Could UST reach $1T?

Dear Bankless Nation,

There are three trillion dollar crypto markets: Bitcoin, Ethereum, and stablecoins.

Sam Kazemian, the one of the big 4 DeFi stablecoins recently said this on our podcast.

He’s right.

Stablecoins have been one of the hottest sectors in crypto, and it hasn’t been just a flash in the pan. The area has been consistently growing for a few years.

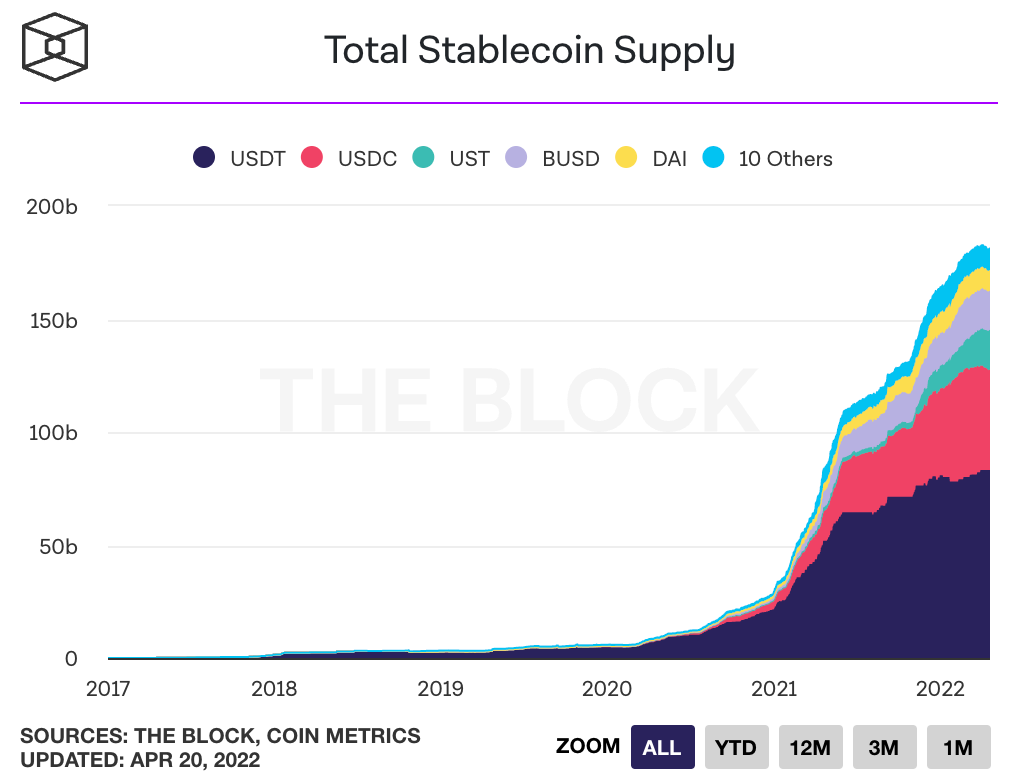

The total market cap of all stablecoins grew by over 100% last year alone, reaching over $180B circulating. Since 2020, this number has exploded by nearly 3000%.

But it’s still early. A trillion dollar market cap is still more than a 5x away.

One of the fastest growing stablecoins in the past year has been Terra’s UST, an algorithmical stablecoin using its native token LUNA and arbitrage incentives to maintain its peg.

This week UST became the 3rd largest stablecoin and 8th largest crypto asset by market cap. (📺 Watch our Bull vs Bear case on UST)

But does it live up to the hype?

What’s going on under the hood?

Could UST become a key player in this multi-trillion dollar market?

How can you capitalize on this potential opportunity?

Ben answers.

- RSA

P.S. Bankless has ad-free podcasts for all premium members! Subscribe now to get access to add-free and bonus episodes on the Bankless Premium RSS feed.

