We've been sharing airdrop alpha since January 2021. We claimed there was a good chance you could make 🤑 serious bank 🤑 by being an early user of these crypto protocols. We were right.

The Bankless Airdrop Guide frontran many of 2023's largest airdrops, from Arbitrum to Blur, and has served the Bankless Nation well, helping Citizens like DougO earn thousands in free tokens!

Some amount of work is required, but have no fear: Bankless is here! While we can't promise anything, spending just 10 minutes poking around the various protocols we cover could land you a massive payday in the future.

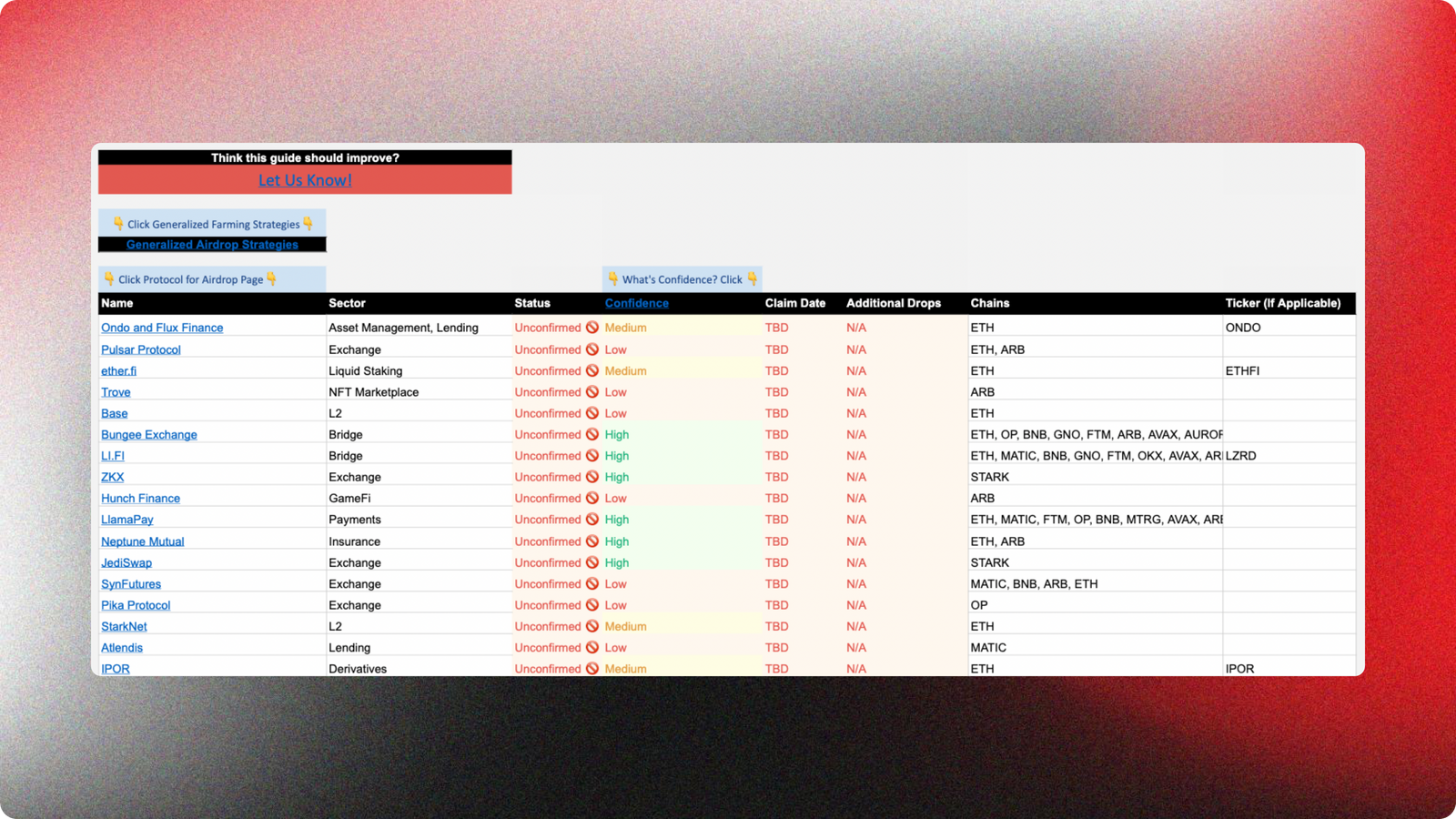

In this guide, we’re serving alpha: 60 protocols with potential airdrops! This guide has been designed exclusively for Bankless premium subscribers.

