If you’re a full subscriber, join the discord for a live video AMA with Antonio Juliano, Founder of dYdX TOMORROW at 2pm EST! If you’re not…subscribe & we’ll send a link!

Dear Bankless Nation,

Bitcoin is a money game. Whether you want to participate in it or not, you are a player.

You have two choices:

- You purchase BTC

- You don’t purchase BTC

What emerges is a game of monetary musical chairs. There’s only 21M seats at the table and anyone can have as many chairs as they can get.

And people are starting to play the game. Paul Tudor Jones, MicroStrategy (a U.S. public company), and others are all rushing to grab their chair.

No one wants to miss out.

There’s also another entrant—Ethereum. It’s a platform for wealth-maximizing money games. It democratizes scarcity so anyone can create & play money games.

And don’t be fooled. Ethereum has its own money game too. It’s the quest for 32 ETH.

If you complete the quest, you get your very own self-sovereign money printer. You get to make the money printer go brrrr just like J. Powell.

And more and more people are starting to pre-order Ethereum’s money game.

Everything I’ve learned about crypto investing in two words:

- RSA

P.S. If you’re an audio learner, David recorded this piece into audio format. Listen here!

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

We released episode 11 of SOTN—BUILDING

📺 Watch State of the Nation #11: BUILDING — ETH2 TESNET BROKE? L2 WILL SAVE US, and THE P-P-PROTOCOL SINK THESIS with special guest Raul Jordan!

State of the Nation is live streamed every Tues at 10am EST—subscribe to join us.

WRITER WEDNESDAY

Bankless Writer: David Hoffman, COO at RealT, Co-Host Bankless podcast & POV Crypto

Monetary Musical Chairs

Bitcoin is a game of “Monetary Musical Chairs”. The 21M cap creates a game-theoretic stand-off between those that do and do not own Bitcoin.

In the Bitcoin game, there are 21M chairs, and anyone is allowed to sit in as many chairs as they can. Because of the supply cap, when a buyer purchases Bitcoin with no intent to sell, a chair is permanently filled. But, there is a price for everything.

We can only assume that everyone could be convinced to offer up their chair, so long that the price is right 😏

The current number of open seats in the Bitcoin network is a function of the number of Bitcoins left to be mined, ~2.6M, and the number of BTC available on the secondary market, which varies based on price. The higher price of Bitcoin, the more willing people are to stand up from their chairs and sell it to the highest bidder.

“Margaret, buy some Bitcoin”

Bitcoin’s Game

You are a player of Bitcoin’s Game, whether you like it or not.

Bitcoin has a few qualities that forces everyone to play the game. The choice to not purchase Bitcoin is just as significant as the choice to purchase Bitcoin. The choice to not purchase BTC is a valid move, but a move nonetheless.

By not purchasing Bitcoin, you are claiming that there will not be much demand for Bitcoin in the future (or you’re uninterested in crypto, investing, etc).

This is why the term “no-coiner” exists. It expresses a group of people that have chosen to cooperate with traditional finance and defect from Bitcoin’s Game.

Defecting from Bitcoin’s Game is a risky move. Choosing to not purchase Bitcoin is a belief that other people will not purchase it as well.

What if you’re wrong?

Cooperate, or Defect?

Game theory in the Bitcoin ecosystem

The prisoner’s dilemma is the foundational scenario of game theory which shows why two completely rational individuals might not cooperate, even if it appears that it is in their best interests to do so.

In the prisoner’s dilemma, two prisoners are captured and questioned separately. They each have a choice to make: strike a deal with the prosecutor and rat out your friend for a reduced sentence, or don’t confess in order to stay loyal to your friend, while hoping that your friend does the same.

Do they cooperate with their fellow prisoner-comrade, in hopes that their comrade cooperated with them? Or do they defect in order to save themselves, while betraying their comrade to time in prison? (Full explanation here)

In Bitcoin, the choice to cooperate with the prosecutor is to choose to remain within the walls of traditional finance and shut your eyes to the possibility of a money outside the rules and regulations of the nation-state fiat regime. The choice to defect is to deploy your value and wealth into BTC in the belief that its qualities as a money are superior than the fiat alternatives, and that others will do the same. Bitcoin game players are incentivized to defect as early as possible, due to the nature of the BTC hard-cap. Gotta claim as many seats as possible!

In Bitcoin, there are 7 billion prisoners instead of 2, and instead of the risk of jail time, the risk is not owning a smaller percentage of bitcoins. The more players there are, the larger the incentive there is to defect, because you really want to defect early here. There is capital at stake!

The three outcomes of Bitcoin’s Prisoners Dilemma is as follows:

- If everyone cooperates with traditional finance, then Bitcoin will not receive sufficient demand for price appreciation. It will not become the worlds global reserve currency

- If everyone defects, then Bitcoin will receive significant demand and will appreciate in price. It will likely become the world’s global reserve currency.

- If some defect while others cooperate, then some will be able to purchase cheaper Bitcoin than others, as they got to purchase first. The laggards are at risk that they will be forced to purchase Bitcoin when much more of the 21 million bitcoins have already been claimed.