The Bull Case for UST

A trillion-dollar opportunity. The largest TAM in crypto. In the treacherous market conditions of 2022, stablecoins have taken center stage.

Stablecoins play an incredibly valuable role within crypto as they allow holders to keep cash in the ecosystem while leveraging the financial superpowers of blockchains and DeFi. The sector also represents one of the fastest-growing verticals in the industry, as the total market cap of stablecoins has increased more than 115% in the past year and 2950% since January 2020.

The most notable of this cohort of recent has been Terra’s UST, the third-largest stablecoin holding a supply of more than $17.7 billion. UST is powered by the Terra blockchain and its native asset LUNA, which has increased more than 15,100% since the beginning of 2021 and sits at a market cap of ~$34 billion - the eighth largest of all cryptoassets.

This of course begs the question: How has Terra become so successful? How fast is UST growing relative to its competitors? And what are some of the risks facing the protocol?

Here are the answers.

How UST Works

First, let’s take a look at UST under the hood so we can get a better understanding of how it works, how it achieves stability, and the role LUNA plays within it.

UST is an algorithmic, dollar-pegged stablecoin. To mint UST, a user must burn a commensurate amount of LUNA (i.e. $1:$1). To redeem LUNA, a user will have to similarly burn an equal of UST. This means that UST is not backed by an external collateral asset, but rather relies on market incentives to maintain stability.

Let’s look at a brief example to see how this mechanism works.

Let’s say the price of UST is $1.01, trading above its $1 peg. This means that demand for the stablecoin is exceeding supply, which the protocol calls “expansion.” In this situation, in order to decrease the price of UST, an arbitrageur is incentivized to burn $1 of LUNA in order to mint new UST in order to capture the $0.01 difference between the target peg and the current peg.

A similar arbitrage opportunity also exists when UST is trading below its peg, meaning supply for the stablecoin is outweighing demand. If the price of UST was at $0.99, an arbitrageur would be incentivized to burn UST to mint $1 of LUNA, reducing its supply, thereby helping to raise the price of UST back to the $1 peg and pocketing the difference.

While relatively simple, this mechanism has so far proven to be highly effective at scaling UST.

UST is very capital efficient as it does not require any backing to mint new units, increasing the ease at which its supply can grow relative to other designs. An example here are overcollateralized stablecoins like DAI where growth is dependent on an increase in demand for debt. It’s also proven to be largely effective in keeping UST trading near its peg, as the protocol has not seen more than $0.02 cent movement since the days following the crash of May 2021.

