Can crypto solve climate change?

Get full access to Market Monday, early access to podcasts, and exclusive debrief episodes!

Dear Bankless Nation,

Climate change is problem for all of us.

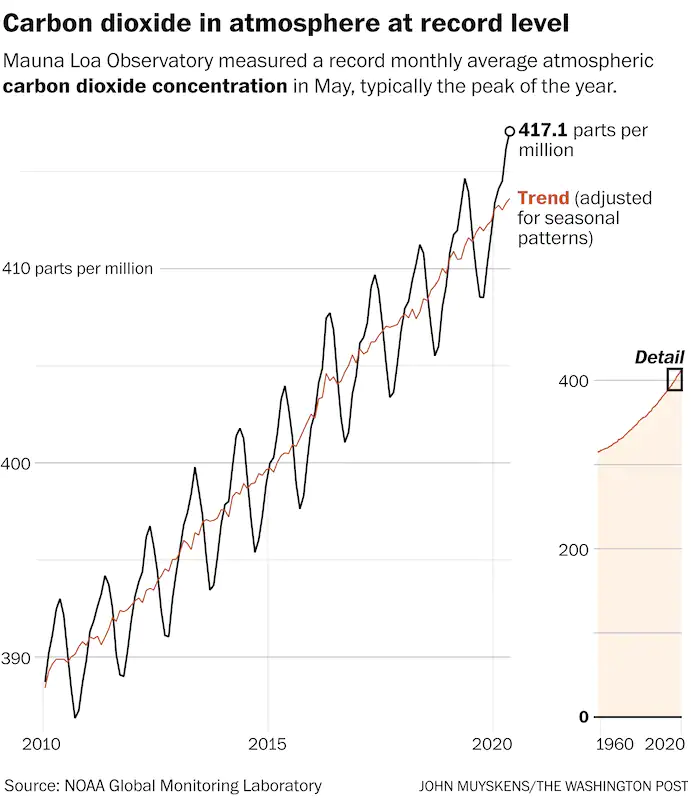

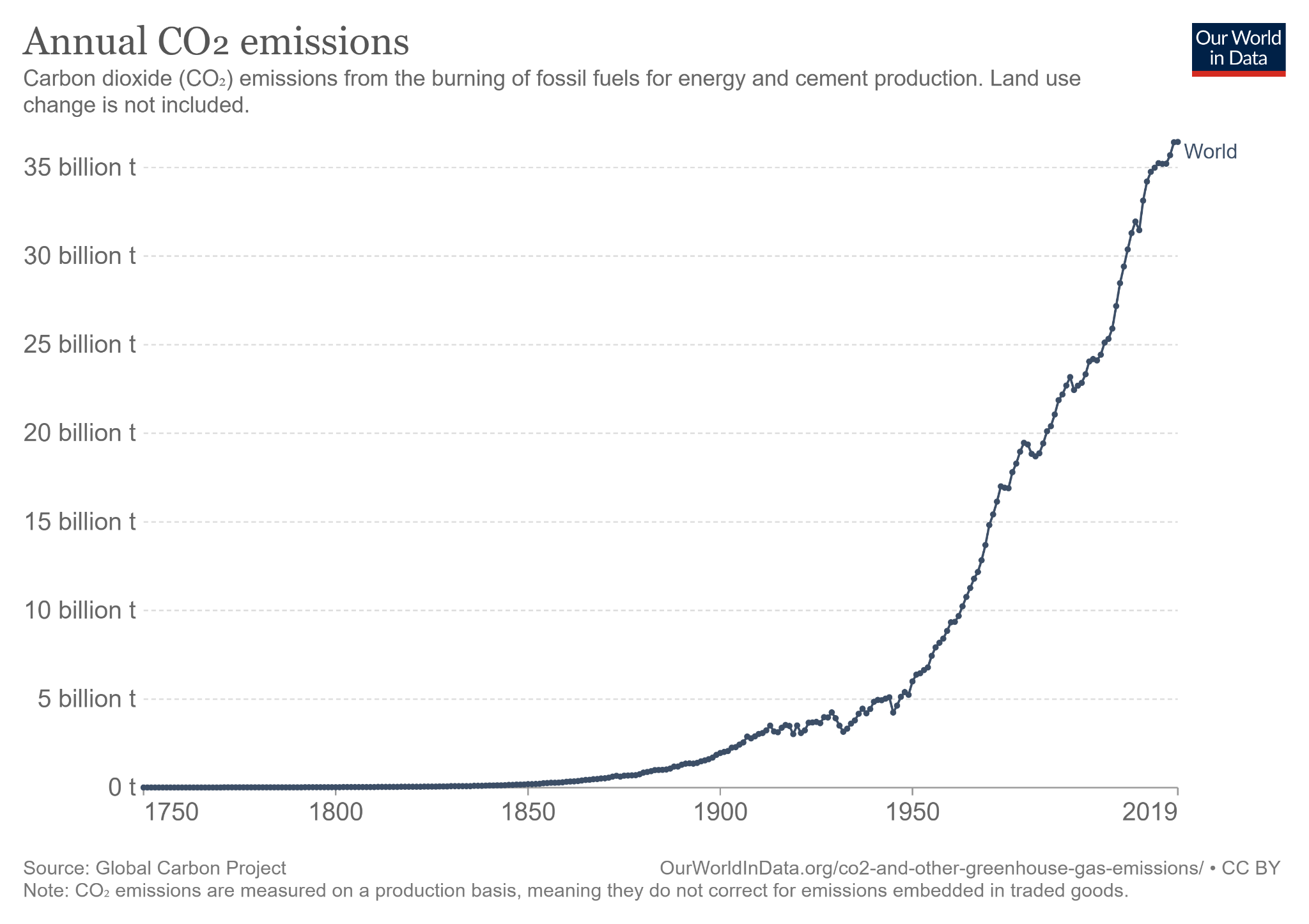

Despite the talk, not much gets done. Carbon emissions continue to reach all-time highs. The nations aren’t solving it. The private sectors are mostly MIA.

Is there any hope?

This is a real-world example of Moloch—the god of human coordination failure. Society simply cannot coordinate on a global scale to solve climate change.

But as we’ve made the case before, Ethereum is the slayer of Moloch. It’s a new technology for human coordination.

So what if we can leverage Ethereum and some game theory developed by OlympusDAO to fight climate change?

What if we started scaling carbon credit markets?

KlimaDAO believes Ethereum is a big unlock for solving client change.

Here’s how it works.

- RSA

P.S. PoolTogether is distributing thousands of prizes from a $1M prize pool. Jump in—the water is great! 🏊

🙏 Sponsor: Lido—simplified and secure liquid staking for digital assets.

📺 Watch A New Era for DeFi | Scoopy Truples of Alchemix

🎙️Listen to Podcast Episode | 📺 Watch the Episode

THOUGHT THURSDAY

Guest Writer: 0xy_Moron, Co-Founder of KlimaDAO

An Attempt at Fixing Climate Change

In October 2020, Bankless released the Slaying Moloch episode discussing how Ethereum can solve coordination failures across the economy and even in our wider society. Moloch represents our inability to coordinate; to be perpetually dissatisfied about the society we are living in.

We are quickly entering a new paradigm where Web3 is scaling, and we now hold tools that enable us to coordinate more efficiently and effectively than ever before.

DeFi offers us an opportunity to slay Moloch.

This essay delves into how KlimaDAO intends to use novel incentive mechanisms developed by OlympusDAO to coordinate markets and move the dial on climate action.

Setting the Scene: DeFi's play on the carbon markets

We're not far off from an unprecedented environmental disaster driven by human activity: burning fossil fuels, decimating our natural assets, and a general disregard for the places we live.

This is happening on a global scale.

Governments, industry leaders, and society have dipped into the climate change toolbox in an attempt to slow down the degradation of our environment and reduce the rate of global warming.

