Level up your crypto finance game five times a week. Subscribe to the Bankless program now.

Dear Bankless Nation,

On Monday we called on you to STAKE! Today we’re calling on you to MEME!

I believe Ethereum will become one of humanity’s most powerful coordination tools. And for that to happen we need a strong social layer that reflects our bankless values.

Scalability isn’t only about transactions per second. We need to scale hearts and minds. But the truth is that Ethereum is still largely unknown. We need to spread the message of ETH as an Internet Bond—about ETH staking. We need to meme.

Two actions for you in this post:

- Spread the word and share dank Eth2 staking memes (here’s our meme pool)

- Contribute even danker memes by tagging @banklesshq w/ something fresh

We’re building a decentralized economic system for the world. Our cause is noble.

So let’s meme.

- RSA

P.S. We’re hosting a YouTube AMA tomorrow with Mel Gelderman from Monolith at 12pm EST (5pm UTC). A bankless Visa Card for the future—subscribe to our channel to get notified.

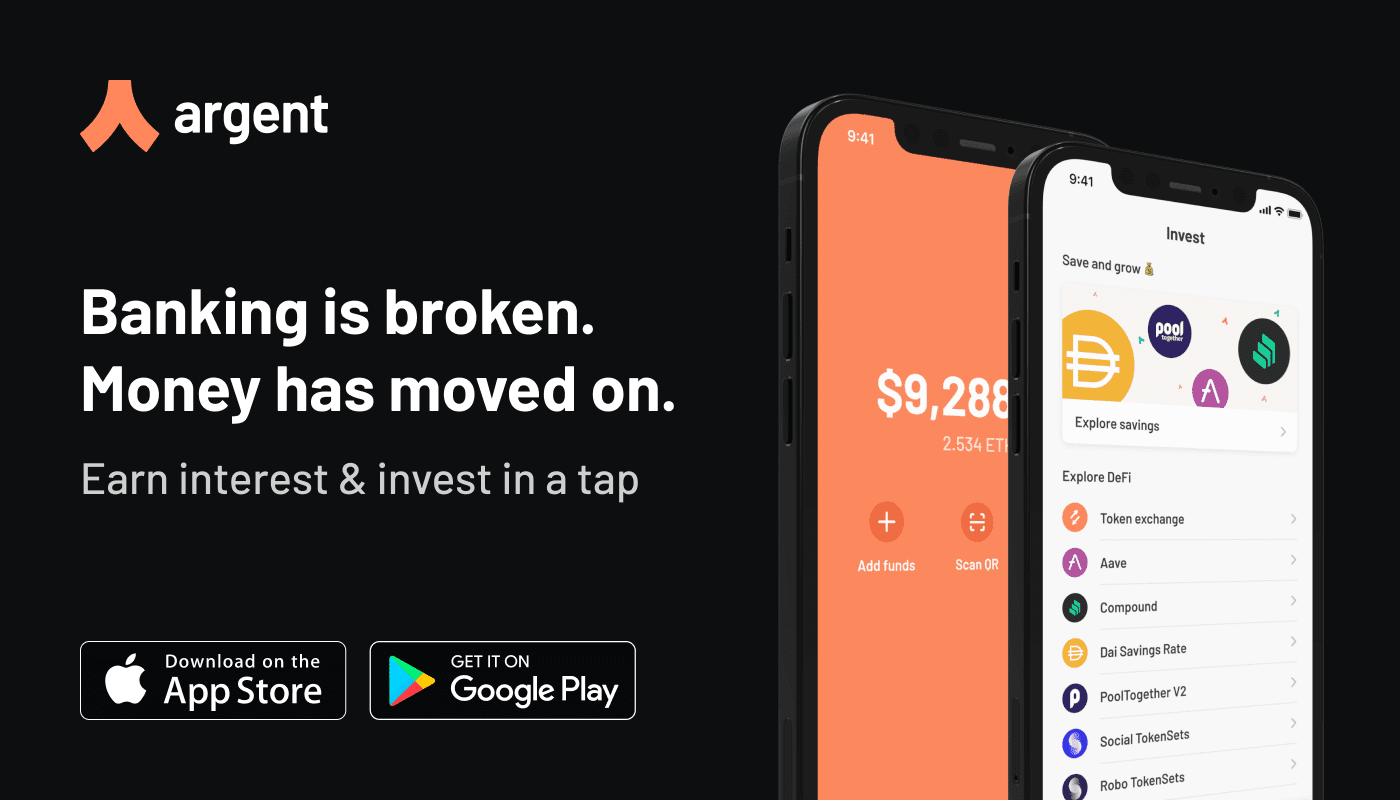

🙏 Sponsor: Argent – DeFi in a tap (👈 go download this wallet now - RSA)

Prefer blog posts read out loud? Watch the YouTube video where David reads to you!

WRITER WEDNESDAY

Bankless Writer: David Hoffman, Bankless Founding Father

Bonding Together

Back in 2017, I discovered that my gaming computer, with a single AMD GPU, could produce roughly $5 a day by ‘mining’ this cryptocurrency called ‘ETH’.

I thought that was pretty cool since $5 a day can really add up! That’s roughly the amount of money that people try and ‘save’ when they cut out their daily Starbucks and instead brew their morning coffee at home.

Doing the math, $5 a day would turn into $1,800 a year, which was quite a lot for a broke student trying to figure out how to get through graduate school! Not only that, but I didn’t need to go to work for this money. This wasn’t a job. I was making money while I was asleep.

I didn’t have a ‘boss’ signing my paychecks, the ETH just showed up automatically! There was no one separating me and my income in ETH. My income was paid by this protocol, Ethereum, and my choice to provide work for this protocol was mine and mine alone.

Realizing the power of protocol-issued income, I decided to double down. From July to September 2017, I had taken over multiple rooms in my dad’s house with a mining computer. At my peak, I had 27 GPUs spinning in different corners of my dad’s house.

We didn’t pay a cent in heating that winter.