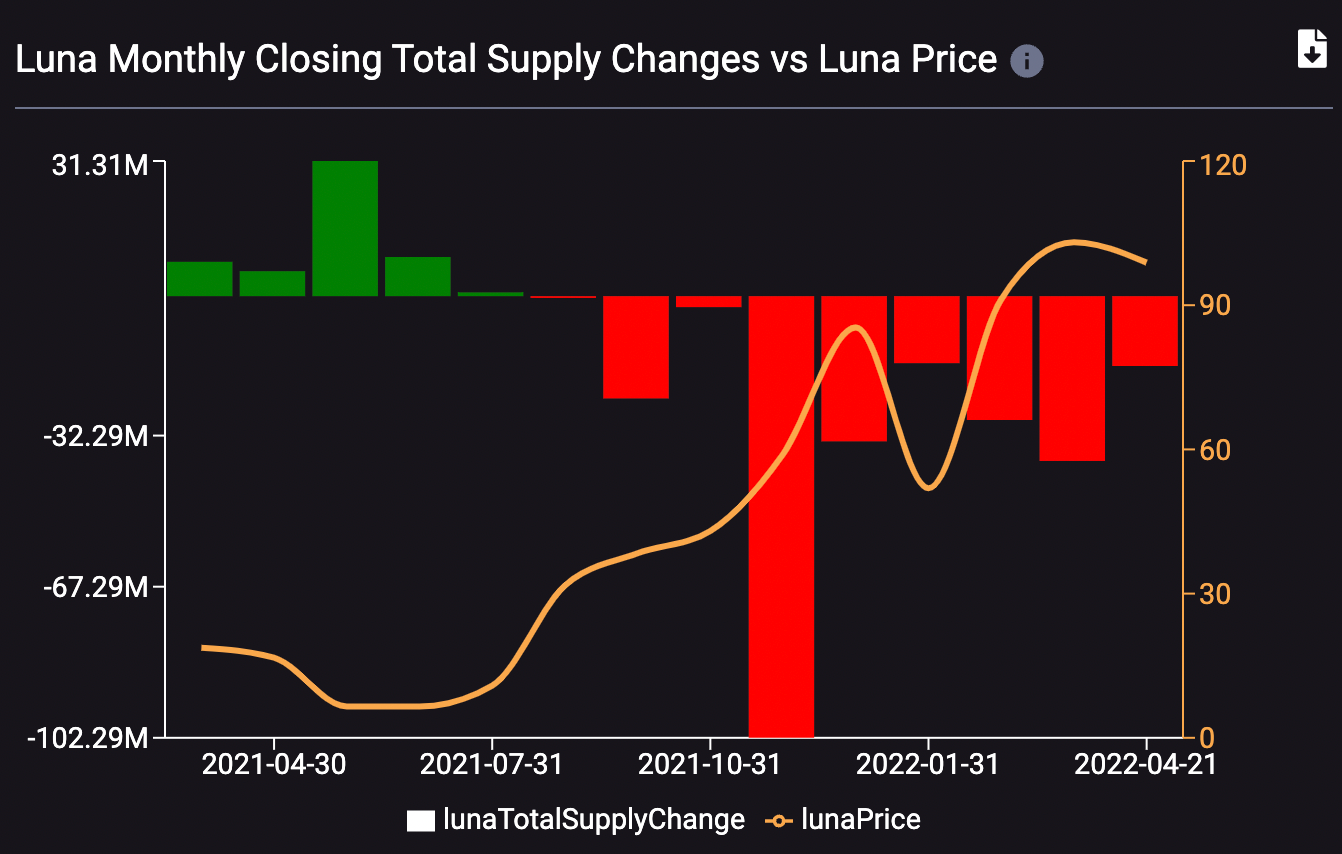

Another key insight to be gleaned from this mechanism is that it ties the value of LUNA to the demand for UST. All else equal, as demand for UST increases, more LUNA will be burned, which should serve to place upward pressure on the price.

Were demand for UST to decrease, LUNA would be minted in order to satisfy redemptions, placing downward, inflationary pressure on its price (more on the externalities of that later in the piece).

While this mechanism is highly reflexive, it places LUNA as a pure bet on the growth of UST, and has led to nine straight months in which the asset has been deflationary.

LUNA and The Terra Blockchain

As mentioned above, Terra is both a stablecoin protocol and an L1 blockchain.

The network is built on Cosmos SDK using Tendermint Proof-Of-Stake (PoS) as its consensus mechanism, where validators bond (stake) LUNA in order to secure the network. Terra recently became IBC compatible, enabling it to facilitate swaps between all the different blockchains in the Cosmos ecosystem. Although its validator set is capped at 130, LUNA bonders can delegate their stake to one of the validators, allowing smaller holders to participate in the staking process. Unlike other PoS chains, LUNA bonders solely earn gas and swap fees — there are no inflationary staking rewards.

LUNA validators have governance rights within the system, voting on network upgrades and parameter changes. A recent important vote was the Columbus-5 upgrade, where LUNA validators voted to burn seigniorage—the fees generated from minting new UST. For a vote to reach quorum, 40% of the staked LUNA supply must vote on a proposal, with a vote needing at least 66.6% approval to pass.

Validators play another key role within the system in that they are responsible for voting on the exchange rate, i.e. the price, of LUNA and UST. Rather than rely on a third-party system such as Chainlink, Terra instead utilizes LUNA validators as its oracle, incentivizing them to vote correctly by rewarding them with a percentage of the fee that is charged on swaps between UST and other Terra stablecoins, as well as UST and LUNA.