Coordination Games in the crypto economy

One of the greatest features of the crypto asset markets are their inherently global nature. Everyone with an internet connection is capable of playing Bitcoin’s Game. Everyone is a player. Bitcoin is a game that incentivizes people to play it and is also playable by everyone.

Some players can sit in many chairs. Investment firms, hedge funds, central banks, governments, or any capital abundant entity, are able to purchase much more than their share of Bitcoin. Bitcoin attracts tech-savy developers along with bleeding-edge investment funds, that can understand Bitcoin’s value proposition of Monetary Musical Chairs. These people are able to move quickly, in order to ensure their seated position.

Not that many need to defect for Bitcoin to significantly appreciate in price

Three Investor Types + One More

From this Prisoner-Dilemma viewpoint, I see three Bitcoin investor types emerging:

Those that want in.

The sound-money revolutionaries. The digital nomads. Freedom seeking, inflation-escaping pioneers. A lot of these people are ‘all-in’, and turn into the evangelists that recruit others to defect as well. These people are Bitcoin’s greatest weapon; the army of marketers that are all financially incentivized to convince people to defect from Fiat, and join the ranks of Hard Money.

Those that don’t want to miss out.

These are the people that see the growing category of the people above and want to hedge their bets on missing out. Those that manage people’s money and have a fiduciary responsibility to generate a diversified portfolio, digital assets included.

These people often have just a little exposure to Bitcoin, but enough to matter. Also, there are many people in this category.

NoCoiners

These people are the prisoners that cooperated with traditional finance in the prisoner’s dilemma. They either decided that the Bitcoin value proposition wasn’t enticing enough to motivate them to buy, or the whole world of crypto assets and investing is not on their radar.

Either way, they are sticking to traditional finance: Equity markets, bond markets, real-estate, or cash savings. These prisoners are hoping, either implicitly or explicitly, that their fellow prisoners will cooperate with them, and not defect to scurry off to buy Bitcoin behind their back.

Fiat-money is the embodiment of the NoCoiner (and Peter Schiff).

Victory Bonus: Forced Bitcoin purchasers (AKA Adoption)

With more and more people defecting into Bitcoin and away from traditional finance, the pools of BTC-owners in the first two above groups grow larger, as do the companies that support them.

This growth grows into network effects where people don’t necessarily need to express an opinion about cooperating or defecting, but instead they purchase, save, store, or spend BTC simply because it is the best option available to them. They don’t think about ‘investing’, they just need to get something done in their life and they use Bitcoin and BTC to do it. Bitcoin becomes the air that people breath, and the water in which we swim. At this point, Bitcoin just is.

Once there is enough of these people, Bitcoin’s Game is over.

If this stage is reached, those that have chosen “cooperate” and stuck with traditional finance will have fallen victim to their defecting comrades. They are the last purchasers of Bitcoin, in a stage where Bitcoin has become less of an investment (because now 1 BTC is worth millions) and instead is treated more like savings. These people are forced to join the last group of Bitcoin adopters, as they are required to own Bitcoin to pay for some service or product, when they could have purchased Bitcoin 10 years earlier, at a much-reduced price.

Players of the Game

No words needed.

Austrian Money

The game described here is at the core of Austrian Money. This is how every single hard-money asset works. If there are strong restrictions on the creation of new units, then the game is destined to be played. There is no opting out of the game.

Bitcoin’s game is an ancient game that underpins all economics. Scarcity and the management of scarce resources is at the heart of the human condition. The fact that Bitcoin seems like a foreign concept to people is a litmus test for the current economic status-quo this world has fallen into.

Fiat Money and money printer go brrr has created the illusion of a world of abundance, with limitless production. This, unfortunately, is an incredible mismatch between the world we think we live in, and organic, natural reality. In real life, things are scarce. In real life, value cannot be printed.

Bitcoin created the system to return organic scarcity back into the world.

But Bitcoin is just the start…

Money Games

A while ago, I wrote an article called Ethereum: The Money-Game Landscape. In light of the resurgence of different types of games (yield-farming, liquidity mining, rebasing etc), I think it’s a timely read for those that haven’t yet.

In summary, Ethereum is a platform for the construction of money-games. The DeFi applications that we all know and love are individual wealth-maximizing mini-games that are played upon one single large board, which we call Ethereum. Every single money-game on Ethereum operates with the same structure of Bitcoin’s Prisoners Dilemma, but with more creative and modular rules.

- Ether, and the fight for 32 ETH for a validator node is the same game.

- MKR is a game of maximizing MKR ownership.

- YAMs and YFI and the fight for the largest share over each’s treasure is the same game.

- AMPL is an accumulation game.

