you are not alone.

This is what bear markets do. They hurt. ‘Depressed’ prices come from depressed market participants. Markets are aggregations of the emotions of those that compose them. Depressed prices come from depressed people.

Those that make it through the bear are those who redirect their emotional strife into positive, opportunity-seeking behavior.

Just because prices are down doesn’t mean there isn’t opportunity. Opportunity exists independently from secondary market prices.

Some will put their tail between their legs, and mute the knocking of opportunity.

Others will grit their teeth, trim their fat, and lean into the bear market opportunity.

And there is so👏much👏opportunity👏out there.

Airdrop Season

It seems we’re on the cusp of a new #AirdropSeason.

And this could be the best opportunity to capitalize on while we wait for markets to turn back.

Two weeks ago, Optimism announced OP—the first token for a major L2.

Last week, Hop Protocol announced HOP—the first token release for a major cross-L2 bridge.

But the airdrop criteria is different now than in the past. If Optimism and Hop are any indications, the days of mindless airdrop farming are gone.

Airdrop designers are getting smarter. They’re finding ways to identify value-adding users while filtering out extractive farmers.

As a result, the meta has shifted for those trying to score an airdrop.

The standards for airdrop criteria are being raised to ensure that only aligned community members receive tokens.

Are you hoping to score some airdrops this season?

We’ll need to explore how the meta has shifted since the last Airdrop season.

Let’s use the two recent airdrops as a case study.

Optimism

The OP Airdrop #1 methodology.

Optimism Users: 109k addresses

Any addresses that used Optimism before March 25th (1 month before airdrop).

Repeat Optimism Users: 20k addresses

Addresses that used Optimism over 4 separate weeks

DAO Voters: 82k addresses

Addresses that have authored or voted on at least one on-chain proposal, or two Snapshot proposals

Multisig Signer: 19k addresses

Gnosis multisig addresses that have made at least 10 transactions

Gitcoin Donors: 24k addresses

Addresses that have engaged in Gitcoin public goods funding

Users Priced Out of Ethereum: 74k addresses

Addresses that have bridges to other chains, but also continued to engage with Ethereum apps

✨ OVERLAP BONUS ✨

A multiplier was given to addresses that met multiple of the above criteria!

In order to optimize the distribution of the airdrop, Optimism had to get extremely surgical with the criteria. The Overlap Bonus is a great mechanism for tilting the distribution towards users that have proven to be good users and not passers-by.

Great airdrops should result in distributions to the most values-aligned parts of a DAO’s community!!

Hop Protocol

Hop Protocol Airdrop methodology.

Bridgooors: 3.35%

Addresses with at least 2 transactions and $1,000 of total volume (10x $100 transactions ✅)

Liquidity Providers

Addresses that provided liquidity to Hop (pro-rated for volume and time LPing)

Bonders

Discord & Twitter users: 0.1%

The top 500 Hop Discord participants and 79 Twitter users who were early evangelists for Hop

External Contributors: 0.05%

3rd party contributors to parts of the Hop ecosystem (

Authereum Users: 0.5%

Ethereum pivoted into Hop; Authereum users were the early Hop supporters.

🗡️ Report Sybil Addresses 🗡️

Hop produced an ingenious mechanism for mitigating Airdrop issuance to misaligned farmers.

They created a bounty for finding airdrop-farming addresses, and rewarded bounty hunters with 25% of the tokens saved.

Bounty hunting criteria was:

- Each report must eliminate a minimum of 20 related addresses.

- Reports must show high-quality research and be easy to verify by the Hop Labs team.

- Reports that have a non-negligible probability of eliminating legitimate users will not be considered

I talked with Chris Winfrey of Hop last Friday, where we discussed the dynamics of the Hop Airdrop. His napkin math was that 25% of the Airdrop was saved from going to airdrop farmers and redirected towards the aligned parts of the community instead.

DAOs Take Note: 2 New Mechanisms

Both Optimism and Hop leveraged a brand new mechanism for ensuring that their airdrop went to the people they wanted it to.

The Overlap Bonus

Both Optimism and Hop created specific, surgical criteria for finding their truest community members. These unique criteria offer new surface area for Airdrop issuers to get granular about their community members.

Optimism’s ‘Overlap Bonus’ created a multiplier for users who matched multiple criteria.

From a protocol perspective, users that met multiple criteria offer stronger assurances to the protocol that they are long-term aligned community members. The Overlap Bonus tilts the distribution towards users that jumped through more hoops than others in usage and alignment to the protocol.