It hasn't really worked. CO2 emissions from human activity are at an all-time high.

From the local level to the international arena, policy, innovation, and civil action has fundamentally been ineffective. When viable solutions (of which there are many) are found, they are deployed slowly and piecemeal. Climate action lacks coordination and meaningful incentive mechanisms to deliver the change required.

Of the tools available in the climate change toolbox, the carbon markets represent a key mechanism that can enable necessary and immediate investments into pro-climate projects across the globe.

The carbon markets do not replace the need to achieve deep decarbonization of carbon-intensive activity across the economy—they sit alongside them.

Scaling the carbon markets is a priority for climate action.

The carbon credits that constitute carbon markets do two things:

- They put a price on emitting carbon that motivates the emitter to reduce or stop the underlying emitting activity

- They finance an equivalent reduction elsewhere that would not otherwise have happened across forestry projects, renewable energy deployment, and an increasingly innovative portfolio of measures.

It is this market-based mechanism that KlimaDAO aims to leverage.

But first, back to Moloch.

Game Theory: Failure at Layer 0?

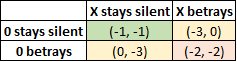

The Prisoner's Dilemma is Albert Tucker's famous illustration of Game Theory, demonstrating coordination failure between people as two completely rational individuals fail to cooperate, even when it would lead to the best outcome.

To summarize, the Prisoner's Dilemma shows how two prisoners, locked in solitary confinement, are offered the opportunity to betray one another by testifying that the other committed a crime. The alternative is to keep quiet.

There are 4 outcomes of this game:

- Both prisoners (0 and X) betray each other, both serve 2 years in prison (-2, -2).

- 0 betrays X, but X remains silent; X serves three years and 0 goes free (0, -3).

- X betrays 0, but 0 remains silent; 0 serves three years and X goes free (-3, 0).

- 0 and X both stay silent, both of them serve 1 year (-1, -1).

The implication here is that at the individual level and with no ability to coordinate, all purely rational and self-interested prisoners will betray the other even though mutual cooperation would be optimal. Hence, the least optimal outcome (-2, -2) is inevitable. In this case, the optimal would be (-1, -1), as presented in the below matrix.

Game Theory and the Prisoner's Dilemma has been used to characterize Roger Hardin's 1968 entry in Science, The Tragedy of the Commons.

The entry discusses how a rational herder using an open pasture will experience the economic benefits from his own cattle grazing freely, but will inevitably suffer costs over the long-term as his cattle and those of others overgraze and reduce the yield.

Every herder is both motivated to add more and more cattle to graze the pasture for his own benefit, and destined to share the costs from overgrazing with all others using the land.

Therein is the tragedy. Each man is locked into a system that compels him to increase his herd without limit—in a world that is limited. Ruin is the destination toward which all men rush, each pursuing his own best interest in a society that believes in the freedom of the commons. (Hardin 1968, p. 1,244)

Despite Hardin's somewhat cynical take, a number of studies demonstrate that humans do indeed have a tendency towards cooperation, it is just not always possible due to lack of coordination and asymmetry of information.

Nobel Prize Winner Elinor Ostrom goes into great depth to explore how humans have overcome the Tragedy of the Commons through bottom-up governance structures and self-regulation in her 1990 book Governing the Commons.

The systems exemplified in the book deliver clarity, fairness, and critically long-term viability of the communities and the environmental resource pools in question. They do this through information sharing and aligning incentives between all stakeholders, and in most cases, they have removed the need for auspicious agents of the state or corporate intermediaries (who may unintentionally, or intentionally, make things worse).

Layer 0 coordination leading to the efficient management of some of our most scarce and valuable resources can happen, and it can happen in tandem with the development of fair and inclusive economic systems.

It is already being done.

Learnings from OlympusDAO: Long-Term Incentives and Protocol-Level Coordination

There are two core pieces of OlympusDAO infrastructure relevant for this discussion.

Firstly, the native token, $OHM, is a free-floating currency backed by a basket of assets held in its treasury. At the time of writing it is backed by DAI, FRAX, and ETH. We'll come back to this in the next section.