Disclaimer: We have no idea if the projects listed below will have an airdrop or what the airdrop criteria might be. These are best guesses based on our experience as crypto users.

🔵 Term Finance

Name: Term Finance

Status: Unconfirmed 🚫

Confidence: Medium

Sector: Lending

Chains: ETH

Why we're watching:

We've previously seen major players in the fixed rate lending space (i.e.; Element Finance) give token allocations to early users, creating precedent for Term to do the same.

While it is not certain that Term will airdrop a token to its earliest users, many DeFi protocols have previously airdropped tokens to users accessing gated and testnet versions of their dApps, and being early is frequently one of the best ways to score an outsized airdrop. Keep reading to learn how you can qualify for early access to Term Finance's gated mainnet!

What is it?

Term Finance is bringing fixed rates lending to DeFi through a novel auction approach, allowing users to fix both the term and rate they borrow at!

Existing fixed rate borrowing and lending platforms, like Pendle and Element, use an AMM, however this model dilutes lender yields by having utilizations under 100%, as idle capital must sit in the AMM to facilitate swaps, and is highly susceptible to slippage, especially for users trading in size (like institutions).

Via a Dutch Auction mechanism, Term matches borrowers with lenders, achieving the highest possible yield for lenders and lowest possible cost of capital for borrowers. Participants submitting bids and asks outside of this market clearing rate have their capital returned to them at the conclusion of the blind auction process, allowing Term to utilize 100% of their users' capital.

Maximize your eligibility by:

☐ Applying for early access to the testnet

Learn More:

🟣 Gravita

Name: Gravita

Status: Unconfirmed 🚫

Confidence: Medium

Sector: Stablecoin

Chains: ETH

Why we're watching:

Gravita states in its docs that the team will release information regarding governance token specifications, including its distribution, at some point in the future and advises readers to tune-in to learn more about a token.

Protocols that align themselves with "Ethereum values" have a higher likelihood of airdropping a portion of their governance tokens to early users; Gravita has done so in two ways. By accepting bLUSD and liquid staking derivatives, Gravita has displayed its desire to serve members of the broader Ethereum community. Crucially, Gravita has been transparent about its forked nature and vision to improve an open-source protocol.

What is it?

Gravita is a Liquity fork built to address the inherent limitations of its immutable predecessor, including the scalability constraints imposed by LUSD's single collateral (ETH) model. As a "friendly fork," Gravita intends to bolster Liquity usage by accepting bLUSD – colloquially known as Chicken Bonds – as collateral, in addition to other decentralized yield-generating assets (like LSDs).

Maximize your eligibility by:

☐ Depositing GRAI in the Stability Pool

☐ Borrowing GRAI on bLUSD (no liquidations on bLUSD!)

☐ Providing liquidity in Uniswap's GRAI/USDC and GRAI/ETH pools or Curve's GRAI/FRAX/USDC pool (Gravita flagged liquidity as a major need in a Twitter space, making this a must for any airdrop farmooor)

☐ Following Gravita's Twitter for info on its governance token distribution

Learn More:

- 🐦 Gravita Airdrop Alpha Thread

- 🐦 DCA into ETH with Gravita's Stability Pool

- 📃 Gravita Protocol: Designed for ETH Derivatives

- 📃 Introducing Gravita

⚪ Linea️

Name: Linea

Status: Unconfirmed 🚫

Confidence: High

Sector: L2

Chains: ETH

Why we're watching:

On May 2, Linea announced the start of its Voyage campaign, a 9-week quest similar to Arbitrum's Odyssey. Users will accumulate points on Galxe for completing a variety of on-chain endeavors and off-chain quizzes, polls, and social challenges.

Top testers will earn the rights to mint a one-of-a-kind NFT at the culmination of the Voyage!

Early-stage project NFTs are often used as a basis to identify a protocol's most dedicated users for future token allocations. Additionally, rollups like Arbitrum and Optimism have airdropped tokens to users, creating strong precedent for an airdropped LINEA token, plus, launching a token could help the network bootstrap liquidity.

What is it?