By utilizing its own sovereign blockchain, as well as an oracle network internal to the system, Terra is able to be decentralized in that it is not dependent on any outside entities in order for the system to function properly.

Adoption & Growth Strategy

As discussed by founder Do Kwon, a core philosophy behind UST’s growth strategy has been to place an emphasis on creating utility and demand for UST, which helps to build out a strong network effect for the stablecoin.

Here are a few ways Terra has gone about doing this.

Anchor and TeFi

One of the most successful ways in which Terra has managed to increase the utility and usage of UST has been Anchor. A money market on Terra and now Avalanche, Anchor allows UST holders to deposit their holdings to earn a fixed yield that currently sits at 19.46% APY. Users can also collateralize the staking derivatives of L1 assets, currently bLUNA, bETH, bATOM, and wasAVAX, to borrow the deposited UST.

The staking rewards accrued by these L1 assets, along with interest paid to borrowers, helps to generate a portion of the 19.46% rate paid out to depositors, with the difference made up from what's known as the yield reserve, which currently holds more than $267 million of UST.

The deposit rate, which is far higher than the typical yields that can be earned from depositing into other major money markets, has helped Anchor attract more than $15.2 billion in TVL and served as the first major demand driver for UST.

Despite this, Anchor could present a risk to the stability of UST, as the proposed rate cuts, along with a yield reserve that is decreasing by $4 million each day which is on pace to be fully depleted in ~2 months, could lead to outflows from the protocol and potential large redemptions of UST.

While Anchor currently accounts for 75.9% of the $20 billion locked in Terra DeFi, there are several other protocols on the network that have seen meaningful traction such as Astroport, a decentralized exchange and Mirror, a synthetic asset protocol which combine to hold more than $2.5 billion in TVL. The ability to put UST to work in these other Terra native protocols could help to offset a potential supply shock that could occur were the Anchor rate to decrease.

Aggressive Multichain Expansion

Another way in which Terra has generated demand for UST is through growing its supply and utility on numerous other blockchains. Leveraging bridging solutions such as Wormhole, Terra has managed to build out liquidity for UST on networks like Ethereum, Avalanche, Solana, and Fantom.

On Ethereum in particular, Terra has pursued numerous integrations that could position UST, which already has a supply of more than $755 million on the network, to become one of the chain's largest stablecoins.

For instance, Terra recently announced a proposal to create the 4pool, a liquidity pool of UST, FRAX, USDC, and USDT on the decentralized exchange Curve. The pool aims to become the base trading pool on the most liquid DEX in DeFi, replacing the current base pool of DAI, USDC, and USDT, which is known as the 3Pool.

Terra, Frax, and [Redacted] Cartel, whom the two stablecoin issuers are partnering with for the initiative, hold about 6.1% of total supply of CVX, the governance token of Convex Finance which controls a plurality of Curve’s native CRV token. Because of this, the 4pool, which has already gone live on Fantom with more than $31 million in TVL, seems to have a solid chance at shaking up the competitive landscape of Curve liquidity.

Along with Curve, Terra has begun to integrate with other protocols in Ethereum DeFi, such as Rari Capital’s Fuse, a permissionless money market protocol, in which it is providing liquidity to pools that list UST.