Reporting Sybil Addresses

This is just good leverage of game theory by Hop.

From the Hop announcement post:

If you are a Sybil attacker who targeted the Hop airdrop with a large number of addresses, you are welcome to report yourself before someone else does. Those who self-report and have not already been eliminated will be included in the proposal to receive 25% of the tokens they may have otherwise received.

If someone reports you first, you will receive nothing.

Basically, they made it rational for Airdrop farmers to turn themselves in, and receive only 25% of their farmed rewards before bounty hunters reported them and they would receive 0 instead.

The New Meta

There’s an arms race going on, between Airdropers and Airdrop farmers.

Airdrop farmers are inherently misaligned with the protocol, as their MO is to maximize profit in any way possible. It’s in the best interest of every DAO to weed these farmers out, and instead send their share of tokens to more aligned community members.

But how?

Last October, we released our Ultimate Guide to Airdrops to Bankless premium members. We listed 25 apps and protocols likely to issue an airdrop to its users (first five are free!)

6 months later, here’s how we’re doing:

Free First Five

- 1. Element Finance (✅ Airdrop confirmed, Bankless readers got this one)

- 2. Hop Protocol (✅ Airdrop confirmed, Bankless readers got this one)

- 3. DeFi Saver (🟠 Airdrop unconfirmed)

- 4. Ondo Finance (🟠 Airdrop unconfirmed)

- 5. Saddle Finance (✅ Airdrop confirmed, Bankless readers got this one)

The Rest

- 6-10 still unconfirmed! 🟠

- 10. Cowswap (✅ Airdrop confirmed, Bankless readers got this one)

- 11-15 still unconfirmed! 🟠

- 16. ENS (✅ Airdrop confirmed, Bankless readers got this one)

- 17-24 still unconfirmed! 🟠

- 25. OpenSea (❌ likely never doing a token)

- Honorable Mentions: MetaMask (❌ likely not doing a token)

We must ask ourselves: Now that the meta has shifted, how do you make sure you get the airdrop?

The answer is simple: Behave like a normal user.

In order to get airdrops that are meant for users, it makes sense to use the application as if you were one, rather than a misaligned airdrop farmer.

- Use a meaningful amount of money.

- Don’t just do the bare minimum; explore and interact with all aspects of the protocol.

- Use the apps on a frequent, recurring basis.

As my wise colleague says “Give a protocol what it wants, and it will pay you for it”.

What do pre-airdrop protocols desire?

They desire users and community members, not farmers. Now they’re equipped with tools to target their users and exclude the farmers.

So how do you capitalize on #airdropseason?

Become a genuine user.

Explore the frontier! Try new things! Experience new applications!

But always remember:

- You could lose what you put in.

- We’re on the frontier

- We’re headed west.

- It’s not for everyone.

- But we’re glad you’re with us on the Bankless Journey.

Don’t let the number stress you out too much—markets reward long-term players.

To those who missed out on the 2021 Airdrop Season…

And to those who need something to distract them from the falling crypto prices…

Get hunting!

Happy Monday.

- David

🙏 Sponsor: Polygon Studios—Fostering culture across Gaming, NFTs, and the Metaverse✨

🎙️ NEW PODCAST EPISODE

Listen to podcast episode | Apple | Spotify | YouTube | RSS Feed

MARKET MONDAY:

Scan this section and dig into anything interesting

Market numbers 📊

- BED falls -7% to $91 from $98 last Monday

- GMI tumbles -20% to $34 from $43 last Monday

- DEX volume increases +11% to $19B from $17B last Monday

- DeFi TVL tumbles -23% to $68B from $75.7B last Monday

- L2 TVL drops -3% to $5.7B from $5.9B last Monday

- BTC funding rate jumps +28% to +2.1% from 1.63% last Monday (Bitmex)

- ETH funding rate soars +72% to +10.2% from 5.9% last Monday(Bitmex)

Market Opportunities 💰

- Join Hype Club to earn HYPE if you’re a Bankless DAO member

- Claim your Hop Protocol airdrop (eligibility only, token coming soon)