Linea is the next generation of the ConsenSys zkEVM, aiming to serve the next generation of dApps built on Ethereum and empower devs with low fees and scalability.

The L2 was designed to be as developer-friendly as possible, coming with out-of-the-box support for popular tools, like MetaMask and Truffle. Linea's unique prover design ensures faster transaction speeds and reduced gas costs, without sacrificing security.

Maximize your eligibility by:

☐ Staying up to date with Linea's Twitter and participating in future Voyage tasks (Week 6 of the campaign is live! Test your Layer 2 knowledge and brush up on Linea's documentation beforehand to ace the questions 🤝)

☐ Getting onto Linea's testnet (works natively with MetaMask!)

☐ Bridging funds to Linea's testnet (use Hop Exchange!)

☐ Funding your wallet with Linea's faucet

☐ Exploring the various dApps Linea currently offers

Learn More:

⚫️ Aori

Name: Aori

Status: Unconfirmed 🚫

Confidence: High

Sector: Options

Chains: N/A (Future: ARB, OP, AVAX)

Why we're watching:

Aori has an early-stage NFT collection. HODLing a "Seat" provides numerous in-protocol benefits – described in further detail below – and we believe their presence indicates a future airdrop, following a similar approach to NFT marketplace Sudoswap.

The protocol has aligned itself with Ethereum's values by giving NFT holders control over certain aspects of governance; it is plausible that the protocol continues on the path towards total decentralization and airdrops a token further along in its roadmap. Seat NFT holders will likely receive outsized allocations compared to other categories of early users.

What is it?

An orderbook-based options protocol in the midst of its journey to mainnet.

Seat NFTs play a core role in the Aori ecosystem. To access the exchange, users must trade through one (whether they own it or not). Seat holders set protocol fees, trade for free, and earn a portion of fees on orders placed through their seat.

Aori Prime (the next iteration of dAMM Finance) serves as the protocol's leverage layer and brings capital efficiency to the exchange. Bad debt is siloed to the Prime pool it originated from, allowing individual Primes to extend off-chain credit-based loans without impacting the solvency of the broader exchange.

Maximize your eligibility by:

☐ Placing the winning bid for an Aori seat (105 are available and minting is set to continue until late July)

☐ Joining Aori's Discord and obtaining an "Alpha" role by completing knowledge and engagement-based quests

☐ Keeping up-to-date with Aori's Twitter for announcements on how you can access their public testnet

Learn More:

🔵 GammaSwap

Name: GammaSwap

Status: Unconfirmed 🚫

Confidence: Medium

Sector: Derivatives

Chains: ARB (Testnet)

Why we're watching:

As part of its incentivized testnet, GammaSwap is rewarding users with the ability to earn Discord roles, custom NFTs, and Galxe OATs (in addition to cash prizes).

Protocols that make an effort to identify their first users often do so with the intention to direct larger airdrop allocations to them. While we do not know with certainty that GammaSwap will airdrop their token, we've previously seen protocols directing similar incentives towards their early users do so.

What is it?

GammaSwap turns an LP’s trash into a tradooor’s treasure.

Providing liquidity to AMMs like Uniswap exposes liquidity providers to impermanent loss, reducing the value of their positions as underlying asset values fluctuate.

Payoffs resulting from liquidity positions mimic constantly adjusting short straddle options in traditional financial markets, where an investor sells both put and call options on the underlying with the same strike and expiration.

Under the current paradigm, LPs are not compensated for writing these options. Creating a marketplace where liquidity providers are matched with parties looking to long volatility allows LPs to generate an additional source of yield from traders or hedge against their own impermanent exposure.

Maximize your eligibility by:

☐ Registering for and participating in the GammaSwap x Rysk Finance trading competition (Rysk Finance is also listed in the Airdrop Guide!)

Learn More:

⚫️ Smilee Finance

Name: Smilee

Status: Unconfirmed 🚫

Confidence: High

Sector: Derivatives

Chains: ARB (Testnet)

Why we're watching:

Smilee recently completed round one of its incentivized testnet. Qualifying traders received allocations of both USDC and SMILEE tokens! While no roadmap to an airdrop has been announced, the team has displayed a clear desire to decentralize governance over their protocol to early users and it appears highly likely they will continue to allocate tokens to their earliest users.

What is it?