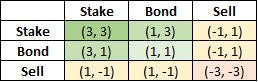

Secondly, the incentive mechanisms in play at OlympusDAO leverage Game Theory and encourage long-term coordination between market participants as follows:

- Bonding: Holders of the backed asset (DAI, FRAX, ETH) can bond with the OlympusDAO treasury and receive OHM at a discount in return for their assets. This is the most cost-effective way to get exposure to OHM.

- Staking: Once OHM is held, stakers can lock their OHM in the treasury; the treasury rewards stakers by paying out rewards in sOHM through rebasing. Staking gives the staker immediate exposure to protocol growth, auto-compounding and access to some of the highest APY returns available in DeFi today.

If a market participant has confidence in OlympusDAO and its growth, the dominant long-term strategy is to bond the backed assets to receive discounted OHM, and immediately stake OHM to get maximum exposure to Olympus' growth.

Staking has the effect of pushing the price up +2. Selling has the effect of pushing the price down -2. The player who moves price gets half of the benefit. Bonding has no price effect but provides a discount of 1 (OlympusDAO Docs, Basics)

Hence, the Game Theory matrix looks like this:

OlympusDAO is a live experiment demonstrating how large-scale cooperation and alignment between market participants can be used to grow for the long-term success of the protocol with maximum benefit for all.

Going Full Circle: KlimaDAO

Let's first address the native token of KlimaDAO, $KLIMA.

As opposed to initially backing the native currency with DAI, as is the case with OlympusDAO, KlimaDAO will back the token with Base Carbon Tonnes (BCT) at a 1:1 ratio. Base Carbon Tonnes are tokenized versions of Verified Carbon Units, which are certificates used to validate emissions reductions within the Voluntary Carbon Market.

Therefore, $KLIMA is a carbon-backed currency.

Markets are dynamic and more than a place of exchange, they are a manifestation of our culture and our time. So, through organisation and coordination we have the power to modify them to reflect what we need and want. If we want the market price to be a fair price of what we value, then we need to move the goalposts and force it to work to the parameters we define. A perfect market should price in carbon. KlimaDAO: Introducing KLIMA, an algorithmic carbon-backed currency.

Coupling the development of a carbon-backed currency with the powerful incentive mechanisms and approach to coordination pioneered by OlympusDAO, KlimaDAO aims to develop this new regenerative economy.

Over time, we will build an economy around KLIMA by driving adoption and unlocking growth of the crypto-carbon economy, bridging Web3 with the real world, and coordinating climate activism at an unprecedented scale.

Our entry Introducing KLIMA, a liquidity engine for the carbon markets indicates how KlimaDAO intends to accelerate the price appreciation of voluntary carbon credits, and the benefits this can bring for both the intrinsic price of KLIMA and to incentivize investment into the development of carbon projects around the globe.

If KlimaDAO's work resonates with you and you'd like to learn more, we recommend you visit our Medium to read up on our work.

You can also catch-up on the conversation with Bankless' content about coordination failures and climate change.

(🌳, 🌳))

Action steps

🌳 Learn more about KlimaDAO and their mission to fight climate change

⬆️ Level up with these bankless resources on climate & Moloch:

Author Bio

0xy_Moron is one of the founding members of KlimaDAO, working to develop the Regenerative Finance economy within DeFi. 0xy has experience in the carbon markets, climate policy and their intersection with Web3.

Subscribe to Bankless. $22 per mo. Includes archive access, Inner Circle & Badge.

🙏Thanks to our sponsor

Lido

👉 Stake your crypto assets on Lido—now supports ETH, SOL, and LUNA

Lido lets users stake their assets and receive a tokenized derivative that automatically earns daily rewards. With Lido, your staked assets can be used across the DeFi ecosystem. You can lend, borrow, and more with your assets while maximizing your yield. Stake with Lido.

Want to get featured on Bankless? Send your article to submissions@banklesshq.com

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.