Forex Reserve

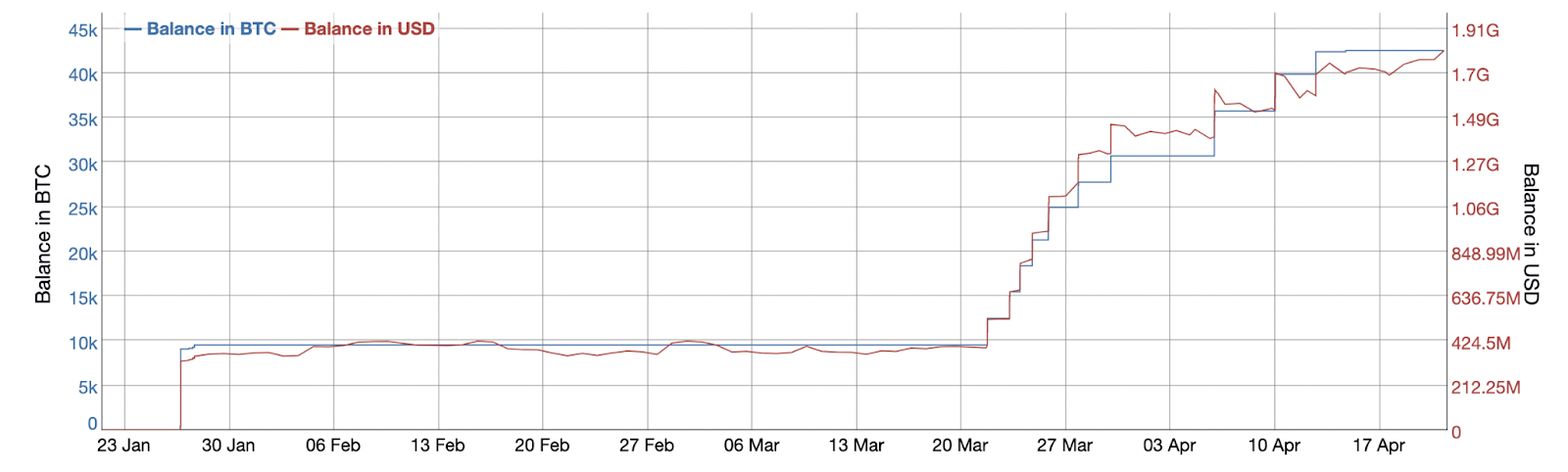

Another, more recent driver of Terra’s growth has been the creation of the “Forex Reserve.” Kickstarted in February 2022 with the announcement of a $1 billion raise from major entities such as Three Arrows Capital and Jump Crypto, the reserve aims to accumulate Bitcoin to serve as a backstop and help maintain the peg of UST.

The reserve, which currently holds more than $1.81 billion in BTC aims to eventually be $10 billion in size, and diversify among other cryptoassets, which it has begun to do through a $100 million LUNA/AVAX token swap with Avalanche’s Ava Labs. This means that UST as of today is ~15-16% backed by other crypto assets.

This reserve, which has helped to buoy prices in the crypto market, has driven demand for UST, likely due to spurring confidence in its ability to maintain its peg and satisfy redemptions, as the market cap of UST has increased by 45% and the price of LUNA 81%, since the announcement of the creation of the reserve.

State of UST

Now that we understand how UST works and the drivers of its adoption, let’s take a look at some on-chain metrics to see how the stablecoin stacks up relative to its competitors.