Operating these mining machines was no easy task. Building and troubleshooting these units were some of the most frustrating times of my life. But when I finally got them working smoothly, it made me feel like a true stakeholder of Ethereum. I was responsible for the uptime of these machines, and by proxy, a maintainer of the Ethereum network. I was a steward of Ethereum.

It was ME that stood in the way of people looking to do harm to this industry, and Ethereum was compensating me for that protection. I was a flag bearer for Ethereum, and I had skin-in-the-game to prove it. It might have been one of your transactions that I processed through my miners back in 2017-18. Thanks for the ETH!

Down the Rabbit Hole

However, just because I was running GPUs didn’t mean I knew what Ethereum was or its significance. I had a lot of learning to do. Instead of focusing on the GRE to get into grad school, I found myself reading whitepapers, watching YouTube videos of Vitalik, and learning about crypto-economics from Karl Floresh’s Cryptoeconomics.study. Having skin in the game with multiple thousands of dollars of mining equipment really incentivizes you to figure out what the hell it is you’re actually mining.

I applied to the ETH Denver conference in February of 2018. I didn’t really know what I was going to do there, but I justified the trip by also planning to go to the University of Colorado Boulder so I could check out the physical therapy program and tour the school. My plan was to go to the ETH Denver conference on Friday and Saturday, then on Sunday Uber over to the school and see if it was a place where I could see myself living for the next 3 years.

At the ETH Denver hackathon, I attended talks about topics I wasn’t familiar with and watched coding lectures that I didn’t remotely understand. There were breakout sessions about crypto and wealth-distribution, political implications, and sci-fi applications. The richness of the conversations I was apart of were unlike anything I had ever experienced before. I had found an industry of intrinsically curious, ideologically motivated, self-starting optimists who all saw the power of Ethereum from a thousand different perspectives.

Sunday came, and instead of getting myself up to Boulder to tour the school, I said ‘fuck it’. I no longer needed to learn if I could live at Boulder for three years; in just those 2 days, I had learned that I could spend a lifetime with Ethereum.

Being apart of this ecosystem was not something I was willing to miss out on. I didn’t know how I was going to get a career in Ethereum, I wasn’t a coder or developer of any kind, but it didn’t matter.

Mentally, I was in Ethereum.