Smilee unlocks the potential of IL by allowing traders to take positions on price volatility. The protocol's core primitives are on-chain options and derivatives enabling volatility trading at scale. To start, Smilee turns IL from a bug to a feature through their "Impermanent Gain" & "Real Yield" products.

Essentially, you can short volatility (akin to LPing on an AMM) while earning a yield, or long volatility with Impermanent Gain options offering up to 5,000x leverage and no liquidations. Smilee allows LPs to hedge their IL exposure and traders to speculate on volatility.

Smilee recently announced components of its Smilee v1.69 update, including a synthetic AMM and Directional Impermanent Gain options, enabling traders to enter and exit positions at any time while giving them the ability to double leverage by taking a directional preference on volatility.

Because of the flexibility of its custom synthetic engine, Smilee can offer a variety of exotic derivative payoff structures, including those for impermanent gain, options, variance swaps, structured products and insurance.

Maximize your eligibility by:

☐ Keeping up-to-date with Smilee's Twitter for announcements on how you can join their upcoming public testnet!

Learn More:

⚫ Stream️ Finance

Name: Stream Finance

Status: Unconfirmed 🚫

Confidence: Medium

Sector: Real World Assets

Chains: ETH

Why we're watching:

In their docs, Stream explicitly addresses the possibility of a STREAM token. Like many quality crypto projects, Stream has chosen to prioritize their product over an airdrop. While they currently have no plans to launch a token and do not encourage any form of speculating or sybiling, if they did so, it would likely be "jointly via an IDO and airdrop mechanism."

What is it?

Stream Finance aims to bring U.S. Treasuries into DeFi and narrow the gap between stablecoin and real world yields, using a tailored, KYC-minimized process to allow any non-U.S. parties to get exposure to U.S. Treasuries.

Currently, Stream allows individuals to set up “vaults” to invest in 4-week U.S. Treasury bonds and withdraw their principal and accrued interest at the end of the term, however, the team intends on adding additional asset types, like corporate bonds.

Flow, a product currently in the works from the Stream team, will bring instant liquidity to depositor positions, but requires users to sacrifice a portion of their yield, reflective of the fact that the smart contract must hold liquid assets to honor redemptions.

Maximize your eligibility by:

☐ Visiting Stream's dApp to start earning real world yield today!

Learn More:

⚪ OpenEden

Name: OpenEden

Status: Unconfirmed 🚫

Confidence: Low

Sector: Real World Assets

Chains: ETH

Why we're watching:

For the foreseeable future, it is highly likely that OpenEden will not airdrop a governance token. Institutional investors seeking real world asset exposure in crypto need assurances that their capital is in safe hands and the current centralized structure of OpenEden allows them to do just that.

Despite present-day restrictions, OpenEden remains committed to decentralizing governance over the protocol "in the spirit of true DeFi." We have seen many protocols turn to airdrops to help decentralize and it appears likely that OpenEden will follow a similar route over the long term.

What is it?

OpenEden is the first smart contract Treasury Bill vault to be managed by a bankruptcy-remote, regulated entity, making it one of the safest methods to access real world yield on-chain.

The protocol places compliance and transparency above all else. Collateral is managed by a Singapore central bank (Monetary Authority of Singapore) regulated fund management company and tokens are exclusively issued from a professional fund regulated by the British Virgin Islands Financial Services Commission.

OpenEden provides a variety of comforting features for investors, like real-time Chainlink Proof of Reserves attestations and daily custodian reserve reports. Instant redemptions are possible, thanks to a 5% USDC reserve, offering investors on-demand liquidity.

TBILL is OpenEden’s first yield-bearing ERC-20 and the team hopes to unlock DeFi lego mode soon.

Maximize your eligibility by:

☐ Connecting to the dApp and completing the KYC process (non-US and accredited US investors only!)

☐ Depositing USDC to mint TBILL tokens

Learn More:

View the Full Guide!

Compiled in a convenient spreadsheet format, your one-stop-shop for all of your airdrop strategy searching needs! Your initiation to airdrop hunting starts now 🤝

** It’s important to keep in mind that using young DeFi and NFT projects can be risky. They’re essentially all experiments. Do more research before diving into any of these protocols. That’s a requirement.

If you do test any of them out, make sure to do it cautiously and only with amounts of crypto that you won’t miss if worst-case scenarios, e.g. hacks, happen.