Circulating Supply & Market Share

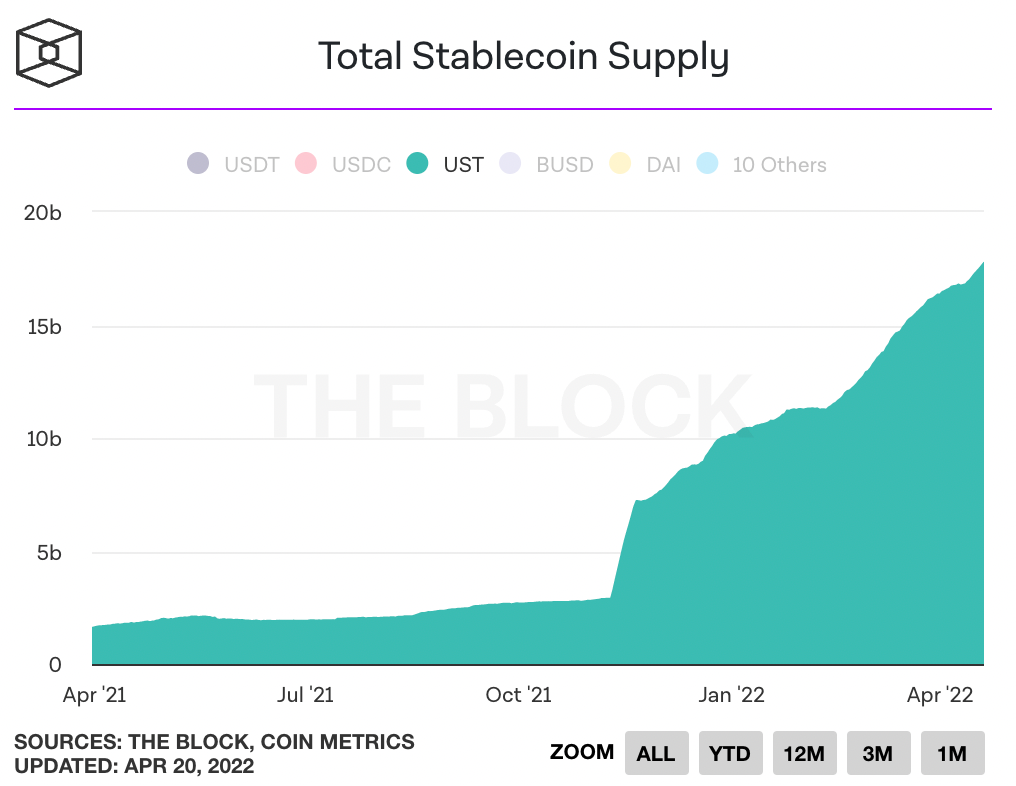

UST has experienced incredibly explosive growth during the past year, having grown more than 987% over the period to a circulating supply of more than $17.7 billion.

This places it as the 3rd largest stablecoin, behind USDT and USDC. Given that the other two are fiat-backed and centrally issued, this makes UST the largest decentralized stablecoin in all of crypto by a wide margin, with it being more than 2x the size of its closest competitor in DAI.