- Work in crypto with this guide on how to get a career in web3

- Earn future airdrops from this list of protocols

- Arbitrage funding rates on Kwneta & Synthetix

- Earn the best yields in crypto with DeFi Llama’s APY dashboard

- Secure your crypto with the Keystone + Metamask Mobile integration

- Mint Orbs on May 10th—free mint for all Wavelength owners

- Track DAO treasuries with this awesome tool

- Mint Forgotten Rune Warriors

Yield Opportunities 🌾

- ETH: Earn 7.2% APY by holding icETH from the Index Coop

- BTC: Earn 27% APY on Polynomial with the sBTC Covered Call Vault

- USD: Earn 7.5% on the FRAX+3Pool by staking LP tokens on Convex

- Wildcard: Earn 142% APY by staking SNX on Optimism

What’s Hot 🔥

- Ethereum had more fee volume in 24 hrs than Bitcoin has in 330 days

- Compound Treasury received a B- credit rating from S&P Global Ratings

- Illicit crypto transactions represent just 0.15% of crypto transaction volume

- Vatican to create an NFT gallery to democratize art

- U.S. Treasury issues first-ever sanction on Blender, a privacy mixer

- Maple Finance announces MPL staking to share in Maple’s growth

- Optimism announces OP Stimpack, 230M OP pool for project growth

- Introducing Yearn V3 Vaults

- Tesla releases bullish statement on crypto

Money reads 📚

- How web3 gaming unlocks the open economy - InRainbows.eth

- The economics of rollup fees - Alex Beckett

- Why we need digital identities in a decentralized world - Next.ID

- Unbundling the unit economics of VC via DAOs - 1kxnetwork

- The ownership economy 2022 - Li Jin

- The first truly global macro trade - Pantera

- Tribe DAO Q1 Financial Report - Llama

Trending Project: TerraUSD (UST) 📈

Analyst: Ben Giove

- Ticker: UST

- Sector: Stablecoin

- Network: Multi-chain

- Market Cap: $18.32 billion

- Hotness Rating: 🔥

TL;DR: Crypto’s largest decentralized stablecoin is under pressure.

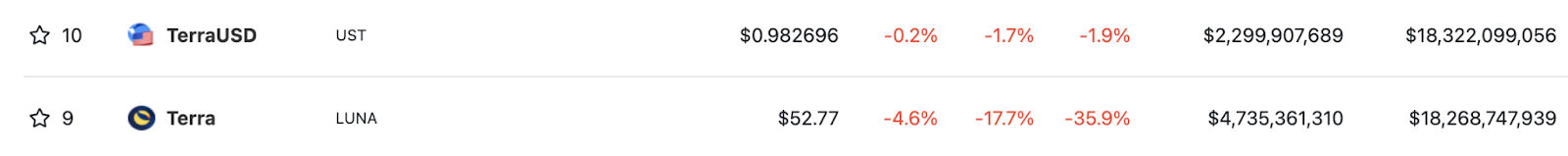

- UST is an algorithmic, dollar-pegged stablecoin. UST is in the midst of a significant stress test as it has experienced significant downward pressure on its peg since May 7. As of writing, the stablecoin currently trades at roughly ~$0.985 on Binance and Curve on Ethereum.

📖 To read more about how UST works in depth, click here.