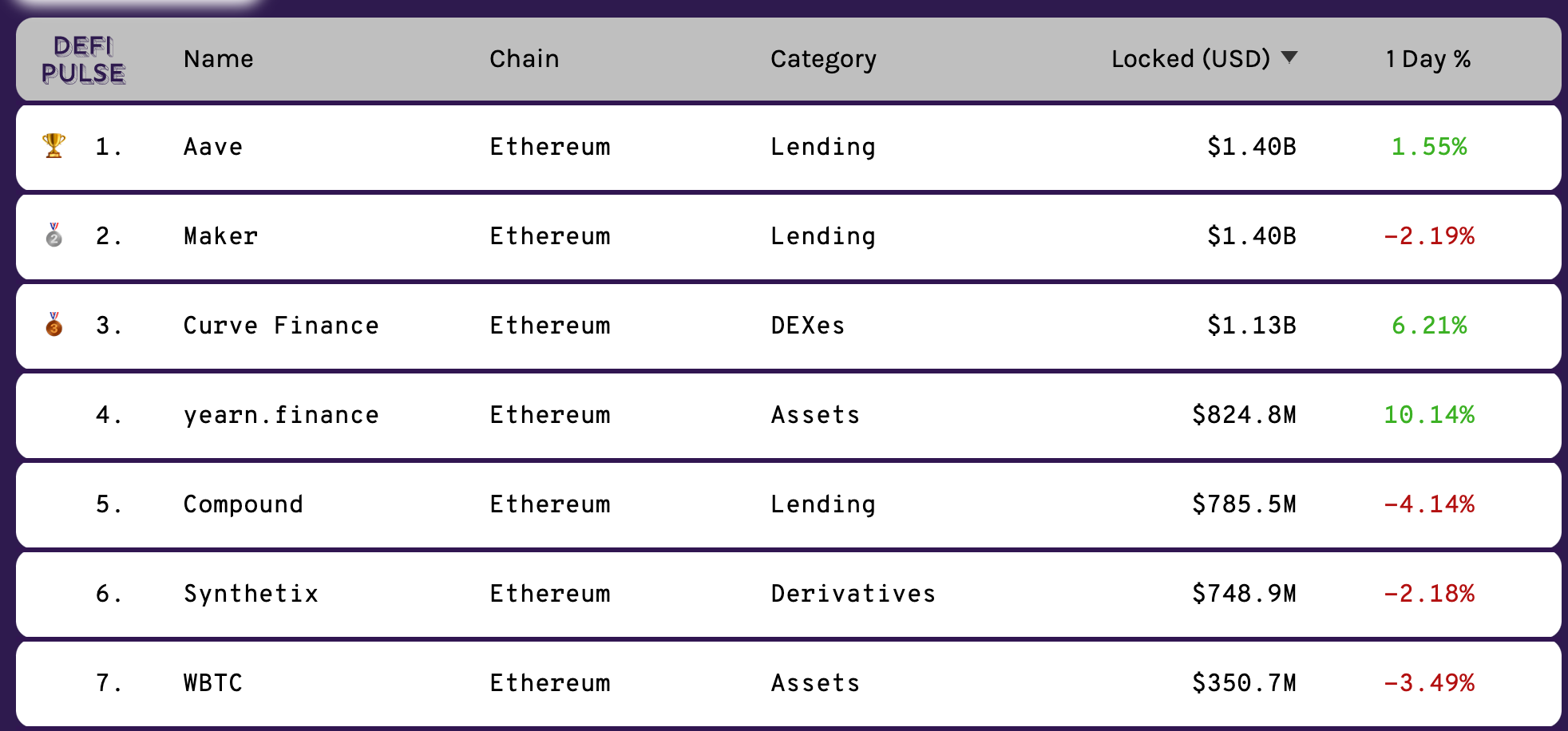

- Currently, Aave is winning the game.

When the ability to freely print new units is removed from the equation, nature and economics takes over. Ethereum is a platform for democratizing scarcity, and as a result we have seen an explosion of scarcity games being played on Ethereum.

The so-called Bull Market that everyone thinks we’re about to embark on is going to be underpinned by this phenomenon: Wealth-maximizing scarcity games.

I’m excited to see these MMO Money-Games built and played on Ethereum. The experiments going on with YFI, AMPL, YAMs is incredibly fascinating, but I’m willing to bet in a few short years we will look back on these games as early primitive designs that would ultimately be apart of much larger, bigger games. Different parts of each game will be repurposed and reconstructed to create new games, which will attract more attention, more hype, more players, and more yields.

This is the story of the next 18 months of Ethereum.

Also, don’t forget about THE Ethereum Game: the quest for 32 ETH. The choice to play the lower-risk ETH-Staking game vs the higher-risk DeFi yield-maximizing game is itself a game.

ETH staking is coming, and more and more people are pre-ordering the game.

Action steps

Play Bitcoin’s & Ethereum’s Money Game (well..you’re already playing it)

Try setting up your own ETH money printer on testnet with our new guide!

Read & listen to David’s writing on Money Games

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Badge.

🙏Thanks to our sponsor

Aave

Aave is an open source and non-custodial protocol for money market creation. Originally launched with the Aave Market, it now supports Uniswap and TokenSet markets and enables users and developers to earn interest and leverage their assets. Aave also pioneered Flash Loans, an innovative DeFi building block for developers to build self-liquidations, collateral swaps, and more. Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.