Ethereum Found Me, and It Will Find You Too

This piece is not an article about my history with Ethereum.

It’s an anecdote about the relationship between the inclusivity of Ethereum’s consensus mechanism and its ability to corral, inspire, and coordinate as many people as possible to ‘join the cause’.

Ethereum was founded on the principles of maximum inclusivity.

Reducing the barrier to participate in blockchain validation to a computer with internet access means that the Ethereum network can be owned and operated by everyone.

Scaling the base-layer by sharding and reducing the costs of transacting on the L1 means that the network can be used by everyone.

Reducing the barrier for these two things is how you create the largest possible group of Ethereum believers, and thus the Ethereum organization as a whole.

Because Ethereum chose to prioritize GPUs over ASICs, individuals like me were able to be included in the consensus of the base-layer. The inclusivity of the base-layer works its way up the techno-social stack that is present in all crypto-economic systems. If base layer validation is confined to a smaller set of people, the organizational scaffolding created by the system doesn’t scale as well. It’s confined to a select few, and thus has not maximized for inclusivity.

Sadly, the era of home-GPU mining has passed. Competition to be a PoW miner for Ethereum is too fierce for the average individual to be able to participate. If you are not leveraging huge economies of scale, and willing to migrate to cheap electricity, then you are no longer in the game. Even worse, ASICs always eventually come, and while Ethash has been a great algorithm for staving them off, the reality is that ASICs have been dominating the Ethereum blockchain for years now.

Proof of Work is inherently centralizing; it reduces the number of global participants who are able to take ownership over the network to a small set of people who are competing on ever-larger economies of scale. PoW inherently results in this outcome, there is no avoiding it.

Proof of Stake, on the other hand, minimizes the costs of validation down to the bare minimum, meaning that the average individual already has the hardware needed to participate in network consensus. The only advantage that a well-capitalized entity has over the average Joe is that they can purchase more stake, but this doesn’t remove Joe’s ability to stake his ETH in a self-sovereign way.

This is why a properly designed Proof of Stake system is genius; by maximizing the size of the population that is capable of participating in network validation, you generate the most socially scalable blockchain. The more people who become apart of the validation at the base-layer, the more likely they become interested in the network itself.

Reducing this barrier down to the absolute minimum for Ethereum means that the only barrier for entry is owning and holding ETH. The elimination of the need to purchase and maintain ASICs means that capital is redirected by the Ethereum consensus system into the purchase and staking of ETH.

Building the Largest Army

In the Bankless podcast episode Slaying Moloch, Ameen, Kevin, Ryan and I discussed the concept of coordinating groups. Ameen raised the point that social groups or organizations form when they are able to out coordinate other groups. Groups rise and fall based on their ability to keep themselves composed and coordinated. If an alternative group can coordinate better, then that group becomes the new status quo.

Humanity is a forward march of groups constantly iterating and improving on their coordination incentives. We have watched these coordination incentives create thousands of types of groups, the most successful of which have been Religions, Companies, and Nation States.

I continued this line of thought in my piece On Coordination vs Defection, in which I claimed that the health of an organizing body is reflected in the ratio of its coordination vs defection incentives. The stronger an organizational body is able to incentivize coordination and disincentive defection, the healthier and more composed a body is able to be.

Nation-States primarily use defection disincentives to maintain their composition. Fines, jail, and reward-exclusion generally keep the citizenry following the rules of the Nation. This strategy has worked pretty well for the Nation-State over the years as they’ve evolved into the largest coordinating body humanity has conceived.

Rather than using punishment to incentive coordination, Ethereum uses rewards. Ethereum pays you for being a part of its organization. Unlike Nation States which taxes you for existing, Ethereum pays you for contributing security to the protocol.

Nation-States need to tax their constituents to maintain upkeep. In contrast, Ethereum pays its constituents to maintain upkeep. That’s the difference.

So which is the more scalable organization? The one that requires payment, or the one that pays you? Which one will recruit a larger, stronger army of individuals who feel ownership and responsibility over the health of the system?

Proof of Stake and the ability to own and operate a share of the network inside your own home will make Ethereum become the largest social organization that the world has ever seen.