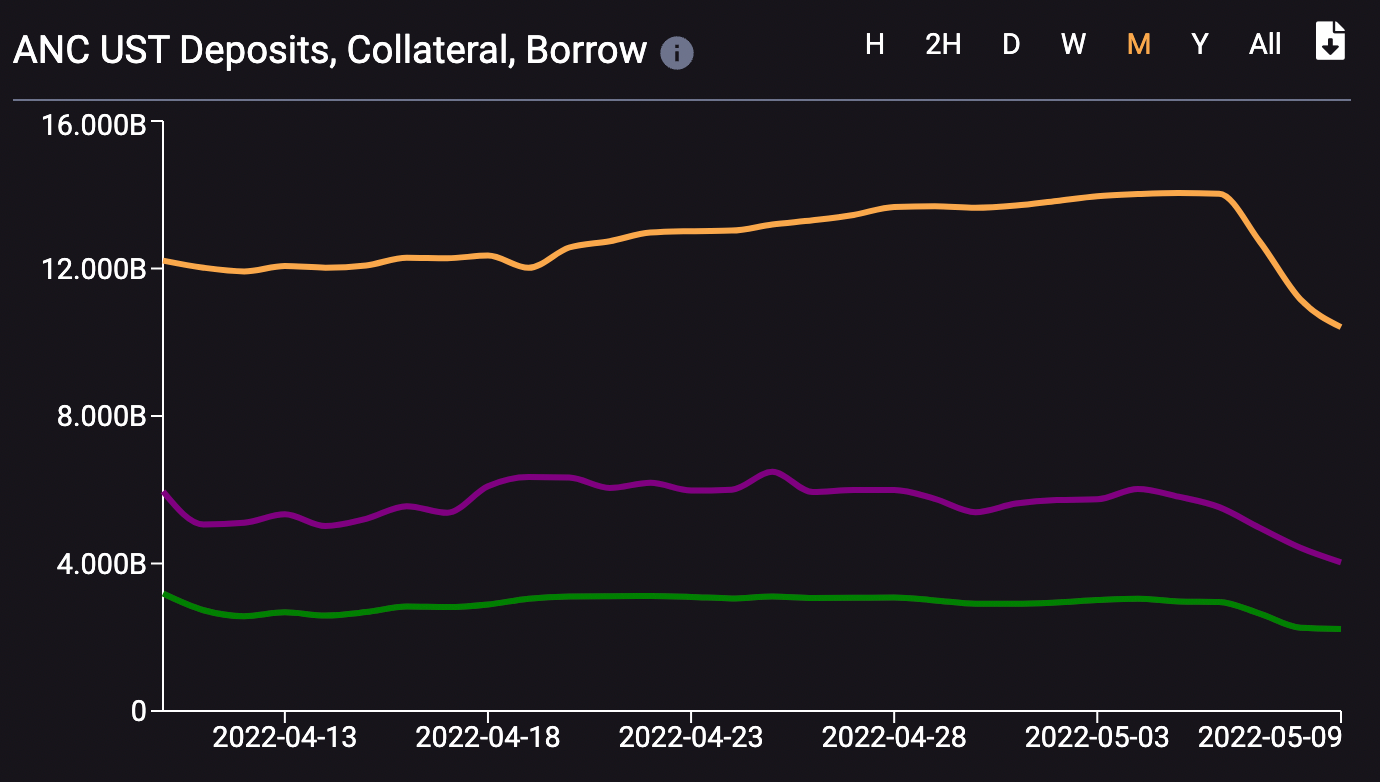

- The de-pegging comes in the midst of major outflows on Anchor, which has seen its UST deposits fall 25.2% over the past 3 days from $14.08 billion to $10.40 billion. Anchor, a money market that has helped to catalyze the growth of UST by paying a fixed rate—currently 18.57%—to UST depositors, holds more than 55.7% of stablecoin’s total supply.