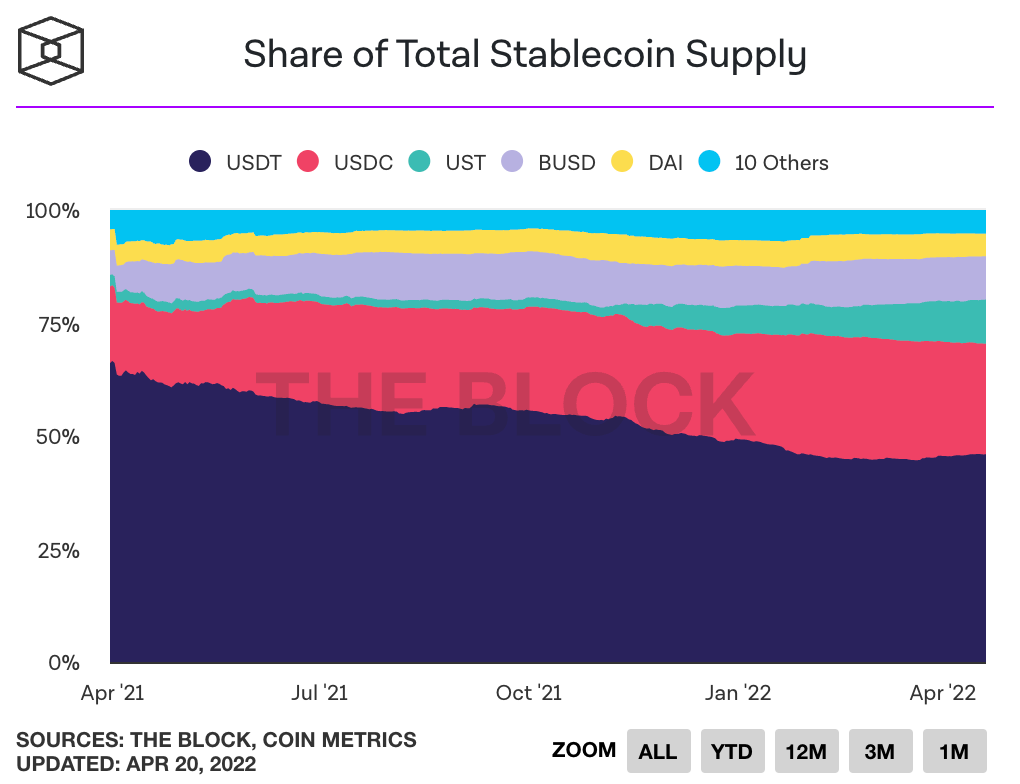

UST has seen its market share grow dramatically over the past two quarters. The protocol currently has a 9.8% share of the total stablecoin supply, a figure that has increased by more than 4x from 2.1% since October 2021.

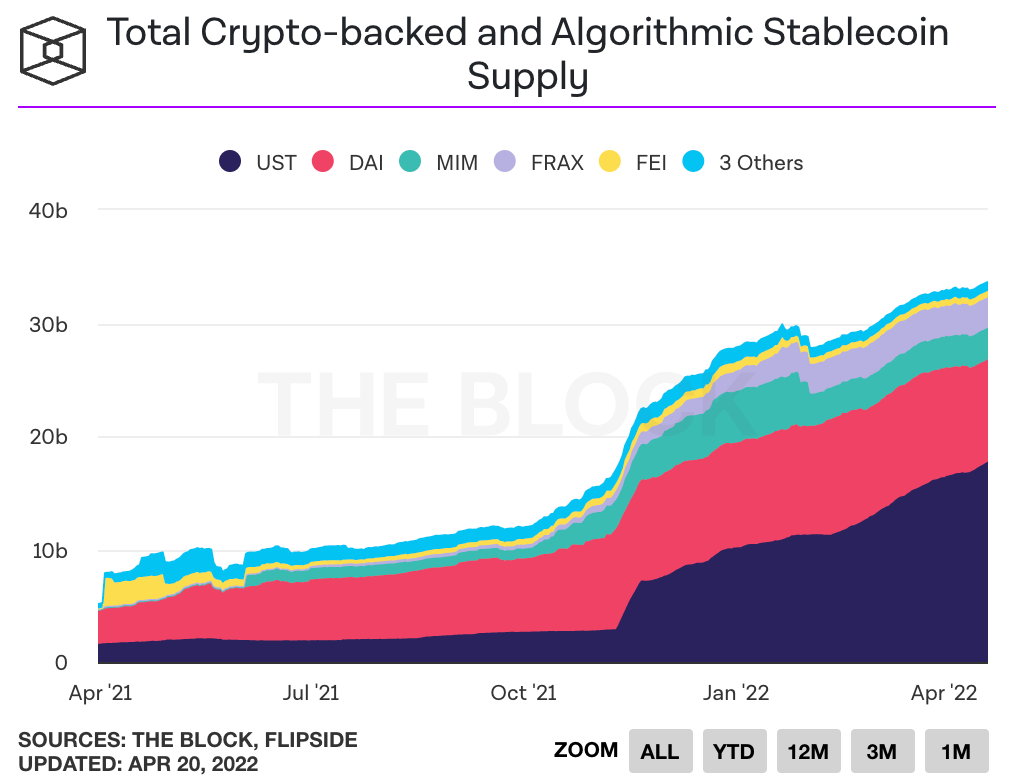

This impressive growth in market share is only highlighted by UST’s competitive positioning relative to other decentralized stablecoins. Per The Block, UST accounts for a majority of the decentralized stablecoin supply, with a 52.7% share of the $33.6 billion among the eight largest crypto-backed and algorithmic stablecoins. This represents a more than 2x increase from its 19.9% share in October 2021.