Security through the Social Layer

First and foremost, crypto-economic systems are secured through incentives. It doesn’t need a social layer to protect the blockchain; a brutal rationalist should be incentivized to stake ETH as a result of raw economic incentives, and Ethereum should be able to achieve sufficient security via incentives alone. That is what Ethereum has been designed to achieve, and that is what it will do. Raw, concrete, cold-blooded incentives.

However, we cannot discount the value of the social layer as it comes to the security of Ethereum. ETH as money has a monetary premium baked into its market price. Because ETH is treated as money by a growing population, it achieves a premium through its valuation as the reserve asset of the Ethereum economy.

Everyone starts off in this industry by reorganizing their brain to integrate a new model of money. ‘The USD is only valuable because of a narrative that we all share!’. Understanding the concept of money as a collective belief, a shared myth, is the first step into the world of cryptocurrency.

Money Memes, Crypto Memes

Out of that collective belief arises real fundamentals. Gold is a shiny yellow rock, yet it has a level of liquidity and salability that is unrivaled by any real asset. The real intrinsic value of gold is a result of a meme layer on top of the asset.

This meme layer is why it is rational to invest millions of dollars in equipment and energy to dig up this shiny yellow rock. The meme makes it profitable. The meme makes it rational.

Ethereum achieves a security premium via its monetary premium in ETH. Ethereum as an institution becomes harder, stronger, and larger when more people treat ETH as money. The sum of all financial returns to staking is a function of the size of ETH’s monetary premium. As many Bitcoiners know full well, the simple act of buying and holding an asset is an active act of monetization. The more people that do this, the more ‘money’ the asset becomes.

The reflexivity of the meme layer becomes a self-fulfilling prophecy, and it is the role and responsibility of the Ethereum’s social layer to guide this meme into its full potential.

The crypto meme layer can’t emerge without being based upon the reality that a brutal rationalist must be incentivized to protect Ethereum. The meme is based on that reality. But once the meme layer does emerge, there becomes more room for more brutal rationalists to stake more ETH, and every further individual that removes ETH from the secondary market and stakes it to Ethereum is someone who is actively monetizing ETH the asset.

This is the genius of the bootstrappability of L1 blockchains. You don’t need to be a builder, you don’t need to know how to code. The bare minimum that is required is to purchase and hold the asset. Rewards from ETH Staking are a revolutionary incentive to get this done.

Memetic Warfare

If you are reading this, then you are in the small cohort of individuals who hold the power to influence the trajectory of this system. I am here to see Ethereum achieve its maximum potential, and I want to see it done quickly.

The world is appearing to fall apart at the seams. Discoordination, lack of trust, wealth inequality, and financial instability are abundant in the legacy world. Ethereum is an ark that we are trying to build before the storm comes and floods the landscape, and any attempt to get this a stronger ark built faster is a noble cause.

There is a fundamentally moral and ethical argument for what we are all doing here in this industry. Cryptocurrency is a political and societal revolution more than it is a technological or monetary one, and I believe everyone who is reading this likely believes that the future will be brighter because of Ethereum.

The critiques of this memetic warfare fight will say this is a coordinated attempt to pump ETH for profit maximization, and that the orchestrators are just trying to shill their bags. Let it be known that this critique exists, and I am aware of it. Let it also be known that I am in crypto for the money. I’m a brutal rationalist. And most importantly, let it be known that this is a feature, not a bug, of the system. Ethereum runs on cold-blooded incentives, and the incentive for a collective group of people to rally behind a token to ‘pump our collective bags’ is how Ethereum achieves outsized success and impact in the world around it.

Ethereum is a massively coordinating machine, and the bigger and more powerful we can make it, the better the world becomes. Let it also be known that I am in crypto for the social, bottom-up, little-guy-first revolution. I’m also an idealist. Intrinsic to the power behind this industry is that it only works when sufficiently large groups of people rally behind the cause.

The nobility of this revolution directly derives from the fact that it garners volunteer support from the bottom up, rather than coerced by a top-down authority. It is inherently a revolution by the people, for the people. It fundamentally cannot work unless it truly serves the needs of real people.