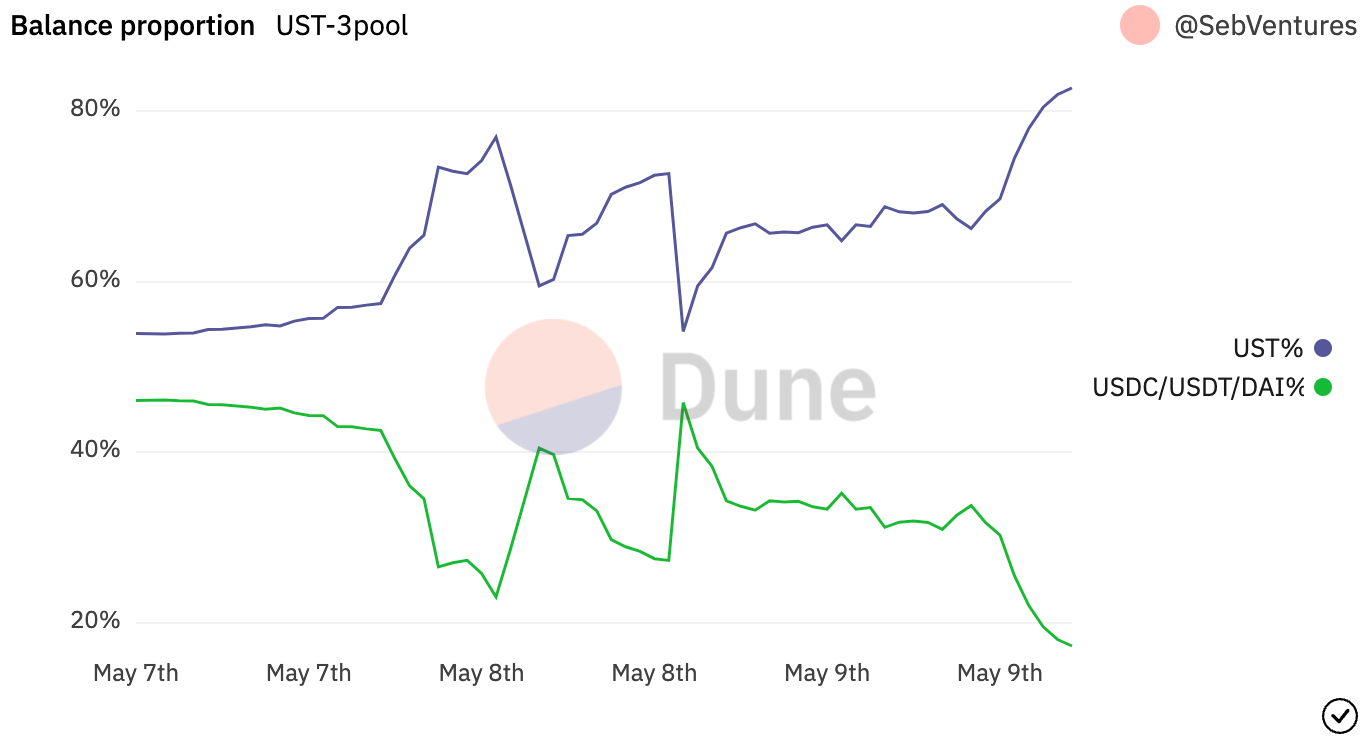

- The UST-3CRV Curve pool, the most liquid pool for the stablecoin on Ethereum, has also become imbalanced, currently at a ratio of ~81.2% UST to ~18.8% 3CRV. The pool, which first became imbalanced on May 7, intends to have a 50/50 split between UST and 3CRV (the base trading pool for stablecoins on the DEX which consists of USDC, USDT, and DAI). While it holds just ~3.4% of the total UST supply, liquidity drying up may prove to have a significant impact on the market psychology and confidence in the stablecoin.

- Along with the duress of the peg and Curve liquidity, the price of LUNA has dropped more than 30% from $76 to $53 over the past three days. With its circulating market cap falling to $18.24 billion, meaning the value of LUNA is less than that of all outstanding UST. As a result, not everyone would be able to exit the system, i.e. redeem $1 of UST for $1 of LUNA, should they choose to.

- To help stabilize the peg, the Luna Foundation Guard (LFG), announced they will be loaning $750 million of Bitcoin and $750 million of UST to OTC desks. This Bitcoin, which was accumulated as a part of the Forex Reserve fund, will likely be sold in order to help bring the peg back to $1, but in doing so, runs the risk of further bringing down the price of LUNA.

- Hotness Rating (🔥): DeFi’s largest decentralized stablecoin is undergoing a significant stress test. Terra investors and UST holders should take precautions and monitor this situation closely.

What We’re Buying 👀

- William, Metaversal: Bought Oddstronauts as a Nansen mint master experiment

- David, Co-Founder: Buying a bunch of ultra sound money

- Donovan, Editor: Bought BTC yesterday (which I thought was the dip)

- Ben, Analyst: Not buying much but keeping a close eye on GMI constituents

Governance Alpha 🚨

- FWB to partner with OpenSea to curate frontpage NFTs

- Lyra Finance distribution proposal for OP tokens

- Perpetual Protocol distribution proposal for OP tokens

- UST on Aurora/Near with Bastion Protocol

Meme of the Week 😂

Jobs opportunities 🧑💼

✨ See all listings on the Bankless Job Board✨

- Marketing Manager at Wanderverse Inc.

- VP of Engineering at ZKX

- Head of Growth at ZKX

- Lead Community Manager at CryptoSkulls DAO

- Senior Product Designer at Parcel Inc

- Ethereum Core Developer at Nethermind

- Golang Engineer at Nethermind

- Bankless Newsletter Editor (come join us!)

- Content Manager at Tally

- Director of Developer Relations at Valist

- Solidity Architect at Alluo

- Marketing Manager at Mesha

- UX Designer at Prometheus Research Lab

Browse more roles (or add your own) at the Bankless Jobs Board

Action Steps

- 🤑 Execute any good market opportunities that you saw

- 🔉 Listen to Timeless Wisdom for Crypto Investors

🙏Thanks to our sponsor

POLYGON STUDIOS

Polygon Studios is on a mission to help build digital culture, play-to-earn gaming, NFTs, and the Metaverse ecosystem on Polygon. Some of the key projects supported by Polygon Studios include The Sandbox, Skyweaver, Big Time, Crypto Unicorns, and Decentraland—among others. Polygon Studios also helps fundraising & onboarding. Check it out here.

Stay updated on the latest amazing gaming, NFT, and metaverse projects:

👉 Join the Polygon Studios Discord

👉 Follow Polygon Studios on Twitter

Want to get featured on Bankless? Send your article to submissions@banklesshq.com

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.