Growth Rates

As indicated by its increasing market share, UST has been growing at faster rates than its competitors. However, a closer look at these growth rates reveals just how large that discrepancy has been.

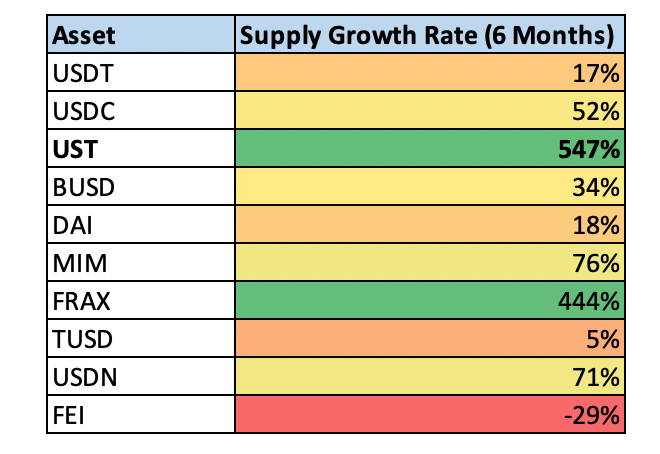

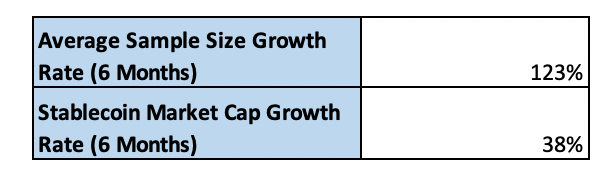

The table above shows the supply growth rates of the ten largest stablecoins by market cap over the past two quarters, including a mix of centralized, decentralized, fiat backed, crypto-collateralized, and algorithmic USD-pegged assets.

As we can see, UST has had far and away the highest growth rates among the ten, having seen its supply increase 547%. It’s one of just two, with the other being FRAX, that expanded at a greater than triple-digit rate over the period.

This means that UST has grown roughly 4.4x faster over the past six months than the average of the ten selected stablecoins, and at a rate more than 14x that of the entire stablecoin sector.

In a rapidly expanding, secularly growing stablecoin sector, UST has shown itself to be the clear fastest horse.

Risk Factors

Now that we’ve highlighted UST’s tremendous growth and the keys to its success, let’s take a moment to highlight some of the risks facing the protocol that are mentioned throughout the piece.

Inflationary Death Spiral

Perhaps the biggest risk facing Terra is what's known as the “death spiral,” such as what was seen with stablecoins such as Iron Finance. This scenario, which other algorithmic stablecoins have succumbed to, consists of a run on UST, i.e. mass redemptions, as a result of the stablecoin losing its peg to the downside. Were this to be the case, LUNA would be minted at increasingly high rates, causing more UST holders to lose confidence and further inflating the supply of the asset until it loses all of its value.

Limited Validator Set

As touched on in the piece, UST is only as decentralized as the network securing it. Given that Terra only supports 130 validators, this could serve as a centralization vector were the protocol to come under significant regulatory scrutiny.

Anchor Rate Cuts

Were the Anchor deposit rate to decrease and the protocol to see UST outflows, the stablecoin would be at risk of redemptions, potentially kickstarting an inflationary if holders choose to deploy their capital elsewhere.

Competition

Competition in the stablecoin sector is incredibly fierce. Terra will need to continue to evolve and iterate on the protocol, as well as build out its network effect in order to defend its competitive positioning.

Conclusion

The largest decentralized stablecoin, UST has taken the crypto world by storm.

With a native asset in LUNA that accrues value based on demand for UST, an aggressive strategy to generate demand, utility, and build out a network effect, and tremendous growth rates, Terra looks poised to continue its lunar ascendence.

Action steps

- 🤓 Evaluate the potential for UST as a stablecoin and the risk

- 📘 Read The Beginner’s Guide to Terra