A Call to Arms

Networks are spread at the individual level. Ethereum adoption occurs one person at a time, and the message of Ethereum is best expressed in the smallest and most viral package as possible. This is why we’ve generated a ton of WWII-era propaganda material to get this movement kick-started.

It was the job of the Ethereum researchers, core devs, and client teams to make Ethereum security work under cold-blooded rational conditions. Ethereum is designed to be protected by raw incentives. It will survive in any condition.

It’s now time for the social layer to take over and amplify the power of this reality to the maximal degree. Let’s add some warmness and meaning on top of the cold-blooded incentives. Let us establish a narrative that makes people feel included and responsible over Ethereum, and give them agency over their future.

Let us together tell the story of Ethereum. Let us get closer as a community, and rally behind shared totems and shared values.

Let us stake our ETH to the Beacon Chain

Let us bond, together.

As stewards of the Ethereum narrative, we are now responsible for the progress of Ethereum to be understood and appreciated by the average individual.

The developers have built the unshakable foundation. It’s now time to convince people to come and settle on this new fertile ground.

The Fight Starts by Staking ETH

First, let me preface this by saying that staking ETH has intentionally been left as a difficult thing to do. It’s going to take work and research to understand what you're doing. And even I haven’t fully figured it out yet. I’m still working on it. This difficulty acts as a filter to ensure that people without the technical capacity to do it, don’t do it.

That being said, staking will become easier over time, and eventually, it will be as simple as buying a staked-ETH derivative token on Uniswap. In ~1-2 years, the unstaked ETH on the ETH 1 chain will become fungible with the staked ETH on the Ethereum beacon chain, and at that point staking ETH will be trivially easy.

Ethereum client teams and developers have 1-2 years to perfect the staking experience. Meanwhile, Ethereum’s social layer has 1-2 years to sharpen our meme game. Just like how developing applications is a constant iterative process of consolidation, efficiency and ease, memes are also an interactive communication tool that compresses information into smaller and more viral packets. They can always get better. They can always become more efficient.

The better we get at sharing memes, the more efficient we can communicate the fundamental merits of this revolution. That effort starts now.

Spread the memes. Learn to efficiently communicate what Ethereum is, what it does, and what it means. Be pragmatic. Use images! Recruit an army.

Ethereum is here to slay Moloch, but it's still in the early stages. It needs to grow stronger. It’s in the hands of the social layer now, and we have the power to steer Ethereum into the future it deserves.

Ethereum is a nation of volunteer-recruits. It lives or dies by the incentives it produces to attract this army.

Any good product is always made better by a marketing effort. If you build it, they won’t necessarily come. But if we meme the best features of this revolutionary technology into the forefront of conversation, then these hardcoded incentives have far more reach and power than they otherwise would have.

The ability to staking your ETH and have a claim on your share of Ethereum’s security budget is powerful. Let’s share it with the world, so everyone can join the revolution. Our staking rewards might be diluted, but the value of ETH and Ethereum will be orders of magnitude higher.

Ethereum is constructing the world’s biggest organization, and it’s our responsibility to get as many people on the ship as possible.

Let’s go recruit an army ⚑

Let’s Meme

Here is a link to a drive with the below image files. Download them. Share them. Spread them. I want to see these on Twitter👏every👏single👏day👏.

Make more! If you want to add to the library of viral images, share it on Twitter and tag @banklesshq. We’ll add to the meme pool! Funny crypto memes are a big part of the game, too.

Action steps

- Stake your ETH! (here’s how)

- Spread the word and share dank Eth2 staking memes (here’s our meme pool)

- Contribute even danker memes by tagging @banklesshq w/ something fresh

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Badge.

🙏Thanks to our sponsor

Argent

You were promised the future of money. Instead you got '90s banking UX and a paper password. Enough is enough. Argent protects your assets and gives you peace of mind. Earn interest and invest in a tap. No seed phrase. No problem. This is one of the best DeFi mobile wallets in the game today. Start exploring DeFi on the go with Argent. 🔥

👆Guys…this is my #1 recommended DeFi wallet. Stop reading this and go download it. - RSA

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.